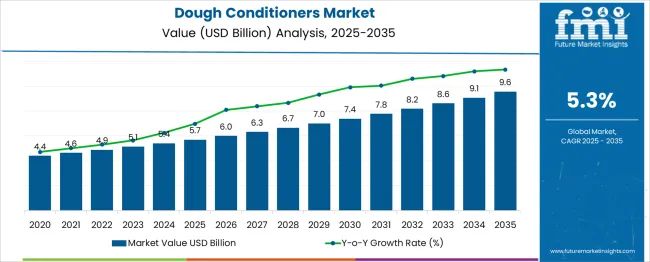

The Dough Conditioners Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 9.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. The dough conditioners market is projected to deliver an incremental gain of USD 1.7 billion, which represents 38.3% of the total incremental growth over the forecast period. This growth, supported by a CAGR of 5.3%, is driven by increasing demand for convenience baked goods, product quality enhancement, and the need for extended shelf life in bread, cakes, and other dough-based products.

In the first five-year phase (2025 to 2030), the market will increase from USD 5.7 billion to USD 7.4 billion, fueled by innovations in clean-label and functional dough conditioners. The second half (2030 to 2035) will contribute USD 2.3 billion, representing 61.7% of the total growth, as consumer preferences shift toward healthier and more sustainable baking ingredients.

Annual increments in the first phase average USD 0.34 billion per year, while later years see higher gains driven by the adoption of plant-based and organic dough conditioners in the foodservice and retail sectors. Manufacturers focusing on natural, non-GMO, and allergen-free formulations will capture the largest share of this USD 4.0 billion growth opportunity, particularly in North America and Europe, where clean-label trends are accelerating.

| Metric | Value |

|---|---|

| Dough Conditioners Market Estimated Value in (2025 E) | USD 5.7 billion |

| Dough Conditioners Market Forecast Value in (2035 F) | USD 9.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The dough conditioners market is gaining momentum due to the rapid expansion of industrial baking, rising demand for consistent texture and extended shelf life, and advancements in enzymatic and emulsification technologies. Accelerated urban lifestyles and the rising preference for ready-to-bake and packaged bakery products have amplified the need for dough conditioners that enhance volume, softness, and gluten structure.

Manufacturers are increasingly aligning formulations with clean-label and non-GMO preferences, prompting investments in natural enzyme blends and plant-derived emulsifiers. Strategic sourcing of functional ingredients, along with tighter quality controls and process optimization in large-scale bakeries, is improving adoption.

Sustainability goals and cost-efficiency in high-speed production environments are pushing bakeries toward customized dough conditioning systems. As consumer expectations around artisanal quality and convenience continue to rise, the market is expected to benefit from hybrid formulations that deliver both performance and label-friendly profiles.

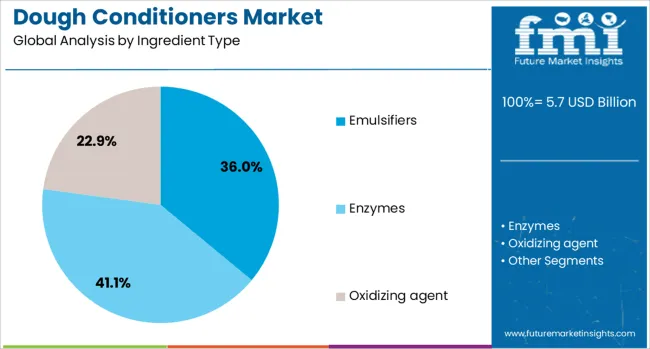

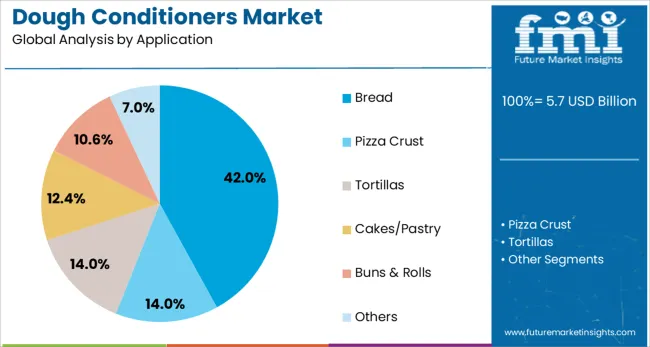

The dough conditioners market is segmented by ingredient type, application, and geographic regions. By ingredient type, the dough conditioners market is divided into Emulsifiers, Enzymes, Oxidizing agents, reducing agents, and others. In terms of application, the dough conditioners market is classified into Bread, Pizza Crust, Tortillas, Cakes/Pastry, Buns & Rolls, and others.

Regionally, the dough conditioners industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Emulsifiers are projected to account for 36.0% of the overall revenue share in 2025, making them the dominant ingredient type within the dough conditioners market. Their performance in improving dough stability, gas retention, and crumb softness has reinforced their value in both industrial and artisanal baking applications.

The ability of emulsifiers to interact with starch and protein structures allows for improved machinability and shelf-life extension, which is vital in high-throughput baking lines. Growing adoption of sustainable and plant-based emulsifiers has further enhanced their appeal among clean-label conscious manufacturers.

As the market shifts toward reduced-fat and additive-minimized formulations, emulsifiers continue to deliver functional performance without compromising final product quality, positioning them as the preferred choice in commercial dough conditioning solutions.

Bread is expected to lead the application landscape, contributing 42.0% of the total dough conditioners market revenue in 2025. This leadership is being shaped by the global demand for packaged bread products that retain freshness and texture across distribution cycles.

Consistency in volume, crumb structure, and softness are key consumer preferences being addressed by dough conditioners in bread formulations. Bakeries are prioritizing ingredient systems that can support stress-free processing, high-speed production, and longer ambient shelf life.

Demand for fortified, gluten-free, and specialty bread varieties is also driving the use of conditioning agents tailored to specific flour types and formulations. As market players scale production while managing formulation costs and consumer transparency, the use of conditioners in bread continues to be critical for delivering uniform quality and extending market reach.

The dough conditioners market is experiencing steady growth, driven by the increasing demand for convenience foods and processed bakery products. In 2024 and 2025, rising consumer preference for consistent quality and texture in baked goods contributed to the market’s expansion. Opportunities lie in the development of clean-label dough conditioners and natural alternatives. Emerging trends include enzyme-based conditioners and custom formulations for various dough types. However, high production costs, stringent food safety regulations, and fluctuating raw material prices remain key restraints limiting market growth.

The major growth driver is the increasing demand for consistent, high-quality bakery products. In 2024 and 2025, manufacturers of bread, pizza dough, and pastries increasingly adopted dough conditioners to ensure uniform texture, improved shelf life, and faster production times. The busy consumer lifestyle and the growing preference for ready-to-eat bakery products created a demand for processed foods that maintain texture and quality. These factors confirm that consumer demand for convenience without compromising quality remains central to market growth.

Significant opportunities are arising in the development of clean-label and natural dough conditioners. In 2025, the growing trend towards clean-label products, free from artificial additives, spurred innovation in plant-based and naturally derived dough conditioners. As consumers become more conscious of ingredient transparency, demand for conditioners made from non-GMO or organic sources increased. Companies are capitalizing on this by introducing conditioners with minimal ingredients, offering health-conscious options while maintaining dough quality. This trend demonstrates how consumer preferences are shaping new product offerings in the market.

Emerging trends indicate a rise in enzyme-based dough conditioners and the demand for custom formulations tailored to specific baked goods. In 2024, enzyme solutions, which improve dough consistency and reduce preparation time, gained traction in industrial bakeries. Custom formulations for different dough types, such as gluten-free and high-protein dough, became more common. These trends reflect a shift towards more specialized, efficient, and diverse products in the dough conditioners market, driven by technological progress and changing consumer needs.

Key restraints include high production costs and stringent regulatory compliance. In 2024 and 2025, the rising cost of raw materials, such as natural enzymes and emulsifiers, increased production costs for dough conditioner manufacturers. Additionally, the need to comply with evolving food safety standards and regulations in various markets added complexity to production and distribution. These barriers highlight the challenges faced by manufacturers in managing costs while ensuring compliance with health and safety regulations, restricting the broader adoption of innovative dough conditioners.

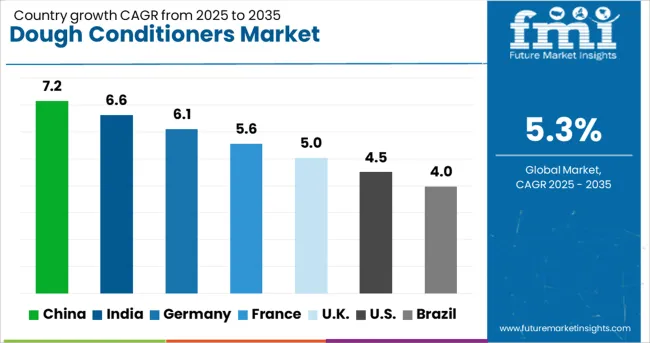

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

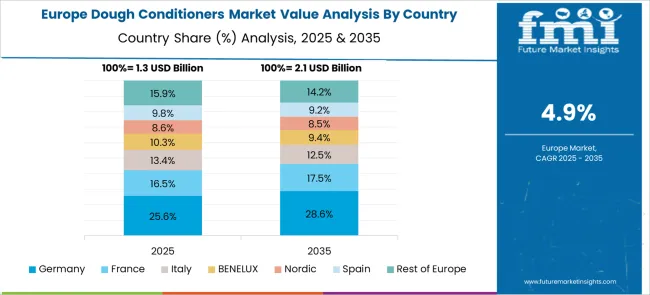

The global dough conditioners market is projected to grow at 5.3% CAGR from 2025 to 2035. China leads with 7.2% CAGR, driven by increasing demand in the rapidly growing bakery sector, particularly for high-quality and mass-produced bread, cakes, and other baked goods. India follows at 6.6%, supported by the growing urban population and rising consumption of packaged food products. France records 5.6% CAGR, reflecting strong demand for premium and organic bakery products in both retail and commercial segments. The United Kingdom grows at 5%, while the United States posts 4.5%, reflecting steady growth in the market with an increasing focus on health-conscious formulations. Asia-Pacific leads in market growth due to expanding baking industries, while Europe and North America focus on innovation and cleaner ingredients. This report includes insights on 40+ countries; the top markets are shown here for reference.

The dough conditioners market in China is forecasted to grow at 7.2% CAGR, driven by the booming bakery and snack food industries. As consumer demand shifts towards high-quality, soft, and easy-to-prepare baked goods, the use of dough conditioners to improve texture, volume, and shelf life increases. The rapid urbanization and growing middle class further stimulate market growth, while bakeries and large-scale food manufacturers seek cost-effective solutions to enhance production efficiency and product consistency.

The dough conditioners market in India is projected to grow at 6.6% CAGR, supported by rising demand for packaged and convenience foods, particularly in urban areas. As India’s food processing industry expands, manufacturers focus on improving the texture, elasticity, and shelf life of bakery products. The growing awareness of the importance of clean-label products and organic ingredients drives the demand for natural dough conditioners, and rising disposable incomes further encourage consumption of high-quality baked goods.

The dough conditioners market in France is expected to grow at 5.6% CAGR, supported by the country's established culinary culture and rising consumer demand for high-quality, artisanal, and organic bakery products. France's strong bakery and pastry sector, known for its quality standards, continues to adopt advanced dough conditioners to maintain consistency and product appeal. The increasing trend toward healthier and clean-label ingredients also accelerates the adoption of natural and sustainable dough conditioners.

The dough conditioners market in the United Kingdom is projected to grow at 5% CAGR, driven by the country’s focus on healthier and more sustainable food options. The UK market sees strong demand for cleaner ingredients, including natural dough conditioners that improve the texture, taste, and shelf life of bakery products. Consumer preference for gluten-free, organic, and low-sugar products further promotes the adoption of specialized dough conditioners in the bakery and foodservice industries.

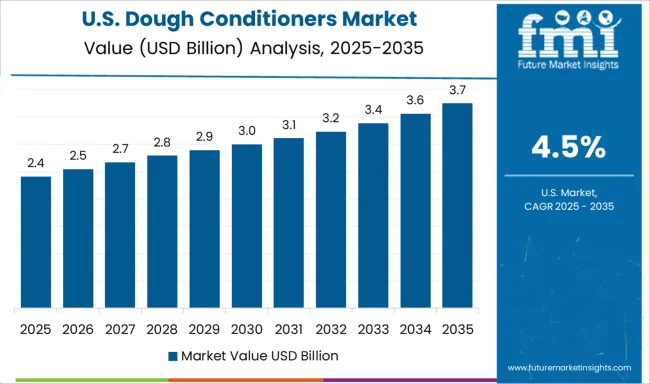

The dough conditioners market in the United States is projected to grow at 4.5% CAGR, driven by the increasing focus on product consistency, shelf life, and efficiency in the bakery industry. The rising consumer interest in clean-label and healthier products, such as gluten-free and low-sugar options, promotes the use of natural and organic dough conditioners. In addition, the increasing trend of homemade and artisanal bakery products further strengthens the market for premium dough conditioners.

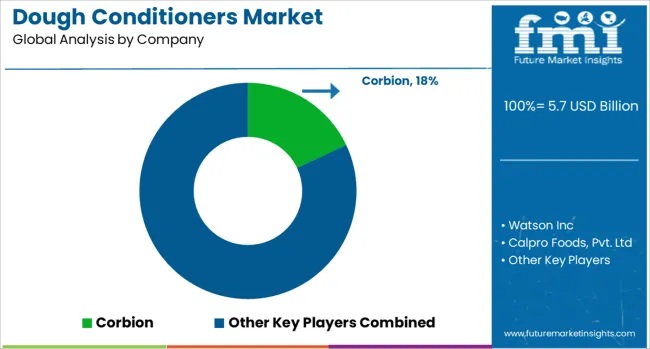

The dough conditioners market is dominated by Corbion, which leads with a wide range of ingredient solutions that enhance dough quality, shelf life, and texture for both artisanal and industrial bakery applications. Corbion’s leadership is supported by its strong global presence, deep R&D capabilities, and focus on clean-label formulations that meet evolving consumer preferences.

Key players such as Watson Inc., Puratos Group, Lallemand Inc., and Archer Daniels Midland Company hold significant market shares by offering specialized dough conditioners that optimize fermentation, improve dough elasticity, and ensure consistent product quality. These companies prioritize product innovation, clean-label ingredients, and sustainability in their solutions for both commercial bakeries and smaller-scale producers.

Emerging players including Calpro Foods Pvt. Ltd, Caldic B.V., Lesaffre, E.I. Du Pont De Nemours and Company, and Oriental Yeast Co., Ltd. are strengthening their market positions by offering customizable, region-specific dough conditioning solutions.

Their strategies focus on enhancing dough processing efficiency, providing solutions for gluten-free and organic baked goods, and expanding production capacity to meet growing demand in emerging markets. Market growth is driven by the increasing demand for convenience bakery products, consumer preference for healthier ingredients, and technological advancements in dough production. Continuous innovation in enzyme-based conditioners and sustainable sourcing will further shape competitive dynamics in this sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.7 Billion |

| Ingredient Type | Emulsifiers, Enzymes, Oxidizing agent, Reducing agent, and Others |

| Application | Bread, Pizza Crust, Tortillas, Cakes/Pastry, Buns & Rolls, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Corbion, Watson Inc, Calpro Foods, Pvt. Ltd, Caldic B.V, Puratos Group, Lallemand Inc, Lesaffre, E.I. Du Pont De Nemours and Company, Oriental Yeast Co., Ltd, and Archer Daniels Midland Company |

| Additional Attributes | Dollar sales by type (enzymes, emulsifiers, oxidizing agents, reducing agents) and form (powder, liquid, semi-liquid, granular); segmentation by application (bread, rolls and buns, pastries and cakes, pizza crust, tortillas); distribution channel breakdown (commercial vs. household). Regional market share: North America leading with 47.9% in 2024, followed by Europe and Asia-Pacific. Innovation in clean-label and gluten-free formulations. Regulatory compliance with food safety standards. Emerging trends in sustainable and organic dough conditioning agents. |

The global dough conditioners market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the dough conditioners market is projected to reach USD 9.6 billion by 2035.

The dough conditioners market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in dough conditioners market are emulsifiers, _mono-glycerides, _calcium stearoyl lactylate, _sodium stearoyl lactylate, _others , enzymes, _amylases, _xylanases, _lipases, _proteases, _others, oxidizing agent, _azodicarbonamide, _potassium iodate, _calcium peroxide, _potassium bromate, _others, reducing agent, _l-cysteine, _glutathione, _sodium bisulphite, _sodium metabisulphite, _others and others.

In terms of application, bread segment to command 42.0% share in the dough conditioners market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dough Based Premixes Market Size and Share Forecast Outlook 2025 to 2035

Dough Processing System Market Analysis & Forecast by Product Type, Application, and Region through 2035

Sourdough Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Sourdough Market Analysis - Size, Share, and Forecast 2025 to 2035

Sourdough Market Share Analysis – Key Trends & Growth Forecast 2025-2035

Bread Dough Improver Market

Frozen Dough Market Analysis by type, distribution channel and region through 2035

UK Sourdough Market Analysis – Size, Demand & Forecast 2025-2035

Cookie Dough Market Analysis by Nature, Ingredients, Flavor, End Use, and Region Through 2035

Charting Winning Approaches in the Frozen Dough Market: A Competitive Perspective

USA Sourdough Market Growth – Demand, Innovations & Forecast 2025-2035

Industry Share Analysis for Bulk Bag Conditioner Companies

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

ASEAN Sourdough Market Trends – Demand, Growth & Forecast 2025-2035

Europe Sourdough Market Insights – Demand, Growth & Forecast 2025-2035

Shelf-Stable Dough Market

Australia Sourdough Market Outlook – Trends, Size & Forecast 2025-2035

Latin America Sourdough Market Report – Size, Share & Forecast 2025-2035

Refrigerated / Frozen Dough Products Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA