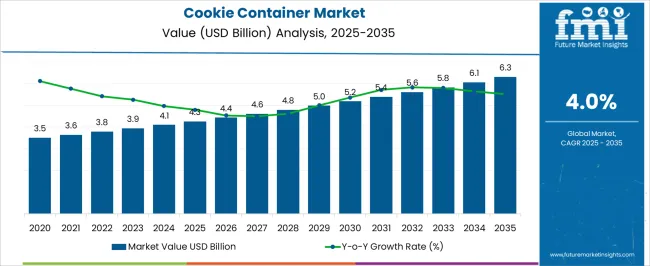

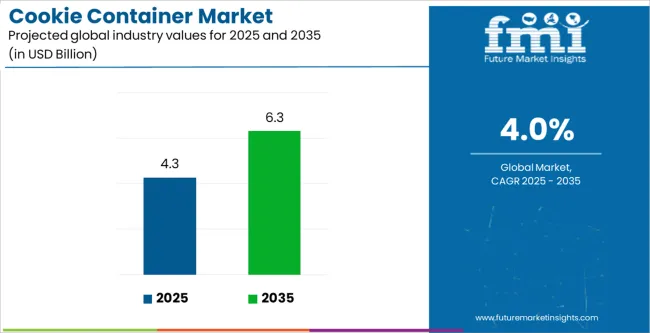

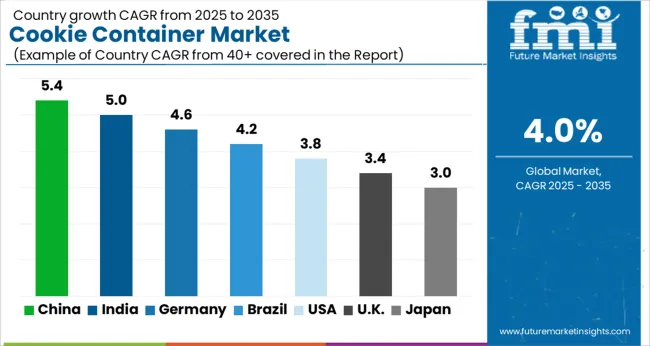

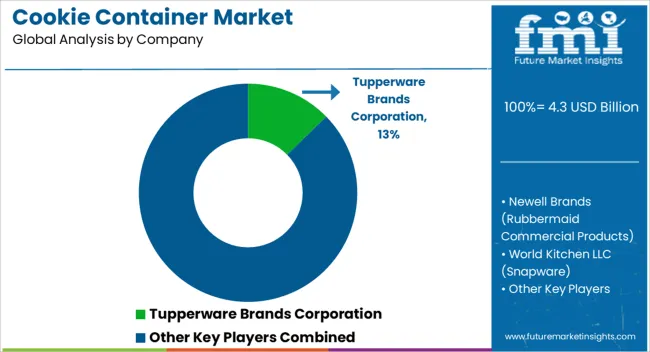

The Cookie Container Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 6.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Cookie Container Market Estimated Value in (2025 E) | USD 4.3 billion |

| Cookie Container Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The cookie container market is advancing steadily, influenced by evolving consumer lifestyles, rising demand for convenient storage solutions, and growing awareness of food safety and freshness. Industry updates and product launch announcements have emphasized the importance of airtight and durable storage containers in extending shelf life and reducing food wastage. Shifts in household consumption patterns, particularly the demand for reusable and aesthetically designed containers, have further contributed to market expansion.

Manufacturers have diversified product portfolios with innovative designs, multifunctional features, and sustainable material choices, catering to both practical use and consumer preferences for eco-friendly products. Offline and online retail channels have widened market accessibility, with offline outlets continuing to dominate due to the tactile buying experience and consumer trust in quality assurance.

Looking forward, the market is expected to benefit from rising urbanization, increased snacking culture, and the emphasis on sustainability, with demand for airtight containers, glass materials, and offline retail purchases leading growth momentum.

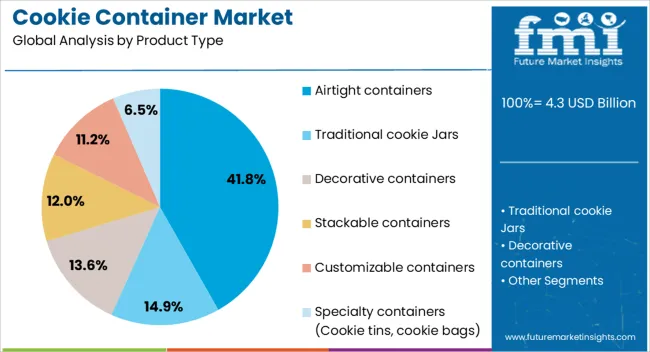

The Airtight Containers segment is projected to hold 41.8% of the cookie container market revenue in 2025, securing its place as the leading product type. Growth of this segment has been driven by consumer preference for containers that preserve freshness, protect against moisture, and prevent contamination.

Airtight containers have been adopted widely due to their ability to extend the shelf life of cookies while retaining flavor and texture. Product innovations such as secure locking mechanisms, stackable designs, and easy-to-clean features have further enhanced consumer appeal.

Retailers have reported strong demand for airtight solutions in both household and gifting categories, highlighting their multifunctionality. As food safety and freshness remain top priorities in consumer purchasing decisions, airtight containers are expected to continue dominating the product segment.

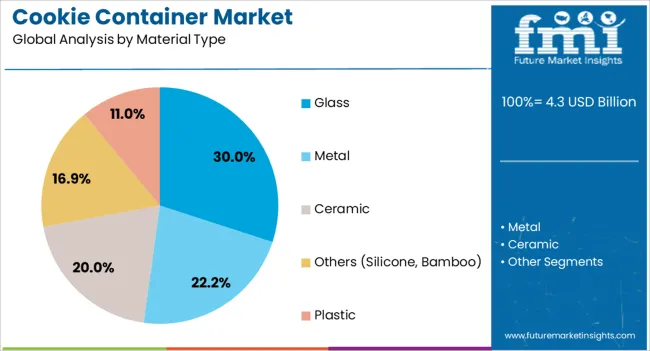

The Glass segment is projected to account for 30.0% of the cookie container market revenue in 2025, reflecting its strong position in material preference. Growth of this segment has been influenced by consumer demand for non-toxic, odor-free, and visually appealing storage solutions.

Glass containers are valued for their durability, ease of cleaning, and ability to maintain the integrity of stored cookies without leaching chemicals. Sustainability trends have further strengthened the adoption of glass, as it is recyclable and perceived as an environmentally responsible choice compared to plastic.

Additionally, glass containers often serve dual purposes, functioning as both storage and display, making them popular in households and specialty retail. With rising awareness of eco-friendly living and premium kitchen aesthetics, the glass segment is expected to maintain steady growth.

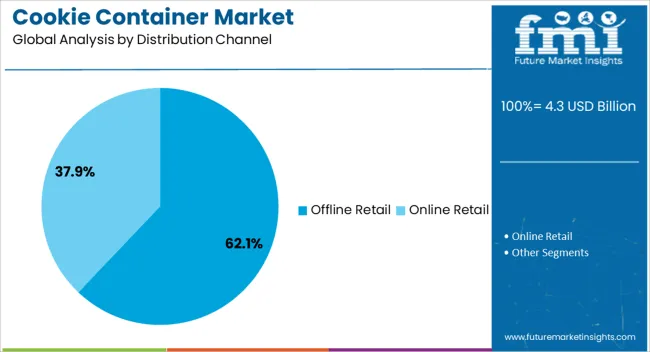

The Offline Retail segment is projected to contribute 62.1% of the cookie container market revenue in 2025, consolidating its leadership in distribution. Growth of this segment has been supported by consumer preference for physical inspection of container quality, design, and durability before purchase.

Supermarkets, hypermarkets, and specialty stores have remained the primary sales channels, offering consumers a wide variety of options and immediate product availability. Retail industry insights have highlighted that promotions, bundling offers, and festive season displays in offline outlets significantly boost sales of cookie containers.

Additionally, offline retail provides greater consumer trust, particularly for premium materials such as glass, where product feel and weight influence buying decisions. While e-commerce is expanding, offline retail continues to dominate due to consumer shopping habits, tactile experience, and direct access to product assurance. This segment is expected to remain the largest revenue contributor, supported by ongoing retail expansion and consumer loyalty to in-store purchasing.

Rising popularity of baking shows and emerging home baking needs is creating a demand for proper storage solutions like cookie containers. Surging demand for artisanal pastries and cookies is propelling sales of premium containers that elevate the presentation.

Growing appeal for recyclable and reusable containers like glass, bamboo, or compostable options are improving the sales of these varieties among eco-conscious consumers.

Budding desire for freshness preservation and convenience are encouraging manufacturers to incorporate features like stackable designs, airtight lids, and single-serve portions.

Intriguing cookie jars displayed on shelves or counters of retail stores and cafes typically act as a silent salesperson to influence impulse purchases by customers. Rising demand for personalization is expected to lead to more customization options for cookie containers, like designs or custom logos.

Given below is a comparative analysis of the cookie container industry, alongside disposable food container industry and rigid packaging container industry. The growth graph, relevant trends, and latent opportunities of each industry are discussed in brief.

Opportunities abundant in the disposable food container landscape with an anticipated CAGR of 5.1% through 2035. Popularity of online food delivery apps has amplified the demand for these containers. On the other hand, rigid packaging containers are likely to see a greener shift during the forecast period.

Cookie Container Industry:

| Attributes | Cookie Container Industry |

|---|---|

| CAGR (2025 to 2035) | 4% |

| Growth Factor | Rising popularity of baking shows and emerging home baking |

| Opportunity | Distributors and restaurant suppliers are forging alliances to ensure brand visibility and product placement |

| Key Trends | Growing appeal for recyclable and reusable containers like glass and compostable options |

Disposable Food Container Industry:

| Attributes | Disposable Food Container Industry |

|---|---|

| CAGR (2025 to 2035) | 5.1% |

| Growth Factor | Heightened demand for fast food, takeout, and ready-made food owing to elevating disposable incomes and lifestyles |

| Opportunity | Increasing investments in attractive packaging to ensure brand recall value among customers |

| Key Trends | Growing demand for customized disposable food containers made of minimal design and sustainable raw materials |

Rigid Packaging Container Industry:

| Attributes | Rigid Packaging Container Industry |

|---|---|

| CAGR (2025 to 2035) | 3% |

| Growth Factor | Rising demand for these containers from industrial and non-industrial goods |

| Opportunity | Surging investments in research and design |

| Key Trends | Paperization trend to positively impact the rigid packaging container industry |

Glass jars are a popular choice to pack cookies. The segment share of glass is estimated to be 30% by 2025. Demand for glass is rising as it imparts no odor or flavor to cookies and is considered fit for food storage.

| Leading Material | Glass |

|---|---|

| Value Share (2025) | 30% |

This material is reusable and can be recycled continuously without losing its quality, making glass jars a sustainable option. Sustainability is another aspect that is creating appeal for glass jars who are seeking ways to cut down waste generation. Additionally, in the preparation of homemade treats or gifts, glass jars are preferred as they add to the presentation.

Cafes and restaurants are the leading users of cookie containers. The segment is projected to acquire 25% in 2025. The airtight sealing of jar containers helps control moisture inside the container and prevent contaminants, thus prolonging the shelf life of cookies. This is especially important for cafes and restaurants that usually don’t sell out their entire cookie inventory daily.

| Leading End-use | Cafes and Restaurants |

|---|---|

| Value Share (2025) | 25% |

Cafes and restaurants use attractive containers to showcase their cookies on shelves or counters, thus making them visually attractive to customers and potentially increasing sales. Several restaurants and cafes utilize versatile containers to hold other baked goods or pastries besides cookies. Thus, allowing them to optimize the use of their containers and lower the supply needs.

An interesting projection pointing at opportunities available in key countries is shown in the table below. The industry is led significantly by sales of cookie containers in India, China, and Thailand.

As a result, Asia Pacific emerges as a key market at a global level. Followed by Asia Pacific, North America sees demand rising at a moderate pace. However, the demand increases prominently during the holiday season.

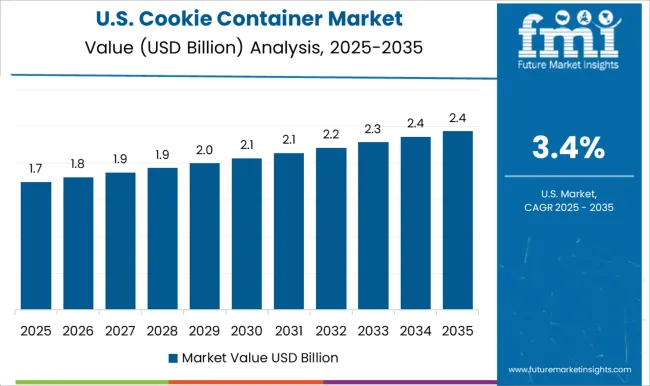

The United States cookie container market is likely to register a CAGR of 1.1% over the forecast period. The market is reaching a saturation point in the United States, with new manufacturers facing difficulty making their footprint in the country. However, there are certain market dynamics that are improving the valuation are, which includes:

The demand scope for cookie containers in the United Kingdom is 0.8% CAGR over the forecast period. Factors spurring the industry growth are as follows:

Sales of cookie containers in India are increasing at a 5.3% CAGR over the forecast period. Key aspects that are fueling the market growth are as follows:

Surging purchases of cookie containers in China are expanding at a 4.4% CAGR over the forecast period. Elements impacting the China cookie container industry are as follows:

In Thailand, the market demand for cookie containers is rising consistently at 4% CAGR during the estimated period. Factors influencing the industry growth are mentioned below:

In this sector, companies are developing cookie jars with different materials that provide benefits like improved stack ability, extended freshness control, or single-serve portion control features. Additionally, with a growing focus on sustainability, players are shedding light on the eco-friendly attributes of glass, compostable plastics, etc., to attract environmentally conscious consumers.

Players are focusing on the attractiveness of their biscuit containers by enhancing the branding elements and creating eye-catching designs, making them more appealing to cafes and restaurants. These establishments stock these containers to promote impulse purchases by their customers.

Industry participants are targeting certain segments within the market, like bakeries, cafes, or home bakers, with containers developed to cater to their distinct needs, like display containers for cafes and bulk storage for bakeries.

Distributors and restaurant suppliers are further building strong relationships to ensure brand visibility and product placement. By implementing all or a combination of these strategies, players are positioning themselves for a greater market share.

Latest Developments Affecting the Cookie Container Industry

Based on material, the industry is divided into glass, plastic, paperboard, metal

This segment is categorized into up to 250 gm, 251 to 500 gm, 501 to 750 gm, and above 750 gm

Different end users in the industry are restaurants and cafes, hotels and lodgings, food courts, online food delivery, and household

Industry analysis has been carried out in key countries of North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

The global cookie container market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the cookie container market is projected to reach USD 6.3 billion by 2035.

The cookie container market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in cookie container market are airtight containers, traditional cookie jars, decorative containers, stackable containers, customizable containers and specialty containers (cookie tins, cookie bags).

In terms of material type, glass segment to command 30.0% share in the cookie container market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cookie Dough Market Analysis by Nature, Ingredients, Flavor, End Use, and Region Through 2035

Cookie Pucks Market

Vegan Cookies Market Analysis by Peanut Butter Vegan Cookies, Molasses Vegan Cookies and Other Cookie Types Through 2035

Sugar-Free Cookies Market Insights - Consumer Trends 2025 to 2035

Low Calorie Cookies Market

Container-based Firewall Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Container As A Service (CaaS) Market Size and Share Forecast Outlook 2025 to 2035

Container Washing System Market Size and Share Forecast Outlook 2025 to 2035

Containerboard Market Size and Share Forecast Outlook 2025 to 2035

Containerized Substation Market Size and Share Forecast Outlook 2025 to 2035

Container Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Container Stacking Machine Market by Automation & System Type Through 2035

Container Weighing Systems Market Growth - Trends & Forecast 2025 to 2035

Analyzing Container Liner Market Share & Industry Leaders

Market Leaders & Share in the Container Stacking Machine Industry

Container Security Market

Container Coating Market

Container Mouth Inner Seal Market

PS Containers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA