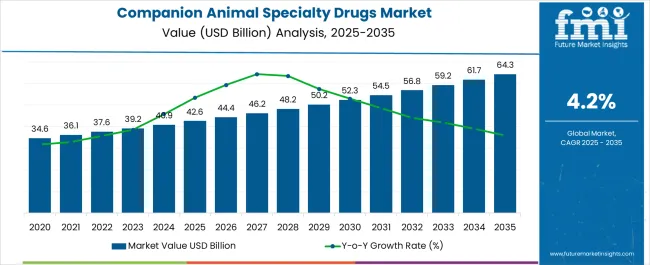

The Companion Animal Specialty Drugs Market is estimated to be valued at USD 42.6 billion in 2025 and is projected to reach USD 64.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Companion Animal Specialty Drugs Market Estimated Value in (2025 E) | USD 42.6 billion |

| Companion Animal Specialty Drugs Market Forecast Value in (2035 F) | USD 64.3 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The companion animal specialty drugs market is expanding steadily, supported by increased pet ownership, rising veterinary expenditures, and the humanization of pets driving demand for high-efficacy treatments. An upsurge in chronic conditions among companion animals, such as parasitic infections, arthritis, and dermatological disorders, has elevated the demand for targeted therapies and specialty drugs.

Advances in veterinary pharmaceutical research and growing awareness of preventive healthcare have encouraged early adoption of therapeutic regimens, particularly in urban households. Enhanced access to veterinary services, improved diagnostic capabilities, and regulatory support for fast-track drug approvals are also strengthening the market landscape.

The market outlook remains positive, with innovation in oral and topical drug formulations, and expanded distribution via digital platforms expected to reshape how specialty drugs are delivered and accessed.

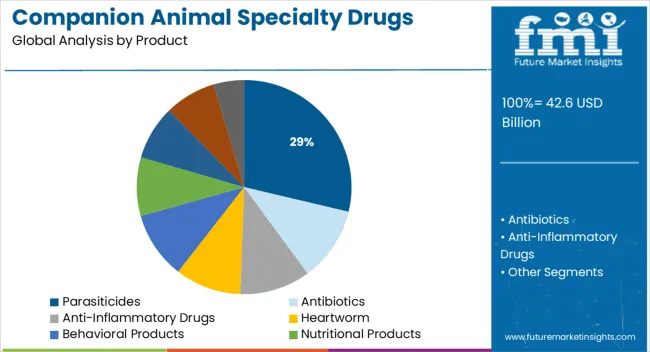

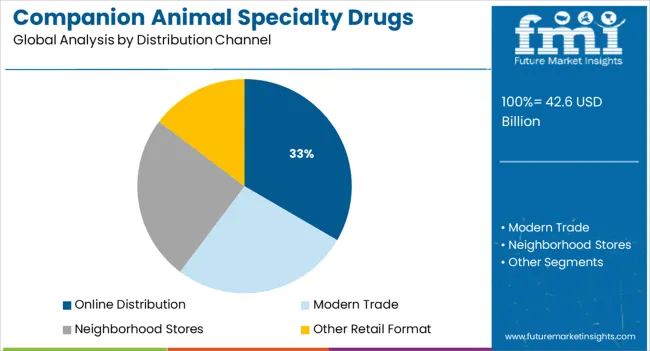

The market is segmented by Product and Distribution Channel and region. By Product, the market is divided into Parasiticides, Antibiotics, Anti-Inflammatory Drugs, Heartworm, Behavioral Products, Nutritional Products, Anti-Obesity Drugs, Skin Care Products, and Vaccines. In terms of Distribution Channel, the market is classified into Online Distribution, Modern Trade, Neighborhood Stores, and Other Retail Format. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Parasiticides are anticipated to account for 28.7% of the total market revenue in 2025, establishing them as the leading product category in the companion animal specialty drugs market. This leadership is being driven by the rising prevalence of internal and external parasites, including fleas, ticks, and heartworms, particularly among dogs and cats in both urban and rural settings.

Parasiticides have remained a primary preventive solution, with strong compliance among pet owners due to veterinarian recommendation and ease of administration. The availability of broad-spectrum formulations and long-acting dosages has further reinforced their adoption.

As awareness increases around zoonotic risks and pet hygiene, this segment is expected to maintain its lead, especially with the introduction of combination therapies and single-application monthly treatments.

Online distribution is expected to represent 33.4% of the total market share in 2025, making it the most prominent sales channel for companion animal specialty drugs. This growth is being driven by rising consumer preference for convenient, subscription-based delivery of pet medications and the proliferation of e-commerce platforms offering regulated veterinary products.

The online model allows for competitive pricing, easy access to prescription refills, and home delivery benefits that are increasingly valued by busy pet owners. Regulatory clarity around licensed online pharmacies and increased digitalization in veterinary practices have further legitimized this channel.

As pet owners increasingly seek digital health solutions and direct-to-door services, online distribution is positioned to lead ongoing transformation in how specialty veterinary drugs reach end users.

According to FMI's analysis, the global companion animal specialty drugs market is experiencing an unprecedented surge, driven by rising animal ownership and increasing demand for animal-derived products.

New veterinary drugs have been launched in recent years, and the ones identified to gain rapid traction are parasiticides. This drug segment accounted for a market share of 32.2% in the base year.

The rising prominence of parasiticides through the forecast period can be attributed to the fact that there is an upsurge in demand for animals and animal-derived products like meat, and the administration of parasiticides enables the boost in the quality of meat for consumption and is most sincerely improving the efficiency of livestock and health of companion animals.

At present, technological advances are being made in the administering of this newly launched specialty drug parasiticide such as collars, sprays, and dips, which in turn is expected to boost the market size of companion animal specialty drugs through the projection period.

| Report Attribute | Details |

|---|---|

| Companion Animal Specialty Drugs Market Value (2025) | USD 42.6 billion |

| Companion Animal Specialty Drugs Market Anticipated Value (2035) | USD 64.3 billio |

| Companion Animal Specialty Drugs Projected Growth Rate (2025 to 2035) | 4.2% |

The global market for companion animal specialty drugs generated huge demand in previous years. The forum registered a gradual CAGR of 5.42% during the period from 2020 to 2024. A number of factors are responsible for this substantial growth.

The expert analysts at FMI have analyzed that the development and approval of new drugs for the treatment of animal diseases are spurring the demand for companion animal specialty drugs. It is identified while studying the market in-details that the rising prevalence of obesity amongst pet dogs and other companion animals has resulted in higher sales of anti-obesity drugs.

Furthermore, significant growth in the number of animal healthcare and NGOs in recent years is also a key aspect majorly contributing to the acceleration of the companion animal specialty drugs. Moreover, some pet diseases also cause serious effects on humans and need to be mitigated for the prevention of infection, which is further identified to boost the market size of companion animal specialty drugs.

The vaccines segment accounted for more than USD 2.89 billion in the base year. The surging market valuation of this product type can be attributed to:

Technological advances are reported in every sector, including animal health, thereby driving the market progression. This segment is expected to account for a market share of 37.8% during the forecast period, growing at a CAGR of 6.8%. The reasons augmenting the growth of this segment are as follows:

The oral segment accounted for a market valuation of USD 2.86 billion in the base year. This route of administration is identified to lead through the forecast period due to:

Strategic Initiatives Coupled with Rising Digitalization Stir Up the Regional Landscapes

| Country/Region | United States |

|---|---|

| Statistics | The USA companion animal specialty drugs market dominated the global market in the base year, with more than 88% of the revenue share in the North American region. It is estimated that approximately 44% of households in the United States have a dog, and nearly 33% have a cat. |

| Key Propellants | The market in the USA is poised to accrue significant gains owing to the following factors:

|

| Country/Region | Brazil |

|---|---|

| Statistics | The market size for companion animal specialty drugs in Brazil was valued at USD 426 million in the base year. |

| Key Propellants | The factors contributing to the rapid progression of the market in Brazil are as follows:

|

| Country/Region | Germany |

|---|---|

| Statistics | Germany is projected to advance at a CAGR of 2.4% through the forecast period. The industry profit margin in Germany has increased over the past five years and is expected to continue growing steadily during the period from 2025 to 2035. |

| Key Propellants | The following aspects fuel the market dynamics in Germany:

|

How are the New Entrants Ceding a Silver Lining to the Forum?

The start-up companies in the companion animal specialty drugs market are continually innovating the drug to better cure companion animals, paying keen attention to faster recovery. The business models are changing due to evolving market dynamics and the start-up firms are in tandem with the pet humanization trends of the populace, investing heavily in common veterinary drugs.

5 Top Start-ups to Watch For

Wiggles

Funding: USD 9 Million

This firm is a provider of a wide range of veterinary care products and services. The company provides pet-focused supplements, foods, medicines, and ayurvedic and herbal care products. In addition to selling its products online, the company also provides vet on-call and grooming services.

FidoCure

Funding: USD 16 Million

An online platform offering health care services for dogs. It connects pet owners and vets. It sends the tumor sample from the original biopsy used to diagnose cancer for DNA sequencing. It identifies genomic mutations and suggests targeted therapy. The vet provides the treatment based on the suggestion given on the platform.

Itch

Funding: USD 16 Million

Itchpet has developed customized flea treatment products. The user can provide the details via the platform to develop a customized flea and tick treatment product. The products developed are flea, calm, dental, warmer, joint, and ear.

PetMedix

Funding: USD 37 Million

Developed monoclonal antibody therapeutics for pets. The company has developed Ky9 and Felyne platforms to generate therapeutic antibodies to treat cancer, inflammation, and other conditions.

Nexvet

Funding: USD 38 Million

Nexvet is focused on developing novel therapies for companion animal care. Its proprietary PETization platform allows for the rapid translation of monoclonal antibodies between species. The current focus is on chronic pain and inflammatory diseases in cats and dogs. Pipeline products include NV-01 for chronic pain associated with osteoarthritis in dogs, NV-02 for chronic pain in cats, and NV-08 targeting inflammation and atopic dermatitis in dogs.

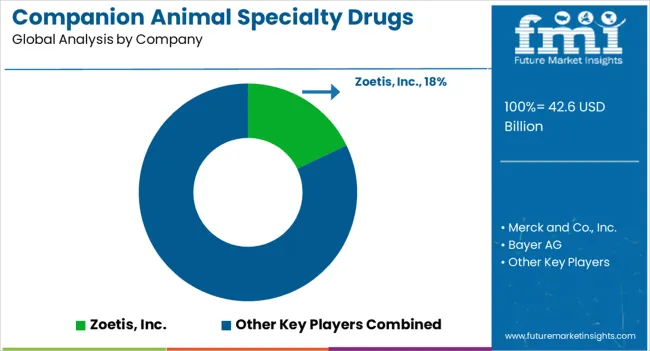

Strong Industry Players Revolutionize & Upscale the Market-o-comics

The global companion animal specialty drugs market is growing rapidly due to the presence of prominent key players as well as start-ups. Most companies are implementing new strategies for the development of innovative companion animal specialty drugs that cause fewer side effects. Consequently, these factors are anticipated to drive the global companion animal drugs market.

Leaders are focusing on new product launches and adopting inorganic growth strategies to remain competitive and sustain in the market. Partnerships with other players are enhancing product offerings, thus helping the companies to increase their customer base by providing superior quality products.

Recent Developments

Some of the key companies proliferating in the market are:

The global companion animal specialty drugs market is estimated to be valued at USD 42.6 billion in 2025.

The market size for the companion animal specialty drugs market is projected to reach USD 64.3 billion by 2035.

The companion animal specialty drugs market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in companion animal specialty drugs market are parasiticides, antibiotics, anti-inflammatory drugs, heartworm, behavioral products, nutritional products, anti-obesity drugs, skin care products and vaccines.

In terms of distribution channel, online distribution segment to command 33.4% share in the companion animal specialty drugs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The Companion Diagnostics Market is segmented by product, technology, application and end user from 2025 to 2035

Companion Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Pain Management Market Size and Share Forecast Outlook 2025 to 2035

The Companion Animal Vaccines Market is segmented by product, indication and end user from 2025 to 2035

Companion Animal Drugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Companion Animal Cardiac Drugs Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA