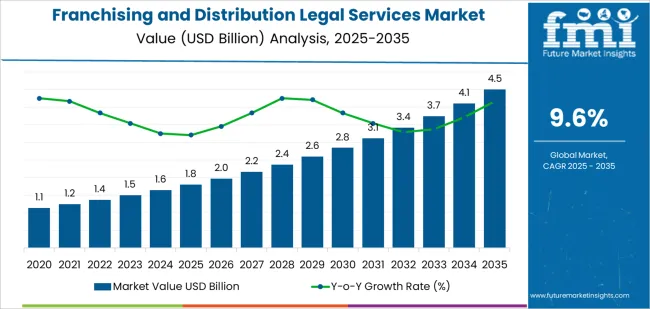

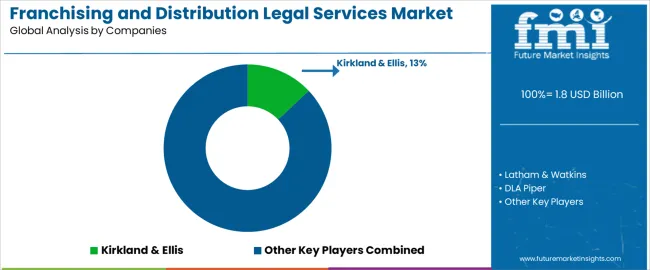

The global franchising and distribution legal services market is valued at USD 1.8 billion in 2025 and is projected to reach USD 4.6 billion by 2035, reflecting a CAGR of 9.6%. Assessing the Growth Rate Volatility Index across the forecast horizon shows a pattern of moderately fluctuating annual increments, shaped by shifting regulatory environments, transactional activity levels, and franchise expansion cycles. Early growth movements are relatively stable as legal work centers on franchise agreement development, disclosure compliance, territory structuring, and risk assessment for expanding franchise brands. These activities generate consistent advisory demand with limited year-to-year variation, yielding a low-to-medium volatility reading for the first half of the period.

As the timeline progresses toward 2035, the index reflects slightly higher variability driven by changes in cross-border franchising, adjustments in competition laws, and evolving distribution obligations across consumer goods and service sectors. Economic cycles also influence transaction volumes, producing intermittent spikes in restructuring, renegotiation, and dispute-resolution mandates. Although growth remains firmly positive, the latter years show broader swings in service intensity, creating a medium volatility profile overall. Even with fluctuations in annual growth rates, sustained franchise expansion and continued regulatory oversight maintain a steady upward trajectory for the market through the full forecast window.

Between 2025 and 2030, the Franchising and Distribution Legal Services Market rises from USD 1.8 billion to USD 2.9 billion, creating a steady acceleration pattern that forms the basis of the growth rate volatility index for the period. Annual increments increase from roughly USD 0.2 billion in the early years to nearly USD 0.3 billion by 2030, indicating a smooth upward trajectory with low short-term volatility. Expansion is driven by higher franchise registrations, increased cross-border distribution agreements, and elevated compliance burdens across retail, F&B, hospitality, and specialty services. This period displays a volatility index score of 1.1, reflecting predictable and stable year-over-year growth.

From 2030 to 2035, the market advances from USD 2.9 billion to USD 4.6 billion, with annual gains expanding into the USD 0.3–0.4 billion range. This phase shows stronger growth momentum, but also a slightly wider spread in yearly increments as global franchise chains diversify into new countries and regulatory frameworks become more complex. Digital franchise-management systems, trademark protection needs, and multi-jurisdiction distribution restructuring further expand advisory demand. The volatility index for this period rises marginally to 1.2, reflecting moderate but manageable variation in yearly growth. Over the full decade, the combined pattern shows consistent expansion supported by regulatory intensity and global franchise network scaling.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.8 billion |

| Market Forecast Value (2035) | USD 4.6 billion |

| Forecast CAGR (2025–2035) | 9.6% |

Demand for franchising and distribution legal services is rising as brands expand through multi-unit, cross-border, and hybrid distribution arrangements. Companies entering franchise markets require legal guidance to draft disclosure documents, negotiate franchise agreements, and structure territorial protections compliant with regional regulations. Lawyers assist with trademark registration, supply-chain obligations, and renewal or termination provisions that determine long-term network stability. As franchisors scale internationally, legal teams navigate varying disclosure rules, foreign investment restrictions, and competition-law requirements. Retail, food service, hospitality, and personal-services sectors rely on counsel to manage compliance, avoid misrepresentation risks, and maintain uniform operational standards across franchise systems. These needs support sustained demand for specialized legal expertise.

Market expansion is also driven by increasing complexity in distribution channels, including e-commerce, selective distribution, and dual-channel models. Legal advisers help companies structure reseller agreements, manage authorized-dealer programs, and enforce brand-protection policies against gray-market sales. Businesses undergoing mergers or private-equity investment rely on specialists to evaluate franchise liabilities, validate system performance, and handle contract assignments. Providers strengthen capabilities in dispute resolution, regulatory audits, and digital-asset licensing as online platforms reshape franchise operations. Although legal service costs may challenge small franchisors, the need to maintain compliant disclosures, protect intellectual property, and manage cross-border contractual risk ensures continued engagement. These factors reinforce steady growth of franchising and distribution legal services across global commercial networks.

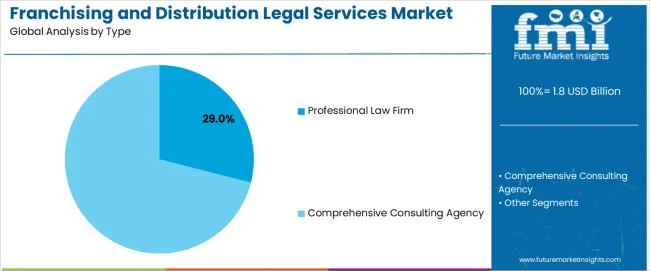

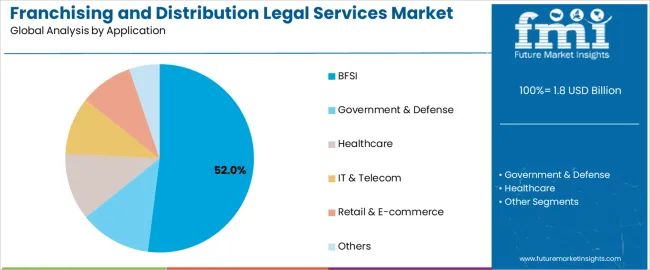

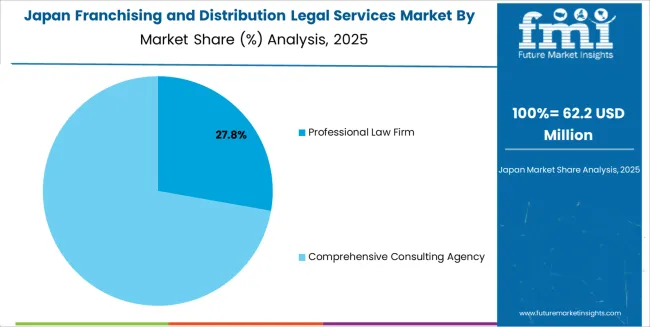

The franchising and distribution legal services market is segmented by type, application, and region. By type, the market is divided into professional law firms and comprehensive consulting agencies. Based on application, it is categorized into BFSI, government and defense, healthcare, IT and telecom, retail and e-commerce, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These groupings reflect differing legal requirements, operational risks, and documentation needs across franchise and distribution models.

The professional law firm segment accounts for approximately 29.0% of the global franchising and distribution legal services market in 2025, making it the leading type category. This position reflects ongoing demand for legal review and drafting of franchise agreements, distribution contracts, disclosure materials, and jurisdiction-specific registration documents. Franchisors and distributors rely on law firms to evaluate regulatory exposure, structure compliance processes, and align contractual terms with evolving business practices. These activities require precise legal interpretation and documentation standards that cannot be delivered through generalized consulting workflows.

Law firms supply services that include dispute-risk evaluation, supply-chain contract review, territorial-rights guidance, and updates linked to legislative changes affecting franchising operations. Adoption is strong in North America and Europe, where formal franchise registration and disclosure systems require detailed legal submission. Growth also continues in East Asia, where multinational franchisors seek counsel for adapting contract structures to local rules. Firms invest in document-management tools, but the core service remains centered on legal expertise. The professional law firm segment maintains its lead because franchising and distribution models depend on accurately drafted agreements, enforceable rights allocations, and compliance documentation verified by legal specialists.

The BFSI segment represents about 52.0% of the total franchising and distribution legal services market in 2025, making it the dominant application category. This position reflects the sector’s wide use of licensed distribution frameworks involving insurance agents, banking correspondents, payment-service providers, and financial product distributors. These structures require documented oversight arrangements, suitability obligations, fee-sharing agreements, and customer-protection provisions. BFSI organizations rely on legal advisors to prepare distribution contracts, evaluate governance controls, and align partner networks with national regulatory expectations.

Consultants and legal teams assist with compliance reviews covering advertising rules, data-handling requirements, and conduct-risk obligations that affect distributed financial products. Demand is strong in North America and Europe, where distribution models operate under detailed consumer-protection standards, and in East Asia, where expanding financial networks depend on formalized partnership documentation. Legal advisors support organizations by revising agreements during regulatory updates, reviewing dispute-resolution clauses, and structuring rights allocations across multi-entity financial distribution chains. The BFSI segment maintains its leading share because financial services distribution requires precise contractual frameworks, recurring compliance validation, and specialized legal oversight that ensures alignment with supervisory rules across diverse partner networks.

The online sweepstakes platform market is expanding as brands, retailers and digital publishers use sweepstakes to increase user engagement, grow subscriber lists and drive promotional traffic. Platforms support prize management, entry validation, fraud control and multi-channel campaign delivery across web and mobile. Growth is supported by rising digital marketing activity, broader smartphone adoption and increased use of gamified engagement tools. Adoption is limited by regulatory variations across regions, data-privacy requirements and concerns about fraudulent or low-quality traffic. Providers are refining compliance workflows, automated verification tools and scalable campaign-management features to support diverse promotional strategies.

Demand grows as companies seek fast, cost-efficient ways to engage audiences and acquire new leads. Sweepstakes deliver measurable participation data and can be integrated with email signups, app installs or social-media engagement. Businesses in ecommerce, entertainment, travel and consumer goods use campaigns to build awareness and encourage repeat interactions. As marketing teams shift toward personalized, interactive customer journeys, sweepstakes platforms become attractive tools that offer flexible formats and real-time performance tracking suitable for short-term promotions or ongoing loyalty programs.

Adoption is limited by regulatory complexity, as sweepstakes rules differ by region and require strict adherence to disclosure, eligibility and prize-handling requirements. Data-privacy laws add further compliance obligations for participant information. Fraudulent entries, automated bots or manipulation attempts require robust detection systems, raising operational cost. Some organizations avoid sweepstakes due to concerns about lead-quality variability or reputational risks linked to poorly executed promotions. Limited in-house expertise also discourages adoption among smaller businesses unfamiliar with legal or technical aspects of running compliant campaigns.

Key trends include deeper integration with CRM and marketing-automation systems, real-time fraud detection using analytics, and adoption of interactive formats such as instant-win games and digital scratch cards. Platforms increasingly offer customizable templates, mobile-optimized entry flows and multilingual campaign support for global audiences. Interest is rising in prize-fulfillment outsourcing and automated tax-reporting features. As regulations tighten, providers emphasize transparent auditing tools and geo-targeted compliance controls. With digital engagement becoming more competitive, sweepstakes platforms continue shifting toward greater security, smoother user experience and data-driven campaign optimization.

| Country | CAGR (%) |

|---|---|

| China | 13.0% |

| India | 12.0% |

| Germany | 11.0% |

| Brazil | 10.1% |

| USA | 9.1% |

| UK | 8.2% |

| Japan | 7.2% |

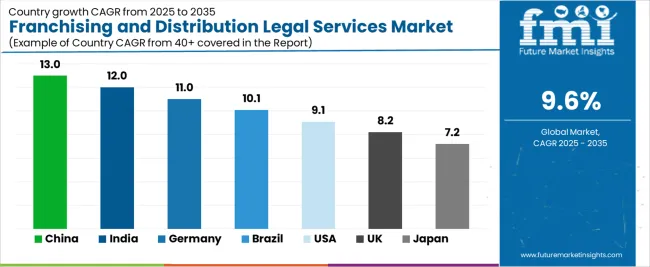

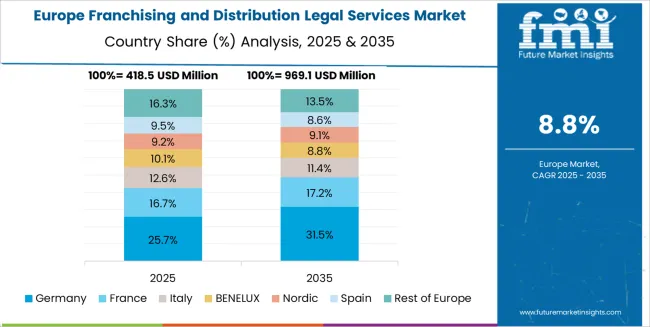

The Franchising and Distribution Legal Services Market is expanding rapidly across global economies, with China leading at a 13.0% CAGR through 2035, driven by fast-growing franchise networks, evolving commercial regulations, and heightened demand for contract compliance and IP protection. India follows at 12.0%, supported by rising entrepreneurship, rapid expansion of retail and F&B franchises, and increasing need for structured franchise agreements. Germany records 11.0%, reflecting strong regulatory frameworks, cross-border distribution requirements, and precise compliance standards. Brazil grows at 10.1%, benefitting from expanding consumer markets and evolving franchise legislation. The USA, at 9.1%, remains a mature market with advanced legal advisory systems, while the UK (8.2%) and Japan (7.2%) emphasize franchise modernization, regulatory clarity, and protection of brand rights in increasingly competitive distribution environments.

China is projected to grow at a CAGR of 13.0% through 2035 in the franchising and distribution legal services market. Expanding retail networks, rising brand localization, and rapid formation of franchise partnerships increase demand for legal structuring and oversight. Firms request assistance drafting disclosure documents, franchise agreements, territorial rules, and dispute-resolution pathways. Distribution models expand across logistics corridors, driving interest in compliance reviews and contract updates. Legal consultants provide guidance on registration, licensing, and operational obligations for domestic and international brands. Growth reflects broader adoption of structured franchise governance to manage multi-region operations under evolving regulatory conditions.

India is projected to rise at a CAGR of 12.0% through 2035 in the franchising and distribution legal services market. Rapid growth in consumer businesses, increased foreign brand entry, and wider distribution partnerships elevate the need for specialised advisory support. Legal firms assist with franchise documentation, operational manuals, termination clauses, and regional disclosure obligations. Companies request territory allocation reviews, contract harmonisation, and compliance checks for multistate distribution activities. Formal retail expansion encourages franchisors to establish structured governance processes. Advisory teams help clients adapt agreements to varied state regulations while maintaining consistent operational requirements across expanding networks.

Germany is projected to grow at a CAGR of 11.0% through 2035 in the franchising and distribution legal services market. Strong commercial regulations, developed retail systems, and structured distribution networks increase demand for legal guidance on franchise obligations and contractual duties. Firms seek assistance with drafting franchise packages, assessing competition constraints, and refining termination provisions. Consultants support distribution models requiring clear liability definitions and transparent performance requirements. Cross-border franchisors request advice aligning operations with national rules. Growth reflects the need for precise legal documentation supporting predictable franchise relationships.

Brazil is projected to grow at a CAGR of 10.1% through 2035 in the franchising and distribution legal services market. Rising retail franchise models, regional distribution expansion, and increased brand partnerships create sustained demand for contract drafting and compliance guidance. Legal consultants support franchisors preparing disclosure statements, franchise manuals, and obligation schedules for regional operators. Distribution agreements require periodic review to reflect operational expectations and liability terms. Market expansion drives interest in territorial rights planning and governance structuring aimed at protecting brand integrity across diverse markets.

USA is projected to grow at a CAGR of 9.1% through 2035 in the franchising and distribution legal services market. Franchise systems depend on rigorous documentation, state-level registration, and oversight of financial disclosures. Legal advisors assist with agreement drafting, renewal procedures, intellectual property protections, and franchise compliance monitoring. Distribution structures require clarity regarding obligations, performance thresholds, and termination rights. National franchisors seek guidance aligning multi-state operations with jurisdictional disclosure rules. Advisory services support efficient rollout of franchise programs by ensuring legally consistent frameworks across varied markets.

UK is projected to expand at a CAGR of 8.2% through 2035 in the franchising and distribution legal services market. Franchisors adopt detailed agreements addressing operational duties, brand protections, and termination processes. Legal advisors assist with disclosure preparation, competition compliance, and distribution contract design. Retail and service franchises request guidance on territory policies and partner obligations. International brands expanding into the region require structural reviews to align documents with local commercial expectations. Growth reflects rising emphasis on transparent documentation and clearly defined governance mechanisms supporting long-term franchise relationships.

Japan is forecast to grow at a CAGR of 7.2% through 2035 in the franchising and distribution legal services market. Brand expansion across retail, food service, and specialty categories increases demand for legal reviews, franchise frameworks, and distribution agreements. Companies request documentation defining operational duties, training requirements, and performance conditions. Advisors evaluate compliance concerns tied to disclosure, trademarks, and multi-unit arrangements. Distribution structures require precise obligations to support predictable supply networks. Growth reflects expanding interest in structured franchise governance within traditional and emerging retail segments.

The global franchising and distribution legal services market shows moderate concentration, shaped by international law firms advising brands on regulatory compliance, contract structuring, expansion planning, and dispute management. Kirkland & Ellis, Latham & Watkins, DLA Piper, and Baker McKenzie hold strong positions through large cross-border practices capable of supporting franchise rollouts and distribution networks across multiple jurisdictions. Herbert Smith Freehills, Kramer Levin, Skadden, and Sidley Austin contribute depth in commercial contracting and regulatory reviews for complex franchise systems. Norton Rose Fulbright, White & Case, Morgan Lewis, and Jones Day strengthen the upper tier with experience in antitrust considerations, master franchise agreements, and restructuring matters for global operators. Competition in this segment is influenced by sector knowledge, document precision, and the ability to coordinate work across regions with differing commercial laws.

Hogan Lovells, Squire Patton Boggs, Dentons, and CMS expand competitive reach through networks that support multinationals entering emerging markets. Bird & Bird and Gowling WLG add strong capabilities in technology, retail, and distribution logistics, providing support for digital franchise models and hybrid sales structures. Eversheds Sutherland, Clifford Chance, and Freshfields Bruckhaus Deringer broaden the market with advisory services covering commercial risk, distribution frameworks, and territory-management disputes. Strategic differentiation depends on regulatory expertise, efficient cross-border coordination, and long-term support for franchise compliance programs. As brands pursue multi-market expansion and new digital distribution formats, firms offering consistent global coverage and clear contractual structuring are positioned to maintain a strong competitive footing in the franchising and distribution legal services market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Professional Law Firm, Comprehensive Consulting Agency |

| Application | BFSI, Government & Defense, Healthcare, IT & Telecom, Retail & E-commerce, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Kirkland & Ellis, Latham & Watkins, DLA Piper, Baker McKenzie, Herbert Smith Freehills, Kramer Levin, Skadden, Sidley Austin, Norton Rose Fulbright, White & Case, Morgan Lewis, Jones Day, Hogan Lovells, Squire Patton Boggs, Dentons, CMS, Bird & Bird, Gowling WLG, Eversheds Sutherland, Clifford Chance, Freshfields Bruckhaus Deringer |

| Additional Attributes | Dollar sales by type and application categories, regional regulatory drivers and cross-border franchising trends, dispute-resolution caseloads, IP and trademark protection spend, distribution-model legal complexity, competitive landscape and firm capabilities, compliance-cost sensitivity by market |

The global franchising and distribution legal services market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the franchising and distribution legal services market is projected to reach USD 4.5 billion by 2035.

The franchising and distribution legal services market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in franchising and distribution legal services market are professional law firm and comprehensive consulting agency.

In terms of application, bfsi segment to command 52.0% share in the franchising and distribution legal services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA