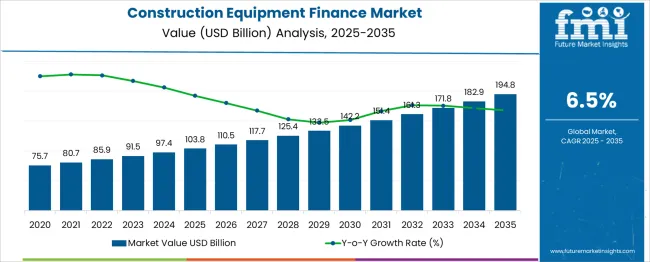

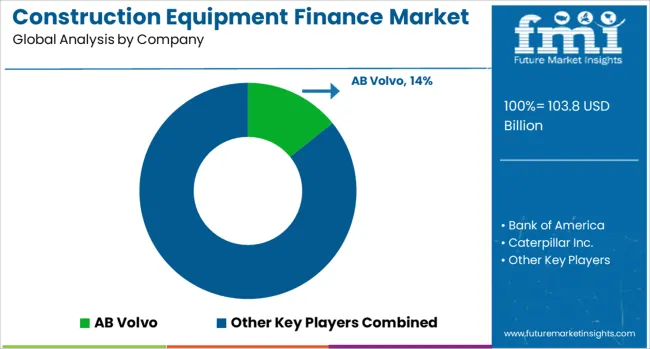

The Construction Equipment Finance Market is estimated to be valued at USD 103.8 billion in 2025 and is projected to reach USD 194.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Construction Equipment Finance Market Estimated Value in (2025 E) | USD 103.8 billion |

| Construction Equipment Finance Market Forecast Value in (2035 F) | USD 194.8 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

With governments and private sectors investing heavily in transportation, housing, and industrial projects, demand for flexible and scalable financial solutions is accelerating. Equipment financing offers businesses capital efficiency, tax benefits, and access to modern machinery without heavy upfront investments. Financial institutions are also expanding their portfolios to include tailored loan and lease products that align with project timelines and cash flows.

As digitization and automation penetrate the construction sector, advanced equipment with higher price tags further necessitates financing options. The future outlook remains positive, with leasing and loans expected to grow as integral components of project financing strategies, especially in emerging economies undergoing large-scale infrastructure expansions.

The construction equipment finance market is segmented by financing type, equipment, and industry vertical and geographic regions. The financing type of the construction equipment finance market is divided into Loans, Leases, and mortgages. The construction equipment finance market is classified into Earthmoving & roadbuilding equipment, Material handling and cranes, and Concrete equipment. The construction equipment finance market is segmented by industry vertical into Construction, Mining, Government & public, Rental, and Others. Regionally, the construction equipment finance industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

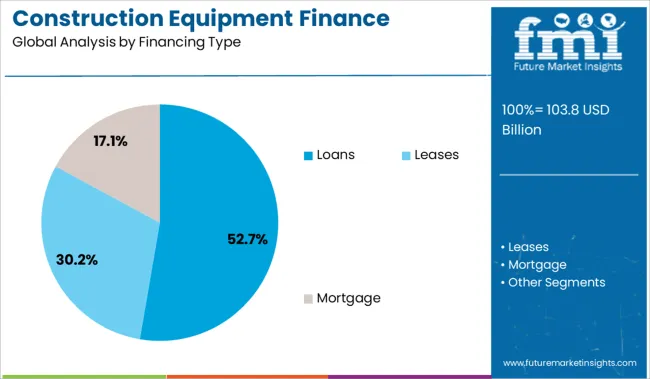

The loans segment leads the financing type category with a 52.7% market share, driven by its widespread acceptance among contractors and businesses seeking long-term ownership of equipment. Loans offer greater flexibility, asset control, and favorable interest rates, making them a preferred choice for established firms with predictable project pipelines.

Financial institutions and OEMs increasingly offer structured loan options, often bundled with insurance and maintenance packages, enhancing their attractiveness. The segment benefits from growing capital expenditure in construction and infrastructure projects, where firms opt for loan financing to align with asset lifecycle planning.

Additionally, government-backed loan schemes and subsidized interest rates in several regions support wider adoption among small and mid-sized enterprises. With rising awareness and improved access to credit, the loans segment is expected to maintain its leading position in the coming years.

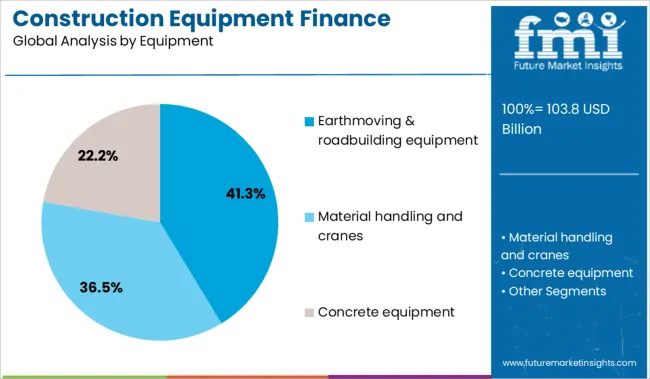

Earthmoving and roadbuilding equipment dominates the equipment category with a 41.3% share, reflecting its fundamental role in nearly all stages of construction, from land development to infrastructure build-out. This segment includes essential machinery such as excavators, bulldozers, loaders, and pavers, which are indispensable across civil and commercial construction sites.

The high capital cost associated with this equipment category drives demand for financing, enabling businesses to manage cash flow while maintaining operational capacity. The segment is supported by ongoing road and highway development programs, smart city initiatives, and industrial zone expansions.

Financing options have evolved to accommodate varied usage intensity and project durations, offering structured terms that fit diverse client needs. As construction projects become more mechanized and time-sensitive, the demand for financing earthmoving and roadbuilding equipment is anticipated to grow consistently.

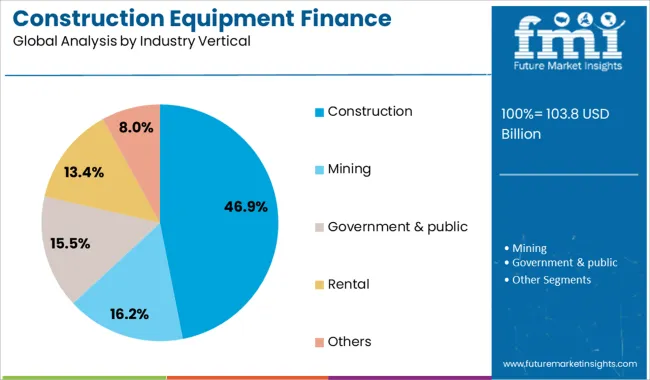

The construction vertical holds a commanding 46.9% share in the industry vertical category, underpinned by strong global investment in commercial, residential, and infrastructure projects. This segment is the primary consumer of financed construction equipment due to the sector’s capital-intensive nature and cyclical cash flows, which often require flexible funding solutions.

Construction companies rely on financing to maintain modern, compliant, and efficient machinery fleets without compromising liquidity. The growth of urban housing, smart infrastructure, and large-scale civil engineering works contributes significantly to the sustained demand for equipment finance in this vertical.

Moreover, financing partners are increasingly offering value-added services such as equipment tracking, fleet management, and upgrade options to meet the evolving needs of construction firms. As public and private construction activity continues to rise globally, the construction vertical is expected to remain the dominant force driving the expansion of the construction equipment finance market.

Construction equipment finance is being leveraged to support growing demand for machinery such as excavators, loaders and cranes without requiring full capital outlay. Flexible financing structures, leasing programs and pay-per-use models are being offered to contractors, rental companies and infrastructure developers. Demand has been observed from both established firms and emerging builders seeking access to modern, emission-compliant machinery. Financial products are being tailored with maintenance packages, warranty extensions and risk sharing clauses to optimize asset uptime and protect lenders.

Flexible finance options have been adopted by businesses seeking predictable cash flow and access to newer equipment generations. Leasing contracts with customised payment schedules have enabled contractors to match machinery costs with project billing cycles. Pay-per-use models have been introduced to allow occasional use of specialised machines, reducing total cost of ownership. Manufacturers and finance providers have collaborated to include maintenance and warranty services within financing terms, mitigating downtime risk and reducing asset lifecycle costs. Credit scoring based on project history and rental revenue has broadened financing access for mid-sized operators. Financing packages incorporating residual value guarantees have provided protection against equipment depreciation for both lessor and lessee.

Equipment finance expansion has been constrained by strict credit policies and collateral requirements exposed to asset depreciation and resale uncertainty. Financial providers have faced elevated default risk during economic downturns, limiting term lengths and increasing interest rates. Regulations governing lease versus loan classification have required tax and accounting adjustments affecting both lenders and borrowers. Asset tracking and inspection protocols have added administrative burden to financing operations. Inconsistent valuation standards for used equipment have led to disputes over residual value assessments. Smaller contractors have been restricted from accessing customised financing due to limited credit history and high down payment requirements.

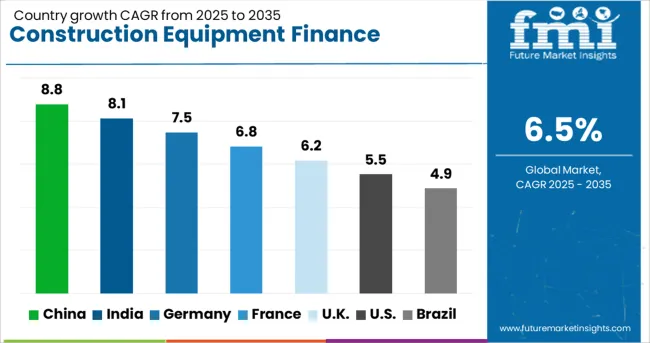

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global construction equipment finance market is expected to grow at a 6.5% CAGR from 2025 to 2035. Of the 40 countries analyzed, China leads at 8.8%, followed by India at 8.1% and Germany at 7.5%, while France posts 6.8% and the United Kingdom records 6.2%. Growth premiums stand at +35% for China, +24% for India, and +15% for Germany, while France and the UK perform near the global average. Drivers include increased leasing adoption for high-value machinery in China, public infrastructure financing programs in India, structured credit solutions in Germany, and modernization of financing models across France and the UK. The report includes analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at an 8.8% CAGR, supported by large-scale infrastructure projects and redevelopment programs. Leasing and hire-purchase agreements remain dominant as contractors seek financing for high-value machinery. Financial institutions are introducing flexible credit terms and reduced down payment schemes to improve accessibility for small and medium enterprises. The adoption of digital financing platforms allows real-time loan approvals and automated verification processes, accelerating disbursements. OEM-backed financing divisions are bundling equipment loans with maintenance contracts and extended warranties to ensure customer retention. Expanding investment in mega projects, combined with government support for construction modernization, strengthens China’s position as a leading market for advanced financing solutions.

India is expected to grow at an 8.1% CAGR, fueled by highway construction, metro expansion, and renewable energy projects under government-led initiatives. Banks and NBFCs are offering specialized credit lines for contractors to meet infrastructure targets. Equipment rental firms are adopting structured leasing models to scale operations and expand fleets. Programs such as the National Infrastructure Pipeline (NIP) and Production Linked Incentive (PLI) schemes provide strong momentum to equipment financing demand. Digital lending ecosystems enable quick approvals and credit assessment for smaller contractors, bridging financial gaps. Strong investment inflows and technology-enabled financing channels position India as a key growth hub in Asia.

Germany is projected to grow at a 7.5% CAGR, driven by advanced financial solutions and technology integration for high-value construction equipment. Lenders are leveraging AI-based credit analytics to manage risk and reduce defaults, ensuring operational transparency. OEM financing arms are introducing subscription-based models, allowing contractors to upgrade equipment without significant upfront investment. Green financing programs are gaining traction, promoting low-emission and electric construction machines. Asset tracking technology embedded in financed equipment enhances lender confidence through real-time usage monitoring and recovery capabilities. These developments position Germany as a leader in structured and sustainable finance for construction machinery, with strong adoption by large contractors and infrastructure firms.

France is forecast to grow at a 6.8% CAGR, supported by increased equipment leasing for large-scale infrastructure and transport modernization projects. Finance providers are introducing bundled packages that include predictive maintenance, insurance, and telematics for operational efficiency. Government incentives for green construction equipment are encouraging lenders to create low-interest financing programs for environmentally friendly machinery. Digital lending platforms enhance approval speed and reduce administrative delays, supporting mid-sized contractors with limited financial resources. The integration of ESG compliance standards into financing models is shaping credit policies for large infrastructure developments. Growing demand for innovative and sustainable finance solutions reinforces France’s position as a dynamic market in Europe.

The United Kingdom is projected to grow at a 6.2% CAGR, driven by strong financing demand for modernization of residential, commercial, and transportation infrastructure. Equipment-as-a-service models are gaining popularity, allowing contractors to avoid large upfront costs while ensuring operational flexibility. OEM partnerships with financial institutions introduce zero-interest and low-EMI financing options for compact and mid-sized equipment. Lenders are implementing telematics-backed financing solutions, enabling performance monitoring and improving compliance with loan agreements. Financing for eco-friendly machinery is also expanding in response to strict emission norms and regulatory mandates. Continued investment in smart financing platforms positions the UK as a key European hub for innovative construction equipment finance solutions.

The construction equipment finance market is dominated by OEM-linked financing divisions of major manufacturers such as Caterpillar, AB Volvo, Deere & Company, Komatsu, and CNH Industrial, offering leasing and installment plans to support equipment sales. Global financial institutions including Bank of America, JPMorgan Chase, and Wells Fargo strengthen market depth through equipment loans and rental financing programs.

Competition focuses on interest rates, loan tenure flexibility, and integration of digital credit platforms for faster approvals. Partnerships between lenders and rental firms are expanding to address growing demand for heavy machinery in infrastructure projects. Leading players are investing in telematics-backed financing models and subscription-based payment schemes to enhance customer convenience and improve credit risk management.

| Item | Value |

|---|---|

| Quantitative Units | USD 103.8 Billion |

| Financing Type | Loans, Leases, and Mortgage |

| Equipment | Earthmoving & roadbuilding equipment, Material handling and cranes, and Concrete equipment |

| Industry Vertical | Construction, Mining, Government & public, Rental, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AB Volvo, Bank of America, Caterpillar Inc., CNH Industrial, Deere & Company, GE Capital, John Deere, JP Morgan Chase, Komatsu, and Well Fargo |

| Additional Attributes | Dollar sales by financing model (lease, loan, rental) and project size (small, medium, large), with lease financing dominating for its cost benefits and flexibility. Demand is driven by large-scale infrastructure development and need for tailored funding options. Regional trends are led by Asia-Pacific, while OEM finance divisions focus on customized packages, digital lending ecosystems, and bundled maintenance services. |

The global construction equipment finance market is estimated to be valued at USD 103.8 billion in 2025.

The market size for the construction equipment finance market is projected to reach USD 194.8 billion by 2035.

The construction equipment finance market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in construction equipment finance market are loans, leases and mortgage.

In terms of equipment, earthmoving & roadbuilding equipment segment to command 41.3% share in the construction equipment finance market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Attachments Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Maintenance & Repair Market Growth - Trends & Forecast 2025 to 2035

Smart Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Compact Construction Equipment

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Compact Construction Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Compact Construction Equipment Market Analysis – Size, Share & Forecast 2025–2035

Latin America Construction Equipment Market Growth - Trends & Forecast 2025 to 2035

Germany Compact Construction Equipment Market Outlook – Share, Growth & Forecast 2025–2035

Gulf Countries Compact Construction Equipment Market Report – Trends, Demand & Industry Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

Finance and Risk Management Consulting Services Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Finance Cloud Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA