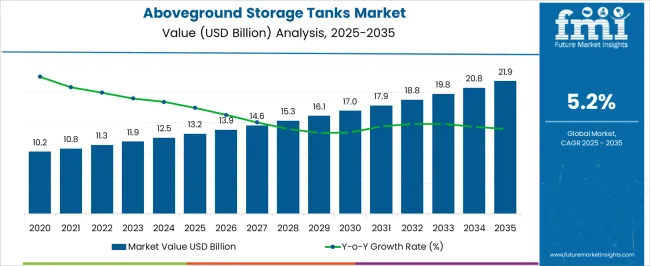

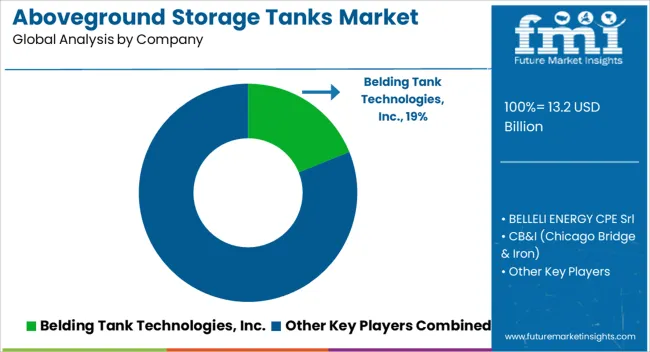

The aboveground storage tanks market is estimated to be valued at USD 13.2 billion in 2025 and is projected to reach USD 21.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The aboveground storage tanks market, valued at USD 13.2 billion in 2025 and projected to reach USD 21.9 billion by 2035, demonstrates a moderate CAGR of 5.2%, reflecting steady expansion across industrial, chemical, and energy sectors. The cost structure of ASTs is predominantly influenced by raw material procurement, manufacturing, and installation processes. Steel, often carbon or stainless, constitutes the primary material cost, accounting for a significant share of overall production expenditure.

Fabrication involves welding, forming, and surface treatment, which introduces labor, energy, and machinery expenses into the cost chain. Transportation and installation, particularly for large-diameter or high-capacity tanks, add logistical costs, with specialized equipment and safety measures contributing further to the final expenditure. The value chain extends from raw material suppliers to tank fabricators, coating providers, and engineering, procurement, and construction (EPC) contractors, followed by operators and maintenance service providers. Coating and lining services, crucial for corrosion resistance and regulatory compliance, represent a key value-added segment in the chain.

Aftermarket services, including inspection, maintenance, and retrofitting, generate recurring revenue streams and enhance long-term market value. Cost optimization is often achieved through modular fabrication, standardization of design, and regional sourcing of materials, while the integration of advanced coatings and monitoring systems adds incremental value without proportionally increasing costs. The AST market reflects a structured cost and value-chain ecosystem, with material sourcing, fabrication, installation, and post-sale services defining profitability and competitive positioning over the forecast period.

| Metric | Value |

|---|---|

| Aboveground Storage Tanks Market Estimated Value in (2025 E) | USD 13.2 billion |

| Aboveground Storage Tanks Market Forecast Value in (2035 F) | USD 21.9 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

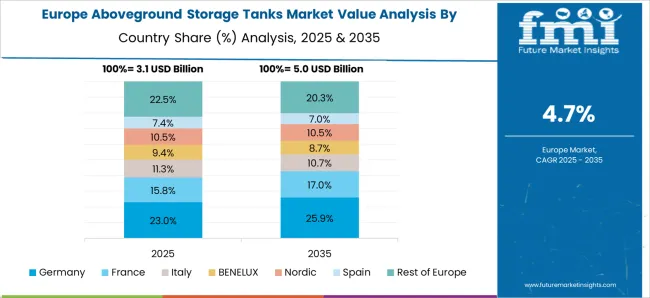

The aboveground storage tanks market represents a specialized segment within the global industrial storage and oil and gas infrastructure industry, emphasizing safe containment, operational efficiency, and regulatory compliance. Within the broader storage solutions sector, it accounts for about 5.6%, driven by demand from oil, gas, chemical, and water storage applications. In the petroleum and chemical processing market, it secures 5.1%, reflecting reliance on high-capacity, corrosion-resistant tanks for bulk storage. Across the industrial equipment and infrastructure sector, the share is 4.3%, supporting storage needs in manufacturing, municipal, and utility operations. Within the energy and utility storage category, it represents 3.9%, highlighting adoption in power generation and emergency storage systems.

In the environmental and water management solutions segment, it contributes about 3.4%, emphasizing applications in potable water, wastewater, and hazardous material containment. Recent developments in this market have focused on advanced materials, modular designs, and safety enhancements. Innovations include composite, stainless steel, and coated carbon steel tanks offering improved durability and corrosion resistance. Key players are collaborating with engineering firms, oil and gas operators, and municipal authorities to deploy modular and prefabricated tank systems for faster installation and maintenance. Adoption of digital monitoring solutions, such as level sensors, leak detection systems, and remote monitoring platforms, is gaining traction to enhance operational reliability. The environmentally compliant coatings and secondary containment measures are being implemented to meet strict regulatory standards. These trends demonstrate how material innovation, safety, and technological integration are shaping the market.

The aboveground storage tanks market is experiencing steady growth due to rising global energy demand, expansion in oil and gas infrastructure, and the increasing need for safe and efficient bulk liquid storage solutions. Regulatory requirements surrounding environmental safety, spill prevention, and emissions control are encouraging the adoption of advanced tank designs with enhanced safety features.

Technological improvements in corrosion resistance, leak detection, and structural integrity have further boosted confidence in aboveground storage solutions. The versatility of these tanks in storing a variety of liquids including petroleum products, chemicals, and water makes them integral to multiple industrial sectors.

The future outlook remains positive as large scale industrial projects, modernization of existing facilities, and stricter safety compliance continue to drive demand for robust and long lasting storage infrastructure.

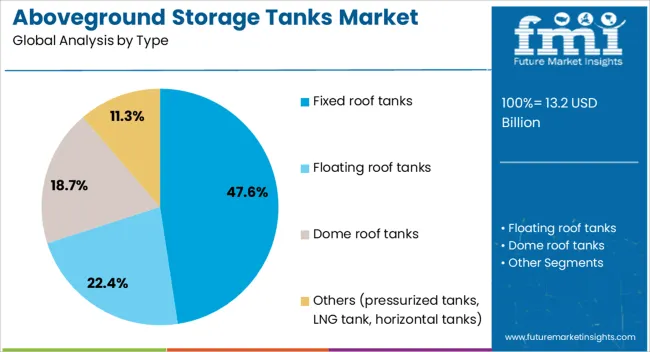

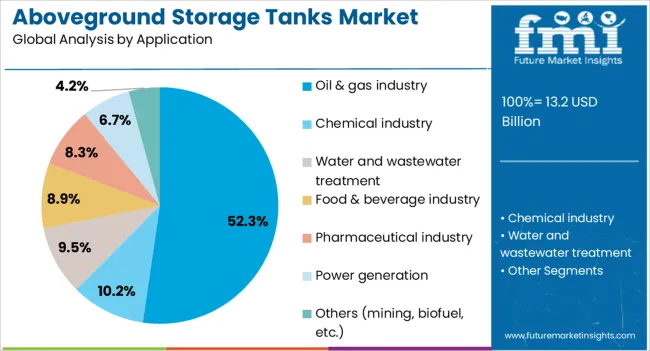

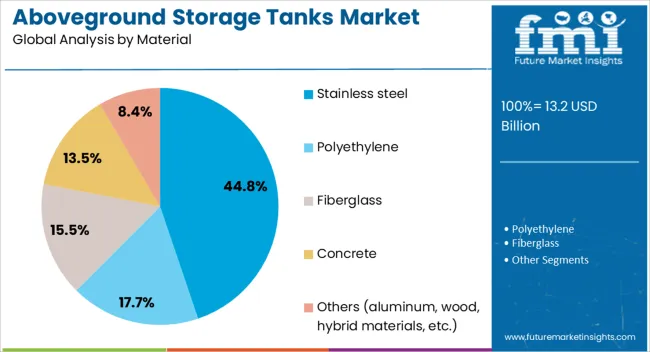

The aboveground storage tanks market is segmented by type, application, material, capacity, and geographic regions. By type, aboveground storage tanks market is divided into fixed roof tanks, floating roof tanks, dome roof tanks, and others (pressurized tanks, LNG tank, horizontal tanks). In terms of application, aboveground storage tanks market is classified into oil & gas industry, chemical industry, water and wastewater treatment, food & beverage industry, pharmaceutical industry, power generation, and others (mining, biofuel, etc.). Based on material, aboveground storage tanks market is segmented into stainless steel, polyethylene, fiberglass, concrete, and others (aluminum, wood, hybrid materials, etc.). By capacity, aboveground storage tanks market is segmented into small tanks (Up to 50,000 gallons), medium tanks (50,000 – 250,000 gallons), and large tanks (Above 250,000 gallons). Regionally, the aboveground storage tanks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed roof tanks segment is projected to hold 47.6% of the total market revenue by 2025 within the type category, making it the leading segment. This dominance is supported by their cost effectiveness, ease of installation, and suitability for storing liquids with low vapor pressure.

Fixed roof designs offer straightforward maintenance and are widely adopted in facilities where emissions control requirements can be met through internal floating covers or vapor recovery systems.

Their reliability and adaptability to diverse industrial storage needs have reinforced their market leadership.

The oil and gas industry segment is expected to account for 52.3% of total revenue by 2025 within the application category, making it the most prominent segment. Growth is being driven by the increasing need for large capacity storage facilities to manage production fluctuations, strategic reserves, and supply chain logistics.

Aboveground tanks in this sector are essential for storing crude oil, refined products, and other hydrocarbons, with designs tailored to meet strict safety and environmental standards.

Ongoing investments in exploration, refining capacity, and terminal infrastructure continue to sustain demand.

The stainless steel material segment is forecasted to hold 44.8% of total revenue by 2025, leading the material category. This preference is due to stainless steel’s superior corrosion resistance, high strength, and long service life, particularly in storing chemicals, fuels, and other corrosive substances.

Stainless steel tanks also offer hygiene benefits for food grade and potable water storage applications.

Their durability reduces long term maintenance costs, while recyclability supports environmental sustainability goals, contributing to their market dominance.

The market has experienced substantial growth due to rising demand across oil, gas, chemical, water treatment, and industrial storage applications. These tanks are designed to store liquids and gases safely, offering accessibility, ease of maintenance, and cost-effective installation compared to underground alternatives. Increasing industrial activity, energy infrastructure development, and expanding petrochemical operations have contributed to market expansion. The adoption of corrosion-resistant materials, modular designs, and advanced coatings has enhanced tank longevity and performance. Market dynamics are influenced by stringent environmental regulations, safety standards, and rising focus on efficient inventory management, which together drive innovation and deployment of AST solutions across diverse sectors.

Aboveground storage tanks are extensively deployed in industrial and petrochemical sectors for storing crude oil, refined products, chemicals, and water. Industrial facilities require tanks that offer durability, chemical compatibility, and ease of monitoring. Petrochemical plants depend on ASTs to ensure safe storage of volatile and hazardous liquids while meeting regulatory standards for fire safety and environmental protection. Modular and prefabricated tanks are increasingly preferred for rapid installation and scalability. The growth of petrochemical production globally, combined with industrial expansion in emerging economies, continues to bolster demand for aboveground storage tanks. These applications also benefit from advanced monitoring systems that provide real-time data on inventory, pressure, and temperature.

Technological innovations have transformed the design, construction, and operation of aboveground storage tanks. Modern ASTs incorporate corrosion-resistant coatings, double-wall containment, leak detection systems, and automated monitoring solutions to enhance safety and compliance. Integration with remote sensing, IoT, and predictive maintenance technologies allows operators to reduce risks and optimize storage management. Materials such as carbon steel, stainless steel, and composite polymers are being engineered for specific chemical compatibilities and environmental conditions. These advancements ensure that tanks can withstand extreme temperatures, pressure variations, and corrosive substances while maintaining operational efficiency and reliability across industrial, energy, and municipal applications.

The aboveground storage tanks market is strongly influenced by regulatory and safety requirements. Environmental protection standards mandate secondary containment, leak prevention, and proper drainage systems to prevent soil and water contamination. Fire safety codes, seismic resistance guidelines, and industry-specific certifications also impact tank design and construction. Compliance with local, national, and international regulations drives innovation in tank materials, coatings, and monitoring technologies. Manufacturers and operators must invest in high-quality construction, regular inspections, and maintenance programs to mitigate environmental and safety risks. Adherence to these regulations ensures operational reliability and enhances the market acceptance of AST solutions globally.

The market faces challenges related to fluctuating raw material prices, particularly steel and specialized coatings, which directly impact production costs. Maintenance requirements, including regular inspections, cleaning, and corrosion prevention, add operational complexity for end users. Harsh environmental conditions, such as extreme temperatures, humidity, or chemical exposure, can accelerate wear and necessitate additional protective measures. Supply chain constraints and skilled labor shortages further affect project timelines and profitability. Market players are increasingly focusing on modular designs, advanced materials, and predictive maintenance technologies to overcome these challenges. Despite these hurdles, strong demand from energy, industrial, and municipal sectors ensure continued growth opportunities.

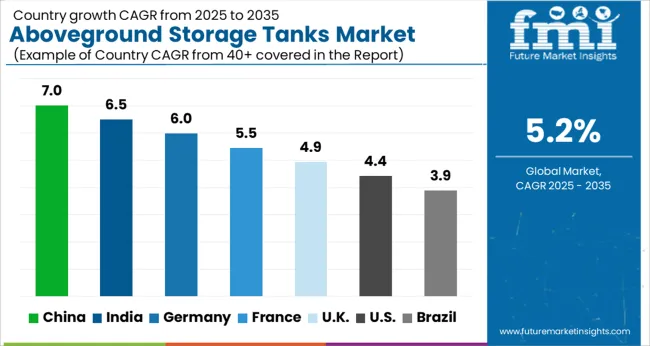

| Countries | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The market is anticipated to grow at a CAGR of 5.2% from 2025 to 2035, fueled by increasing storage infrastructure across industrial and energy sectors. Germany reached 6.0%, driven by modernization of storage facilities and compliance with safety standards. India recorded 6.5%, reflecting expansion in chemical, oil, and gas storage capacities. China led with 7.0%, supported by large-scale industrial and energy storage projects. The United Kingdom accounted for 4.9%, where infrastructure upgrades and technological adoption advanced market development. The United States registered 4.4%, sustained by maintenance, retrofitting, and regulatory compliance activities. Collectively, these countries form the core landscape of production, deployment, and technology integration in the storage tanks sector. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.0%, driven by industrial expansion, petrochemical infrastructure development, and increasing storage needs for oil, chemicals, and water. Adoption has been reinforced by domestic manufacturers producing carbon steel, stainless steel, and composite storage tanks for industrial, municipal, and energy applications. Investments in refinery upgrades, petrochemical plants, and infrastructure projects further support market growth. Emphasis on high capacity and modular tanks enables scalability for large industrial operations.

India is expected to grow at a CAGR of 6.5%, supported by increasing demand from oil storage, water management, and chemical industries. Adoption has been reinforced by domestic manufacturers providing welded steel, bolted, and composite tanks for industrial and municipal use. Investments in infrastructure projects, refinery modernization, and urban water storage programs further stimulate demand. Demand for high durability and corrosion resistant tanks is increasing across regions with industrial clusters and chemical parks.

Germany is projected to grow at a CAGR of 6.0%, driven by industrial storage, petrochemical, and energy infrastructure requirements. Adoption has been reinforced by domestic manufacturers focusing on high quality, corrosion resistant, and EU compliant tanks for liquids and chemicals. Applications include oil, chemical, and water storage for industrial and municipal purposes. German firms emphasize durability, safety compliance, and environmental standards to meet regulatory requirements.

The United Kingdom is expected to grow at a CAGR of 4.9%, supported by adoption in oil storage, chemical, and water management sectors. Imports dominate high end storage solutions, while domestic manufacturers focus on standard capacity and modular tanks. Industrial and municipal projects requiring compliant and durable tanks reinforce market growth. Emphasis on environmental standards and safety regulations further drives adoption.

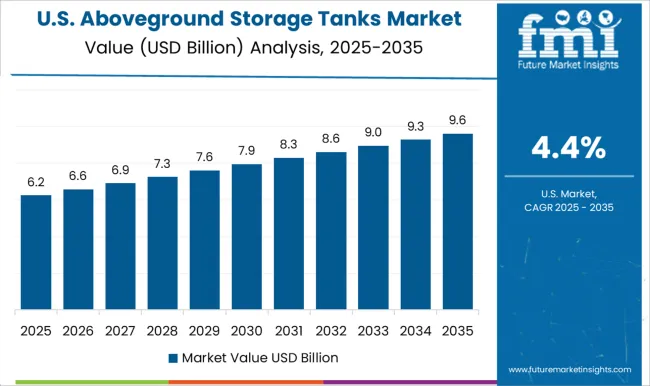

The United States is projected to grow at a CAGR of 4.4%, driven by adoption in industrial, municipal, and energy sectors. Domestic manufacturers focus on high quality, corrosion resistant, and modular storage tanks for oil, chemicals, and water. Rising demand from refinery expansions, chemical plants, and water management projects supports market expansion. Technological integration in automated monitoring and maintenance enhances operational efficiency.

The AST Market is dominated by companies providing storage solutions for petroleum, chemicals, water, and industrial liquids, focusing on durability, compliance with safety standards, and customization capabilities. Belding Tank Technologies, Inc. and CST Industries offer engineered steel tanks with advanced corrosion protection and modular designs, catering to large-scale industrial and municipal applications. CB&I (Chicago Bridge & Iron) and Matrix Service Company provide turnkey storage solutions, including design, fabrication, installation, and maintenance services, targeting oil, gas, and chemical sectors.

Companies such as Columbian TecTank (CTT), Tank Connection, and Snyder Industries emphasize modular and prefabricated tank systems, enabling rapid deployment and reduced installation costs. BELLELI ENERGY CPE Srl and ZCL Composites Inc. focus on composite and specialty material tanks, offering lightweight solutions with enhanced chemical resistance. PermianLide, Pfaudler, and Worthington Industries serve niche markets with corrosion-resistant, high-capacity, or custom-engineered storage systems.

Market competition is influenced by technological innovation, material selection, regulatory compliance, and after-sales services. Companies differentiate through engineering expertise, structural reliability, environmental compliance, and integration with monitoring and safety systems. Growing industrialization, increasing storage demands for hydrocarbons, and stringent environmental and safety regulations are driving manufacturers to expand capabilities and adopt innovative tank designs to enhance market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.2 billion |

| Type | Fixed roof tanks, Floating roof tanks, Dome roof tanks, and Others (pressurized tanks, LNG tank, horizontal tanks) |

| Application | Oil & gas industry, Chemical industry, Water and wastewater treatment, Food & beverage industry, Pharmaceutical industry, Power generation, and Others (mining, biofuel, etc.) |

| Material | Stainless steel, Polyethylene, Fiberglass, Concrete, and Others (aluminum, wood, hybrid materials, etc.) |

| Capacity | Small tanks (Up to 50,000 gallons), Medium tanks (50,000 – 250,000 gallons), and Large tanks (Above 250,000 gallons) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Belding Tank Technologies, Inc., BELLELI ENERGY CPE Srl, CB&I (Chicago Bridge & Iron), Columbian TecTank (CTT), CST Industries, Matrix Service Company, Motherwell Bridge Industries, PermianLide, Pfaudler, Snyder Industries, Superior Tank Co., Inc., Tank Connection, Tarsco (TF Warren Group), Worthington Industries, and ZCL Composites Inc. |

| Additional Attributes | Dollar sales by tank type and application, demand dynamics across oil and gas, chemical, and water storage sectors, regional trends in aboveground storage adoption, innovation in corrosion resistance, structural design, and safety systems, environmental impact of material use and spill prevention, and emerging use cases in renewable fuel storage, industrial liquids management, and modular storage solutions. |

The global aboveground storage tanks market is estimated to be valued at USD 13.2 billion in 2025.

The market size for the aboveground storage tanks market is projected to reach USD 21.9 billion by 2035.

The aboveground storage tanks market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in aboveground storage tanks market are fixed roof tanks, floating roof tanks, dome roof tanks and others (pressurized tanks, lng tank, horizontal tanks).

In terms of application, oil & gas industry segment to command 52.3% share in the aboveground storage tanks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Storage Tank Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage Area Network (SAN) Market Analysis by Component, SAN Type, Technology, Vertical, and Region through 2035

Storage as a Service Market Trends – Growth & Forecast 2020-2030

Storage Virtualization Market

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

LNG Storage Tank Market Growth - Trends & Forecast 2025 to 2035

Toy Storage Market Insights - Trends & Forecast 2025 to 2035

Lab Storage Container Market

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Storage Container Market Size and Share Forecast Outlook 2025 to 2035

Kids Storage Furniture Market by Type, Material, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Tire Storage Rack Market Growth - Trends & Forecast 2025 to 2035

Food Storage Bags Market Trends - Demand & Forecast 2025 to 2035

Cold Storage Tape Market Analysis – Trends & Forecast 2024-2034

Shoe Storage & Organizers Market

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA