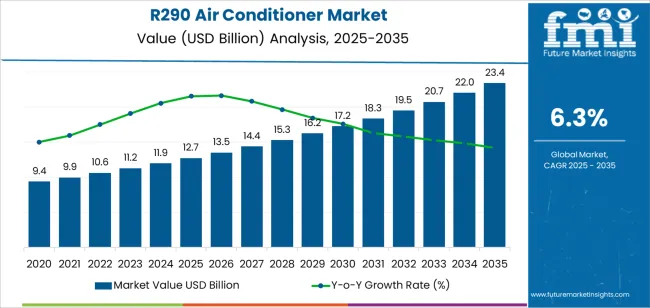

The R290 air conditioner market is valued at USD 12.7 billion in 2025 and is expected to reach USD 23.5 billion by 2035, advancing at a CAGR of 6.3%. Market growth is driven by the global transition toward low-global-warming-potential (GWP) refrigerants, increasing regulatory restrictions on hydrofluorocarbons (HFCs), and the growing focus on ecofriendly cooling technologies. R290 (propane) refrigerant offers high energy efficiency, low environmental impact, and compatibility with existing air-conditioning systems, making it a preferred alternative in both residential and commercial applications.

Split-type air conditioners represent the leading segment due to their widespread installation flexibility, strong energy efficiency ratings, and ability to accommodate R290’s thermodynamic properties effectively. Manufacturers are improving system safety through leak detection mechanisms, optimized charge volumes, and hermetically sealed compressor designs to ensure compliance with international safety standards. The rising adoption of inverter-based and variable-speed systems further enhances operational efficiency and reduces power consumption.

Asia Pacific dominates global market growth, supported by rapid urbanization and increased residential cooling demand in China, India, and Southeast Asia. Europe and North America maintain adoption through decarbonization initiatives and government-backed refrigerant transition programs. Key players include Panasonic, CIAT, Godrej & Boyce, Midea, Gree, Haier, TCL, Aux, Hisense, Changhong, and Justy Industrial, focusing on green refrigerant technology, product reliability, and global compliance.

The early growth curve, covering 2025 to 2029, will show rapid acceleration driven by global initiatives to phase down high-GWP refrigerants and adopt R290 (propane) as an environmentally ecofriendly alternative. This phase will be characterized by increasing regulatory support, manufacturing adaptation to flammable refrigerants, and growing consumer acceptance in residential and light commercial applications. Rapid production scaling and technology transfer in Asia-Pacific will further reinforce early momentum.

From 2030 to 2035, the late growth curve will show moderate deceleration as adoption reaches maturity in developed regions. Market expansion will become steadier, with demand shifting toward system replacements and efficiency upgrades rather than new installations. Continuous innovation in leak detection systems, safety standards, and compressor optimization will maintain growth during this phase. The early-to-late curve comparison illustrates a transition from regulation-led acceleration to technology-driven stabilization, reflecting a maturing yet resilient market supported by environmental compliance, cost efficiency, and continued preference for low-impact refrigerant solutions in the global cooling industry.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 12.7 billion |

| Market Forecast Value (2035) | USD 23.5 billion |

| Forecast CAGR (2025-2035) | 6.3% |

The R290 air conditioner market is expanding as regulatory frameworks push for reduced greenhouse‐gas emissions and lower global warming potential refrigerants. R290 (propane) offers a very low GWP and superior thermodynamic efficiency compared with many synthetic refrigerants, making it attractive for residential and commercial cooling systems. Manufacturers and utilities increasingly favour equipment that aligns with energy-efficiency standards and clean-technology mandates, supporting the shift toward R290-based systems. Rising demand in emerging regions such as Southeast Asia and India, combined with replacement of older systems in mature markets, creates growth opportunities. Cooling loads will continue to rise globally as temperatures increase, urbanisation advances and consumer access to air conditioning rises.

The market faces challenges from the flammability of R290, which requires specific safety measures, charge size limits and compliance with national installation regulations. Equipment capable of using R290 may involve higher certification and cost burdens. Supply-chain constraints for specialised components, variable regional code harmonisation and competition from alternative low-GWP refrigerants may limit growth.

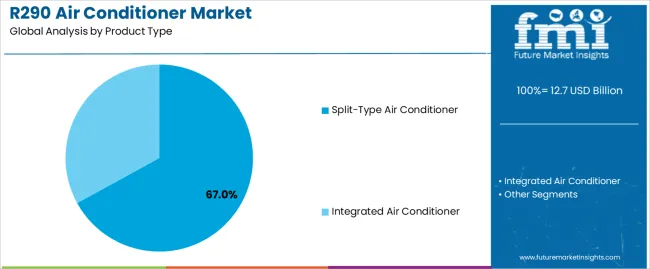

The R290 air conditioner market is segmented by product type and application. By product type, the market is divided into split-type air conditioner and integrated air conditioner. Based on application, it is categorized into commercial and household segments. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

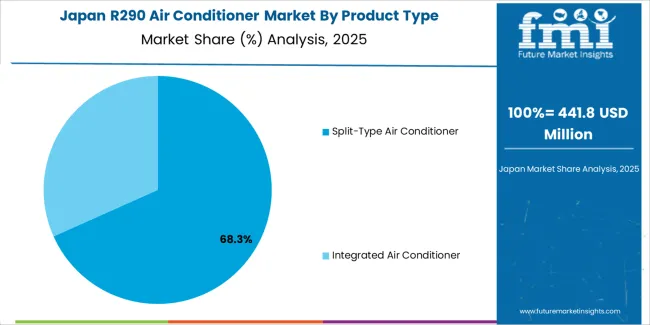

The split-type air conditioner segment holds the leading position in the R290 air conditioner market, representing an estimated 67.0% of total market share in 2025. Split-type systems dominate due to their energy efficiency, flexible installation options, and widespread use across residential and small commercial buildings. Utilizing R290 (propane) as a refrigerant, these units deliver high cooling efficiency while maintaining a low global warming potential (GWP), aligning with environmental regulations and green building standards.

The segment’s leadership is reinforced by rising adoption in emerging economies transitioning from high-GWP refrigerants toward ecofriendly cooling solutions. Split systems also provide superior noise control and zonal cooling capabilities, making them preferred for urban and domestic use. The integrated air conditioner segment, estimated at 33.0%, serves large commercial facilities and industrial sites requiring centralized cooling and greater capacity per unit.

Key factors supporting the split-type air conditioner segment include:

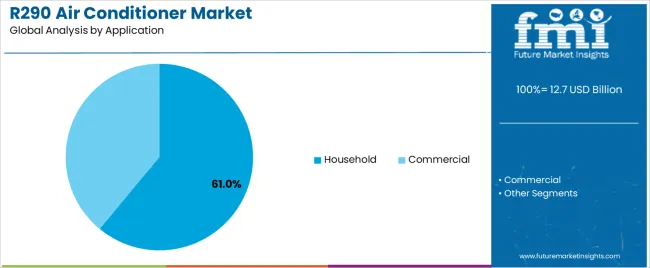

The household segment accounts for approximately 61.0% of the R290 air conditioner market in 2025. This dominance is attributed to growing residential demand for eco-friendly and cost-efficient cooling systems amid rising global temperatures and stricter climate policies. Homeowners increasingly prefer R290-based air conditioners for their superior energy efficiency, low carbon footprint, and reduced operating costs compared to conventional refrigerant systems.

The commercial segment, representing about 39.0%, follows closely, supported by adoption in offices, retail outlets, and hospitality facilities. The use of R290 in commercial systems is expanding as building operators transition toward ecofriendly HVAC technologies that meet international environmental compliance standards such as F-Gas and Kigali Amendment regulations.

Primary dynamics driving demand from the household segment include:

Rapid regulatory phase-out of high-GWP refrigerants, strong demand for energy-efficient cooling, and heightened ecofriendly focus are driving market growth.

The R290 air conditioner market is expanding as global policy frameworks phase down hydrofluorocarbon (HFC) refrigerants and promote natural alternatives such as R-290 (propane) with very low global warming potential. This transition creates strong substitution demand for R290-based systems across residential, commercial and portable air conditioning segments. Growing consumer and commercial demand for energy-efficient cooling solutions in warmer climates, combined with tighter emissions and efficiency targets, increases uptake of R290 air conditioners. Manufacturers are also scaling production and adapting product lines to meet low-GWP refrigerant standards and growing green-building requirements.

Flammability concerns, higher certification and manufacturing complexity, and limited retrofit compatibility restrain market penetration.

Although R290 offers environmental advantages, its flammability poses safety and regulatory challenges for deployment in air conditioning systems. Compliance with safety standards requires specialised equipment, additional sensors, limits on refrigerant charge size, and designer training, which raise costs and slow rollout. Many existing HVAC installations may not be readily compatible with R290 without redesign, limiting retrofit uptake. In some price-sensitive markets the premium cost of R290-equipped units and infrastructure investment hamper adoption relative to conventional systems.

Modular product growth, Asia-Pacific expansion and integration of IoT/efficiency features define the market outlook.

Product trends increasingly favour portable and split-type air conditioners pre-charged for R290, enabling easier installation and flexible deployment. The Asia-Pacific region is set to lead growth thanks to rising disposable incomes, urbanisation, hotter climate zones and supportive policy frameworks. Manufacturers are embedding smart controls, IoT-based monitoring and power-consumption analytics into R290 systems to enhance energy performance and user value. These innovations, together with evolving safety certification standards and broader regional market acceptance, are positioning R290 air conditioners as a mainstream ecofriendly cooling solution for the coming decade.

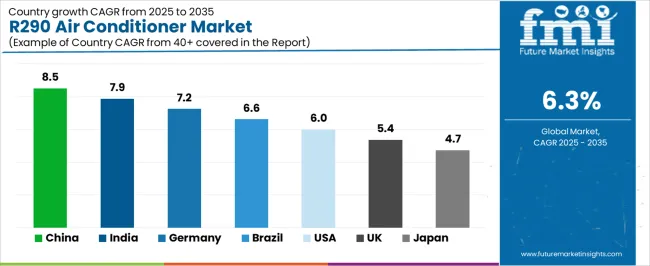

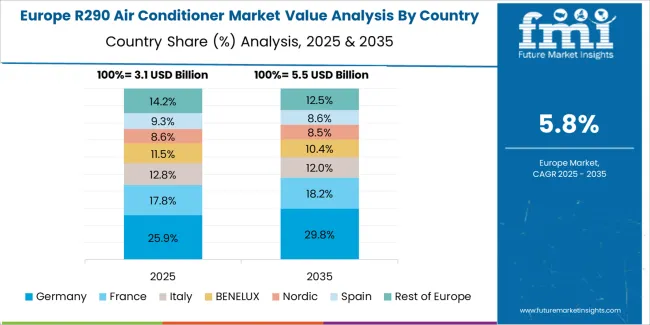

The global R290 air conditioner market is expanding steadily through 2035, driven by regulatory pressure to reduce greenhouse gas emissions, increasing awareness of natural refrigerants, and technological advancements in compressor design. China leads with an 8.5% CAGR, followed by India at 7.9%, reflecting strong manufacturing growth and eco-friendly policy adoption. Germany grows at 7.2%, supported by energy efficiency mandates and innovation in green cooling systems. Brazil records 6.6%, driven by ecofriendly refrigerant transitions and industrial modernization. The United States grows at 6.0%, emphasizing environmental compliance and retrofitting projects, while the United Kingdom (5.4%) and Japan (4.7%) maintain stable demand through mature HVAC markets and R&D-led system optimization.

| Country | CAGR (%) |

|---|---|

| China | 8.5 |

| India | 7.9 |

| Germany | 7.2 |

| Brazil | 6.6 |

| USA | 6.0 |

| UK | 5.4 |

| Japan | 4.7 |

China’s R290 air conditioner market grows at 8.5% CAGR, driven by large-scale manufacturing capacity, policy mandates, and ecofriendly refrigerant initiatives. The China Green Cooling Action Plan encourages the use of R290 (propane) as a low-GWP refrigerant alternative to R22 and R410A. Domestic HVAC manufacturers are expanding production of split and portable systems designed for high energy efficiency and safety compliance. Research in heat exchanger miniaturization and refrigerant charge optimization improves overall system performance. Export markets in Asia and Africa are adopting Chinese R290 systems due to their low emissions and affordability.

Key Market Factors:

India’s market grows at 7.9% CAGR, supported by ecofriendly cooling programs, manufacturing expansion, and environmental compliance. The India Cooling Action Plan (ICAP) promotes low-GWP refrigerant adoption to reduce HFC emissions. Domestic firms are increasing R290 air conditioner production through partnerships with global HVAC manufacturers. R&D efforts focus on safety enhancements, flammability management, and system reliability under tropical operating conditions. Rising urbanization and higher cooling demand in residential sectors strengthen long-term market potential. Capacity expansion under Make in India initiatives supports local production and reduced import dependency.

Market Development Factors:

Germany’s market grows at 7.2% CAGR, supported by stringent environmental standards and innovation in heat pump technology. Adoption of R290 aligns with the EU F-Gas Regulation, which targets phasedown of high-GWP refrigerants. HVAC manufacturers are integrating natural refrigerant systems with inverter compressors and heat recovery technologies. The Ecodesign Directive promotes life-cycle energy efficiency, fostering demand for propane-based systems. Research in hermetic compressor safety and flame arrestor integration improves performance stability. Commercial and residential buildings increasingly adopt R290 systems for compliance and ecofriendly goals.

Key Market Characteristics:

Brazil’s market grows at 6.6% CAGR, driven by environmental regulation, tropical climate demand, and import substitution efforts. The National Climate Policy encourages the adoption of low-GWP refrigerants in residential and light commercial air conditioners. Domestic assemblers are licensing R290 technologies from Asian manufacturers. Incentive programs support modernization of manufacturing lines for eco-refrigerant compliance. Demand for energy-efficient cooling systems is increasing due to rising electricity costs and heatwave frequency. Government-backed efficiency labeling promotes R290 adoption in middle-income residential segments.

Market Development Factors:

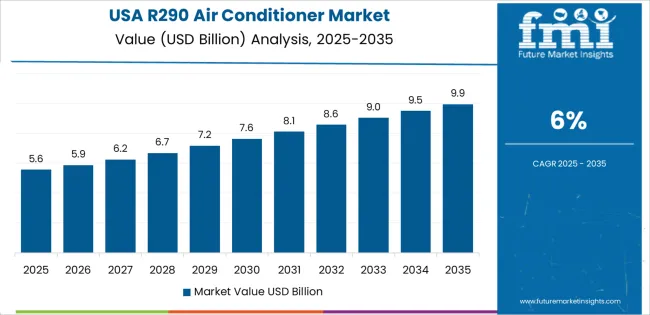

The United States grows at 6.0% CAGR, driven by regulatory realignment, technological advancement, and retrofitting activity. The American Innovation and Manufacturing (AIM) Act supports HFC reduction and natural refrigerant adoption. Manufacturers are developing R290-compatible HVAC units with enhanced leak detection and ventilation safety systems. Integration with smart thermostats and inverter-driven compressors improves energy performance. Retrofit projects replacing R22 systems with propane-based alternatives are expanding, particularly in light commercial applications. The presence of advanced testing infrastructure supports continued development of safe, low-emission systems.

Key Market Factors:

The United Kingdom’s market grows at 5.4% CAGR, supported by regulatory enforcement, decarbonization targets, and green building trends. The UK F-Gas Regulation and Net Zero Strategy encourage adoption of propane-based air conditioning solutions. Manufacturers are developing compact, hermetically sealed R290 systems for residential and small commercial installations. Industry collaboration with European partners promotes standardized safety and installation practices. Increasing retrofits of older refrigerant systems, along with energy performance certification requirements, drives demand for natural refrigerant-based solutions.

Market Development Factors:

Japan’s market grows at 4.7% CAGR, supported by R&D in energy-efficient cooling and natural refrigerant transition. Domestic HVAC manufacturers are producing R290 air conditioners with enhanced thermal performance and reduced refrigerant charge. The Green Innovation Fund and Top Runner Program promote low-carbon cooling technology development. Integration of smart control systems improves energy monitoring and adaptive temperature management. Japan’s precision manufacturing and safety engineering expertise facilitate large-scale deployment in both residential and commercial environments. Continued investment in material science enhances component durability and efficiency.

Key Market Characteristics:

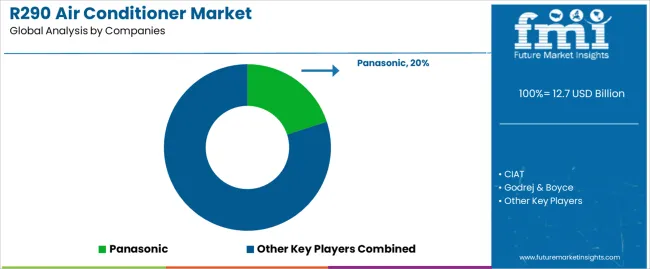

The R290 air conditioner market is moderately consolidated, with around ten key manufacturers developing propane-based cooling systems that meet global environmental and efficiency standards. Panasonic leads the market with an estimated 20.0% global share, supported by its early adoption of R290 refrigerant technology, wide product portfolio, and strong distribution networks across Asia and Europe. Its leadership is reinforced by consistent investment in low-GWP (Global Warming Potential) technologies and manufacturing facilities aligned with international climate compliance frameworks.

Midea, Gree, and Haier follow as leading competitors, offering high-efficiency residential and commercial R290 models integrated with inverter compressors and smart control systems. Their competitiveness is driven by large-scale production, regional availability, and strong export capacity in emerging markets. Godrej & Boyce plays a pioneering role in India, holding a strong domestic presence through energy-efficient R290 air conditioners supported by in-house compressor technology and government-backed green initiatives. TCL, Aux, and Hisense occupy mid-tier positions, emphasizing cost optimization, performance reliability, and accessibility in mass-market segments. CIAT contributes specialized R290 units for commercial HVAC applications in Europe, while Changhong and Justy Industrial provide region-specific production for OEM and private-label supply chains.

Competition in this market centers on energy efficiency, refrigerant safety, and compliance with evolving environmental standards. Growth is driven by global regulatory transitions from HFCs to natural refrigerants, with manufacturers investing in component compatibility, leak prevention systems, and scalable production to meet rising demand for ecofriendly, high-performance air conditioning solutions.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Split-Type Air Conditioner, Integrated Air Conditioner |

| Application | Commercial, Household |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Panasonic, CIAT, Godrej & Boyce, Midea, Gree, Haier, TCL, Aux, Hisense, Changhong, Justy Industrial |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of R290-based air conditioning system manufacturers; advancements in propane (R290) refrigerant technology for low-GWP cooling; integration with energy-efficient HVAC systems and eco-friendly building solutions. |

The global R290 air conditioner market is estimated to be valued at USD 12.7 billion in 2025.

The market size for the R290 air conditioner market is projected to reach USD 23.4 billion by 2035.

The R290 air conditioner market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in R290 air conditioner market are split-type air conditioner and integrated air conditioner.

In terms of application, household segment to command 61.0% share in the R290 air conditioner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Household R290 Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Demand for R290 Air Source Heat Pump in USA Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA