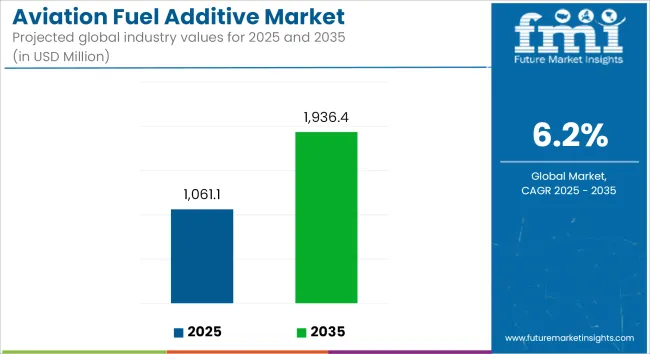

The global aviation fuel additives market is estimated to be valued at USD 1,061.1 million in 2025 and is projected to reach USD 1,936.4 million by 2035, reflecting a CAGR of 6.2% during the forecast period. Market growth is being driven by increasing global air traffic, the need for fuel efficiency improvements, and rising adoption of sustainable aviation fuels across commercial and defense aviation sectors.

| Metric | Value |

|---|---|

| Industry Size (2025) | USD 1,061.1 million |

| Industry Value (2035) | USD 1,936.4 million |

| CAGR (2025 to 2035) | 6.2% |

Fuel additives are being used to enhance fuel performance, prevent operational issues, and ensure compliance with stringent emission standards. Additives such as antioxidants, anti-icing agents, metal deactivators, and corrosion inhibitors are being incorporated into jet fuel formulations to improve combustion, prevent freezing, and reduce engine wear. According to the International Air Transport Association, jet fuel consumption is projected to rise steadily through 2035 as passenger and cargo volumes increase globally.

The shift toward sustainable aviation fuels (SAFs) is creating demand for advanced additive packages to address the distinct thermal and chemical properties of bio-based and synthetic fuels. Formulations are being tailored to improve thermal stability, reduce oxidation risk, and ensure compatibility with existing engine systems and fuel infrastructure. Regulatory mandates in the United States and Europe for reduced carbon emissions are accelerating the commercial integration of SAFs, thereby reinforcing additive demand.

In military aviation, fuel additives are being deployed to ensure operational reliability in extreme weather conditions and extended deployment cycles. Anti-icing agents and dispersants are being used to prevent crystallization at high altitudes, while corrosion inhibitors are minimizing maintenance requirements and extending engine life.

Nanotechnology-based additives and hybrid anti-corrosion agents are being developed to improve fuel atomization and engine protection. These innovations are contributing to improved energy density, reduced deposit formation, and enhanced combustion efficiency.

The market is expected to benefit from ongoing investment in fuel performance optimization, aircraft engine innovation, and government incentives for clean aviation technologies. As airlines and defense operators prioritize engine reliability, lifecycle cost reduction, and environmental performance, aviation fuel additives are projected to play a critical role in achieving next-generation propulsion standards through 2035.

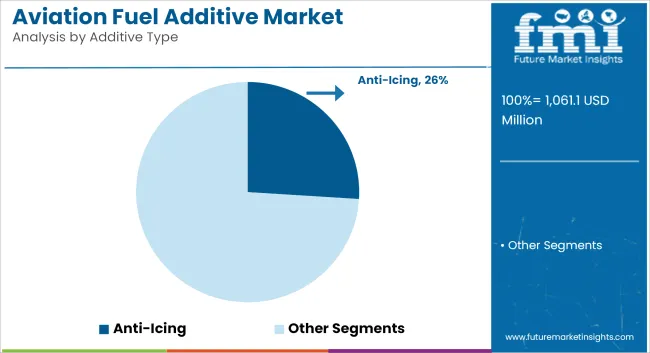

Anti-icing additives are estimated to account for approximately 26% of the global aviation fuel additive market share in 2025 and are projected to grow at a CAGR of 6.4% through 2035. These additives, such as Diethylene Glycol Monomethyl Ether (DiEGME), are essential for preventing ice crystal formation in aircraft fuel systems, particularly at high altitudes and low temperatures.

Their use is mandated in both commercial and military aviation to ensure fuel flow reliability and avoid potential engine flameouts. Demand continues to rise with increasing flight operations across colder regions, stricter international safety regulations, and the rising use of extended-range twin-engine operations (ETOPS). Manufacturers are focused on developing more efficient, cleaner-burning anti-icing formulations compatible with modern turbine engines and sustainable aviation fuel (SAF) blends.

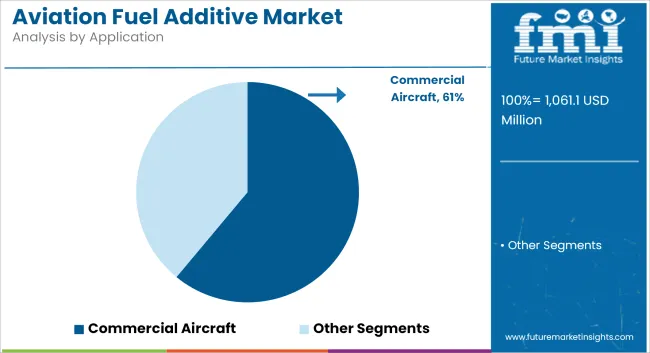

The commercial aircraft segment is projected to hold approximately 61% of the global aviation fuel additive market share in 2025 and is expected to grow at a CAGR of 6.3% through 2035. With the resurgence of air travel, fleet modernization, and longer flight routes, airlines increasingly rely on additives to enhance fuel stability, minimize system deposits, and improve combustion efficiency.

Additives such as antioxidants, metal deactivators, and dispersants are critical in maintaining fuel cleanliness and extending engine component life, especially in high-utilization aircraft. The integration of aviation fuel additives is also essential in supporting the transition to SAF and bio-based jet fuels, where additive compatibility ensures seamless performance across mixed fuel types. As airlines pursue operational reliability and sustainability, commercial aviation continues to be the primary growth engine for fuel additive deployment globally.

Regulatory Compliance and Environmental Impact

The strict standards for aviation fuels regarding emissions, fuel composition, and sustainability requirements are the primary challenges for additive manufacturers. For instance, following the international standards for aviation, such as ASTM D1655, which relates to jet fuel specifications, calls for continual innovation and testing. In addition to that, the depletion of the environment due to the additives used in fuel is forcing the industry to choose environmentally-friendly options.

High Production Costs and Supply Chain Constraints

The production of high-performance aviation fuel additives is a costly affair as it entails huge investment in both research and raw materials. For instance, the high and low prices of crude oil, the disruption of the global supply chain, and the geopolitical tensions that are present can all have an effect on the key additive components' availability and price. The supplier of high-purity additives has to secure the supply of such but at the same time, they face the continuous issue of cost-effectiveness.

Sustainable Aviation Fuel (SAF) Adoption

The international aim for carbon footprint-free aviation is propelling the demand for SAF plug-and-play additives. Biofuels and synthetic fuels will have to deal with the integration of new additives that help these fuels to be energy-rich, stable, and durable at the same time. With the increasing scope of SAF in the market, additive producers will have the chance to invent fuel with new characteristics that will improve the performance of the renewable fuel.

Advancements in High-Efficiency Fuel Additives

The aviation sector is channeling its funds into the next generation of the fuel additives which will not only facilitate combustion, minimize greenhouse gases, but also prolong the engines' lifespan. New solutions, such as nanomaterials dispersants and hybrid anti-corrosion agents, always come up with new paths for fueling performance. These innovations can assist airlines in accomplishing their very ambitious demand for increased efficiency and a greener footprint.

Rising Demand for Military and Defense Applications

The diversification of military air operations, which now includes fighter planes, drones, and unmanned aerial machines, has led to an increased need for superior aviation fuel additives. Manufacturers have the opportunities to develop highly specialized fuel additives that increase the stability of fuel, thermal resistance, and the efficiency of combustion under severe conditions which are the dream solutions for the military.

The United States additive sector for aviation fuel is developing mainly due to the increased demand for passenger flights, the development of new generation fuel-saving technologies, and stricter regulations placed on emissions. The Federal Aviation Administration (FAA) and the Environmental Protection Agency (EPA) are taking steps against the carbon emissions by supporting fuel additives that increase combustion efficiency and cut down on particulate matter.

The military aviation uplift and the commercial aircraft operation expansion are in turn the major factors triggering the demand for anti-icing, corrosion inhibitors, and deposit control additives. The market's growth journey is also continuously shaped by the trend towards sustainable aviation fuels (SAF) and the development of biofuel-compatible additives.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

The UK aviation fuel additives market is experiencing a stable development due to the government initiatives which are aimed at cutting carbon emissions and bolstering fuel effectiveness in the aviation sector. The uptake of sustainable aviation fuel (SAF) and bio-based additives is on the rise, and this is made possible thanks to the relevant policies that promote the use of the environment-friendly aviation industry.

Plus, the development of anti-static, anti-icing, and lubricity-enhancing additives is resulting in better operation and safety of aircraft engines. The rise in air travel as well as the research work on alternative fuels is propelling the market to grow higher.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.0% |

The aviation fuel additives market in the European Union (EU) is experiencing fast growth spurred on by the imposition of stringent emission regulations and the region's commitment to the development of carbon-neutral aviation. The European Green Deal and the REFuelEU program are the main drivers behind the shift to the use of environmentally friendly aviation fuel (SAF) and advanced fuel additives that result in efficiency gains and contribute to the environmental impact less.

The trend of increasing investments in the R&D sector for alternative fuel options and the use of performance-enhancing additives is the major factor that continues to boost market development. The aviation sector is witnessing the growing use of multi-functional fuel additives that not only increase engine performance but also minimize wear and protect against fuel degradation.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

The aviation chemical additives sector in Japan goes up with the technological advancements, fuel efficiency, and tough government regulations on emissions that are directly driving the industry. The steps the country is taking to cut greenhouse gas emissions and the adoption of the improved aircraft engine are bringing the high-quality fuel additives with it.

The inventions in anti-oxidation, dispersant, and deposit control additives are the very things that we need to enhance fuel stability and efficiency. The outlay on sustainable aviation fuel (SAF) and hydrogen-powered aviation from Japan is likely to give a push to the further demand for specialized fuel additives.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The South Korean aviation fuel additives market is witnessing growth on the back of its robust aerospace sector, investments in eco-friendly aviation, and innovative fuel performance improvement technologies. The country is primarily concentrating on cutting down aviation emissions and promoting engine efficiency; thus, the need for anti-static, anti-icing, and corrosion-resistant additives is growing.

Also, South Korea involvement in global agreements on carbon reduction coupled with its investments in additives intended for SAF are among the major factors to speed up market growth. Moreover, the increase in regional and international air travel is also a factor supporting the demand for high-efficiency fuel additives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

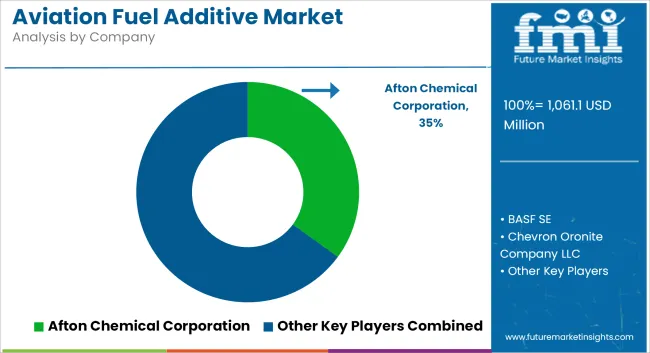

The aviation fuel additives market is driven by a small group of dominant players who are focused on advancing fuel efficiency, performance, and regulatory compliance. Companies such as Chevron, INEOS, and BASF are continuously innovating to offer fuel additives that improve engine performance, reduce emissions, and extend the shelf life of aviation fuel.

As the aviation sector faces increasing environmental pressures, these companies are developing eco-friendly additives that align with global sustainability goals, including bio-based options and solutions designed to lower carbon footprints. Smaller players are leveraging their agility to target niche segments with custom additives, offering tailored solutions to regional markets or specific types of aircraft.

Afton Chemical Corporation

Afton Chemical Corporation is a top-ranked company selling performance fuel additives for aviation. The business is mainly concerned with fuel efficiency and featuring low emissions and high thermal stability. The company's R&D environmentally friendly fuel solutions initiatives. Afton Chemical is a company that is addressing the aviation industry's request for fuel that is more environmentally friendly and rich in resources through its market growth. It has a wide-ranging global distribution network and is a specialist in additive formulations.

BASF SE

BASF SE is a company that manufactures high-quality aviation fuel additives like stabilizers, anti-oxidants, and lubricity improvers. The focus of the company is on sustainability, providing solutions that curtail carbon emissions and facilitate superior performance of fuel. The extensive research capabilities of BASF allow the creation of advanced fuel treatment technologies, thus enabling the compliance with redefining environmental laws. Its competitive market positioning is available due to its strong tie-ups with aviation fuel suppliers and manufacturers.

Innospec Inc.

Innospec Inc. is a company that mainly produces high-performance fuel additives. Among these are anti-icing agents, anti-corrosion solutions, and cetane improvers. The aviation division of this company is concentrating on fuel combustion, efficiency, and safety improvements.

By virtue of investments in the field of sustainable fuel technologies, Innospec seeks to limit the negative impact on the environment while also conforming to international standards for aviation. The geographical presence that the company holds around the globe as well as the technical know-how contributes significantly to its key role in the aviation fuel additives market.

Shell plc

Shell plc is a prominent distributor of aviation fuel additives that are aimed at increasing combustion efficiency, decreasing emissions, and averting the degradation of fuel. The company is also a participant in "green" aviation fuel technologies development through its investment in future fuels. In the pursuit of improving fuel performance as well as following the strict environmental rules, Shell continues to deliver innovative products in this sector. It has become a dominant player in the industry with the help of an extensive supply chain and successful global operations.

Chevron Oronite Company LLC

Chevron Oronite Company LLC is a company that, through the development of multi-functional aviation fuel additives, improves fuel stability, reduces wear, and prevents engine deposits. The firm is directed towards integrating research call-driven innovations to jet fuel performance and reliability. Connecting its additive formulations knowledge, Chevron Oronite practically assists aviation operators in meeting regulations related to operation and environment. Quality and sustainability in the behavioral commitment are the reasons for being competitive in the market.

In terms of Additive Type, the industry is divided into Dispersants, Antioxidants, Anti-Icing, Corrosion Inhibitors, Antiknock, Metal Deactivators, Others

In terms of material type, the industry is divided into Commercial Aircraft, Military Aircraft Others

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA)

The global aviation fuel additives market is projected to reach USD 1,061.1 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.2% over the assessment period.

By 2035, the aviation fuel additives market is expected to reach USD 1,936.4 million.

The commercial aviation segment is expected to hold a significant share due to the rising global air passenger traffic and increasing airline operations.

Major companies operating in the aviation fuel additives market include Afton Chemical Corporation, BASF SE, Chevron Oronite Company LLC, Innospec Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aviation Life Rafts Market Size and Share Forecast Outlook 2025 to 2035

Aviation Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Aviation Compliance Monitoring Software Market Size and Share Forecast Outlook 2025 to 2035

Aviation Analytics Market Size and Share Forecast Outlook 2025 to 2035

Aviation Cloud Market Size and Share Forecast Outlook 2025 to 2035

Aviation Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Aviation Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Aviation Connector Market

Aviation IoT Solutions Market

Aviation Cabin Cleaning Chemical Market

Aviation Gas Turbines Market

Aviation Lubricants Market

Aviation Biofuel Market

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Aviation Fuels Market

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

5G in Aviation Market – Future of In-Flight Connectivity

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA