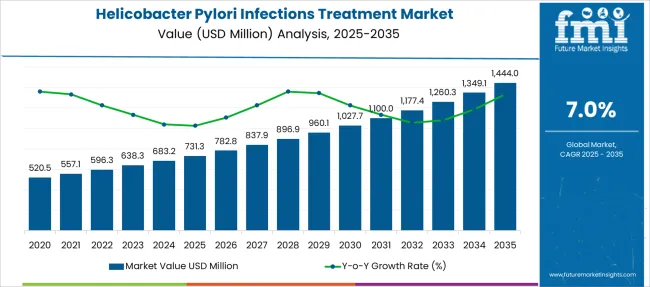

The Helicobacter Pylori Infections Treatment Market is estimated to be valued at USD 731.3 million in 2025 and is projected to reach USD 1444.0 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Helicobacter Pylori Infections Treatment Market Estimated Value in (2025 E) | USD 731.3 million |

| Helicobacter Pylori Infections Treatment Market Forecast Value in (2035 F) | USD 1444.0 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The Helicobacter Pylori Infections Treatment market is experiencing notable growth, driven by the global rise in gastrointestinal disorders and increased awareness of early diagnosis and eradication therapies. Treatment protocols are evolving in response to growing antibiotic resistance, with healthcare systems and clinical researchers emphasizing multi-drug regimens for better therapeutic outcomes. A significant boost in screening programs and diagnostic endoscopy procedures has contributed to earlier detection and timely intervention, particularly in regions with high H.

pylori prevalence. Press releases and pharmaceutical investor briefings have pointed toward expanding R&D for newer formulations that target resistant strains while minimizing side effects. The future outlook is expected to be shaped by advancements in precision medicine, growing access to healthcare in emerging economies, and updates to international treatment guidelines.

In addition, the clinical preference for therapies with improved eradication rates and reduced recurrence risk is influencing market direction With changing antibiotic stewardship policies and patient-centered approaches, the market is poised for sustained development in both treatment innovation and access expansion.

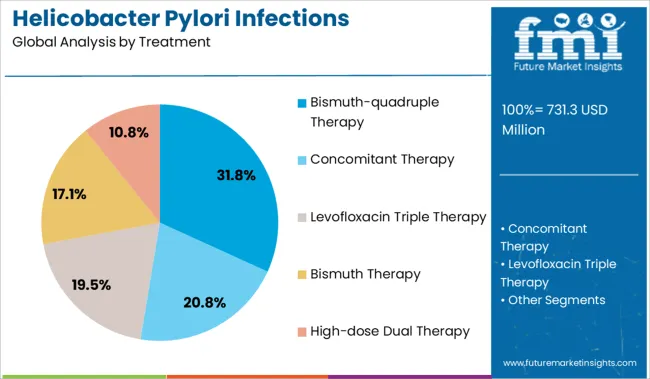

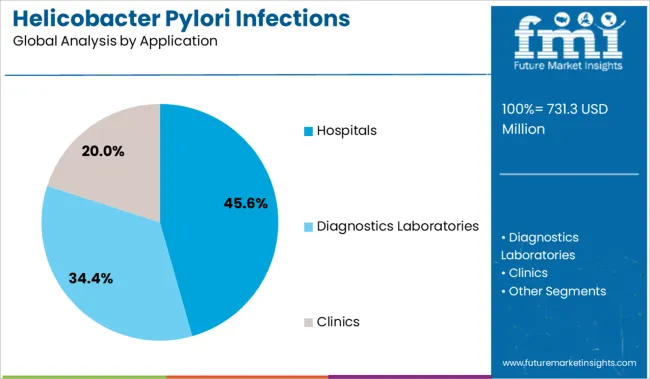

The market is segmented by Treatment and Application and region. By Treatment, the market is divided into Bismuth-quadruple Therapy, Concomitant Therapy, Levofloxacin Triple Therapy, Bismuth Therapy, and High-dose Dual Therapy. In terms of Application, the market is classified into Hospitals, Diagnostics Laboratories, and Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bismuth-quadruple therapy segment is anticipated to account for 31.8% of the Helicobacter Pylori Infections Treatment market revenue share in 2025, establishing it as the leading treatment type. This dominance has been shaped by its proven efficacy in cases of antibiotic resistance, which has become increasingly common in standard triple therapies. Clinical updates and healthcare journals have highlighted this regimen for its consistent eradication rates, especially in populations with high clarithromycin resistance.

The segment's strength is also reinforced by its inclusion in revised international guidelines as a first-line treatment, further validating its therapeutic value. Its composition, typically combining bismuth, metronidazole, tetracycline, and a proton pump inhibitor, offers broad-spectrum coverage and minimizes treatment failure.

Pharmaceutical manufacturers have expanded production and distribution of fixed-dose combinations to improve patient adherence These factors, combined with the therapy's effectiveness in second-line and rescue treatments, have significantly contributed to its prominent position in the market for 2025.

The hospitals segment is expected to lead the Helicobacter Pylori Infections Treatment market with a revenue share of 45.6% in 2025. This segment’s dominance is being supported by the concentration of diagnostic capabilities, inpatient treatment resources, and access to specialist care in hospital settings. Physicians in hospital environments are more likely to adopt guideline-recommended regimens and conduct follow-up diagnostics such as endoscopy and urea breath tests.

Institutional protocols often emphasize the use of advanced therapeutic approaches and multi-drug therapies, especially in cases involving resistance or treatment failure. Hospitals are also at the forefront of clinical trials and protocol-based therapy rollouts, which has reinforced their role in driving prescription volume. In addition, patient access to full diagnostic workups and immediate treatment in hospitals improves eradication outcomes, especially in severe or chronic cases.

These clinical, operational, and infrastructure-driven advantages have positioned hospitals as the primary application area for H pylori infection treatment in 2025.

COVID-19 is an unprecedented global public health crisis that has impacted nearly every marketplace, and the lengthy effects are expected to have an influence on the industry's expansion over the forecast period. Our continuing research expands our research framework to include underlying COVID-19 concerns and potential next steps.

Antibiotic availability and affordability in addition to shorter processing duration will increase antibiotic implementation and requirement for pre and post-surveillance tests. Moreover, rising H. pylori infection rates, the necessity for early diagnosis of symptoms, and technological innovations in diagnostic procedures are estimated to drive overall growth over the forecast period.

Soaring Infectious Disease Incidence Rates and Increased Awareness to propel growth

The growing incidence of communicable diseases and soaring public awareness about infections are the key causes of the industry. Tuberculosis, Chlamydia, gonorrhea, other sexually transmitted illnesses (STDs), stomach flu (gastroenteritis), and bladder infections represent the most prevalent infectious illnesses caused by viruses (UTIs).

For example, according to a research released in 2024 titled "The Global Prevalence of Peptic Ulcer in the World: A Systematic Review and Meta-analysis," the worldwide incidence of peptic ulcer was around 8.4% in 2024. Because helicobacter pylori diagnostics are widely accepted for infectious disease diagnosis, such occurrences indicate that the market is projected to expand at a substantial rate over the coming years.

Diagnostic cost-effectiveness and the necessity for personalized antibiotic therapy drive market expansion

The market is expanding due to increased diagnostic cost-effectiveness and the requirement for personalized antibiotic therapy. The accessibility of low-cost antibiotics and short processing durations are anticipated to boost antibiotic regimen implementation, which will benefit consumers for both pre-and post-monitoring tests.

Furthermore, a rise in the prevalence of Helicobacter pylori infection, higher demand for early recognition of symptoms, and advancements in diagnostic methods all contribute to the market's growth.

Diagnostic test restrictions limit growth in the economy

Diagnostic test constraints are predicted to be a significant impediment to the expansion of the Helicobacter pylori diagnostics market. Serology-based assays, for example, have low sensitivity and specificity because they cannot distinguish between acute illness and IgG antibodies present after treatment.

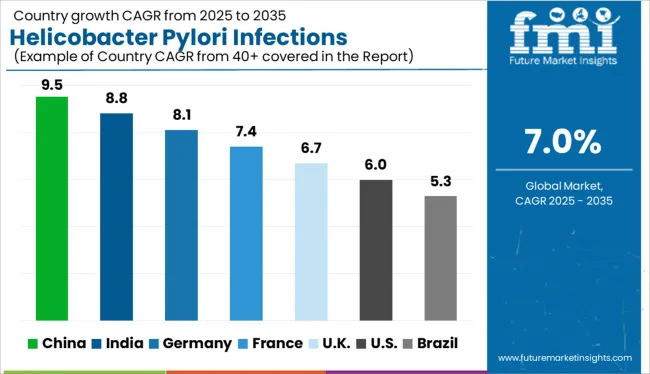

North American Market Growth is credited to rising transmissible diseases

Over the projected timeframe, North America is likely to dominate the global helicobacter pylori diagnostics industry. The rise is attributed to aspects such as a rise in the instances of transmissible diseases, increased awareness of infectious diseases, and the introduction of new products.

For example, Biomerica Inc. announced in June 2024 that it had signed an exclusive five-year partnership deal with a Canadian partner for the marketing and sale of Biomerica's new and proprietary Helicobacter pylori test, hp+detect. The hp+detect product was created to identify and supervise helicobacter pylori infection, which is the major cause of stomach and duodenal ulcers and a health risk for gastric cancer.

As a result, such occurrences are expected to propel market expansion in the region. The gender representation of H. pylori infection indicates a male predominance worldwide, with an estimated 62,500,000 male and approximately 56,900,000 female cases in the United States in 2024.

Europe is estimated to have the second-highest volume of H. pylori sales

Europe is expected to possess the second-largest H. pylori sales volume, with 30% revenue by 2025. The extensive use of antibiotics in several countries is an important factor. Furthermore, rising investments and the emergence of different major influencers are being assessed as potential drivers of market growth.

The European Helicobacter Pylori Infections Treatment market is forecast to be the second biggest. The growing number of patients seeking an early diagnosis of helicobacter pylori infection in order to avoid peptic ulcers is predicted to boost the market growth in the European region.

Based on the National Institute for Health Research, Helicobacter pylori is prevalent in most nations, along with North European communities, in which an estimated one-third of grownups are still contaminated, meanwhile, the incidence is higher than 50% in South America, Asia, and south and east Europe. Moreover, Helicobacter pylori are still prominent in immigrants from Helicobacter pylori-endemic European countries. These aspects are predicted to propel the global helicobacter pylori testing market in Europe forward.

The diagnostic laboratories segment to grow at the fastest pace

During the forecast period, the diagnostic laboratories segment is anticipated to expand at the fastest rate. The primary reasons for healthy growth are more specialized and effective infection identification, along with greater awareness of infectious diseases.

In regards to revenue, the hospitals and diagnostics laboratories segments were responsible for more than 82% of the industry in 2025.

HDDT (high-dose dual therapy) segment to Grow Rapidly

Bismuth quadruple therapy (BQT) is currently widely used to eliminate H pylori. High-dose dual therapy (HDDT) is an effective alternative diagnosis.

As per the latest analysis, both BQT and HDDT can achieve comparable elimination rates and adherence, with HDDT causing fewer side effects in general. As a result, these segments are expected to witness major market growth.

The growing number of start-ups in the Helicobacter Pylori Infections Treatment market has increased product quality and worldwide sales. Furthermore, in order to gain a competitive edge, new start-ups are operating on recent developments and releasing new products such as:

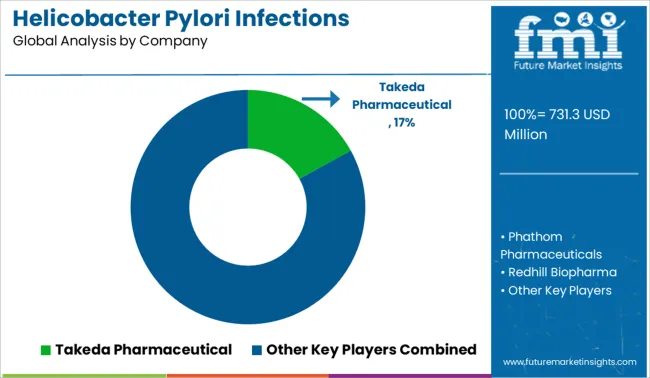

Key players in the helicobacter pylori infections treatment market are Takeda Pharmaceutical, AbbVie, Cumberland Pharmaceuticals, Eisai Co, Bio-Rad Laboratories, F. Hoffmann-La, Roche, Alpha Laboratories, Biohit, Biomerica, Inc., QuickNaviTM-H. pylori.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 731.3 million |

| Market Value in 2035 | USD 1444.0 million |

| Growth Rate | CAGR of 7.04% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Treatment, Application, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa (MEA) |

| Key Countries Profiled | The USA, Canada, Brazil, Mexico, Mexico, Germany, The UK, France, Spain, Italy, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Phathom Pharmaceuticals; Redhill Biopharma; Takeda Pharmaceuticals; AbbVie; Cumberland Pharmaceuticals; Eisai Co.; Bio-Rad Laboratories; F. Hoffmann-La Roche; Alpha Laboratories; Biohit |

| Customization | Available Upon Request |

The global helicobacter pylori infections treatment market is estimated to be valued at USD 731.3 million in 2025.

The market size for the helicobacter pylori infections treatment market is projected to reach USD 1,444.0 million by 2035.

The helicobacter pylori infections treatment market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in helicobacter pylori infections treatment market are bismuth-quadruple therapy, concomitant therapy, levofloxacin triple therapy, bismuth therapy and high-dose dual therapy.

In terms of application, hospitals segment to command 45.6% share in the helicobacter pylori infections treatment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Helicobacter Pylori Testing Market Size and Share Forecast Outlook 2025 to 2035

Helicobacter Pylori Non-Invasive Testing Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA