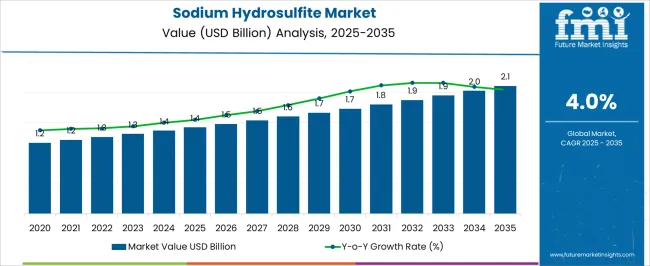

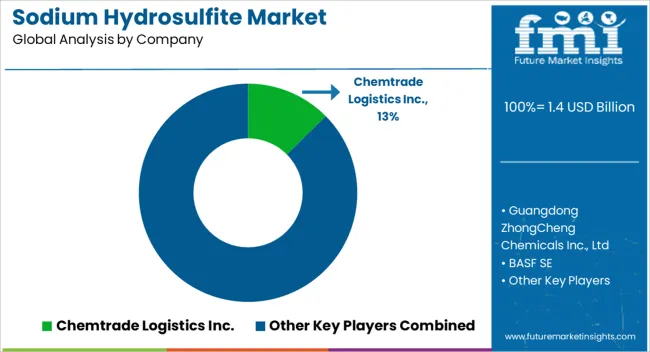

The sodium hydrosulfite market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

This growth represents an absolute dollar opportunity of USD 0.7 billion over the decade. Beginning at USD 1.2 billion in the early years, the market experiences gradual expansion, reaching USD 1.7 billion by 2030. For companies in the chemical and textile processing sectors, this steady growth indicates a reliable revenue potential. By aligning production, distribution, and market strategies with this trend, businesses can capture incremental value while maintaining stable operations in a gradually expanding market. The absolute dollar opportunity from 2025 to 2035 emphasizes consistent annual gains, with the market rising from USD 1.4 billion to USD 2.1 billion over the decade.

Incremental growth moves from USD 1.5 billion in 2026 to USD 2.0 billion in 2034, culminating at USD 2.1 billion in 2035. This predictable expansion allows businesses to plan capacity, supply chain, and sales strategies efficiently. Capturing market share during this period ensures meaningful revenue gains while limiting exposure to volatility. Companies that time their investments strategically can strengthen their position in the evolving sodium hydrosulfite market.

| Metric | Value |

|---|---|

| Sodium Hydrosulfite Market Estimated Value in (2025 E) | USD 1.4 billion |

| Sodium Hydrosulfite Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

A breakpoint analysis of the sodium hydrosulfite market highlights phases of gradual and slightly faster growth. From 2025 to 2028, the market grows from USD 1.4 billion to USD 1.5 billion, with annual increments of around USD 0.1 billion. This early-stage period represents a stable, low-risk phase where companies can establish operations, optimize supply chains, and evaluate customer demand. Recognizing this initial breakpoint allows businesses to allocate resources efficiently, test strategies, and gradually build market presence. Early engagement during this period provides a foundation for capturing higher-value opportunities as the market continues to expand steadily in the subsequent years.

The next breakpoint occurs between 2030 and 2035, as the market expands from USD 1.7 billion to USD 2.1 billion, with annual increments averaging USD 0.1–0.2 billion. This stage represents accelerated growth relative to earlier years, offering meaningful absolute dollar opportunity and making strategic positioning essential. Companies entering or scaling operations during this phase can capture significant revenue gains while strengthening their competitive position. Understanding these breakpoints helps stakeholders plan investments, production, and market expansion strategies to maximize returns in the evolving sodium hydrosulfite market.

The sodium hydrosulfite market is experiencing steady expansion, supported by its critical role as a reducing agent across diverse industrial applications. Chemical industry reports and manufacturing sector updates have emphasized its importance in paper, textile, and mineral processing industries, driven by consistent global demand for high-quality finished products. In the pulp and paper sector, the need for improved brightness and reduced environmental impact in bleaching processes has strengthened sodium hydrosulfite usage.

Additionally, technological enhancements in production methods have improved product purity and reduced operational costs, making it more competitive in bulk supply markets. Regulatory trends promoting sustainable manufacturing have further encouraged adoption, particularly in processes where sodium hydrosulfite offers efficiency and reduced chemical waste.

Strategic sourcing agreements between producers and large-scale industrial consumers have ensured stable supply chains. Going forward, growth is expected to be underpinned by the zinc-based production process, which offers cost advantages, and by the continued demand for wood pulp bleaching in response to rising paper and packaging consumption.

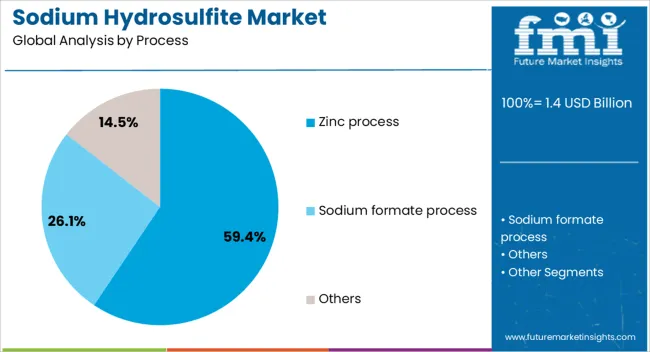

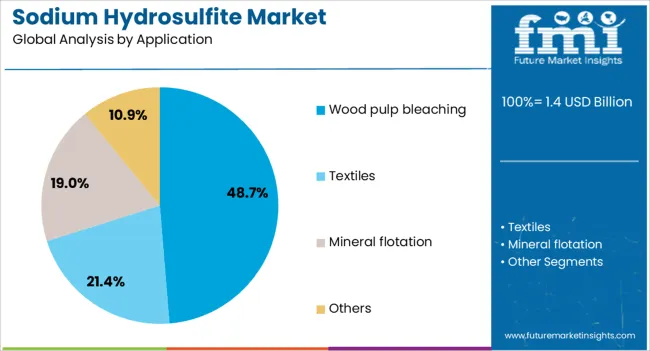

The sodium hydrosulfite market is segmented by process, application, and geographic regions. By process, sodium hydrosulfite market is divided into zinc process, sodium formate process, and others. In terms of application, sodium hydrosulfite market is classified into wood pulp bleaching, textiles, mineral flotation, and others. Regionally, the sodium hydrosulfite industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The zinc process segment is projected to account for 59.4% of the sodium hydrosulfite market revenue in 2025, maintaining its position as the primary production method. This segment’s strength is derived from its cost-effectiveness, scalability, and established industrial adoption.

Industry analyses have noted that the zinc process enables efficient large-scale production while delivering high-purity sodium hydrosulfite suitable for sensitive applications like paper and textile processing. The availability of zinc dust as a consistent feedstock and the maturity of associated production infrastructure have further reinforced this method’s dominance.

Moreover, process optimizations in waste management and energy consumption have enhanced its environmental performance, aligning it with evolving sustainability requirements. While alternative production methods such as the formate process are emerging, the zinc process continues to lead due to its proven reliability, integration with existing manufacturing systems, and ability to meet high-volume industrial demand.

The wood pulp bleaching segment is projected to hold 48.7% of the sodium hydrosulfite market revenue in 2025, solidifying its status as the largest application category. Growth in this segment has been driven by the global increase in demand for high-brightness paper and packaging materials, particularly in publishing, printing, and consumer goods sectors.

Sodium hydrosulfite has been favored for its effectiveness in removing residual lignin without damaging cellulose fibers, resulting in superior brightness and quality. Pulp and paper industry sources have highlighted that its selective reducing properties allow mills to achieve targeted brightness levels with lower chemical consumption compared to some alternatives.

Additionally, the chemical’s compatibility with both mechanical and chemical pulps has expanded its applicability across various paper grades. With sustainable packaging trends gaining momentum and recycled pulp utilization increasing, the demand for sodium hydrosulfite in wood pulp bleaching is expected to remain strong, supported by consistent paper industry growth and quality-driven production standards.

The sodium hydrosulfite market is expanding due to rising demand from textile, pulp and paper, and water treatment industries. Asia-Pacific leads consumption driven by large-scale textile production and industrial applications, while Europe and North America focus on high-purity applications and regulatory-compliant usage. Key manufacturers differentiate through product grade, process efficiency, and supply reliability. Market trends include improved formulation stability, controlled particle size, and multi-industry application growth. Regional dynamics, raw material availability, and production costs influence adoption, pricing, and supplier competitiveness.

Sodium hydrosulfite purity varies among manufacturers and production methods, influencing industrial suitability. High-purity grades are preferred in European and North American pulp, paper, and water treatment applications, while Asian markets often accept lower-grade products for textile bleaching. Differences in purity affect reaction efficiency, product yield, and safety compliance. Established global suppliers maintain consistent high-purity outputs, ensuring reliability for sensitive applications, whereas smaller regional producers may experience batch-to-batch variability. Variations in purity also influence pricing, storage requirements, and handling protocols. Buyers in regulated industries favor certified, traceable products, giving premium suppliers a competitive edge. These contrasts between purity levels and market segments shape adoption patterns, particularly in applications requiring strict quality and regulatory adherence.

Production capacity and supply timing differ across regions. Asia-Pacific dominates global production, supplying both domestic and export markets. Europe and North America rely on fewer high-purity manufacturers with controlled output schedules. Seasonal fluctuations in raw material availability, energy costs, and transportation infrastructure create differences in supply reliability. Established multinational manufacturers with vertically integrated operations ensure consistent year-round supply, whereas smaller or local suppliers may experience delays during peak demand. These dynamics influence contract negotiations, pricing, and adoption in textile, paper, and water treatment industries. Companies that can maintain steady supply across regions gain stronger market presence and long-term contracts compared with suppliers facing logistical or raw material constraints.

Sodium hydrosulfite consumption patterns differ by end-use industry. Textile and garment manufacturers in Asia-Pacific account for high-volume usage, prioritizing cost-efficiency. In contrast, paper and water treatment industries in Europe and North America demand precise dosages and high stability for consistent bleaching and dechlorination. Variations in process requirements affect product grade selection, packaging, and handling. Leading suppliers adapt offerings based on industry-specific standards, whereas smaller producers may provide only standard grades. Differences in demand by industry and region impact production planning, inventory management, and revenue allocation. Understanding these contrasts allows suppliers to strategically target high-value segments and maintain competitiveness across global markets.

Sodium hydrosulfite pricing varies due to raw material costs, production efficiency, and regional regulatory requirements. Asia-Pacific suppliers often offer lower-cost products to meet high-volume textile demand, while European and North American producers maintain higher pricing for certified, regulatory-compliant grades. Regulatory frameworks for storage, handling, and environmental impact influence market entry, especially in sensitive chemical applications. Suppliers capable of balancing cost efficiency with compliance secure premium contracts, while others struggle in highly regulated markets. Differences in price, quality, and regulatory alignment create competitive gaps among key players, affecting adoption rates, long-term market share, and profitability. Buyers consider these factors when selecting suppliers for both high-volume commodity applications and specialized industrial processes.

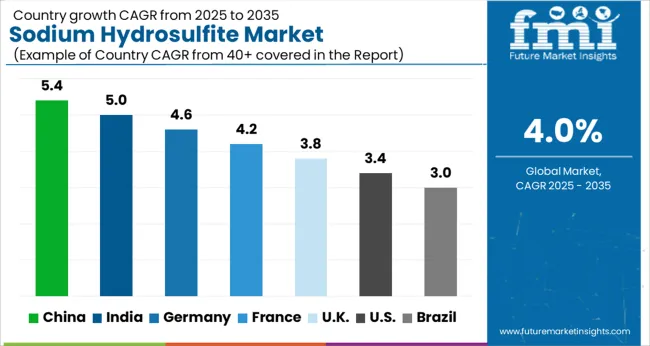

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

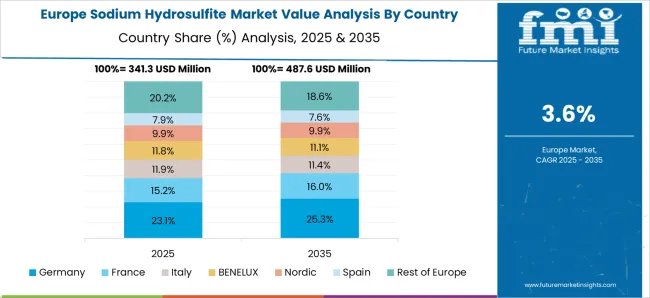

| France | 4.2% |

| UK | 3.8% |

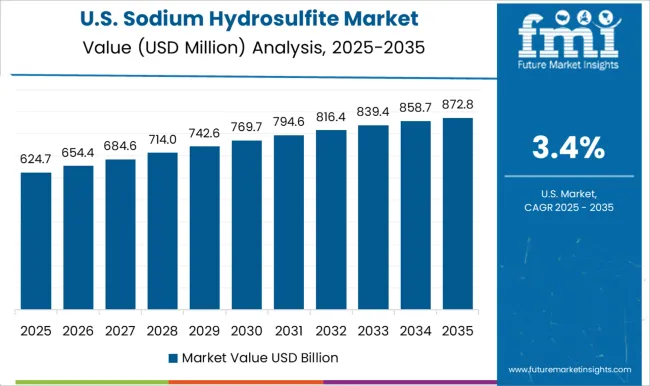

| USA | 3.4% |

| Brazil | 3.0% |

The global sodium hydrosulfite market was projected to grow at a 4.0% CAGR through 2035, driven by demand in textiles, paper, and water treatment applications. Among BRICS nations, China recorded 5.4% growth as large-scale production facilities were commissioned and compliance with chemical safety standards was enforced, while India at 5.0% growth saw expansion of manufacturing units to meet rising regional industrial demand. In the OECD region, Germany at 4.6% maintained substantial output under strict chemical and industrial regulations, while the United Kingdom at 3.8% relied on moderate-scale operations for textile and water treatment applications. The USA, expanding at 3.4%, remained a mature market with steady demand across industrial segments, supported by adherence to federal and state-level chemical safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Sodium hydrosulfite market in China is growing at a CAGR of 5.4%. Between 2020 and 2024, growth was driven by demand from textile, paper, and water treatment industries. Domestic manufacturers focused on producing high purity and cost effective sodium hydrosulfite to meet industrial requirements. Expansion of textile and chemical processing facilities supported market development. In the forecast period 2025 to 2035, growth is expected to accelerate with adoption of advanced formulations for environmental compliance and industrial efficiency. Rising industrialization, stricter environmental regulations, and increasing exports of treated products will drive demand. Research and development in safer and more stable hydrosulfite compounds will support continued market expansion. China remains a leading market for sodium hydrosulfite in Asia due to industrial growth and strong manufacturing capabilities.

Sodium hydrosulfite market in India is growing at a CAGR of 5.0%. During 2020 to 2024, market growth was supported by increasing demand in textile dyeing, paper bleaching, and water treatment applications. Domestic manufacturers focused on improving product quality and reducing production costs. Expansion of textile and chemical processing industries created steady demand. In the forecast period 2025 to 2035, growth is expected to continue with wider adoption of environmentally friendly and high efficiency hydrosulfite products. Increasing regulatory standards, industrial modernization, and rising exports of treated products will further support market development. India is projected to maintain strong growth as an emerging market for sodium hydrosulfite in Asia.

Sodium hydrosulfite market in Germany is growing at a CAGR of 4.6%. Historical period 2020 to 2024 saw demand from textile, paper, and chemical industries. Manufacturers focused on high purity products that complied with strict EU environmental and safety standards. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption of safer and more efficient formulations. Increasing emphasis on sustainability, recycling, and process optimization will support demand. Research in stable and high performance hydrosulfite compounds is likely to drive innovation. Germany market growth reflects high industrial standards, regulatory compliance, and technological advancement.

Sodium hydrosulfite market in the United Kingdom is growing at a CAGR of 3.8%. Between 2020 and 2024, market growth was supported by textile processing, paper bleaching, and water treatment applications. Manufacturers focused on reliable and efficient production to meet industrial demand. In the forecast period 2025 to 2035, market growth is expected to continue moderately with increasing adoption of environmentally friendly and high efficiency products. Government regulations and industrial modernization will influence market expansion. The United Kingdom market reflects stable growth with emphasis on quality, process efficiency, and environmental compliance.

Sodium hydrosulfite market in the United States is growing at a CAGR of 3.4%. Historical period 2020 to 2024 saw growth due to demand from textile, paper, and water treatment industries. Manufacturers focused on improving purity, stability, and process efficiency. In the forecast period 2025 to 2035, market growth is expected to continue gradually with adoption of environmentally friendly hydrosulfite products and optimized production methods. Industrial modernization, regulatory compliance, and process innovation will remain key factors supporting market expansion. The United States market demonstrates steady growth with emphasis on safety, quality, and sustainable production practices.

The sodium hydrosulfite market is supplied by Chemtrade Logistics Inc., Guangdong ZhongCheng Chemicals Inc., Ltd, BASF SE, Jinhe Group, AZ Chemicals, Inc., Bruggemann Chemical, Mitsubishi Gas Chemical Company, Inc., TCP Limited, Royce International Corp, Montgomery Chemicals, Tokyo Chemical Industry Co., Ltd., Sigma-Aldrich Co. LLC, Finetech Industry Limited, Alfa Chemistry, and Triveni Interchem Pvt. Ltd., with competition shaped by purity, particle size, and reducing strength. BASF and Chemtrade brochures highlight high-purity grades for textile and paper bleaching, specifying concentration, solubility, and storage conditions.

Guangdong ZhongCheng and Jinhe provide technical sheets with assay percentages, moisture content, and standard compliance for industrial applications. Mitsubishi Gas Chemical and AZ Chemicals emphasize controlled particle morphology and thermal stability, with datasheets covering decomposition temperature, reducing potential, and reaction kinetics. Observed industry patterns indicate demand growth for stable, high-activity products in textile processing, pulp bleaching, and chemical reduction processes. Market strategies focus on differentiation through product quality, application support, and logistics.

BASF, Chemtrade, and Mitsubishi Gas Chemical invest in high-activity, low-moisture grades for critical industrial processes. Jinhe, AZ Chemicals, and Triveni Interchem target emerging markets with flexible packaging sizes, smaller batch options, and regional supply networks. Guangdong ZhongCheng and Bruggemann Chemical emphasize fast delivery and technical support for integration into bleaching and reduction systems.

Observed trends show suppliers adopting scalable production and consistent quality control to maintain reliability for textile, paper, and chemical industries. TCP Limited and Sigma-Aldrich provide specialty grades for research and small-scale chemical synthesis, while Alfa Chemistry and Montgomery Chemicals focus on custom formulations for industrial trials and pilot projects. Product brochures and technical datasheets communicate critical specifications including purity percentage, reducing strength, particle size distribution, solubility, moisture content, storage stability, and safety precautions.

Chemtrade and BASF provide data on decomposition rates, handling conditions, and recommended storage temperatures. Jinhe, Guangdong ZhongCheng, and Mitsubishi Gas Chemical include guidance for reaction kinetics, bleaching efficiency, and industrial compatibility. Tokyo Chemical Industry and Sigma-Aldrich highlight laboratory-scale performance, assay verification, and traceability certificates. Clear technical documentation enables process engineers, chemical formulators, and industrial operators to evaluate suitability, ensuring adoption based on verified performance, stability, and compatibility with textile, pulp, and specialty chemical processes.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 billion |

| Process | Zinc process, Sodium formate process, and Others |

| Application | Wood pulp bleaching, Textiles, Mineral flotation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Chemtrade Logistics Inc., Guangdong ZhongCheng Chemicals Inc., Ltd, BASF SE, Jinhe Group, AZ Chemicals, Inc., Bruggemann Chemical, Mitsubishi Gas Chemical Company, Inc., TCP Limited, Royce International Corp, Montgomery Chemicals, Tokyo Chemical Industry Co., Ltd., Sigma-Aldrich Co. LLC, Finetech Industry Limited, Alfa Chemistry, and Triveni Interchem Pvt. Ltd. |

| Additional Attributes | Dollar sales vary by grade, including industrial and technical grades; by application, such as textiles, paper & pulp, water treatment, and chemical manufacturing; by end-use industry, spanning textiles, chemicals, water treatment, and pulp & paper; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by rising demand for bleaching agents, textile processing chemicals, and water treatment solutions. |

The global sodium hydrosulfite market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the sodium hydrosulfite market is projected to reach USD 2.1 billion by 2035.

The sodium hydrosulfite market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in sodium hydrosulfite market are zinc process, sodium formate process and others.

In terms of application, wood pulp bleaching segment to command 48.7% share in the sodium hydrosulfite market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauroyl Isethionate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Metasilicate Pentahydrate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA