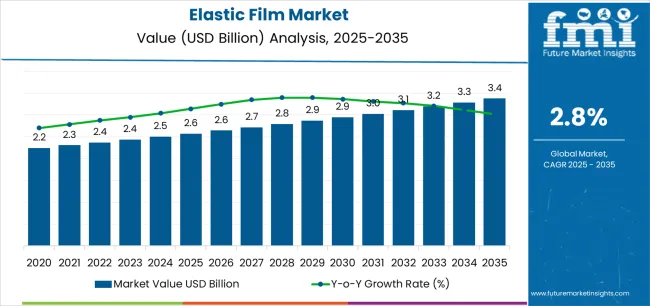

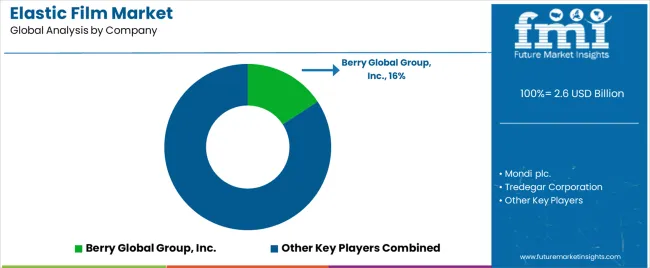

The Elastic Film Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 2.8% over the forecast period.

The Elastic Film market is experiencing strong growth, driven by increasing demand across hygiene and food and beverage industries for high-performance, flexible packaging and protective films. Rising awareness of hygiene and sanitation, coupled with the need for convenient, single-use, and protective packaging solutions, is fueling adoption. Advancements in material science, particularly in propylene-based elastomers and other flexible polymers, are enhancing mechanical strength, elasticity, and barrier properties, making elastic films suitable for diverse applications.

Regulatory focus on product safety, sustainability, and compliance with food contact standards is further encouraging the adoption of high-quality elastic films. Growing investments in healthcare and food packaging infrastructure, along with expanding consumer preference for hygienic and durable packaging, are contributing to market expansion.

The ability to develop customized film properties, including transparency, thickness, and stretchability, is also supporting broad adoption As industries increasingly prioritize efficiency, cost-effectiveness, and sustainability, the Elastic Film market is expected to maintain strong momentum, with ongoing innovation in polymer technologies and processing methods shaping future growth opportunities.

| Metric | Value |

|---|---|

| Elastic Film Market Estimated Value in (2025 E) | USD 2.6 billion |

| Elastic Film Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

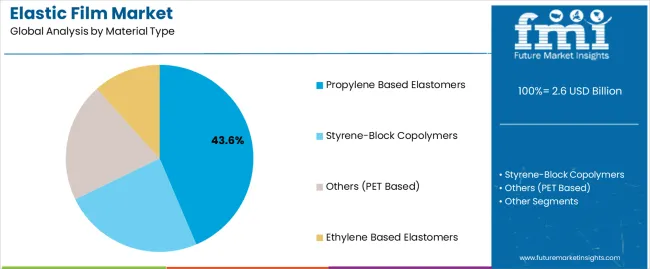

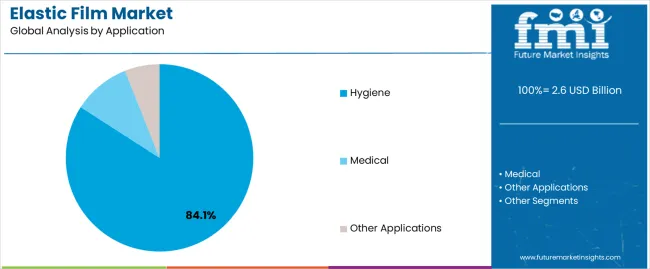

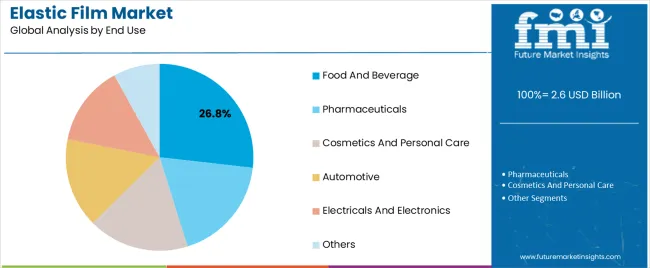

The market is segmented by Material Type, Application, and End Use and region. By Material Type, the market is divided into Propylene Based Elastomers, Styrene-Block Copolymers, Others (PET Based), and Ethylene Based Elastomers. In terms of Application, the market is classified into Hygiene, Medical, and Other Applications. Based on End Use, the market is segmented into Food And Beverage, Pharmaceuticals, Cosmetics And Personal Care, Automotive, Electricals And Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The propylene-based elastomers segment is projected to hold 43.6% of the market revenue in 2025, establishing it as the leading material type. Its growth is being driven by superior mechanical properties, elasticity, and chemical resistance, which enable diverse applications in hygiene and packaging solutions. These elastomers provide excellent stretchability and strength while maintaining processability, making them preferred among manufacturers seeking high-performance films.

The material supports customization in film thickness, transparency, and barrier properties, allowing optimized performance for specific end-use requirements. Cost-effectiveness and scalability in production further enhance adoption across industries.

Continuous improvements in polymer formulation and processing technologies have strengthened consistency, quality, and reliability, reinforcing preference among global manufacturers As demand for durable, flexible, and sustainable films continues to rise, the propylene-based elastomers segment is expected to maintain its leading position, supported by innovations in material design and processing techniques that meet evolving industrial and consumer needs.

The hygiene application segment is expected to account for 84.1% of the market revenue in 2025, making it the largest application category. Growth is being driven by increasing consumer awareness of personal hygiene and the rising demand for disposable products such as diapers, adult incontinence items, and sanitary solutions. Elastic films provide the required flexibility, softness, and stretchability, enabling comfortable and high-performance hygiene products.

The ability to combine barrier properties with breathability ensures effectiveness while maintaining comfort for end-users. Regulatory standards regarding safety, skin-friendliness, and material quality further support adoption in this segment.

Advancements in propylene-based elastomers and other polymer technologies have improved film elasticity, durability, and cost efficiency, making them ideal for large-scale production As population growth, urbanization, and awareness of hygiene increase globally, the hygiene segment is expected to remain the primary growth driver, with elastic films continuing to play a critical role in product performance and consumer satisfaction.

The food and beverage end-use segment is projected to hold 26.8% of the market revenue in 2025, establishing it as a leading sector. Growth is being driven by the increasing demand for flexible, protective packaging that preserves freshness, prevents contamination, and extends shelf life. Elastic films provide high elasticity, mechanical strength, and barrier properties suitable for wrapping, sealing, and packaging food products and beverages.

The ability to customize film thickness, transparency, and stretchability ensures optimal protection while maintaining product visibility. Rising consumer preference for packaged and ready-to-eat foods, combined with stricter food safety regulations, is further accelerating adoption.

Continuous innovations in propylene-based elastomers and sustainable film materials have enhanced processability, performance, and cost-efficiency for manufacturers As the global food and beverage industry continues to expand and prioritize safety, convenience, and sustainability, the elastic film segment is expected to remain a key contributor, supporting efficient packaging solutions and strengthening market growth.

The market has historically developed at a CAGR of 2.10%. However, sales have increased rapidly, displaying a CAGR of 2.90% from 2025 to 2035.

| Attributes | Details |

|---|---|

| Historical CAGR for 2020 to 2025 | 2.1% |

Environmental protection organizations' strict regulations on plastics-based products is curbing market growth due to their adverse environmental impact. Moreover, the emergent availability of alternatives elastic laminates, such as elastic strands, netting, and nonwovens, is slowing down the market as well.

Acute aspects that are anticipated to influence the demand for elastic films through 2035.

Market players are going to desire to be prudent and flexible over the anticipated period since these challenging attributes position the industry for accomplishment in subsequent decades.

Baby Care Products Exploded the Demand for Elastic Films

Development of Sustainable Packaging Solutions Fuels the Demand

The demand for sustainable packaging solutions is advancing due to environmental consciousness. Elastic films are eco-friendly, lightweight, and require less material, making them definitive for businesses to minimize waste and carbon footprint.

Radical Material Science Skyrockets the Demand

An in-depth segmental analysis of the elastic film market indicates that propylene-based elastomers are in significant demand. Similarly, hygiene applications develop an emergent demand based on the application of elastic films.

| Attributes | Details |

|---|---|

| Top Application | Hygiene |

| Market share in 2025 | 84.1% |

Demand for elastic films for developing hygiene products is significant in 2025, holding a market share of 84.1%. The following aspects display the demand for elastic films for the production of hygiene products:

| Attributes | Details |

|---|---|

| Top Material Type | Propylene-based Elastomers |

| Market share in 2025 | 43.6% |

The propylene-based elastomers segment is set to acquire almost 43.6% market share in 2025. The development of the propylene-based elastomers demands the following aspects:

The following section explains the demand in various countries. Markets in China and India are experiencing intermediate growth in the upcoming decade, while Thailand and Spain are slowly progressing in elastic film packaging, with France having a lower CAGR than other nations.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| Spain | 2.5% |

| Thailand | 3.9% |

| China | 4.4% |

| India | 5.5% |

| France | 1.9% |

The elastic film industry in India to experience a CAGR of 5.5% through 2035. Here are a few of the major aspects:

Demand in China to develop at a CAGR of 4.4%. The following factors are thrusting the demand for elastic films in China:

Adoption of elastic films in Thailand to showcase a CAGR of 3.9% between 2025 and 2035. Some of the primary drifts in the industry are:

Demand in France to report a CAGR of 1.9% from 2025 to 2035. Some of the primary trends are:

The elastic films industry in Spain is to display a CAGR of 2.5% by 2035. Among the primary drivers of the market are:

The market is competitive and has evolved significantly in recent years. Elastic films are in high demand, especially in emerging countries. Manufacturers invest heavily in research and development, employ pristine machinery, and construct manufacturing facilities to keep up with the market demand and competition. Such methodologies are anticipated to improve production capabilities and stay ahead of the competition.

Top manufacturers are working to improve their distribution networks to make their products more accessible to customers. They want to meet the changing needs of consumers and maintain their market share in an industry that is growing quickly. Companies leveraging new technologies to meet consumer demands are projected to propel market growth in the forthcoming decade.

Recent Developments

The global elastic film market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the elastic film market is projected to reach USD 3.4 billion by 2035.

The elastic film market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in elastic film market are propylene based elastomers, styrene-block copolymers, others (pet based) and ethylene based elastomers.

In terms of application, hygiene segment to command 84.1% share in the elastic film market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Film and TV IP Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Elastic Laminate Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Elastic Therapeutic Tape Market Growth – Trends & Forecast 2025 to 2035

Competitive Overview of Elastic Laminate Companies

Filmic Tapes Market

PC Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

PE Film Market Insights – Growth & Forecast 2024-2034

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA