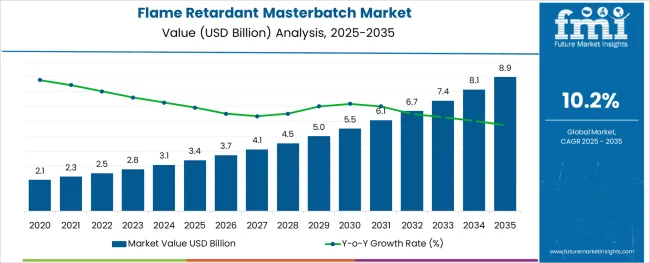

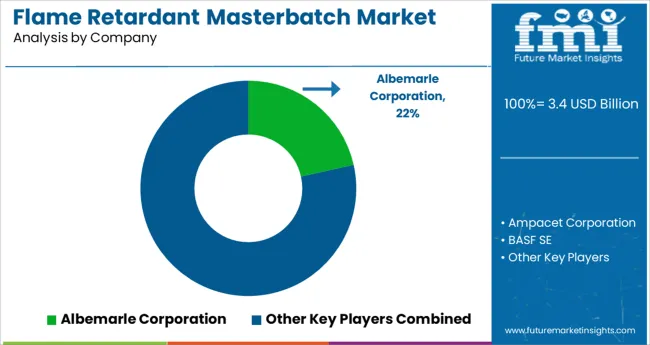

The Flame Retardant Masterbatch Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.2% over the forecast period.

The flame retardant masterbatch market is progressing steadily as demand rises for materials that enhance fire safety across various industries. Increasing safety regulations and stricter fire standards are pushing manufacturers to incorporate flame retardant compounds into plastics and polymers. This is especially critical in sectors like automotive where fire safety is paramount.

Technological advances in masterbatch formulations have improved flame resistance while maintaining material properties such as strength and flexibility. Additionally, the focus on eco-friendly and halogen-free flame retardants is shaping product innovation and adoption.

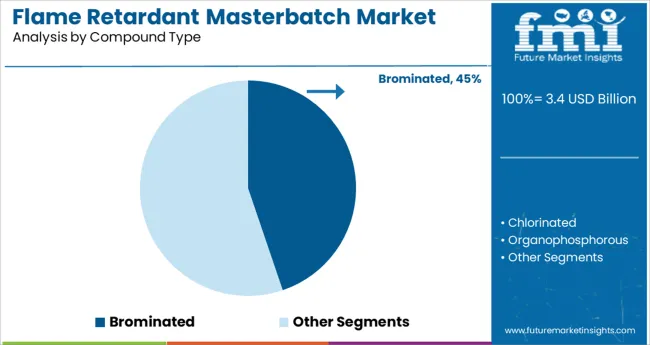

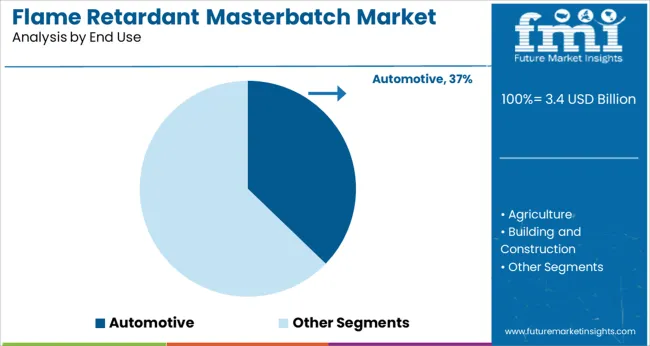

Growth in end-use industries like automotive is driven by increasing production volumes and the integration of advanced safety features in vehicles. Infrastructure development and consumer safety awareness are also important factors influencing market expansion. The market outlook remains optimistic with ongoing regulatory support and innovation. Segmental growth is led by brominated compounds as the preferred compound type and automotive applications as the key end use segment.

The market is segmented by Compound Type and End Use and region. By Compound Type, the market is divided into Brominated, Chlorinated, Organophosphorous, and Other Compound Types. In terms of End Use, the market is classified into Automotive, Agriculture, Building and Construction, Packaging, and Electrical and Electronics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The brominated compound segment is projected to hold 44.8% of the flame retardant masterbatch market revenue in 2025, retaining its leadership position. This segment’s growth is supported by the effective flame retardant properties of brominated compounds, which provide excellent thermal stability and inhibit combustion.

These compounds have been widely used due to their compatibility with a variety of polymer matrices and their ability to meet stringent fire safety standards. Moreover, brominated masterbatches offer cost-effective solutions for manufacturers seeking reliable fire protection without compromising material performance.

Despite increasing interest in alternative halogen-free options, brominated compounds continue to dominate due to their proven efficacy and broad regulatory acceptance. The segment is expected to maintain strong growth as industries balance performance requirements and safety compliance.

The automotive segment is expected to account for 37.2% of the flame retardant masterbatch market revenue in 2025, positioning it as the largest end use segment. Growth in this segment is driven by the automotive industry’s increasing focus on occupant safety and regulatory mandates for fire-resistant materials in vehicle interiors and electrical components.

Manufacturers have incorporated flame retardant masterbatches in dashboards, wiring insulation, seating, and under-the-hood components to meet safety requirements. The push for lightweight and sustainable materials has further encouraged the use of advanced flame retardants that maintain performance while reducing weight.

Expansion in electric vehicle production has also created new demand for fire-safe polymer components. As the automotive sector continues to innovate and adopt stringent safety standards, the flame retardant masterbatch market is expected to benefit significantly from this end-use segment.

Over the recent past, there has been significant growth in the automotive vehicle production, especially electric vehicles, owing to which demand for plastic materials is increasing incessantly which in turn is expected to drive the demand for global flame retardant Masterbatch market.

Along with this, Flame retardant Masterbatch is preferred in several applications, such as building & construction, household appliances and many other appliances.

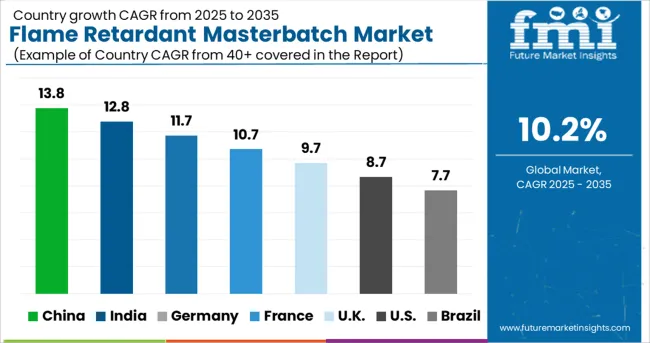

Thus, growing Infrastructure development in developing and developed countries such as India and China and Brazil, among others is the key factor driving growth of the building and construction industry.

Attributing to this, the demand for plastic products is rising significantly which in turn is expected to drive the sales of global flame retardant Masterbatch.

In Europe, various regulations such as REACH and WEEE (Waste Electrical and Electronic Equipment) restrict the use of brominated and chlorinated flame retardant Masterbatch as they adversely affect the environment.

Owing to this, the use of halogenated flame retardant Masterbatch is highly regulated in Europe, which is subsequently affecting the demand for global flame retardant Masterbatch in plastic processing.

Europe is expected to witness significant growth opportunities in the strong>global flame retardant masterbatch market.

With stringent government regulations, the sales of flame retardant Masterbatch is gaining traction in applications, such as automotive, building & construction, to name a few.

Europe holds a significant share in global automotive production. Production of passenger cars in Europe increased by 2.6% Y-o-Y between 2020 and 2020.

Further, stringent government norms pertaining to CO2 emission and pollution control promote reduction in vehicle weight so as to increase vehicle efficiency.

Attributing to which, the demand for high performance plastics has increased in vehicle interiors and exteriors. This, in turn, has led to the increase in demand for flame retardant Masterbatch to impart thermal stability into plastics for the automotive industry.

Prompt growth of plastic and packaging sectors in APAC is in turn expected to drive the sales of flame retardant Masterbatch.

In APAC, China is a major manufacturer of plastic and contributed over 27% to the global plastic production in 2020. Further, the growing demand for various high performance plastic materials with functional properties for various end-use applications will subsequently result in increased demand for flame retardant Masterbatch.

The key players of the global flame retardant masterbatch market are focusing on enhancing and adopting strategies like enhancing the durability, sizes and its use to thrive business. This is driving the global flame retardant masterbatch.

These market players are anticipated to drive the global flame retardant masterbatch market by introducing new products and expanding geographically.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 10.2% from 2025 to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in billion, volume in kilotons, and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Compound type, End Use, Region |

| Regional scope | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Japan; Middle East and Africa (MEA) |

| Country scope | USA, Canada, Mexico, Brazil, Germany, Italy, France, UK, Spain, Poland, Russia, India, China, ASEAN, Japan, Australia & New Zealand, GCC Countries, South Africa, North Africa |

| Key companies profiled | Albemarle Corporation; Ampacet Corporation; BASF SE; Clariant International AG; Cromex S/A; DIC Corporation; Dongguan GreenTech Plastics Co. Ltd; DOVER CHEMICAL CORPORATION; FERRO-PLAST Srl; LANXESS AG; Nouryon; Polyplast Muller GmbH; Polytechs; Tosaf |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global flame retardant masterbatch market is estimated to be valued at USD 3.4 billion in 2025.

It is projected to reach USD 8.9 billion by 2035.

The market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types are brominated, chlorinated, organophosphorous and other compound types.

automotive segment is expected to dominate with a 37.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flame Detector Market Size and Share Forecast Outlook 2025 to 2035

Flameproof Equipment Market Size and Share Forecast Outlook 2025 to 2035

Flame Barrier Market Size and Share Forecast Outlook 2025 to 2035

Flame Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Flame Photometer Market Size and Share Forecast Outlook 2025 to 2035

Flame Ionization Detectors Market Size and Share Forecast Outlook 2025 to 2035

Flame Proof Lighting Market Growth 2025 to 2035

Flame Arrester Market

Flame Retardant Chemicals Market Growth - Trends & Forecast 2025 to 2035

Flame Retardant Film Market Analysis & Forecast 2024-2034

Flame Retardant Market Growth – Trends & Forecast 2024-2034

Aramid Flame Retardant Webbing Market Size and Share Forecast Outlook 2025 to 2035

Bromine Flame Retardant Market Growth – Trends & Forecast 2024-2034

Inorganic Flame Retardants Market

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Non-Halogenated Flame Retardants Market- Growth & Demand 2025 to 2035

Reactive Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Fire Retardant Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA