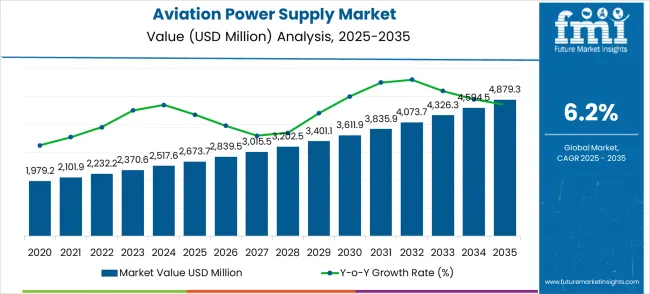

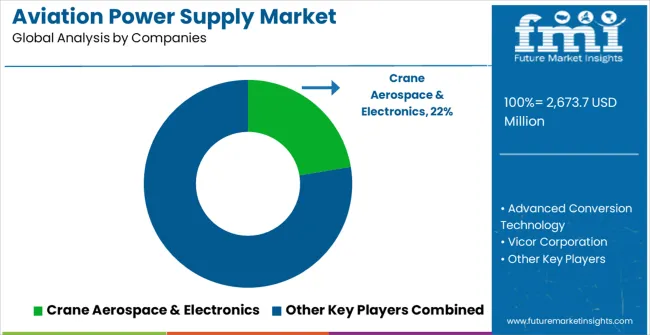

The aviation power supply market is expected to grow from an estimated USD 2,673.7 million in 2025 to USD 4,879.3 million in 2035, reflecting a steady CAGR of 6.2%. This indicates healthy, steady growth driven by rising demand for advanced avionics, increased aircraft production, and technological innovations in power supply systems. Over the decade, the market value is projected to increase by USD 2,205.6 million. This steady expansion is supported by the increasing adoption of energy-efficient power systems, advancements in aircraft electronics, and stricter safety regulations requiring upgraded aviation power solutions.

Year-over-year (YoY) analysis reveals steady growth with minimal volatility. The lowest annual increase occurs in 2026, where the market grows from USD 2,673.7 million to USD 2,839.5 million, representing a 6.2% YoY increase. This pattern continues consistently, with each subsequent year showing incremental gains in line with the CAGR. By 2027, the market will reach USD 3,015.5 million, a 6.2% increase, and by 2028, it will attain USD 3,202.5 million. This reflects a stable growth trajectory, driven by ongoing upgrades in commercial and military aircraft fleets worldwide.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,673.7 million |

| Forecast Value in (2035F) | USD 4,879.3 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

Mid-period years such as 2029 to 2032 see steady growth rates ranging between 6.1% and 6.3%, with the market rising from USD 3,401.1 million in 2029 to USD 4,073.7 million in 2032. These years represent a steady adoption phase where replacement cycles for legacy power supply systems and integration of new aviation technologies drive steady expansion. There are no years of stagnation or decline, indicating a resilient market. The highest absolute growth occurs between 2034 and 2035, where the market increases by USD 284.8 million, reflecting the continued integration of advanced power systems into next-generation aircraft.

From a comparative perspective, the market’s best-performing year in terms of absolute growth is projected to be 2035, driven by high demand for hybrid-electric and fully electric propulsion systems. The worst year, is 2026, which records the smallest YoY increase of USD 165.8 million. The average YoY growth rate across the decade stands at approximately 6.2%, consistent with the CAGR. This steady upward trend reflects strong fundamentals in the aviation industry, including expanding air travel demand, fleet modernization, and regulatory focus on performance efficiency, which collectively ensure constant growth in the market through 2035.

Market expansion is being supported by the exponential growth of commercial aviation traffic and the corresponding demand for reliable electrical power systems that can support advanced avionics, flight management systems, and passenger comfort technologies in modern aircraft operations. Modern aviation operators are increasingly focused on power supply solutions that provide high reliability, lightweight design, and compatibility with advanced aircraft electrical architectures. Aviation power supplies' proven ability to deliver consistent performance, operational safety, and system integration makes them essential components for aircraft electrical systems and aviation safety optimization initiatives.

The growing focus on electric aircraft development and sustainable aviation technologies is driving demand for power supply systems that can support electric propulsion, battery management, and hybrid-electric powertrains. Aviation preference for power solutions that combine high efficiency with compact design and electromagnetic compatibility is creating opportunities for innovative aviation power supply implementations. The rising influence of digitalization in aviation and advanced avionics integration is also contributing to increased adoption of power supplies that can provide clean, stable power for sophisticated flight systems and electronic equipment.

The aviation power supply market represents a stable, mission-critical infrastructure opportunity, with the market projected to grow from USD 2,673.7 million in 2025 to USD 4,879.3 million by 2035 at a steady 6.2% CAGR, an 82.5% expansion driven by increasing aircraft production, advancing avionics integration, and the emergence of electric aviation technologies. This market benefits from stringent safety requirements that create high barriers to entry while ensuring long-term customer relationships and predictable revenue streams.

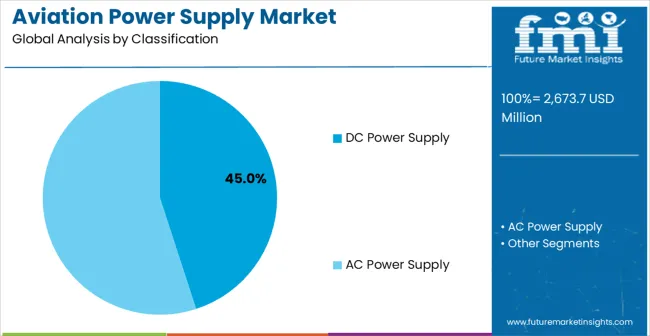

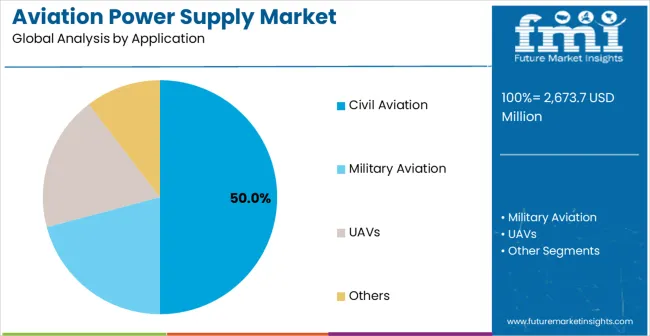

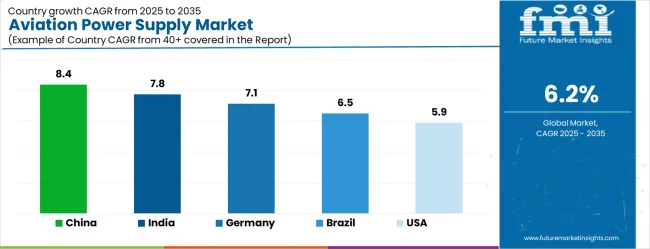

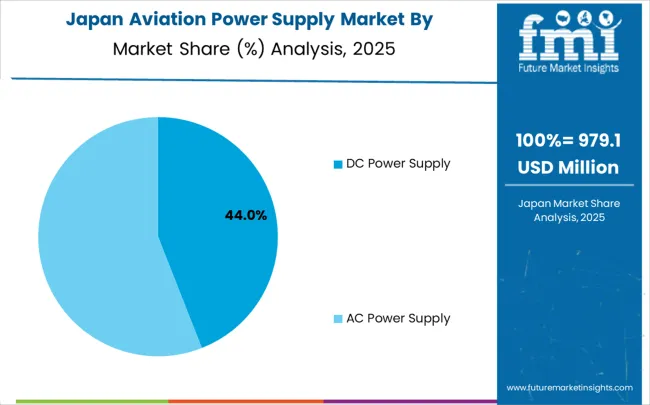

The transition toward more electric aircraft (MEA) and eventually electric propulsion systems creates fundamental shifts in power requirements, moving from traditional hydraulic and pneumatic systems to electrical alternatives. DC power supplies dominate due to their efficiency and compatibility with modern avionics, while civil aviation leads applications given the scale of commercial aircraft production. Geographic growth is strongest in China (8.4% CAGR) and India (7.8% CAGR), driven by expanding aircraft manufacturing and aviation infrastructure development.

Pathway A - DC Power Supply Technology Leadership. Modern aircraft increasingly rely on DC systems for avionics, flight controls, and passenger systems. Companies developing high-efficiency, lightweight DC power supplies with superior electromagnetic compatibility and aviation certification will capture the dominant market segment. Expected revenue pool: USD 1,500-2,000 million.

Pathway B - Electric Aircraft Power Systems. The emerging electric and hybrid-electric aircraft segment requires fundamentally different power architectures with higher power density and advanced battery management capabilities. Early movers developing specialized power systems for electric propulsion will establish leadership in this transformative segment. Opportunity: USD 600-900 million.

Pathway C - Advanced Avionics Integration. Next-generation aircraft feature integrated flight management systems, fly-by-wire controls, and digital cockpits requiring ultra-reliable, clean power delivery. Power supplies with advanced digital interfaces, real-time monitoring, and predictive maintenance capabilities command premium pricing. Revenue uplift: USD 500-750 million.

Pathway D - Geographic Expansion in High-Growth Markets. China and India's aircraft manufacturing expansion, military modernization, and aviation infrastructure development create substantial opportunities. Strategic partnerships with local manufacturers and compliance with regional certification requirements enable market penetration. Pool: USD 800-1,200 million.

Pathway E - Military and Defense Applications. Military aviation demands ruggedized power systems with enhanced electromagnetic pulse (EMP) resistance, extreme temperature operation, and cybersecurity features. Defense contractors require specialized solutions with long-term support contracts and technology refresh capabilities. Expected upside: USD 400-600 million.

Pathway F - UAV and Unmanned Systems. The rapidly expanding unmanned aerial vehicle market requires compact, lightweight power supplies optimized for autonomous operations, extended flight times, and payload flexibility. Commercial and military drone applications offer significant volume opportunities with shorter certification cycles. USD 300-500 million.

Pathway G - Ground Support Equipment and Infrastructure. Aviation ground power units, battery chargers, and airport electrical systems require specialized power supplies meeting aviation standards. This adjacent market offers steady revenue streams with lower certification barriers and established customer relationships. Pool: USD 400-650 million.

Pathway H - Advanced Power Management and Digital Integration. Smart power systems with IoT connectivity, predictive analytics, and remote monitoring capabilities enable new service business models. Power-as-a-service offerings, predictive maintenance contracts, and digital twin technologies create recurring revenue streams beyond traditional hardware sales. Expected revenue: USD 300-450 million.

The market is segmented by power supply type and application. By power supply type, the market is divided into DC power supply, AC power supply, and others. Based on application, the market is categorized into civil aviation, military aviation, UAVs, and others.

The DC power supply segment is projected to account 45.0% share for the market in 2025, reaffirming its position as the leading power supply type category. DC power supply system’s increasingly attract aircraft manufacturers for their efficiency characteristics, compatibility with modern avionics, and suitability for various aircraft electrical system applications. DC systems' simplicity and proven reliability directly address the operational and safety requirements for aircraft electrical power distribution across different aviation applications.

This power supply type segment forms the foundation of aviation electrical system adoption, as it represents the power supply category with the greatest appeal for modern aircraft requiring efficient power conversion and distribution without complex AC-to-DC conversion stages. Aviation investments in electrical system optimization and weight reduction strategies continue to strengthen adoption among DC power supply users. With aircraft designers prioritizing system efficiency and reliability, DC power supplies align with both performance requirements and certification standards, making them the central component of aviation power supply market growth strategies.

Civil aviation is projected to account 50.0% market share for application segment of aviation power supply demand in 2025, underscoring its critical role in driving market growth and technology adoption. Civil aviation applications prefer reliable power supplies for their operational safety requirements, passenger comfort systems support, and ability to meet stringent aviation certification standards. Positioned as essential safety-critical components for commercial aircraft operations, aviation power supplies offer both operational advantages and regulatory compliance benefits for civil aviation applications.

The segment is supported by continuous expansion in commercial aircraft production and the growing recognition of the importance of power supply reliability, which enables safe aircraft operations and passenger service systems. Additionally, power supply manufacturers are investing in civil aviation-focused solutions to support commercial aircraft requirements and airline operational needs. As civil aviation becomes more technology-dependent and passenger-focused, it will continue to dominate aviation power supply utilization while supporting market expansion and aviation safety improvements.

The market is advancing steadily due to increasing aircraft production rates and growing demand for reliable electrical systems that support modern aviation operations and advanced avionics integration. The market faces challenges, including stringent aviation certification requirements, concerns about electromagnetic interference and system compatibility, and high development costs for aviation-grade power supply systems. Innovation in power conversion technology and electromagnetic compatibility solutions continues to influence market development and adoption patterns.

The expanding development of electric and hybrid-electric aircraft systems is enabling aviation power supplies to support revolutionary propulsion applications where traditional aircraft electrical systems cannot provide sufficient power density and efficiency for electric flight operations. Electric aircraft development provides enhanced market opportunities while allowing advanced power management solutions across various aircraft configurations and propulsion systems. Aviation organizations are increasingly recognizing the competitive advantages of advanced power supplies for sustainable aviation and next-generation aircraft applications.

Modern aviation power supply providers are incorporating advanced power management features and digital integration capabilities to enhance system appeal and address aircraft manufacturer concerns about power quality, system reliability, and avionics compatibility. These technological enhancements improve power supply value while enabling new market segments, including fly-by-wire aircraft and autonomous flight systems requiring ultra-reliable power delivery and advanced monitoring capabilities. Advanced integration also allows aviation power supplies to differentiate from conventional electrical systems while supporting next-generation aircraft technologies and operational efficiency.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| USA | 5.9% |

| UK | 5.3% |

| Japan | 4.7% |

The market is experiencing robust growth globally, with China leading at an 8.4% CAGR through 2035, driven by massive commercial aircraft production expansion, comprehensive military aviation modernization programs, and extensive investment in domestic aviation technology development. India follows closely at 7.8%, supported by rapidly expanding aviation infrastructure, increasing aircraft manufacturing capabilities, and growing adoption of advanced aviation technologies. Germany shows strong growth at 7.1%, emphasizing advanced aerospace engineering capabilities and comprehensive aviation technology development programs. Brazil records 6.5%, focusing on regional aircraft manufacturing and aviation technology advancement. The United States shows 5.9% growth, prioritizing aviation innovation leadership and next-generation aircraft development. The United Kingdom demonstrates 5.3% growth, supported by an advanced aerospace industry and aviation technology capabilities. Japan shows 4.7% growth, prioritizing precision aerospace technology and quality aviation systems development.

China is projected to exhibit exceptional growth with a CAGR of 8.4% through 2035, driven by massive commercial aircraft production expansion and advancing aerospace technology development programs requiring sophisticated electrical power systems. The country's leadership in aircraft manufacturing and strong government support for aviation industry development are creating significant demand for advanced aviation power supply technologies. Major domestic and international aerospace companies are establishing comprehensive power supply development and manufacturing capabilities to serve both domestic aviation markets and global aerospace export opportunities.

Revenue from aviation power supplies in India is expanding at a CAGR of 7.8%, supported by the rapidly developing aviation infrastructure, expanding aircraft manufacturing sector, and increasing adoption of advanced aviation technologies among growing aerospace companies. The country's large aviation market potential and strong focus on domestic aircraft production are driving requirements for sophisticated power supply solutions. International aerospace companies and domestic manufacturers are establishing comprehensive development and production capabilities to address the growing demand for aviation electrical systems.

Germany is projected to grow at a CAGR of 7.1% through 2035, focusing advanced aerospace engineering capabilities and comprehensive aviation technology development programs within Europe's leading aviation technology hub. The country's established aerospace industry and commitment to technological excellence are driving sophisticated power supply system requirements. German aerospace companies and technology developers consistently demand high-precision power supply systems that meet stringent aviation standards and provide superior integration capabilities with advanced aircraft electrical architectures.

Brazil is expanding at a CAGR of 6.5% through 2035, focusing on regional aircraft manufacturing and aviation technology advancement across Latin America's leading aerospace market. Brazilian organizations value cost-effective aviation solutions, operational reliability, and proven performance characteristics, positioning aviation power supplies as essential components for modern aircraft applications. The country's expanding regional aviation sector and increasing focus on aerospace manufacturing are creating constant demand for advanced power supply technologies.

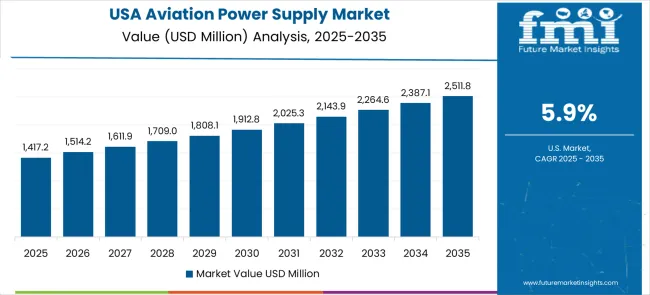

The United States is projected to grow at a CAGR of 5.9% through 2035, driven by aviation innovation leadership, next-generation aircraft development programs, and established regulatory frameworks supporting advanced aerospace technologies. American companies prioritize technological innovation, operational safety, and regulatory compliance, making aviation power supplies a strategic choice for advanced aircraft applications. The market benefits from mature aerospace infrastructure and sophisticated aviation technology requirements.

The United Kingdom is expanding at a CAGR of 5.3% through 2035, supported by advanced aerospace industry expertise, established aviation technology capabilities, and growing commitment to sustainable aviation and next-generation aircraft development. British organizations value regulatory compliance, technological sophistication, and operational reliability, positioning aviation power supplies as essential technology for modern aerospace applications.

Japan is projected to grow at a CAGR of 4.7% through 2035, focusing precision aerospace technology development, advanced quality control standards, and comprehensive aviation system integration aligned with Japanese aerospace excellence. Japanese organizations prioritize technological precision, operational reliability, and long-term performance, making aviation power supplies a strategic choice for premium aerospace applications. The market is supported by sophisticated aerospace infrastructure and established aviation technology expertise.

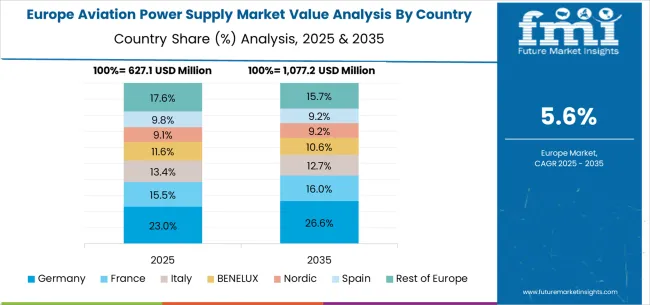

The aviation power supply market in Europe is projected to grow from USD 689.4 million in 2025 to USD 1,197.8 million by 2035, registering a CAGR of 5.7% over the forecast period. Germany is expected to maintain its leadership position with a 33.2% market share in 2025, projected to reach 34.1% by 2035, supported by its advanced aerospace engineering capabilities and major aircraft manufacturers, including comprehensive operations in Hamburg, Munich, and other aerospace centers.

The United Kingdom follows with a 24.6% share in 2025, projected to reach 25.2% by 2035, driven by comprehensive aerospace industry development and advanced aviation technology programs in major aerospace clusters. France holds a 19.8% share in 2025, expected to reach 20.1% by 2035 due to expanding aerospace technology development and aircraft manufacturing initiatives. Italy commands a 12.7% share, while Spain accounts for 6.9% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 2.8% to 3.1% by 2035, attributed to increasing aviation power supply adoption in Nordic countries and emerging Eastern European aerospace markets implementing advanced aviation technology programs.

The market is characterized by competition among established aerospace technology companies, specialized power electronics manufacturers, and emerging aviation electrical system providers. Companies are investing in advanced power conversion technology development, aviation certification processes, electromagnetic compatibility solutions, and comprehensive aircraft electrical system integration to deliver reliable, efficient, and aviation-certified power supply systems. Innovation in power density optimization, digital power management, and system integration capabilities is central to strengthening market position and aviation industry acceptance.

Crane Aerospace & Electronics leads the market with comprehensive aviation power solutions, offering advanced power supply systems with a focus on aviation certification standards and operational reliability. Advanced Conversion Technology provides specialized power conversion solutions with focus on aerospace applications and high-reliability requirements. Vicor Corporation delivers innovative power supply technologies with a focus on high efficiency and compact design for aviation applications. Viable Power Conversion Technologies Inc. focuses on custom power solutions with emphasis on aviation-specific requirements and certification compliance.

Aegis Power Systems specializes in aerospace power solutions with focus on military and commercial aviation applications. Levon Aviation provides aviation-specific power supply systems with a focus on aircraft electrical integration. DSC Power Solutions offers comprehensive power supply solutions with aviation industry expertise. BC Systems focuses on aviation ground support equipment and power systems. White Lightning - Aviation Ground Power specializes in aviation ground power equipment and systems. Additional key players, including Tianjin Hangyuan Technology Development Co., Ltd., Acsoon EIE, Shanghai Yuhang Industrial Co., Ltd., and Tianjin Ruiyi Electronics Co., Ltd., contribute specialized manufacturing capabilities and regional market development across various aviation power supply applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2,673.7 million |

| Power Supply Type | DC Power Supply, AC Power Supply, Others |

| Application | Civil Aviation, Military Aviation, UAVs, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Crane Aerospace & Electronics, Advanced Conversion Technology, Vicor Corporation, Viable Power Conversion Technologies Inc., Aegis Power Systems, Levon Aviation, DSC Power Solutions, BC Systems, White Lightning - Aviation Ground Power, Tianjin Hangyuan Technology Development Co., Ltd., Acsoon EIE, In Shanghai Yuhang Industrial Co., Ltd., Tianjin Ruiyi Electronics Co., Ltd. |

| Additional Attributes | Dollar sales by power supply type and application, regional demand trends, competitive landscape, aviation preferences for DC versus AC power systems, integration with aircraft electrical architectures and avionics systems, innovations in power conversion technology and electromagnetic compatibility for diverse aviation applications |

The global cordless wood planer market is estimated to be valued at USD 1,425.1 million in 2025.

The market size for the cordless wood planer market is projected to reach USD 2,700.3 million by 2035.

The cordless wood planer market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in cordless wood planer market are 12v, 18v and 40v.

In terms of application, furniture assembly segment to command 52.4% share in the cordless wood planer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aviation Life Rafts Market Size and Share Forecast Outlook 2025 to 2035

Aviation Compliance Monitoring Software Market Size and Share Forecast Outlook 2025 to 2035

Aviation Analytics Market Size and Share Forecast Outlook 2025 to 2035

Aviation Cloud Market Size and Share Forecast Outlook 2025 to 2035

Aviation Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Aviation Fuel Additives Market Growth 2025 to 2035

Aviation Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Aviation Connector Market

Aviation IoT Solutions Market

Aviation Cabin Cleaning Chemical Market

Aviation Biofuel Market

Aviation Gas Turbines Market

Aviation Lubricants Market

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Aviation Fuels Market

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

Adoption Analysis of 5G in Aviation Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA