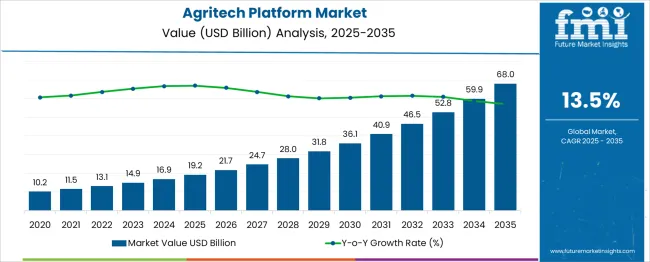

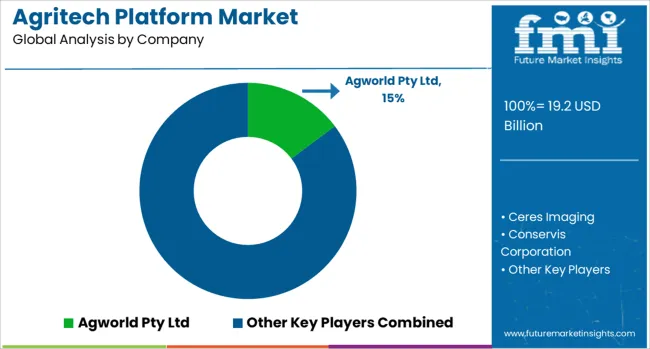

The Agritech Platform Market is estimated to be valued at USD 19.2 billion in 2025 and is projected to reach USD 68.0 billion by 2035, registering a compound annual growth rate (CAGR) of 13.5% over the forecast period.

| Metric | Value |

|---|---|

| Agritech Platform Market Estimated Value in (2025 E) | USD 19.2 billion |

| Agritech Platform Market Forecast Value in (2035 F) | USD 68.0 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

The agritech platform market is evolving rapidly as agriculture becomes increasingly data-driven, with farmers and agribusinesses leveraging technology to improve productivity, efficiency, and sustainability. The need for real-time decision-making, resource optimization, and climate-resilient farming methods is propelling the integration of digital tools and platforms into core farming operations.

Supportive government policies, rising food security concerns, and growing investment in agri-innovation are further fueling adoption across developed and emerging markets. The market outlook remains positive as cloud-based solutions, IoT, AI, and satellite imagery become embedded into everyday farming practices.

Continued expansion of internet access in rural regions and the increasing availability of mobile-based platforms are expected to accelerate platform-based digital transformation in agriculture. As technology becomes more accessible and user-friendly, agritech platforms will continue to play a central role in reshaping how farming is managed, monitored, and optimized across value chains.

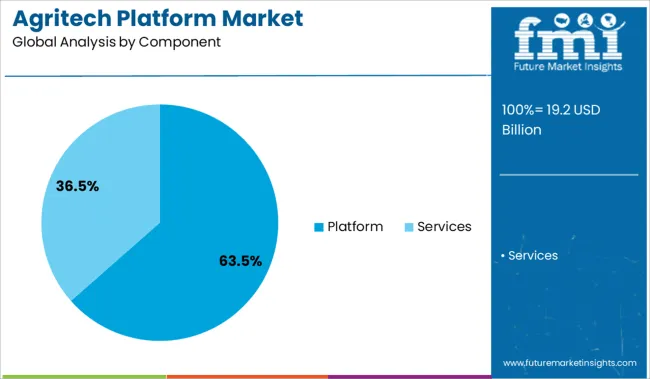

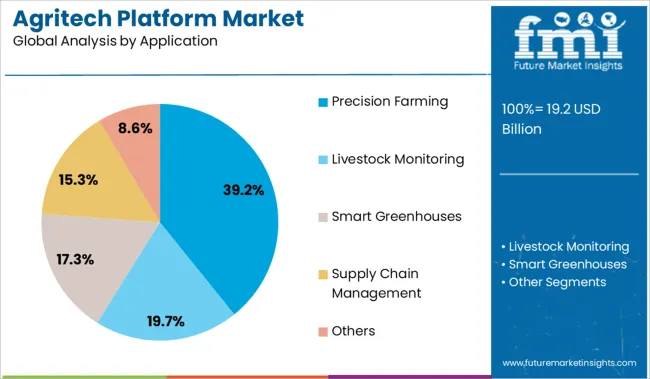

The agritech platform market is segmented by component and application, and geographic regions. The agritech platform market is divided into Platform and Services. In terms of application of the agritech platform, the market is classified into Precision Farming, Livestock Monitoring, Smart Greenhouses, Supply Chain Management, and Others. Regionally, the agritech platform industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The platform segment dominates the component category with a commanding 63.5% market share, underscoring its central role in enabling integrated digital solutions for modern agriculture. Agritech platforms serve as unified hubs that aggregate data from various sources such as sensors, drones, weather stations, and satellite feeds, offering actionable insights through user-friendly dashboards.

This segment’s growth is being driven by increasing farmer awareness of the benefits of real-time monitoring, predictive analytics, and farm automation. Platforms are also preferred for their scalability, allowing smallholders and large enterprises alike to tailor tools to specific operational needs.

The ability to connect input suppliers, financial services, and end markets within a single digital ecosystem adds to their strategic value. As agribusinesses prioritize technology-enabled decision-making and sustainable practices, investment in comprehensive digital platforms is expected to remain strong, supporting continuous innovation in the segment.

Precision farming accounts for 39.2% of the agritech platform market, reflecting the sector’s increasing reliance on data-driven technologies to enhance yield, minimize waste, and optimize input usage. This application is driven by the growing demand for site-specific crop management, which involves precise application of water, fertilizers, and pesticides based on soil conditions and crop needs.

Agritech platforms are central to enabling these practices by integrating sensor data, GPS mapping, and satellite imagery into cohesive recommendations for farmers. The segment’s growth is also supported by rising awareness of environmental sustainability and the economic advantages of maximizing resource efficiency.

Governments and agricultural institutions worldwide are promoting precision farming through subsidies and pilot programs, further boosting platform adoption. As pressure mounts to produce more food with fewer resources, the precision farming segment is expected to remain at the forefront of innovation and digital transformation in the agricultural sector.

The agritech platform market is being driven by digital farming tools, AI-driven insights, and cloud-based solutions, enhancing crop management efficiency. Automation, robotics, blockchain-enabled supply chains, and strong connectivity infrastructure are accelerating adoption across global agricultural ecosystems.

The agritech platform market has been influenced by the increasing adoption of data-centric tools in farming operations. Precision agriculture, IoT-enabled equipment, and remote sensing have been widely implemented to optimize crop management practices. Emphasis has been placed on digital platforms that integrate predictive analytics with real-time monitoring to reduce input wastage and improve yield predictability. Cloud-based solutions are being prioritized by enterprises to ensure scalability and data security for farm operations. The inclusion of AI-driven insights for soil health and crop protection has improved decision-making processes. Demand is being encouraged by initiatives promoting smart farming techniques, supported by financial incentives and strategic collaborations among technology providers and agribusiness companies.

Automation in farm equipment and advanced connectivity solutions have gained importance in operational efficiency. Platforms facilitating mechanization through robotics and drone-assisted crop assessment are being explored by large-scale farming units. Connectivity through 5G and satellite-based networks has contributed to seamless data exchange between farms and centralized platforms. Market penetration has been supported by subscription-based service models and integrated advisory platforms, reducing operational risks for growers. Blockchain-enabled supply chain systems have emerged as a critical tool for ensuring traceability and quality compliance. Growing interest from venture capital firms and government-backed digital agriculture programs has encouraged rapid platform adoption across developed and emerging economies.

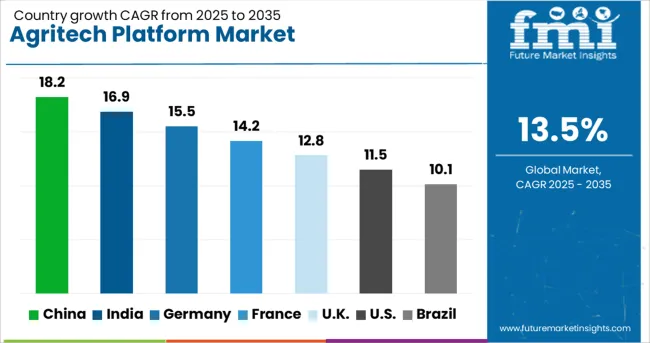

| Country | CAGR |

|---|---|

| China | 18.2% |

| India | 16.9% |

| Germany | 15.5% |

| France | 14.2% |

| UK | 12.8% |

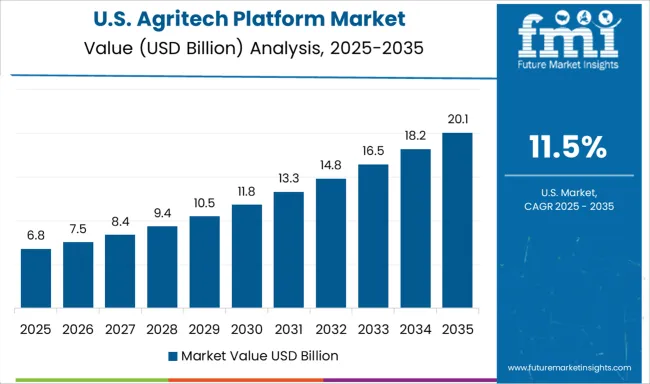

| USA | 11.5% |

| Brazil | 10.1% |

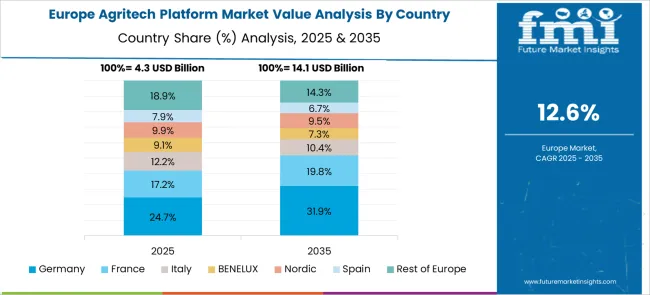

The agritech platform industry, projected to expand at a global CAGR of 13.5% from 2025 to 2035, shows diverse growth patterns across leading markets. A robust 18.2% CAGR is being recorded in China, a BRICS member, due to rapid digital farming adoption and large-scale mechanization initiatives. India, another BRICS member, is reporting a 16.9% CAGR, supported by significant investment in agri-tech startups and government-led digital agriculture programs. Germany, an OECD member, is achieving a 15.5% CAGR with increased deployment of precision agriculture platforms and smart equipment in advanced farming systems. The United Kingdom is experiencing a 12.8% CAGR, supported by integrated farm management software and advisory services targeting large farms and cooperatives. The United States, a major OECD economy, stands at 11.5% CAGR, driven by a focus on cloud-based solutions and automation technologies in commercial farming. High-growth potential remains evident in BRICS nations due to expanding smallholder digitalization, while steady adoption is seen in OECD markets with advanced infrastructure. The report covers detailed analysis for over 40 countries, with the top five presented as a reference.

The agritech platform market in the United States is forecasted to grow at a CAGR of 11.5% from 2025-2035, supported by the broader implementation of cloud-based farm management and the integration of advanced analytics tools. Adoption was driven by larger farming enterprises embracing digital solutions to optimize yield prediction and resource efficiency. Growing utilization of precision farming techniques encouraged the inclusion of AI-powered platforms for decision-making and crop disease monitoring. Subscription-based digital services combined with IoT hardware gained traction among commercial growers aiming for real-time visibility. Strategic partnerships with equipment manufacturers and digital advisory providers reinforced technology accessibility.

Demand for agritch platform in Germany is growing at a CAGR of 15.5% through 2035, supported by the rapid adoption of precision farming technologies in high-value crops and greenhouse systems. Farmers invested in advanced imaging platforms, sensors, and AI-based crop advisory tools to improve operational precision and reduce labor dependency. Strategic programs for digital agriculture were rolled out at the federal and EU levels, facilitating grants for farm automation and integrated management platforms. German agritech companies increased product development for robotic weed control, drone-assisted spraying, and predictive analytics in horticulture. Data governance and cybersecurity protocols for farm operations became a key investment priority among leading cooperatives.

The CAGR for the United Kingdom improved from nearly 8.4% during 2020-2024 to 12.8% in 2025-2035, encouraged by increasing government-led programs for smart agriculture and farm data integration. Investments in remote sensing platforms, weather-adaptive irrigation, and satellite-based monitoring gained momentum to offset climate-related yield variability. Growing emphasis on automated greenhouse farming stimulated platform demand across horticulture and vertical farming segments. Digital solutions bundled with subscription-based advisory services became popular among farmers seeking efficiency in crop forecasting and compliance tracking. Leading agri-tech startups collaborated with agricultural cooperatives to introduce affordable digital adoption models tailored for smallholder farms.

The agritech platform market in China is accelerated from 12.4% in 2020-2024 to 18.2% during 2025-2035, driven by large-scale mechanization and widespread integration of AI-enabled farm solutions. Centralized agriculture programs prioritized digital transformation, promoting IoT deployment across crop production clusters. State-owned enterprises partnered with technology developers for advanced irrigation monitoring, pest detection, and yield analytics. E-commerce channels fueled demand for digital farm management services by cooperatives and individual farmers. Regional agritech hubs in Jiangsu, Guangdong, and Shandong supported mass deployment of blockchain-based platforms for supply chain traceability and procurement automation. China’s policy reforms accelerated tax benefits for digital investments in agriculture post-2026.

The agritech platform market in India increased from 11.6% in 2020-2024 to 16.9% during 2025-2035, supported by strong venture capital funding and government-backed digitization initiatives. Startups introduced low-cost farm management solutions tailored for smallholders, while large cooperatives adopted subscription-based advisory models. Expansion in irrigation-linked sensor deployment and integration of AI-driven pest control platforms accelerated platform penetration in horticulture and cash crops. Digital agriculture schemes under national missions enabled farmer access to credit for technology investments. Adoption of multi-lingual mobile platforms widened reach in rural regions, while private enterprises partnered with logistics providers to digitize post-harvest operations.

In the agritech platform market, leading players are focusing on digital integration, precision agriculture, and remote monitoring technologies to optimize farm productivity and resource efficiency. Companies such as Agworld Pty Ltd, Ceres Imaging, and Conservis Corporation are building cloud-based solutions for farm management, providing real-time data analytics and crop planning tools tailored to both large-scale farms and smallholder segments. Cropin Technology Solutions and CropX Inc. are concentrating on AI-driven decision support systems that enhance soil health monitoring, irrigation scheduling, and yield forecasting for diverse geographies. Advanced geospatial insights are being delivered by Descartes Labs Inc., while Farmer's Business Network (FBN) continues to expand its digital marketplace, offering agronomic advisory and input procurement platforms. Precision agriculture pioneers like Farmers Edge Inc., PrecisionHawk, and Taranis specialize in remote sensing, drone imagery, and predictive analytics, enabling actionable intelligence for disease detection and risk management in farming operations. These companies are leveraging partnerships with input suppliers and machinery manufacturers to enhance technology adoption.

In February 2025, Agworld announced an expansion of its USA presence, emphasizing its management of more than 100 million paid acres over five continents, and highlighting new tools for streamlined crop planning, budget tracking, agronomic monitoring, and input management.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.2 Billion |

| Component | Platform and Services |

| Application | Precision Farming, Livestock Monitoring, Smart Greenhouses, Supply Chain Management, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Agworld Pty Ltd, Ceres Imaging, Conservis Corporation, Cropin Technology Solutions Private Limited, CropX inc., Descartes Labs Inc., Farmer's Business Network (FBN), Farmers Edge Inc., PrecisionHawk, Taranis, and The Climate Corporation (Climate FieldView) |

| Additional Attributes | Dollar sales, share, regional adoption rates, competitive positioning, key growth segments, pricing benchmarks, regulatory drivers, investment patterns, technology integration trends, and opportunities in precision farming and cloud-based solutions. |

The global agritech platform market is estimated to be valued at USD 19.2 billion in 2025.

The market size for the agritech platform market is projected to reach USD 68.0 billion by 2035.

The agritech platform market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in agritech platform market are platform, _big data & analytics, _biotechnology & biochemical, _mobility, _sensors & connected devices, _others and services.

In terms of application, precision farming segment to command 39.2% share in the agritech platform market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Platform Architecture Market Size and Share Forecast Outlook 2025 to 2035

Platform Boots Market Trends - Growth & Industry Outlook to 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Platform Trolley Market Growth – Trends & Forecast 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Sales Platforms Software Market Size and Share Forecast Outlook 2025 to 2035

AIOps Platform Market Forecast and Outlook 2025 to 2035

Cross-Platform & Mobile Advertising Market Report – Growth 2018-2028

RevOps Platform Market Insights – Growth & Forecast 2023-2033

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Trusted Platform Module (TPM) Market

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Coaching Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Assessing Coaching Platform Market Share & Industry Trends

Vertical Platform Lift Market

AI Trading Platform Market Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA