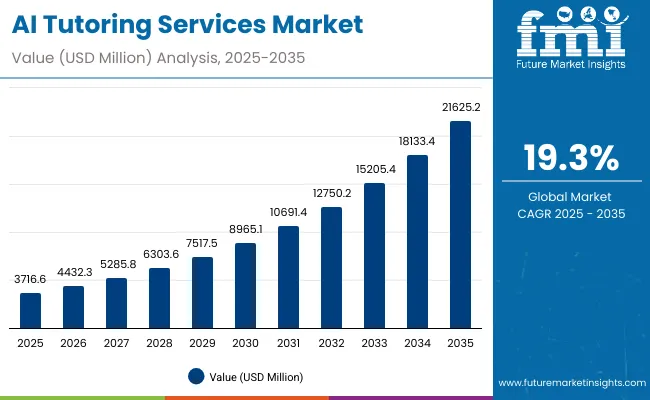

The AI Tutoring Services Market is expected to record a valuation of USD 3,716.6 million in 2025 and USD 21,625.2 million in 2035, with an increase of USD 17,908.6 million, which equals a growth of 481% over the decade. The overall expansion represents a CAGR of 19.3% and nearly a 6X increase in market size.

AI Tutoring Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 3,716.6 million |

| Market Forecast Value in (2035F) | USD 21,625.2 million |

| Forecast CAGR (2025 to 2035) | 19.3% |

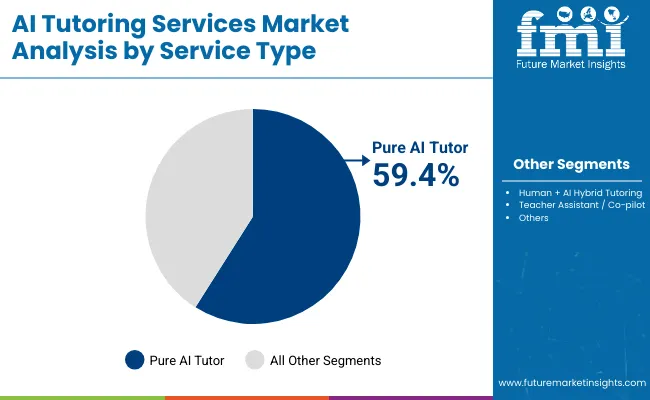

During the first five-year period from 2025 to 2030, the market increases from USD 3,716.6 million to USD 8,965.1 million, adding USD 5,248.5 million, which accounts for 29.3% of the total decade growth. This phase records steady adoption in K-12 learning, language learning, and STEM education, driven by the need for scalable, personalized, and cost-effective tutoring. Pure AI tutors dominate this period with over 59% share, supported by high demand for standalone app/web platforms that cater to over 65% of users.

The second half from 2030 to 2035 contributes USD 12,660.1 million, equal to 70.7% of total growth, as the market jumps from USD 8,965.1 million to USD 21,625.2 million. This acceleration is powered by widespread deployment of AI-driven co-pilot tutoring systems, LMS-integrated AI assistants, and multimodal learning solutions. Emerging markets, particularly India and China, drive this surge with CAGRs of 19.2% and 17.1% respectively. Hybrid human-AI tutoring gains traction, and subscription-based models coupled with AI analytics platforms increase recurring revenue, lifting the share of integrated solutions well above earlier levels by the end of the decade.

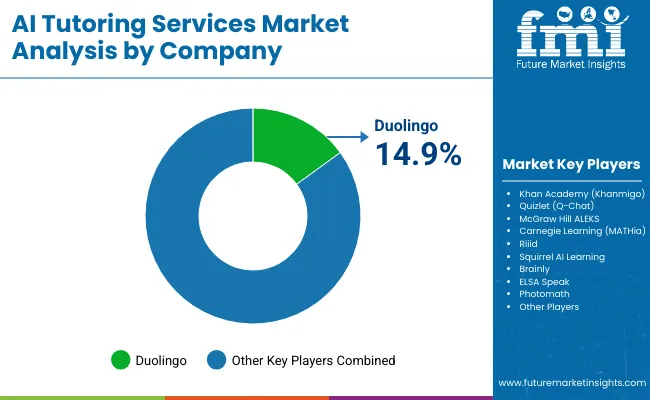

From 2020 to 2024, the AI Tutoring Services Market grew steadily, driven by early adoption in language learning apps, STEM-focused tutoring platforms, and test preparation tools. During this period, the competitive landscape was dominated by well-funded EdTech platforms, with leaders such as Duolingo, Khan Academy, and Quizlet leveraging AI for personalized learning paths. Competitive differentiation relied on adaptive learning algorithms, gamification, and multilingual capabilities, while human tutoring remained a secondary, premium add-on for advanced learners. Service-based hybrid tutoring models had minimal penetration, contributing less than 15% of the total market value.

Demand for AI tutoring is projected to reach USD 3,716.6 million in 2025, with the revenue mix shifting toward more integrated and hybrid solutions. Traditional app-based leaders face rising competition from AI-first platforms offering multimodal tutoring (text, voice, and code interpretation), cloud-based learning analytics, and subscription-driven personalized curriculums. Major incumbents are pivoting to hybrid human-AI teaching models, integrating AI co-pilots and school LMS compatibility to maintain relevance. Emerging entrants specializing in STEM-specific AI tutors, K-12 curriculum alignment, and industry-specific upskilling platforms are gaining share. The competitive advantage is moving away from content libraries alone toward ecosystem strength, cross-platform scalability, and recurring subscription revenues.

Unlike traditional tutoring, AI tutoring platforms can deliver highly customized learning experiences to millions of students simultaneously. Advanced algorithms adapt content difficulty, pace, and format based on individual learner performance, ensuring engagement and better outcomes. This scalability makes it attractive for both cost-sensitive K-12 education systems and rapidly growing adult upskilling markets.

AI tutoring is increasingly embedded into tools students already use from mobile apps and messaging platforms to school LMS systems and productivity software. This seamless integration reduces adoption barriers and makes AI learning support available on-demand, whether during homework help, exam prep, or skill training, driving sustained usage and market expansion.

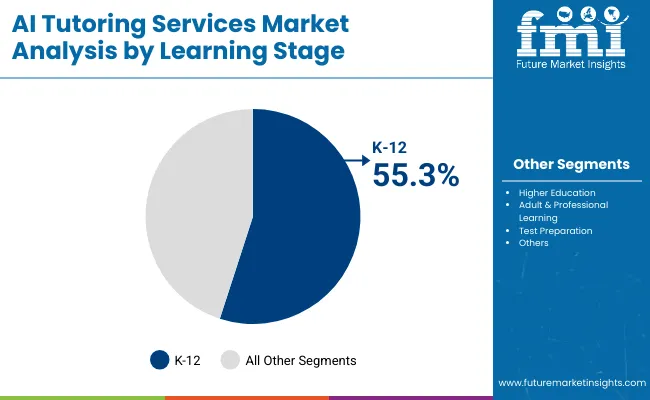

The AI Tutoring Services Market is segmented by learning stage, subject use case, interaction mode, service type, delivery method, and pricing model, each contributing to the market’s growth dynamics. By learning stage, K-12 dominates adoption due to curriculum integration and parental demand for personalization, followed by higher education for supplementary learning, adult and professional learning for upskilling, and test preparation for competitive exam success.

By subject, Math & STEM lead thanks to measurable outcomes, while language learning, coding, humanities, and homework help also see strong uptake. In terms of interaction, text chat remains the most accessible, voice is rising in language-focused platforms, multimodal formats enhance comprehension through images and code, and live co-tutoring blends human expertise with AI support. By service type, pure AI tutors offer scalable automation, hybrid human-AI models address complex needs, and AI teacher assistants aid educators with grading and resource recommendations.

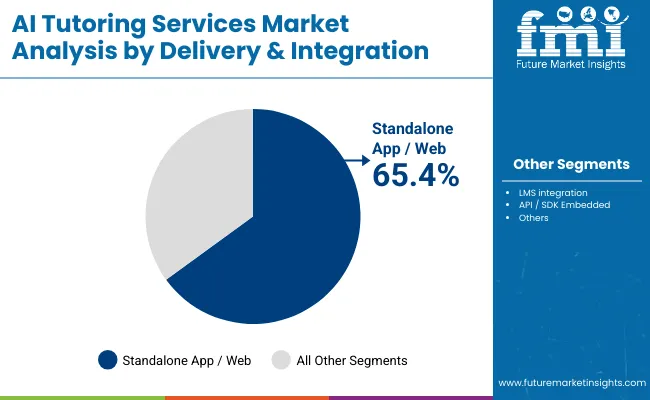

Delivery is dominated by standalone app/web platforms, with growing LMS integration in institutions and API/SDK embedding for developers. Pricing models range from freemium for mass reach, subscriptions for continuous learning, and usage-based models for short-term needs, to institutional licenses for bulk deployment across schools and universities. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Service Type | Value Share% 2025 |

|---|---|

| Pure AI tutor | 59.4% |

| Others | 40.6% |

The Pure AI Tutor segment is projected to contribute 59.4% of the AI Tutoring Services Market revenue in 2025, maintaining its lead as the dominant service type category. This leadership is driven by the scalability of AI-driven learning platforms, which can deliver personalized, adaptive education to millions of learners simultaneously without the need for proportional increases in human resources. Pure AI tutors are particularly popular in K-12 and language learning segments, where automation and low delivery costs are key adoption drivers.

The segment’s growth is further supported by continuous advancements in natural language processing, multimodal learning capabilities, and real-time feedback mechanisms. As integration with mobile apps, cloud-based analytics, and learning management systems becomes more widespread, Pure AI Tutors are evolving into comprehensive learning companions rather than standalone Q&A tools. This ability to combine cost efficiency with high personalization is expected to ensure the segment retains its dominant position in the AI Tutoring Services market throughout the forecast period.

| Learning Stage | Value Share% 2025 |

|---|---|

| K-12 | 55.3% |

| Others | 44.7% |

The K-12 segment is forecasted to hold 55.3% of the AI Tutoring Services Market share in 2025, driven by the rapid adoption of digital learning tools in primary and secondary education. Schools and districts are increasingly integrating AI tutors to provide personalized learning experiences, adaptive assessments, and real-time progress tracking, addressing diverse student needs and bridging learning gaps.

This segment benefits from strong government initiatives, education technology funding, and the rising acceptance of AI-driven supplementary education among parents and educators. The flexibility of AI tutors to offer subject-specific guidance, homework help, and test preparation further boosts their adoption in K-12 settings. As hybrid and remote learning environments become a lasting part of the education system, the K-12 segment is expected to sustain its dominant position in the market.

| Delivery & Integration | Value Share% 2025 |

|---|---|

| Standalone app / web | 65.4% |

| Others | 34.6% |

The standalone app/web segment is projected to account for 65.4% of the AI Tutoring Services Market revenue in 2025, establishing itself as the most popular delivery method. This format is favored for its ease of access, device compatibility, and minimal setup requirements, enabling learners to engage with AI tutors across desktops, tablets, and smartphones without additional integrations.

Its dominance is further supported by the rise of direct-to-consumer AI tutoring platforms that provide seamless onboarding, personalized dashboards, and instant content updates. The ability to push feature enhancements and integrate AI-driven analytics without dependency on third-party systems ensures a faster innovation cycle. As mobile-first and web-based education consumption continues to rise, standalone app/web platforms are expected to maintain their leadership, appealing to both individual learners and institutional customers.

Scalable Personalization in Learning

One of the most significant growth drivers for the AI Tutoring Services Market is the ability to deliver scalable personalized learning experiences. Traditional tutoring requires a one-to-one or small group setting, which is resource-intensive and often costly. AI-powered tutoring platforms can simulate that personalization at scale by dynamically adjusting lesson content, difficulty levels, and pacing based on each learner’s progress and preferences. Advanced natural language processing, adaptive testing, and performance analytics allow these systems to identify knowledge gaps and deliver targeted interventions in real time.

This not only improves learning outcomes but also ensures continuous engagement by catering to different learning styles. Institutions, parents, and individual learners find value in the consistent quality of AI tutors, especially for subjects like math, science, and language learning. The scalability of this approach makes it ideal for large educational systems and emerging markets, where demand far exceeds the supply of qualified human tutors.

Rising Adoption in K-12 and Test Preparation

The K-12 and test preparation segments are at the forefront of AI tutoring adoption. Schools are integrating AI tutors into classroom and homework settings to provide personalized support, while after-school programs are using them to supplement traditional tutoring. AI tutors help students improve performance through instant feedback, gamified learning modules, and adaptive exercises tailored to standardized tests and competitive exam requirements.

Parents, increasingly concerned about their children’s academic competitiveness, are investing in AI tutoring subscriptions that offer measurable improvement in grades and test scores. In test prep, AI tutors can simulate exam environments, track progress, and adjust study plans automatically, reducing student stress and maximizing efficiency. This growth is also reinforced by government-backed digital learning initiatives, particularly in countries with large student populations like India and China. The ability to serve millions of learners simultaneously, while keeping costs lower than in-person tutoring, makes this segment a key revenue driver.

Data Privacy and Security Concerns

Data privacy remains a significant challenge for the AI Tutoring Services Market. AI tutoring systems rely heavily on collecting and analyzing large volumes of personal and performance data to customize learning experiences. This includes sensitive information such as student names, ages, academic records, behavioral patterns, and in some cases, biometric data for voice or facial recognition. In regions with strict data protection regulations, such as the EU’s GDPR or California’s CCPA, ensuring compliance can be complex and costly.

Parents and institutions are often wary of sharing student data with third-party platforms, particularly when those platforms operate internationally and store data in multiple jurisdictions. Security breaches could compromise sensitive information, leading to reputational damage and potential legal consequences for providers. As awareness of digital privacy increases, companies must invest heavily in encryption, secure cloud storage, and transparent data handling policies. Failure to address these concerns could slow adoption, especially in regulated education markets.

Growth of Hybrid Human-AI Tutoring Models

While pure AI tutors dominate in scalability and cost efficiency, there is a growing trend toward hybrid human-AI tutoring models. In this approach, AI handles routine tasks such as grading, delivering personalized lesson recommendations, and tracking progress, while human tutors provide contextual guidance, emotional support, and complex problem-solving. This combination leverages the strengths of bothAI ensures efficiency and consistency, while human educators add empathy and adaptability.

Hybrid models are especially popular in higher education, professional learning, and advanced test preparation, where nuanced explanations and real-world application examples are crucial. Schools and private tutoring companies are increasingly adopting this approach to maximize engagement and improve outcomes. Furthermore, this model addresses one of the key criticisms of AI tutorsthat they lack the human touchmaking it appealing to parents and learners who want a balance between technology and personal mentorship. As AI capabilities advance, these hybrid solutions are expected to become more seamless and widespread.

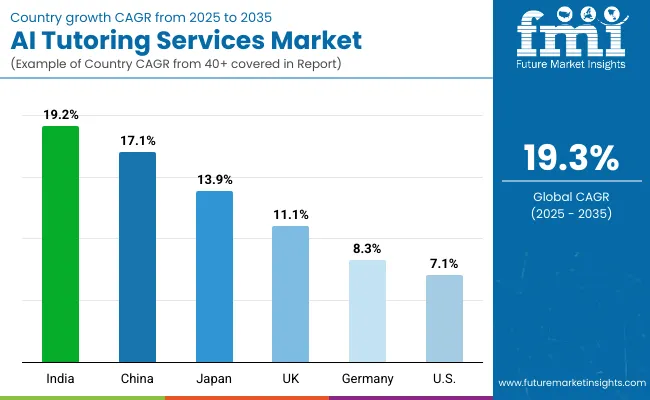

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 17.1% |

| USA | 7.1% |

| India | 19.2% |

| UK | 11.1% |

| Germany | 8.3% |

| Japan | 13.9% |

The global AI Tutoring Services Market displays strong regional variation, shaped by education digitization policies, broadband penetration, and cultural receptiveness to AI-assisted learning.

Asia-Pacific leads the growth trajectory, with India at 19.2% CAGR and China at 17.1%, driven by large student populations, national digital learning initiatives, and rising middle-class demand for affordable, scalable education solutions. China benefits from heavy investment in AI edtech startups and integration into government-backed smart classroom programs. India’s rapid expansion is fueled by competitive exam preparation demand, mobile-first learning platforms, and the growing acceptance of AI tutors in K-12 and higher education.

Japan follows closely with 13.9% CAGR, supported by its emphasis on lifelong learning and technology-driven workforce reskilling. In Europe, the UK (11.1%) and Germany (8.3%) maintain strong growth on the back of hybrid tutoring adoption and institutional licensing in universities. North America shows steadier expansion, with the USA at 7.1%, reflecting a mature edtech ecosystem where growth is more service-oriented, focusing on AI-teacher assistant tools and integration into existing learning management systems rather than pure tutoring apps.

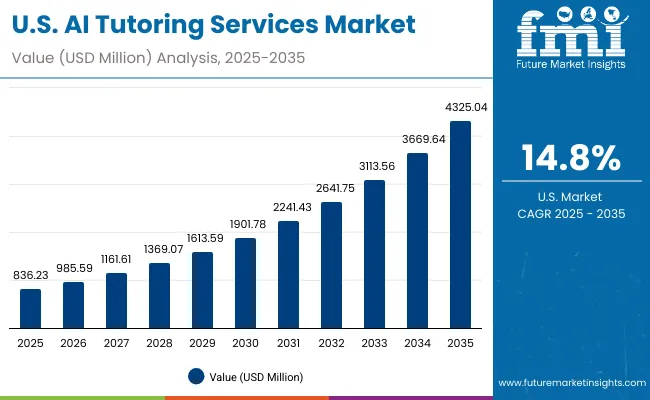

| Year | USA AITutoring Services Market (USD Million) |

|---|---|

| 2025 | 836.23 |

| 2026 | 985.59 |

| 2027 | 1161.61 |

| 2028 | 1369.07 |

| 2029 | 1613.59 |

| 2030 | 1901.78 |

| 2031 | 2241.43 |

| 2032 | 2641.75 |

| 2033 | 3113.56 |

| 2034 | 3669.64 |

| 2035 | 4325.04 |

The AI Tutoring Services Market in the United States is forecast to grow at a CAGR of 14.8% from 2025 to 2035, driven by rising adoption across K-12 schools, higher education institutions, and corporate training programs. Increased funding for digital learning infrastructure and government-backed AI education initiatives are accelerating deployment. The integration of AI tutors as teacher assistants in blended classrooms is also expanding, improving student engagement and reducing educator workload. The USA market benefits from high broadband penetration, strong edtech startup ecosystems, and strategic collaborations between AI developers and educational publishers.

The AI Tutoring Services Market in the United Kingdom is projected to grow at a CAGR of 11.1% between 2025 and 2035, driven by strong adoption in K-12 schools, higher education, and professional upskilling programs. Government-backed digital education strategies, such as the UK’s EdTech Demonstrator Programme, are fostering early adoption of AI-powered personalized learning tools. Universities are integrating AI tutors into virtual learning environments to enhance accessibility for remote learners. In the corporate sector, AI tutors are gaining traction for continuous workforce training, particularly in finance, healthcare, and technology fields. Collaborations between AI edtech startups and educational publishers are further enriching content quality and delivery.

India is witnessing rapid growth in the AI Tutoring Services Market, forecast to expand at a CAGR of 19.2% through 2035. The expansion is fueled by rising digital adoption in tier-2 and tier-3 cities, affordable subscription models, and government-led initiatives like PM eVidya to promote online learning. EdTech startups are increasingly offering AI-powered tutors in regional languages, bridging accessibility gaps for rural learners. Schools and coaching centers are integrating AI tutoring into hybrid learning models to improve test preparation and skill development. Corporate L&D teams are also leveraging AI tutors for continuous workforce training, particularly in IT and BFSI sectors.

The AI Tutoring Services Market in China is expected to grow at a CAGR of 17.1%, the highest among leading economies. Growth is propelled by nationwide digital education reforms, rapid EdTech adoption, and strong competition among domestic AI innovators. Public school systems in major provinces are integrating AI tutors to support personalized learning paths and reduce teacher workload. The government’s “Smart Education” initiative is expanding AI-assisted classrooms, while private tutoring platforms are embedding AI into K-12, university prep, and vocational training services. Affordable solutions from local tech companies are boosting penetration into rural and underserved areas, making AI tutoring a mainstream supplement to traditional teaching.

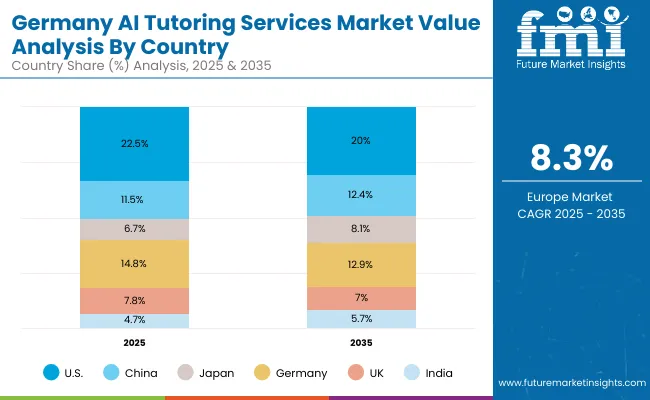

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.5% |

| China | 11.5% |

| Japan | 6.7% |

| Germany | 14.8% |

| UK | 7.8% |

| India | 4.7% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.0% |

| China | 12.4% |

| Japan | 8.1% |

| Germany | 12.9% |

| UK | 7.0% |

| India | 5.7% |

The AI Tutoring Services Market in Germany is projected to grow at a CAGR of 8.3%, driven by the country’s strong emphasis on education quality, digital transformation in schools, and compliance with EU education technology standards. Public and private institutions are adopting AI tutoring platforms to support differentiated instruction, cater to multilingual classrooms, and address teacher shortages. Universities and vocational schools are integrating AI tutors into STEM and technical training programs to enhance practical skill development. Corporate training providers are leveraging AI tutoring for upskilling employees in emerging technologies. Germany’s focus on data privacy and GDPR compliance is shaping platform design, ensuring secure and ethical AI usage.

.webp)

| USA By Service Type | Value Share% 2025 |

|---|---|

| Pure AI tutor | 57.7% |

| Others | 42.3% |

The AI Tutoring Services Market in the United States is expected to witness steady growth, with pure AI tutors accounting for 57.7% of market value in 2025, reflecting the nation’s early adoption of advanced edtech solutions. The strong preference for AI-driven platforms stems from their ability to deliver personalized learning paths, real-time feedback, and adaptive assessments that align with Common Core and state-specific academic standards.

The USA edtech ecosystem is benefiting from significant venture capital funding and partnerships between technology providers, K-12 districts, and higher education institutions. Growth is also supported by the integration of AI tutors into corporate e-learning modules, particularly in technology, healthcare, and finance sectors. AI tutor adoption is accelerating in test preparation and professional certification programs, where tailored practice modules and performance analytics provide measurable outcomes.

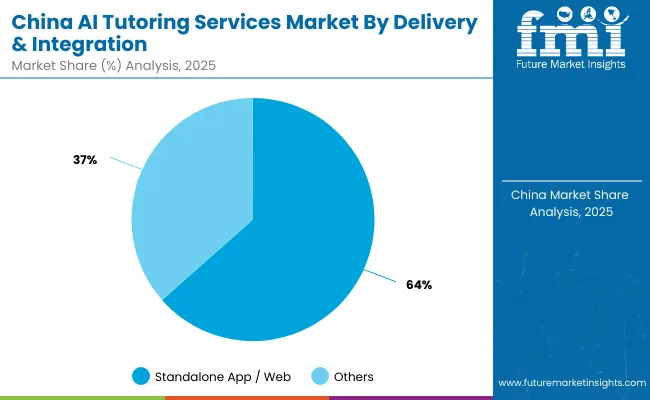

| China By Delivery & Integration | Value Share% 2025 |

|---|---|

| Standalone app / web | 63.5% |

| Others | 36.5% |

The AI Tutoring Services Market in China is expected to see robust expansion, with standalone app/web platforms commanding 63.5% of market value in 2025. This dominance stems from China’s highly mobile-first digital ecosystem, where super apps, online education portals, and integrated payment systems drive rapid adoption. Standalone AI tutoring platforms cater to the nation’s competitive academic culture, offering adaptive learning modules for K-12 students, university entrance preparation, and professional upskilling.

Government policy promoting digital education, coupled with nationwide 5G rollout, has further enabled seamless delivery of AI-powered learning experiences even in rural areas. Local edtech companies are leveraging proprietary AI algorithms, gamified content, and live tutoring integration to boost engagement and retention. The other segmentcomprising embedded AI tutors in learning management systems and hybrid classroom setupsis growing steadily as schools adopt blended learning models.

The AI Tutoring Services Market is moderately fragmented, featuring global edtech giants, emerging AI-driven innovators, and niche content specialists. Leading players like Duolingo, BYJU’S, and Khan Academy hold notable market positions by combining adaptive AI algorithms with large-scale content libraries, multilingual support, and gamified learning experiences. Their strategies increasingly focus on integrating generative AI for real-time feedback, personalized learning pathways, and immersive AR/VR-based modules for enhanced engagement.

Mid-sized innovators such as Squirrel AI, Quizlet, and Lingvist target specific learning outcomesranging from K-12 academic tutoring to professional skill developmentoffering affordable subscription models and mobile-first experiences. These platforms are expanding rapidly in emerging markets through localized content and partnerships with educational institutions.

Specialist providers, including Knowre and Elsa Speak, carve out niches in areas like AI-powered mathematics tutoring and spoken language improvement. Their competitive advantage lies in hyper-focused feature sets and high adaptability to local curricula.

Competitive differentiation in this space is moving beyond core content delivery toward AI ecosystem integration, combining predictive learning analytics, gamified retention strategies, and subscription-based hybrid learning models.

Key Developments in AI Tutoring Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,716.6 Million |

| Learning Stage | K-12, Higher Education, Adult & Professional Learning, Test Preparation |

| Subject / Use Case | Math & STEM, Language Learning, Coding & Computer Science, Humanities & Social Sciences, Homework Help & Study Skills |

| Interaction Mode | Text chat, Voice, Multimodal (text + images/code), Live co-tutoring |

| Service Type | Pure AI tutor, Human + AI hybrid tutoring, Teacher assistant / co-pilot |

| Delivery & Integration | Standalone app / web, LMS integration, API / SDK embedded |

| Pricing Model | Freemium, Subscription, Usage-based / pay per session, Institutional license |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Khan Academy (Khanmigo), Duolingo, Quizlet (Q-Chat), McGraw Hill ALEKS, Carnegie Learning (MATHia), Riiid, Squirrel AI Learning, Brainly, ELSA Speak, Photomath |

| Additional Attributes | Dollar sales by service type and learning stage, adoption trends in hybrid human-AI tutoring and personalized learning platforms, rising demand for multimodal interaction (text, voice, images, code), sector-specific growth in K-12, higher education, and professional learning, software vs. platform revenue segmentation, integration with AR/VR classrooms and gamified learning systems, regional trends influenced by government digital education initiatives, and innovations in adaptive learning algorithms, natural language processing, and emotion recognition for personalized feedback. |

The global AI Tutoring Services Market is estimated to be valued at USD 3,716.6 million in 2025.

The market size for the AI Tutoring Services Market is projected to reach USD 21,625.2 million by 2035.

The AI Tutoring Services Market is expected to grow at a 19.3% CAGR between 2025 and 2035.

The key product types in the AI Tutoring Services Market are Pure AI Tutor, Human + AI Hybrid Tutoring, and Teacher Assistant / Co-pilot.

In terms of service type, the Pure AI Tutor segment is projected to command 57.7% share in the AI Tutoring Services Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

The AI Legal Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Air Ambulance Services Market Size and Share Forecast Outlook 2025 to 2035

AI Consulting Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Airline A-la-carte Services Market Analysis by Product Type, Carrier Type and Region from 2025 to 2035

The Car Detailing Services Market is segmented by service type and region from 2025 to 2035.

AI In Government And Public Services Market Size and Share Forecast Outlook 2025 to 2035

Global On-Demand Repair Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Foundation Repair Services Market Outlook from 2025 to 2035

Managed Blockchain Services Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Automotive Repair & Maintenance Services Market Growth - Trends & Forecast 2025 to 2035

United States & Canada Hair Salon Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

United States & Canada Foundation Repair Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

AI Code Assistant Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA