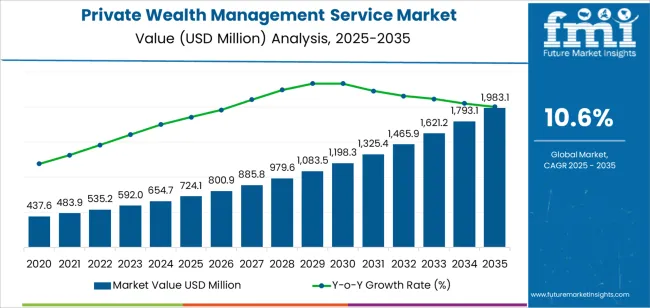

The global private wealth management service market is valued at USD 724.1 million in 2025 and is expected to reach USD 1,983.1 million by 2035, indicating a CAGR of 10.6%. This rise produces an absolute dollar opportunity of USD 1,259.0 million across the forecast period. Rolling CAGR analysis points to a pronounced expansion phase through the late 2020s, supported by rising high-net-worth populations, broader adoption of advisory platforms, and increased diversification of client portfolios across global asset classes.

Private wealth management services encompass financial planning, investment advisory, portfolio construction, and risk assessment tailored for affluent clients. Firms are expanding their offerings through more refined asset allocation tools, enhanced client reporting systems, and greater integration of alternative investment strategies. Emphasis is being placed on multi-jurisdictional compliance capabilities and improved digital engagement platforms that allow real-time visibility into portfolio performance.

North America remains the leading region due to large concentrations of high-net-worth individuals and well-developed advisory networks. Europe follows with stable growth linked to structured financial planning frameworks. Asia Pacific shows the fastest acceleration as rising income levels and expanding capital markets encourage greater use of wealth advisory services. Toward 2035, advancements in portfolio analytics, advisory automation, and cross-border service models are expected to guide continued market progression.

Between 2025 and 2030, the Private Wealth Management Service Market is projected to expand from USD 724.1 million to USD 1,198.3 million, with client asset inflows rising in parallel from approximately 800.9 thousand accounts to 1.1983 million accounts. The growth volatility index (GVI) for this period is 1.3, indicating a strong acceleration phase supported by expanding high-net-worth populations, increased allocation toward professional advisory structures, and broader integration of multi-asset portfolio models.

Demand is driven by rising participation in discretionary portfolio management, cross-border asset structuring, and digital advisory platforms using predictive analytics for asset allocation. Performance benchmarks such as fee efficiency, risk-adjusted return optimization, and multi-jurisdictional compliance capabilities are influencing service-provider selection. North America, Europe, and East Asia together will contribute more than 65% of incremental growth due to rapid wealth creation and deeper financial-market penetration.

From 2030 to 2035, the market is expected to advance from USD 1,198.3 million to USD 1,983.1 million, with client participation increasing toward 1.7931–1.9831 million accounts. The GVI decreases to 0.9, signaling moderated expansion as wealth management platforms transition from rapid client acquisition toward retention, personalization, and long-horizon portfolio structuring.

Growth during this phase will be shaped by increased demand for alternative investment access, AI-driven personalized advisory engines, and the expansion of multi-family-office style service models across emerging markets. Regional service-capacity expansion in Asia-Pacific and the Middle East is expected to provide 12–15 % of new global growth, supporting rising affluent-class participation and broader adoption of structured wealth-preservation tools.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 724.1 million |

| Market Forecast Value (2035) | USD 1,983.1 million |

| Forecast CAGR (2025 to 2035) | 10.6% |

Demand for private wealth management services is rising as high-net-worth individuals seek structured strategies for capital preservation, cross-border diversification, and tax-efficient asset allocation. Families and entrepreneurs require advisory teams capable of coordinating portfolio management, estate planning, and risk assessment within increasingly complex regulatory environments. Firms refine discretionary mandates, reporting systems, and multi-asset research to support stable long-term returns under volatile market conditions. Digital platforms improve account aggregation and scenario analysis, while human advisors oversee governance structures and liquidity planning. Growth in newly created wealth across Asia-Pacific and the Middle East increases service uptake, with clients favoring institutions that provide transparent fee models, regional expertise, and consistent investment oversight across multiple jurisdictions.

Market expansion also reflects rising demand for specialized solutions, including family-office support, succession planning, and private market access. Wealth managers strengthen due diligence on alternative assets, integrating real estate, infrastructure, and private equity allocations into diversified portfolios. Regulatory initiatives promoting investor protection push firms to implement stronger compliance systems and clearer disclosure processes. Providers enhance cybersecurity measures and secure communication tools to protect sensitive client information. Competition intensifies as banks, independent advisors, and fintech entrants extend services to emerging wealthy segments. Although market volatility and regulatory costs remain obstacles, continued global wealth creation and the need for coordinated advisory frameworks sustain demand for private wealth management services across regional and international financial hubs.

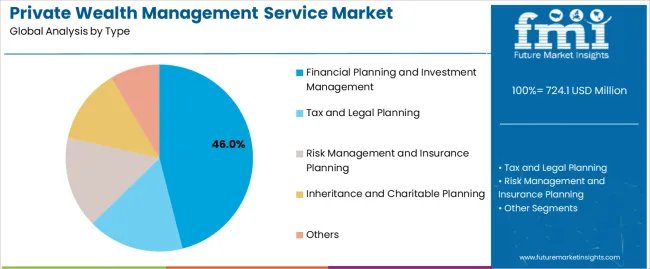

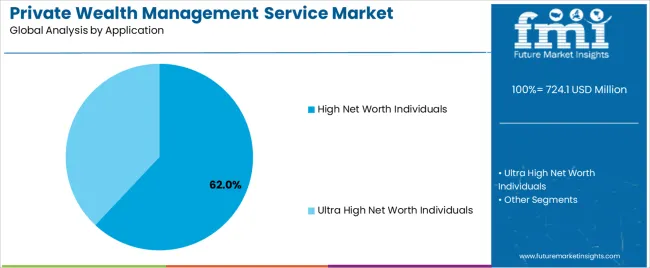

The private wealth management service market is segmented by type, application, and region. By type, the market is divided into financial planning and investment management, tax and legal planning, risk management and insurance planning, inheritance and charitable planning, and others. Based on application, it is categorized into high net worth individuals and ultra-high net worth individuals. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect service specialization, financial complexity, and regional private wealth distribution patterns.

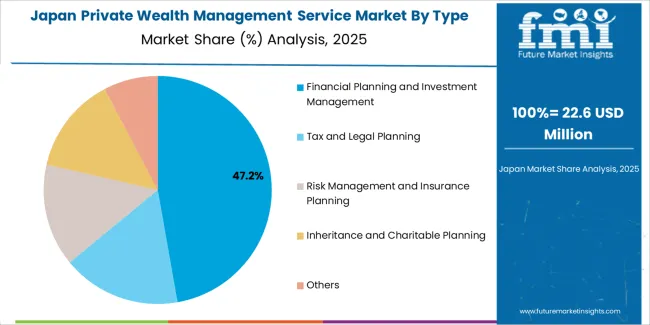

The financial planning and investment management segment accounts for approximately 46.0% of the global private wealth management service market in 2025, making it the leading type category. Its position reflects sustained demand for structured portfolio oversight, asset allocation guidance, and long-term financial planning among clients managing diversified domestic and international holdings. This service area forms the foundation of private wealth management strategies, covering routine investment advisory, risk-based portfolio construction, and ongoing market monitoring that supports client financial objectives across varying economic cycles.

Providers in this segment integrate quantitative analysis, discretionary portfolio management, and advisory frameworks tailored to liquidity needs and risk tolerance. Growth is supported by increasing use of multi-asset portfolios and broader access to private market instruments among affluent clients. Regions such as North America and Europe exhibit strong adoption due to established financial advisory ecosystems and mature capital markets. Technology-driven reporting, automated rebalancing, and scenario-based planning tools continue to strengthen client engagement. The segment maintains its leadership because it remains the central point of client advisory relationships, providing consistent value through structured investment oversight and long-term financial planning activities aligned with evolving wealth preservation goals.

The high net worth individuals (HNWIs) segment represents about 62.0% of the total private wealth management service market in 2025, making it the dominant application category. Its leadership stems from the substantial global population of HNWIs compared with the relatively smaller group of ultra-high net worth clients. HNWIs seek advisory support for diversified portfolio management, tax exposure considerations, retirement structuring, and intergenerational planning, generating consistent demand for core private wealth services.

This group often engages wealth managers for guidance on asset transitions, global investment access, and risk mitigation strategies linked to equity, fixed income, and alternative investments. Growth in the segment is reinforced by expanding affluent populations in East Asia and North America, where rising entrepreneurship and increasing business-owner liquidity events contribute to wealth accumulation. Providers enhance service offerings through integrated digital platforms, consolidated reporting, and coordinated advisory structures that address personal, business, and estate planning requirements. The HNWI segment remains the principal driver of market activity due to its broad client base, recurring advisory needs, and reliance on professional wealth management services for long-term financial organization and capital preservation.

The private wealth management service market is expanding as high-net-worth individuals seek more structured financial guidance, diversified portfolios and long-term preservation strategies. Growth is supported by rising global wealth, increasing cross-border asset allocation and broader use of advisory services among emerging affluent groups. Providers offer portfolio management, estate planning, tax coordination and family-office support. The market faces constraints such as regulatory compliance burdens, talent shortages in specialised advisory roles and heightened client expectations for transparency. Firms are refining digital tools, personalised advisory models and integrated planning frameworks to meet shifting client priorities across regions.

Demand is increasing as clients seek more tailored financial strategies, clearer reporting and coordinated planning across investments, tax and succession goals. Many wealthy households prefer advisory relationships that emphasise long-term stability, risk-adjusted returns and multi-jurisdictional expertise. Younger affluent clients often expect digital access, scenario modelling and real-time portfolio visibility. Expansion of entrepreneur-led wealth in emerging regions also broadens demand for structured advisory services. These evolving expectations push firms to refine communication, portfolio construction and planning tools to match diverse client profiles.

Several challenges limit market expansion. High service fees discourage some affluent clients from engaging full advisory support. Regulatory requirements governing suitability, disclosures and cross-border operations add compliance cost and complexity for firms. Limited advisor capacity and difficulty maintaining consistent service quality at scale create operational constraints. Some clients prefer self-directed investment approaches or rely on informal guidance within family networks. These factors slow adoption, particularly among newly affluent groups or segments uncertain about long-term advisory commitments.

Key trends include increased use of digital platforms for portfolio tracking, risk analysis and client communication. Firms are strengthening integrated planning capabilities, combining investment management with tax, estate, philanthropy and business-transition advice. Demand is growing for sustainable investing strategies and diversified private-market exposure. Multi-family office models and modular service tiers are gaining traction among clients seeking flexibility. Regional growth is notable in Asia-Pacific, where wealth creation and cross-border asset flows are rising. Providers are also expanding education and planning tools to support next-generation wealth holders and inter-generational transitions.

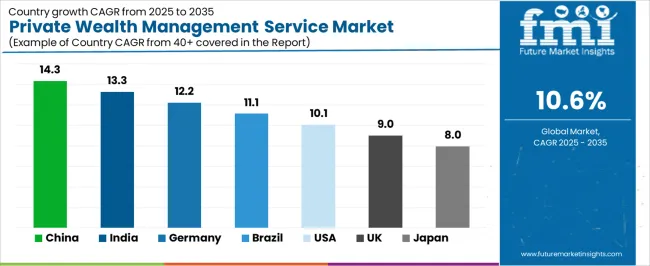

| Country | CAGR (%) |

|---|---|

| China | 14.3% |

| India | 13.3% |

| Germany | 12.2% |

| Brazil | 11.1% |

| USA | 10.1% |

| UK | 9.0% |

| Japan | 8.0% |

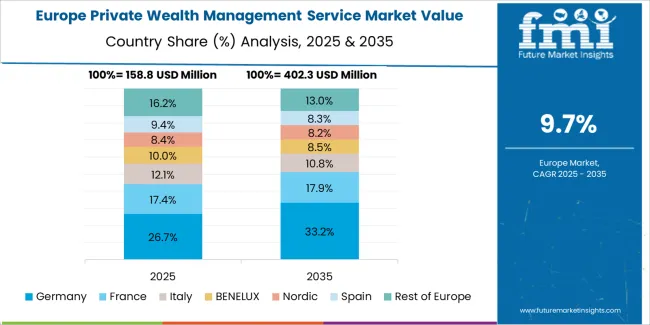

The private wealth management service market is expanding rapidly worldwide, with China leading at a 14.3% CAGR through 2035, driven by rising ultra-high-net-worth individuals, rapid financial market development, and increased adoption of digital advisory platforms. India follows at 13.3%, supported by strong economic growth, expanding affluent populations, and greater diversification in investment portfolios. Germany records 12.2%, reflecting advanced financial advisory frameworks, robust regulatory systems, and strong adoption of sustainable and thematic investments.

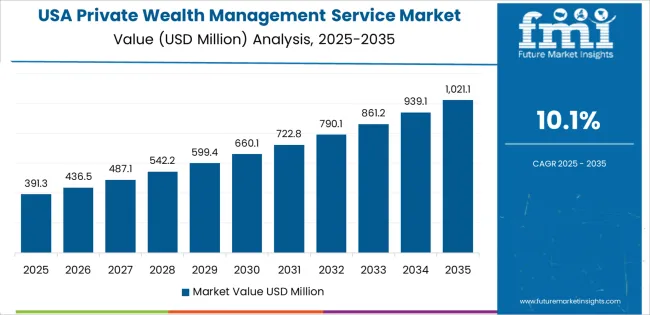

Brazil grows at 11.1%, benefiting from wealth creation in emerging sectors and modernization of financial services. The USA, at 10.1%, remains a mature yet innovation-focused market emphasizing AI-driven advisory and holistic planning, while the UK (9.0%) and Japan (8.0%) prioritize customized wealth strategies, intergenerational planning, and high-trust advisory ecosystems.

China is experiencing strong momentum in the private wealth management service market, projected to grow at a CAGR of 14.3% through 2035. Growth in household financial assets, rising adoption of structured investment plans, and wider access to advisory services across major cities are shaping the sector. Providers refine portfolio-allocation tools, risk-profiling models, and digital advisory platforms. Increased interest in long-term planning among affluent individuals supports steady service utilization. Institutional expansion across banking and non-banking channels broadens client coverage.

India is seeing firm progress in the private wealth management service market, advancing at a CAGR of 13.3% through 2035. Expansion of equity participation, broader mutual-fund usage, and rising income among urban households support advisory demand. Providers enhance asset-allocation frameworks, client-risk mapping, and goal-based planning models. Growth in digital investment channels encourages wider adoption among first-generation investors. Family-business transitions and intergenerational planning reinforce the need for structured financial guidance.

Across Germany, the private wealth management service market is expanding at a CAGR of 12.2%, guided by advanced financial-planning practices and structured advisory frameworks. Providers emphasize transparent fee models, diversified portfolio allocation, and high-quality research support. Growth in retirement planning, cross-border asset management, and long-term capital preservation encourages stable service use. Wealth units within banks and independent advisory firms refine digital reporting features to improve client oversight.

Brazil is recording steady advancement in the private wealth management service market, projected to rise at a CAGR of 11.1% through 2035. Rising participation in investment funds, greater financial-literacy initiatives, and expanding high-income groups support advisory activity. Providers refine risk-management systems, structured product offerings, and client-reporting tools. Growth in private-bank divisions across national financial institutions enhances service availability. Increased interest in diversified portfolios encourages broader advisory engagement.

In the United States, the private wealth management service market is progressing at a CAGR of 10.1% through 2035. High adoption of advisory services for retirement planning, estate management, and tax-efficient investment strategies supports steady client engagement. Providers refine digital-reporting systems, rebalancing algorithms, and discretionary-management offerings. Growth in independent advisory firms and family-office structures expands service models. Rising interest in long-term wealth preservation reinforces advisory utilization.

Across the United Kingdom, the private wealth management service market is expanding at a CAGR of 9.0% through 2035. Increased awareness of structured wealth planning, growth in investment-account adoption, and wider use of advisory platforms encourage service uptake. Providers focus on multi-asset allocation, transparent reporting, and regulated advisory frameworks. Rising interest in retirement income strategies strengthens long-term engagement. Expansion of digital wealth channels supports broader client access.

Japan is experiencing measured advancement in the private wealth management service market, expected to grow at a CAGR of 8.0% through 2035. Aging demographics, growing interest in retirement planning, and broader adoption of structured investment products support advisory usage. Providers improve goal-setting tools, asset-allocation models, and risk-assessment procedures. Demand for capital preservation and intergenerational transfer planning reinforces service continuity. Enhanced digital engagement platforms help streamline client interactions across major financial institutions.

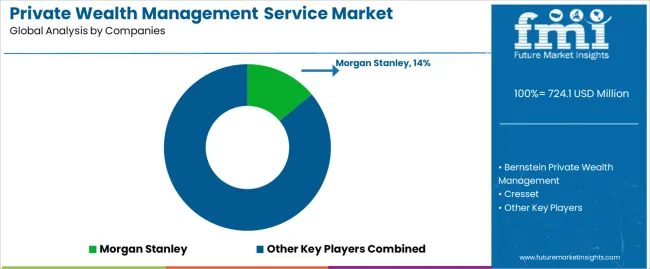

The global private wealth management service market shows moderate concentration, shaped by financial firms offering advisory, portfolio management, and family office services to high-net-worth clients. Morgan Stanley holds a leading position through its global research, estate planning capabilities, and structured investment solutions. Bernstein Private Wealth Management and Cresset support the upper-tier advisory segment with customized asset allocation and multi-generational planning expertise.

RBC Wealth Management and Merrill Lynch maintain wide international coverage through integrated banking and investment platforms. Holborn Assets, Focus Partners Wealth, and William Blair expand competitiveness with planning-led advisory models suited for entrepreneurial and cross-border clients.

Tolleson Wealth Management and Raymond James strengthen the market’s regional and multi-family office segment, focusing on discretionary management, tax coordination, and client-specific reporting. BNY Wealth and Mariner add scale to the independent advisory sector through fee-based wealth planning and broad manager access.

Competition across this market is influenced by advisory depth, access to global investment products, and sophistication of digital portfolio tools. Strategic differentiation depends on risk management frameworks, continuity in client relationships, and the ability to deliver coordinated solutions across investment, trust, and estate structures. Long-term competitiveness will be shaped by fiduciary standards, talent retention, and integrated planning models aligned with evolving client expectations.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type / Classification | Financial planning and investment management; Tax and legal planning; Risk management and insurance planning; Inheritance and charitable planning; Others |

| Application | High net worth individuals, Ultra high net worth individuals |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Morgan Stanley, Bernstein Private Wealth Management, Cresset, RBC Wealth Management, Merrill Lynch, Holborn Assets, Focus Partners Wealth, William Blair, Tolleson Wealth Management, Raymond James, BNY Wealth, Mariner |

| Additional Attributes | Dollar sales by service type; AUM and client-account counts; fee model split (AUM/flat/performance); discretionary vs advisory share; HNWI vs UHNW segmentation; cross-border vs domestic account split; digital platform adoption metrics; product access (private equity, infrastructure, real estate) and allocation averages; client retention & lifetime-value metrics; regulatory & tax-compliance mapping by jurisdiction; talent pool/advisor headcount and productivity; case studies and buyer decision drivers (wealth transfer, succession, philanthropy). |

The global private wealth management service market is estimated to be valued at USD 724.1 million in 2025.

The market size for the private wealth management service market is projected to reach USD 1,983.1 million by 2035.

The private wealth management service market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in private wealth management service market are financial planning and investment management, tax and legal planning, risk management and insurance planning, inheritance and charitable planning and others.

In terms of application, high net worth individuals segment to command 62.0% share in the private wealth management service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Private Security Market Size and Share Forecast Outlook 2025 to 2035

Private Tutoring Market Forecast and Outlook 2025 to 2035

Private Label Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Private Electric Vehicle Charging Station Market Size and Share Forecast Outlook 2025 to 2035

Private 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Private office-based clinics Market Size and Share Forecast Outlook 2025 to 2035

Private LTE Market Size and Share Forecast Outlook 2025 to 2035

Private Cloud Services Market by Services, Type, Industry Vertical, and Region – Growth, Trends, and Forecast through 2025 to 2035

Virtual Private Cloud Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Network VPN Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Server Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Private Network Market Size and Share Forecast Outlook 2025 to 2035

Demand for Hybrid Protein Blends in Private Label Formulations in CIS Size and Share Forecast Outlook 2025 to 2035

WealthTech Solutions Market Size and Share Forecast Outlook 2025 to 2035

Wealth Management Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA