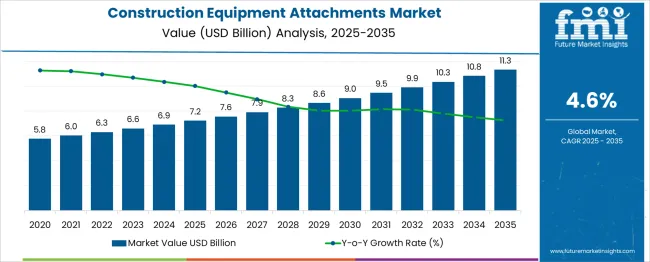

The Construction Equipment Attachments Market is estimated to be valued at USD 7.2 billion in 2025 and is projected to reach USD 11.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| Construction Equipment Attachments Market Estimated Value in (2025 E) | USD 7.2 billion |

| Construction Equipment Attachments Market Forecast Value in (2035 F) | USD 11.3 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The construction equipment attachments market is gaining traction due to increasing infrastructure development, urbanization, and a rising preference for equipment customization to improve operational efficiency. Attachments are increasingly seen as critical value additions, enabling machinery to perform multiple functions and reducing the need for separate heavy equipment.

This adaptability has significantly reduced ownership and operational costs, making attachments a cost-effective solution for contractors. The market outlook remains strong, driven by the expansion of smart city projects, government investments in public infrastructure, and a growing emphasis on productivity enhancement across both developed and developing regions.

As equipment lifecycle management gains importance, the demand for versatile, durable, and high-performance attachments is expected to rise. Continuous technological advancements, including quick-attach systems and hydraulics, further reinforce market growth by reducing downtime and enabling seamless integration with various base machines.

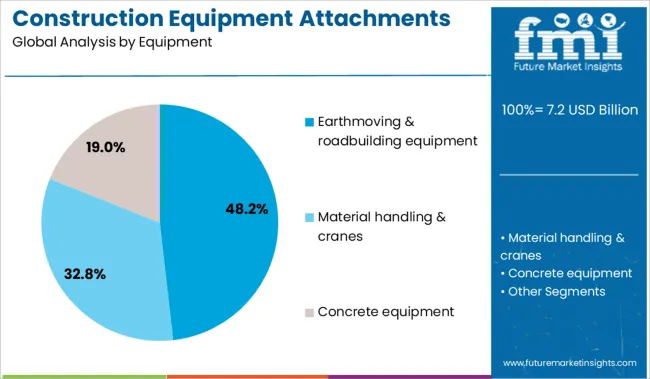

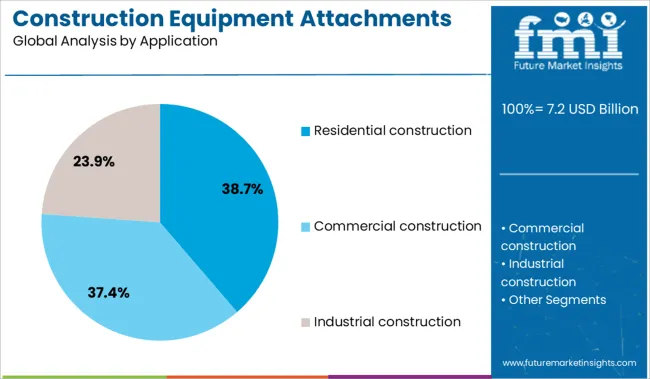

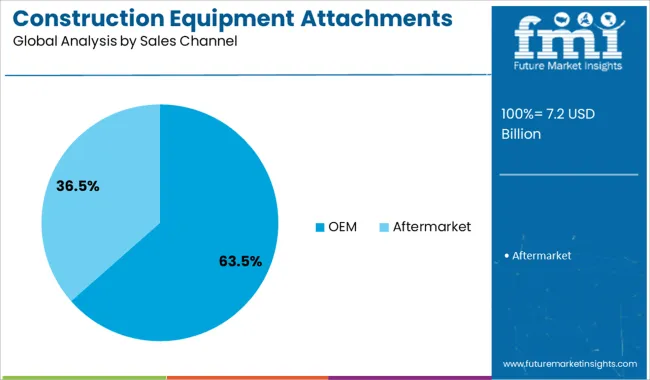

The construction equipment attachments market is segmented by equipment, application, sales channel, and end-user and geographic regions. The construction equipment attachments market is divided into Earthmoving & roadbuilding equipment, Material handling & cranes, and Concrete equipment. In terms of application, the construction equipment attachments market is classified into Residential construction, Commercial construction, and Industrial construction. Based on the sales channel, the construction equipment attachments market is segmented into OEM and Aftermarket. The end-user of the construction equipment attachments market is segmented into Contractors, Rental companies, and Mining companies. Regionally, the construction equipment attachments industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The earthmoving and roadbuilding equipment segment leads the equipment category with a 48.2% market share, owing to its wide applicability in excavation, grading, and site preparation tasks. This segment benefits from strong global demand for earthmoving activities in both urban and rural construction projects, including highways, railways, and large-scale infrastructure.

Attachments such as buckets, rippers, and blades are essential to maximize the productivity and versatility of bulldozers, loaders, and excavators. OEMs and aftermarket suppliers have increasingly focused on developing high-strength, wear-resistant attachments that can withstand heavy-duty use under varying terrains.

The ability to rapidly switch between different attachments has added significant value to this segment, reducing machine idle time and enabling operators to handle diverse job site demands. With the acceleration of road construction and mining activities in emerging economies, the segment is expected to maintain its growth momentum supported by rising equipment rental trends and attachment leasing models.

The residential construction segment accounts for 38.7% of the market by application, driven by rapid urban development, population growth, and increased investments in housing infrastructure. Demand for compact, maneuverable construction equipment with adaptable attachments is rising in residential settings due to space constraints and the need for multifunctional performance.

Attachments for trenching, grading, digging, and material handling play a vital role in reducing labor dependency and improving site efficiency. Contractors and builders are increasingly opting for equipment solutions that offer versatility across various stages of residential construction-from site clearing and foundation work to finishing tasks.

As governments implement housing schemes and real estate developers expand affordable housing projects, the segment continues to witness consistent growth. Innovation in lightweight, noise-reduced, and environmentally sustainable attachments also contributes to greater adoption in densely populated areas where construction regulations are strict.

The OEM sales channel dominates the market with a 63.5% share, reflecting strong customer reliance on manufacturer-supplied attachments for performance consistency and warranty assurance. OEMs offer integrated solutions that ensure compatibility between base equipment and attachments, minimizing operational risks and reducing installation complexities.

This segment has gained momentum as end users prioritize equipment packages that include factory-fitted or certified attachments to optimize machine efficiency and lifecycle value. Leading OEMs have expanded their product lines with specialized attachments tailored for regional requirements and specific applications, reinforcing brand loyalty.

Additionally, advancements in telematics and equipment monitoring are enhancing OEM value propositions by enabling predictive maintenance and usage tracking for both machines and attachments. As large contractors and construction firms seek dependable, single-source procurement options, the OEM channel is expected to maintain its leadership position, supported by after-sales services and strategic partnerships.

Construction equipment attachments are being integrated to improve jobsite productivity and expand machine versatility across diverse applications. In 2024, earthmoving and material handling tasks advanced through the use of high-performance hydraulic tools and quick-coupler systems. In 2025, contractors emphasized attachment compatibility over complete fleet replacement to lower operating costs and reduce downtime. Growth opportunities exist in intelligent attachments featuring integrated sensors and telematics for real-time monitoring. Manufacturers delivering interoperable, data-enabled tools with predictive maintenance capabilities are positioned to gain traction in connected construction environments.

The requirement for reduced machine idle time and higher equipment utilization has been identified as a key driver for attachment market growth. In 2024, contractors increasingly relied on quick-coupler systems to switch between buckets, breakers, and grapples without needing extra machines on site. In 2025, rental firms were found to stock universal attachments compatible across multiple carrier brands, enabling clients to maximize asset usage. These shifts show that efficiency gains and operational flexibility-rather than attachment cost alone-are shaping procurement trends. Manufacturers delivering high-performance, quick-swap tools are therefore being positioned to lead in fleet-optimized construction environments.

In 2024, trials commenced on attachments fitted with built-in sensors to monitor usage, pressure, and wear in real-time. In 2025, fleets were observed integrating smart attachments into telematics platforms to trigger maintenance alerts and optimize work cycles. These implementations demonstrate that attachments can transition from expendable tools to data-generating assets. Attaching sensor-rich, IoT-ready attachments that seamlessly integrate with fleet management systems will position suppliers as central players in next-gen, performance-driven construction equipment ecosystems.

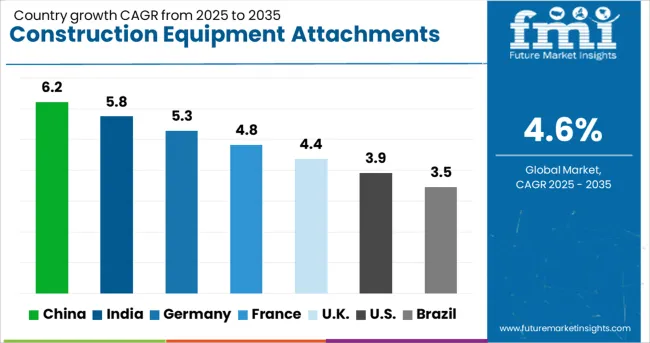

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The global construction equipment attachments market is projected to grow at a CAGR of 4.6% from 2025 to 2035. China leads with 6.2%, followed by India at 5.8% and Germany at 5.3%. France records 4.8%, while the United Kingdom posts 4.4%. Infrastructure projects, demand for machine versatility, and rising adoption of quick-attach systems fuel growth. China and India dominate due to large-scale infrastructure developments, while Germany focuses on high-performance attachments for precision applications. France and the UK emphasize compact, multifunctional attachments suited for urban construction projects.

China is forecast to grow at 6.2%, supported by aggressive infrastructure expansion and real estate development. Hydraulic breakers, buckets, and grapples dominate due to widespread use in road and mining projects. Domestic OEMs invest in high-strength materials and quick-coupling systems for faster changeovers. Growing demand for attachments compatible with electric construction machinery also drives innovation.

India is projected to grow at 5.8%, driven by rapid urban infrastructure development and government-backed highway projects. Demand is rising for multipurpose attachments like tilt buckets, augers, and rippers for varied applications. Rental companies expand attachment fleets to meet short-term project needs. Local manufacturers focus on cost-effective, durable solutions to cater to price-sensitive markets.

Germany is expected to grow at 5.3%, supported by strong demand for high-precision attachments in civil engineering and road maintenance projects. Manufacturers prioritize technologically advanced designs, including tilt rotators and quick couplers for enhanced efficiency. Attachments with smart sensors for real-time performance monitoring gain traction. Sustainability compliance pushes adoption of lightweight, high-strength steel attachments.

France is projected to grow at 4.8%, driven by renovation projects and increased investment in public infrastructure. Compact and multifunctional attachments are in demand for city-based construction and landscaping. Manufacturers introduce attachments optimized for mini-excavators and skid-steer loaders to suit confined spaces. Demand for noise-reduced hydraulic hammers rises under urban noise regulations.

The UK is projected to grow at 4.4%, supported by housing projects, roadworks, and renewable energy site development. Multipurpose buckets, augers, and hydraulic breakers dominate adoption in construction and demolition sectors. Local suppliers emphasize quick-delivery solutions and easy-maintenance designs. Demand for attachments compatible with hybrid and electric construction equipment is gaining momentum.

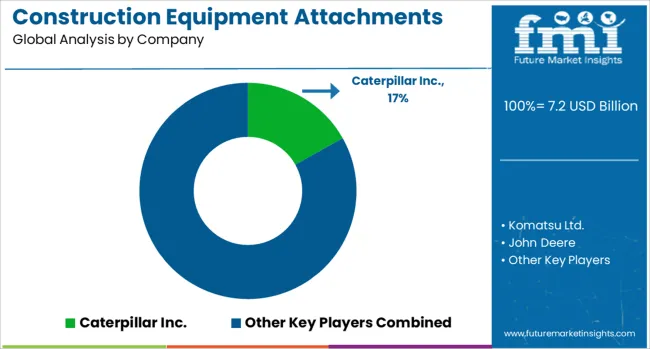

The construction equipment attachments market is moderately consolidated, led by Caterpillar Inc. with a significant market share. The company holds a dominant position through its wide range of OEM-certified attachments, strong global distribution network, and advanced integration with machine control and telematics systems. Dominant player status is held exclusively by Caterpillar Inc.

Key players include Komatsu Ltd., John Deere, Hitachi Construction Machinery Co., Ltd., Kubota Corporation, Doosan Bobcat, Sany Group, Liebherr Group, JCB, and Terex Corporation, each offering specialized attachments such as buckets, hydraulic breakers, augers, and grapples designed to enhance equipment versatility, improve site productivity, and meet varied application requirements in construction and mining sectors.

Emerging players remain limited due to high capital investment needs, strict safety standards, and strong brand loyalty within the heavy equipment industry. Market demand is driven by rising infrastructure development, increasing adoption of multi-purpose machinery, and growing preference for cost-effective solutions through equipment adaptability.

In September 2024, Caterpillar launched eight next-generation skid steer and compact track loader models-250, 260, 270, 270 XE, 275, 275 XE, 285, and 285 XE-featuring higher hydraulic flow, greater lifting capacity, enhanced operator comfort, and seamless compatibility with advanced construction attachments.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.2 Billion |

| Equipment | Earthmoving & roadbuilding equipment, Material handling & cranes, and Concrete equipment |

| Application | Residential construction, Commercial construction, and Industrial construction |

| Sales Channel | OEM and Aftermarket |

| End-User | Contractors, Rental companies, and Mining companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Komatsu Ltd., John Deere, Hitachi Construction Machinery Co., Ltd., Kubota Corporation, Doosan Bobcat, Sany Group, Liebherr Group, JCB, and Terex Corporation |

| Additional Attributes | Dollar sales by attachment type (buckets, breakers, grapples, thumbs), regional demand trends, competitive landscape, buyer preferences for quick couplers and multi-functionality, integration with telematics for performance tracking, innovations in lightweight alloy construction, low-emission hydraulic systems, and energy-efficient designs enhancing operational productivity. |

The global construction equipment attachments market is estimated to be valued at USD 7.2 billion in 2025.

The market size for the construction equipment attachments market is projected to reach USD 11.3 billion by 2035.

The construction equipment attachments market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in construction equipment attachments market are earthmoving & roadbuilding equipment, material handling & cranes and concrete equipment.

In terms of application, residential construction segment to command 38.7% share in the construction equipment attachments market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Finance Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Maintenance & Repair Market Growth - Trends & Forecast 2025 to 2035

Smart Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Compact Construction Equipment

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Compact Construction Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Compact Construction Equipment Market Analysis – Size, Share & Forecast 2025–2035

Latin America Construction Equipment Market Growth - Trends & Forecast 2025 to 2035

Germany Compact Construction Equipment Market Outlook – Share, Growth & Forecast 2025–2035

Gulf Countries Compact Construction Equipment Market Report – Trends, Demand & Industry Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA