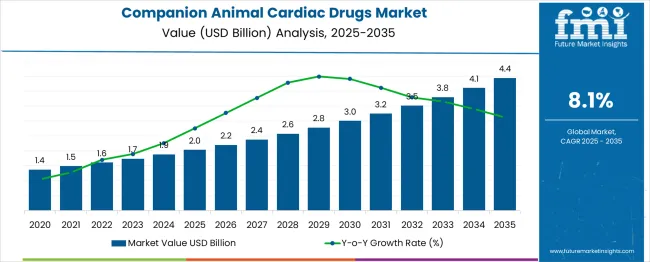

The companion animal cardiac drugs market is projected to reach 2 USD billion in 2025 and expand to 4.4 USD billion by 2035, representing a CAGR of 8.1% over the 2025-2035 period. Growth during this period is anticipated to be driven by rising prevalence of cardiac disorders in dogs and cats, increasing awareness among pet owners about cardiovascular health, and expanding veterinary healthcare services across major regions. Market expansion is supported by the development of advanced cardiac therapeutics, including ACE inhibitors, beta-blockers, antiarrhythmic agents, and diuretics tailored for companion animals. Over the first five-year block (2025–2030), the market is expected to rise from 2 USD billion to 2.6 USD billion, highlighting steady adoption of preventive and therapeutic cardiac interventions.

The mid-period phase (2030–2035) will witness accelerated uptake, with the market reaching 4.4 USD billion, as veterinary clinics increasingly integrate diagnostic tools and personalized treatment plans for pets with heart disease. Innovations in oral and injectable formulations, growth in pet insurance coverage, and enhanced veterinary practitioner training are anticipated to enhance drug accessibility and patient outcomes. Regional disparities will be observed, with North America and Europe leading in market penetration due to established veterinary infrastructure, while Asia-Pacific regions are expected to experience higher growth rates due to increasing pet ownership and rising disposable incomes.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2 billion |

| Forecast Value in (2035F) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The companion animal cardiac drugs market is shaped by several interconnected parent markets that collectively define its growth trajectory and product adoption. The veterinary pharmaceuticals segment contributes the largest share at 48%, driven by the rising prevalence of heart diseases in pets, particularly dogs, and the widespread use of medications such as pimobendan for managing congestive heart failure. The dogs segment holds 65%, as cardiac conditions like myxomatous mitral valve disease are highly common in small and aging dog breeds. The congestive heart failure (CHF) indication accounts for 38% of the market, reflecting the critical need for effective cardiac care in companion animals. Veterinary hospitals and clinics serve as the primary distribution channel, holding 45% of the market, due to their comprehensive medical services and access to specialized cardiac medications.

Collectively, these parent markets drive strong dollar sales and significant market share growth, with veterinary pharmaceuticals and the dogs segment leading over 70% of total demand. North America holds a dominant regional share of 38%, supported by high pet ownership rates, advanced veterinary healthcare infrastructure, and strong spending power for specialized treatments. The sector’s future trajectory is expected to strengthen with increasing awareness of pet health, rising investment in veterinary care, and the expansion of online pharmacy platforms that facilitate easy access to cardiac medications.

Market expansion is being supported by the increasing awareness about cardiovascular diseases in companion animals and the corresponding demand for effective therapeutic interventions. Modern pet owners are increasingly focused on preventive healthcare measures that can protect their pets against heart conditions, age-related cardiac decline, and congenital heart defects. The proven efficacy of specialized cardiac medications in managing conditions like congestive heart failure and arrhythmias makes them essential components in veterinary treatment protocols.

The growing focus on pet humanization and quality veterinary care is driving demand for advanced cardiac therapeutics that mirror human pharmaceutical standards. Pet owners' preference for comprehensive treatment options that combine multiple therapeutic benefits is creating opportunities for innovative drug formulations. The rising influence of veterinary specialists and cardiac-focused veterinary clinics is also contributing to increased product adoption across different pet demographics and age groups.

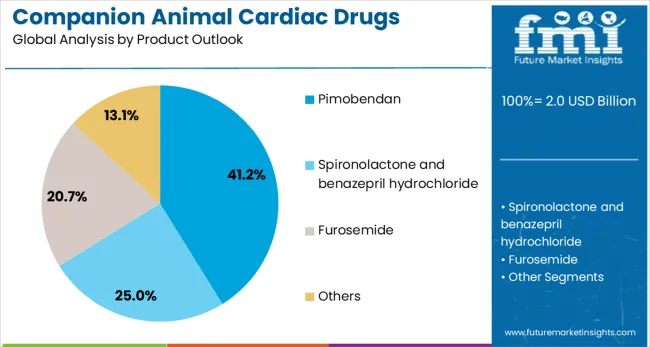

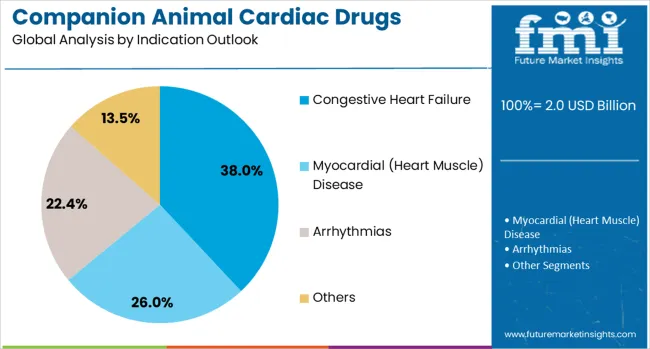

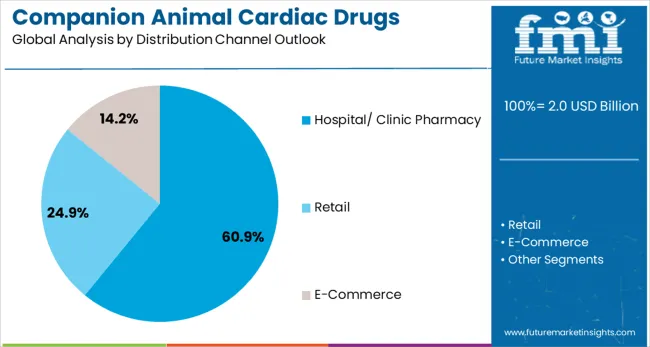

The market is segmented by animal type, product, indication, end-use, and distribution channel. By animal type, the market is divided into dogs, cats, horses, and others. Based on product, the market is categorized into pimobendan, spironolactone, and benazepril hydrochloride, furosemide, and others. In terms of indication, the market is segmented into congestive heart failure, myocardial (heart muscle) disease, arrhythmias, and others. By end-use, the market is classified into veterinary hospitals & clinics and others. By distribution channel, the market is divided into hospital/clinic pharmacy, retail, and e-commerce. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The dogs segment is projected to account for 65% of the companion animal cardiac drugs market in 2025, reaffirming its position as the category's primary focus. Dogs represent the largest population of companion animals globally and demonstrate higher susceptibility to various cardiac conditions, particularly as they age. The strong emotional bond between dog owners and their pets drives willingness to invest in comprehensive cardiac care, including specialized medications for heart conditions.

This segment benefits from extensive veterinary research focused on canine cardiovascular health and the development of dog-specific cardiac therapeutics. The increasing lifespan of dogs due to improved veterinary care creates a larger population of senior dogs requiring cardiac management. Breed-specific predispositions to heart conditions in popular dog breeds further support the demand for specialized cardiac medications, making dogs the central driver of market growth.

Pimobendan is projected to represent 41% of companion animal cardiac drug demand in 2025, underscoring its role as the preferred medication for canine heart failure management. This drug's unique mechanism of action, combining positive inotropic effects with vasodilation, makes it particularly effective for treating congestive heart failure in dogs. Veterinarians prefer pimobendan for its proven efficacy in improving cardiac contractility while reducing the workload on the heart.

The segment is supported by extensive clinical evidence demonstrating pimobendan's effectiveness in extending survival time and improving quality of life in dogs with heart conditions. The drug's favorable safety profile and ease of administration make it a first-line treatment choice for veterinary cardiologists. As awareness of pimobendan's benefits continues to grow among veterinary professionals, its dominance in the companion animal cardiac drugs market is expected to strengthen further.

The congestive heart failure indication is forecasted to contribute 38% of the companion animal cardiac drugs market in 2025, reflecting its status as one of the most common cardiac conditions affecting companion animals. Congestive heart failure represents a significant health concern for aging pets, particularly dogs, and requires comprehensive pharmaceutical management to maintain quality of life and extend survival.

This indication drives significant demand for specialized cardiac medications as it often requires long-term treatment protocols combining multiple therapeutic approaches. The segment benefits from growing awareness among pet owners about the signs and symptoms of heart failure, leading to earlier diagnosis and intervention. With improved diagnostic capabilities and increased veterinary expertise in cardiac care, the congestive heart failure segment continues to be a primary growth driver in the companion animal cardiac therapeutics market.

Veterinary hospitals and clinics are projected to account for 60% of the companion animal cardiac drugs market in 2025, establishing their role as the primary channel for cardiac medication dispensing and administration. These facilities serve as the main point of contact between pet owners and specialized cardiac care, providing diagnostic services, treatment planning, and ongoing monitoring of cardiac conditions in companion animals.

The segment's dominance is supported by the need for professional veterinary supervision when administering cardiac medications and the importance of regular monitoring for treatment effectiveness and potential side effects. Veterinary hospitals and clinics also provide the expertise necessary for proper dosage adjustments and combination therapy protocols, ensuring optimal therapeutic outcomes for pets with cardiac conditions.

Hospital and clinic pharmacies are forecasted to contribute 61% of the companion animal cardiac drugs market in 2025, reflecting their central role in the veterinary pharmaceutical supply chain. These pharmacies provide direct access to specialized cardiac medications immediately following diagnosis and treatment planning, ensuring continuity of care and proper medication management.

The segment benefits from the trust and confidence pet owners place in veterinary-recommended medications and the convenience of obtaining prescriptions directly from the treating facility. Hospital and clinic pharmacies also provide important counseling services regarding medication administration, potential side effects, and treatment compliance, making them essential partners in successful cardiac treatment outcomes for companion animals.

The companion animal cardiac drugs market is expanding due to the increasing prevalence of heart diseases such as congestive heart failure, cardiomyopathy, and valvular disorders in pets. Early detection through routine checkups and diagnostic imaging enables timely treatment, while growing awareness of preventive cardiac care, including diet and exercise, encourages proactive interventions by pet owners. Simultaneously, pharmaceutical companies are introducing advanced drug formulations, including long-acting oral medications, palatable chewables, and combination therapies that simplify dosing. Targeted therapies addressing multiple cardiac conditions and companion animal-specific pharmacokinetics enhance treatment efficacy and minimize side effects.

The companion animal cardiac drugs market is witnessing growth due to the rising prevalence of heart diseases in dogs, cats, and other pets. Conditions such as congestive heart failure, cardiomyopathy, and valvular disease are increasingly diagnosed by veterinary practitioners, driving demand for specialized cardiac medications. Pet owners are becoming more proactive in seeking treatment options to improve longevity and quality of life. Early detection through routine checkups and diagnostic imaging has enabled timely therapeutic interventions. The market is further supported by growing awareness of preventive cardiac care, including diet and exercise programs.

Pharmaceutical companies are focusing on developing advanced cardiac drug formulations tailored for companion animals. Efforts include long-acting oral medications, palatable chewable tablets, and combination therapies that simplify dosing regimens. Research is directed towards drugs that target multiple cardiac conditions simultaneously, including heart failure, arrhythmia, and hypertension. Companion animal-specific pharmacokinetics and dosing studies ensure efficacy and minimize adverse effects. Veterinary practitioners are adopting multimodal treatment strategies combining pharmacological therapy with lifestyle and dietary management.

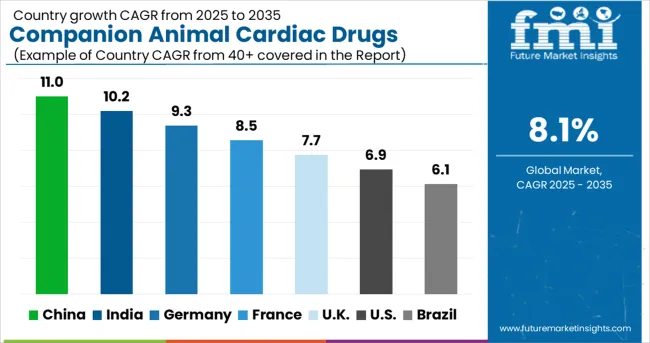

| Countries | CAGR (2025-2035) |

|---|---|

| China | 11% |

| India | 10.2% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

The global companion animal cardiac drugs market is projected to grow at a CAGR of 8.0% between 2025 and 2035. China leads this expansion with an 11.0% CAGR, driven by rising pet ownership, increasing awareness of animal cardiac health, and growing veterinary infrastructure. India follows at 10.2%, supported by a surge in companion animal adoption, expanding veterinary care access, and higher use of advanced cardiac medications. Germany shows growth at 9.3%, emphasizing high standards in veterinary care and innovation in cardiac therapeutics. France records 8.5%, fueled by advanced veterinary diagnostics and treatment protocols. The UK grows at 7.7%, focusing on preventive cardiac care and specialized veterinary programs. The USA stands at 6.9%, reflecting steady demand for prescription cardiac drugs.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

The companion animal cardiac drugs market in China is projected to grow at a CAGR of 11% from 2025 to 2035, driven by rising pet ownership, increasing awareness of animal health, and expansion of veterinary services. Urbanization and higher disposable incomes have accelerated the adoption of premium pet care products, including cardiac medications. Veterinary clinics are integrating advanced diagnostic tools, enabling early detection and management of heart diseases in dogs and cats. Pharmaceutical companies are developing species-specific drugs, including ACE inhibitors, beta-blockers, and diuretics, tailored for companion animals. E-commerce platforms and pet health subscription services are improving accessibility for urban pet owners. Collaborations between domestic and international veterinary pharmaceutical firms are expanding product availability and innovation in cardiac therapeutics.

Revenue from companion animal cardiac drugs in India is expanding at a CAGR of 10.2%, supported by increasing urbanization, growing disposable income, and rising awareness about pet healthcare needs. The country's young demographic profile and increasing adoption of Western pet care practices are driving demand for specialized veterinary treatments, including cardiac therapeutics. International pharmaceutical companies and domestic manufacturers are establishing distribution channels to serve the growing demand for quality veterinary medications. Rising awareness about preventive veterinary care and early intervention for cardiac conditions is creating opportunities for specialized medications across urban and metropolitan markets. Growing influence of veterinary professionals and pet healthcare education is driving treatment adoption among pet owners seeking comprehensive healthcare solutions for their animals.

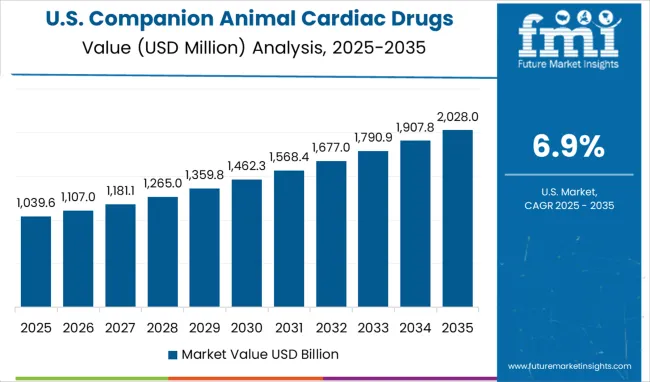

Demand for companion animal cardiac drugs in the USA is projected to grow at a CAGR of 6.9%, supported by mature veterinary healthcare infrastructure, high pet ownership rates, and established veterinary specialty services. American pet owners demonstrate a strong commitment to comprehensive veterinary care and a willingness to invest in specialized treatments for cardiac conditions. The market is characterized by advanced veterinary cardiology services, extensive pet insurance coverage, and sophisticated treatment protocols. Veterinary specialty clinics and cardiology departments are driving demand for advanced cardiac medications through expert diagnosis and comprehensive treatment planning.

The companion animal cardiac drugs market in Germany is projected to grow at a CAGR of 9.3% from 2025 to 2035, driven by a well-established veterinary infrastructure and high adoption of advanced pet healthcare solutions. German pet owners increasingly invest in preventive and therapeutic cardiac medications, supported by early disease detection using echocardiography and diagnostic biomarkers. Pharmaceutical firms are developing tailored drugs for companion animals, focusing on safety and efficacy. Collaboration between research institutions and veterinary hospitals is leading to innovation in cardiac therapies. The growth is also fueled by insurance coverage for pet healthcare and premium pet care services, enabling adoption of prescription drugs. Veterinary e-commerce channels and specialty pharmacies are improving access to cardiac drugs.

Revenue from companion animal cardiac drugs in the UK is projected to grow at a CAGR of 7.7% through 2035, supported by established veterinary specialty services, high pet insurance penetration, and a strong commitment to evidence-based veterinary medicine. British pet owners value professional expertise, treatment efficacy, and comprehensive care approaches for managing cardiac conditions in companion animals. Growth in veterinary specialty referral centers and cardiology services is increasing access to advanced cardiac treatments across diverse geographic regions.

The companion animal cardiac drugs market in France is forecasted to grow at a CAGR of 8.5% from 2025 to 2035, supported by rising pet ownership and increasing emphasis on preventive healthcare. Veterinary hospitals and clinics are expanding cardiac diagnostic and treatment services, including echocardiography and ECG monitoring. Pharmaceutical companies are introducing species-specific ACE inhibitors, diuretics, and beta-blockers to manage common cardiac conditions in dogs and cats. Awareness campaigns by veterinary associations educate pet owners about early detection and ongoing treatment of cardiac diseases. Specialty pet pharmacies and online distribution channels enhance drug accessibility, particularly in urban regions. Collaboration between global and domestic manufacturers further supports innovation in formulations and delivery methods, ensuring effective therapy and improved quality of life for companion animals.

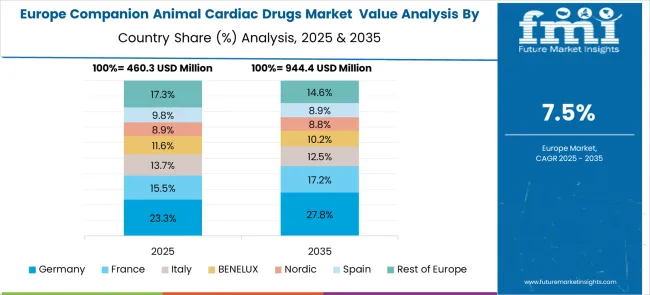

The companion animal cardiac drugs market in Europe demonstrates mature development across major economies with Germany showing a strong presence through its advanced veterinary healthcare infrastructure and high pet ownership rates, supported by veterinary practices emphasizing comprehensive cardiac care and preventive treatment protocols for companion animals. France represents a significant market driven by its strong veterinary education system and sophisticated understanding of animal cardiology, with veterinary professionals and pharmaceutical companies developing innovative cardiac therapeutics that combine clinical efficacy with improved quality of life for pets.

The UK exhibits considerable growth through its established veterinary specialty services and pet insurance penetration, with veterinary cardiologists and specialty clinics leading the adoption of advanced cardiac medications and comprehensive treatment protocols. Italy and Spain show expanding interest in specialized veterinary care, particularly in premium cardiac therapeutics targeting specific conditions like congestive heart failure and arrhythmias. BENELUX countries contribute through their focus on high-quality veterinary services and preventive healthcare approaches, while Eastern Europe displays growing potential driven by increasing pet ownership and expanding access to specialized veterinary medications across diverse distribution channels.

Market players are focusing on research and development, regulatory compliance, clinical trials, and the expansion of distribution networks to ensure safe, effective, and accessible cardiac therapeutics for companion animals. Innovation in drug formulation, targeted therapies for specific cardiovascular conditions, and development of species-specific treatments are central to strengthening market positions. Strategic engagement with veterinary professionals, training programs, and enhanced market access initiatives is increasingly influencing product adoption and market penetration.

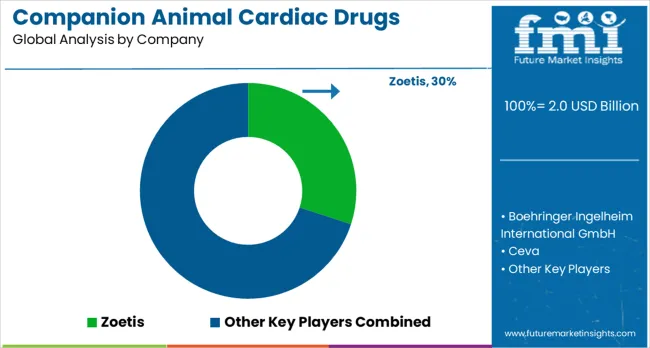

Zoetis, headquartered in the USA, leads the market with a 30% global value share, offering a broad portfolio of cardiac medications that support both canine and feline cardiovascular health. Its focus on evidence-based therapies, professional veterinary education, and global distribution ensures widespread adoption and clinical reliability. Boehringer Ingelheim, Germany-based, emphasizes innovation in cardiac therapeutics, investing in clinical research, veterinary education programs, and targeted drug development to enhance treatment outcomes. Ceva, France-based, provides specialized animal health solutions, including cardiovascular drugs, supported by global distribution networks and tailored veterinary support services. Elanco, USA-based, combines a comprehensive companion animal health portfolio with strategic initiatives to expand access to cardiac therapeutics across veterinary clinics worldwide.

Other significant players focus on regional specialization and professional engagement. Virbac, France-based, prioritizes veterinary-exclusive distribution and the development of strong professional relationships to optimize cardiac drug accessibility. Dechra Pharmaceuticals, UK-based, emphasizes companion animal therapeutic areas, providing specialized pharmaceuticals that address both common and complex cardiovascular conditions. Bimeda Corporate and Biogénesis Bagó deliver regional expertise in animal health and pharmaceutical distribution, supporting veterinary professionals with locally adapted solutions. Merck & Co. Inc. and Vetoquinol SA maintain comprehensive animal health portfolios, leveraging established veterinary networks and global market presence to ensure reliable delivery of cardiac medications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2 billion |

| Animal Type | Dogs, Cats, Horses, Others |

| Product | Pimobendan, Spironolactone, and benazepril hydrochloride, Furosemide, Others |

| Indication | Congestive Heart Failure, Myocardial (Heart Muscle) Disease, Arrhythmias, Others |

| End-use | Veterinary Hospitals & Clinics, Others |

| Distribution Channel | Hospital/Clinic Pharmacy, Retail, E-Commerce |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Zoetis, Boehringer Ingelheim, Ceva, Elanco, Virbac, Dechra Pharmaceuticals, Bimeda Corporate, Biogénesis Bagó, Merck & Co. Inc., and Vetoquinol SA |

| Additional Attributes | Dollar sales by cardiac drug type and therapeutic indication, regional demand trends, competitive landscape, veterinary prescribing preferences, integration with specialty veterinary services, innovations in drug formulation and delivery systems, regulatory compliance, and approval processes |

The global companion animal cardiac drugs market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the companion animal cardiac drugs market is projected to reach USD 4.4 billion by 2035.

The companion animal cardiac drugs market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in companion animal cardiac drugs market are dogs, cats, horses and others.

In terms of product outlook, pimobendan segment to command 41.2% share in the companion animal cardiac drugs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The Companion Diagnostics Market is segmented by product, technology, application and end user from 2025 to 2035

Companion Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Pain Management Market Size and Share Forecast Outlook 2025 to 2035

The Companion Animal Vaccines Market is segmented by product, indication and end user from 2025 to 2035

Companion Animal Drugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Companion Animal Specialty Drugs Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA