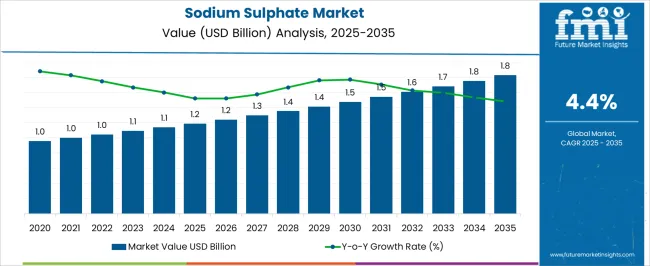

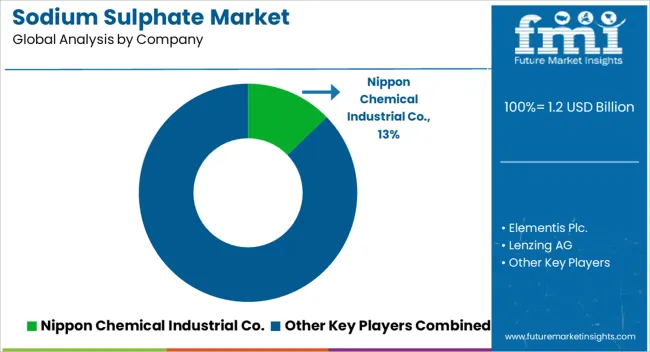

The sodium sulphate market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

A year-on-year (YoY) growth analysis reveals gradual expansion driven by increasing demand in detergents, textiles, and chemicals. From 2021 to 2025, the market grows from USD 1.0 billion to 1.2 billion, with annual increments at USD 1.0 billion, 1.0 billion, 1.1 billion, and 1.1 billion. This early phase exhibits modest YoY growth, fueled by steady consumption across various industries and limited new market drivers. The growth is primarily volume-based, as industries continue to utilize sodium sulfate for cleaning and processing applications. From 2026 to 2030, values rise from USD 1.2 billion to 1.5 billion, passing through USD 1.2 billion, 1.3 billion, and 1.4 billion.

This mid-term phase shows stronger YoY growth as new applications in the production of glass, textiles, and detergents gain traction, while global trade and industrialization contribute to incremental demand. From 2031 to 2035, the market progresses from USD 1.5 billion to 1.8 billion, moving through USD 1.6 billion, 1.7 billion, and 1.8 billion. The YoY growth becomes more pronounced in this period, supported by increased demand for high-performance and eco-friendly formulations, alongside expansion in emerging markets.

The sodium sulfate market is driven by five parent markets that collectively define its growth, demand, and application across various industrial sectors. The detergents and cleaning products market contributes the largest share, about 25-30%, as sodium sulfate is widely used as a filler and a builder in powdered laundry detergents and dishwashing products, enhancing their cleaning efficiency and cost-effectiveness.

The textile and dyeing market adds approximately 20-24%, where sodium sulfate acts as a carrier and electrolyte in dyeing processes, particularly for wool and silk, to ensure uniform color application and improve the overall quality of textile products. The glass manufacturing market contributes around 15-18%, where sodium sulfate is used as a fining agent to remove bubbles and impurities from molten glass, improving its clarity and finish.

The paper and pulp market accounts for roughly 12-15%, with sodium sulfate utilized in the kraft pulping process as a chemical that enhances the efficiency of wood digestion and improves pulp quality. Finally, the chemical manufacturing market represents about 8-10%, where sodium sulfate is used in the production of various chemicals, including sodium silicate and detergents, which are key intermediates in several industrial applications.

| Metric | Value |

|---|---|

| Sodium Sulphate Market Estimated Value in (2025 E) | USD 1.2 billion |

| Sodium Sulphate Market Forecast Value in (2035 F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The sodium sulphate market is experiencing steady expansion, supported by its wide-ranging industrial applications and stable supply from both natural and synthetic sources. Industry reports and manufacturing sector updates have noted sustained demand in the detergents, glass, and textile industries, where sodium sulphate serves as a cost-effective processing aid and functional additive.

The market has benefited from consistent availability of natural deposits, which provide high-purity material at competitive extraction costs. Trade data and chemical production statistics indicate a steady balance between regional consumption and exports, particularly from countries with abundant mineral reserves.

Additionally, technological advancements in purification and processing have enhanced the quality of sodium sulphate for high-value applications. The market outlook remains positive as emerging economies increase industrial output, driving demand in detergent manufacturing and other sectors. Future growth is expected to be shaped by supply chain optimization, environmental considerations in mining and production, and continued reliance on sodium sulphate in established manufacturing processes.

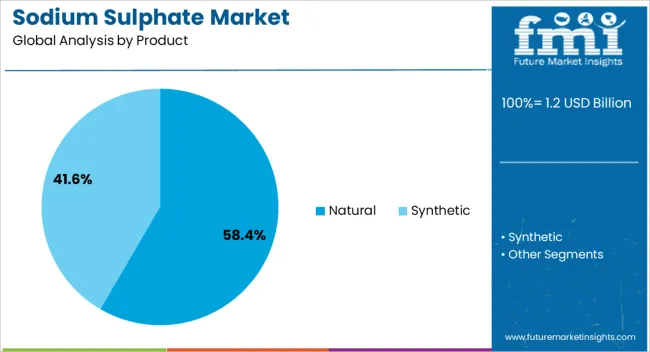

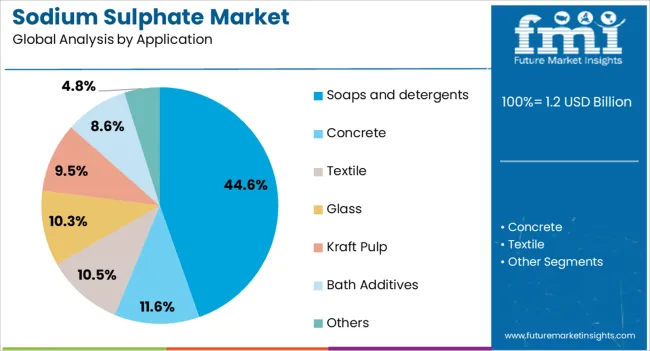

The sodium sulphate market is segmented by product, application, and geographic regions. By product, sodium sulphate market is divided into natural and synthetic. In terms of application, sodium sulphate market is classified into soaps and detergents, cconcrete, textile, glass, kraft pulp, bath additives, and others. Regionally, the sodium sulphate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural segment is projected to hold 58.4% of the sodium sulphate market revenue in 2025, maintaining its leadership due to the abundance of naturally occurring deposits and the cost advantages associated with their extraction. Geological surveys and industry data have highlighted that large reserves in regions such as North America, Europe, and Asia have supported a stable supply base for decades. Natural sodium sulphate typically requires minimal processing, reducing production costs and environmental impact compared to synthetic methods.

This cost efficiency has reinforced its preference among manufacturers in price-sensitive industries like detergents and glass production. Furthermore, natural sources provide consistent purity levels, ensuring reliability in large-scale industrial applications. Established mining operations and well-developed logistics networks have also contributed to the segment’s strong position, enabling steady global trade flows. As demand continues from core industries, the natural segment is expected to retain its market dominance, supported by resource availability and favorable production economics.

The soaps and detergents segment is projected to account for 44.6% of the sodium sulphate market revenue in 2025, securing its place as the largest application category. This dominance has been driven by sodium sulphate’s role as a filler and processing aid in powdered detergent formulations, where it improves product texture, consistency, and bulk density. Manufacturing data and industry publications have noted that its non-toxic nature and chemical stability make it well-suited for large-scale detergent production.

The global expansion of urban populations and rising household hygiene awareness have sustained demand for affordable cleaning products, directly benefiting sodium sulphate consumption. Additionally, detergent producers in emerging markets have favored sodium sulphate for its cost efficiency and ability to enhance manufacturing throughput. Seasonal peaks in laundry product sales and the continued popularity of powdered detergents in developing regions further reinforce the segment’s market share. As the global cleaning products industry grows, the soaps and detergents segment is expected to maintain its leading position in sodium sulphate usage.

The sodium sulphate market is growing due to rising demand from the detergent, textile, and chemical industries, particularly in emerging markets. Sodium sulphate plays a critical role in detergent production, textile dyeing, glassmaking, and other industrial applications. Challenges include rising raw material costs, environmental regulations, and production inefficiencies. Opportunities exist in emerging economies, specialty applications, and innovations in product quality and sustainable production methods. Manufacturers focusing on high-purity products, eco-friendly practices, and digitalization are best positioned to capitalize on market growth.

The sodium sulphate market is expanding due to increasing demand from detergent, textile, and chemical industries. Sodium sulphate is primarily used as a filler in laundry detergents and as a key ingredient in textiles for dyeing and finishing processes. The growth of the consumer goods sector, especially in emerging economies across Asia-Pacific, Latin America, and the Middle East, is driving the demand for sodium sulphate. Additionally, it plays a vital role in manufacturing glass, detergents, and other chemicals, boosting its adoption across various industrial applications. Companies like Alkim Alkali, Tata Chemicals, and Chemical Company of Malaysia focus on enhancing product quality and diversifying their portfolios to meet the growing demand from the detergent, textile, and chemical sectors.

Despite growing demand, the sodium sulphate market faces challenges from rising raw material costs, energy-intensive production processes, and environmental regulations. Mining and manufacturing of sodium sulphate, particularly from natural sources like the evaporation of saltwater, can lead to significant environmental impacts. Compliance with safety and environmental standards, such as waste disposal regulations and air emissions control, adds operational complexity. Furthermore, market players face challenges regarding raw material volatility and production waste management. Manufacturers are investing in cleaner production technologies and more sustainable sourcing to minimize environmental impact while ensuring product consistency and high performance. Companies focusing on sustainable processes can gain a competitive advantage in the global market.

Emerging economies in Asia-Pacific, Africa, and Latin America present significant growth opportunities for sodium sulphate. These regions are witnessing increased industrialization, urbanization, and a rise in consumer demand for cleaning products. Sodium sulphate’s role in specialized applications such as water treatment, paper production, and the manufacture of detergents opens new avenues for market growth. The development of alternative production methods, such as using industrial by-products and improving recovery processes, also presents opportunities. Companies that can offer cost-effective, high-purity sodium sulphate for niche applications like glassmaking and pulp and paper industries will be well-positioned for market success.

Key trends in the sodium sulphate market include innovations in product formulations, efficient production practices, and the integration of digital technologies. Manufacturers are focusing on producing high-purity sodium sulphate to meet the demands of specialty applications such as glass and detergents. There is a growing emphasis on improving production processes to reduce energy consumption, minimize waste, and lower operational costs. Digitalization in manufacturing, such as automation and predictive maintenance technologies, is enhancing operational efficiency, optimizing production cycles, and reducing downtime. Companies that prioritize innovation, cost-effective practices, and digital advancements are well-positioned to lead in the competitive global market.

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

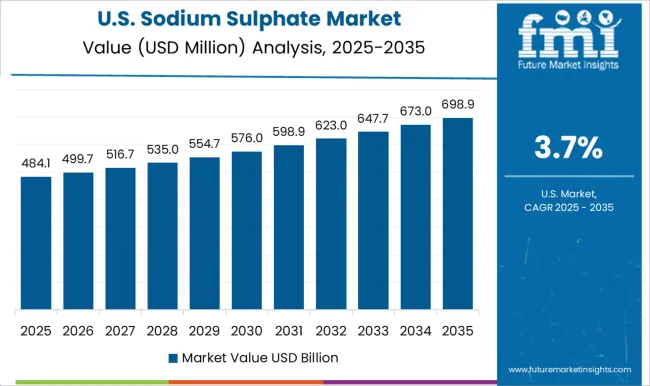

| USA | 3.7% |

| Brazil | 3.3% |

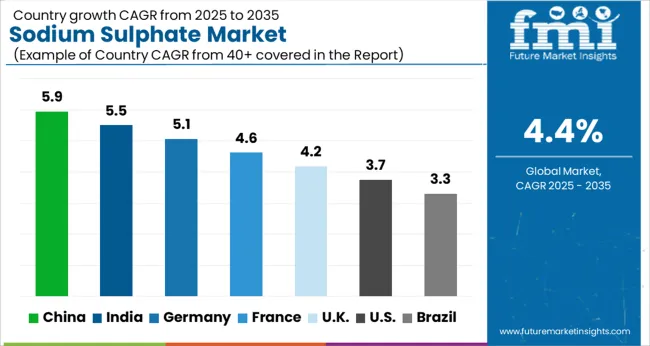

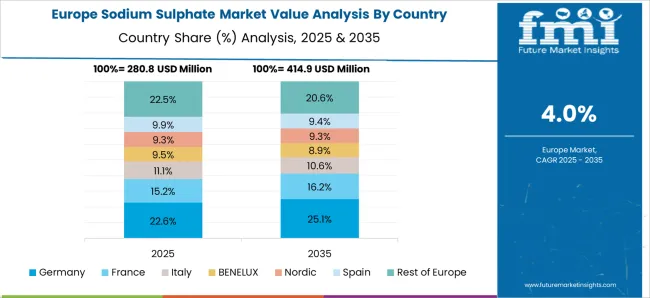

The global sodium sulphate market is projected to grow at a CAGR of 4.4% from 2025 to 2035. China leads the market with a growth rate of 5.9%, followed by India at 5.5% and Germany at 5.1%. The demand for sodium sulphate is primarily driven by its use in detergents, textiles (especially for dyeing), and chemicals. The increasing industrial and urban expansion, along with rising demand for household and industrial cleaning products, is expected to fuel market growth. The UK and USA will experience moderate growth rates of 4.2% and 3.7%, respectively, as demand remains steady across various sectors. The analysis includes over 40+ countries, with the leading markets detailed below.

The sodium sulphate market in China is anticipated to grow at a CAGR of 5.9% from 2025 to 2035, driven by the growing demand in the detergent, textile, and chemicals industries. The country's industrial sector’s expansion continues to increase the need for sodium sulphate as a raw material in manufacturing processes. The rising population and improving living standards are spurring consumption of household and industrial detergents, which is a key driver for the market. China’s textile industry also contributes significantly to the demand for sodium sulphate, as it is used extensively in dyeing processes. The large-scale manufacturing capabilities and the strategic position as a global export hub give China a competitive advantage, and the government’s initiatives supporting industrial growth further propel market expansion.

The sodium sulphate market in India is expected to grow at a CAGR of 5.5% from 2025 to 2035. The demand for sodium sulphate in the country is largely driven by the expanding detergent, textile, and chemicals industries. As India’s population grows and disposable income increases, the demand for household cleaning products, including detergents, rises. Sodium sulphate is a critical component in the production of detergents and cleaning products. Furthermore, the textile industry continues to experience rapid growth, where sodium sulphate is crucial in the dyeing and finishing processes. The chemicals industry, which uses sodium sulphate for producing sodium salts and other compounds, is expected to see further expansion. As urbanization and industrialization continue, the demand for sodium sulphate will rise steadily across different sectors.

The sodium sulphate market in Germany is anticipated to grow at a CAGR of 5.1% from 2025 to 2035. The country’s sodium sulphate demand is largely driven by the detergent, industrial cleaning, and textile sectors. Sodium sulphate is used extensively in detergent production, and the demand is growing due to the increasing population and urbanization. The textile industry also represents a significant segment, as sodium sulphate plays an essential role in dyeing and finishing fabrics. Germany’s strong industrial base, particularly in chemicals and manufacturing, continues to drive the need for industrial cleaners and detergents, which further boosts sodium sulphate consumption. In addition, continuous innovation in the chemical industry and improvements in sodium sulphate production methods will support the market’s growth. Germany’s robust research and development efforts ensure the development of advanced production technologies to meet the growing demand.

The UK sodium sulphate market is expected to grow at a CAGR of 4.2% from 2025 to 2035. Sodium sulphate is primarily used in detergent production, and the growing population and urbanization in the UK are driving demand. The country’s textile industry, a significant contributor to sodium sulphate consumption, utilizes the chemical for dyeing and finishing processes. In addition, the chemicals industry continues to grow, requiring sodium sulphate for various applications, including the production of sodium salts and other compounds. With advancements in sodium sulphate production technologies and regulatory changes, the market will continue to evolve. The rising demand for household and industrial cleaning products is expected to sustain steady market growth in the coming years.

The USA SAR market is projected to expand at a CAGR of 8.5% from 2025 to 2035, led by defense, homeland security, and commercial remote-sensing applications. The Department of Defense and NASA are expanding SAR deployments for reconnaissance, Earth observation, and disaster management. Airborne SAR platforms with advanced phased-array antennas and AI-based processing are increasingly adopted. The commercial sector is leveraging SAR for agriculture monitoring, environmental analysis, and infrastructure inspection. Domestic manufacturers are focusing on miniaturized payloads, high-resolution imaging, and real-time data analytics. Collaborations between private radar firms and federal agencies are accelerating the deployment of innovative SAR systems.

The sodium sulphate market is highly competitive, with prominent players such as Nippon Chemical Industrial Co., Elementis Plc., Lenzing AG, Shikoku Chemicals Corporation, Atul Limited, Nikunj Chemicals, Cooper Natural Resources Inc., Searles Valley Minerals, Sigma Aldrich, and TCI Chemicals. Each of these companies employs a unique strategy to capture market share.

Nippon Chemical Industrial Co. emphasizes high-purity sodium sulphate for detergents and textiles, leveraging its reputation for consistent quality and compliance with international standards. Product brochures highlight technical aspects such as safety, purity, and versatility across industrial applications. Elementis Plc. focuses on providing sodium sulphate solutions for personal care and industrial markets, marketing its products based on efficiency and value for large-scale applications. Lenzing AG and Shikoku Chemicals Corporation target niche markets in textiles and agriculture. They promote sodium sulphate as a key component for fiber production and soil treatment, with brochures emphasizing non-toxic production methods and environmental compliance.

Atul Limited and Nikunj Chemicals focus on the glass manufacturing and chemical industries. Their brochures underscore the cost-effectiveness and high-quality specifications of their sodium sulphate products. This positions them as reliable suppliers for bulk industrial applications, where performance and consistency are critical. Cooper Natural Resources Inc. and Searles Valley Minerals lead in the extraction and supply of natural sodium sulphate. Their marketing strategy highlights the reliability of their products, offering competitive pricing and a dependable supply chain.

Sigma Aldrich and TCI Chemicals serve the pharmaceutical and research sectors, offering premium-grade sodium sulphate. Their product brochures highlight features such as purity, consistency, and specialized packaging, targeting the precise needs of laboratory environments. These companies compete by emphasizing product quality, cost-efficiency, and technical specifications in their promotional materials. The effective use of product brochures remains central to conveying the strengths of each company's offerings in a crowded market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 billion |

| Product | Natural and Synthetic |

| Application | Soaps and detergents, Concrete, Textile, Glass, Kraft Pulp, Bath Additives, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nippon Chemical Industrial Co., Elementis Plc., Lenzing AG, Shikoku Chemicals Corporation, Atul Limited, Nikunj Chemicals, Cooper Natural resources Inc, Searles valley minerals, Sigma Aldrich, and TCI Chemicals |

| Additional Attributes | Dollar sales by application type (detergents, glass manufacturing, textiles, paper & pulp), production method (natural, synthetic), and purity level (technical grade, industrial grade). Demand is driven by industrial expansion, detergent manufacturing, and sustainable practices in textile production. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, with increasing industrialization, demand for eco-friendly products, and raw material sourcing innovation. |

The global sodium sulphate market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the sodium sulphate market is projected to reach USD 1.8 billion by 2035.

The sodium sulphate market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in sodium sulphate market are natural and synthetic.

In terms of application, soaps and detergents segment to command 44.6% share in the sodium sulphate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauroyl Isethionate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Metasilicate Pentahydrate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA