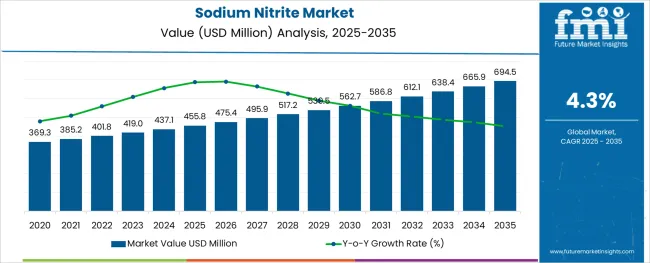

The Sodium Nitrite Market is estimated to be valued at USD 455.8 million in 2025 and is projected to reach USD 694.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The sodium nitrite market is experiencing steady growth driven by its widespread use as a preservative and color fixative in the food and beverages sector. Increasing consumer demand for processed and packaged foods has led to higher utilization of sodium nitrite to maintain product freshness and inhibit microbial growth.

Regulatory emphasis on food safety and quality has further encouraged the adoption of reliable preservation agents like sodium nitrite. Additionally, growth in the meat processing industry has bolstered market demand, as sodium nitrite plays a crucial role in curing meats and enhancing flavor.

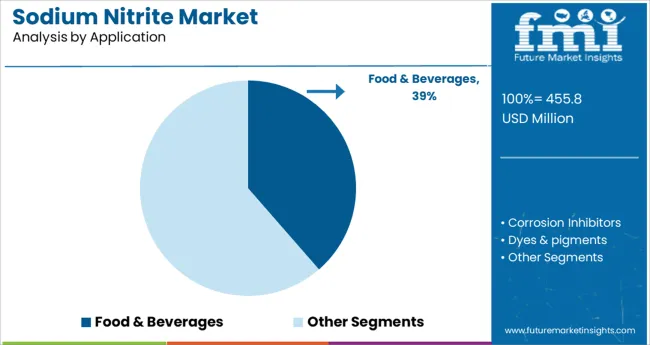

Advancements in food processing technologies and rising consumer awareness about food shelf life are expected to support market expansion. The food and beverages application segment dominates the market due to its critical function in ensuring product safety and appealing sensory qualities.

The market is segmented by Application and region. By Application, the market is divided into Food & Beverages, Corrosion Inhibitors, Dyes & pigments, Pharmaceuticals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food and beverages segment is projected to hold 38.6% of the sodium nitrite market revenue in 2025, establishing itself as the leading application area. The growth of this segment has been driven by the essential role sodium nitrite plays in preserving meat products, preventing spoilage, and enhancing color and flavor.

Food manufacturers rely on sodium nitrite for its antimicrobial properties that help inhibit the growth of harmful bacteria such as Clostridium botulinum. Moreover, the increasing demand for ready-to-eat and processed foods has amplified the need for effective preservation techniques, further driving segment growth.

The application is also supported by regulatory frameworks that permit controlled use of sodium nitrite to ensure food safety. As consumer preference for convenient and safe food products continues to rise, the food and beverages segment is expected to sustain its market leadership.

The growing demand for sodium nitrite along with organic products has prompted small-scale farmers in developing economies to adopt organic farming practises which also surges the sales of sodium nitrite.

Sodium nitrite market growth is particularly strong in emerging economies such as China, India, and Argentina, owing to growing farmer awareness of the dangers of chemical fertilisers also surging the sodium nitrite market key trends and opportunities.

In these countries, significant investments are being made in organic production in order to transition away from conventional farming practises. Organic packaged food products had a sizable sodium nitrite market in Asia-Pacific, particularly in Japan and South Korea.

However, significant sodium nitrite market opportunities have been witnessed in countries such as China and India. In such countries, the agricultural sector's focus is shifting from exports to domestic consumption. The government's encouragement of organic farming is also important resulting in the mounting of the adoption of sodium nitrite and therefore soaring the sodium nitrite adoption trends.

Excess sodium nitrate consumption causes a variety of health issues, including colorectal cancer, non-Hodgkin lymphoma, heart disease, leukaemia, and stomach, ovarian, pancreatic, esophageal, and thyroid cancers.

Some processed meats, such as jerky, bacon, and luncheon meats, contain sodium nitrate as a preservative. This can increase the risk of developing heart disease. Nitrates can also alter how the body uses sugar, potentially leading to diabetes. These health risks associated with excessive sodium nitrate use may act as a restraint on the global sodium nitrate market and may impede the sodium nitrite market future trends.

Rapid changes in consumer tastes and preferences, combined with changing lifestyles, have resulted in a high reliance on convenience snacks such as hot dogs and bacon in recent years affecting the sodium nitrite adoption trends together with sodium nitrite market opportunities.

The consumption of convenience snacks began in Western countries and has rapidly spread to other regions in turn influencing the sodium nitrite market future trends.

Due to its role in the production of diazo dyes, sodium nitrite is an important component of the textile industry. Given that the global textile industry is expected to grow steadily over the next few years, the demand for sodium nitrite majorly dying materials is expected to rise in tandem.

This is expected to propel the global sodium nitrite market and sales of sodium nitrite on a higher growth trajectory during the forecast period and also boosting the sodium nitrite market trends and forecast.

In 2025, the food and beverages segment dominates the sodium nitrite market, accounting for the highest revenue of the sodium nitrite market share of 24.0%. The increased use of food additives in the poultry and meat industries is attributed to the sodium nitrite market growth.

Apart from being a pigment inhibitor, the product also acts as an antimicrobial in the meat industry, limiting the growth of foodborne pathogens affecting the sodium nitrite market future trends and escalating the adoption of sodium nitrite.

A common preservative found in processed meats is sodium nitrite. It is added to meat during the curing process to keep it fresh and bacteria-free. Sodium nitrite can kill germs in meat that grow in the presence of moisture-dehydrating bacteria.

Corrosion inhibitors have been the second-largest application segment of the sodium nitrite market, with a CAGR of 4.0% predicted over the forecast period. The increase is due to the interaction of sodium nitrite with the anodic process, which aids in the reduction of corrosion rate.

Long-term demand for sodium nitrite majorly corrosion inhibitors is expected to be driven by end-use industries such as oil and gas, power generation, metal processing, chemical processing, and water treatment, among others and positively impacting the sodium nitrite market opportunities.

In electrochemical grinding production processes, sodium nitrite can be used as an electrolyte. It is used in the textile industry as a bleaching agent. As sodium nitrite is also used in the production of dye colours, it is an important component of the textile industry.

As the global textiles industry is expected to grow at a consistent rate over the next few years, so will the demand for dying materials constructively influencing the sodium nitrite market key trends and opportunities.

Asia Pacific dominates the sodium nitrite market, accounting for 74.3% of revenue for the year 2025. Over the forecasted years, the segment is expected to grow at the fastest rate of 4.7%. The increase is attributed to rising demand for food-grade sodium nitrite, particularly in India, China, and Japan.

China

China is the world's largest consumer of food and beverages. Population growth and rising per capita disposable income are expected to drive growth in the food and beverage industry. Due to their hectic lifestyles, Chinese consumers' eating habits have shifted. They prefer to eat packaged foods rather than prepare their own meals. This has an escalated impact on the sodium nitrite market future trends.

India

According to the IBEF November 2025 report, India is the world's largest generic drug provider for the sodium nitrite market. India accounts for half of the world's supply of various drugs.

Many top pharmaceutical companies are headquartered in India. Medicines are expected to boost the pharmaceutical market in India as manufacturing advances. This is expected to have a positive impact on demand for sodium nitrite along with the sodium nitrite adoption trends in the coming years and will witness encouraging emerging trends in sodium nitrite market.

Europe and North America

In terms of revenue, Europe held the second-largest sodium nitrite market share, accounting for more than 17.0% in 2025. Numerous regulations, particularly in North America and Europe, limit the use of chemically derived products in food and beverages. Due to the associated health concerns, government bodies have established regulations.

Over the forecast period, this is likely to increase demand for sodium nitrite sources such as lettuce, celery, and other vegetables in Europe and North America.

Deepak; Airedale Chemical Company Ltd.; BASF SE; UralChem JSC; Shijiazhuang Fengshan Chemical Co. Ltd.; Radiant Indus Chem Pvt. Ltd.; SABIC; Chemtrade Logistics are among the legacy players vendors, according to a new research report on sodium nitrite market.

Companies such as BASF SE have chosen third-party distributors to supply their products to the sodium nitrite market. The study provides a thorough competition analysis of these top competitors in the sodium nitrite market, including sodium nitrite market growth, sodium nitrite market share, sodium nitrite market key trends and opportunities, and key sodium nitrite market statistics.

Recent Development:

Many new sodium nitrite market opportunities are emerging as manufacturers invest in research and development to create more advanced sodium nitrite solutions.

Manufacturers of sodium nitrite have been increasing their production capacity to meet rising customer demand. SQM, for example, announced that it would increase its total potassium nitrate production capacity by 500,000 metric tonnes per year.

Due to product differentiation, financial stability, strategic developments, and diversified regional presence, companies such as BASF SE (Germany) and Shandong Haihua Group (China) dominate the sodium nitrite market. The sodium nitrite market players are concentrating their efforts on R&D.

Furthermore, they pursue strategic sodium nitrite market growth initiatives such as expansion, product launches, joint ventures, and partnerships in order to strengthen their sodium nitrite market position and gain a large customer base.

The sodium nitrite market is highly competitive and fragmented, with no dominant players.

The global sodium nitrite market is estimated to be valued at USD 455.8 million in 2025.

It is projected to reach USD 694.5 million by 2035.

The market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types are food & beverages, corrosion inhibitors, dyes & pigments, pharmaceuticals and others.

segment is expected to dominate with a 0.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA