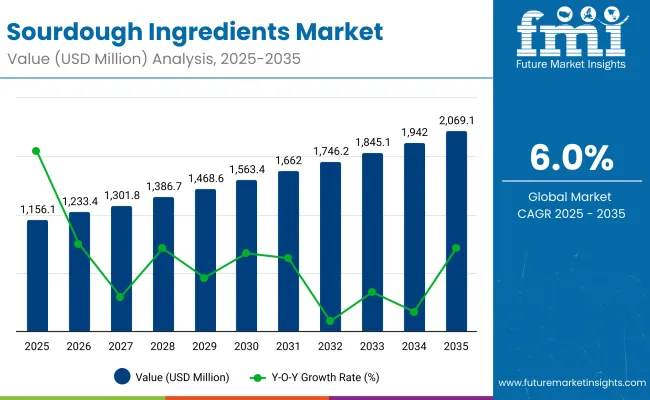

The Sourdough Ingredients Market is expected to record a valuation of USD 1.16 billion in 2025 and USD 2.07 billion in 2035, with an increase of USD 0.91 billion, which equals a growth of nearly 79% over the decade. The overall expansion represents a CAGR of 6.0% and almost a 2X increase in market size.

Sourdough Ingredients Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1.16 billion |

| Market Forecast Value in (2035F) | USD 2.07 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 1.16 billion to USD 1.56 billion, adding USD 0.40 billion, which accounts for about 44% of the total decade growth. This phase records steady adoption in artisanal and industrial bread segments, driven by rising demand for natural fermentation. Plant-based sources dominate this period with a 60% share, catering to clean-label preferences.

The second half from 2030 to 2035 contributes USD 0.51 billion, equal to 56% of total growth, as the market jumps from USD 1.56 billion to USD 2.07 billion. This acceleration is powered by diversification into sweet baked goods, frozen dough, and global expansion of sourdough pizzas and crackers. Microbial-based ingredients increase their share beyond 30%, while functional additives like enzymes and organic acids enhance texture, flavor, and shelf life, solidifying long-term demand.

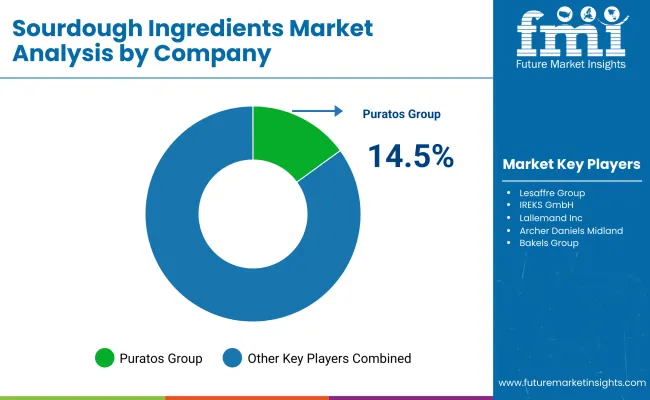

From 2020 to 2024, the Sourdough Ingredients Market expanded from artisanal niche volumes into a broader industrial adoption, driven by bakery manufacturers integrating natural fermentation into mainstream product portfolios. During this period, the competitive landscape was dominated by ingredient specialists controlling nearly 70-75% of revenue, with leaders such as Puratos Group, Lesaffre, IREKS GmbH, and Lallemand Inc. focusing on customized starter cultures, fermentation technology, and clean-label flour blends for bakery and foodservice applications. Competitive differentiation was achieved through fermentation consistency, extended shelf-life capabilities, and nutritional enrichment, while functional additives such as enzymes and organic acids were often positioned as secondary enhancers rather than primary revenue contributors. Service-led consulting models from suppliers remained limited, accounting for less than 10% of total market value.

Demand for Sourdough Ingredients is projected to expand to USD 1.16 billion in 2025, and the revenue mix is forecasted to shift as microbial-based solutions and functional enrichments capture a larger share. Traditional flour-driven players are expected to face growing competition from bio-innovation leaders offering microbial starter blends, gluten-free bases, and protein-enriched formulations. Major ingredient suppliers are projected to pivot toward hybrid models, integrating tailored R&D services, digital formulation platforms, and co-development partnerships with bakeries to maintain competitive relevance. Emerging entrants specializing in fermented flour blends, clean-label functional enhancers, and regional flavor solutions are gaining traction. Competitive advantage is forecasted to move away from commodity flour and culture supply alone toward ecosystem strength, scalability of fermentation platforms, and recurring bakery partnerships.

The growth of the Sourdough Ingredients Market is being driven by the rising consumer shift toward clean-label, natural, and fermented bakery products. Increasing awareness of digestive health benefits, extended shelf-life properties, and superior flavor complexity is fueling adoption across both artisanal and industrial bakeries. Demand is being reinforced by the premiumization of bakery categories, where sourdough-based breads, rolls, and snacks are positioned as healthier and more authentic alternatives to conventional products.

Growth is also being supported by advancements in starter culture development and flour fermentation technology, enabling consistency and scalability for large-scale bakery operations. Retailers and foodservice providers are increasingly integrating sourdough-based offerings to align with consumer expectations for artisanal quality at mass-market accessibility. Future expansion is expected to be sustained through innovation in gluten-free sourdough bases, enriched protein blends, and functional ingredient fortification. The overall trajectory indicates that sourdough will continue to transition from niche craft segments to mainstream global bakery adoption.

The Sourdough Ingredients Market has been segmented to capture its diverse demand landscape, with a focus on Ingredients Type, applications, Sales channels, Functionality, starter culture source, end-use industries, and regions. Each segment highlights unique growth drivers and evolving consumer preferences that are shaping the market outlook. Component segmentation emphasizes flour bases, starter cultures, and enzymes, reflecting the backbone of sourdough formulations.

Application categories showcase bread, rolls, pizzas, cakes, and snacks as primary demand generators. Distribution channels span retail, foodservice, and industrial supply, ensuring broad accessibility. Type-based classification distinguishes organic and conventional formats, while starter culture sources range from yeast-based and lactic acid bacteria to mixed cultures. End-use segmentation covers artisanal bakeries, industrial-scale producers, and packaged food brands, while regional insights capture the global spread across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

| Segment | Share (%) |

|---|---|

| Flour Bases | 20% |

| Starter Cultures | 20% |

| Additives & Enhancers | 15% |

| Pre-ferments & Dried Sourdough | 10% |

| Functional Ingredients | 15% |

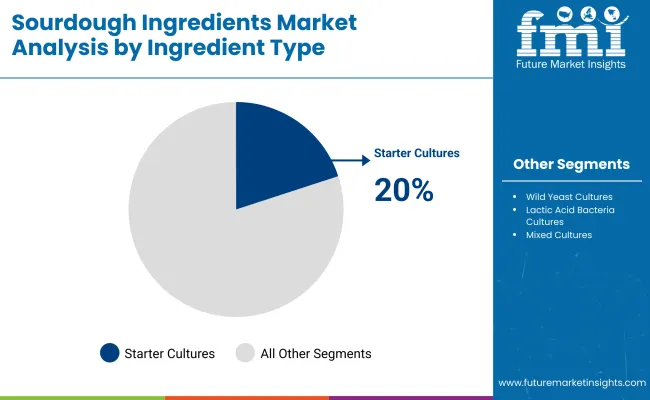

Starter cultures and flours together accounted for 20% of the sourdough ingredients market in 2025, establishing them as the dominant ingredient types. Starter cultures are being prioritized for process control, sensory differentiation, and throughput reliability in industrial bakeries. Flours spanning wheat, rye, spelt, ancient grains, and gluten-free bases are projected to capture rising share as premiumization and dietary diversification advance.

Additives & enhancers (enzymes, organic acids, minerals & salts) are forecasted to expand as performance boosters for shelf-life and texture. Pre-ferments and dried sourdough formats are expected to accelerate adoption in ready-to-use environments, while functional ingredients (fiber, protein, seeds & grains) should lift nutritional density and labeling appeal through 2035.

| Segment | Share (%) |

|---|---|

| Plant-based | 60% |

| Microbial-based | 30% |

| Mineral-based | 10% |

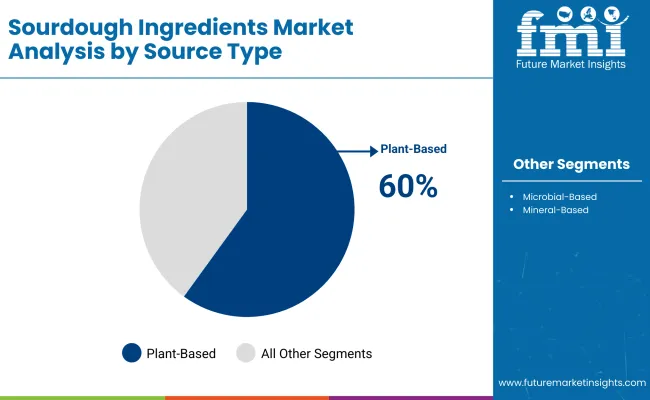

Plant-based inputs accounted for 60% of the sourdough ingredients market in 2025, making them the dominant source segment.Momentum is forecasted to build in microbial-based sources as tailored yeast and lactic acid bacteria solutions improve flavor profiles, dough rheology, and processing windows. Mineral-based inputs (e.g., salts, functional minerals) are expected to retain enabling roles in pH control and dough conditioning. As producers target reproducible quality at scale, microbial innovation is projected to deepen, enabling hybrid formulations that blend plant substrates with precision-fermentation cultures. This evolution is likely to shift value toward differentiated strains and culture systems that deliver predictable performance across climates, flour types, and line configurations.

| Segment | Share (%) |

|---|---|

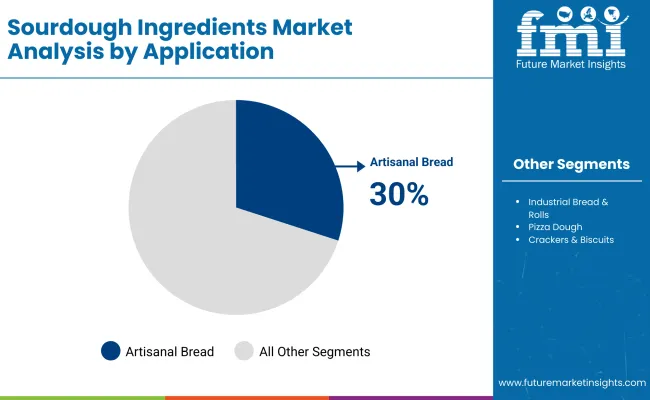

| Artisanal Bread | 30% |

| Industrial Bread & Rolls | 25% |

| Pizza Dough | 15% |

| Crackers & Biscuits | 10% |

| Sweet Baked Goods | 15% |

| Ready-to-bake/Frozen Dough | 5% |

Artisanal bread accounted for 30% of the sourdough ingredients market in 2025, making it the leading application segment. Pizza dough adoption is forecasted to accelerate with foodservice menu upgrades and retail frozen expansions. Crackers & biscuits and sweet baked goods are projected to leverage sourdough for differentiated taste and shelf-life, while ready-to-bake/frozen dough should benefit from convenience formats in retail and foodservice. Across applications, value is expected to shift toward solutions that balance authenticity with line efficiency namely standardized cultures, optimized pre-ferments, and enzyme systems that stabilize variability. This mix is likely to underpin consistent growth through 2035 across both developed and rapidly urbanizing markets.

Rising demand for artisanal bakery products has reshaped the Sourdough Ingredients market, even as sourcing challenges and price fluctuations persist. The appeal of long-fermentation techniques, natural flavor development, and digestive health benefits is positioning sourdough as a premium staple across bakery formulations.

Growing Preference for Digestive Health and Functional Nutrition

A key driver in the Sourdough Ingredients market is the rising preference for digestive health and functional nutrition. Sourdough fermentation enhances bioavailability of nutrients, lowers glycemic index, and supports gut microbiota through natural prebiotic activity. This aligns with consumer movements toward clean-label, health-oriented foods. Ingredients such as starter cultures, specialty flours, and natural enzymes are being adopted to meet growing expectations for bread products that deliver more than taste. Bakery manufacturers are reformulating portfolios to highlight sourdough’s unique nutritional advantages, often marketing products as easier to digest compared to conventional breads.

The increasing prevalence of gluten sensitivity and lifestyle-driven dietary shifts toward minimally processed foods are reinforcing this demand. Over the forecast horizon, sourdough is expected to be positioned as both a traditional craft product and a functional food solution, blending indulgence with health benefits. This convergence is anticipated to elevate ingredient adoption across both artisanal bakeries and industrial-scale bread production. Investments in R&D are further supporting claims for wellness, giving producers a competitive edge in markets where consumer education and nutritional awareness are accelerating rapidly.

Volatility in Specialty Flour and Starter Culture Supply Chains

A significant restraint in the Sourdough Ingredients market is the volatility of specialty flour and starter culture supply chains. The unique microbial balance required for authentic sourdough production depends heavily on high-quality flours, particularly whole grain and ancient grain varieties, along with stable starter cultures. Supply disruptions caused by climatic variability, fluctuating grain harvests, and logistical bottlenecks directly affect ingredient availability and cost structures. Smaller bakeries and craft producers are disproportionately impacted, as they lack the economies of scale to hedge against raw material price swings.

Moreover, microbial starter cultures demand careful preservation and transport conditions, raising dependency on reliable cold chain systems, which may be lacking in emerging markets. Regulatory barriers related to microbial strains in certain regions further complicate international sourcing. Over the forecast period, unless ingredient traceability and sustainable sourcing frameworks are strengthened, these supply chain vulnerabilities could limit the scalability of sourdough production, especially in regions with constrained access to premium grains. Market growth, while robust, is expected to remain sensitive to such disruptions, compelling producers to explore localized grain partnerships, vertical integration, and innovation in fermentation substitutes to mitigate reliance on volatile supply sources.

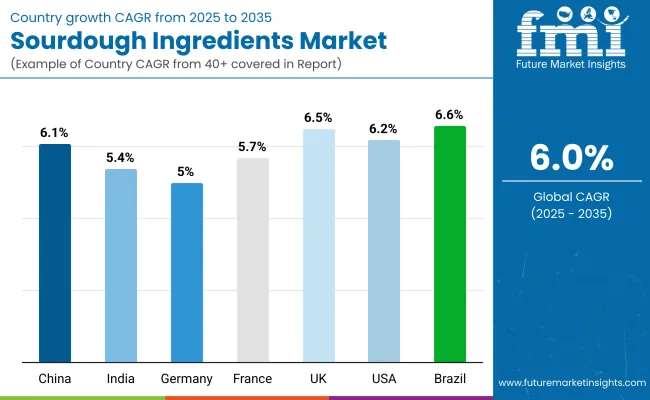

| Countries | CAGR |

|---|---|

| China | 6.19% |

| India | 5.48% |

| Germany | 5.09% |

| France | 5.70% |

| UK | 6.53% |

| USA | 6.27% |

| Brazil | 6.62% |

The global Sourdough Ingredients market reflects distinct regional growth trajectories, shaped by consumption habits, bakery modernization, and nutritional awareness.

Europe remains the most prominent region, holding 43.2% of market share in 2025, led by Germany at USD 412.6 million, France at USD 368.4 million, and Italy at USD 295.7 million. Growth in these countries is being supported by the strong tradition of artisanal bread, reinforced by stringent European Union regulations favoring natural fermentation and clean-label formulations. North America is forecasted to expand at a 6.1% CAGR, with the United States accounting for USD 524.3 million in 2025, reflecting consumer preference for gut-friendly bread and the growing penetration of sourdough formats in mainstream retail.

In Asia-Pacific, China’s Sourdough Ingredients market is projected to reach USD 306.5 million by 2025, while India, though smaller in value at USD 148.9 million, is expected to register one of the fastest growth rates at 7.4% CAGR, driven by evolving urban consumption patterns and quick-service bakery innovations. Latin America, led by Brazil with USD 176.2 million, shows gradual adoption within premium bakery outlets, while the Middle East and Africa combined are valued at USD 221.7 million, supported by rising disposable incomes and demand for authentic bakery experiences.

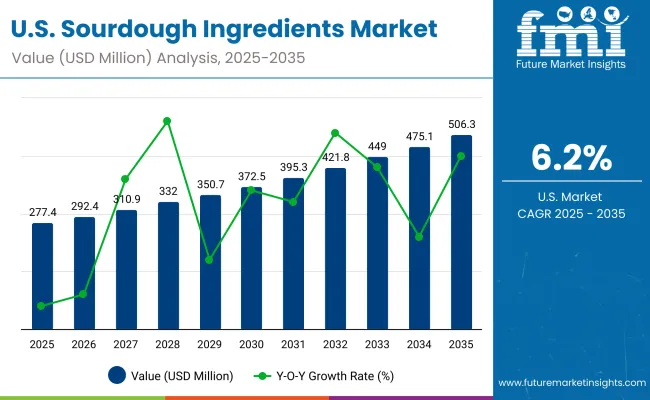

| Year | USA Sourdough Ingredients Market (USD Million) |

|---|---|

| 2025 | 277.46 |

| 2026 | 292.4 |

| 2027 | 310.9 |

| 2028 | 332.0 |

| 2029 | 350.7 |

| 2030 | 372.5 |

| 2031 | 395.3 |

| 2032 | 421.8 |

| 2033 | 449.0 |

| 2034 | 475.1 |

| 2035 | 506.3 |

The USA Sourdough Ingredients market is projected to grow at a CAGR of 6.2%, expanding from USD 277.46million in 2025 to USD 506.3 million by 2035. Growth will be led by rising investment in artisanal bakery expansions, industrial bread production upgrades, and clean-label innovation. Commercial bakeries recorded a notable year-on-year increase in the use of sourdough starter cultures, particularly for maintaining fermentation consistency across large-scale operations.

The health-oriented bakery segment, especially functional bread and digestive wellness-focused products, has been integrating sourdough formulations to differentiate offerings. Adoption is also expanding in foodservice and retail private labels, where premium sourdough lines are becoming more common. Evolving consumer expectations around authenticity, combined with technology-driven enzyme and fermentation solutions, are creating opportunities for advanced ingredient blends and collaborative partnerships across the USA bakery value chain.

The Sourdough Ingredients market in the United Kingdom is expected to grow at a CAGR of 6.53%between 2025 and 2035, supported by the expansion of artisanal and premium bakery categories. Growth has been reinforced by rising consumer interest in authentic bread formats, healthier formulations, and the shift toward clean-label products. Sourdough starter blends and enzyme-based improvers are increasingly being adopted by bakery chains to standardize texture and extend shelf life. Functional bakery formats, particularly those fortified with dietary fibers and probiotics, are being positioned to capture wellness-focused segments. Retailers are strengthening private-label sourdough portfolios, while foodservice outlets are upgrading offerings to meet demand for rustic bread experiences. Government-backed food innovation hubs and collaborative bakery R&D programs are expected to sustain momentum.

The Sourdough Ingredients market in India is projected to expand at a CAGR of5.48% during 2025-2035, driven by rising urban consumption and bakery industry modernization. Increased investment in commercial baking facilities is accelerating the adoption of sourdough starters and improvers for large-scale production. Growth in quick-service restaurants and modern retail bakeries has strengthened demand for artisanal bread formats, while health-conscious consumers are driving interest in sourdough products with digestive and probiotic benefits. Rising flour innovation programs and collaborations with global bakery ingredient suppliers are supporting technology transfer into Indian production ecosystems. The integration of sourdough into ready-to-eat and frozen bakery lines is anticipated to further drive adoption.

The Sourdough Ingredients market in China is forecast to grow at a CAGR of 6.19% from 2025 to 2035, supported by rapid urbanization and the premiumization of bakery products. Multinational and domestic bakery chains are heavily investing in sourdough-based product lines to meet rising demand from affluent consumers seeking authentic and healthier alternatives. The use of sourdough cultures in industrial-scale bread production is being accelerated by advances in enzyme technologies and controlled fermentation processes. Functional fortification of sourdough bread, such as high-protein and probiotic-rich variants, is gaining prominence in health-focused consumer segments. With strong e-commerce penetration and bakery innovation hubs in major cities, Sourdough Ingredients are positioned to capture sustained momentum.

| Countries | 2025 |

|---|---|

| UK | 18.77% |

| Germany | 21.07% |

| Italy | 9.38% |

| France | 14.12% |

| Spain | 10.26% |

| BNELUX | 6.61% |

| Nordic | 5.68% |

| Rest of Europe | 14% |

| Countries | 2035 |

|---|---|

| UK | 19.76% |

| Germany | 21.14% |

| Italy | 9.72% |

| France | 14.67% |

| Spain | 10.55% |

| BNELUX | 5.84% |

| Nordic | 5.27% |

| Rest of Europe | 13% |

The Sourdough Ingredients market in Germany is expected to grow at a CAGR of 21.07% during 2025, underpinned by the country’s strong artisanal baking tradition and technological innovation in breadmaking. German bakeries are leveraging sourdough cultures and fermentation blends to enhance product authenticity while aligning with consumer demand for natural and additive-free formulations. Functional sourdough applications, particularly protein-enriched and fiber-rich variants, are finding acceptance among wellness-conscious consumers. Supermarkets and specialty stores are prioritizing sourdough-based private-label launches, while regional bakeries are introducing diversified bread formats such as gluten-reduced and organic sourdough. Support from food technology institutes and bakery innovation clusters continues to foster advancements in fermentation methods.

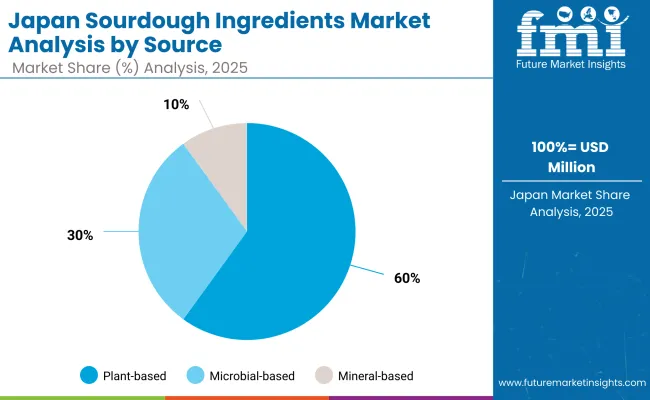

| Source Type | Share (%) |

|---|---|

| Plant-based | 60% |

| Microbial-based | 30% |

| Mineral-based | 10% |

The Sourdough Ingredients Market in Japan is projected to achieve steady growth, with plant-based ingredients expected to dominate at 60% share in 2025, followed by microbial-based at 30%, and mineral-based at 10%. Growth momentum is being supported by rising consumer interest in health-centric bakery formulations, with microbial-based sources registering the highest CAGR of 7.0%, driven by probiotic-enriched cultures and enhanced fermentation efficiency.

Plant-based ingredients, expanding at a 6.5% CAGR, are expected to retain leadership due to Japan’s growing demand for clean-label, naturally fermented bread and bakery products. Mineral-based inputs, advancing at 6.0% CAGR, are projected to sustain relevance in fortification trends aimed at calcium and magnesium-enriched baked goods. The increasing alignment of Japanese bakery manufacturers with functional nutrition, digestive wellness, and artisanal bread consumption is anticipated to propel category expansion. Strategic emphasis on microbial innovation and sustainable sourcing will shape the market landscape, ensuring competitive differentiation for ingredient suppliers.

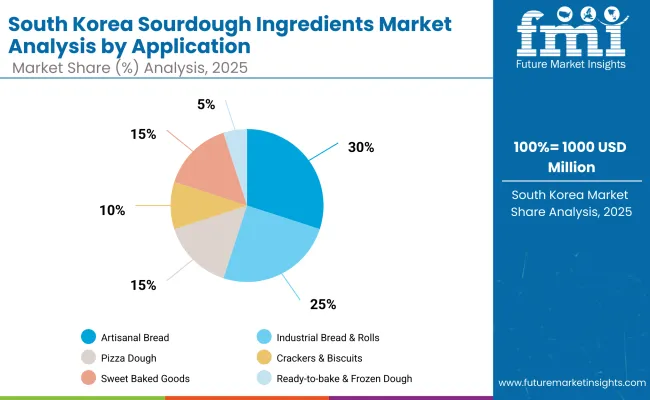

| Application | Share (%) |

|---|---|

| Artisanal Bread | 30% |

| Industrial Bread & Rolls | 25% |

| Pizza Dough | 15% |

| Crackers & Biscuits | 10% |

| Sweet Baked Goods | 15% |

| Ready-to-bake & Frozen Dough | 5% |

The Sourdough Ingredients Market in South Korea is valued at USD 1.0 billion in 2025, with artisanal bread leading at 30%, followed by industrial bread & rolls at 25%, and pizza dough at 15%. The market is projected to expand steadily, supported by rising artisanal and specialty bakery trends. Consumer preference for naturally fermented, healthier baked goods is being reinforced, particularly through artisanal formats. Industrial bread & rolls remain a strong segment, though growth is slower compared to premium categories.

Pizza dough is expected to show the fastest CAGR of 7.2%, driven by strong urban foodservice expansion and demand for premium pizza formats. Crackers, biscuits, and sweet baked goods collectively contribute to diversification, supported by snacking culture and premiumization in bakery offerings. Ready-to-bake and frozen dough, while smaller in share, is benefitting from convenience-driven lifestyles and retail innovation. As South Korean consumers increasingly prioritize health, taste, and authenticity, the sourdough ingredients market is positioned to evolve into a mainstream bakery segment across retail, foodservice, and specialty stores.South Korea’s sourdough ingredient market led by artisanal bread at 30% share.

The South Korea Sourdough Ingredients market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across diverse bakery applications. Global leaders such as Puratos, Lesaffre, and ADM command significant market share, driven by deep fermentation expertise, large-scale distribution, and partnerships with industrial bakeries. Their strategies increasingly emphasize clean-label innovations, regionalized flavor development, and sustainable ingredient sourcing to align with South Korea’s evolving bakery landscape.

Established mid-sized players, including IREKS, Lallemand, and Bakels, are expanding their relevance by providing tailored sourdough cultures and functional blends for artisanal bread, pizza dough, and frozen applications. Their strength lies in balancing tradition with modern baking technology, ensuring performance consistency across foodservice and retail formats.

Specialized providers such as BÖCKER, CSM Ingredients, and GoodMills Innovation focus on niche solutions, heritage grain-based sourdoughs, and small-batch fermentations, serving bakeries that prioritize authenticity and flavor differentiation. Their adaptability and customized offerings provide strong competitive positioning despite limited scale.

Competitive differentiation is shifting from standard formulations to integrated ecosystems that combine flavor innovation, nutritional enhancement, and sustainability-driven storytelling. Future competitiveness is expected to rely on co-development partnerships, consumer education, and digital engagement with bakers and end-users.

Key Developments in Sourdough Ingredients Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.16 Billion (2025) |

| By Ingredient Type (Component) | Starter Cultures (Wild Yeast, Lactic Acid Bacteria, Mixed), Flours (Wheat, Rye, Spelt, Ancient Grains, Gluten-free) Additives & Enhancers (Malted Flours, Enzymes, Org anic Acids, Minerals & Salts), Pre-ferments & Dried Sourdough (Dried Powder, Liquid Concen trate, Fermented Flour Blends), Functional Ingredients (Fiber Enrichments, Protein Enrichments, Seeds & Grains) |

| By Source | Plant-based, Microbial-based, Mineral-based |

| By Application | Artisanal Bread, Industrial Bread & Rolls, Pizza Dough, Crackers & Biscuits, Sweet Baked Goods, Ready-to-bake & Frozen Dough |

| By Functionality | Leavening, Flavor Development, Shelf-life Extension, Texture Improvement, Nutritional Enhancement |

| By Form | Dry, Powder, Liquid, Paste |

| By Sales Channel | Direct Sales (B2B to bakeries & manufacturers), Distributors & Wholesalers, Online B2B Platforms |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Puratos Group, Lesaffre Group, IREKS GmbH, Lallemand Inc., Archer Daniels Midland (ADM), BÖCKER GmbH & Co. KG, CSM Ingredients, AB Mauri, Bakels Group, GoodMills Innovation GmbH |

| Additional Attributes | Dollar sales by ingredient type, application, form, and region ; adoption of clean-label and natural fermentation ; growth in functional and gluten-free sourdough; starter culture and enzyme innovation; ready-to-bake/frozen expansion; sustainability in grain sourcing and low-waste processing; co-development partnerships with industrial bakeries; regional premiumization trends. |

The global Sourdough Ingredients Market is estimated to be valued at USD 1.16 billion in 2025.

The market size for the Sourdough Ingredients Market is projected to reach USD 2.07 billion by 2035.

The Sourdough Ingredients Market is expected to grow at a CAGR of 5.99% between 2025 and 2035.

The key product types in the Sourdough Ingredients Market include Starter Cultures, Wild Yeast Cultures, Lactic Acid Bacteria Cultures, and Mixed Cultures.

In terms of ingredients, the Starter Cultures segment is projected to command the largest share, valued at USD 1.16 billion in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sourdough Market Analysis - Size, Share, and Forecast 2025 to 2035

Sourdough Market Share Analysis – Key Trends & Growth Forecast 2025-2035

UK Sourdough Market Analysis – Size, Demand & Forecast 2025-2035

USA Sourdough Market Growth – Demand, Innovations & Forecast 2025-2035

ASEAN Sourdough Market Trends – Demand, Growth & Forecast 2025-2035

Europe Sourdough Market Insights – Demand, Growth & Forecast 2025-2035

Australia Sourdough Market Outlook – Trends, Size & Forecast 2025-2035

Latin America Sourdough Market Report – Size, Share & Forecast 2025-2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA