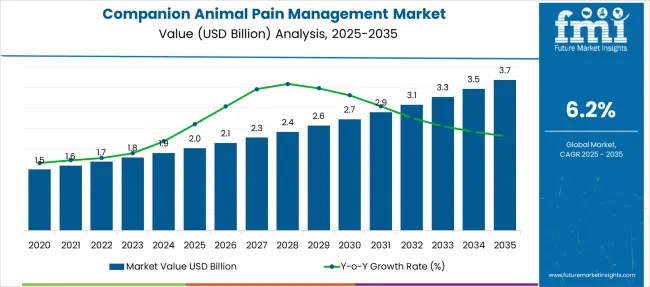

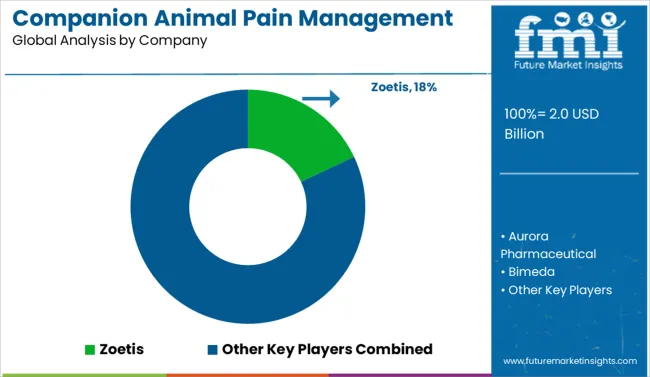

The Companion Animal Pain Management Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Companion Animal Pain Management Market Estimated Value in (2025E) | USD 2.0 billion |

| Companion Animal Pain Management Market Forecast Value in (2035F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The companion animal pain management market is experiencing consistent expansion, driven by the increasing awareness of pet health, rising pet adoption rates, and growing demand for long-term wellness care. Veterinary clinics and animal hospitals are witnessing heightened emphasis on chronic condition management, particularly for musculoskeletal disorders and age-related degeneration.

Advancements in veterinary diagnostics and an expanding pipeline of targeted pain relief solutions have elevated treatment outcomes and client trust. With pet owners increasingly willing to invest in preventive care and quality of life improvements, the market is benefitting from innovations in pharmacological therapies and non-invasive interventions.

Regulatory support for companion animal drug development, along with the adoption of pet insurance coverage in key markets, is expected to further accelerate the deployment of pain management solutions tailored to diverse animal needs..

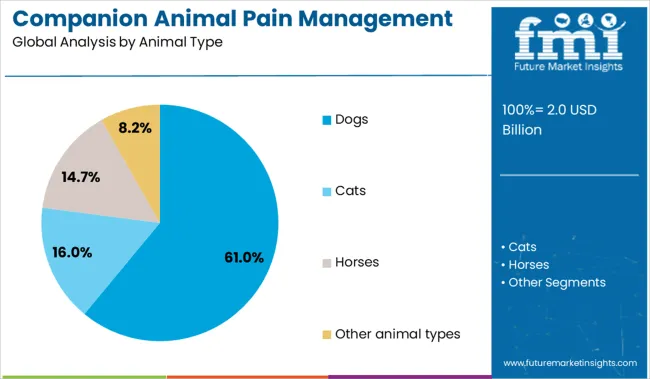

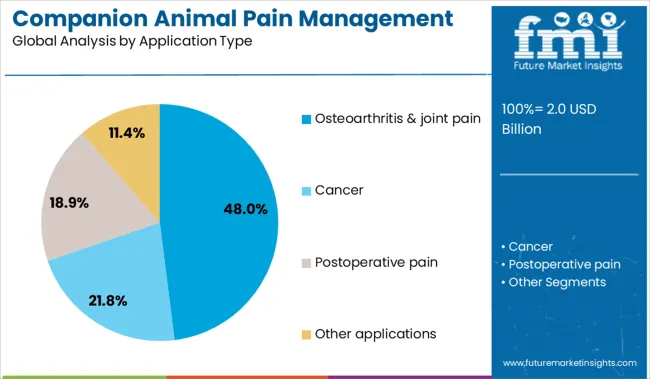

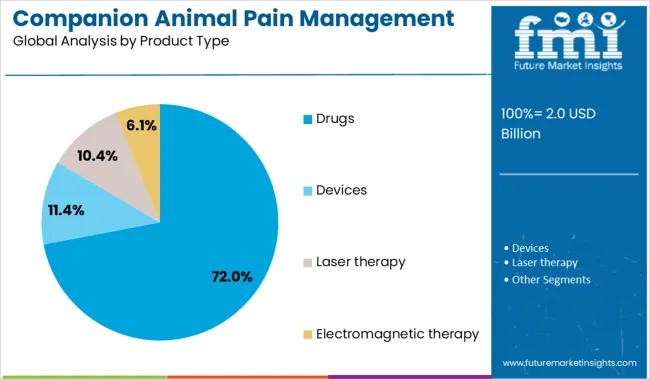

The companion animal pain management market is segmented by animal type, application type, and product type and geographic regions. The companion animal pain management market is divided by animal type into Dogs, Cats, Horses, and Other animal types. The companion animal pain management market is classified by application type into Osteoarthritis & joint pain, Cancer, Postoperative pain, and Other applications. Based on the product type, the companion animal pain management market is segmented into Drugs, Devices, Laser therapy, and Electromagnetic therapy. Regionally, the companion animal pain management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Dogs are expected to account for 61.00% of total market revenue in 2025, establishing them as the leading animal type in the companion animal pain management market. This dominance is attributed to their higher susceptibility to conditions such as osteoarthritis, hip dysplasia, and chronic joint issues, particularly among large and aging breeds.

The growing human-animal bond has led to increased veterinary visits and proactive pain treatment approaches. Canine-specific drug formulations and dosage technologies have evolved significantly, offering targeted relief with minimal side effects.

Furthermore, heightened public education and awareness campaigns around canine mobility and age-related discomfort are reinforcing the demand for long-term pain management solutions among dog owners..

Osteoarthritis and joint pain are projected to contribute 48.00% of the total revenue in 2025, marking this segment as the most prominent application in the companion animal pain management market. The prevalence of degenerative joint conditions among senior pets and those with active lifestyles has led to increased veterinary diagnoses and sustained demand for anti-inflammatory and analgesic therapies.

Advances in early detection, imaging techniques, and continuous monitoring technologies are enabling more personalized treatment strategies.

The shift toward long-term pain control over symptomatic relief has driven veterinarians to adopt multimodal approaches, combining pharmacological agents, physical therapy, and nutraceuticals to manage chronic conditions effectively..

Drugs are anticipated to dominate the market with a 72.00% revenue share in 2025, making them the primary product type used in companion animal pain management. This leading position is supported by a broad range of approved medications, including NSAIDs, opioids, and adjunctive therapies tailored for canine and feline use.

The rapid onset of action, regulatory clearance for specific animal use, and growing preference for veterinarian-prescribed medications have contributed to the strong performance of this segment. Innovations in drug delivery systems—such as chewables, injectables, and transdermal formulations—have improved treatment compliance and pet comfort.

As chronic pain management becomes central to long-term animal care plans, pharmaceutical solutions remain the most reliable and scalable option for both acute and maintenance treatments..

Growing pet adoption and emotional bonding have driven demand for chronic pain solutions, especially in aging animals. Regulatory easing and broader insurance coverage are expanding access to multimodal pain therapies globally.

A consistent rise in pet adoption across developed and emerging economies has been widely observed, resulting in increased spending on animal health and wellness. This trend has been significantly shaped by the emotional bonding between pet owners and their animals, with pain management products increasingly viewed as essential rather than optional. Veterinary clinics and animal hospitals have reported a growing demand for both pharmaceutical and non-pharmaceutical pain therapies. Premiumization of animal care has further led to a shift toward preventive treatments, particularly in high-income households. As a result, demand for chronic pain solutions in aging pets has surged, with long-acting injectables, NSAIDs, and neuropathic pain relief options gaining substantial traction across the global market.

Companion animal pain management has been influenced by evolving regulatory frameworks that have eased approval pathways for veterinary therapeutics. Pet insurance penetration, especially across the USA, UK, and Nordic markets, has played a significant role in encouraging broader access to pain management therapies. Increased veterinary practitioner awareness and continuing education on animal pain behaviors have also been emphasized as critical market accelerators. Shifts in prescription patterns have been observed, with multi-modal approaches being favored, especially in post-surgical and orthopedic cases. Extended product shelf lives and reduced dosing frequency are now being prioritized in product development pipelines. As awareness of chronic pain in animals continues to grow, a more holistic, compliance-driven market environment is being steadily reinforced.

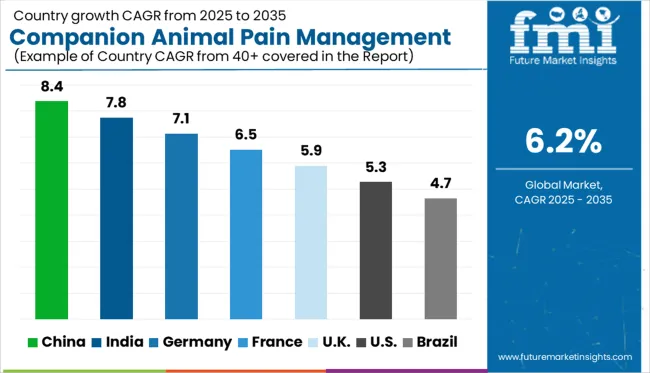

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The global companion animal pain management market is growing at a CAGR of 6.2% from 2025 to 2035, yet growth in several BRICS and OECD countries significantly surpasses this rate. China leads with a CAGR of 8.4%, underpinned by rising pet ownership, expanding veterinary infrastructure, and greater awareness of animal welfare. India follows at 7.8%, benefiting from a fast-growing urban pet population, increased veterinary pharmaceutical penetration, and domestic production of analgesic formulations. Germany, an OECD leader, is growing at 7.1%, driven by its mature pet healthcare system and ongoing innovation in pain therapies and orthopedics. The UK, at 5.9%, and the USA, at 5.3%, are growing below the global average due to market saturation and slower uptake of newer biologics. However, both continue to dominate in dollar sales and share. ASEAN countries are gaining traction with expanding veterinary services and urban pet trends. The report offers insights into 40+ countries, with the top five profiled here.

The CAGR in the United Kingdom rose from around 4.4% during 2020–2024 to 5.9% over 2025–2035, aided by broader access to insurance-backed veterinary pain care and stronger guidance from RCVS-recognized veterinary colleges. During 2020–2024, market expansion was relatively slow due to post-Brexit import constraints and limited adoption of multimodal therapies. However, by 2025, pet health insurance participation increased, especially in southern England, improving affordability and uptake. Veterinary hospitals began using opioid-sparing protocols for chronic pain, which led to rising interest in non-NSAID therapies. Pain awareness campaigns run by the BVA helped normalize early diagnosis. Demand also expanded in senior pet care services supported by retail-veterinary hybrid models.

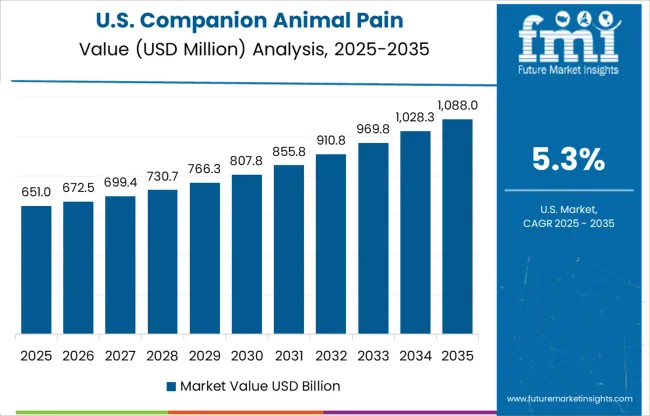

The CAGR in the United States climbed from 4.1% during 2020–2024 to 5.3% from 2025 to 2035, supported by wider clinical recognition of animal pain and stronger retail-channel integration. During the earlier period, fragmented veterinary care and low emphasis on preventive pain solutions limited market maturity. From 2025 onward, higher spending on aging pets, combined with changes in AVMA recommendations, accelerated prescription-based product sales. Veterinary telemedicine also enabled wider access to pain consultations in rural and suburban regions. OTC formulations, including joint-care blends, entered mainstream retail through partnerships with pharmacy chains.

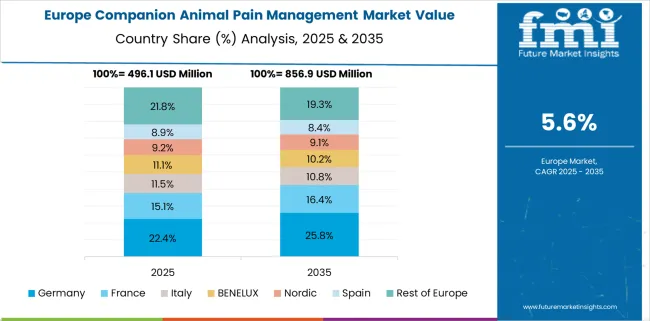

Germany’s CAGR improved from 6.0% in 2020–2024 to 7.1% between 2025 and 2035, as advanced pain protocols were integrated into standardized small animal care by tierkliniks and local veterinarians. Earlier, limitations in insurance uptake and decentralized veterinary practices had slowed adoption. Post-2025, a clearer regulatory pathway for long-acting pain relief injections and EU-backed data standardization enabled faster product introductions. The demand for neuropathic pain treatment rose, especially among small breeds and senior pets. Germany also saw a strong push from pharmacy-aligned clinics for nutraceutical pain solutions.

The CAGR in China grew from an estimated 6.6% during 2020–2024 to 8.4% in 2025–2035, supported by rapid veterinary infrastructure expansion and a pet ownership boom in urban centers. In the earlier phase, inconsistent pain diagnostics and lower public awareness had curbed product penetration. However, post-2025, pain management became a key component in companion animal health policies across cities like Shanghai, Guangzhou, and Chengdu. Institutional investment in animal hospitals rose sharply. Nutritional and herbal analgesics gained momentum, especially among middle-class pet parents who favor TCM-based support for chronic conditions.

India’s CAGR moved up from nearly 5.2% during 2020–2024 to 7.8% in 2025–2035, driven by increasing pet adoption in metros and mid-tier cities and expanding networks of urban veterinary clinics. During 2020–2024, the market remained underdeveloped due to low awareness of chronic pain symptoms and minimal insurance coverage. However, from 2025, rapid digitization of vet services and growing demand for herbal and affordable pain therapies helped transform access. Influencer-led campaigns on pet wellness also boosted consumer engagement. Partnerships between Indian pharma firms and vet chains improved domestic manufacturing of cost-effective NSAIDs and neuropathic agents.

In the companion animal pain management market, top players are addressing chronic and acute pain in pets through a combination of pharmaceutical, nutraceutical, and device-based therapies. Companies such as Zoetis, Elanco, and Merck have built strong portfolios of NSAIDs, long-acting injectables, and nerve pain therapies approved for dogs and cats. Boehringer Ingelheim and Ceva Santé Animale are enhancing their market presence through novel drug delivery systems and behavioral pain management integration. Dechra Pharmaceuticals and Virbac continue to expand their veterinary-focused distribution channels across Europe and North America, with attention to osteoarthritis and post-operative pain protocols. Mid-sized players like Aurora Pharmaceutical, Chanelle Pharma, Vetaquinol, and Norbrook are offering cost-competitive generics and regionally adapted products tailored to veterinary practices. Device-focused firms such as INDIBA, PainTrace, and Companion Animal Health are commercializing electrotherapy and bio-signal pain detection technologies. Vetnation Pharma and others are gaining traction with herbal, opioid-sparing, and neuropathic alternatives in Asia and Latin America.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Animal Type | Dogs, Cats, Horses, and Other animal types |

| Application Type | Osteoarthritis & joint pain, Cancer, Postoperative pain, and Other applications |

| Product Type | Drugs, Devices, Laser therapy, and Electromagnetic therapy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zoetis, Aurora Pharmaceutical, Bimeda, Boehringer Ingelheim, Ceva Sante Animale, Chanelle Pharma, Companion Animal Health, Dechra Pharmaceuticals, Elanco, INDIBA, Merck, Norbrook, PainTrace, Vetaquinol, Vetnation Pharma, and Virbac |

| Additional Attributes | Dollar sales, share by therapy type, adoption by species, growth by region, vet clinic trends, OTC vs Rx mix, reimbursement outlook, and innovation pipeline. |

The global companion animal pain management market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the companion animal pain management market is projected to reach USD 3.7 billion by 2035.

The companion animal pain management market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in companion animal pain management market are dogs, cats, horses and other animal types.

In terms of application type, osteoarthritis & joint pain segment to command 48.0% share in the companion animal pain management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The Companion Diagnostics Market is segmented by product, technology, application and end user from 2025 to 2035

Companion Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Cardiac Drugs Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Specialty Drugs Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Drugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Companion Animal Vaccines Market is segmented by product, indication and end user from 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA