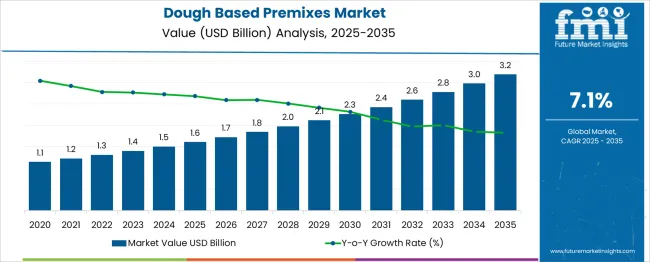

The Dough Based Premixes Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. The market generates an absolute dollar opportunity of USD 1.6 billion over the decade. This expansion represents a growth multiplier of 2.0x, supported by a strong CAGR of 7.1%, driven by the rising demand for convenient baking solutions across both household and commercial channels. In the first five-year phase (2025–2030), the market is expected to advance from USD 1.6 billion to approximately USD 2.3 billion, delivering USD 0.7 billion in incremental gains, accounting for 43.8% of the total opportunity, fueled by growth in artisan and specialty bread segments.

The second phase (2030–2035) will add USD 0.9 billion, representing 56.2% of incremental growth, indicating steady momentum driven by increasing adoption of clean-label, fortified, and gluten-free premixes across bakeries and quick-service restaurants. Annual increments will rise from USD 0.14 billion in early years to USD 0.19 billion in the final phase, reflecting consistent growth dynamics. Manufacturers focusing on customizable premix formulations, regional flavor adaptations, and efficient supply chain networks will capture maximum value within this USD 1.6 billion growth window, particularly as consumer preference for convenience-based bakery solutions intensifies globally.

| Metric | Value |

|---|---|

| Dough Based Premixes Market Estimated Value in (2025 E) | USD 1.6 billion |

| Dough Based Premixes Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The dough-based premixes market occupies a significant niche within multiple food and bakery-related sectors. In the bakery ingredients market, its share is approximately 15–18%, as premixes simplify production for bread, rolls, and specialty baked goods, reducing time and ensuring consistency. Within the food premixes market, dough-based premixes account for about 20–22%, since this category also includes beverage and nutritional premixes. In the convenience food products market, their share is around 5–6%, as ready-to-eat meals and frozen products dominate this segment. For the prepared and processed food market, dough-based premixes contribute approximately 4–5%, given the wide range of packaged foods competing for market share. In the retail and foodservice bakery products market, their share is close to 8–10%, due to increasing demand from quick-service restaurants, cafes, and in-store bakeries for standardized recipes. Growth in this market is driven by rising consumer preference for fresh bakery products, coupled with the need for operational efficiency in commercial kitchens. Advances in fortified, gluten-free, and clean-label premixes are also supporting adoption. With the global bakery industry expanding and home baking trends rising, dough-based premixes are expected to increase their penetration across these parent markets, offering both time savings and consistent quality for manufacturers and end-users.

The Dough Based Premixes market is experiencing consistent growth, driven by the rising demand for convenient and time-saving baking solutions across commercial and household applications. A significant increase in artisanal and industrial baking activities has led to a broader adoption of standardized premix formulations that ensure product consistency, reduce preparation time, and minimize skilled labor dependency. Shifts in consumer preferences toward high-quality, fresh-baked products with clean-label ingredients are also influencing innovation in dough premix formulations.

The market is further supported by foodservice expansion, growing investments in automation, and streamlined supply chains. Advancements in ingredient technologies and extended shelf life attributes are enhancing the appeal of dough premixes for large-scale bakers and food manufacturers.

As global demand for baked products rises, manufacturers are optimizing premix formulations to cater to evolving taste profiles and functional benefits. The sector’s future outlook remains positive, sustained by innovations in product fortification, specialty diets, and an increasing number of distribution partnerships across emerging regions..

The dough based premixes market is segmented by product type, application, distribution channel, and geographic regions. By product type, the dough-based premixes market is divided into Bread and roll mixes, Cake and muffin mixes, Pizza dough mixes, Pastry and cookie mixes, and Specialty and functional mixes. In terms of application, the dough-based premixes market is classified into Commercial baking, Food service, Food manufacturing, and Retail and consumer. The distribution channel of the dough-based premixes market is segmented into Direct sales, Distributors and wholesalers, Retail channels, and Equipment and technology partnerships. Regionally, the dough based premixes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

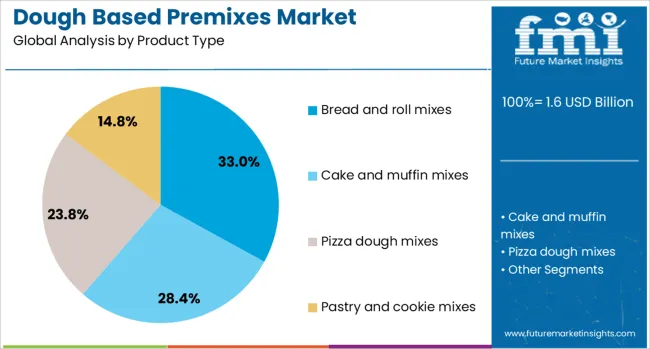

The bread and roll mixes subsegment within the product type segment is projected to account for 33% of the market revenue share in 2025, positioning it as the leading category. Growth in this segment has been attributed to its widespread use in both commercial and retail baking environments where consistency, flavor, and texture are critical to consumer satisfaction. Bread and roll mixes are often formulated with precise ingredient combinations that simplify baking operations while delivering reliable quality across batches.

This has made them the preferred choice for bakeries aiming to streamline operations and reduce preparation errors. Demand has also been reinforced by growing consumer interest in freshly baked bread varieties that meet health and taste expectations.

Manufacturers have increasingly invested in expanding the variety of bread and roll mixes, including options enriched with grains, seeds, or functional additives. This innovation pipeline and operational efficiency have significantly contributed to the segment’s leading market share..

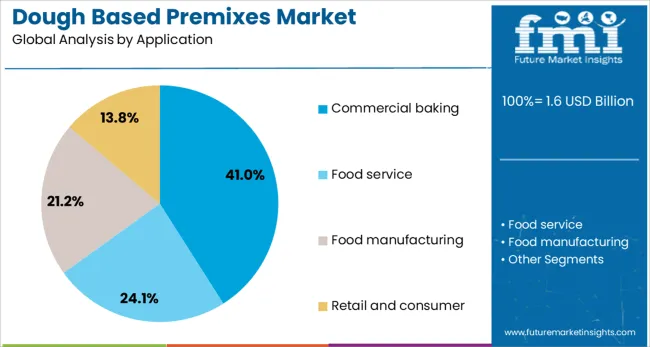

The commercial baking subsegment under the application segment is expected to contribute 41% to the Dough Based Premixes market revenue in 2025, making it the dominant application area. Growth in this segment has been supported by a rising number of industrial-scale bakeries and quick-service food chains that require standardized, scalable solutions to meet large-volume demand.

Premixes tailored for commercial baking ensure uniformity in product taste, appearance, and shelf stability, which are essential factors in maintaining brand reputation. Additionally, commercial operators benefit from reduced preparation times and the elimination of manual ingredient measurement, leading to improved operational efficiency.

As food safety standards and regulatory compliance continue to evolve, commercial baking facilities have increasingly favored premix adoption due to their traceability and formulation control. The segment’s leadership has also been strengthened by its adaptability to automated production lines, where consistency and throughput are critical success factors..

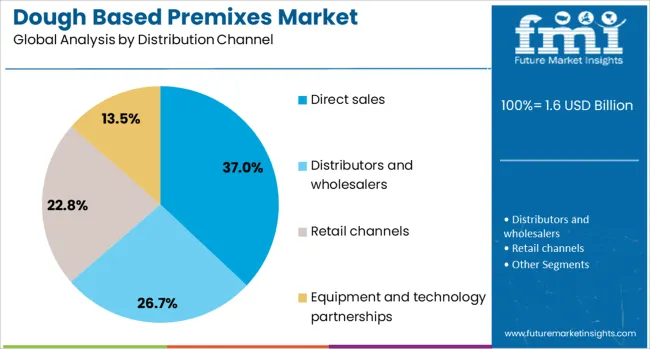

The direct sales subsegment within the distribution channel segment is forecasted to hold a 37% revenue share in the Dough Based Premixes market in 2025, establishing it as the leading distribution route. This segment’s growth has been driven by the direct engagement between manufacturers and commercial baking businesses, which enables more responsive service and customized product offerings.

Direct sales channels facilitate the delivery of tailored premix solutions that align with specific production requirements, including batch sizes, baking methods, and flavor preferences. Additionally, direct distribution allows for better technical support, improved logistics coordination, and faster response to quality feedback.

Long-term supply agreements and strategic partnerships with large-scale food processors have also contributed to the dominance of direct sales. In emerging markets, direct distribution networks are playing a pivotal role in expanding manufacturer reach and building trust with industrial clients, thereby reinforcing this channel’s stronghold in the market..

The dough-based premixes market is gaining momentum due to rising bakery demand and convenience-focused formulations for foodservice and retail channels. Growth drivers include strong preference for consistent quality and time-efficient production in bread, pizza bases, and specialty baked goods. Opportunities are visible in gluten-free, high-protein, and regional-flavor premixes across emerging economies. Key trends include clean-label formulations, fortified ingredients, and automation compatibility for industrial bakeries. However, restraints such as volatile wheat prices, storage limitations, and higher costs compared to scratch baking have slowed penetration in cost-sensitive regions. Overall, the sector demonstrates a promising growth trajectory.

The primary growth driver is the demand for convenient and standardized baking solutions across commercial kitchens and industrial bakeries. In 2024 and 2025, quick-service restaurants and frozen dough producers widely adopted premixes to reduce preparation time and maintain consistent product quality. Bread, pizza, and artisan products benefited from premixes that simplified complex ingredient sourcing. Expansion of modern retail channels and the surge in home baking kits during festive seasons further fueled growth. This shift reflects a strong inclination toward operational efficiency and predictable results in large-scale bakery operations.

Significant opportunities are being created by the rising popularity of gluten-free, multigrain, and fortified dough-based premixes. In 2025, several companies launched premixes enriched with protein and fiber to meet evolving dietary preferences. Demand in Asia-Pacific and Middle Eastern markets for regional bread variants such as flatbreads and pita has encouraged innovation in localized blends. Foodservice operators seeking differentiated offerings have adopted functional premixes for premium product lines. These opportunities indicate strong growth potential for suppliers focusing on nutrition-focused and culturally tailored solutions in the global bakery and foodservice segments.

Emerging trends include the growing shift toward fortified and clean-label dough-based premixes. In 2024, industrial bakeries adopted premixes with added micronutrients, aligning with rising consumer interest in nutrient-rich options. Formulations featuring minimal additives and natural ingredients gained traction in premium retail bakery products. Automation-friendly premixes designed for high-speed production lines have also become prominent as large-scale bakers prioritize consistency and throughput. These trends signal an increasing emphasis on health-conscious attributes and technological adaptability within the dough premix category, shaping product innovation and positioning in competitive bakery segments.

Key restraints include the premium pricing of dough-based premixes compared to traditional scratch baking and supply chain disruptions affecting raw material availability. In 2024 and 2025, volatility in wheat and specialty ingredient costs significantly impacted pricing strategies, particularly in cost-sensitive regions. Storage and shelf-life limitations of certain premixes have also created operational challenges for smaller bakeries. These factors have slowed adoption despite growing demand for convenience. To overcome these barriers, manufacturers are exploring localized sourcing, cost optimization, and packaging innovations to make premixes more accessible to diverse customer segments.

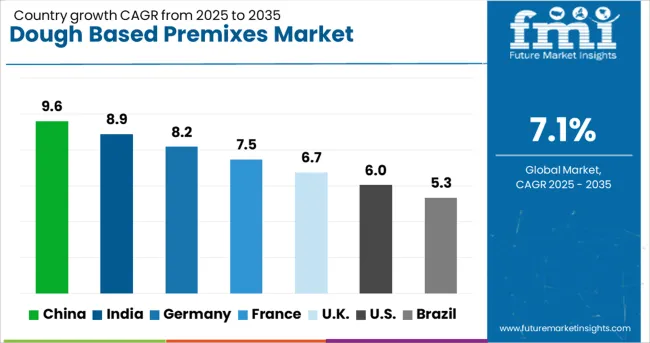

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global dough-based premixes market is projected to grow at a 7.1% CAGR during 2025–2035. China leads at 9.6% CAGR, driven by industrial bakery expansion and growing consumer demand for convenient baking solutions. India follows with 8.9%, supported by rising consumption of bread, cakes, and confectionery in urban and semi-urban regions. Germany posts 8.2%, reflecting strong growth in artisanal and clean-label baking segments. The UK grows at 6.7%, while the United States records 6.0%, highlighting steady demand in mature bakery markets. Asia-Pacific dominates overall market expansion, focusing on cost-effective premixes for industrial and home baking, whereas Western markets prioritize high-quality, fortified, and specialty variants aligned with health-conscious trends.

China remains the largest and fastest-growing market for dough-based premixes, with a projected 9.6% CAGR. Demand is fueled by increasing adoption of premixes in large-scale commercial bakeries and quick-service restaurants. Urban consumers show strong preference for convenience baking solutions due to changing lifestyles and time constraints. Domestic manufacturers scale production of bread and cake premixes with fortified formulations to cater to nutritional needs. Rising interest in premium baked goods also drives innovation in specialty premixes, such as high-protein and gluten-free variants. E-commerce platforms further boost distribution across metropolitan and tier-2 cities.

The dough-based premixes market in India is expected to achieve 8.9% CAGR, driven by strong growth in the bakery industry, particularly in bread, cookies, and sweet bakery categories. The rapid expansion of QSR chains and organized retail fosters demand for standardized premixes that ensure consistent quality and faster preparation. Rising consumer interest in Western bakery trends stimulates adoption in cafes and patisseries. Manufacturers are developing fortified and fiber-rich variants to align with health-focused consumption patterns. Additionally, the penetration of premixes in institutional catering and home-baking kits through e-commerce strengthens future growth.

Germany posts a 8.2% CAGR, supported by strong demand for artisanal bakery products and specialty baked goods. Consumers exhibit high preference for clean-label, organic, and natural ingredient-based premixes, which shapes the product portfolio of leading manufacturers. Innovation in gluten-free and low-carb dough premixes addresses the health-conscious demographic, while industrial bakeries increasingly adopt automated premix solutions for efficiency. The expanding frozen bakery segment further adds to premix consumption as convenience and quality remain key priorities for both retail and foodservice sectors.

The UK market is expected to grow at 6.7% CAGR, reflecting steady demand for convenience baking solutions and premium specialty products. Increasing consumer interest in artisan-style breads and functional bakery items drives innovation in enriched premixes. Foodservice operators and QSR chains prefer standardized dough premixes for operational efficiency and consistency. The growing trend of home baking, combined with online retail, supports the distribution of DIY baking kits featuring premixes. Regulatory emphasis on nutritional labeling promotes the adoption of fortified premixes across retail channels.

The United States posts a 6.0% CAGR, indicating moderate but stable growth in a mature bakery industry. Demand is concentrated in premium and health-oriented product segments, including high-protein, keto-friendly, and gluten-free premixes. The rise of frozen and par-baked bakery items boosts industrial adoption of standardized premixes for consistent quality and extended shelf life. Manufacturers are leveraging functional ingredients, such as whole grains and plant-based additives, to cater to health-conscious consumers. Direct-to-consumer channels, including subscription-based baking kits, present significant growth opportunities in the retail segment.

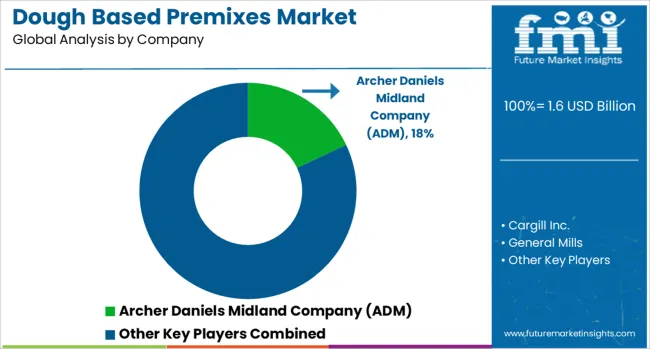

The dough based premixes market is moderately consolidated, with Archer Daniels Midland Company (ADM) recognized as a leading player due to its extensive portfolio of bakery solutions and global supply capabilities. ADM focuses on delivering high-quality premixes for bread, cakes, pastries, and specialty bakery applications, offering consistency and ease of production for industrial and artisanal bakers.

Key players include Cargill Inc., General Mills, Puratos Group, Kerry Group, Bakels Group, and Lesaffre. These companies provide dough-based premixes enriched with functional ingredients, flavors, and nutritional additives to cater to the growing demand for convenience and value-added bakery products. Their offerings support large-scale bakeries and foodservice operations with solutions tailored for enhanced shelf life, texture, and taste. Market growth is driven by the rising popularity of ready-to-use baking solutions, increased demand for premium bakery products, and the expansion of quick-service restaurants.

Leading manufacturers are investing in clean-label formulations, gluten-free and fortified variants, and digital tools for recipe customization to meet evolving consumer preferences. Emerging trends include the integration of plant-based ingredients and functional additives to support health-oriented bakery innovations. Asia-Pacific is witnessing rapid market expansion due to urban lifestyle changes and increasing bakery consumption, while North America and Europe maintain strong demand for artisanal and specialty bread premixes.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Product Type | Bread and roll mixes, Cake and muffin mixes, Pizza dough mixes, Pastry and cookie mixes, and Specialty and functional mixes |

| Application | Commercial baking, Food service, Food manufacturing, and Retail and consumer |

| Distribution Channel | Direct sales, Distributors and wholesalers, Retail channels, and Equipment and technology partnerships |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland Company (ADM), Cargill Inc., General Mills, Puratos Group, Kerry Group, Bakels Group, and Lesaffre |

| Additional Attributes | Dollar sales by product type (bread & roll mixes ~54 %, pastry/pizza blends, muffin mixes) and end-use (commercial F&B, packaged food, household retail). Global market ~USD 1.5 billion in 2024, ~7.1 % CAGR. Buyers seek consistency, convenience, clean-label. Innovations include enzymatic systems, gluten-free blends, functional fortification, and sustainably sourced raw materials. |

The global dough based premixes market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the dough based premixes market is projected to reach USD 3.2 billion by 2035.

The dough based premixes market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in dough based premixes market are bread and roll mixes, _white bread mixes, _whole grain and specialty bread mixes, _artisanal bread mixes, cake and muffin mixes, _layer cake mixes, _cupcake and muffin mixes, _specialty cake mixes, pizza dough mixes, _traditional pizza dough, _thin crust varieties, _gluten-free pizza dough, pastry and cookie mixes, _danish and croissant mixes, _cookie and biscuit mixes, _specialty pastry mixes, specialty and functional mixes, _gluten-free formulations, _organic and clean label products and _high-protein and fortified mixes.

In terms of application, commercial baking segment to command 41.0% share in the dough based premixes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dough Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Dough Processing System Market Analysis & Forecast by Product Type, Application, and Region through 2035

Sourdough Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Sourdough Market Analysis - Size, Share, and Forecast 2025 to 2035

Sourdough Market Share Analysis – Key Trends & Growth Forecast 2025-2035

Bread Dough Improver Market

Frozen Dough Market Analysis by type, distribution channel and region through 2035

UK Sourdough Market Analysis – Size, Demand & Forecast 2025-2035

Cookie Dough Market Analysis by Nature, Ingredients, Flavor, End Use, and Region Through 2035

Charting Winning Approaches in the Frozen Dough Market: A Competitive Perspective

USA Sourdough Market Growth – Demand, Innovations & Forecast 2025-2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

ASEAN Sourdough Market Trends – Demand, Growth & Forecast 2025-2035

Europe Sourdough Market Insights – Demand, Growth & Forecast 2025-2035

Shelf-Stable Dough Market

Australia Sourdough Market Outlook – Trends, Size & Forecast 2025-2035

Latin America Sourdough Market Report – Size, Share & Forecast 2025-2035

Refrigerated / Frozen Dough Products Market Size and Share Forecast Outlook 2025 to 2035

Si-based Hall Effect Sensors Market Size and Share Forecast Outlook 2025 to 2035

AI-based 3D reconstruction Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA