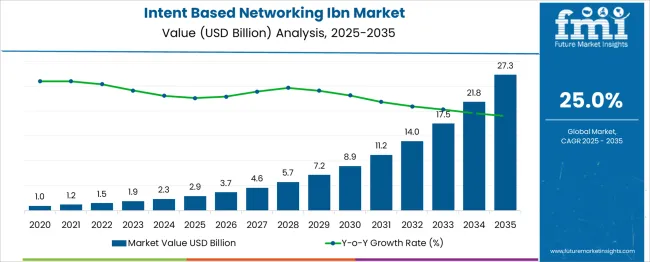

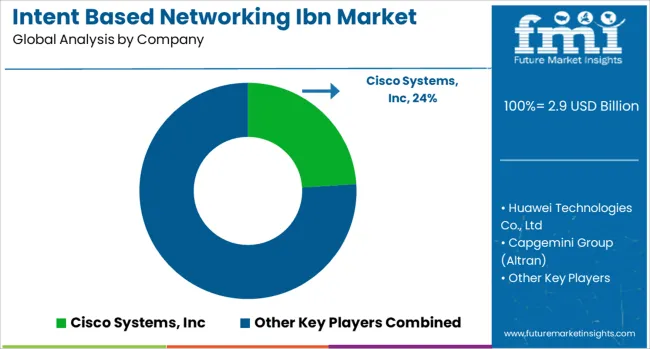

The Intent-Based Networking IBN Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 27.3 billion by 2035, registering a compound annual growth rate (CAGR) of 25.0% over the forecast period. Rather than solely relying on the overall CAGR of 25.0% from 2025 to 2035, a rolling CAGR approach focuses on interim performance across smaller timeframes. This analysis helps isolate periods of acceleration or deceleration in momentum.

From 2025 to 2028, growth appears steady yet modest, with rolling CAGR values hovering around 22 to 23% annually. However, as the market shifts into the 2029 to 2032 interval, a marked acceleration occurs. During these years, CAGR calculations between each point-to-point segment rise incrementally, signifying a stronger rate of compound expansion driven by both broader adoption and increasing enterprise-grade implementations. Between 2032 and 2035, the growth becomes more pronounced, with rolling CAGR crossing the 26% mark, indicating peak compounding effects.

The transition from USD 11.2 billion in 2030 to USD 27.3 billion by 2035 involves the largest rolling CAGR segment, which underscores late-decade acceleration. This suggests the market is experiencing progressive intensity rather than flattening over time. The rolling CAGR framework thus identifies a maturing inflection pattern where early adoption transitions into full-scale market penetration, particularly post-2029.

| Metric | Value |

|---|---|

| Intent-Based Networking IBN Market Estimated Value in (2025 E) | USD 2.9 billion |

| Intent-Based Networking IBN Market Forecast Value in (2035 F) | USD 27.3 billion |

| Forecast CAGR (2025 to 2035) | 25.0% |

The Intent Based Networking market is undergoing a pivotal shift driven by growing demand for autonomous network management, dynamic scalability, and AI-integrated decision-making. Organizations are accelerating the adoption of IBN solutions to reduce manual network provisioning, streamline operations, and align network performance with real-time business intent.

This trend is being amplified by rising complexities in hybrid and multi-cloud environments, where centralized control and predictive analytics are critical to maintaining service assurance. Investment from hyperscale data center operators and enterprise IT teams is further validating the value proposition of policy-driven, self-healing networks.

Emphasis on zero-touch provisioning, real-time telemetry, and closed-loop automation is expected to reinforce demand over the forecast period. Additionally, continuous innovations in AI/ML engines embedded within software-defined infrastructure are enabling IBN platforms to adapt and optimize at scale, paving the way for wider deployment across industries.

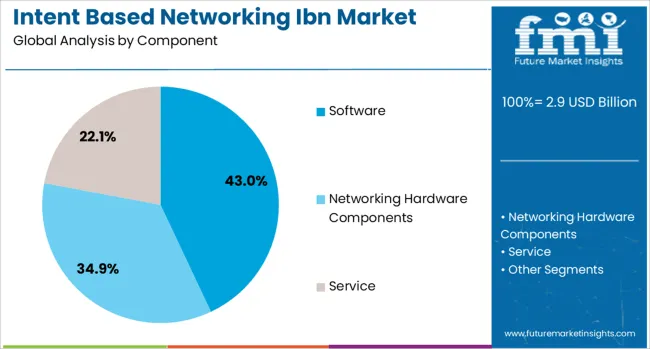

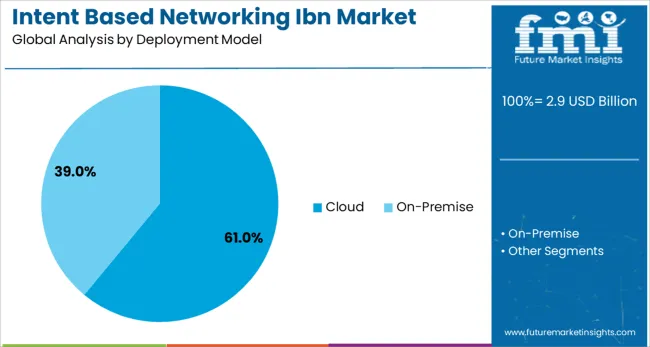

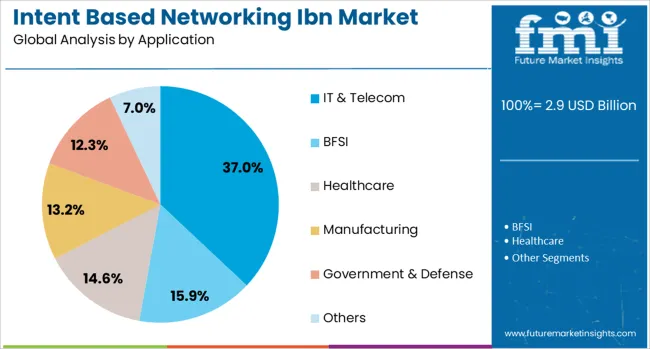

Component, deployment model, application, and geographic regions segment the intent-based networking IBN market. The component of the intent-based networking IBN market is divided into Software, Networking Hardware Components, and Service. In terms of the deployment model of the intent-based networking IBN market, it is classified into Cloud and On-Premise. Based on the application of the intent-based networking, the IBN market is segmented into IT & Telecom, BFSI, Healthcare, Manufacturing, Government & Defense, and others. Regionally, the intent-based networking IBN industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Software is projected to contribute 43.0% of the total revenue in the IBN market by 2025, positioning it as the leading component segment. This dominance is being driven by the need for intelligent orchestration, intent translation, and automated policy enforcement across increasingly distributed networks.

Software platforms enable real-time interpretation of user-defined intents into actionable network configurations, making them indispensable for enterprises managing complex IT landscapes. The modularity and scalability of software-driven models allow integration with third-party analytics, AI, and automation frameworks.

Furthermore, recurring license-based revenue models and over-the-air updates provide cost efficiency and operational agility for both service providers and enterprises. As networks shift from reactive to proactive frameworks, software continues to be the foundational layer enabling intent awareness, automation, and continuous assurance.

Cloud deployment is forecast to account for 61.0% of total IBN market revenue in 2025, making it the leading deployment model. This growth is being attributed to the increasing shift of enterprises toward hybrid and cloud-native environments where agility, scalability, and remote management are paramount.

Cloud-based IBN solutions facilitate centralized control, faster rollout of updates, and enhanced integration with analytics engines hosted on public and private clouds. The ability to leverage elastic compute and storage in cloud environments improves data processing for real-time intent verification and compliance monitoring.

Additionally, the need for operational resilience and business continuity planning is accelerating the preference for cloud-native IBN, particularly among enterprises undergoing digital transformation. The model’s lower upfront costs and subscription-based pricing structures further contribute to its rapid adoption across diverse industry verticals.

The IT & telecom sector is expected to lead the IBN market in 2025 with a 37.0% revenue share, driven by heightened demand for agile, policy-driven network environments capable of managing high data volumes and dynamic user expectations. Telecom operators are increasingly adopting IBN frameworks to automate network slicing, service provisioning, and anomaly detection in 5G and fiber rollouts.

In IT infrastructure, the pressure to enhance user experience while minimizing latency and downtime has pushed the adoption of intent-based architectures that align network behavior with application performance requirements. The sector's complex, multi-domain environments benefit significantly from AI-assisted root cause analysis and intent validation, reducing operational risk and cost.

With edge computing and virtualized infrastructure gaining traction, IBN is becoming central to managing orchestration and policy enforcement across distributed architectures in real time.

The Intent Based Networking market has been influenced by the need to improve network agility, automate configuration processes, and reduce human error across increasingly complex digital infrastructures. IBN platforms have been designed to interpret high-level business intent into automated network actions, providing real-time adaptability and enhanced performance oversight. Enterprises have adopted IBN to simplify network operations, meet compliance goals, and address fast-changing bandwidth and security requirements. Deployment has been concentrated in data centers, campus networks, and cloud-driven environments, where dynamic traffic management and policy enforcement are crucial.

The rising complexity of enterprise networks has primarily driven the adoption of IBN. Traditional manual network management practices have been challenged by hybrid infrastructures, multi-cloud environments, and application-specific bandwidth demands. IBN platforms have been implemented to abstract low-level configurations into intent-driven workflows, enabling policy deployment and traffic steering without human intervention. Self-healing capabilities and closed-loop automation have been prioritized to enhance service availability. Network administrators have utilized IBN dashboards to validate intent, detect anomalies, and simulate configuration changes before implementation. Integration with existing SDN and NFV platforms has improved orchestration and centralized policy control. Enterprises in sectors such as finance, healthcare, and manufacturing have relied on IBN to maintain application availability, enforce compliance, and align network behavior with evolving operational priorities. As a result, intent-based paradigms have replaced rule-based systems in complex network environments.

Artificial intelligence and machine learning technologies have played a pivotal role in advancing IBN capabilities. These algorithms have been employed to continuously analyze telemetry data, detect configuration drift, and recommend adjustments aligned with declared intent. Predictive analytics has allowed IBN systems to forecast network bottlenecks and propose preventive measures before performance issues arise. Machine learning models have facilitated policy optimization by correlating traffic patterns, user behavior, and application performance. Intent inference engines have been used to translate business-level directives into network-level policies across multiple domains. Root cause analysis functions powered by AI have reduced mean time to resolution by highlighting specific network segments responsible for failures. In cloud-native deployments, AI-integrated IBN platforms have supported dynamic scaling, multitenant policy enforcement, and security posture management. These advancements have enhanced operational agility while reducing manual configuration errors across both centralized and distributed architectures.

The evolution of IBN solutions has been shaped by the need to operate seamlessly across multi-domain and multi-vendor environments. Network administrators have sought IBN tools capable of interfacing with routers, switches, and firewalls from different manufacturers while maintaining uniform intent expression. Open APIs and standard data models have been developed to facilitate cross-platform integration and unified policy governance. Automation engines have been configured to execute intent-based directives across campus, WAN, cloud, and edge networks. Interoperability with identity and access management tools has enabled contextual policy enforcement based on user roles, devices, and locations. Software-defined approaches have allowed abstraction of underlying hardware, enabling intent translation across heterogeneous infrastructure. Service providers and global enterprises have increasingly adopted interoperable IBN systems to consolidate network management and reduce operational silos. This focus on vendor-agnostic frameworks has improved scalability, flexibility, and time-to-value for IBN implementations in real-world deployments.

Network security and compliance demands have significantly influenced IBN adoption strategies. Organizations have used IBN to codify security policies that reflect access controls, segmentation requirements, and regulatory guidelines. Intent-driven segmentation has been enforced to restrict lateral movement of threats and to isolate sensitive workloads. Real-time validation mechanisms have ensured that network configurations remain compliant with declared policies, minimizing the risk of drift. IBN systems have integrated with SIEM and threat intelligence platforms to receive alerts and automatically adapt firewall rules or access permissions. Regulatory standards such as HIPAA, PCI DSS, and GDPR have necessitated consistent network policy enforcement, which has been facilitated by IBN’s centralized control and audit capabilities. Automated compliance reporting features have assisted in audit preparation and incident response. As security posture management becomes more dynamic, IBN’s ability to align policy with organizational intent and changes in the threat landscape has positioned it as a strategic tool in enterprise network design.

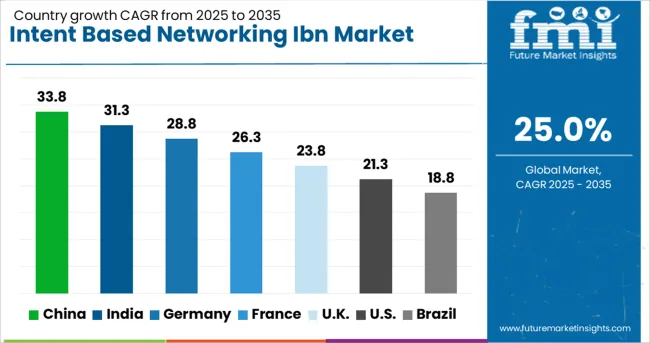

| Country | CAGR |

|---|---|

| China | 33.8% |

| India | 31.3% |

| Germany | 28.8% |

| France | 26.3% |

| UK | 23.8% |

| USA | 21.3% |

| Brazil | 18.8% |

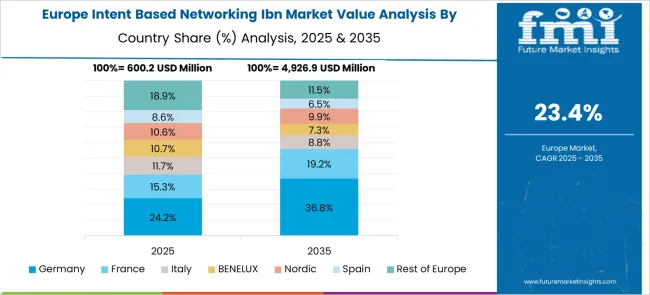

The IBN market is forecast to grow at a CAGR of 25.0% between 2025 and 2035. Market expansion is being catalyzed by growing demand for automated network operations, adaptive policy management, and the need for real-time intent verification. China, with a projected CAGR of 33.8%, leads the transformation, supported by widespread integration of AI-driven network orchestration in telecom and data centers. India follows at 31.3%, fueled by rising cloud-native enterprise deployments and investments in intelligent network management. Germany, with a CAGR of 28.8%, benefits from demand in manufacturing and smart infrastructure sectors. The UK is estimated at 23.8% due to increased enterprise migration to software-defined networks. The USA stands at 21.3%, backed by steady adoption in Fortune 500 companies and the broader IT services landscape. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to witness a CAGR of 33.8% in the IBN space between 2025 and 2035. Adoption has intensified across government-backed cloud migration projects and manufacturing digitization clusters. Domestic tech vendors are embedding policy inference engines within software-defined infrastructure stacks. Demand for AI-driven intent mapping across hybrid networks has grown as enterprises aim to minimize latency in edge-to-cloud flows. With strong emphasis on deterministic automation, pilot projects in the Yangtze River Delta are being scaled nationally. Vendor alliances have focused on closed-loop telemetry and intent assurance layers to manage dynamic routing.

India is estimated to grow at a CAGR of 31.3% from 2025 to 2035 with telecom operators, data center hubs, and public sector IT initiatives integrating IBN systems. Operators like Reliance Jio and Bharti Airtel have piloted intent-aware configurations to reduce downtime during service provisioning. Educational institutions and healthcare systems are leveraging natural language policy setups to manage complex multi-site connectivity. Startups are building NLP-integrated interfaces to simplify network automation for SMEs. Growth has also come from partnerships between cloud vendors and regional ISPs aiming to optimize QoS in rural connectivity efforts.

Germany is expected to expand at a CAGR of 28.8% through 2035 as IBN becomes integral to regulated industries including automotive, energy, and telecom. German firms are leading in integrating IBN into industrial IoT architectures to meet deterministic latency goals and ensure fault tolerance. Use cases in automotive testing labs and smart grids have demanded real-time policy enforcement tied to operational data. Enterprise network managers are increasingly using model-driven APIs to validate intent assurance loops. Cybersecurity policy enforcement through intent-based declarative automation has become a focal area for system integrators.

The United Kingdom is forecast to grow at a CAGR of 23.8% during the forecast timeline as financial institutions and healthcare trusts automate policy delivery across distributed networks. IBN systems have enabled seamless audit-ready policy enforcement in line with data residency and access control mandates. NHS technology partners have utilized predictive analytics embedded within IBN platforms to preempt network events. Cloud-native microservices firms have adopted these solutions for proactive service assurance in containerized environments. Growth is fueled by demand for verifiable, human-readable intent templates amid stricter compliance regimes.

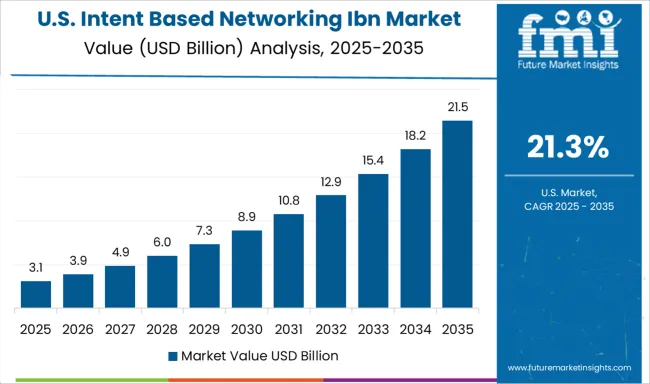

The United States is set to expand at a CAGR of 21.3% from 2025 to 2035 in the IBN domain, underpinned by growing adoption in hyperscale data centers and critical infrastructure operations. Tech giants have begun deploying intent-driven systems to manage inter-region routing complexity and streamline automated remediation. Public sector networks have piloted secure IBN deployments to govern zero-trust architecture compliance. Enterprises are increasingly blending IBN with AI observability tools to correlate intent gaps with behavioral anomalies. System integrators are creating cross-layer visibility dashboards tailored for policy-based network automation.

The competitive environment in the intent based networking market has been shaped by a mix of established networking giants and emerging vendors that are focused on automation and AI enabled solutions. Cisco Systems has remained a dominant force, expanding its IBN offerings through acquisitions and heavy research spending, while Juniper Networks has strengthened its position with Apstra to enhance multivendor interoperability.

IBM and Hewlett Packard Enterprise are leveraging their cloud and AI capabilities to integrate IBN with hybrid IT environments, targeting enterprise clients that require scalable and adaptive network operations. Huawei and Nokia are placing emphasis on large scale deployments in Asia and Europe, often competing on cost efficiency and integration with 5G infrastructure.

Forward Networks, Gluware, NetBrain, and Veriflow represent the more agile innovators, differentiating through advanced intent verification, network assurance, and policy driven orchestration tools that appeal to enterprises seeking granular control. Strategic priorities for these players include expanding into vertical specific use cases such as banking, healthcare, and government, building long term service contracts, and advancing AI driven policy engines.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Component | Software, Networking Hardware Components, and Service |

| Deployment Model | Cloud and On-Premise |

| Application | IT & Telecom, BFSI, Healthcare, Manufacturing, Government & Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems, Inc, Huawei Technologies Co., Ltd, Capgemini Group (Altran), Fortinet, Inc, Gluware, Inc, Indeni Ltd, and Juniper Networks Inc. |

| Additional Attributes | Dollar sales by component type and enterprise scale, demand dynamics across IT infrastructure, cloud data centers, and telecom environments, regional trends in deployment across North America, Europe, and Asia-Pacific, innovation in AI-driven policy automation, real-time analytics, and closed-loop network assurance, environmental impact of data processing energy usage and infrastructure consolidation, and emerging use cases in autonomous network management, hybrid cloud orchestration, and dynamic cybersecurity response systems. |

The global intent-based networking IBN market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the intent-based networking IBN market is projected to reach USD 27.3 billion by 2035.

The intent-based networking IBN market is expected to grow at a 25.0% CAGR between 2025 and 2035.

The key product types in intent-based networking IBN market are software, networking hardware components, _router, _switch, _firewall, _others, service, _professional service and _managed service.

In terms of deployment model, cloud segment to command 61.0% share in the intent-based networking IBN market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

High-Speed Connectivity – AI-Optimized Optical Networking

Multi-Cloud Networking Market Forecast Outlook 2025 to 2035

Time Sensitive Networking TSN Market Size and Share Forecast Outlook 2025 to 2035

Packet Optical Networking Market

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Virtual Dispersive Networking (VDN) Market Growth – Trends & Forecast 2025 to 2035

Software Defined Video Networking Market

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA