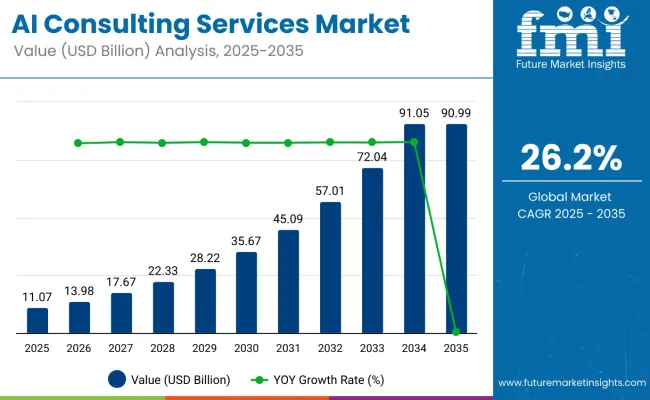

The global AI consulting services market is projected to grow dramatically, expanding from USD 11.07 billion in 2025 to an impressive USD 90.99 billion by 2035, reflecting a strong compound annual growth rate (CAGR) of 26.2% over the forecast period. This rapid growth is driven by widespread adoption of artificial intelligence technologies across diverse industries, increasing demand for digital transformation, and the rising complexity of AI implementation projects, which require specialized consulting expertise.

AI consulting services encompass a wide range of solutions including AI strategy development, technology assessment, machine learning model creation, system integration, and post-deployment support. Enterprises in sectors such as finance, healthcare, retail, manufacturing, and telecommunications are leveraging AI to optimize processes, enhance customer engagement, and drive competitive advantage. This has fueled strong demand for expert consultants who can guide organizations through the AI journey efficiently and responsibly.

The explosion of big data, cloud computing, and advanced analytics has intensified the need for consulting firms to help businesses address challenges related to data governance, algorithmic fairness, and scalable infrastructure. Additionally, evolving regulatory frameworks and cybersecurity concerns compel companies to seek trusted partners to ensure ethical and secure AI adoption.

North America currently dominates the AI consulting market owing to its mature technology ecosystem, high AI adoption rates, and concentration of leading consulting firms. However, the Asia-Pacific region is expected to witness the fastest growth, driven by robust government initiatives promoting AI innovation, rapid enterprise digitization, and a large, skilled AI workforce in countries like China, India, and Japan.

In a 2024 interview with Business Insider, Martín Migoya, CEO of Globant, remarked, “We're shifting to a subscription-based model for AI services because businesses today seek flexible, scalable, and outcome-driven solutions. This approach allows clients to leverage AI dynamically, aligning costs directly with business value.” This statement underscores the market’s ongoing transformation towards innovative, client-centric consulting models

As AI technologies continue to evolve and mature, and as organizations increase their investments in AI-driven innovation, the AI consulting services market is set to sustain its remarkable growth trajectory through 2035.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 11.07 billion |

| Market Size (2035) | USD 90.99 billion |

| CAGR (2025 to 2035) | 26.2% |

Government regulations in the AI consulting services market focus primarily on data privacy, security, transparency, and ethical AI deployment. Key regulatory frameworks include data protection laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, which impose strict guidelines on how personal data is collected, processed, and stored. Additionally, governments are increasingly emphasizing AI transparency and accountability to prevent biased or discriminatory outcomes.

The AI consulting services market is rapidly expanding as businesses across industries seek to implement artificial intelligence solutions to improve efficiency and decision-making. With the increasing adoption of AI, regulatory bodies worldwide have introduced stringent requirements focused on data privacy, security, and ethical AI use. Compliance with these regulations is essential for companies offering AI consulting services to maintain trust and operate legally.

The below table presents the expected CAGR for the global AI Consulting Services market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the AI Consulting Services industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year. H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 25.5%, followed by a slightly higher growth rate of 25.7% in the second half H2 of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 25.5% (2024 to 2034) |

| H2 2024 | 25.7% (2024 to 2034) |

| H1 2025 | 26.3% (2025 to 2035) |

| H2 2025 | 26.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 26.3% in the first half and remain higher at 26.5% in the second half. In the first half H1 the market witnessed an increase of 20 BPS while in the second half H2, the market witnessed an increase of 20 BPS.

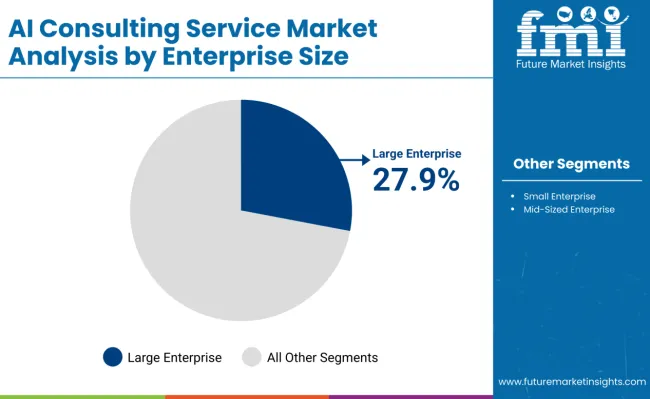

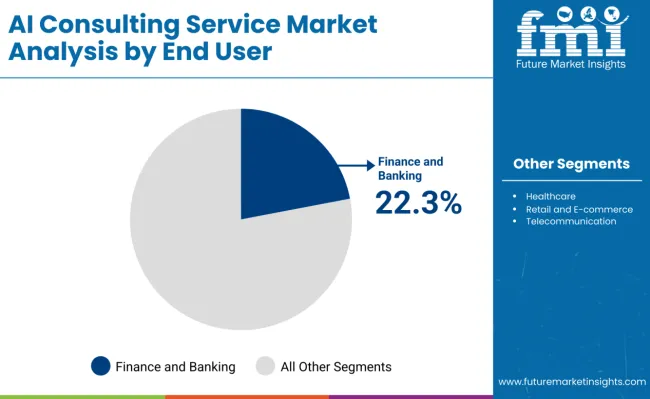

Large enterprises are expanding rapidly with a 27.9% CAGR from 2025 to 2035, driven by AI integration to optimize operations and automation. The finance and banking sector leads the end-user segment, commanding a 22.3% market share due to AI’s role in fraud detection and customer experience.

Large enterprises, particularly those with 500-999 employees, are leading growth in the AI Consulting Services Market, projected to expand at a CAGR of 27.9% from 2025 to 2035. These organizations leverage AI solutions for customer service automation, predictive analytics, AI-powered cybersecurity, and enterprise resource planning (ERP).

Investments in AI-driven automation have yielded a 40% increase in operational efficiency and a 25% reduction in hiring costs, boosting workforce productivity. Governments are catalyzing AI adoption, with the US allocating USD 2.8 billion in 2024 for AI-driven business transformations and China targeting AI implementation in 70% of large enterprises by 2030.

Such initiatives are expected to enhance AI-led productivity by 45% within large enterprises by 2035, reinforcing their dominant position in the AI consulting market and driving sustained demand for AI advisory services.

Finance and banking lead the AI Consulting Services Market with a 22.3% share in 2025, driven by widespread AI adoption to improve fraud detection, risk management, customer experience, and regulatory compliance. Over 80% of global banks use AI-powered chatbots and fraud prevention tools, reducing operational costs by 25% and enhancing transaction efficiency.

Government support is significant; the European Union allocated USD 1.5 billion in 2023 to develop AI-driven banking risk solutions, while India’s Reserve Bank mandates AI-based KYC and AML systems to combat financial crime. These technologies have reduced fraud cases by 35%, bolstering trust in digital banking.

The finance sector’s ongoing AI investments ensure it remains the leading end-user segment in the AI consulting market, as institutions seek advanced AI advisory to maintain competitive edge and regulatory compliance.

More and more organizations are looking for strategy consulting as part of their AI consulting services to improve their competitive advantage. AI has become a non-negotiable element for organizations that drive innovation, increase efficiency, and develop a competitive edge. With AI-powered insights being harnessed for predictive analytics, customer segmentation, and strategic decision-making, companies are increasingly leaning on AI-centric strategy consulting.

While digital consultants have been helping businesses migrate to the cloud, strategy consultants would help define what models and frameworks make sense for the business and its governance structures as companies pivot to AI-powered operating models.

Governments around the world are investing in AI initiatives to drive economic growth and technological leadership. For example, the USA government set aside USD 1.8 billion in its 17 trillion-dollar budget for research into AI and quantum computing to bolster generative AI usage in various fields. Like China’s AI policy, the new goal is a USD 150 billion AI industry by 2030 and forcing businesses to implement AI strategies. That is why there is a demand for strategy consulting to ensure that corporate AI adoption is in synch with national AI policies.

Management consulting demand is being propelled by AI-driven business process optimization, as companies pursue efficiency and savings through AI automation. AI is being used by companies from various sectors for automating workflows, process intelligence and improving decision-making. Intelligent process mining tools powered by AI are being used by firms to review inefficiencies and optimize operations in their finance, HR, supply chain and customer service functions.

This trend is further amplified by government initiatives. The European Union’s USD 1 billion AI Innovation Fund helps businesses adopt AI processes for automation. Moreover, the National AI Mission by India, supported by a whopping USD 7 billion investment, is another initiative targeting AI-powered operational efficiency of enterprises. Such initiatives push the enterprises to drive AI use cases in development, compliance, and scalability, making AI-powered management consulting evident.

The digital transformation globally being dominated by AI, there is a tremendous demand for IT consulting services. From further AI investments to cloud cost optimization, enterprises are aggressively pursuing AI-driven solutions to shift the IT environment, build cybersecurity models in real-time, and focus on optimizing cloud adoption. Through AI-driven cloud computing, intelligent automation, and advanced analytics, IT consulting is being disrupted by AI, empowering companies to scale their operations in a much more efficient manner.

AI led digital transformation are being fueled by government policies around the globe. The UK government has also recently revealed a USD 100 million AI investment fund to push for AI adoption in enterprises, thus boosting AI-based IT solutions market.

In Japan, the government works on promoting AI use cases in cloud computing, with the goal of increasing the AI adoption of IT-driven cloud computing by 60%, by 2027, therefore generating demand for AI consulting for IT transformation projects to support this push. Such initiatives drive the role of AI-based IT consulting in helping companies navigate digital transformation.

Organizations aspiring to AI-led transformation struggle to find talent including but not limited to machine learning, deep learning, natural language processing (NLP), and AI governance. This lack of knowledge severely limits the use of AI, as firms are unable to appropriately create, implement and oversee AI systems in the absence of relevant skills. AI consulting firms are increasingly being called upon to fill this gap yet many struggle in their own recruitment of AI specialists as demand continues to outstrip supply.

Further, existing professionals must keep upskilling themselves as AI technologies evolve rapidly. But, retraining employees on AI is expensive, time-consuming, and hence many businesses avoid AI integration. For smaller organizations, the situation is even more dire, as they typically don't have the budget to lure top AI talent away or a war chest to spend on specialized training programs.

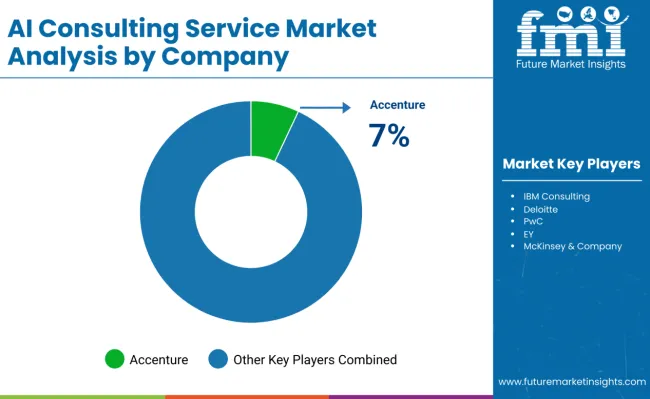

Tier 1 vendors have the most significant market share at 50-55% of the total AI consulting services market. Included in this group are the major global IT leaders and technology consulting firms, like IBM, Accenture, Deloitte, PwC, Capgemini, etc. Such firms offer end-to-end AI consultancy, developing credible strategies and assisting with enterprise-level AI deployment across industries. They have a very strong position owing to their large presence worldwide, huge investment in R&D as well as tie-ups with AI software providers.

These types of vendors comprise around 15 to 20% of the market share (the so-called Tier 2 vendors) with categories like mid-sized consulting firms and niche-specific AI solution vendors (like Fractal Analytics, BCG Gamma, ZS Associates, TCS AI Solutions). These firms focus on industry-specific applications of AI, advanced data analytics and AI-driven automation, servicing a mix of large enterprises and mid-sized businesses.

Tier 3 vendors own the other 20-25% of the market and consist of boutique AI consulting firms, startups, and regional AI service providers. These firms serve niche AI use cases, AI-driven startups, and small businesses, providing tailored AI solutions at lower costs. This agility combined with a technology agnostic approach taken on specialized AI consulting, machine learning artifacts development and AI ethics consulting makes them emerging players in the market.

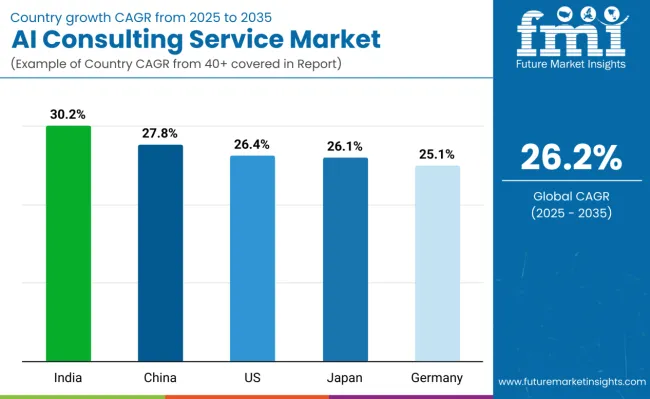

The section highlights the CAGRs of countries experiencing growth in the AI Consulting Services market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 30.2% |

| China | 27.8% |

| Germany | 25.1% |

| Japan | 26.1% |

| United States | 26.4% |

The manufacturing sector in India is experiencing a tremendous change by Industry 4.0 initiatives. AI consulting services are vital for enterprises to lend support to intelligent automation, predictive maintenance, and smart factory initiatives.

Despite the new AI regulation, the Indian government has remained keen to promote AI in manufacturing through initiatives such as "Make in India" and the National AI Strategy, which focus enablers for AI-driven enhancements in efficiency. AI-enabled robotics process automation (RPA) is being used for simplifying operations, minimizing production downtime by 30% and boosting overall equipment effectiveness (OEE) by 25%.

The Indian government announced this week an investment of USD 1.2 Billion into AI-driven manufacturing projects, adopting a dual approach to boost local AI start-ups while speeding up AI consulting services in the industrial sector. This initiative centres on AI backed quality control systems, supply chain optimization, and production forecasting through machine-lending. India is anticipated to see substantial growth at a CAGR 30.2% from 2025 to 2035 in the AI Consulting Services market.

The USA telco sector is experiencing a wave of AI adoption, especially as 5G deployments ramp up across the country. More and more AI consulting services are in high demand for AI-based optimization of networks, predictive maintenance, and real-time traffic media management.

Leading telecom companies in the United States are harnessing AI to maximize network availability, boost user experience and take a share of operational expenses - up to 20 percent. AI-enabled self-optimizing networks (SON) enable telecom providers to dynamically configure parameters without human-in-the-loop intervention, resulting in 40% uptime improvement.

So, the USA government has set aside USD 3.2 billion for advancements in 5G telecom infrastructure, as well as for AI-based cybersecurity solutions. In fact, AI in telecom is getting regulatory support as well, for example, agencies such as Federal Communications Commission (FCC) are pushing for AI-based solutions to manage network congestion or preventing cyber threats.

35% decrease in outages in telecom with AI-driven predictive maintenance allows consumers and businesses to remain continuously connected. USA AI Consulting Services market is anticipated to grow at a CAGR 26.4% during this period.

In China, the retail and e-commerce sector is leading the way in AI-powered innovation; AI for automation, personalized recommendations, and supply chain optimization are transforming the retail sector. In China, the government is pouring money into AI to improve retail efficiency, increase customer engagement, and spur economic growth.

AI consulting services are a broad-scale way to implement AI-powered, customer-facing solutions like chatbots, visual search, and dynamic pricing models-significantly improving the customer experience and sales by extension. As a result of AI personalization, online conversion rates are projected to jump by 35%, indicating a marked shift toward AI-assisted purchasing journeys.

The Chinese government allocated USD 5 billion has been set aside for AI technology-driven retail initiatives, such as widespread usage of AI-based robotics and AI-powered inventory management systems in warehouses. This investment is anticipated to drive up the adoption of artificial intelligence in 80% of Chinese retail businesses by 2030, and would potentially provide a USD 200 billion boost in retail productivity. AI Consulting Services market in China accounts for 69.0% of global market share and continues to grow at a high CAGR between 2025 and 2035.

The AI Consulting Services market is highly competitive and is driven by increased adoption of Artificial Intelligence across the industries. The new world of competition is all about custom AI strategy, industry-specific solutions, and expertise in implementation. There are pressures from both specialist AI companies, IT services companies, and management consultancies competing in the market. Firms are hiring AI talent, forming partnerships, and developing proprietary AI frameworks to be ahead of the curve. The competition is further accelerated by increased enterprise demand of AI-led transformation and regulatory compliance roles.

Industry Update

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 11.07 billions |

| Projected Market Size (2035) | USD 90.99 billions |

| CAGR (2025 to 2035) | 26.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and number of projects/contracts for volume |

| Service Types Analyzed (Segment 1) | Strategy Consulting, Management Consulting, Operations Consulting, Financial Advisory Consulting, Human Resource Consulting, IT Consulting, Others |

| Enterprise Sizes Analyzed (Segment 2) | Small & Mid-sized Enterprises, Large Enterprises |

| End Users Analyzed (Segment 3) | Healthcare, Finance and Banking, Retail and E-commerce, Manufacturing, Telecommunications, Energy and Utilities, Automotive, Logistics and Transportation, Education, Real Estate, Others |

| Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, Saudi Arabia, South Africa |

| Key Players Influencing the Market | Accenture, IBM Consulting, Deloitte, PwC, EY, McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Tata Consultancy Services (TCS), Capgemini |

| Additional Attributes | Key growth segments by dollar sales, market share of leading providers, regional demand distribution, industries driving AI adoption, emerging service trends, competitive pricing dynamics, client spending forecasts. |

In terms of service type, the segment is divided into Strategy Consulting, Management Consulting, Operations Consulting, Financial Advisory Consulting, Human Resource Consulting, IT Consulting, Others.

In terms of enterprise size, the segment is segregated into small & mid-sized and large enterprise.

In terms of end user, the segment is segregated into Healthcare, Finance and Banking, Retail and E-commerce, Manufacturing, Telecommunications, Energy and Utilities, Automotive, Logistics and Transportation, Education, Real Estate, Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global AI Consulting Services industry is projected to witness CAGR of 26.2% between 2025 and 2035.

The Global AI Consulting Services industry stood at USD 11.07 billion in 2025.

The Global AI Consulting Services industry is anticipated to reach USD 90.99 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 28.7% in the assessment period.

The key players operating in the Global AI Consulting Services Industry Accenture, IBM Consulting, Deloitte, PwC, EY, McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Tata Consultancy Services (TCS), Capgemini.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

The AI Legal Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

AI Tutoring Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Air Ambulance Services Market Size and Share Forecast Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Airline A-la-carte Services Market Analysis by Product Type, Carrier Type and Region from 2025 to 2035

The Car Detailing Services Market is segmented by service type and region from 2025 to 2035.

Network Consulting Services Market

AI In Government And Public Services Market Size and Share Forecast Outlook 2025 to 2035

Global On-Demand Repair Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Foundation Repair Services Market Outlook from 2025 to 2035

Litigation Consulting Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Blockchain Services Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Automotive Repair & Maintenance Services Market Growth - Trends & Forecast 2025 to 2035

United States & Canada Hair Salon Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Finance and Risk Management Consulting Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Foundation Repair Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

AI Code Assistant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA