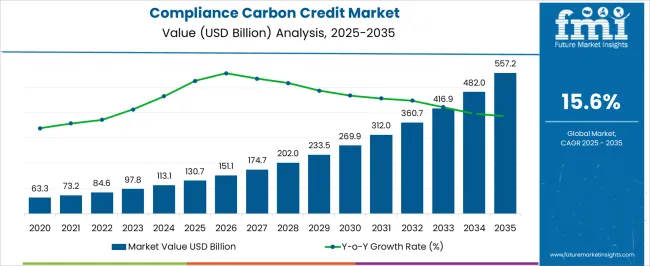

The compliance carbon credit market achieves USD 130.7 billion in 2025 and is expected to reach USD 557.2 billion by 2035, growing at a CAGR of 15.6%. From 2021 to 2025, the market is projected to grow from USD 63.3 billion to USD 130.7 billion, with annual increments reaching USD 73.2 billion, USD 84.6 billion, USD 97.8 billion, and USD 113.1 billion. This phase is driven by increasing global regulatory focus on emissions reduction, with significant policy shifts and the rise of mandatory carbon trading mechanisms.

As industries and governments work toward meeting emissions targets, the market experiences rapid growth, driven by both the demand for carbon credits and the tightening of carbon allowances. Between 2026 and 2030, the market is expected to strengthen from USD 130.7 billion to USD 233.5 billion, passing through USD 151.1 billion, USD 174.7 billion, USD 202.0 billion, and finally reaching USD 233.5 billion. The period reflects the accelerated adoption of carbon credit systems by businesses seeking compliance with new regulations and shifting corporate sustainability strategies.

By 2035, the market is expected to reach USD 557.2 billion, progressing through intermediate values of USD 269.9 billion, USD 312.0 billion, USD 360.7 billion, USD 416.9 billion, and USD 482.0 billion. This final phase marks a significant market acceleration, driven by stricter government regulations, the global shift toward a low-carbon economy, and the further integration of carbon trading markets across industries, indicating robust growth in both developed and emerging economies.

| Metric | Value |

|---|---|

| Compliance Carbon Credit Market Estimated Value in (2025 E) | USD 130.7 billion |

| Compliance Carbon Credit Market Forecast Value in (2035 F) | USD 557.2 billion |

| Forecast CAGR (2025 to 2035) | 15.6% |

In the carbon trading market, the compliance carbon credit market holds a share of approximately 15-20%. This is primarily driven by government-enforced cap-and-trade systems, where companies are mandated to buy carbon credits to meet their emission reduction targets. The renewable energy market accounts for around 10-15%, with renewable energy projects such as solar, wind, and hydro generating carbon credits as they reduce CO2 emissions. These credits are then traded within the compliance market to help organizations meet regulatory requirements. The environmental services market contributes about 8-12%, as consultants and verification bodies play a vital role in certifying carbon credits and ensuring compliance with global carbon offset standards.

Within the government regulatory market, the compliance carbon credit market represents around 20-25%, driven by national and international regulations that require industries to participate in carbon credit systems. This includes both voluntary and mandatory programs that are crucial for achieving emission reduction targets. The corporate sustainability and ESG market is expected to add around 10-15% as businesses increasingly turn to carbon credits to meet their environmental, social, and governance (ESG) goals.

The compliance carbon credit market is expanding steadily, driven by the tightening of emission reduction targets under international climate agreements and the enforcement of carbon pricing mechanisms. Governments and regulatory bodies across multiple regions are implementing cap-and-trade programs and compliance schemes, compelling industries to offset emissions through certified credits.

This structured approach ensures a transparent and verifiable mechanism for achieving sustainability goals while stimulating investments in renewable energy, reforestation, and low-carbon technologies. The market is currently characterized by increasing liquidity, greater participation from heavy-emitting sectors, and the integration of carbon credits into corporate ESG strategies.

Future growth is expected to be reinforced by broader geographic adoption of compliance frameworks, rising carbon prices, and enhanced monitoring and reporting systems. As carbon neutrality becomes a binding commitment rather than a voluntary initiative, compliance credits are positioned as a critical tool in achieving measurable emission reductions and fostering a low-carbon economy on a global scale.

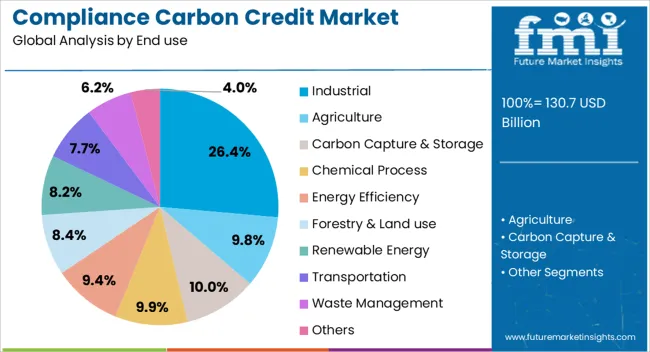

The compliance carbon credit market is segmented by end use, and geographic regions. By end use, compliance carbon credit market is divided into Industrial, Agriculture, Carbon Capture & Storage, Chemical Process, Energy Efficiency, Forestry & Land use, Renewable Energy, Transportation, Waste Management, and Others. Regionally, the compliance carbon credit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industrial segment accounts for approximately 26.4% of the compliance carbon credit market, driven by stringent emission reduction requirements across manufacturing, energy, and heavy industry sectors. The high share reflects the sector’s substantial contribution to greenhouse gas emissions and its consequent obligation to participate in regulated carbon markets.

Compliance frameworks mandate industrial operators to purchase credits to offset emissions exceeding their assigned caps, thereby creating consistent demand for certified carbon offsets. The segment’s growth is also influenced by the rising cost of carbon allowances, which incentivizes investment in energy-efficient technologies and cleaner production methods.

Industries with integrated sustainability strategies increasingly leverage compliance credits to meet regulatory requirements while aligning with corporate environmental commitments. With ongoing policy reinforcement, technological advancements in emissions monitoring, and cross-border carbon trading collaborations, the industrial segment is expected to sustain its pivotal role in driving demand within the compliance carbon credit market over the forecast period.

The compliance carbon credit market is expanding as governments, industries, and corporations prioritize meeting regulatory emission reduction targets. Demand is driven by mandatory carbon reduction targets, cap-and-trade systems, and carbon offset programs across sectors like energy, manufacturing, and transportation. Challenges include regulatory complexities, fluctuating carbon credit prices, and limited market transparency. Opportunities exist in expanding market participation, blockchain integration for transaction transparency, and carbon credit trading platforms. Trends highlight market-based mechanisms, cross-border carbon credit exchanges, and stricter emission regulations.

Governments globally are tightening emissions regulations, compelling businesses across various sectors to purchase carbon credits to meet their reduction obligations. Compliance credits are in high demand due to mandatory targets set by international agreements, national regulations, and corporate climate commitments. High-emission industries such as energy, transportation, and manufacturing are particularly focused on buying carbon credits to comply with their legal obligations while managing their environmental impact. This growing trend is further intensified by international initiatives, including carbon taxes and emissions cap-and-trade systems. As these regulations become stricter, the compliance carbon credit market is positioned as a vital element in helping industries comply with emission reduction laws, ensuring companies can meet their environmental targets and mitigate potential legal penalties.

The compliance carbon credit market faces several challenges, including fluctuating prices and supply-demand imbalances. Regulatory complexities, along with varying international emission standards, make developing consistent credit structures difficult. The process of verifying and certifying carbon credit projects is costly and requires extensive audits and third-party validation. Many projects experience delays in certification due to stringent requirements. Certain countries impose specific trade regulations, tariffs, and allocation rules, further complicating market participation. These factors contribute to uncertainties in the market. As a result, buyers are increasingly relying on suppliers who offer verified, traceable carbon credits with transparent validation processes to ensure regulatory compliance and avoid the risks associated with uncertified credits in the carbon trading market.

Blockchain technology presents significant opportunities for enhancing transparency, traceability, and fraud prevention in carbon credit transactions. By integrating blockchain into the carbon credit market, participants can benefit from more secure, efficient, and transparent trading practices. The development of global carbon trading platforms and cross-border exchanges also facilitates market growth by improving access and liquidity for both buyers and sellers. As international frameworks and carbon credit policies align, there is increased potential for a unified, global carbon credit market. Carbon credit buyers, both in developed and developing markets, are actively seeking trusted, cost-effective solutions to meet their regulatory obligations. This opens up avenues for new market entrants that can provide innovative, verified carbon credits to meet growing demand.

The carbon credit market is witnessing a trend toward digitization, with online trading platforms offering greater accessibility and real-time pricing transparency. This digital shift enables more efficient and streamlined transactions, allowing businesses to access and purchase carbon credits easily. Regulatory integration is also becoming more pronounced as industries adopt stricter emissions reduction strategies and compliance measures.

Corporate initiatives focused on managing emissions are driving demand for carbon credits, as companies seek to meet regulatory targets and bolster their environmental performance. Collaborative efforts between governments, NGOs, and private entities are also contributing to the availability of high-quality credits. Suppliers that provide transparent, verifiable, and cost-effective carbon credit solutions are well-positioned to lead in this evolving and dynamic market.

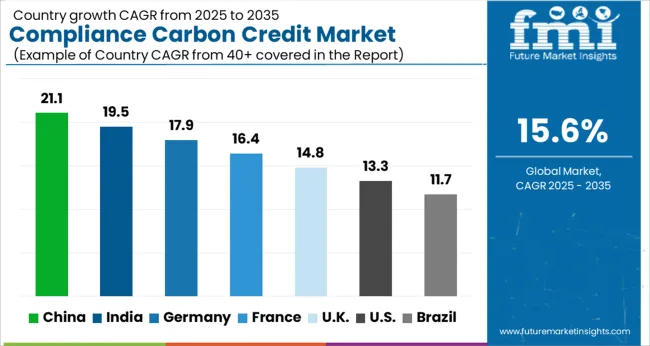

| Country | CAGR |

|---|---|

| China | 21.1% |

| India | 19.5% |

| Germany | 17.9% |

| France | 16.4% |

| UK | 14.8% |

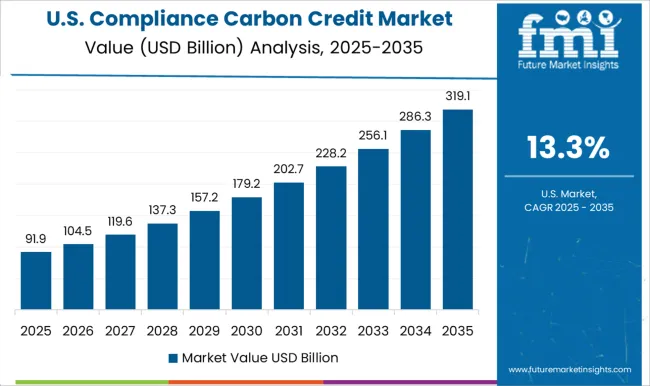

| USA | 13.3% |

| Brazil | 11.7% |

The global compliance carbon credit market is projected to grow at a CAGR of 15.6% from 2025 to 2035. China leads with a 21.1% CAGR, followed by India at 19.5% and Germany at 17.9%. The market’s growth is driven by regulatory pressures in OECD nations and increasing carbon credit adoption in BRICS countries. The UK and USA also show significant growth, driven by tightening regulations and increasing investments in carbon reduction technologies. With a strong regulatory environment, participation from major industrial sectors, and a rising focus on clean technologies, the market is poised for continued expansion globally. The analysis includes over 40+ countries, with the leading markets detailed below.

The compliance carbon credit market in China is projected to grow at a remarkable CAGR of 21.1% from 2025 to 2035, driven by extensive infrastructure development, urbanization, and industrial growth. The country is a global leader in carbon trading, driven by its ambitious climate goals and the government’s strong focus on reducing carbon emissions. China’s emissions trading system (ETS) is expanding rapidly, with increasing participation from industries such as manufacturing, energy, and utilities. The government’s tightening of regulations on carbon emissions is encouraging more companies to invest in carbon credits to comply with regulations. The growth of green energy and technology sectors is also boosting demand for carbon credits. Local and international players are increasingly active in the market, with government policies that favor green infrastructure and cleaner technologies.

The compliance carbon credit market in India is expected to grow at a CAGR of 19.5% over the next decade, supported by government initiatives such as the Perform, Achieve, and Trade (PAT) scheme and national renewable energy targets. The market’s growth is driven by India’s commitment to reducing carbon emissions under international climate agreements. The participation of the industrial and power sectors is crucial, as both sectors represent a significant portion of India’s carbon footprint. Regulatory pressure to meet emission targets is increasing, prompting companies to seek carbon credits for compliance. India’s rapidly developing renewable energy infrastructure further drives the market, as renewable energy credits are integrated into the carbon credit trading system.

Germany is expected to experience a CAGR of 17.9% in the compliance carbon credit market by 2035. As one of the leading nations in Europe for carbon reduction, Germany’s emissions trading scheme (ETS) has been a key driver of the market. The regulatory landscape continues to tighten, prompting industries such as manufacturing, transport, and energy to seek compliance through carbon credits. Germany’s focus on the decarbonization of energy sectors is creating significant demand for carbon credits, particularly from heavy industries and utilities. In addition, the country’s robust financial markets are making it an attractive hub for trading carbon credits, both within the EU and internationally.

The UK market is forecast to grow at a CAGR of 14.8% from 2025 to 2035, driven by stringent regulatory targets under the Climate Change Act and the Carbon Pricing Floor mechanism. The UK continues to develop its national carbon market and is also an active participant in the EU ETS. Companies in industries like energy, manufacturing, and transport are increasingly turning to carbon credits to meet their emission reduction targets. The growing role of renewable energy, particularly offshore wind, and the country’s leadership in green finance are driving the demand for compliance credits.

The USA compliance carbon credit market is expected to grow at a CAGR of 13.3% from 2025 to 2035, driven by a combination of state-level cap-and-trade systems and national initiatives. California’s carbon market, one of the largest in the world, plays a pivotal role in shaping policies and serves as a model for other states looking to implement similar systems. The Biden administration’s federal carbon pricing mechanism is expected to accelerate demand for carbon credits as states move toward a unified national framework. This push for carbon reduction at the federal level will compel more industries, particularly energy and transportation, to seek carbon credits to comply with new emission regulations. The private sector is becoming increasingly proactive in addressing emissions reduction goals, further driving demand for compliance credits.

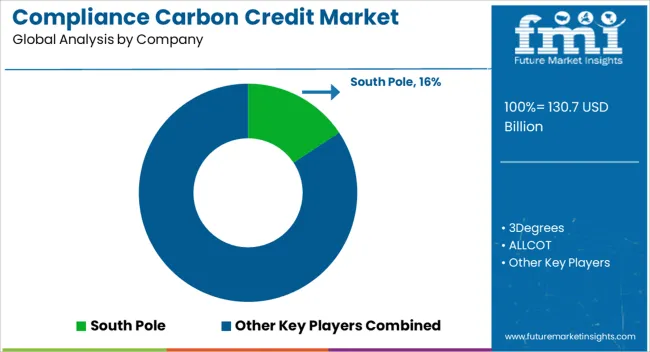

The compliance carbon credit market is highly competitive, with key players offering various services in carbon credit management, verification, and offset purchasing. South Pole holds a prominent position, providing a wide range of verified carbon projects and solutions tailored for large corporations and governments seeking to meet emission reduction targets. 3Degrees competes by offering customized carbon offset services, focusing on aligning client goals with appropriate credit types across diverse industries.

ALLCOT serves as a bridge between carbon project developers and companies looking for verified credits, promoting transparency and ease in transactions. Atmosfair specializes in air travel carbon offsets, offering airline-specific solutions that cater to both passengers and corporations. CarbonClear and ClimeCo focus on managing carbon portfolios and ensuring regulatory compliance for corporate clients, offering services that go beyond simple credit purchases.

Climate Impact Partners stands out by offering integrated solutions with an emphasis on creating verified carbon credit portfolios across various credit standards, ensuring clients have access to high-quality credits. Companies differentiate themselves by their service offerings and niche positioning. South Pole and 3Degrees focus on providing end-to-end solutions, assisting clients with not only purchasing credits but also managing their carbon offset strategies. VERRA and Ecosecurities emphasize their rigorous credit certification and verification processes, ensuring trust and credibility in the carbon credits traded. Shell and WGL Holdings combine their energy expertise with carbon offset programs, targeting industries in need of energy-linked credits.

TerraPass and The Carbon Collective Company cater to both businesses and individual consumers by offering straightforward paths to purchase verified credits, appealing to those looking to support emission reduction efforts in a simple and accessible manner. Product brochures from these companies highlight tailored carbon credit management plans, access to verified carbon projects, and comprehensive reporting tools. South Pole, 3Degrees, and Climate Impact Partners focus on large-scale, custom solutions, while VERRA and Ecosecurities emphasize their robust verification processes. Shell and TerraPass promote energy-backed credits, while others provide seamless access to verified carbon offset projects.

| Item | Value |

|---|---|

| Quantitative Units | USD 130.7 Billion |

| End use | Industrial, Agriculture, Carbon Capture & Storage, Chemical Process, Energy Efficiency, Forestry & Land use, Renewable Energy, Transportation, Waste Management, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | South Pole, 3Degrees, ALLCOT, Atmosfair, CarbonClear, ClimeCo, Climate Impact Partners, Ecosecurities, Green Mountain Energy Company, Shell, Sterling Planet Inc., TerraPass, The Carbon Collective Company, The Carbon Trust, VERRA, and WGL Holdings, Inc. |

| Additional Attributes | Dollar sales by application type (detergents, glass manufacturing, textiles, paper & pulp), production method (natural, synthetic), and purity level (technical grade, industrial grade). Demand is driven by industrial expansion, detergent manufacturing, and sustainable practices in textile production. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, with increasing industrialization, demand for eco-friendly products, and raw material sourcing innovation. |

The global compliance carbon credit market is estimated to be valued at USD 130.7 billion in 2025.

The market size for the compliance carbon credit market is projected to reach USD 557.2 billion by 2035.

The compliance carbon credit market is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in compliance carbon credit market are industrial, agriculture, carbon capture & storage, chemical process, energy efficiency, forestry & land use, renewable energy, transportation, waste management and others.

In terms of , segment to command 0.0% share in the compliance carbon credit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compliance Testing Solutions Market Size and Share Forecast Outlook 2025 to 2035

Compliance Monitoring Devices Market Trends and Forecast 2025 to 2035

Compliance Automation Tools Market – Automating Regulatory Compliance

Compliance and Traceability Solution Market – AI-Powered Regulations

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Aviation Compliance Monitoring Software Market Size and Share Forecast Outlook 2025 to 2035

Quality and Compliance Management Solution Market Forecast and Outlook 2025 to 2035

Legal, Risk and Compliance Solution Market Forecast and Outlook 2025 to 2035

Enterprise AI Governance and Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

AI-Driven CRE Compliance Tools – Navigating Regulatory Challenges

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA