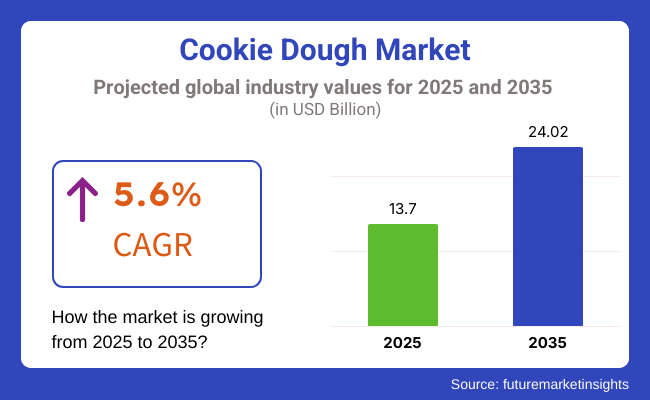

The cookie dough market is estimated to grow to USD 13.7 billion by 2025, at a growth rate of 5.6% CAGR, thereby reaching a total of USD 24.02 billion by 2035. The major drivers of this growth are the increasing consumer demand, the launch of new flavors, and the growing availability of the product in retail and online channels.

The market is thriving, as customers are gradually discovering the benefits it offers in terms of multiple usages and convenience. Dough for cookies, normally made by mixing flour, sugar, butter, eggs, and flavorings, has several applications in the food industry.

It is a popular baking ingredient, often mixed with milk to make milkshake, used in desserts, or even eaten raw in the case of ready-to-eat, egg-free product varieties. The quick use of the product in the preparation of various foods as well as its increasing consumption in ice creams and confectionery is the reason for the growing demand for the product.

The upward surge in product demand in the market can be attributed to several major factors which include the convenience foods' higher demand. The hectic and busy lifestyle of customers is often leading them to choose fast and handy snack options, which has pushed cookie dough to be the product of choice. Raw eating dough, especially, is also very famous nowadays, with brands associating it with being safe and good to eat without any additional effort.

Not only that, but the trends are also positively impacted by the presence of the health-conscious products like vegan, gluten-free, and organic product varieties, which are the driving factors for the cookie dough market's successful progress. Moreover, the proliferation of online retail platforms is a big contributor to the expansion of the product, whereby people can have access to a greater number of products than the physical stores provide to the customers.

The industry is being driven by the health-conscious factor which is likely to continue in the future. The consumer's interest in healthy alternatives such as low-sugar, gluten-free, and plant-based product, which are available, has brought such developments into being. These are the focal points of dietary preferences and allergens that now help the customers to try out the product for the first time.

Even still, when it comes to pleasure, the product remains a top attraction. Many clients are still interested in trying rich, extreme sensations, and the flavors that remind them of cakes, which have a special place in their hearts. The other factor that is affecting the buying decision is the sustainability of the packaging. Companies are increasingly adopting ways to use recycled wrapping materials and ingredients that have been harvested in a responsible manner as they concern themselves with environmental issues.

Between 2020 and 2024, the cookie dough market experienced a rise in demand for edible raw dough and ready-to-bake, fueled by indulgence and convenience trends. Health-oriented consumers drove growth in gluten-free, vegan, and high-protein products, while direct-to-consumer and e-commerce brands increased their presence. Sustainability also emerged as a driver, with brands emphasizing clean-label ingredients and environmentally friendly packaging.

Between 2025 and 2035, the industry will grow with innovation in functional and protein-fortified products for fitness-oriented consumers. AI-powered personalization and smart kitchen integrations could improve home baking experiences. Carbon-neutral production and sustainable ingredient sourcing will be industry norms.

Growth will be driven by emerging industries, especially in Asia, as Western-style baked foods become increasingly popular. Moreover, food safety technology advancements will continue to drive the raw, edible cookie dough market forward, making it safer to consume without affecting taste or texture.

A Comparative Shift Analysis (2020 to 2024 vs 2025 to 2025)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Home baking and decadent consumption surged in the industry, particularly during the COVID-19 epidemic when people were cooped up at home and in need of comfort food. | The trend will be snacking, with cthe product being a convenient snack option rather than used as a dessert component. Premium and customized flavorings willbe in greater demand. |

| The industry responded to rising health consciousness by introducing vegan, gluten-free, and organic brands. | The low-calorie, low-carb, and high-protein dough trend will continue to grow. To appeal to fitness fanatics, brands will encourage product formulations that include functional ingredients like collagen, probiotics, and plant proteins. |

| Luxury flavors, premium chocolate, and organic vanilla extracts have grown in popularity as a result of consumers' rising interest in gourmet and artisanal dough. Companies sold the product in tiny batches. | With businesses selling do-it-yourself flavor kits and websites where customers can choose the mix-ins, textures, and ingredients they want, personalization will be a major differentiation. Flavors with ethnic and exotic influences will likewise be well-liked. |

| With the rise in e-commerce and DTC sales, availability was increased. | The sales in supermarkets, specialty store and convenience store will increase, while food delivery apps and subscription-based models also become popular. Companies will also expand into Asian-pacific and Latin American retail market to reach emerging customers. |

| The dough was mainly used in bakery products, ice cream, milkshakes and desserts. Many ice cream brands are using cookie dough pieces to add extra texture and innovate different flavours. | The dough will expand beyond desserts, appearing in breakfast items, protein bars, and even beverages. |

| Brands started focusing on sustainable sourcing of ingredients, such as ethically sourced chocolate and organic flour. | Biodegradable and recyclable packaging will be the norm. Brands will increasingly make carbon-neutral production a commitment, with plant-based ingredients and sustainable agriculture to reflect concerns for the environment. |

| North America and Europe dominated the market due to high consumer demand for indulgent and premium dough products. Asia-Pacific was growing moderately with Western-style desserts gaining popularity. | The market would expand significantly in Asia Pacific and Latin America as a result of increasing disposable income as well as urbanization. Western dessert culture will penetrate even deeper, promoting demand for ready-to-bake and frozen products. |

Impact of Pricing on Customer Loyalty & Repeat Purchases

Price points of Cookie dough: Cookie dough market is segmented, and the final positioning will affect the cookie dough pricing strategy. Refrigerated products from high-volume brands like Nestlé Toll House or Pillsbury commonly retails USD 3.50-USD 6 per tub (16 oz.); premium brands (think the gourmet and organic types) range from USD 7-USD 12 per tub. Niche options such as keto or CBD-infused cookie dough can go for USD 12-USD 18 per tub, thanks to the higher price of specialty ingredients.

Products made from organic, high-protein or other specialty ingredients command a twenty to forty percent premium consumer are willing to pay. Doughs that are keto-compliant, generally made with almond or coconut flour and sugar substitutes, can cost as much as double their regular counterparts. CBD-infused product is still a niche but high-margin category, and customers familiar with CBD pricing can stomach a 30-50% premium.

At greater price points, significant brand differentiation is needed to maintain a loyal customer base. Consumers who experience better taste, clean ingredients, and/or dietary benefits are retained at high levels even at premium prices. Frequent promotions along with subscription models (e.g., USD 30 monthly cookie dough clubs) can blunt price sensitivity and encourage repeat purchases. Multi-pack discounts and exclusive flavors, competitive pricing strategies, all keep incoming demand and brand loyalty high.

Product Line Innovation to Target Multiple Adjacent Markets

The cookie dough market is witnessing product extensions aimed at multiple consumer segments. Consumer product companies are introducing hybrid products, which include cookie dough and ice cream hybrids inspired by Ben & Jerry’s as well as pre-baked frozen bites for on-the-go snacking and protein-rich products for fitness-focused individuals looking for indulgence combined with nutrition.

In the children’s space, brands are launching nut-free, dye-free products to quell parental fears of allergens and artificial ingredients. For kids, there are even DIY kits, complete with mix-in toppings and decorating packs for an interactive experience.

Even the luxury and gourmet segment is growing, with all their limited-edition flavors like saffron pistachio, truffle-infused, and birthday cake with edible gold flakes targeting high-end customers. The dough in small-batch, handcrafted varieties, with limited availability in upscale bakeries and specialty food shops, also boosts exclusivity and aims to redefine the treat as a more sophisticated indulgence.

| Key Factors | Details |

|---|---|

| Key Buyers | Key consumers are millennials, Gen Z, and families. Higher-income households gravitate toward gourmet or health-driven options, while middle-income buyers focus on affordability and indulgence. |

| Emotional Drivers | Consumers buy the product for indulgence, nostalgia, and convenience. Health-conscious customers want protein-rich, keto or organic varieties. |

| Baking vs. Snacking | A growing percentage of consumers eat the product raw as a snack rather than baking it. Pre-portioned, edible dough formats are gaining traction. |

| Brand Loyalty vs. Switching Behavior | Legacy brands (Nestlé, Pillsbury) still hold market share, but indie brands attract health-focused buyers. Consumers value clean-label ingredients, but bundling strategies (e.g., cookie dough + ice cream) enhance retention. |

| Preferred Sales Channels | Grocery and specialty food stores dominate, but e-commerce and direct to consumer (DTC) channels (Amazon, brand websites, subscription boxes) are the fastest growing. Purchasing choices are greatly influenced by social media trends on TikTok and Instagram. |

Increasing demand for healthy snacks is a key factor fueling the growth of the global organic segment, a sub segment of the larger organic food industry. The segment's share is expected to reach around 58 percent of the total market by 2025, driven by increasing consumer preference for natural and high-quality ingredients. This is further propelled by the inclination towards plant-based, allergen-free, and clean-label formulations in the organic segment. While North America and Europe dominate this segment owing to region-specific developed organic food industry, Asia-Pacific is on a trench as one of the growing regions as organic and sustainable food products are fast gaining popularity.

In 2025, the conventional segment is anticipated to harbor over 42% market share of the overall industry owing to the increasing demand for convenient and indulgent snack food options. It is fair to say that it is an all-time favorite for people of all age groups, and its predominant use in retail and foodservice applications contributes to its reach.

North America and Europe hold the largest share in the conventional market thanks to the high consumption of packaged and frozen baked foods in both regions, while Asia-Pacific is emerging as a major growing area with urbanization, growing disposable incomes and the popularization of western-style desserts.

Wheat-based product is expected to lead the industry owing to its convenient usage, low cost, and high acceptance among consumers. This segment will account for a substantial share of 70%-75% by 2025 and is expected to grow steadily till 2035. Ingredion describes wheat-based ingredients as a mainstay for several applications, including baked goods, snacks, and cookie dough. Increasing demand from developing markets such as Asia-Pacific and Africa, supported by urbanization, increasing disposable income and dietary changes impacted by Western eating habits.

Growing health awareness among consumers is also leading to their shift towards whole-grain and fortified wheat-based options creating perspectives for growth in healthy formulations. Notably, innovations in fortified and high-protein wheat-based products along with robust demand in developing regions make this segment credibly positioned to remain an industry leader in the coming decade, despite these challenges.

EMEA includes bean and legume-based products, which is a pioneering segment gaining an uptick as it caters health-conscious and specialty diet consumers. Chickpeas, lentils and black beans are increasingly being used as replacements for traditional flours, said the report, with higher fiber and protein content and appeal to gluten-intolerant and vegan consumers.

Long term (2025 to 2035), growth of this segment is likely to be driven by growth of plant-based diets and growing interest for functional foods with health benefits beyond basic nutrition. This segment is dominated by North America and Europe as they have established markets for healthy and alternative baking ingredients, whereas Asia-Pacific is experiencing significant growth, driven by rising awareness of plant-based nutrition and the ongoing incorporation of this nutrition into traditional diets.

The USA industry is developing exponentially based on its convenience, versatility, and nostalgic appeal. The product is being valued by the consumer as an instant dessert item that may be eaten raw, baked, or used as an ingredient. Health trends have propelled the availability of vegan, gluten-free, organic, and low-sugar versions, extending its popularity even further.

Growth in the foodservice segment, such as restaurants and bakeries, has also stimulated demand for the product as an anytime dessert ingredient. Availability of premium and artisanal forms and the emergence of e-commerce websites have also extended this dough's availability, further fueling popularity and industry growth.

Growth Factors in the USA

| Key Factors | Implications |

|---|---|

| High Demand for Ready-to-Eat Snacks | Customers love convenience, so promoting the sale of cookie dough to eat. |

| Strong E-Commerce & DTC Growth | Direct-to-consumer companies and internet retailers increase industry reach. |

| Health-Conscious Trends | Expansion in organic, vegan, and gluten-free products. |

| Innovation in Flavors & Ingredients | Firms launch new flavors and protein types. |

| Large Retail & Supermarket Presence | Convenient on-shelf availability at retail stores such as Walmart, Target, and Costco. |

The UK industry is growing with the rising demand among consumers for indulgent, easy-to-consume desserts. The dessert cafe and foodservice unit trend with cookie dough desserts has also grown in popularity. Its growth has also been driven by expanding e-commerce and high-end products, leading to its consistent industry growth in the UK.

Growth Factors in the UK

| Key Factors | Implications |

|---|---|

| Rise in At-Home Baking Culture | Increased demand for refrigerated and frozen products. |

| Growing Preference for Clean-Label Products | Consumers seek organic, preservative-free, and natural ingredients. |

| Premium & Artisanal Offerings | Growth in gourmet, hand-made brands. |

| Expanding Online Grocery Market | Convenience results in higher online buying of the product. |

| Increasing Vegan & Dairy-Free Demand | More plant-based and allergen-free options. |

The industry in Germany is growing due to increasing demand for convenience desserts and growing international food trends. German consumers are adopting this dough as a treat that can be consumed raw, baked, or used in desserts. The industry is also being driven by health-oriented innovations, including vegan, organic, and gluten-free foods, which find traction with Germany's healthy and green consumers.

Influence of American cuisine, coupled with a growing inclination towards indulgent and novel desserts, has also contributed to it becoming more popular. Development in the e-commerce sector and dessert cafes also contributes to the surging demand for the product in Germany.

Growth Factors in Germany

| Key Factors | Implications |

|---|---|

| Strong Organic & Natural Ingredient Preference | Consumers prioritize high-quality, non-GMO, and organic products. |

| Growth of Vegan & Gluten-Free Market | Rising demand for health-conscious and allergy-friendly options. |

| Expansion of Specialty & Artisan Bakeries | Local bakeries and premium brands drive market growth. |

| Strict Food Regulations | Companies must comply with high food safety and ingredient standards. |

| Increasing Popularity of Eco-Friendly Packaging | Sustainability influences product packaging decisions. |

Indian economy is expanding at a fast rate because of changing consumer needs and increasing popularity of Western food trends. Urbanization, higher disposable incomes, and sugary craving for ease are fueling its demand. Younger consumers in specifically are drawn to the product because of its heaviness and versatility, it can be eaten raw, baked, or incorporated into new recipes.

With the growing consumption culture being low-sugar, vegan, gluten-free, and health-oriented, new products have emerged targeting Indian consumers. The growth of online industries and dessert cafe culture has facilitated greater penetration and demand for the product in India

Growth Factors in India

| Key Factors | Implications |

|---|---|

| Growing Urbanization & Western Influence | Rising exposure to Western desserts increases demand. |

| Increasing Disposable Income | Consumers willing to spend on premium and imported products. |

| Growth of QSRs & Cafés | Chains like Starbucks and McDonald’s drive industry expansion. |

| Digital Food Delivery Boom | Online platforms like Swiggy & Zomato make the product more accessible. |

| Demand for Eggless & Fusion Flavors | Local preferences shape new product innovations. |

The industry in China is expanding due to the expanding influence of Western food culture and rising demand for rich, convenient desserts among urban consumers. Health-conscious newer product lines in plant-based and lower-sugar versions also appeal to China's health-conscious growing population. Sudden expansion of online platforms and dessert shops also drive its demand and availability.

Growth Factors in the China

| Key Factors | Implications |

|---|---|

| Expanding Bakery & Café Culture | Western sweets make it popular in city centers. |

| Strong E-Commerce & Social Commerce | Sites like Alibaba & JD.com dominate online revenues. |

| Preference for Premium & Imported Products | They prefer international and good quality brands. |

| Regulatory & Taste Adaptation Challenges | Companies need to localize taste and follow regulation. |

| Increasing Interest in Low-Calorie & Healthy Options | Growing demand for healthier, sugar-free, and protein-based alternatives. |

The industry is competitive, though moderately concentrated, wherein a few multinationals own extensive distribution systems and brand values. Tier 1 companies rely on advanced manufacturing capacity and advanced packaging, format, and flavor innovation to dominate the space, meeting the evolving consumer need for indulgence and convenience.

These leaders utilize strategic alliances, robust supply chain management, and direct-to-consumer marketing to expand reach and deepen customer loyalty. Their smaller rivals are not able to match the size, resources, and technological capabilities of these leaders, further solidifying their position at the top of the industry.

The competition in the industry is characterized by the presence of several industry players with varying growth strategies aimed at the acquisition of industry shares and shifting consumer demands. The major industry players-General Mills Inc., Nestlé S.A., Cérélia Group, Dawn Foods, UK Ltd., and Rhino Foods Inc., have well-established their respective footprints in the cookie dough industry.

These companies conduct product innovation and the diversification of their portfolios in the health-conscious category by offering gluten-free and organic doughs to align with the consumer trend toward healthier indulgences. More marketing opportunities are worked upon to create a platform for enhancing consumer engagement and loyalty.

In order to stand out in the highly competitive environment, new brands such as Crumbl Cookies have their unique mechanisms for setting themselves apart. Founded in 2017, Crumbl has been on a mission to sell cool and interesting cookie flavors and in so doing has grown to over 1000 outlets across the nation in a very short time, about five years, creating novel experiences for the consumer. Heavy reliance on social media platforms especially TikTok, has played a phenomenal role in maximizing visibility and consumer engagement, thus ensuring quick growth.

Likewise, a bunch of companies including Sweet Loren's, have targeted health-conscious consumers by offering all-natural options for clean label products. These strategies demonstrate the fast-paced, flexible approach that firms are adopting to prevail in the ever-changing industry.

Key Company Insights

Nestlé S.A.

Deploys artificial intelligence for swift product development, resulting in a remarkable five-fold reduction in the time taken to enter the market.

Mondelez International

Uses the power of AI to facilitate the innovation of snack recipes which expedites product launches while improving overall responsiveness to the markets.

Crumbl Cookies

Focuses on fast development of franchise locations and massive social media presence, resulting in over 1,000 locations and massive publicity for the brand.

Sweet Loren's

It forms part of an ever-increasing selection of all-natural, plant-based cookie dough options for health-conscious consumers while extending its reach to over 25,000 supermarkets.

Arnott's

Extending its investment in gluten-free products to attract health-conscious consumers and gain greater market share.

The industry has been studied based on various segments, including nature, ingredients, flavor, end use, sales channel, and region.

In terms of nature, the industry is bifurcated into conventional and organic.

By ingredients, the industry is divided into wheat-based, bean & legume, grain-based, root flours, nut-based, multi-grain, and others.

By flavor, the industry is divided into chocolate chip, double chocolate, snickerdoodle, peanut butter, oatmeal raisin, ginger snap, lemon zest, mint chocolate, and others.

By end use, the market is divided into food, bakery, confectionery, dairy, food service, and household/retail.

By sales channel, the market is divided into direct/B2B, indirect/B2C, modern grocery retailers, hypermarkets/supermarkets, discount stores, specialty retail stores, wholesale club stores, traditional grocery, and online retailers.

Regionally, the industry is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is slated to be valued at USD 13.7 billion in 2025.

The industry is predicted to reach a size of USD 24.02 billion by 2035.

Some of the key companies include General Mills Inc., Nestlé S.A., Cérélia Group, Dawn Foods UK Ltd., Dough-to-Go Inc., Rhino Foods Inc., Neighbors LLC, Gregory's Foods Inc., & Co. Do-Biz Foods LLC, Mo's Ltd., Foxtail Foods, Michael's Bakery Products LLC, George Weston Limited, Wewalka, and Sara Lee Bakery Group.

Chocolate chip is the widely consumed flavor.

The USA is a prominent hub for product suppliers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cookie Container Market Size and Share Forecast Outlook 2025 to 2035

Dough Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Dough Based Premixes Market Size and Share Forecast Outlook 2025 to 2035

Dough Processing System Market Analysis & Forecast by Product Type, Application, and Region through 2035

Cookie Pucks Market

Sourdough Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Sourdough Market Analysis - Size, Share, and Forecast 2025 to 2035

Sourdough Market Share Analysis – Key Trends & Growth Forecast 2025-2035

Vegan Cookies Market Analysis by Peanut Butter Vegan Cookies, Molasses Vegan Cookies and Other Cookie Types Through 2035

Bread Dough Improver Market

Frozen Dough Market Analysis by type, distribution channel and region through 2035

UK Sourdough Market Analysis – Size, Demand & Forecast 2025-2035

Charting Winning Approaches in the Frozen Dough Market: A Competitive Perspective

USA Sourdough Market Growth – Demand, Innovations & Forecast 2025-2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

ASEAN Sourdough Market Trends – Demand, Growth & Forecast 2025-2035

Europe Sourdough Market Insights – Demand, Growth & Forecast 2025-2035

Sugar-Free Cookies Market Insights - Consumer Trends 2025 to 2035

Low Calorie Cookies Market

Shelf-Stable Dough Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA