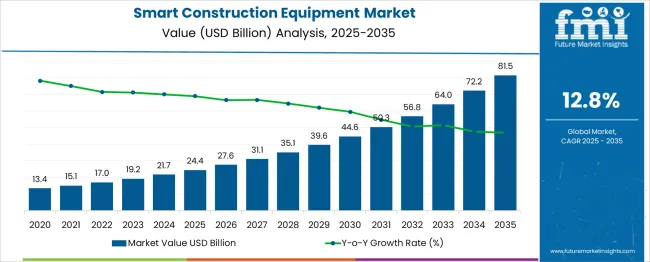

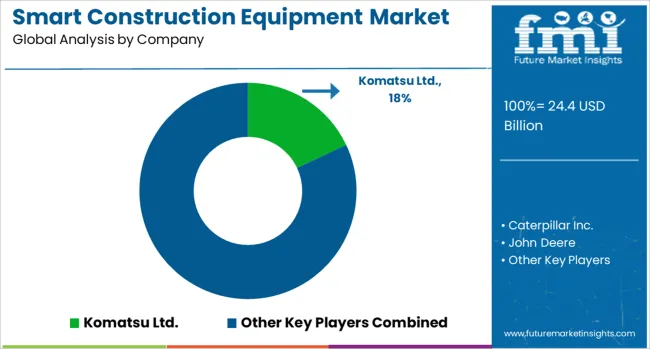

The Smart Construction Equipment Market is estimated to be valued at USD 24.4 billion in 2025 and is projected to reach USD 81.5 billion by 2035, registering a compound annual growth rate (CAGR) of 12.8% over the forecast period. In the first five years from 2020 to 2025, the market expands from USD 13.4 billion to USD 21.7 billion, accounting for about 24.3% of the total projected growth. This period is driven by increased adoption of automation, telematics, and Internet of Things (IoT) technologies within construction machinery, especially in emerging economies where infrastructure development is intensifying.

Annual market values show steady gains, including USD 15.1 billion in 2021 and USD 19.2 billion in 2024, reflecting ongoing efficiency improvements and regulatory focus on safety and environmental standards. From 2026 to 2035, the market growth accelerates considerably, adding USD 59.8 billion, which represents approximately 75.7% of the overall increase. This surge is propelled by advancements in artificial intelligence, machine learning, and sensor integration that boost equipment performance while lowering operational costs and project durations. The introduction of connected and autonomous equipment that minimizes human intervention addresses rising demands for productivity and workforce safety. Further momentum is derived from digital twin technology and predictive maintenance, enabling smarter asset management. The ongoing transition toward sustainable construction methods and the electrification of machinery also stimulate innovation and investment. The market’s trajectory signals strong and sustained expansion, supported by technological adoption, infrastructure investments, and evolving regulatory frameworks through 2035.

| Metric | Value |

|---|---|

| Smart Construction Equipment Market Estimated Value in (2025 E) | USD 24.4 billion |

| Smart Construction Equipment Market Forecast Value in (2035 F) | USD 81.5 billion |

| Forecast CAGR (2025 to 2035) | 12.8% |

The smart construction equipment market is advancing rapidly due to rising infrastructure development, labor shortages, and the growing need for project efficiency and safety. Integration of digital technologies into construction machinery is helping contractors reduce downtime, monitor real-time performance, and improve fuel efficiency.

Government initiatives promoting smart cities and automation-friendly policies are further pushing adoption of intelligent machinery across developed and emerging economies. Additionally, the availability of telematics, predictive maintenance systems, and remote diagnostics is transforming operational workflows.

Demand is also being fueled by sustainability efforts, as smart equipment contributes to reduced emissions and optimized resource usage.

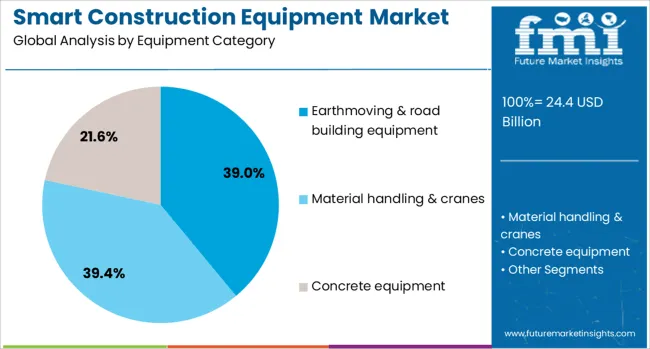

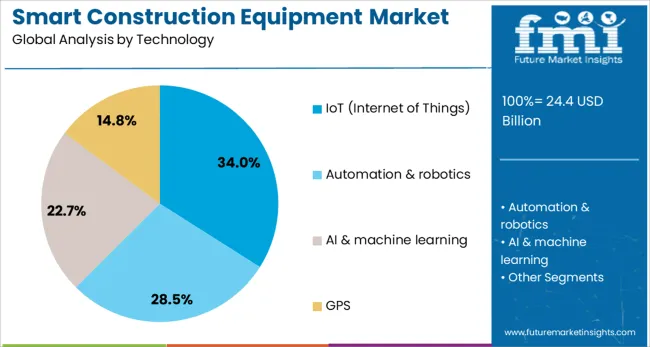

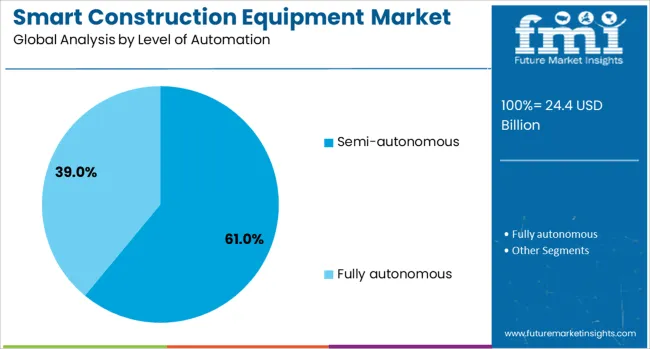

The smart construction equipment market is segmented by equipment category, technology, level of automation, application, end-user, and geographic regions. The smart construction equipment market is divided into the following equipment categories: Earthmoving & road building equipment, Material handling & cranes, Concrete equipment, Crushing & screening equipment. In terms of technology, the smart construction equipment market is classified into IoT (Internet of Things), Automation & robotics, AI & machine learning, and GPS. Based on the level of automation, the smart construction equipment market is segmented into semi-autonomous and fully autonomous.

The application of the smart construction equipment market is segmented into Residential construction, Commercial construction, Mining and quarrying, and Industrial construction. The end-user of the smart construction equipment market is segmented into Construction companies, Government agencies, Rental companies, and Contractors. Regionally, the smart construction equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Earthmoving and road building equipment is expected to account for 39.00% of total market revenue in 2025, making it the leading equipment category. This dominance is driven by high utilization across infrastructure, highway expansion, and urban construction projects.

The integration of sensors, GPS tracking, and automated controls in excavators, bulldozers, and graders is improving precision and safety on job sites. These machines are critical for foundational tasks, and their automation-readiness makes them ideal candidates for smart upgrades.

Increased investment in transportation infrastructure globally ensures consistent demand for this equipment category.

IoT technology is projected to hold a 34.00% market share in 2025, establishing it as the leading technology within smart construction equipment. IoT enables remote monitoring, fault detection, and asset management through real-time data exchange between machines and centralized systems.

This results in improved fleet utilization, reduced maintenance costs, and enhanced decision-making for contractors. Adoption of IoT is being driven by the need for uptime visibility and operational transparency.

As 5G connectivity and cloud infrastructure expand, the deployment of IoT-powered systems is expected to grow across small and large-scale construction projects.

Semi-autonomous systems are anticipated to dominate with a 61.00% share of the market in 2025. These systems offer a balanced approach—leveraging automation for efficiency and safety while retaining operator control when needed.

Semi-autonomous equipment is gaining traction due to its cost-effectiveness, faster training cycles, and easier integration into existing fleets. Applications include auto-grading, assisted steering, and collision avoidance systems.

Their compatibility with current job-site conditions and reduced dependence on skilled labor make them a preferred choice for contractors transitioning toward full automation in phases.

Smart construction equipment adoption is accelerating through connected systems, safety enhancements, and predictive analytics. Rental market expansion and integration with digital platforms are strengthening its position in construction industry growth strategies.

The demand for connected equipment solutions in construction has increased due to the need for operational efficiency and cost control. Smart construction equipment integrates telematics and IoT features that allow real-time monitoring of performance, fuel consumption, and predictive maintenance. These capabilities help reduce downtime and extend equipment life cycles, making them attractive for contractors managing multiple projects. Fleet managers benefit from enhanced data visibility, allowing for timely repairs and resource allocation. The growing use of remote monitoring ensures better compliance with project timelines and minimizes financial risk associated with unexpected breakdowns. This shift toward data-driven decision-making reinforces the importance of advanced machinery in modern construction environments.

Telematics systems have become essential in smart construction equipment as they provide actionable insights for contractors and rental companies. Data analytics from these systems enables accurate fuel tracking, operator behavior assessment, and predictive maintenance scheduling. Such solutions reduce operating costs and increase productivity by optimizing usage patterns. Companies are investing in platforms that integrate machine data with construction management software for seamless reporting. Remote diagnostics further enhance service efficiency, reducing the time needed to resolve equipment issues. This integration aligns with industry trends focused on improving workflow precision and minimizing losses caused by operational inefficiencies on large-scale projects.

Safety requirements in construction projects have driven the development of smart features in heavy machinery. Equipment equipped with sensors and AI-assisted safety systems reduces workplace accidents by monitoring operator actions and detecting hazards. Compliance with stringent regulations regarding site safety standards has made these solutions more desirable among contractors. Intelligent alerts, geofencing, and automated shutdown features add layers of security in high-risk environments, mitigating liabilities for construction firms. These capabilities are particularly critical for large infrastructure projects, where heavy machinery usage is extensive. As regulatory bodies enforce stricter norms, manufacturers prioritize technologies that guarantee operator protection and operational compliance.

The rental and leasing market has witnessed growing demand for smart construction equipment as contractors seek cost-efficient solutions for short-term projects. Smart-enabled machines provide rental firms with an advantage, offering enhanced tracking capabilities and operational transparency to clients. This trend is driven by the need for flexibility and the ability to monitor rented machinery remotely. Rental companies leverage telematics to ensure proper usage and prevent misuse of assets. Contractors increasingly prefer these options to avoid the high capital expenditure of owning advanced machines. This dynamic is reshaping ownership models, with rental businesses adopting connected fleets to stay competitive and meet evolving client expectations.

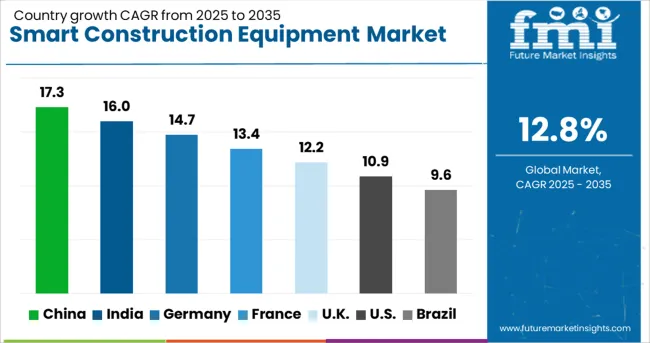

| Country | CAGR |

|---|---|

| China | 17.3% |

| India | 16.0% |

| Germany | 14.7% |

| France | 13.4% |

| UK | 12.2% |

| USA | 10.9% |

| Brazil | 9.6% |

The smart construction equipment market is projected to grow globally at a CAGR of 12.8% from 2025 to 2035, driven by increasing adoption of connected machinery, advanced telematics, and automation in construction projects. China leads with a CAGR of 17.3%, propelled by large-scale infrastructure development and integration of digital control systems across heavy machinery. India follows at 16.0%, supported by rapid construction of commercial spaces and government-backed infrastructure programs demanding high-efficiency equipment. France posts a growth rate of 13.4%, benefiting from investments in advanced construction technology for urban redevelopment and industrial facilities. The United Kingdom records 12.2%, driven by demand for productivity-enhancing equipment in high-value residential and public projects. The United States achieves 10.9%, influenced by rising renovation activities, increasing labor cost pressures, and growing preference for rental fleets equipped with smart capabilities, ensuring better project cost control and operational safety.

The CAGR for the smart construction equipment market in the United Kingdom was estimated at 8.6% during 2020–2024 and advanced to 12.2% between 2025 and 2035, signaling stronger adoption of connected machinery solutions. Early growth was moderate due to slower integration of digital control systems and a cautious investment approach among contractors. In the next phase, demand accelerated with rising emphasis on productivity, labor efficiency, and compliance-driven safety systems in public and commercial projects. Increasing penetration of telematics-based monitoring and fleet management tools strengthened procurement decisions. The shift toward rental models offering smart-enabled machines further influenced growth momentum by reducing upfront capital expenditure for contractors.

China’s CAGR for the smart construction equipment market was 11.9% during 2020–2024 and surged to 17.3% for 2025–2035, reflecting aggressive modernization in the construction sector. The initial phase showed strong traction in urban megaprojects and industrial parks, driven by investments in mechanization. Later, integration of AI-driven diagnostics and IoT systems became a key procurement factor for large contractors seeking to minimize downtime. Rapid infrastructure initiatives under government programs, combined with e-commerce-driven equipment leasing, positioned China as a global leader in smart equipment penetration. Strategic partnerships between domestic OEMs and international tech firms further accelerated localization of advanced systems.

India registered a CAGR of 10.7% from 2020–2024, which rose to 16.0% between 2025 and 2035, underscoring the transformative role of connected systems in the construction sector. Early growth was influenced by digital adoption in urban development projects and premium residential construction. Subsequent acceleration was driven by government-backed infrastructure initiatives and rising labor shortages, prompting contractors to adopt automation-supported machinery. The popularity of rental models equipped with real-time monitoring systems helped control operating costs. Manufacturers emphasized quick-setup telematics packages and localized solutions to boost accessibility for mid-tier contractors, reinforcing India’s position as a priority market for advanced construction technologies.

France’s CAGR for the smart construction equipment market was nearly 9.5% during 2020-2024 and improved to 13.4% for 2025-2035, reflecting sustained demand for automation in infrastructure projects. Early-stage growth centered around modernization of municipal assets and selective adoption in high-value developments. The future trajectory is shaped by requirements for enhanced operator safety and efficiency through digital control platforms. Integration with building information modeling (BIM) and advanced telematics reinforced project accuracy and compliance with regulatory standards. Suppliers offering hybrid rental-ownership plans and software-driven diagnostics captured a significant share of demand, making France a competitive player in the European smart equipment landscape.

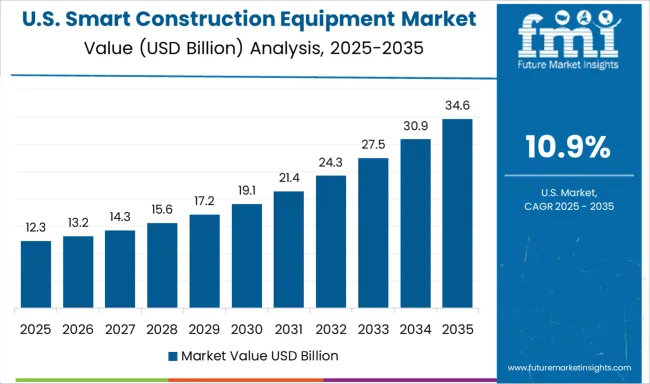

The CAGR for the United States market stood at 7.8% between 2020-2024 and climbed to 10.9% for 2025-2035, indicating gradual but steady acceptance of connected equipment solutions. Initial growth was driven by selective deployment in large industrial refurbishments and highway projects. Accelerated adoption in the later phase is linked to rising labor costs, heightened demand for predictive maintenance, and increased reliance on telematics-based fleet management. Rental companies in the USA acted as catalysts, equipping fleets with IoT-enabled systems to attract contractors seeking cost-effective alternatives. These dynamics have positioned the United States as a strong, mature market with sustained innovation in machine connectivity.

The smart construction equipment market is highly competitive, featuring leading global players such as Komatsu Ltd., Caterpillar Inc., John Deere, Liebherr Group, Kubota Corporation, JCB, Terex Corporation, Doosan Infracore Co., Ltd., Hitachi Construction Machinery Co., Ltd., and Sany Group. The industry structure blends multinational giants with regional manufacturers, creating a dynamic competitive environment centered on automation, connectivity, and enhanced productivity. Komatsu Ltd. focuses on developing intelligent machine control systems, while Caterpillar Inc. leverages advanced telematics and integrated digital platforms to maintain its leadership position. John Deere emphasizes precision solutions for earthmoving and road construction equipment, aligning with connected site strategies. Liebherr Group targets efficiency through machine monitoring technologies, while Kubota Corporation caters to compact equipment markets with IoT-enabled capabilities.

Differentiation strategies revolve around innovations in predictive maintenance, operator-assist features, and hybrid power solutions, alongside rental fleet optimization for cost-sensitive markets. Players such as JCB and Terex Corporation strengthen their portfolios by integrating data analytics services and remote diagnostics, while Doosan Infracore and Hitachi Construction Machinery focus on autonomous operation systems to improve site productivity. Sany Group capitalizes on its cost competitiveness by embedding smart control features in heavy-duty equipment. Strategic initiatives across the sector include forming alliances with software developers, expanding telematics subscription services, and enhancing aftermarket support to deliver complete lifecycle value. Future growth will depend on scaling connected ecosystems, investing in AI-driven performance tools, and offering modular solutions that cater to both large-scale infrastructure projects and small-to-medium contractors.

In October 2024, Deere announced a $13.5M expansion of its Reman Core Center in Missouri to be completed in 2026, growing its footprint to 400,000 sq. ft.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.4 Billion |

| Equipment Category | Earthmoving & road building equipment, Material handling & cranes, Concrete equipment, and Crushing & screening equipment |

| Technology | IoT (Internet of Things), Automation & robotics, AI & machine learning, and GPS |

| Level of Automation | Semi-autonomous and Fully autonomous |

| Application | Residential construction, Commercial construction, Mining and quarrying, and Industrial construction |

| End-User | Construction companies, Government agencies, Rental companies, and Contractors |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Komatsu Ltd., Caterpillar Inc., John Deere, Liebherr Group, Kubota Corporation, JCB, Terex Corporation, Doosan Infracore Co., Ltd., Hitachi Construction Machinery Co., Ltd., and Sany Group |

| Additional Attributes | Dollar sales by equipment category, share by application, regional demand outlook, competitive positioning, telematics adoption trends, rental market impact, regulatory compliance, pricing benchmarks, future growth projections, and technology integration analysis. |

The global smart construction equipment market is estimated to be valued at USD 24.4 billion in 2025.

The market size for the smart construction equipment market is projected to reach USD 81.5 billion by 2035.

The smart construction equipment market is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product types in smart construction equipment market are earthmoving & road building equipment, _backhoe, _excavator, _loader, _compaction equipment, _others, material handling & cranes, _storage and handling equipment, _engineered systems, _industrial trucks, _bulk material handling equipment, concrete equipment, _concrete pumps, _crusher, _transit mixers, _asphalt pavers, _batching plants, crushing & screening equipment, _crushers, _screens and _others.

In terms of technology, IoT (internet of things) segment to command 34.0% share in the smart construction equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Nano-Construction Materials Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Attachments Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Finance Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Maintenance & Repair Market Growth - Trends & Forecast 2025 to 2035

Smart Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Compact Construction Equipment

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Compact Construction Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Compact Construction Equipment Market Analysis – Size, Share & Forecast 2025–2035

Latin America Construction Equipment Market Growth - Trends & Forecast 2025 to 2035

Germany Compact Construction Equipment Market Outlook – Share, Growth & Forecast 2025–2035

Gulf Countries Compact Construction Equipment Market Report – Trends, Demand & Industry Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA