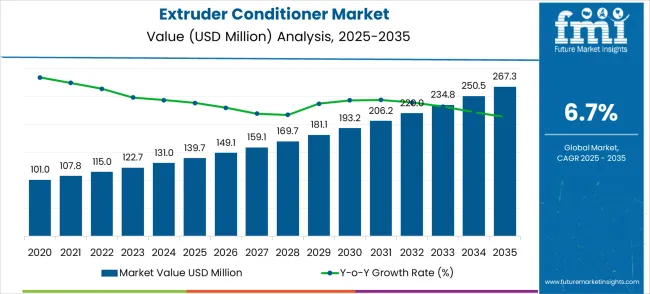

The global extruder conditioner market is projected to reach USD 267.3 million by 2035, recording an absolute increase of USD 127.6 million over the forecast period. The market is valued at USD 139.7 million in 2025 and is set to rise at a CAGR of 6.7% during the assessment period. The overall market size is expected to grow by nearly 1.91 times during the same period, supported by increasing demand for efficient material processing solutions across feed manufacturing, biomass processing, and food production industries. Market expansion is constrained by high capital equipment costs and the technical complexity required for specialized applications.

Between 2025 and 2030, the extruder conditioner market is projected to expand from USD 139.7 million to USD 193.2 million, resulting in a value increase of USD 53.5 million, which represents 41.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for advanced material conditioning solutions in feed processing facilities, product innovation in single-shaft paddle technology and heat treatment systems, and expanding applications across biomass pelletizing, food processing, and agricultural material preparation sectors. Companies are establishing competitive positions through investment in conditioning technology development, strategic processing equipment partnerships, and market expansion across feed manufacturers, biomass processors, and specialized material handling facilities.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 139.7 million |

| Market Forecast Value (2035) | USD 267.3 million |

| Forecast CAGR (2025-2035) | 6.7% |

The extruder conditioner market has been positioned as a critical subset within broader industrial equipment categories, where its share is calculated at around 7.6% of the food processing equipment market, 9.2% of the animal feed equipment market, 5.1% of the plastic extrusion machinery market, 4.4% of the agricultural machinery market, and 3.8% of the chemical processing equipment market. Taken together, the contribution of the extruder conditioner market across these parent industries is estimated at roughly 30.1%.

The extruder conditioner market grows by enabling processors to achieve optimal material conditioning that improves product quality while reducing energy consumption and processing time across diverse manufacturing applications. Demand drivers include expanding feed industry production requiring consistent material conditioning for pellet quality improvement, increasing biomass and biofuel processing driving adoption of efficient conditioning systems for renewable energy applications, and growing food processing automation where extruder conditioners support product consistency and quality control. Priority segments include feed manufacturing plants and biomass processing facilities, with China and India representing key growth geographies due to expanding livestock production and growing renewable energy initiatives. Market growth faces constraints from high initial equipment investments and the need for specialized technical expertise to optimize conditioning processes for different materials.

The Extruder Conditioner market is entering a phase of steady growth, driven by demand for efficient material processing, expanding agricultural production, and evolving sustainability standards across processing industries. By 2035, these pathways together can unlock USD 380-480 million in incremental revenue opportunities beyond baseline growth.

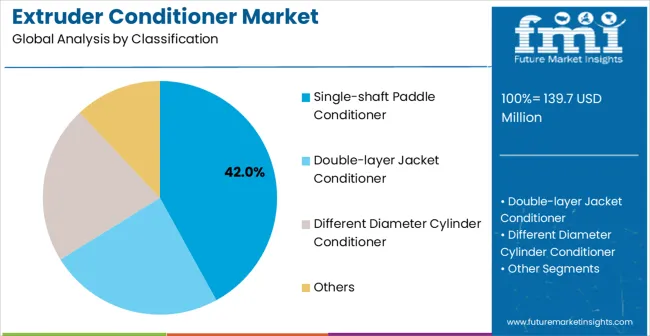

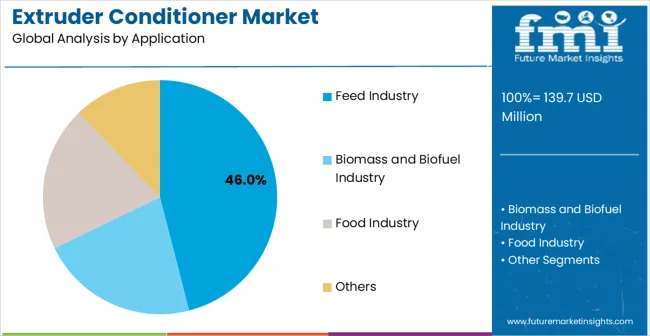

The market is segmented by product type, application, end-user, capacity range, and region. By product type, the market is divided into single-shaft paddle conditioner, double-layer jacket conditioner, different diameter cylinder conditioner, and others. Based on application, the market is categorized into Feed Industry, Biomass and Biofuel Industry, Food Industry, and Other applications. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

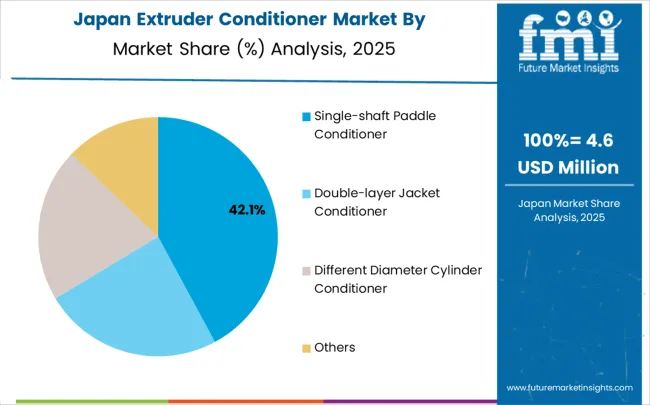

Single-shaft paddle conditioner is projected to account for a substantial portion of 42% of the extruder conditioner market in 2025. This share is supported by superior mixing efficiency characteristics and versatile application compatibility. Single-shaft paddle conditioner technology provides uniform material conditioning that enables processors to achieve consistent moisture and temperature distribution while maintaining optimal processing throughput rates. The segment enables stakeholders to benefit from simplified maintenance requirements and enhanced operational reliability for diverse material conditioning applications.

The dominance of single-shaft paddle conditioners stems from their proven effectiveness across multiple material types and processing conditions. These systems feature robust paddle designs that provide thorough mixing action while generating the heat and moisture distribution necessary for optimal material conditioning. The technology particularly excels in feed processing applications where consistent pellet quality depends on uniform moisture content and temperature conditioning throughout the material mass. Single-shaft designs offer advantages in terms of maintenance accessibility, with fewer moving parts compared to multi-shaft alternatives, reducing downtime and service requirements.

Furthermore, single-shaft paddle conditioners demonstrate excellent scalability, accommodating production capacities from small-scale operations to large industrial facilities. The technology enables precise control over conditioning parameters including retention time, steam injection, and paddle speed, allowing processors to optimize conditions for specific material characteristics and end product requirements. The segment benefits from ongoing technological improvements in paddle design, wear-resistant materials, and automated control systems that enhance conditioning performance while reducing operational costs.

Key factors supporting single-shaft paddle conditioner adoption:

Feed industry applications are expected to represent the largest share of 46% of the extruder conditioner applications in 2025. This dominant share reflects the critical need for material conditioning in feed processing that appeals to feed manufacturers and agricultural processing companies. The segment provides essential conditioning support for pellet production, feed quality improvement, and nutritional value enhancement in animal feed manufacturing. Growing global meat consumption and livestock production drives adoption in this application area.

The feed industry segment's dominance stems from the fundamental role of material conditioning in producing high-quality animal feed pellets that meet nutritional standards and durability requirements. Extruder conditioners enable feed manufacturers to achieve optimal moisture content and temperature distribution throughout feed ingredients, ensuring proper gelatinization of starches and protein denaturation that improves digestibility and nutritional availability. The technology is particularly crucial in aquaculture feed production, where pellet water stability and nutrient retention directly impact fish and shrimp growth rates and feed conversion efficiency.

Furthermore, the segment benefits from increasing regulatory requirements for feed safety and quality standards, driving feed manufacturers to invest in advanced conditioning equipment that ensures consistent product specifications and compliance with food safety regulations. The rising global demand for protein sources, particularly in emerging economies, creates sustained growth opportunities for feed conditioning technology as producers expand capacity to meet livestock, poultry, and aquaculture production requirements. Additionally, the trend toward specialized and premium feed formulations, including organic and medicated feeds, requires precise conditioning control that extruder conditioners provide, enabling manufacturers to maintain ingredient integrity while achieving optimal processing parameters for enhanced animal performance and feed efficiency.

Feed Industry segment advantages include:

Market drivers include expanding global feed production requiring efficient conditioning systems for pellet quality and nutritional value optimization, increasing biomass processing for renewable energy applications driving demand for specialized conditioning equipment, and growing food processing automation where extruder conditioners support product consistency and manufacturing efficiency. These drivers reflect direct processing outcomes including improved product quality, enhanced energy efficiency, and reduced processing costs across multiple manufacturing applications.

Market restraints encompass high capital equipment costs limiting adoption among smaller processing facilities, technical complexity requiring specialized operator training and process optimization expertise, and material-specific conditioning requirements necessitating customized equipment configurations that increase investment costs. Additional constraints include maintenance complexity for specialized conditioning systems and the need for comprehensive process integration that affects total system implementation costs.

Key trends show adoption accelerating in China and India where expanding livestock production and renewable energy initiatives drive conditioning equipment demand, while technology evolution toward automated control systems and energy-efficient designs enables broader operational optimization. Innovation focuses on digitalization and predictive maintenance capabilities that reduce operational costs and improve system reliability. Market thesis faces risk from alternative processing technologies that could provide similar conditioning results with different equipment approaches or operational requirements.

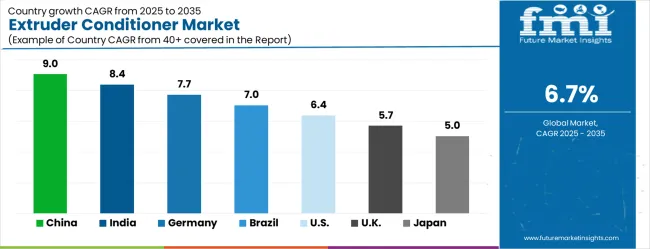

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| Brazil | 7.0% |

| USA | 6.4% |

| UK | 5.7% |

| Japan | 5.0% |

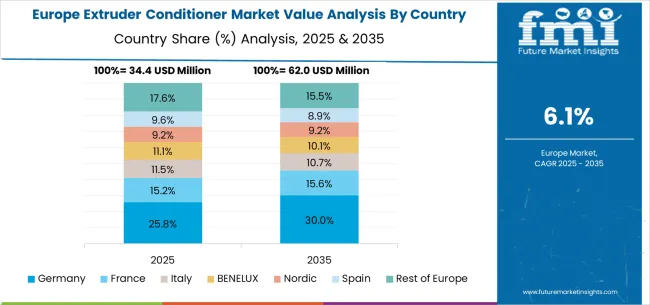

The extruder conditioner market shows strong growth dynamics across key countries from 2025-2035. China leads globally with a CAGR of 9.0%, fueled by massive livestock production expansion, growing biomass processing industry, and increasing feed manufacturing capacity driving demand for advanced conditioning solutions. India follows closely at 8.4%, driven by expanding dairy and poultry sectors, growing renewable energy initiatives, and increasing feed processing modernization supporting agricultural productivity. Germany remains Europe's growth engine with 7.7%, leveraging its advanced agricultural technology sector and strong focus on sustainable processing solutions and renewable energy applications. Brazil records 7.0%, reflecting opportunities in livestock production growth and biomass processing expansion despite infrastructure challenges. The United States maintains steady expansion at 6.4%, supported by established feed manufacturing industry and growing biofuel processing requirements. Growth in the United Kingdom (5.7%) and Japan (5.0%) remains moderate, backed by mature agricultural markets and established processing technologies, though comparatively slower due to market maturity.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the extruder conditioner market with its massive livestock production sector and substantial investment in agricultural modernization. The market is projected to grow at a CAGR of 9.0% through 2035, driven by expanding pig and poultry production requiring advanced feed processing capabilities, growing biomass pelletizing industry supporting renewable energy initiatives, and increasing feed manufacturing capacity across major agricultural regions in Shandong, Henan, and Jiangsu provinces. Chinese feed manufacturers and processing companies are adopting extruder conditioners for production efficiency improvement and feed quality enhancement applications, with particular emphasis on cost-effective solutions and large-scale processing capabilities. Government support for agricultural modernization and renewable energy development programs expand opportunities in feed processing and biomass conditioning sectors.

India's extruder conditioner market reflects strong potential based on expanding livestock sector and increasing focus on agricultural productivity improvement. The market is projected to grow at a CAGR of 8.4% through 2035, with growth accelerating through feed processing modernization under efficiency and quality constraints, particularly in dairy and poultry feed manufacturing and biomass processing applications in Punjab, Haryana, and Uttar Pradesh. Indian feed manufacturers and agricultural processors are adopting extruder conditioners for production capacity enhancement and product quality improvement, with growing emphasis on technology transfer and local manufacturing capabilities. Government agricultural development programs and renewable energy initiatives expand access to advanced conditioning technologies and technical support services.

Germany demonstrates established strength in the extruder conditioner market through its advanced agricultural technology sector and robust focus on sustainable processing solutions. The market shows strong growth at a CAGR of 7.7% through 2035, with established agricultural equipment manufacturers and processing facilities driving innovation in Bavaria, Lower Saxony, and North Rhine-Westphalia. German agricultural facilities focus on energy-efficient conditioning systems and sustainable processing applications, particularly in feed manufacturing and biomass pelletizing requiring advanced environmental compliance. The country's strong engineering expertise and established agricultural technology supply chains support consistent market development across European and international agricultural markets.

Brazil's extruder conditioner market shows solid growth potential at a CAGR of 7.0% through 2035, driven by expanding livestock production and growing biomass processing industry. The market benefits from increasing cattle and poultry production and agricultural modernization initiatives, with particular strength in feed manufacturing and renewable energy applications. Brazilian agricultural companies and feed manufacturers adopt extruder conditioners for production efficiency improvement and product quality enhancement, addressing both domestic consumption needs and export market requirements. Market development benefits from agricultural sector growth despite economic challenges affecting equipment procurement and technology investment levels.

The United States maintains steady growth in the extruder conditioner market through its established feed manufacturing sector and growing biofuel processing industry. Market expansion at a CAGR of 6.4% through 2035 reflects consistent demand from feed manufacturers, biomass processors, and food processing companies requiring advanced conditioning solutions. American agricultural companies utilize extruder conditioners across livestock feed production, biofuel manufacturing, and food processing applications, with particular emphasis on automation integration and energy efficiency improvements. The country's mature agricultural technology market and established processing infrastructure support stable conditions and continued innovation in conditioning applications.

The United Kingdom demonstrates steady progress in the extruder conditioner market with a CAGR of 5.7% through 2035, supported by established agricultural sector and growing focus on sustainable processing technologies. British agricultural companies and feed manufacturers adopt extruder conditioners for feed processing and biomass applications, with particular focus on environmental sustainability and processing efficiency improvements. The market benefits from established agricultural supply chains and strong relationships with international processing equipment suppliers. Development remains consistent across agricultural applications despite economic uncertainties affecting capital equipment investments in farming sectors.

Japan's extruder conditioner market shows steady development with a CAGR of 5.0% through 2035, as established agricultural technology companies and processing facilities maintain demand for high-quality conditioning equipment. Market growth reflects mature agricultural market conditions and established technology standards across feed manufacturing and food processing sectors. Japanese companies utilize extruder conditioners for precision feed processing and specialized food applications, particularly in aquaculture feed and high-value agricultural products requiring advanced processing capabilities. The market benefits from domestic agricultural technology expertise and strong technical support infrastructure, with steady growth supported by technology innovation and quality improvement requirements.

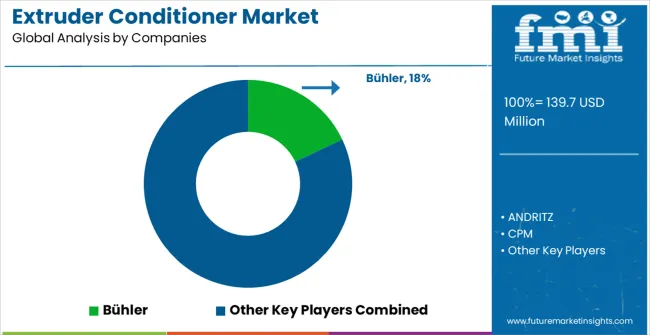

The extruder conditioner market operates with a moderately concentrated structure featuring approximately 20-25 meaningful players, with the top five companies holding roughly 50-55% market share. Competition centers on technological innovation, processing efficiency, and comprehensive solution capabilities rather than price competition alone. Market leaders include Bühler, ANDRITZ, CPM, Amandus Kahl, and Van Aarsen, which maintain competitive positions through established global distribution networks, comprehensive product portfolios, and strong research and development capabilities in material processing technologies. These companies benefit from scale advantages in manufacturing, extensive technical support networks, and established relationships with feed manufacturers, biomass processors, and food processing companies worldwide.

Secondary tier companies include Yemmak, Rosal, Fragola, R K Bio Feed Machine, and FeedTech, which compete through specialized product offerings, regional market focus, and niche application expertise. These companies differentiate through custom solutions, competitive pricing strategies, and targeted customer service in specific industry segments or geographic markets.

Additional significant players including Famsun, Jiangsu Zheng Chang Group, Kerunde, and FDSP contribute to market dynamics through cost-competitive solutions, local market expertise, and specialized customer relationships in specific applications or regional markets, particularly in Asia-Pacific regions where agricultural processing expansion drives equipment demand.

The competitive landscape reflects diverse market segments ranging from large-scale industrial feed manufacturing to specialized biomass processing applications, with companies requiring different expertise in mechanical engineering, process optimization, material science, and automation integration. Market participants differentiate through conditioning efficiency, energy consumption, maintenance requirements, and integration capabilities that influence purchasing decisions across feed, biomass, and food processing applications.

Competition intensifies around innovation in automation and energy efficiency, with companies investing in digital control systems, predictive maintenance capabilities, and sustainable processing technologies that improve operational efficiency while reducing environmental impact. Market dynamics reflect the importance of technical support services, process optimization expertise, and comprehensive solution offerings that influence long-term customer relationships. Strategic partnerships with system integrators, process consultants, and industry-specific solution providers shape competitive positioning across different market segments and regional agricultural markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 139.7 million |

| Product Type | Single-shaft Paddle Conditioner, Double-layer Jacket Conditioner, Different Diameter Cylinder Conditioner, Others |

| Application | Feed Industry, Biomass and Biofuel Industry, Food Industry, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ additional countries |

| Key Companies Profiled | Bühler, ANDRITZ, CPM, Amandus Kahl, Yemmak, Van Aarsen, Rosal, Fragola, R K Bio Feed Machine, FeedTech, Famsun, Jiangsu Zheng Chang Group, Kerunde, FDSP |

| Additional Attributes | Dollar sales by application categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging companies, adoption patterns across feed manufacturers and processing facilities, integration with automated production systems and quality control platforms, innovations in energy-efficient processing and digital control technology, and development of sustainable conditioning platforms with enhanced environmental compliance capabilities. |

The global extruder conditioner market is estimated to be valued at USD 139.7 million in 2025.

The market size for the extruder conditioner market is projected to reach USD 267.3 million by 2035.

The extruder conditioner market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in extruder conditioner market are single-shaft paddle conditioner, double-layer jacket conditioner, different diameter cylinder conditioner and others.

In terms of application, feed industry segment to command 46.0% share in the extruder conditioner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extruder and Compounding Machines Market Size and Share Forecast Outlook 2025 to 2035

Extruder Market Size, Share, Trends & Forecast 2024-2034

Food Extruder Market Size and Share Forecast Outlook 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Twin Screw Extruders Market Size and Share Forecast Outlook 2025 to 2035

Pipe Screw Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Algae-Polymer Extruders Market Size and Share Forecast Outlook 2025 to 2035

Hollow Core Slab Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Dough Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Flour Conditioner Market

Bakery Conditioner Market

R290 Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Bulk Bag Conditioner Companies

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Silicon Soil Conditioner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Portable Air Conditioner Market Analysis by Capacity, End Use, Sales Channel and Region from 2025 to 2035

Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Household R290 Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA