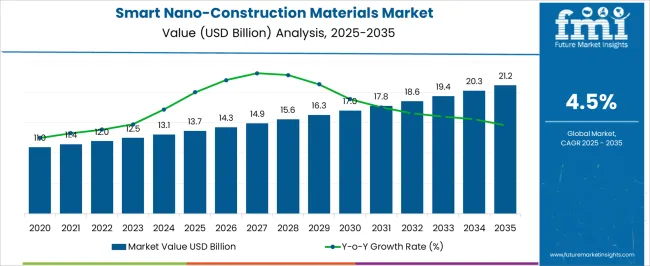

The smart nano-construction materials sector is forecasted to move from USD 13.7 billion in 2025 to USD 21.2 billion in 2035 at a CAGR of 4.5%. Year-on-year analysis shows consistent progression, with values increasing from 13.7 billion in 2025 to 14.9 billion in 2027 and 16.3 billion in 2029. This steady advance reflects growing use of nano-engineered inputs that improve strength, durability, and energy efficiency across infrastructure and building projects.

YoY curve highlights measured adoption rather than sharp surges, with emphasis on performance-driven benefits. Such stability is viewed as vital for long-term integration across construction ecosystems. By 2030, the industry is expected to reach 17.0 billion, moving to 17.8 billion in 2031 and 18.6 billion in 2032. The upward momentum continues with 19.4 billion in 2033 and 20.3 billion in 2034 before closing at 21.2 billion in 2035.

The YoY growth curve suggests that uptake will remain dependable, reinforced by adoption in mega infrastructure, high-rise development, and smart city planning. Industry analysts consider this path indicative of steady value creation, where engineered materials offer clear cost-to-performance advantages.

| Metric | Value |

|---|---|

| Smart Nano-Construction Materials Market Estimated Value in (2025 E) | USD 13.7 billion |

| Smart Nano-Construction Materials Market Forecast Value in (2035 F) | USD 21.2 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The smart nano-construction materials segment is estimated to hold about 7% of the construction materials market, close to 12% of the nanotechnology materials market, nearly 10% of the smart materials market, around 9% of the advanced building materials market, and about 8% of the infrastructure development materials market.

This contributes to an aggregated share of approximately 46% across its parent sectors. This proportion underscores the strategic positioning of smart nano-construction materials as a catalyst for change in how buildings, bridges, and large-scale structures are engineered. Their value has been recognized in applications where performance, longevity, and structural efficiency define project success. This category as more than a subset, describing it as a force that reshapes procurement strategies and architectural standards.

Demand has been driven by projects requiring lighter weight, higher durability, and enhanced resilience under varying environmental conditions, thereby expanding adoption across both public and private investments. The reliance on smart nano-construction materials is seen as integral to competitiveness, as firms using them can offer better lifecycle performance and reduced maintenance costs.

The smart nano-construction materials market is experiencing steady expansion, driven by advancements in nanotechnology, growing sustainability mandates, and the increasing need for high-performance construction solutions. Industry publications and infrastructure development reports have emphasized the role of nano-engineered materials in enhancing structural durability, reducing maintenance requirements, and enabling energy-efficient designs. Governments and private sector developers are increasingly adopting these materials in urban infrastructure, green buildings, and large-scale civil engineering projects due to their long-term performance benefits.

The integration of self-sensing, self-healing, and energy-harvesting capabilities in construction materials has elevated their value proposition in both new builds and renovation projects. Moreover, investments in nanotechnology research have accelerated the commercialization of innovative formulations, especially in concrete, coatings, and composites.

The market’s growth trajectory is expected to remain strong as construction industries worldwide prioritize lifecycle cost optimization, structural resilience, and compliance with stricter environmental standards, with leading demand concentrated in smart nano concrete, active smart materials, and structural applications.

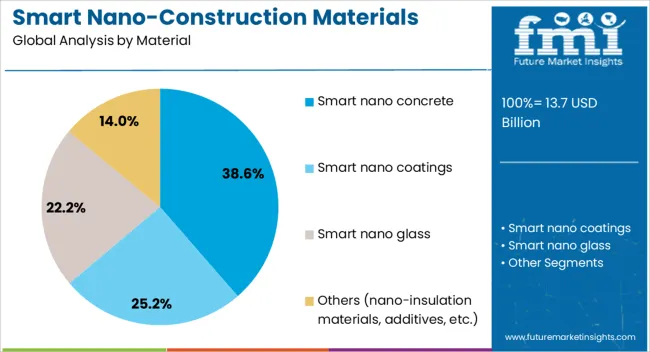

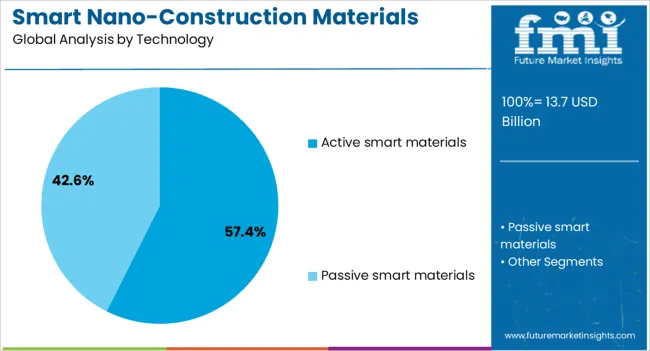

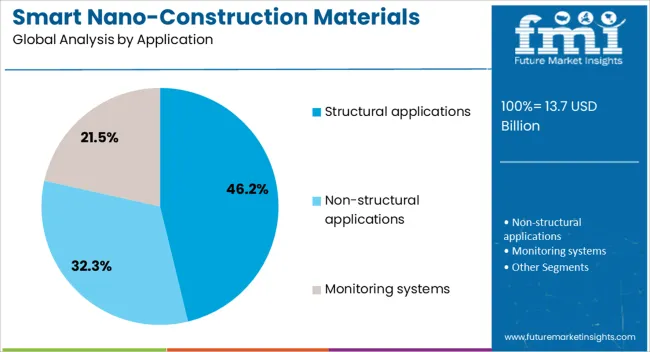

The smart nano-construction materials market is segmented by material, technology, application, end use, distribution channel, and geographic regions. By material, smart nano-construction materials market is divided into Smart nano concrete, Smart nano coatings, Smart nano glass, and Others (nano-insulation materials, additives, etc.). In terms of technology, smart nano-construction materials market is classified into Active smart materials and Passive smart materials. Based on application, smart nano-construction materials market is segmented into Structural applications, Non-structural applications, and Monitoring systems. By end use, smart nano-construction materials market is segmented into Commercial buildings, Residential buildings, Infrastructure, and Industrial. By distribution channel, smart nano-construction materials market is segmented into Direct and Indirect. Regionally, the smart nano-construction materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The smart nano concrete segment is projected to hold 38.60% of the smart nano-construction materials market revenue in 2025, securing its place as the leading material category. Growth in this segment has been driven by the ability of nano-engineered concrete to significantly enhance compressive strength, durability, and resistance to environmental degradation.

The incorporation of nanoparticles such as nano-silica and carbon nanotubes improves pore structure, reduces microcracking, and extends the service life of concrete structures. Construction industry assessments have highlighted its superior performance in harsh climates and high-load environments, making it attractive for critical infrastructure projects.

Additionally, the potential for integrating self-sensing and self-healing properties has positioned smart nano concrete as a strategic choice for reducing long-term maintenance costs. As sustainable construction practices become more prevalent, the use of nano concrete to achieve lower cement content and reduced carbon emissions is expected to reinforce its leadership in the material segment.

The active smart materials segment is projected to account for 57.40% of the market revenue in 2025, maintaining its dominant position due to its dynamic responsiveness to environmental and structural stimuli. Active smart materials, such as shape memory alloys, piezoelectric materials, and magnetorheological compounds, have gained traction for their ability to adapt properties in real-time to external conditions like stress, temperature, or vibration.

Industry case studies have shown their effectiveness in enabling real-time structural health monitoring and adaptive performance optimization, particularly in high-value infrastructure. These materials contribute to enhancing safety, extending asset lifecycles, and reducing repair needs.

Furthermore, ongoing technological advancements and cost reductions in nanofabrication have made active smart materials more accessible for large-scale construction applications. Their ability to deliver multifunctionality in a single material solution positions them as a critical driver of innovation within the smart nano-construction materials market.

The structural applications segment is projected to represent 46.20% of the smart nano-construction materials market revenue in 2025, retaining its role as the largest application area. Growth in this segment has been supported by the demand for enhanced load-bearing capacity, resilience, and longevity in both residential and commercial construction.

Smart nano-construction materials have been increasingly utilized in foundations, beams, bridges, and high-rise frameworks due to their capacity to withstand mechanical stress and environmental challenges over extended periods. Engineering reports have highlighted their contribution to minimizing structural fatigue, reducing downtime for repairs, and optimizing performance under dynamic load conditions.

Additionally, the integration of self-sensing capabilities in structural materials has enabled continuous monitoring, allowing for proactive maintenance and improved safety standards. As global infrastructure investments rise and projects demand higher efficiency and reliability, structural applications are expected to remain at the forefront of market adoption.

The smart nano-construction materials market is anticipated to expand as demand strengthens for durable, energy-efficient, and performance-enhanced building materials. Growth is fueled by interest in self-healing concrete, nanocoatings, and advanced composites that improve structural longevity. Opportunities are opening in large-scale infrastructure projects, green building certifications, and specialized industrial applications. Key trends involve the integration of nano-additives for thermal insulation, antibacterial surfaces, and lightweight structural designs. However, challenges such as high production costs, limited commercialization, and complex regulatory approvals continue to restrict faster adoption across construction and engineering sectors.

Demand for smart nano-construction materials has been reinforced by the rising preference for durability, lower maintenance, and enhanced performance in modern infrastructure projects. Self-healing concretes, nano-enhanced coatings, and high-strength composites are being prioritized by developers who require structures with longer lifespans and reduced lifecycle costs. Industries are increasingly recognizing the benefits of nano-modified materials, especially in transportation, residential, and commercial construction. These materials offer superior resistance to wear, moisture, and chemical exposure, making them highly attractive in sectors where safety and resilience are critical. Growing adoption in bridges, tunnels, and smart cities demonstrates how nanotechnology-based solutions are being evaluated as strategic investments. The strength of demand lies not just in performance metrics but in the assurance of long-term reliability, positioning smart nano-construction materials as the future cornerstone of infrastructure development.

Opportunities in the smart nano-construction materials market are expanding through infrastructure development, green-certified buildings, and industrial applications requiring advanced performance. Large-scale public works such as highways, airports, and smart cities are adopting nano-enhanced materials to improve durability and reduce maintenance expenses. Opportunities are also evident in healthcare and hospitality sectors, where antimicrobial nanocoatings are favored for high-traffic environments. Opportunity lies in combining nanomaterials with digital construction practices to deliver superior structural integrity. Emerging economies with ambitious construction pipelines are expected to become prime adopters, as demand for advanced solutions grows alongside investment in urban infrastructure. Specialized applications in aerospace hangars, energy plants, and marine construction are opening niche opportunities for material suppliers. This breadth of applications underscores how nano-construction materials are moving beyond experimental adoption into critical industrial domains.

Trends shaping the smart nano-construction materials market involve product innovation, integration into construction processes, and heightened focus on specialized performance. Nanocoatings with self-cleaning, anti-corrosive, and thermal insulation properties have gained prominence in commercial and industrial applications. Lightweight composites reinforced with nanomaterials are trending in projects where load-bearing efficiency and flexibility are prioritized.

Emerging trend lies in multi-functional materials, where properties such as fire resistance, soundproofing, and antibacterial capabilities are combined into a single solution. Demand for energy-efficient building envelopes is also pushing adoption of nano-insulation foams and coatings. Construction firms are gradually adopting digital simulation models to predict how nano-enhanced materials perform under extreme conditions. These trends demonstrate a clear shift toward construction materials being redefined as intelligent assets that improve both operational efficiency and long-term performance outcomes.

Challenges in the smart nano-construction materials market are linked to high production costs, limited scalability, and complex regulatory frameworks. The cost of synthesizing and integrating nanomaterials has restricted broader adoption, confining usage largely to premium projects or pilot-scale deployments. Manufacturing scalability has been difficult, as maintaining uniform quality across bulk production remains a challenge. Regulatory approval for nano-enabled materials is often delayed due to safety and environmental testing requirements, slowing market penetration.

Small and mid-sized construction firms find it difficult to justify higher upfront investments, especially in cost-sensitive regions. Competition from conventional construction materials with proven track records also hinders faster replacement. These structural challenges illustrate why the widespread commercialization of nano-construction materials has been gradual, despite their performance advantages. Greater collaboration between regulators, manufacturers, and construction firms is essential to overcome these barriers.

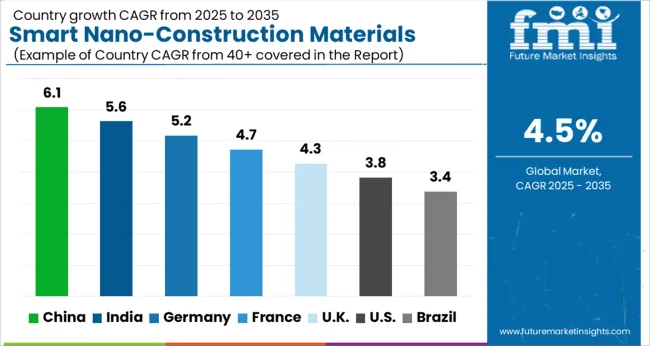

| Countries | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global smart nano construction materials market is projected to grow at a CAGR of 4.5% between 2025 and 2035. China is anticipated to lead with a growth rate of 6.1%, followed by India at 5.6% and France at 4.7%. The United Kingdom is set to expand at 4.3%, while the United States posts a slower rate of 3.8%. Growth is being shaped by demand for self healing concrete, nanocoatings, and energy efficient composites that improve durability and performance in infrastructure and real estate. Asia benefits from rapid infrastructure expansion and government backed programs supporting advanced material adoption, while Europe emphasizes performance compliance and environmental considerations. The USA market shows steady but slower gains, reflecting its maturity and reliance on selective high value projects. This report includes insights on 40+ countries; the top markets are shown here for reference.

The smart nano construction materials market in China is projected to grow at a CAGR of 6.1%. Expansion is driven by large scale public infrastructure programs, rapid urban construction, and adoption of advanced materials to improve energy efficiency and durability. Nanocoatings for buildings, self healing concrete in highways, and nano composites in structural applications are gaining prominence. Government backed R&D centers and collaborations with universities accelerate commercialization of novel materials. China continues to position itself as a hub for large scale testing and deployment.

The smart nano construction materials market in India is forecast to grow at a CAGR of 5.6%. Demand is underpinned by large scale infrastructure development, expansion of urban housing, and growing investments in commercial real estate. Nano engineered materials improve structural life, reduce maintenance, and enhance thermal efficiency in buildings. The government’s focus on affordable housing and smart city projects is creating wider adoption opportunities. Domestic producers are also investing in R&D to meet construction sector requirements.

The smart nano construction materials market in France is projected to grow at a CAGR of 4.7%. Demand is supported by strict building codes, adoption of eco labels, and government initiatives promoting long lasting construction solutions. French companies focus on nanocoatings, insulation materials, and nano additives for concrete to meet efficiency and compliance standards. Renovation of old housing stock and investments in commercial complexes further sustain growth. France’s emphasis on premium and high performance materials positions it as a stable but competitive market.

The smart nano construction materials market in the UK is projected to grow at a CAGR of 4.3%. Expansion is encouraged by building refurbishment programs, adoption of advanced insulation solutions, and emphasis on green construction practices. Nanocoatings for corrosion resistance and self cleaning surfaces are gaining traction across residential and commercial applications. Public and private stakeholders are collaborating on pilot projects, ensuring steady but measured adoption. Growth remains moderate due to the maturity of infrastructure, yet new innovations maintain market relevance.

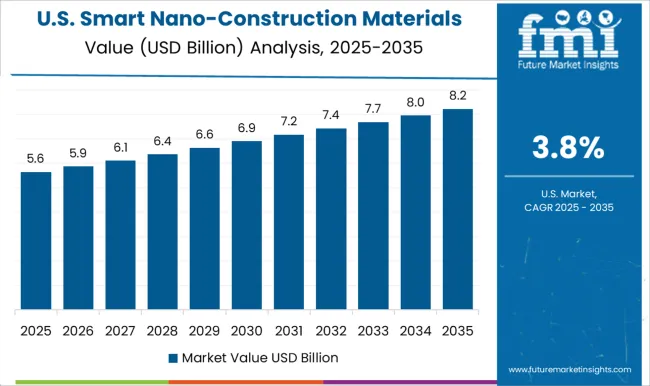

The smart nano construction materials market in the US is expected to expand at a CAGR of 3.8%. Growth remains moderate due to reliance on conventional materials, but specialized projects in high rise construction, defense infrastructure, and premium housing are driving demand. Adoption of nano additives in concrete, thermal insulation materials, and protective nanocoatings supports long term performance improvements. USA research institutes and material companies are focusing on high value applications rather than mass scale deployment.

The smart nano-construction materials market is characterized by a competitive landscape involving established construction material manufacturers, nanotechnology firms, and specialized startups focusing on high-performance building solutions. Companies such as BASF, Saint-Gobain, and 3M dominate through extensive product portfolios, strong patent holdings, and broad global distribution networks. They invest heavily in R&D to develop materials offering enhanced strength, self-healing properties, thermal regulation, and resistance to corrosion and wear.

Mid-sized firms and emerging players target niche segments such as nano-insulation coatings, photocatalytic cement, and self-cleaning glass to gain traction in regional markets. Strategic partnerships between nanomaterial developers and construction companies have become common to accelerate commercialization and adoption in large-scale infrastructure projects. Competitive differentiation relies on technological innovation, cost efficiency, performance certification, and compliance with evolving building regulations.

Market competition is further shaped by collaborations with academic institutions for advanced material research and by mergers or acquisitions to expand product lines. Companies that combine proprietary nanotechnology expertise with scalable manufacturing and strong contractor relationships are well-positioned to secure market leadership in the smart nano-construction materials sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.7 Billion |

| Material | Smart nano concrete, Smart nano coatings, Smart nano glass, and Others (nano-insulation materials, additives, etc.) |

| Technology | Active smart materials and Passive smart materials |

| Application | Structural applications, Non-structural applications, and Monitoring systems |

| End Use | Commercial buildings, Residential buildings, Infrastructure, and Industrial |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Advenira Enterprises, Inc., Aerogel Technologies, LLC, AkzoNobel N.V., Arkema, BASF SE, Cabot Corporation, Dupont, Evonik Industries AG, Haliburton Company, Nanogate SE, Nanophase Technologies Corporation, NanoPore Incorporated, Saint-Gobain, and XG Sciences, Inc. |

| Additional Attributes | Dollar sales by material type (nanocement, nanocoatings, nanoadmixtures, nanocomposites), Dollar sales by application (residential, commercial, industrial, infrastructure), Trends in self-healing, self-cleaning, and high-strength nanomaterials, Role of nanotechnology in enhancing thermal insulation and corrosion resistance, Growth in adoption for energy-efficient buildings and advanced infrastructure projects, Regional deployment patterns across North America, Europe, and Asia Pacific. |

The global smart nano-construction materials market is estimated to be valued at USD 13.7 billion in 2025.

The market size for the smart nano-construction materials market is projected to reach USD 21.2 billion by 2035.

The smart nano-construction materials market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in smart nano-construction materials market are smart nano concrete, smart nano coatings, smart nano glass and others (nano-insulation materials, additives, etc.).

In terms of technology, active smart materials segment to command 57.4% share in the smart nano-construction materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA