The Correspondence Management Solution Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 12.8 billion by 2035, registering a compound annual growth rate (CAGR) of 11.3% over the forecast period.

| Metric | Value |

|---|---|

| Correspondence Management Solution Market Estimated Value in (2025 E) | USD 4.4 billion |

| Correspondence Management Solution Market Forecast Value in (2035 F) | USD 12.8 billion |

| Forecast CAGR (2025 to 2035) | 11.3% |

The correspondence management solution market is experiencing consistent growth, driven by the increasing need for organizations to streamline communication workflows, manage regulatory compliance, and ensure secure documentation handling. Rising adoption of digital transformation strategies across industries has elevated the demand for platforms capable of integrating email, records, case files, and official communications into centralized systems.

The market is also benefiting from advancements in cloud computing and artificial intelligence, which enable automated categorization, archiving, and retrieval of correspondence, thereby reducing manual workloads and improving efficiency. Growing emphasis on data privacy and compliance with global regulations is further pushing enterprises and government entities to adopt robust correspondence solutions.

Additionally, the growing complexity of customer engagement channels, including multi-platform communications, is fueling the adoption of integrated solutions capable of delivering transparency and traceability With organizations increasingly focused on operational efficiency and digital resilience, the market is positioned to expand steadily, supported by technology innovation and rising adoption in large-scale enterprises, public institutions, and regulated industries.

The correspondence management solution market is segmented by deployment type, organization size, vertical, functionality, and geographic regions. By deployment type, correspondence management solution market is divided into Cloud and On-premises. In terms of organization size, correspondence management solution market is classified into Large Enterprises, Mid-sized Businesses, and Small and Medium-sized Businesses (SMBs). Based on vertical, correspondence management solution market is segmented into Government, Healthcare, Financial Services, Education, Legal, Manufacturing, and Retail. By functionality, correspondence management solution market is segmented into Compliance Management, Document Capture, Document Classification, Document Routing, Document Archival, and Document Collaboration. Regionally, the correspondence management solution industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud deployment type segment is projected to hold 61.3% of the correspondence management solution market revenue share in 2025, making it the leading deployment approach. Its leadership is being supported by cost efficiency, scalability, and reduced infrastructure requirements compared to on-premise systems. Cloud-based platforms enable organizations to streamline implementation timelines, reduce maintenance costs, and facilitate remote access, which has become increasingly critical in hybrid and distributed work environments.

The ability to integrate cloud-based correspondence solutions with enterprise applications and document repositories is also contributing to their rapid adoption. Enhanced features such as real-time collaboration, data backup, and disaster recovery capabilities are strengthening trust in cloud models.

Regulatory advancements in data security and availability of region-specific data centers are further addressing concerns of sensitive information handling, particularly in government and regulated sectors As enterprises continue prioritizing digital-first strategies, the flexibility and continuous improvement provided by cloud platforms are expected to maintain this segment’s dominant market position.

The large enterprises segment is expected to represent 42.3% of the correspondence management solution market revenue share in 2025, making it the largest organization size category. This dominance is being explained by the complex communication ecosystems managed by large corporations, which involve high volumes of correspondence across multiple departments, subsidiaries, and geographic locations.

The growing need to centralize workflows, ensure compliance with evolving regulations, and maintain transparency in communication processes is accelerating adoption. Large organizations are increasingly leveraging correspondence management solutions to integrate with enterprise resource planning, customer relationship management, and case management platforms, thereby improving efficiency and reducing operational risks.

The capability to scale solutions across thousands of users while maintaining role-based access controls and audit trails is another factor reinforcing preference among large enterprises With increasing regulatory scrutiny and the heightened importance of digital communication security, large enterprises are expected to continue investing significantly in advanced correspondence management platforms to safeguard information and optimize operations.

The government vertical is projected to account for 29.6% of the correspondence management solution market revenue share in 2025, positioning it as the leading vertical segment. This leadership is being driven by the critical role of government agencies in managing high volumes of citizen communication, policy documents, contracts, and regulatory records. Adoption of correspondence management solutions is being prioritized to enhance transparency, improve citizen services, and comply with stringent archival and documentation regulations.

Governments across various regions are accelerating digital transformation initiatives to modernize administrative processes, which is significantly contributing to demand. Secure document handling, efficient workflow management, and traceability are being recognized as essential for government operations, particularly in areas involving sensitive citizen data.

The shift toward paperless governance and e-government frameworks is further accelerating the deployment of correspondence management platforms As public sector institutions continue to emphasize accountability, efficiency, and secure communication management, the government vertical is expected to sustain its leadership position in the global market.

Over the years correspondence management has increasingly transformed itself to be one of the core business pillars for enterprises across industries. Across all industries from Banking & Financial Services to Public Sectors - real time and constant communication with client or other associated members in client value chain through correspondence management solution is witnessing ever increasing demand.

However, in spite of being crucial, many enterprises over the years are not able to leverage crucial solution like correspondence management to automate certain parts of their processes to save cost for document aggregation and delivery; other than that by not adopting relevant correspondence solutions enterprises have also failed to gain advantage of reusing existing content and avoid duplication.

Real adoption of correspondence management solutions not only save cost, but also provide enterprise with options like compliance with ever changing government regulations, enhanced content efficiency, & better employee productivity.

As going gets tough for enterprises and they are trying to save dollars from every opportunity, increasing uptake of correspondence management solutions can certainly improve the bottom line.

Overall, the market for correspondence management solution market size is close to US$1 billion in 2025 and is expected to register growth of 10.5% till 2025 and will reach US$ 1.8 billion by 2025.

For vendors it will represent an incremental correspondence management opportunity of US$820 million during the forecast period. In terms of regional adoption, North America is leading the pie of correspondence management by occupying more than 30% of the total market opportunity. At a country level, USA represents the highest potential market for correspondence management, followed by UK and Germany.

Within Europe, Scandinavian countries have also demonstrated their interest for the solution in the recent past. Among emerging geographies, Brazil is slightly green field geography, in process of dramatically reducing paper correspondence however, interestingly Middle East Africa is a growing market for correspondence management solution.

In terms of vertical adoption of correspondence management, Financial Services and Public Sector entities are leading the charge and constitute more than 60% of the total market share in 2025.

The key drivers for increasing uptake of correspondence management among public sector are increasing traction of electronic communication systems along with emphasis on digitization where old processes are getting streamlined by implementing new technologies. For financial services, increasing requirement of adhering to compliance is driving the correspondence management solution uptake.

Software License revenue primarily dominates the correspondence management market by holding more than 35% of the total correspondence management solution market opportunity; however for vendors this is an opportunity as the providers need to showcase this as an end-to-end solution; combination of software & services; FMI also noted that Service Providers with Case as a Service portfolio is witnessing preference in the market.

The correspondence management solution market is expected to flourish over the forecast period owing to the growing need to reduce budgeting and planning cycles. In addition to this, the market is predicted to witness rapid automation of internal as well as external communication as analytics, and big data solutions are increasing. Further, the correspondence management solution market size is expanding on account of the rapid adoption rate of correspondence management software by organisations to effectively implement real-time communication and thus manage correspondence. Companies, at a certain stage, requires to enhance efficiency, accuracy, auditability, and controls. A correspondence management system helps in automation and, thus, delivers speed and agility to deliver quality insights about customer and internal affairs.

The correspondence management software enables businesses to boost revenues by keeping the shareholders and customers in the loop via regular correspondence, thereby resulting in a high adoption rate. Furthermore, the advent of new IT applications and related infrastructures, such as advanced analytics and big data, are accelerating the market growth of correspondence management systems. Coupled with this, companies are now leveraging big data, which helps make more precise decisions via correspondence management solutions’ predictive capabilities. The market is also being driven by rising internet access and the introduction of smart offices. Digitalisation across the globe is bolstering the implementation of correspondence management solutions among businesses to effectively communicate and manage documents.

The usage of a correspondence management solution helps mitigate the utilisation of printed correspondence, which causes inefficiency and considerable time wastage. The correspondence management system is considered a valuable solution for institutions and organisations as it helps in minimising paper wastage, consequently reducing the printing cost. Thus, the move towards a paper-free environment is boosting the deployment of correspondence management solutions. The market, however, may impede due to expensive costs associated with the maintenance and implementation of the software and the dearth of technical experts in the market.

The North America correspondence management system market is expected to represent the largest market share. This can be attributed to the rising adoption rate of automation and the surging requirement for effective internal and external communication to sustain the growth of various industry verticals like government, BFSI, and eCommerce. Within North America, the United States of America and Canada are two leading markets observing robust adoption of modern technologies, like correspondence management system solutions. The key players present in the region are providing several cloud-based solutions at competitive prices, thus promoting market growth of correspondence management systems in the region.

FMI in the upcoming report highlighted that there are several options how vendor can tap this opportunity. The Service Providers should try to go to the market through a solution approach by tying up with software houses and providing it as an end to end solution and behaving like a one stop shop for the correspondence management solution.

Also, service providers can evaluate options of offering correspondence management solution as a service under their BPO portfolios.

This research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data and statistically-supported and industry-validated market data and projections with a suitable set of assumptions and methodology.

It provides analysis and information by categories such as market segments, regions, product type and distribution channels.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

| Country | CAGR |

|---|---|

| China | 15.2% |

| India | 14.1% |

| Germany | 12.9% |

| France | 11.8% |

| UK | 10.7% |

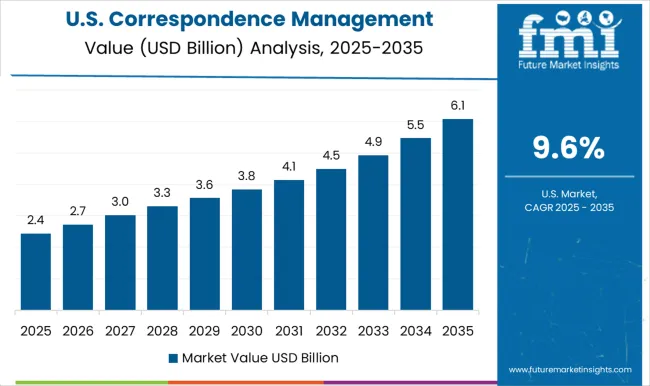

| USA | 9.6% |

| Brazil | 8.4% |

The Correspondence Management Solution Market is expected to register a CAGR of 11.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 15.2%, followed by India at 14.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 8.4%, yet still underscores a broadly positive trajectory for the global Correspondence Management Solution Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 12.9%. The USA Correspondence Management Solution Market is estimated to be valued at USD 1.5 billion in 2025 and is anticipated to reach a valuation of USD 3.8 billion by 2035. Sales are projected to rise at a CAGR of 9.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 200.0 million and USD 121.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Deployment Type | Cloud and On-premises |

| Organization Size | Large Enterprises, Mid-sized Businesses, and Small and Medium-sized Businesses (SMBs) |

| Vertical | Government, Healthcare, Financial Services, Education, Legal, Manufacturing, and Retail |

| Functionality | Compliance Management, Document Capture, Document Classification, Document Routing, Document Archival, and Document Collaboration |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | OpenText, Iron Mountain, Hyland, DocuWare, Ephesoft, Xerox, Square 9, MFiles, Laserfiche, ABBYY, Nintex, Serengeti, Verint, Kodak Alaris, and Kofax |

| Additional Attributes |

The global correspondence management solution market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the correspondence management solution market is projected to reach USD 12.8 billion by 2035.

The correspondence management solution market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in correspondence management solution market are cloud and on-premises.

In terms of organization size, large enterprises segment to command 42.3% share in the correspondence management solution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Space Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Revenue Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Parking Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Network Management Solutions Market

Comprehensive Management Solution for Power Quality Market Size and Share Forecast Outlook 2025 to 2035

Building Energy Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Bimodal Identity Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Drone Management Solutions Market Analysis 2025 to 2035 by Type, Technology, Application, and Region

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Rights Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Hospital Capacity Management Solutions Market Insights - Growth & Forecast 2024 to 2034

On-Demand Delivery Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Multicarrier Parcel Management Solutions Software Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Asset And Liability Management Solutions Market

Quality and Compliance Management Solution Market Forecast and Outlook 2025 to 2035

Commodity Supply Chain Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Incident and Deviation Management Solution Market

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Europe Hospital Capacity Management Solution Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA