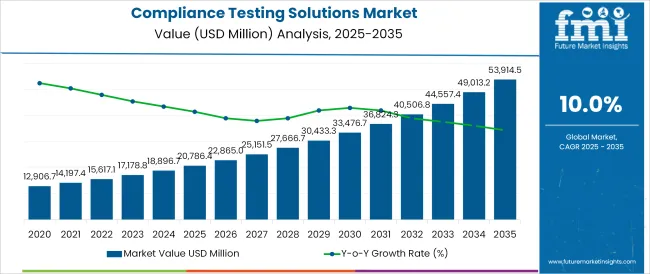

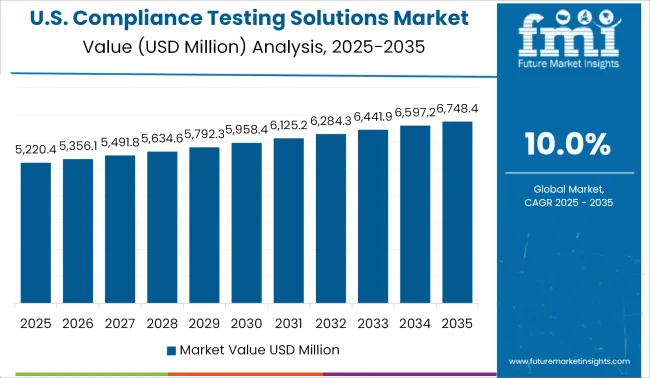

The Compliance Testing Solutions Market is estimated to be valued at USD 20,786.4 million in 2025 and is projected to reach USD 53,914.5 million by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

The compliance testing solutions market is advancing steadily, driven by the increasing complexity of regulatory frameworks and the growing emphasis on data security and operational transparency across industries. Industry publications and corporate compliance reports have highlighted rising enterprise investments in automated compliance platforms to mitigate risks associated with regulatory violations.

Technological advancements in cloud based testing platforms, cybersecurity protocols, and continuous monitoring solutions have enhanced the efficiency and accuracy of compliance testing processes. Enterprises have expanded their focus from manual auditing to integrated compliance testing ecosystems, supporting proactive risk management.

Additionally, the globalization of IT infrastructures has increased cross-border compliance needs, prompting organizations to adopt scalable solutions that address international standards. As industries such as financial services, healthcare, and IT & telecom face stricter compliance mandates, demand for comprehensive testing solutions has accelerated.

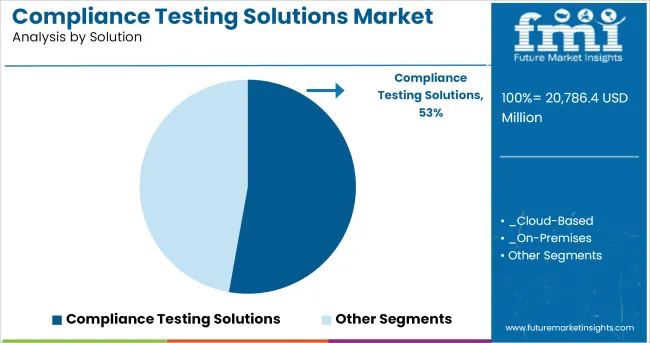

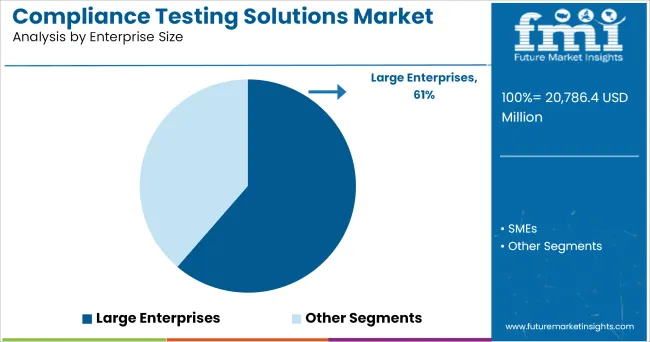

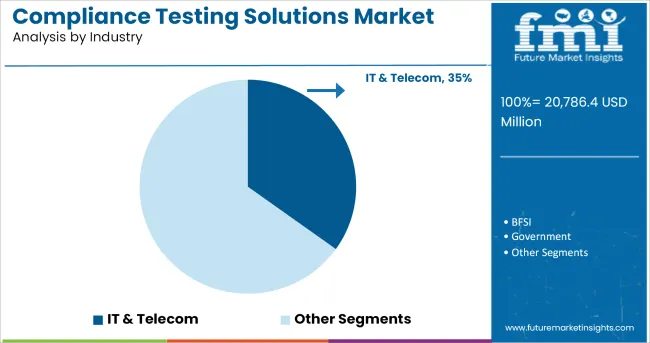

Segmental growth is being led by Compliance Testing Solutions as the core offering, Large Enterprises as the primary adopters, and the IT & Telecom sector due to its high regulatory exposure and complex operational environments.

The market is segmented by Solution, Enterprise Size, and Industry and region. By Solution, the market is divided into Compliance Testing Solutions, Cloud-Based, On-Premises, Services, Integration & Implementation, Consulting Services, and Support & Maintenance.

In terms of Enterprise Size, the market is classified into Large Enterprises and SMEs. Based on Industry, the market is segmented into IT & Telecom, BFSI, Government, Retail, Healthcare, Education, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Compliance Testing Solutions segment is projected to contribute 52.8% of the compliance testing solutions market revenue in 2025, sustaining its position as the leading solution category. Growth in this segment has been driven by the escalating demand for automated tools that ensure adherence to dynamic regulatory standards.

Organizations have prioritized compliance testing solutions for their ability to streamline audit processes, identify vulnerabilities, and validate adherence to security frameworks in real time. Technology vendors have expanded their offerings with integrated platforms that combine compliance reporting, vulnerability assessments, and policy management, reducing operational silos.

Moreover, industry shifts toward continuous compliance monitoring and agile development practices have amplified the need for testing solutions that adapt to frequent code changes and evolving regulatory requirements. As regulatory landscapes become increasingly complex across global markets, the Compliance Testing Solutions segment is expected to remain central to enterprise compliance strategies.

The Large Enterprises segment is projected to account for 61.3% of the compliance testing solutions market revenue in 2025, establishing itself as the leading enterprise size category. Growth of this segment has been driven by the scale and complexity of compliance operations within large organizations, which operate across multiple jurisdictions and industry sectors. Large enterprises have demonstrated a proactive approach to risk mitigation by investing in sophisticated compliance infrastructures and testing frameworks.

Corporate disclosures and IT governance reports have underscored the role of compliance testing in supporting audit readiness and regulatory reporting in multinational environments. Additionally, large organizations have greater financial and technical resources to implement enterprise-wide compliance platforms, integrate testing with security operations, and automate compliance workflows.

As regulatory scrutiny intensifies across sectors such as financial services, healthcare, and technology, large enterprises are expected to remain the primary adopters of comprehensive compliance testing solutions.

The IT & Telecom segment is projected to contribute 34.9% of the compliance testing solutions market revenue in 2025, maintaining its leadership among industry verticals. Growth in this segment has been driven by the sector’s exposure to data privacy regulations, cybersecurity mandates, and operational compliance standards. IT and telecom companies have faced increased scrutiny over data protection, network security, and service reliability, prompting investments in robust compliance testing solutions.

Industry trends have highlighted the adoption of DevSecOps frameworks and continuous integration pipelines that incorporate compliance checks at every stage of software delivery. Moreover, the expansion of 5G networks, cloud services, and digital platforms has introduced new compliance challenges, further elevating the importance of comprehensive testing.

As technology service providers cater to enterprise clients subject to strict regulatory requirements, the IT & Telecom segment is expected to sustain its demand for scalable, adaptive compliance testing solutions.

According to latest research, compliance testing solutions market is estimated to grow with an expected CAGR of 10%. Adoption of compliance testing solution is increasing among developers to deliver optimized software.

Many software or applications fail to meet the high quality standards because of improper debugging. The increasing diversity of and networks result in emergence of more bugs. A software or application has to be tested, keeping in mind various factors, such as other software or application running in the background, which could affect the overall performance.

With increasing number of software, the release cycles for software are getting shorter, as the market becomes more and more competitive. However, to avoid this the companies are performing compliance testing through third party vendor. Companies hire teams for doing the compliance testing before releasing the software or application.

An increasing number of enterprises are investing significantly to implement enterprise mobility to improve their business processes. Moreover, enterprises seeking mobile applications that provide mobility is expected to drive growth of the compliance testing solution. Also, enterprises prefer high security features from applications because of the sensitive data stored in their devices, which is a primary area that testers need to focus on with regard to business applications.

Use of smartphones is increasing for resolving different queries or gathering information or finding solutions for meeting various requirements results in growing demand for such devices. Thereby driving the demand for mobile applications, due to this the demand for compliance testing solution is increasing.

Banks are adopting applications for enabling better accessibility options for the customers, while fitness applications and online shopping applications connected with smart devices are also gaining popularity. With a greater variety of applications, users can choose an application based on its functionality. Testers are therefore expected to test an application according to the user feedback related to network issues, GUI, etc.

Increasing use of m-Commerce distribution channel is estimated to increase in the region with the increasing number of mobile device users opting for online wallet and e-Payment features. Developers are offering advanced testing for mobile applications used for the purpose of banking and financial services. These advanced applications go through compliance testing to ensure data security and eliminate the threats of cyber-attacks and privacy breaches.

Such features are estimated to boost the adoption of compliance testing solution by vendors in the region. As a result, improved testing processes are required to be performed to ensure enhanced and secure security and privacy of users.

Cloud service providers are playing a significant part in this ever-changing technological world. With the continuous advancements in cloud security, more and more enterprises are going in for cloud services, be it software-as-a-service (SaaS) or cloud-based data storage. Cloud service providers are expected to create a huge opportunity for compliance testing solution vendors, in terms of providing cost-effective solutions and services to customers.

Cloud service providers can also assist compliance testing solution vendors in the region to expand their business to different regional markets without expanding their physical distribution channel.

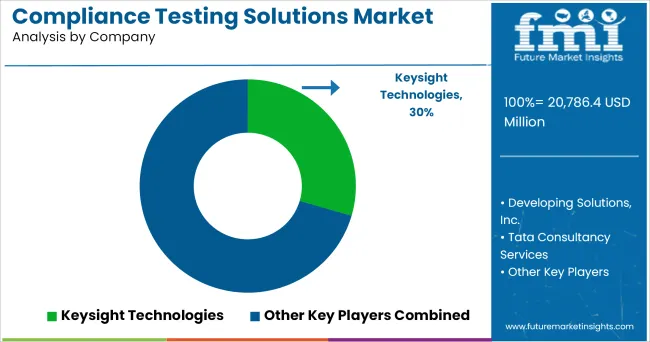

Some of the leading Compliance Testing Solutions providers include Developing Solutions, Inc., Tata Consultancy Services, SNIA, Keysight Technologies, Microsoft Corporation, Spirent Communications, among others.

These vendors are adopting different strategies for enhancing the customer base and their product offering locally and globally. Companies are also investing millions of dollars into research and development activities to fulfill the unmet needs of their customers. Furthermore, many companies are focusing on inorganic strategies by acquiring small and mid-sized organizations present in this market.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global compliance testing solutions market is estimated to be valued at USD 20,786.4 million in 2025.

The market size for the compliance testing solutions market is projected to reach USD 53,914.5 million by 2035.

The compliance testing solutions market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in compliance testing solutions market are compliance testing solutions, cloud-based, on-premises, services, integration & implementation, consulting services and support & maintenance.

In terms of enterprise size, large enterprises segment to command 61.3% share in the compliance testing solutions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compliance Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Compliance Monitoring Devices Market Trends and Forecast 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Compliance Automation Tools Market – Automating Regulatory Compliance

Compliance and Traceability Solution Market – AI-Powered Regulations

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

5PL Solutions Market

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA