The litigation consulting services market is expected to grow from USD 61.3 billion in 2025 to USD 104.7 billion by 2035, at a CAGR of 5.5%, driven by rising complexity in global disputes, expanding regulatory scrutiny, and increased reliance on expert-driven legal strategy. Growth is influenced by heightened corporate exposure to financial misconduct cases, intellectual property conflicts, antitrust actions, and regulatory investigations that require multidisciplinary advisory capabilities. Litigation consulting firms deliver forensic accounting, economic modelling, damages quantification, expert testimony, e-discovery, and case-strategy alignment, making them indispensable across enterprise-level disputes. As cross-border transactions expand and multinational corporations face multi-jurisdictional legal risks, demand for consultants who combine legal understanding with financial, operational, and analytical depth grows.

Professional law firms remain the dominant classification with a 60% share, reinforcing their role as primary integrators of litigation consulting into high-stakes legal workflows. Enterprises account for 55% share of market demand, driven by governance pressures, risk-management expectations, and the rising financial impact of corporate disputes. Adoption is further accelerated by the integration of AI-assisted review, predictive analytics, scenario modelling, and digital forensic tools that enhance the speed and clarity of litigation strategy. China and India demonstrate the strongest expansion as their commercial sectors mature, while the USA, Germany, the UK, and Japan maintain stable, high-value demand through established legal ecosystems. As litigation financing expands, dispute volumes rise, and global compliance becomes more stringent, the market shows a steady, long-term trajectory, shaped by increasing case complexity and a growing reliance on specialized consulting expertise.

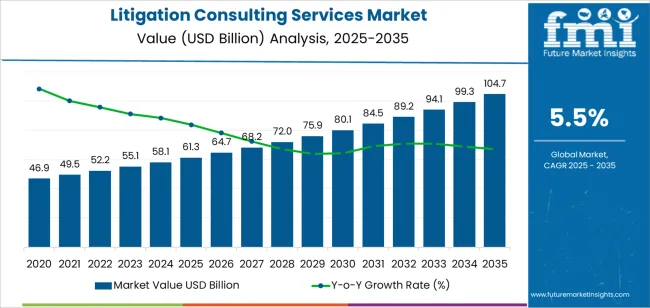

The long-term value accumulation curve for the litigation consulting services market reveals steady growth over the forecast period from 2025 to 2035, with a gradual increase in value. Starting at USD 61.3 billion in 2025, the market will grow to USD 104.7 billion by 2035, contributing a total increase of USD 43.4 billion over the 10-year period.

From 2025 to 2030, the market will expand from USD 61.3 billion to USD 80.1 billion, adding USD 18.8 billion in value. This early growth will be driven by the increasing complexity of litigation and the rising need for specialized consulting in corporate disputes and financial litigation. The steady rise in the number of global lawsuits, particularly in emerging markets, will contribute to this growth.

Between 2030 and 2035, the market will continue its upward trajectory, growing from USD 80.1 billion to USD 104.7 billion, contributing another USD 24.6 billion in value. The later years will see stronger value accumulation as the demand for data-driven litigation support, forensic accounting services, and global legal consulting expertise increases. The expansion of cross-border disputes and the integration of AI technologies into litigation consulting will drive demand in this phase. The curve indicates steady market growth with consistent value accumulation, fueled by increasing complexity in global legal challenges and a growing focus on expert litigation consulting services.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 61.3 billion |

| Market Forecast Value (2035) | USD 104.7 billion |

| Forecast CAGR (2025-2035) | 5.5% |

The litigation consulting services market is expanding as corporations face an increasing volume of complex legal disputes and heightened regulatory scrutiny. Businesses across sectors such as finance, healthcare, technology and energy are engaged in more frequent and higher value litigations and arbitrations, which drives demand for specialists in expert witness services, forensic accounting, e discovery, data analytics and case strategy support. Many organisations now view litigation consulting as an integral element of their legal risk management framework rather than an ad hoc engagement.

Another key driver is the rise of technological tools and methodologies that enhance the efficiency and effectiveness of litigation consulting. Advancements in legal data analytics, artificial intelligence enabled document review, predictive modelling of litigation outcomes, and remote collaboration platforms allow consultants to manage large volumes of data, identify key issues earlier and provide strategic insights. At the same time, growing globalisation of business introduces cross border legal exposure, requiring consulting firms with multi jurisdictional capabilities and specialised expertise. Nonetheless, obstacles remain including the high cost of specialised consulting services, competition from alternative legal service providers, and the challenge of integrating consulting outcomes with internal legal teams. Despite these constraints, the overall trend toward more sophisticated, analytics driven support for litigation matters suggests that the litigation consulting services market will continue to grow steadily.

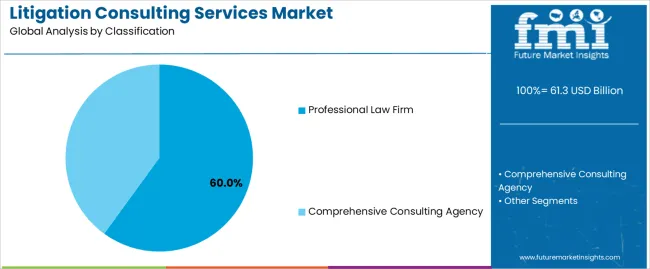

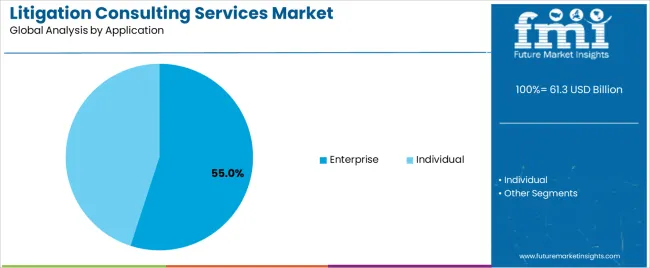

The litigation consulting services market is segmented by classification and application. The leading classification is professional law firm, which holds 60% of the market share, while the dominant application segment is enterprise, accounting for 55% of the market. These segments are critical drivers of market growth, supported by the increasing demand for expert advice in legal disputes, particularly in corporate and commercial sectors.

The professional law firm classification leads the litigation consulting services market, capturing 60% of the market share. Law firms play a pivotal role in providing litigation consulting services, offering expertise in legal strategy, case evaluation, evidence analysis, and witness preparation. These firms typically employ specialized consultants with deep legal and industry-specific knowledge to assist clients in complex litigation matters, such as commercial disputes, regulatory investigations, and intellectual property cases.

The dominance of professional law firms in the market is driven by their established relationships with clients, in-depth legal expertise, and their ability to provide comprehensive litigation support. As businesses continue to face more intricate legal challenges, especially in areas such as mergers and acquisitions, antitrust issues, and compliance, the demand for professional law firms offering litigation consulting services is expected to continue to grow, maintaining their position as the market leader.

The enterprise application segment is the leading segment in the litigation consulting services market, accounting for 55% of the market share. Enterprises, particularly large corporations, often face complex legal challenges that require specialized litigation consulting services. These services help businesses navigate legal disputes, assess risk, and develop strategies for litigation or settlement, covering areas such as corporate governance, regulatory compliance, intellectual property, and commercial contracts.

As the global business environment becomes increasingly complex and regulated, enterprises require expert guidance to manage legal risks effectively. Litigation consulting services are essential for protecting the interests of enterprises in high-stakes legal matters, particularly those that can have significant financial or reputational consequences. The demand for these services is expected to remain strong as enterprises continue to invest in litigation support to safeguard their operations and strategic goals.

The litigation consulting services market is expanding as corporations and legal practices face an increasing number of complex disputes, regulatory challenges and high stakes litigation. Specialists in this market provide support such as damages quantification, expert witness preparation, forensic accounting, scenario modelling and strategy consulting. Technological advances such as data analytics, e discovery and AI enabled case simulation heighten the value of consulting inputs. Meanwhile, broader factors like the rise in cross border disputes, integration of litigation finance, and organisational pressure to manage risk and legal spend are shaping demand, though varying regulatory landscapes and cost pressures affect adoption rates.

Several drivers support this market’s growth. First, the increasing volume and complexity of litigation including corporate regulatory investigations, antitrust actions, IP disputes and financial market litigation require specialist consulting capabilities beyond traditional law firm services. Second, litigation consulting firms are increasingly leveraging advanced analytics, scenario modelling and expert systems to deliver insight on risk, likely outcomes and settlement strategies, which appeals to corporate clients seeking better predictability. Third, growth in the use of litigation financing and third party funders creates additional demand for consulting work related to case viability, value assessment and funding decision support. Fourth, internationalisation of business operations and increased enforcement actions across jurisdictions drive demand for consulting services with global reach and cross discipline expertise.

Despite promising growth, the market faces several constraints. The high cost associated with engaging specialist consultants including expert witness fees, data modelling and extensive case analysis may limit uptake among smaller companies or less resource intensive disputes. Difficulties in modelling litigation outcomes and translating consultant work into predictable value can reduce client confidence, particularly when metrics for success remain ambiguous. Regulatory and ethical considerations especially around expert testimony, data privacy and regional legal standards add complexity and may slow project initiation. In some jurisdictions, limited availability of local expertise or specialist consulting firms may further restrict access or escalate costs.

Several trends are shaping the future of this market. One key trend is increased integration of predictive analytics platforms, machine learning derived scenario modelling and virtual case simulation to better forecast litigation risks and outcomes. Another trend is the expansion of consulting services into adjacent areas such as regulatory compliance consulting, dispute prevention strategy and litigation funding support, increasing the breadth of services offered. Multi disciplinary firms, combining legal expertise, financial modelling, digital forensics and regulatory knowledge, are gaining importance. Additionally, regional growth is accelerating in emerging markets as companies and governments mature their litigation risk management capabilities and use external consultants more frequently. Finally, evolving delivery models, including subscription based consulting platforms, remote expert networks and software as a service tools for litigation strategy, are making specialised consulting more accessible.

The litigation consulting services market is experiencing steady growth as businesses and law firms increasingly seek expert support for complex litigation processes. These services, which include legal strategy, expert witness testimony, financial analysis, and data management, are becoming more essential as disputes grow in complexity and scale. The demand for litigation consulting services is driven by factors such as globalization, regulatory changes, increasing litigation costs, and the growing need for specialized expertise in various industries.

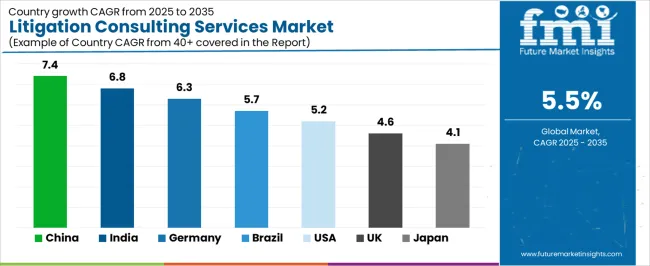

Countries like China and India are seeing strong growth in this market as their economies expand, while developed countries like the USA and Germany continue to drive demand for these services due to their established legal and financial sectors. This analysis explores the factors driving the growth of the litigation consulting services market across different countries.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.4% |

| India | 6.8% |

| Germany | 6.3% |

| Brazil | 5.7% |

| USA | 5.2% |

| United Kingdom | 4.6% |

| Japan | 4.1% |

China leads the litigation consulting services market with a CAGR of 7.4%. As China’s legal and business sectors continue to grow, the demand for specialized litigation consulting services is increasing. With the rise of complex disputes related to intellectual property, commercial contracts, and regulatory matters, businesses in China are seeking expert support to navigate the increasingly complex legal landscape.

China’s rapid economic development and expansion into international markets also contribute to the growing need for litigation consulting services. As companies become more involved in cross-border transactions and face new legal challenges, the demand for litigation consultants who can provide financial analysis, expert testimony, and strategic legal advice is expected to rise. The country’s ongoing commitment to modernizing its legal system and improving regulatory enforcement further drives market growth.

India’s litigation consulting services market is growing at a CAGR of 6.8%. As one of the world’s fastest-growing economies, India is experiencing an increase in business activity, particularly in sectors like technology, manufacturing, and finance. This growth is driving the need for more specialized litigation consulting services as businesses face an increasing number of legal disputes.

India’s legal system, with its evolving corporate governance and growing regulatory complexities, further drives demand for consulting services. The rise of commercial litigation, intellectual property disputes, and financial investigations requires skilled consultants to help organizations navigate the legal processes efficiently. Additionally, the increasing focus on compliance and legal risk management in India’s business sector is also contributing to the steady demand for litigation consulting services.

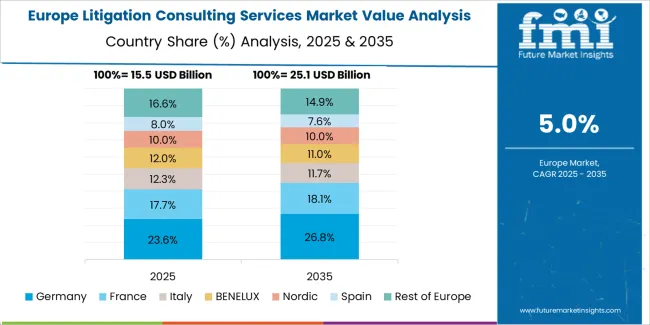

Germany’s litigation consulting services market is projected to grow at a CAGR of 6.3%. Germany, being one of the leading economies in Europe, has a well-established legal system, which is experiencing increased demand for litigation consulting services due to the rise in complex commercial disputes, antitrust matters, and regulatory investigations.

The country’s strong industrial base, combined with its focus on high-quality legal services, is driving the market for litigation consultants. Germany’s legal framework, which emphasizes thorough legal analysis and expert testimony, makes litigation consulting a crucial part of the dispute resolution process. Additionally, the rising demand for cross-border dispute resolution in the European Union and beyond is expected to further fuel the market's growth.

Brazil’s litigation consulting services market is expected to grow at a CAGR of 5.7%. As Brazil’s economy continues to recover and expand, the demand for litigation consulting services is increasing, particularly in sectors such as banking, energy, and construction. With an increasingly complex regulatory environment and a growing number of legal disputes related to commercial contracts and corporate governance, the need for expert advice is rising.

The country’s expanding legal and financial services sectors are also contributing to the demand for specialized litigation consultants. Brazil’s ongoing efforts to strengthen its legal and regulatory frameworks, particularly in areas like competition law and intellectual property, are likely to continue driving the demand for litigation consulting services. As the country modernizes its legal infrastructure, the market for these services will continue to grow steadily.

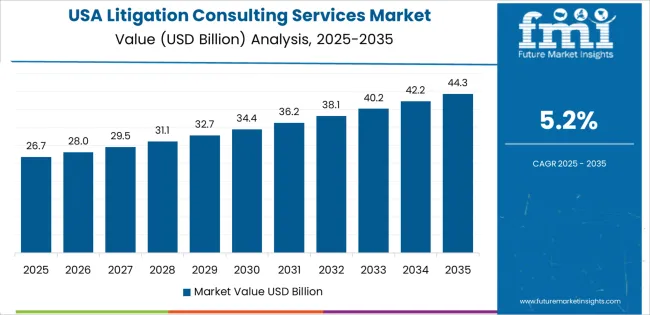

The United States has a projected CAGR of 5.2% for the litigation consulting services market. The USA remains a global leader in the legal services sector, with a strong demand for litigation consulting driven by the complexity and volume of legal disputes across industries such as finance, healthcare, technology, and energy. The increasing number of class-action lawsuits, regulatory investigations, and intellectual property disputes fuels demand for expert legal consultants who can offer financial analysis, expert testimony, and strategic guidance.

The USA market is also supported by the constant evolution of its legal system, which requires businesses to seek expert advice to navigate new laws and regulations. With a large pool of multinational corporations, government entities, and law firms, the litigation consulting services market in the USA is expected to maintain steady growth.

The United Kingdom’s litigation consulting services market is projected to grow at a CAGR of 4.6%. The UK’s well-established legal system, with its strong focus on commercial litigation, financial disputes, and regulatory compliance, drives the demand for litigation consulting services. The increasing complexity of cross-border disputes, along with a rise in arbitration and competition law matters, is further contributing to market growth.

The UK’s financial services sector, which is one of the largest in the world, is a key driver of demand for litigation consultants. As businesses face new regulatory challenges and increasing scrutiny, the need for specialized advice and expert testimony continues to grow. The UK’s legal infrastructure, coupled with its position as a major hub for international business, ensures continued demand for high-quality litigation consulting services.

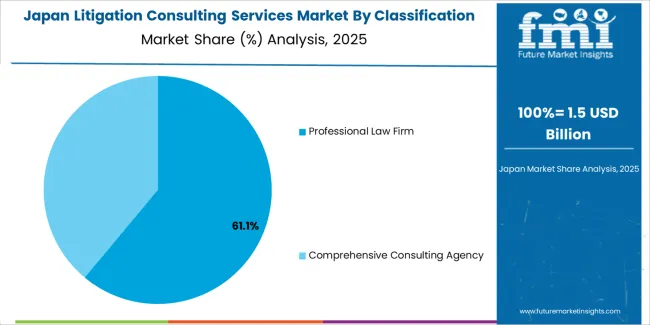

Japan’s litigation consulting services market is expected to grow at a rate of 4.1%. Japan’s well-developed legal system and business environment are contributing to a steady rise in demand for litigation consulting services, particularly in sectors such as automotive, technology, and finance. With an increasing number of complex commercial disputes and the growing importance of regulatory compliance, businesses in Japan are seeking expert advice to navigate the legal landscape.

The country’s focus on intellectual property rights, antitrust law, and corporate governance is further driving the need for litigation consulting services. As Japan’s economy becomes more globalized and its companies expand internationally, the need for litigation consulting services to address cross-border legal issues will continue to grow.

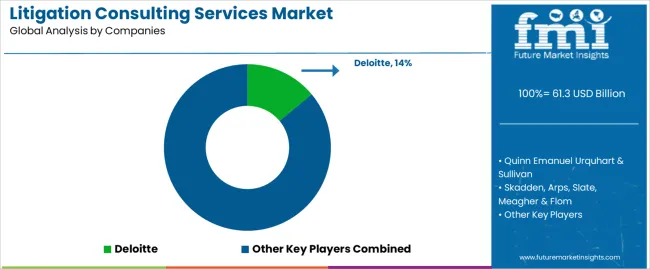

In the litigation consulting services market, firms such as Deloitte (holding about 14% share), Quinn Emanuel Urquhart & Sullivan, Skadden Arps Slate Meagher & Flom, Latham & Watkins, Jones Day, Perkins Coie, White & Case, K&L Gates, Hogan Lovells, Sidley Austin, Kirkland & Ellis, EY, PwC Advisory, KPMG Advisory, FTI Consulting, Alvarez & Marsal, Guidehouse, Control Risks, and NERA Economic Consulting compete across a specialised segment of advisory services that support legal disputes, regulatory investigations and expert testimony. Demand is driven by the complexity of litigation, the growth of regulatory enforcement actions, and the need for forensic, economic, and analytic expertise in high-stakes cases.

Firms in this sector distinguish themselves through a number of strategic approaches. One core strategy is deep technical and subject-matter expertise: consultants build teams of economists, accountants, investigators, and former regulators to deliver credible work in areas such as damages estimation, forensic accounting, data analytics, and expert-witness services. Another strategy emphasises global and multidisciplinary service: large consulting firms leverage international networks and combine dispute-advisory with digital forensics, e-discovery, cybersecurity, and strategy, offering clients a one-stop solution.

A further strategy focuses on value-based positioning and risk-management insight: rather than purely reacting to litigation, consulting firms offer early-stage risk assessment, case-strategy input, and settlement-support modelling. Brochures and client-facing materials typically present case studies of significant engagements, credentials of expert-witness staff, service breadth (for example, antitrust, IP, international arbitration), and technology platforms for data analysis. By aligning offerings with law-firm and corporate-legal-department needs such as quantification of exposure, clarity in testifying, and speed of response, these companies aim to strengthen their leadership in the litigation consulting services market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Classification | Professional Law Firm, Comprehensive Consulting Agency |

| Application | Enterprise, Individual |

| Key Companies Profiled | Deloitte, Quinn Emanuel Urquhart & Sullivan, Skadden, Arps, Slate, Meagher & Flom, Latham & Watkins, Jones Day, Perkins Coie, White & Case, K&L Gates, Hogan Lovells, Sidley Austin, Kirkland & Ellis, EY, PwC Advisory, KPMG Advisory, FTI Consulting, Alvarez & Marsal, Guidehouse, Control Risks, Nera Economic Consulting |

| Additional Attributes | The market analysis includes dollar sales by classification and application categories. It also covers regional adoption trends across major markets. The competitive landscape focuses on key players in litigation consulting services, with a focus on both professional law firms and comprehensive consulting agencies. Trends in the growing demand for litigation consulting in the enterprise and individual sectors are explored, along with advancements in data analytics, economic consulting, and strategic advisory in legal disputes. |

The global litigation consulting services market is estimated to be valued at USD 61.3 billion in 2025.

The market size for the litigation consulting services market is projected to reach USD 104.7 billion by 2035.

The litigation consulting services market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in litigation consulting services market are professional law firm and comprehensive consulting agency.

In terms of application, enterprise segment to command 55.0% share in the litigation consulting services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Litigation Funding Investment Market – Trends & Forecast 2025 to 2035

AI Consulting Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

HR Tech Consulting Market - Forecast through 2034

Network Consulting Services Market

Wind Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Renewables Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Information Security Consulting Market

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Oracle Services Market Analysis – Trends & Forecast 2024-2034

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

AR Tour Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tableau Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA