The global finance and risk management consulting services market is valued at USD 27.1 billion in 2025 and is projected to reach USD 50.9 billion by 2035, reflecting a CAGR of 6.5%. Half-decade weighted growth analysis shows stronger momentum in the first five-year block (2025–2030), where demand rises steadily as firms respond to evolving capital requirements, tightening audit expectations, and broader adoption of integrated risk frameworks. This period carries the highest weight in overall expansion because organizations actively adjust to updated financial reporting standards, stress-testing protocols, and risk governance structures. Consulting activity is further reinforced by increased adoption of digital finance tools, which require guided implementation and risk controls.

In the second half-decade (2030–2035), weighted growth moderates but remains solid as consulting needs shift from initial framework deployment to refinement, scenario modeling, and continuous monitoring. Institutions focus more on enhancing operational resilience, improving real-time risk intelligence, and aligning governance structures across international branches, giving this period a stable but lower weighted contribution. As regulatory updates become incremental rather than sweeping, the market’s expansion leans on periodic reassessment cycles and targeted optimization efforts. Combined weighting across the two blocks indicates a durable growth profile, with early-cycle regulatory adjustment driving the strongest lift and late-cycle refinement sustaining the upward trajectory through 2035.

From 2025 to 2030, the Finance and Risk Management Consulting Services Market grows from USD 27.1 billion to USD 37.1 billion, adding USD 10.0 billion in five years. This phase reflects strong enterprise demand for advisory support in credit-risk modeling, stress testing, capital adequacy assessments, and operational-risk framework upgrades. Annual increases range from USD 1.8 billion to USD 2.2 billion as financial institutions respond to evolving regulatory expectations and modernization of risk analytics. Digital transformation drives additional growth, with firms increasing investment in model validation, scenario-based forecasting, and governance program restructuring across global operations.

Between 2030 and 2035, the market expands from USD 37.1 billion to USD 50.9 billion, generating USD 13.8 billion in added value, outpacing the earlier period. Annual increases accelerate to the USD 2.7–3.0 billion range as organizations intensify adoption of real-time risk scoring, integrated finance–risk platforms, and predictive compliance technologies. Large banks and insurers lead demand through multi-year modernization programs involving climate-risk analytics, digital asset oversight, and automated reporting architectures. By 2035, total decade growth reaches USD 23.8 billion, reflecting a steady shift toward high-complexity, data-driven risk consulting engagements across global financial markets.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 27.1 billion |

| Market Forecast Value (2035) | USD 50.9 billion |

| Forecast CAGR (2025–2035) | 6.5% |

Demand for finance and risk management consulting services is rising as organizations navigate volatile markets, complex reporting standards, and heightened regulatory expectations. Companies rely on consultants to strengthen capital planning, liquidity oversight, and financial forecasting models that must remain resilient under stress scenarios. Firms exposed to interest-rate fluctuations, supply-chain instability, or currency risk seek advisory support to refine hedging strategies and evaluate downside exposures with data-driven frameworks. Consultants enhance capabilities in IFRS, GAAP, and statutory-reporting alignment, helping clients improve audit readiness and internal-control documentation. As digital finance platforms expand, organizations also require expert guidance on integrating analytics tools, upgrading treasury operations, and validating financial models used for strategic planning. These factors support consistent adoption across global corporate, financial, and public-sector institutions.

Market expansion is further supported by increased attention to enterprise-wide risk management, cybersecurity resilience, and operational-risk controls. Consultants develop structured governance models that define risk ownership, strengthen board oversight, and ensure compliance with regional financial-sector regulations. Companies undergoing mergers, restructurings, or geographic expansion rely on advisory teams to harmonize risk policies, evaluate integration risks, and coordinate regulatory submissions across multiple jurisdictions. Providers invest in scenario-analysis platforms, data-quality assessment tools, and industry-specific benchmarking to support precision in client decision-making. Although consulting budgets remain sensitive to economic cycles, rising scrutiny from regulators, investors, and rating agencies reinforces the need for specialized risk-governance expertise. These dynamics ensure steady demand for finance and risk management consulting services across global markets.

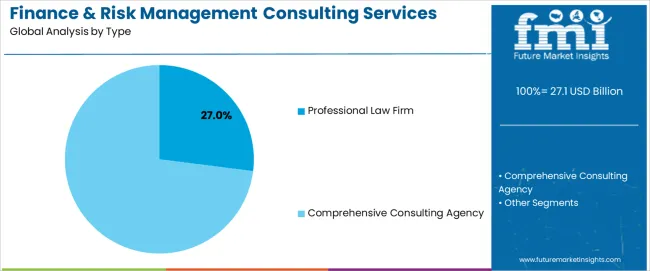

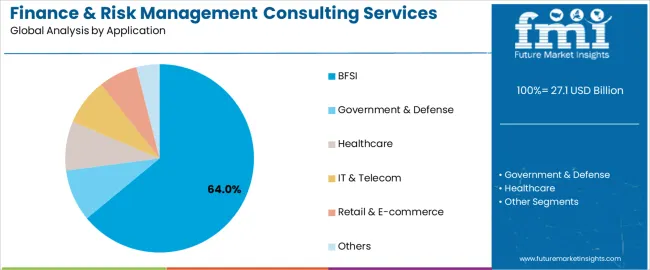

The finance and risk management consulting services market is segmented by type, application, and region. By type, the market is divided into professional law firms and comprehensive consulting agencies. Based on application, it is categorized into BFSI, government and defense, healthcare, IT and telecom, retail and e-commerce, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differences in regulatory demands, enterprise risk structures, and organizational advisory requirements.

The professional law firm segment accounts for approximately 27.0% of the finance and risk management consulting services market in 2025, making it the leading type category. Its position reflects steady demand for advisory support rooted in statutory interpretation, regulatory compliance, and legal risk assessment. Financial institutions and public bodies frequently rely on law firms to clarify obligations under sector-specific legislation, review internal documentation structures, and prepare responses to audits or supervisory examinations. These services require specialized legal expertise that cannot be standardized through broader management-consulting workflows.

Law firms supply targeted work covering disclosure requirements, enforcement-readiness assessments, and contract-risk evaluations that allow clients to align internal processes with applicable regulations. Adoption is strong in North America and Europe, where oversight frameworks are detailed and organizations face recurring documentation updates. The segment also benefits from cross-border transactions that demand jurisdiction-specific guidance. Firms invest in analytical tools supporting document review, but delivery remains led by legal specialists providing structured interpretation. The professional law firm category maintains its lead because many financial and public organizations must address legal dimensions of risk exposure, compliance obligations, and governance processes that require expert evaluation rather than general advisory practices.

The BFSI segment represents about 64.0% of the total finance and risk management consulting services market in 2025, making it the dominant application category. This position reflects the sector’s complex regulatory environment and its reliance on structured risk frameworks covering capital adequacy, liquidity, credit exposure, operational resilience, and customer-protection standards. Banks and insurance companies rely on consulting support to assess risk-control processes, review governance structures, and adapt to revisions in prudential rules and reporting requirements.

Consultants develop standardized assessment methods, review policy inventories, and assist in preparing internal documents required for supervisory reviews. The segment sees strong adoption in North America and Europe, where institutions operate under detailed oversight regimes, and in East Asia, where expanding financial networks integrate updated governance practices. Consulting providers offer expertise in risk modeling, incident reporting, compliance testing, and policy alignment across multiple business units. BFSI retains its lead because its operations require continuous evaluation of risk positions, controlled documentation cycles, and advisory input tailored to regulatory developments that directly affect system stability and institutional performance.

The online sweepstakes platform market is expanding as brands, retailers and digital publishers use sweepstakes to increase user engagement, grow subscriber lists and drive promotional traffic. Platforms support prize management, entry validation, fraud control and multi-channel campaign delivery across web and mobile. Growth is supported by rising digital marketing activity, broader smartphone adoption and increased use of gamified engagement tools. Adoption is limited by regulatory variations across regions, data-privacy requirements and concerns about fraudulent or low-quality traffic. Providers are refining compliance workflows, automated verification tools and scalable campaign-management features to support diverse promotional strategies.

Demand grows as companies seek fast, cost-efficient ways to engage audiences and acquire new leads. Sweepstakes deliver measurable participation data and can be integrated with email signups, app installs or social-media engagement. Businesses in ecommerce, entertainment, travel and consumer goods use campaigns to build awareness and encourage repeat interactions. As marketing teams shift toward personalized, interactive customer journeys, sweepstakes platforms become attractive tools that offer flexible formats and real-time performance tracking suitable for short-term promotions or ongoing loyalty programs.

Adoption is limited by regulatory complexity, as sweepstakes rules differ by region and require strict adherence to disclosure, eligibility and prize-handling requirements. Data-privacy laws add further compliance obligations for participant information. Fraudulent entries, automated bots or manipulation attempts require robust detection systems, raising operational cost. Some organizations avoid sweepstakes due to concerns about lead-quality variability or reputational risks linked to poorly executed promotions. Limited in-house expertise also discourages adoption among smaller businesses unfamiliar with legal or technical aspects of running compliant campaigns.

Key trends include deeper integration with CRM and marketing-automation systems, real-time fraud detection using analytics, and adoption of interactive formats such as instant-win games and digital scratch cards. Platforms increasingly offer customizable templates, mobile-optimized entry flows and multilingual campaign support for global audiences. Interest is rising in prize-fulfillment outsourcing and automated tax-reporting features. As regulations tighten, providers emphasize transparent auditing tools and geo-targeted compliance controls. With digital engagement becoming more competitive, sweepstakes platforms continue shifting toward greater security, smoother user experience and data-driven campaign optimization.

| Country | CAGR (%) |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| USA | 6.2% |

| UK | 5.5% |

| Japan | 4.9% |

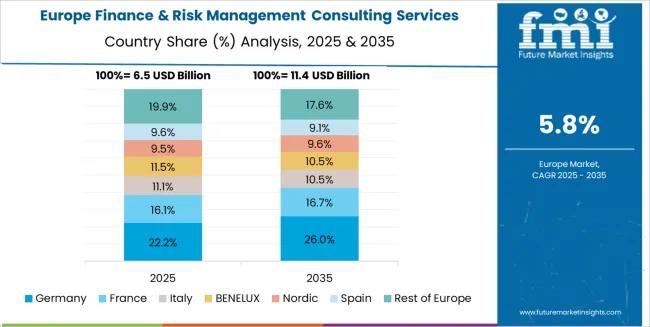

The Finance & Risk Management Consulting Services Market is expanding steadily across global economies, with China leading at an 8.8% CAGR through 2035, driven by rapid financial sector digitalization, strengthening regulatory requirements, and increased adoption of strategic risk management frameworks. India follows at 8.1%, supported by growing corporate governance reforms, fintech expansion, and rising demand for advisory services in compliance, analytics, and enterprise risk planning. Germany records 7.5%, reflecting strong regulatory rigor, high adoption of advanced risk modeling tools, and the prominence of risk analytics in banking and manufacturing sectors. Brazil grows at 6.8%, benefiting from financial modernization and evolving risk governance standards. The USA, at 6.2%, remains a mature market focused on integrated risk platforms and AI-enhanced consulting services, while the UK (5.5%) and Japan (4.9%) emphasize strategic oversight, digital governance solutions, and enterprise-wide risk resilience enhancement.

China is projected to grow at a CAGR of 8.8% through 2035 in the finance and risk management consulting services market. Expanding corporate balance sheets, rapid enterprise digitization, and growing capital markets increase demand for advisory on capital allocation and liquidity planning. Consulting firms are supplying stress testing, scenario analysis, and integrated risk dashboards to support board level decision making. Banks and large corporates request model validation, regulatory reporting assistance, and enterprise risk frameworks aligned with market conditions and supervisory expectations. Service providers expand regional delivery capability and standardise risk reporting to help firms improve transparency and decision quality.

India is projected to grow at a CAGR of 8.1% through 2035 in the finance and risk management consulting services market. Rising formal credit penetration, fintech expansion, and growing corporate investment needs increase advisory demand for credit risk assessment and portfolio analytics. Consulting firms provide credit model development, stress scenario design, and risk adjusted performance metrics for lenders and corporate treasuries. Enterprises seek cash flow modelling, hedging guidance, and capital planning support to manage funding costs and operational volatility. Providers scale analyst teams and deploy standardised toolkits to meet expanding client workloads across urban regions.

Germany is projected to grow at a CAGR of 7.5% through 2035 in the finance and risk management consulting services market. Export oriented industries and complex supply chains increase advisory demand for trade finance, liquidity management, and counterparty risk controls. Consulting firms deliver structured risk quantification, scenario mapping, and capital stress assessment for corporate treasuries and financial institutions. Banks request model governance improvements, regulatory capital optimisation, and documented validation of internal measurement systems. Providers align services with engineering standards and local regulatory expectations to support reliable reporting and operational continuity.

Brazil is projected to grow at a CAGR of 6.8% through 2035 in the finance and risk management consulting services market. Currency volatility, expanding corporate credit, and infrastructure investment create advisory needs for hedging, liquidity buffers, and credit monitoring. Consulting firms deliver macro scenario analysis, cash flow forecasting, and portfolio stress testing for corporates and banks. Institutions require provisioning model reviews, portfolio-level risk assessment, and compliance support for supervisory reporting. Services focus on local market conditions and operational resilience to support long term planning under variable macroeconomic cycles.

USA is projected to grow at a CAGR of 6.2% through 2035 in the finance and risk management consulting services market. Complex capital markets, large institutional investors, and fintech innovation increase demand for advanced analytics and model validation services. Consultants provide portfolio stress testing, liquidity scenario planning, and counterparty risk analysis for sophisticated financial operations. Corporates engage advisors for capital allocation frameworks, enterprise risk dashboards, and regulatory readiness across multiple jurisdictions. Firms expand quantitative teams and deploy cloud toolchains to accelerate model delivery and governance.

UK is projected to grow at a CAGR of 5.5% through 2035 in the finance and risk management consulting services market. Financial centres and corporate groups require guidance on prudential frameworks, conduct risk, and capital optimisation. Consulting firms offer model governance, recovery planning, and stress test orchestration aligned with local regulatory practice. Asset managers and banks request enhanced measurement of market, credit, and operational risks to support decision making. Providers combine advisory and implementation capability to improve control environments and reporting accuracy across institutions.

Japan is projected to grow at a CAGR of 4.9% through 2035 in the finance and risk management consulting services market. Demographic shifts, corporate restructuring, and regional trade exposure increase demand for balance sheet resilience and credit assessment expertise. Consulting firms provide scenario modelling, liquidity planning, and counterparty exposure analysis tailored to domestic corporate structures. Banks request model validation services, provisioning frameworks, and compliance reporting support for evolving supervisory requirements. Service providers focus on rigorous documentation and process controls to sustain reliable risk management across varied business units.

The global finance and risk management consulting services market shows moderate concentration, led by firms advising banks, insurers, and corporations on capital efficiency, regulatory alignment, and enterprise-wide risk frameworks. McKinsey, BCG, and Bain support board-level and executive initiatives that integrate financial strategy with risk governance, balance-sheet planning, and stress-scenario preparation. Deloitte Consulting, PwC, EY, and KPMG hold strong positions through audit-linked technical depth, covering credit-risk modeling, regulatory reporting, liquidity assessments, and operational-risk controls. Roland Berger, Kearney, and Accenture strengthen mid-to-upper tier competitiveness with programs focused on process redesign, digital risk architecture, and transformation support for large financial institutions.

Oliver Wyman and Booz & Company provide specialized financial-sector expertise in market-risk analytics, capital modeling, and supervisory engagement. Capgemini Invent and IBM Consulting expand the technology and data-management dimension with tool-based solutions for regulatory data, workflow automation, and model-risk governance. Moody’s Analytics reinforces the ecosystem through quantitative platforms and advisory services that support credit assessment, scenario modeling, and regulatory compliance. Competition across this market is influenced by analytical accuracy, regulatory insight, and the ability to implement large-scale risk systems. Strategic differentiation depends on cross-jurisdictional expertise, digital-risk tools, and long-term advisory structures that help institutions strengthen resilience and adapt to shifting financial and regulatory conditions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Professional Law Firm, Comprehensive Consulting Agency |

| Application | BFSI, Government & Defense, Healthcare, IT & Telecom, Retail & E-commerce, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | McKinsey, BCG, Bain & Company, Deloitte Consulting, PwC, EY, KPMG, Roland Berger, Kearney, Accenture, Oliver Wyman, Booz & Company, Capgemini Invent, IBM Consulting, Moody’s Analytics |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across North America, Europe, and East Asia, competitive landscape of consulting firms, regulatory drivers and governance frameworks, integration with compliance software and automated reporting tools |

The global finance and risk management consulting services market is estimated to be valued at USD 27.1 billion in 2025.

The market size for the finance and risk management consulting services market is projected to reach USD 50.9 billion by 2035.

The finance and risk management consulting services market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in finance and risk management consulting services market are professional law firm and comprehensive consulting agency.

In terms of application, bfsi segment to command 64.0% share in the finance and risk management consulting services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Finance Cloud Market Size and Share Forecast Outlook 2025 to 2035

Embedded Finance Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Finance Market Trends - Growth & Forecast 2025 to 2035

Decentralized Finance Technology Market Trends - Growth & Forecast 2025 to 2035

Europe Embedded Finance Market – Trends & Forecast 2025 to 2035

Electric Vehicle Finance Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Finance Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA