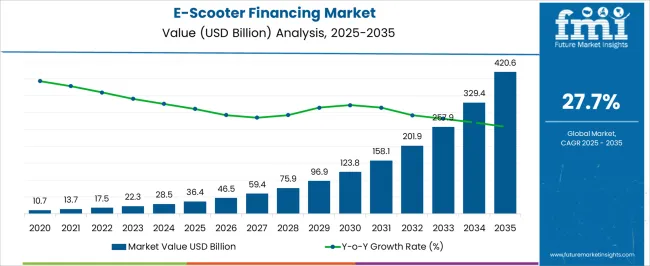

The E-Scooter Financing Market is estimated to be valued at USD 36.4 billion in 2025 and is projected to reach USD 420.6 billion by 2035, registering a compound annual growth rate (CAGR) of 27.7% over the forecast period.

| Metric | Value |

|---|---|

| E-Scooter Financing Market Estimated Value in (2025 E) | USD 36.4 billion |

| E-Scooter Financing Market Forecast Value in (2035 F) | USD 420.6 billion |

| Forecast CAGR (2025 to 2035) | 27.7% |

The e-scooter financing market is advancing rapidly, supported by the growing adoption of shared and personal e-mobility solutions in urban centers worldwide. Industry publications and financial sector updates have emphasized the increasing affordability challenges of e-scooters, which has fueled demand for structured financing solutions. Banks, non-banking financial companies, and fintech platforms have been expanding offerings tailored to two-wheeler electrification, aligning with broader sustainability and decarbonization targets.

Rising government incentives for electric mobility adoption and supportive regulatory frameworks have encouraged both consumers and fleet operators to seek financing assistance for electric scooters. Additionally, the evolution of consumer credit assessment tools and digital lending platforms has enhanced financing accessibility, particularly for younger and first-time buyers.

Looking ahead, the market is expected to benefit from the convergence of e-mobility adoption, financial inclusion strategies, and the emergence of subscription-based or pay-as-you-go financing models. Segmental growth is anticipated to be led by electric kick scooters, banks as primary providers, and loans as the dominant financing purpose due to their scale, accessibility, and structured repayment advantages.

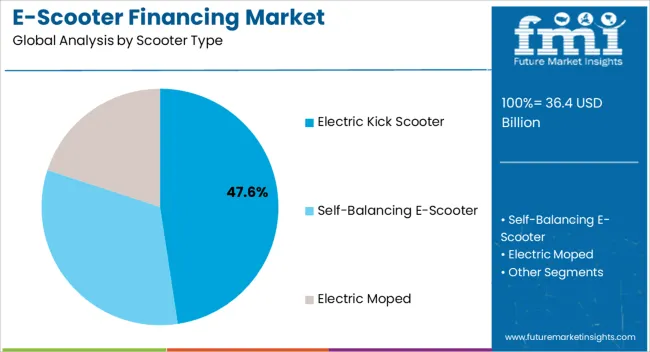

The Electric Kick Scooter segment is projected to contribute 47.60% of the e-scooter financing market revenue in 2025, establishing itself as the leading scooter type. This segment’s dominance has been driven by the rising popularity of lightweight, foldable, and urban-friendly scooters, which are particularly suited for short-distance commuting.

Urban mobility studies have noted that electric kick scooters are increasingly favored by younger demographics and city dwellers for first- and last-mile connectivity. Their relatively lower upfront cost compared to heavy-duty e-scooters has encouraged a surge in financing demand, as consumers seek flexible repayment options without high initial expenditure.

Additionally, the expansion of shared mobility operators deploying kick scooters has influenced consumer behavior, leading to higher private ownership demand. The segment’s growth is further supported by infrastructure readiness, including charging solutions compatible with residential and commercial environments. These factors have positioned electric kick scooters as the most financed type within the e-scooter market.

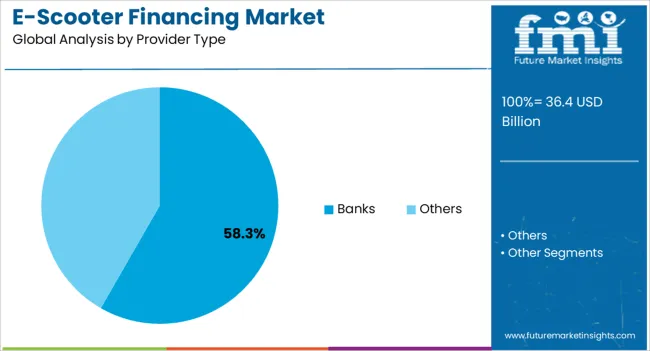

The Banks segment is projected to account for 58.30% of the e-scooter financing market revenue in 2025, maintaining its leadership position among provider types. This dominance has been attributed to the strong trust factor and established financial networks that banks provide.

Banks have been able to leverage their extensive branch and digital platforms to extend credit for e-scooters, supported by lower interest rates compared to non-banking entities. Press releases and financial disclosures have highlighted that banks have increasingly aligned financing products with green mobility programs, offering preferential terms for electric vehicle adoption.

The ability to provide structured loan products, credit score-based approvals, and bundled insurance services has further strengthened banks’ role in this market. Moreover, collaborations between banks and e-scooter manufacturers have enhanced point-of-sale financing, improving consumer affordability. With ongoing policy support for electric mobility financing, banks are expected to remain the primary channel for e-scooter financing in the foreseeable future.

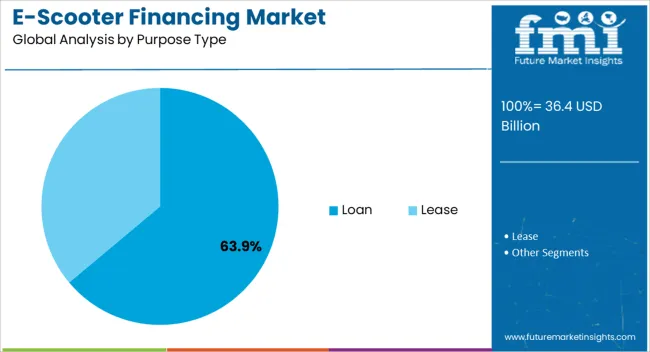

The Loan segment is projected to contribute 63.90% of the e-scooter financing market revenue in 2025, establishing itself as the leading purpose type. Growth of this segment has been fueled by consumer preference for ownership models over leasing or rental options.

Loans have provided consumers with structured repayment terms, enabling affordability while ensuring long-term ownership benefits. Industry financial updates have noted that repayment flexibility, competitive interest rates, and bundling of insurance and after-sales services have made loans the most attractive financing mechanism for e-scooters.

Additionally, government-backed credit programs for electric vehicle adoption have further incentivized loan-based purchases. The growing middle-class population and increased credit penetration in emerging markets have also supported loan adoption for e-scooters. As consumers continue to seek financial security and asset ownership, the loan segment is expected to retain its leadership in the e-scooter financing market, supported by favorable financial product innovation and policy-driven incentives.

The e-scooter financing demand is estimated to grow at a CAGR of 29% between 2025 and 2035 in comparison with a CAGR of around 26% registered between 2020 to 2025. Earlier, traditional procedures in the vehicle financing sector were extremely complicated and time-consuming. Manually processing the application used to take many days. Thanks to digitization, the identical procedure now just takes a few minutes. As a result, customers can simply take advantage of rapid and painless transactions.

Electric scooters are more popular than traditional scooters since they are more environmentally friendly. They have LED lights that power the light and use a little amount of energy. These scooters have additional benefits such as agility, versatility, eco-friendliness, and ease of maneuvering in congested places, all of which have increased the sales of electric scooters.

From investments and portfolios to salaries and purchases, cryptocurrency is already a part of many regular financial discussions. Investing in cryptocurrencies has grown in popularity as a result of the possibility of big financial returns and the growing number of virtual currencies to choose from. Bitcoin, Bitcoin Cash and Ethereum are starting to be accepted in an increasing number of stores.

Purchasing an e-scooter using cryptocurrency is becoming possible in 2025. While there aren't as many alternatives for buying an e-scooter with crypto as there are for buying an e-scooter with cash, it is feasible to buy an e-scooter with crypto. Blockchain with related technologies is set to redefine the automotive industry and how consumers purchase, insure, and use vehicles. Through these technologies, the adoption of e-scooters is on the rise, benefiting the original equipment manufacturers, suppliers, government institutions/ non-banking financials.

The fintech industry is currently undergoing a significant shift. Customers now have easier access to credit, making purchases and transactions easier than ever. Because of digitization, open API, and machine learning integration, the fintech sector has experienced a revolution.

The e-scooter loan sector is being transformed by machine learning. E-scooter finance lenders who are able to implement artificial intelligence are able to attract more consumers while taking less risk. When it comes to streamlining finance and loan processes like credit scoring, risk management, and compliance reporting, banks see machine learning as a natural fit.

E-scooter finance companies are focusing on providing better-quality services to their end users, and strengthening existing products and services by implementing technologies such as artificial intelligence, business analytics, and blockchain. Thus, technological advancements are driving growth in the e-scooter financing market.

Rising Awareness Regarding E-scooter Payment Plans in Germany is expected to Boost Sales

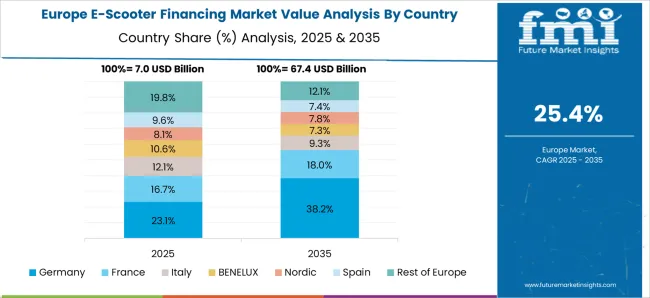

Germany is predicted to offer an absolute $ opportunity of USD 420.6 billion by the end of 2035. Many cities in Germany are adopting electric scooters to reduce their carbon footprint and increase mobility options. The German government has implemented rigorous rules and restrictions on carbon emissions caused by vehicles.

These laws are compelling e-scooter manufacturers to develop low-emission vehicles, resulting in the widespread adoption of electric vehicles and a rise in the number of charging stations. In addition, various e-scooter financing companies are present in Germany that provide integrated e-scooter financing services by leveraging digital technologies and advanced analytics.

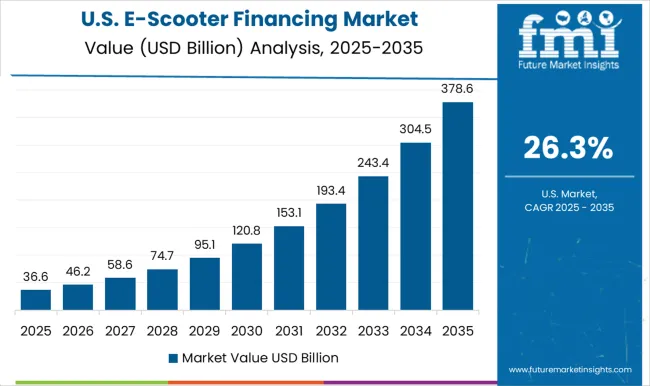

High Demand for Smart E-scooters in the United States is projected to Augment Growth

The demand for e-scooter financing in the United States is expected to account for nearly 69% of the North American market share by 2035. Electronic scooters are gaining popularity in the country and are quickly becoming preferable modes of transportation.

There is rapid adoption of shared e-scooters in the United States to cut carbon emissions. Electric scooters are becoming more common on university campuses, parks, and other public spaces as a result of stricter emission laws in the country.

Smart charging stations' accessibility and growing use of micro-mobility in logistics applications have resulted in high demand for smart e-scooters. Consumers in the United States are availing of e-scooter financing solutions from banks and non-banking financial companies, which is expected to drive the market in the forthcoming years.

Rising Preference for Smart Mobility Solutions in India is poised to Spur Sales of E-scooter Financing

Sales in India are estimated to grow at an impressive rate of around 37% CAGR between 2025 and 2035. The government of India has adopted a number of steps to reduce vehicle pollution, including tax exemptions, purchase rebates, and financial incentives by providing subsidies for electric vehicle customers.

Non-banking financial companies are gaining popularity in the vehicle financing sector in semi-urban and rural India. They are also tying up with scooter manufacturers to provide affordable electric scooter finance options for buyers.

E-scooter Payment Plans for Electric Mopeds are Anticipated to Gain Traction

Based on the scooter type, the electric moped segment is expected to offer an absolute $ opportunity of USD 420.6 billion by the end of 2035. These scooters are convenient and accessible modes of transportation and use electricity, which is typically less polluting than gasoline or other fossil fuels.

Rising petroleum cost is the most critical factor responsible for the adoption of high-speed electric scooters. Electric two-wheelers have cheap running costs and more efficiency compared to traditional vehicles. Electronic systems are more efficient and long-lasting than mechanical systems since there is less friction between them.

Sales of E-scooter Financing Plans Across Non-Banking Finance Corporation are assumed to Increase

In terms of provider type, demand in non-banking finance corporations and credit unions is likely to increase by 13.4X between 2025 to 2035. Electric scooter manufacturers are partnering with non-banking financial corporations to deliver e-scooter loans by providing various e-scooter payment plans.

Non-banking finance corporations are improving their services by providing consumers with low-interest rates, flexible tenure options, and extended EMI alternatives with minimal documentation. With easy financing options available for customers, the adoption of electric scooters is rapidly increasing. NBFCs are also focusing on developing innovative products and services powered by advanced technologies.

Consumers are Preferring Lease for E-scooter Financing

By purpose type, demand in the lease segment is anticipated to grow at a CAGR of 31% during the forecast period. Leasing services are available for both new and used scooters.

E-scooter leasing entails borrowing a scooter from a dealership for a set period of time. Customers can also receive a better scooter at a reduced cost through leasing, and they can change or upgrade their vehicles without any hassle.

In the e-scooter leasing sector, the growing trend of upgradation facilities and personalized services offered by auto financers are poised to boost sales. Auto leasing companies are investing in digitization technologies such as blockchain to improve the customer experience and increase profit.

E-scooter financing providers are building strategies such as product innovation to improve their services to meet the growing demand. Players are collaborating with technology professionals to gain a competitive edge.

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 36.4 billion |

| Projected Market Valuation (2035) | USD 420.6 billion |

| Value-based CAGR (2025 to 2035) | 27.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Segments Covered | Scooter Type, Provider Type, Purpose Type, Region |

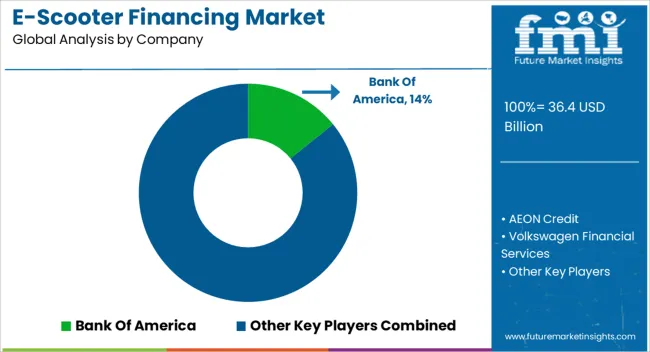

| Key Companies Profiled | Bank of America; AEON Credit; Volkswagen financial services; HDB Financial Services; IDFC First Bank; Klarna; Katapult; greaves finance; L&T Finance; Hyundai Capital; Affirm |

| Customization & Pricing | Available upon Request |

The global e-scooter financing market is estimated to be valued at USD 36.4 billion in 2025.

The market size for the e-scooter financing market is projected to reach USD 420.6 billion by 2035.

The e-scooter financing market is expected to grow at a 27.7% CAGR between 2025 and 2035.

The key product types in e-scooter financing market are electric kick scooter, self-balancing e-scooter and electric moped.

In terms of provider type, banks segment to command 58.3% share in the e-scooter financing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asset Financing Platform Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA