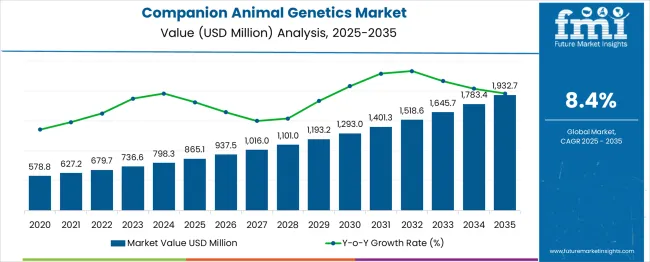

The companion animal genetics market is estimated to reach 865.1 USD million in 2025 and is projected to expand to 1,932.7 USD million by 2035, exhibiting a CAGR of 8.4% over the 2025–2035 period. The absolute dollar opportunity over this decade is substantial, driven by growing demand for genetic testing, breeding solutions, and disease risk assessment in dogs, cats, and other companion animals. During the early phase (2025–2030), the market is expected to progress from 865.1 USD million to approximately 1,101.0 USD million, increasing adoption of DNA-based diagnostics, genotyping services, and precision breeding tools among veterinary clinics and pet owners.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 865.1 million |

| Forecast Value in (2035F) | USD 1,932.7 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

The companion animal genetics market is shaped by several interconnected parent markets that collectively define its growth trajectory and adoption across industries. The genetic testing services segment contributes the largest share at 48%, driven by increasing demand for breed identification, parentage verification, and health screening in pets. The genomic/genetic testing segment follows closely, holding 43%, as advancements in DNA analysis enable early detection of inherited diseases, allowing for better-informed breeding decisions. The assistive reproductive technologies segment accounts for 9%, with techniques like artificial insemination and embryo transfer facilitating the propagation of desirable traits in companion animals. North America leads the market with a 38% share, attributed to high pet ownership rates, advanced veterinary healthcare infrastructure, and the strong spending capacity of pet owners on specialized genetic services.

These parent markets drive strong dollar sales and significant market share growth, with genetic testing services and genomic/genetic testing leading over 90% of total demand. The sector’s future trajectory is anticipated to gain further momentum from technological advancements, the rise of AI-driven genetic analysis tools, and the increasing adoption of personalized pet care. Adoption is expected to accelerate in emerging regions where digital transformation initiatives, industrial expansion, and infrastructure modernization fuel the demand for genetic services.

Market expansion is being supported by the increasing pet ownership globally and the corresponding demand for advanced veterinary care that includes genetic health screening and personalized medicine approaches. Modern pet owners are increasingly focused on providing comprehensive healthcare for their companion animals, including proactive measures to identify genetic predispositions and optimize care plans. Companion animal genetics testing's proven ability to identify disease risks, confirm breeding decisions, and guide treatment strategies makes it an essential technology for modern veterinary medicine and responsible pet ownership.

The growing focus on preventive veterinary care and personalized animal medicine is driving demand for genetic testing services that can provide detailed information about breed composition, health risks, and trait characteristics. Pet owners' preference for services that combine scientific accuracy with practical healthcare guidance is creating opportunities for comprehensive genetic testing platforms. The rising influence of pet humanization trends and increasing veterinary expenditures are also contributing to the expanded adoption of genetic testing services across diverse pet populations and geographic markets.

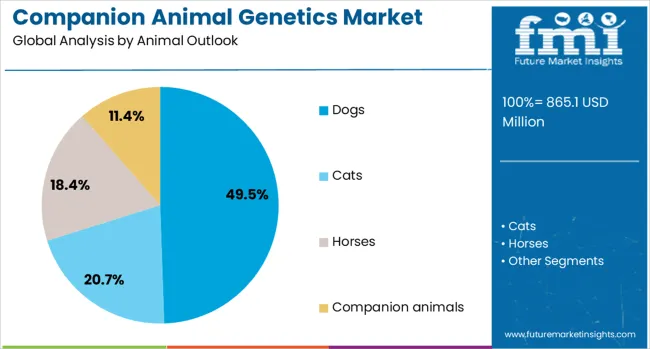

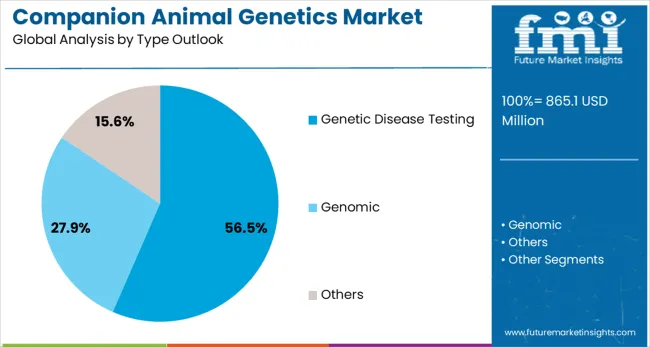

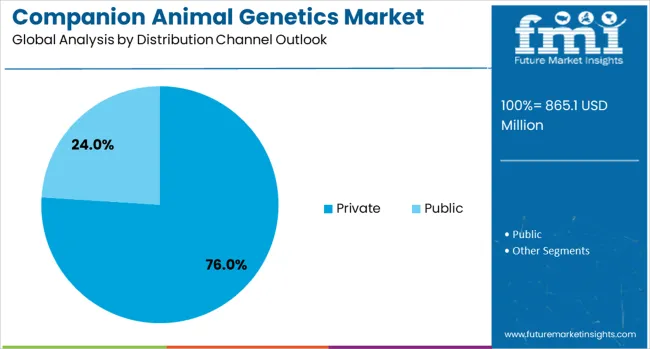

The market is segmented by animal type, test type, distribution channel, and region. By animal type, the market is divided into dogs, cats, horses, and companion animals. Based on test type, the market is categorized into genetic disease testing, genomic, and others. In terms of distribution channel, the market is segmented into private and public. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The dogs segment is projected to account for 49% of the companion animal genetics market in 2025, reaffirming its position as the dominant animal category. Pet owners increasingly invest in genetic testing for dogs due to their popularity as companion animals and the extensive breed diversity that creates varied genetic health risks and characteristics. Dog genetic testing's proven utility in identifying breed composition, health predispositions, and trait inheritance directly addresses owner' needs for a comprehensive understanding of their pets' genetic makeup and healthcare requirements.

This animal type forms the foundation of companion animal genetics testing, as it represents the largest pet population with established testing protocols and extensive genetic databases supporting accurate analysis and interpretation. Veterinary genetics company investments in canine genetic research and breed-specific testing panels continue to strengthen the adoption of dog genetic testing. With pet owners prioritizing their dogs' health and wellness, canine genetic testing aligns with both preventive healthcare objectives and responsible ownership practices, making it the central component of companion animal genetics services.

Genetic disease testing is projected to represent 57% of companion animal genetics demand in 2025, underscoring its critical role as the primary application for genetic analysis in veterinary care. Pet owners and veterinarians prefer genetic disease testing for its ability to identify hereditary conditions, assess disease risks, and guide preventive care strategies that can improve animal health outcomes. Positioned as an essential tool for proactive healthcare management, genetic disease testing offers both diagnostic benefits and preventive care advantages.

The segment is supported by growing awareness about hereditary diseases in companion animals and increasing focus on preventive veterinary medicine that requires early identification of genetic health risks. Genetic disease testing enables informed breeding decisions and family planning that can reduce the incidence of inherited conditions. As veterinary care becomes more personalized and prevention-focused, genetic disease testing will continue to dominate applications while supporting comprehensive animal health management and responsible breeding practices.

The private distribution channel segment is forecasted to contribute 76% of the companion animal genetics market in 2025, reflecting the predominant role of private veterinary practices and commercial testing companies in delivering genetic testing services. Pet owners increasingly access genetic testing through private veterinary clinics and direct-to-consumer platforms that provide convenient and comprehensive testing services. This aligns with companion animal healthcare trends that emphasize accessible and personalized service delivery through private sector providers.

The segment benefits from established private veterinary practice infrastructure and growing consumer preference for convenient testing options that can be accessed directly or through trusted veterinary relationships. With proven service quality and comprehensive testing menus, private distribution channels serve as the primary access point for companion animal genetic testing, making them a critical foundation for market growth and service accessibility.

The companion animal genetics market is being significantly influenced by the growing demand for breed-specific genetic testing and increased investment in veterinary genetic research. Pet owners are seeking detailed insights into hereditary conditions and disease predispositions, prompting veterinary clinics and diagnostic laboratories to offer advanced multi-marker testing panels. These insights support early detection, preventive care, and informed breeding decisions to reduce the prevalence of genetic disorders. Collaborations between companies, universities, and research institutions are driving innovation through the development of new genetic markers, diagnostic kits, and functional genomics solutions. Strategic partnerships also enable regional expansion, improved service offerings, and wider adoption of genetic testing in companion animal healthcare.

The companion animal genetics market is increasingly driven by the demand for breed-specific genetic testing. Pet owners are seeking insights into hereditary conditions, predisposition to diseases, and health risks in dogs, cats, and other companion animals. Veterinary clinics and diagnostic labs are offering advanced testing panels that analyze multiple genetic markers, enabling early detection and preventive care. Breed-specific insights also assist breeders in making informed breeding decisions to reduce disease prevalence.

The companion animal genetics market benefits from increased investment in veterinary genetic research and partnerships between companies, universities, and research institutions. Collaborative initiatives focus on identifying disease-related genes, developing new genetic markers, and improving testing accuracy. Companies are leveraging research insights to introduce innovative diagnostic kits, breed-specific panels, and functional genomics solutions. Strategic alliances allow access to regional markets, enhance service offerings, and expand testing capabilities.

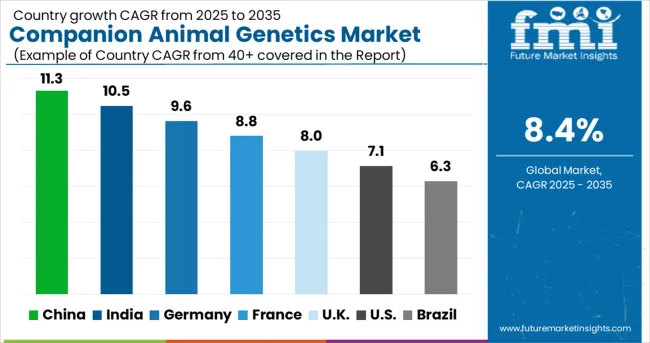

| Countries | CAGR (2025-2035) |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.6% |

| France | 8.8% |

| UK | 8% |

| USA | 7.1% |

| Brazil | 6.3% |

The global companion animal genetics market is projected to grow at a CAGR of 8.0% between 2025 and 2035. China leads this expansion with an 11.3% CAGR, driven by increasing adoption of genetic testing, rising awareness of breed-specific health risks, and growing veterinary genomics services. India follows at 10.5%, supported by expanding veterinary infrastructure, rising companion animal ownership, and growing use of advanced genetic diagnostics. Germany shows growth at 9.6%, emphasizing precision veterinary care and integration of genetic technologies. France records 8.8%, fueled by preventive animal health programs and genomic research. The UK grows at 8.0%, focusing on genetic testing for inherited conditions and breed optimization. The USA stands at 7.1%, reflecting steady demand for DNA-based diagnostics and breed management solutions.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

Revenue from companion animal genetics in China is projected to exhibit exceptional growth with a CAGR of 11.3% through 2035, driven by rapidly increasing pet ownership and growing middle-class spending on premium pet care services. The country's expanding pet care market and rising awareness about genetic testing benefits are creating significant demand for companion animal genetics services. Major international and domestic genetics companies are establishing comprehensive capabilities to serve the growing pet owner population and veterinary market. Government support for pet industry development and animal welfare improvement is driving demand for advanced genetic testing services throughout major metropolitan areas and developing pet markets.

The companion animal genetics market in India is anticipated to grow at a CAGR of 10.5% from 2025 to 2035, driven by increasing awareness of genetic disorders in pets and growing demand for personalized veterinary care. Veterinary clinics and diagnostic laboratories are adopting genomic testing for breed verification, disease predisposition, and tailored treatment plans. Partnerships between domestic companies and international genetics providers are expanding the availability of advanced test panels. Urban pet owners are showing higher adoption of genetic testing services, particularly for pedigree dogs and cats. Awareness campaigns by veterinary associations and pet health organizations are educating owners on preventive and diagnostic genetic services. E-commerce platforms and tele-veterinary consultation services enable convenient access to genetic testing kits across urban and semi-urban regions.

Demand for companion animal genetics in Germany is projected to grow at a CAGR of 9.6%, supported by the country's animal health leadership and strong focus on veterinary medicine excellence and advanced pet care services. German pet owners and veterinarians consistently demand high-quality genetic testing services that meet stringent accuracy requirements and provide comprehensive health and breed analysis. Animal health excellence and veterinary innovation leadership are driving demand for advanced genetic testing solutions that combine scientific accuracy with comprehensive breed and health analysis for dogs, cats, and other companion animals. Pet care quality focus and animal welfare priorities are supporting adoption of genetic testing services that provide enhanced health risk assessment and personalized care recommendations for optimal animal health and wellbeing.

The companion animal genetics market in France is anticipated to grow at a CAGR of 8.8% from 2025 to 2035, fueled by rising pet ownership, growing preventive healthcare adoption, and increased availability of genetic testing services. Veterinary clinics and specialty diagnostic centers provide testing for breed identification, hereditary disease detection, and personalized wellness planning. Companies are introducing advanced genomic panels, including tests for predisposition to cardiac, orthopedic, and metabolic disorders. Tele-veterinary services and online delivery of genetic kits improve accessibility for pet owners across urban and semi-urban regions. Awareness programs conducted by veterinary associations educate owners about proactive genetic health management. Partnerships between local and international biotech companies ensure access to cutting-edge technologies and contribute to innovation in companion animal genetics.

The companion animal genetics market in the United Kingdom is projected to grow at a CAGR of 8% from 2025 to 2035, supported by increasing pet ownership, preventive veterinary care, and growing demand for personalized health solutions. Genetic testing services are widely used for breed verification, hereditary disease detection, and risk management in dogs and cats. Veterinary clinics and diagnostic laboratories are integrating advanced sequencing technologies, while tele-veterinary platforms and online test kits are expanding accessibility. Insurance coverage for preventive veterinary services further encourages adoption of genetic testing. Biotech firms and veterinary institutions collaborate to develop species-specific genomic panels and improve diagnostic accuracy. Public awareness campaigns and educational programs by veterinary associations enhance understanding of genetic health management among pet owners.

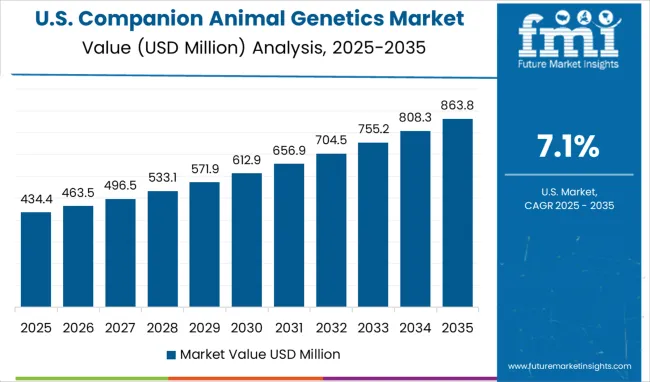

The companion animal genetics market in the United States is forecasted to grow at a CAGR of 7.1% from 2025 to 2035, driven by mature veterinary infrastructure, rising pet healthcare spending, and growing demand for precision care. Genetic testing is widely adopted for disease risk assessment, breed identification, and personalized care plans. Veterinary hospitals, specialty clinics, and diagnostic labs offer advanced genomic panels and sequencing services. Insurance coverage and premium veterinary services encourage adoption, particularly among urban pet owners. Collaboration between biotech companies and veterinary institutions drives innovation in companion animal genetic diagnostics. Tele-veterinary services and online genetic test kits provide convenient access to services across urban and suburban areas, enhancing market reach and awareness.

The companion animal genetics market in Brazil is anticipated to grow at a CAGR of 6.3% from 2025 to 2035, supported by increasing pet ownership and rising awareness of genetic health among pet owners. Veterinary clinics and diagnostic laboratories are expanding genetic testing services for breed identification, hereditary disease detection, and wellness planning for dogs and cats. International and domestic biotech companies are providing advanced genomic panels and sequencing technologies. Awareness campaigns educate pet owners on the importance of genetic health and preventive care. Tele-veterinary platforms and online delivery of test kits enhance accessibility in urban centers, while collaborations between veterinary institutions and service providers promote technological innovation. Market growth is also supported by the rising popularity of pedigree pets and preventive health practices in companion animals.

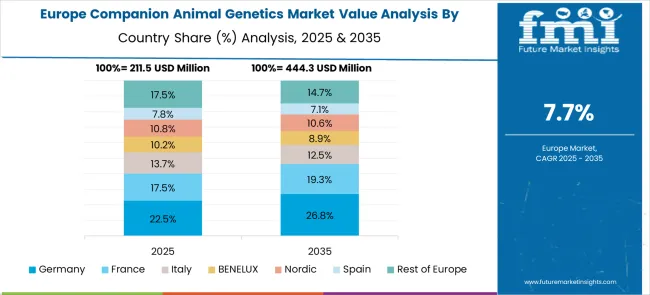

The companion animal genetics market in Europe demonstrates advanced development across major economies, with Germany showing a strong presence through its established veterinary care infrastructure and focus on animal health and welfare, supported by pet owners leveraging veterinary expertise to implement comprehensive genetic testing programs that emphasize preventive care, breed identification, and health risk assessment across dogs, cats, and other companion animals. France represents a significant market driven by its strong pet ownership culture and sophisticated understanding of animal genetics and veterinary medicine, with pet owners focusing on advanced genetic testing solutions that combine French veterinary expertise with cutting-edge genetic technologies for enhanced animal health management and breeding decisions in companion animal care.

The UK exhibits considerable growth through its focus on animal welfare and advanced veterinary services, with strong adoption of companion animal genetic testing across veterinary practices, breeding organizations, and pet owner communities. Germany and France show expanding interest in genomic applications, particularly in breed health databases and personalized veterinary medicine approaches. BENELUX countries contribute through their focus on animal welfare and advanced veterinary care delivery. At the same time, Eastern Europe and Nordic regions display growing potential driven by increasing pet ownership and expanding veterinary genetics capabilities.

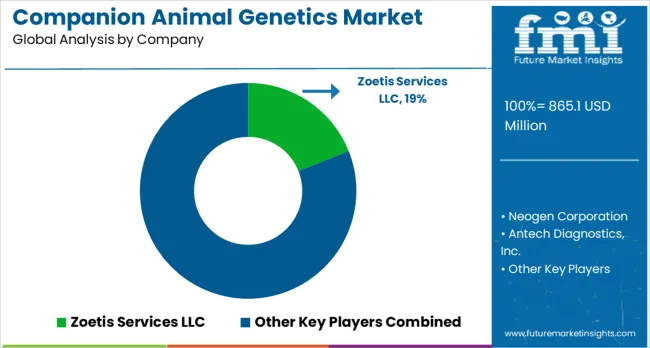

Established veterinary diagnostics companies, specialized pet genetics providers, and emerging direct-to-consumer (DTC) platforms are the main competitive forces shaping this market. Companies are increasingly focusing on expanding their genetic test portfolios, improving analytical accuracy, and integrating results into actionable insights for veterinarians and pet owners.

Zoetis Services LLC remains a dominant player, leveraging its extensive veterinary network and research-backed genetics services to provide solutions spanning disease risk assessment, trait prediction, and breed verification. Its services are designed to integrate seamlessly into veterinary practice workflows, ensuring clinical utility and fostering adoption among practitioners. Neogen Corporation provides a strong presence in breeding-focused genetic tests, offering health, lineage, and trait-specific screenings that support breeders in making informed decisions. Antech Diagnostics Inc. delivers broad veterinary diagnostic services, including advanced genetic testing for disease susceptibility, carrier detection, and breed identification, enhancing clinical decision-making.

Emerging DTC platforms, including Embark Veterinary Inc. and Basepaws, have driven consumer awareness by offering accessible, easy-to-use tests. Embark focuses primarily on canine genetics, providing breed identification, ancestry tracing, and health risk evaluation, while Basepaws specializes in feline genomics, offering insights into breed, genetic mutations, and predisposition to hereditary conditions. Academic and research-focused players such as UC Davis Veterinary Genetics Laboratory (VGL) emphasize scientifically rigorous testing, supporting both clinical applications and research studies. Other specialized providers like ZOOGEN, Orivet Genetic Pet Care, Animal Genetics Inc., and Generatio GmbH offer niche solutions with tailored testing for specific breeds, rare genetic disorders, or advanced genomic analysis, often combined with educational resources for veterinarians and pet owners.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 865.1 million |

| Animal Type | Dogs, Cats, Horses, Companion animals |

| Test Type | Genetic Disease Testing, Genomic, Others |

| Distribution Channel | Private, Public |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Zoetis Services LLC, Neogen Corporation, Antech Diagnostics Inc., Embark Veterinary Inc., Basepaws, UC Davis Veterinary Genetics Laboratory (VGL), ZOOGEN, Orivet Genetic Pet Care, Animal Genetics Inc., and Generatio GmbH |

| Additional Attributes | Dollar sales by animal type and test type category, regional demand trends, competitive landscape, buyer preferences for genetic disease testing versus genomic analysis, integration with veterinary care, innovations in direct-to-consumer platforms, AI-powered analysis, and comprehensive breed database development |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global companion animal genetics market is estimated to be valued at USD 865.1 million in 2025.

The market size for the companion animal genetics market is projected to reach USD 1,932.7 million by 2035.

The companion animal genetics market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in companion animal genetics market are dogs, cats, horses and companion animals.

In terms of type outlook, genetic disease testing segment to command 56.5% share in the companion animal genetics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The Companion Diagnostics Market is segmented by product, technology, application and end user from 2025 to 2035

Companion Animal Cardiac Drugs Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Specialty Drugs Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Pain Management Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Drugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Companion Animal Vaccines Market is segmented by product, indication and end user from 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA