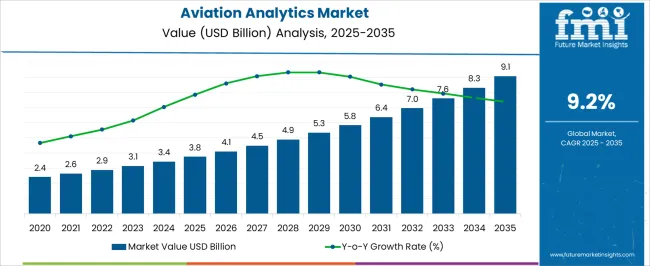

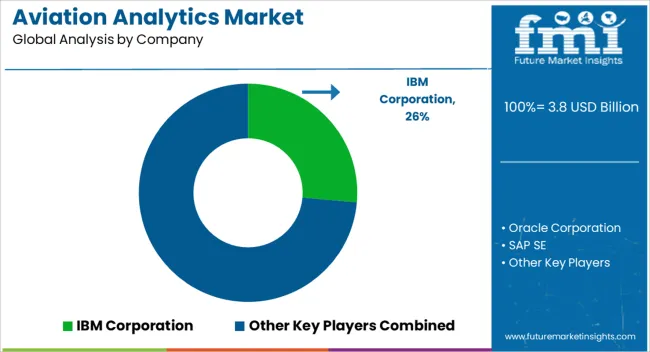

The Aviation Analytics Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 9.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

| Metric | Value |

|---|---|

| Aviation Analytics Market Estimated Value in (2025 E) | USD 3.8 billion |

| Aviation Analytics Market Forecast Value in (2035 F) | USD 9.1 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The Aviation Analytics market is witnessing robust expansion driven by the increasing complexity of global air transportation networks and the growing need for operational efficiency. The current market landscape reflects heightened adoption of data-driven solutions that support predictive maintenance, fuel optimization, and passenger experience enhancement. Airlines are investing in analytics platforms that process large volumes of operational and flight data in real time, enabling proactive decision-making and risk mitigation.

The future outlook is shaped by advancements in artificial intelligence and machine learning algorithms that offer deeper insights into maintenance schedules, crew optimization, and delay management. Furthermore, the integration of analytics solutions with existing airline infrastructure is being facilitated by cloud computing and scalable software architectures.

As air traffic volumes rise and regulatory frameworks around safety and environmental compliance evolve, analytics-driven strategies are being prioritized to ensure reliability and cost-efficiency With increasing collaboration between aviation stakeholders, the market is expected to grow steadily, offering actionable intelligence that enhances operational effectiveness and passenger satisfaction.

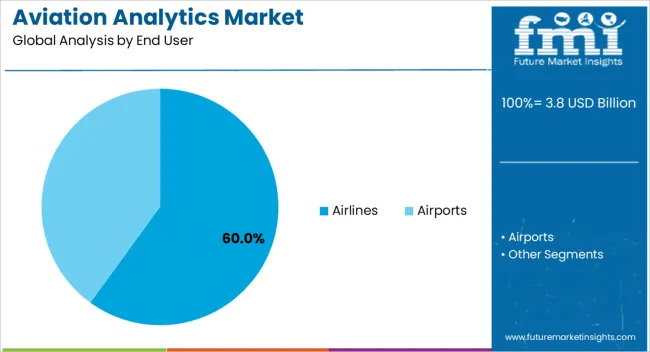

The Airlines end-use segment is expected to hold 60.00% of the Aviation Analytics market revenue in 2025, positioning it as the leading sector in the industry. This dominant share is being attributed to the strategic necessity for airlines to leverage data insights across fleet management, scheduling, and customer engagement. Analytics is being used to enhance fuel efficiency, monitor aircraft health, and reduce downtime by anticipating maintenance needs before failures occur.

Airlines are also focusing on optimizing route planning and crew utilization through advanced forecasting tools. The growth of this segment is being supported by the increasing volume of flight operations and a heightened focus on cost reduction and regulatory compliance.

The scalability of analytics solutions has enabled airlines of all sizes to adopt data-driven frameworks, improving operational responsiveness and safety As competition intensifies and passenger expectations rise, analytics has become indispensable in offering personalized services, efficient scheduling, and seamless airport experiences, further driving the segment’s growth.

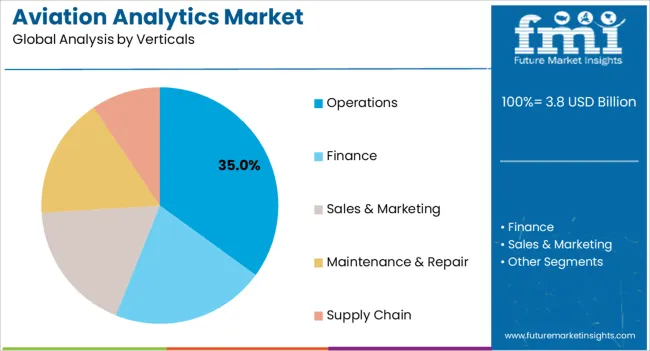

The Operations vertical is projected to account for 35.00% of the Aviation Analytics market revenue in 2025, emerging as a key area of focus within the industry. The prominence of this segment is being driven by the need to streamline operational workflows, reduce delays, and enhance resource allocation across airports and airlines. Analytics solutions are being utilized to monitor maintenance schedules, track equipment performance, and ensure compliance with safety standards, enabling real-time adjustments that improve overall reliability.

Operational analytics is also being applied to optimize crew management, gate assignments, and baggage handling processes, helping reduce turnaround times. The segment’s growth is being supported by the adoption of integrated platforms that combine historical data with predictive algorithms to mitigate disruptions and minimize costs.

As airlines and airports aim to improve on-time performance and reduce environmental impact through efficient fuel usage and optimized routing, the reliance on analytics is expected to increase This trend is reinforcing the importance of operations-focused analytics in supporting strategic planning and operational resilience across the aviation sector.

Presently, the vendors of the aviation analytics market are focusing on intelligence and analytics solutions to boost the profitability of their business. This, in turn, is driving the demand for the aviation analytics market. In addition, the growing emphasis on jet fuel management is another factor driving the demand in the aviation analytics market.

The increasing demand for real-time analytics in the aviation industry is positively influencing the demand for aviation analytics. Additionally, increasing centricity in the aviation industry is also one of the major factors contributing to the growth of the aviation analytics market.

The key challenge faced by the vendors in the aviation analytics market is the dearth of availability of suitable analytical skills. In addition, on certain days, more than two lakh flights operate, making data collection a challenge for the aviation analytics industry. The number of flights that operate is more than the speed of data collection, making it difficult for aviation analytics to use the data for future purposes.

| Countries | Revenue Share % (2025) |

|---|---|

| The United States | 18.1% |

| Germany | 8.2% |

| Japan | 5.4% |

| Australia | 4.1% |

| North America | 30.2% |

| Europe | 21.2% |

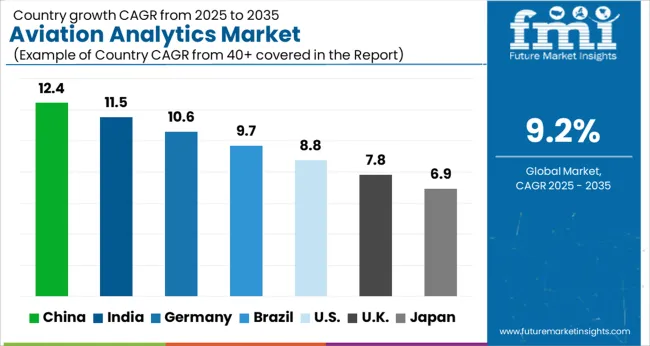

| Countries | CAGR % (2025 to 2035) |

|---|---|

| China | 8.3% |

| India | 10.2% |

| The United Kingdom | 7.3% |

Demand for Improving Operational Performance Creating Significant Opportunities

Among various regions, the aviation analytics market in North America is expected to dominate during the forecast period owing to the high adoption of industrial aviation analytics by medium and large size enterprises to improve their operational performance. Moreover, the strong presence of aircraft operators along with key manufacturers of aviation analytics is propelling the integration of the same. Thus, owing to the reasons mentioned above, North America held a market share of 30.25% in 2025.

Technological Advancements Driving Growth

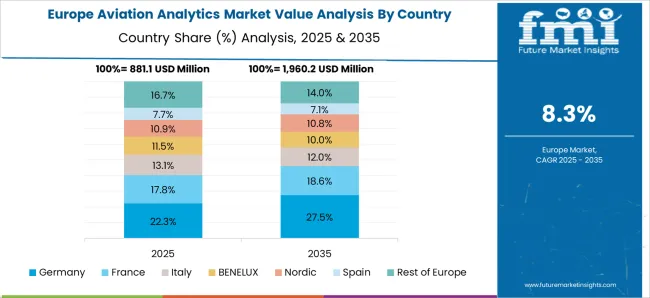

Countries such as Germany and the United Kingdom are notably contributing to the growth of the aviation analytics market. This is owing to the technological advancements in the aviation analytics sector. Moreover, the increase in travel and tourism along with the modernization of the aviation sector is bolstering the demand for aviation analytics in the region.

The use of artificial intelligence and the Internet of Things has annihilated the requirement for human intervention, making aviation analytics an easy task for companies. Europe held a market share of 21.2% in 2025.

| Category | By End User Type |

|---|---|

| Leading Segment | Airlines |

| Market Share (2025) | 65.4% |

| Category | By Verticals Type |

|---|---|

| Leading Segment | Operations |

| Market Share (2025) | 49.3% |

Based on end-user type, the airlines segment leads the market as it held a market share of 65.4% in 2025. The vertical category is dominated by the operation segment as it held a market share of 49.3% in 2025.

The global aviation analytics market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the aviation analytics market is projected to reach USD 9.1 billion by 2035.

The aviation analytics market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in aviation analytics market are airlines and airports.

In terms of verticals, operations segment to command 35.0% share in the aviation analytics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aviation Life Rafts Market Size and Share Forecast Outlook 2025 to 2035

Aviation Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Aviation Compliance Monitoring Software Market Size and Share Forecast Outlook 2025 to 2035

Aviation Cloud Market Size and Share Forecast Outlook 2025 to 2035

Aviation Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Aviation Fuel Additives Market Growth 2025 to 2035

Aviation Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Aviation Connector Market

Aviation IoT Solutions Market

Aviation Cabin Cleaning Chemical Market

Aviation Biofuel Market

Aviation Gas Turbines Market

Aviation Lubricants Market

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Aviation Fuels Market

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

5G in Aviation Market – Future of In-Flight Connectivity

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Analytics as a Service (AaaS) Market - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA