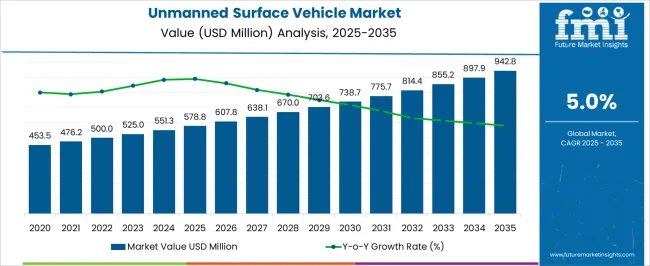

The unmanned surface vehicle market, valued at USD 578.8 million in 2025 and projected to reach USD 942.8 million by 2035 at a CAGR of 5.0%, reflects a cost-structure and value-chain composition dominated by high-value components, integration processes, and service-driven revenue streams. The primary cost elements in the manufacturing phase include advanced sensor arrays, navigation and propulsion systems, hull materials, and embedded communication modules. Sensors, such as radar, LiDAR, and sonar, represent a significant portion of the production expenditure due to the precision and reliability requirements for autonomous maritime operations. High-efficiency propulsion systems and hull fabrication account for substantial material and labor costs, particularly for corrosion-resistant and lightweight composite structures.

The value chain further extends into system integration, software development, and testing, where costs are associated with developing autonomous navigation algorithms, mission planning software, and cybersecurity frameworks to ensure safe operations in complex maritime environments. Post-sale services, including maintenance contracts, software updates, and remote monitoring solutions, contribute additional revenue but also incur operational costs.

The supply chain complexity is increased by reliance on specialized electronics suppliers, composite material manufacturers, and propulsion component vendors, making logistics and quality assurance critical for margin preservation. Over the forecast period, the USV market demonstrates a gradual increase from USD 578.8 million in 2025 to USD 942.8 million in 2035, with the cost-structure remaining heavily weighted toward technological components and integration services. The balance of upstream manufacturing and downstream service provision shapes the overall value-chain dynamics and profitability.

| Metric | Value |

|---|---|

| Unmanned Surface Vehicle Market Estimated Value in (2025 E) | USD 578.8 million |

| Unmanned Surface Vehicle Market Forecast Value in (2035 F) | USD 942.8 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The unmanned surface vehicle market represents a specialized segment within the global autonomous marine systems and maritime technology industry, emphasizing surveillance, data collection, and operational efficiency. Within the broader unmanned vessel and marine robotics market, it accounts for about 5.4%, driven by adoption in defense, oceanographic research, and offshore monitoring applications. In the maritime security and naval equipment sector, it holds nearly 4.8%, reflecting deployment for reconnaissance, patrol, and threat detection missions. Across the environmental monitoring and scientific research segment, the market captures 4.2%, supporting hydrographic surveys, water quality assessment, and oceanographic data acquisition.

Within the commercial shipping and port management category, it represents 3.7%, highlighting applications in port inspections, logistics, and asset monitoring. In the industrial offshore operations sector, it secures 3.3%, emphasizing utility in oil and gas, renewable energy, and subsea maintenance tasks. Recent developments in this market have focused on autonomy, AI integration, and modular payload systems. Innovations include high-endurance propulsion units, sensor fusion for navigation and obstacle avoidance, and cloud-based data analysis platforms. Key players are collaborating with defense agencies, research institutions, and commercial maritime operators to expand operational capabilities and reliability.

Adoption of remote monitoring, real-time telemetry, and automated mission planning is gaining traction for improved decision-making and reduced human intervention. The lightweight composite hulls, solar-assisted propulsion, and modular sensor packages are being deployed to enhance performance, endurance, and adaptability. These trends demonstrate how innovation, digitalization, and operational efficiency are shaping the unmanned surface vehicle market.

Technological advancements in autonomous navigation, communication systems, and sensor integration are enabling more precise and efficient maritime operations.

The current market scenario reflects heightened investment from both government and private sectors to enhance operational capabilities, reduce human risk in hazardous environments, and improve mission endurance. The ability to operate with minimal human intervention while collecting high-quality data has positioned these systems as critical assets in modern naval strategies and offshore operations.

Future growth is expected to be driven by the integration of AI-driven decision-making, advanced propulsion systems, and renewable energy sources, which will expand the operational range and reduce lifecycle costs. As maritime security concerns increase and offshore industries demand more cost-effective monitoring solutions, the market is anticipated to witness sustained expansion over the coming decade.

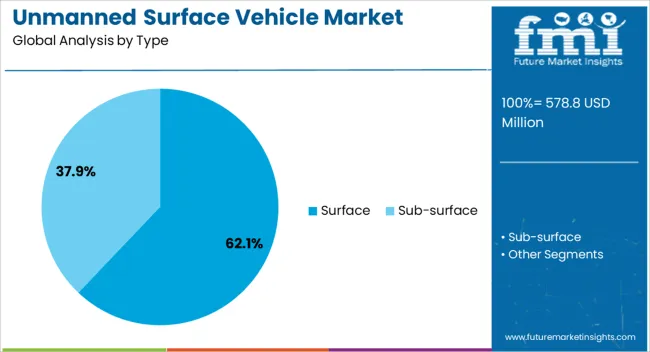

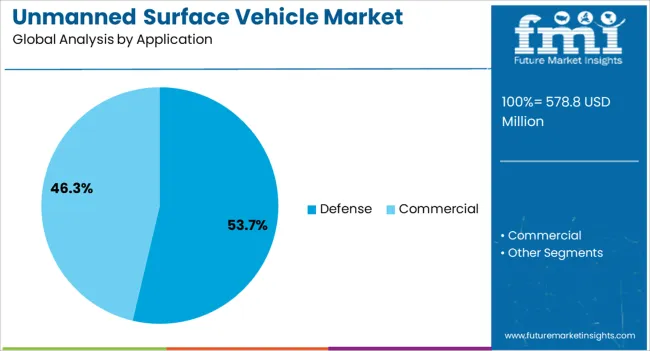

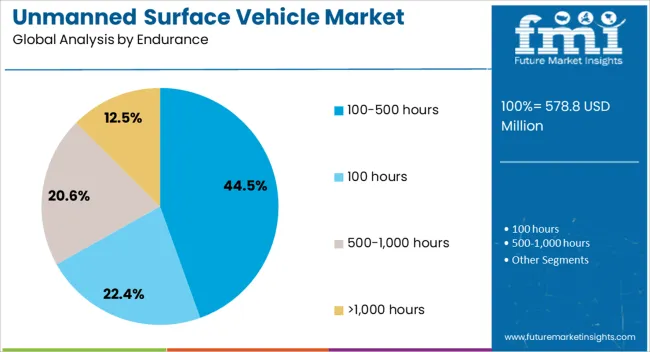

The unmanned surface vehicle market is segmented by type, application, endurance, operation, system, hull type, size, and geographic regions. By type, unmanned surface vehicle market is divided into surface and sub-surface. In terms of application, unmanned surface vehicle market is classified into defense and commercial. Based on endurance, unmanned surface vehicle market is segmented into 100-500 hours, 100 hours, 500-1,000 hours, and >1,000 hours. By operation, unmanned surface vehicle market is segmented into autonomous surface vehicle and remote operated surface vehicle. By system, unmanned surface vehicle market is segmented into propulsion, chassis material, payload, component, software, and communication. By hull type, unmanned surface vehicle market is segmented into catamaran, kayak, trimaran, and rigid inflatable hull. By size, unmanned surface vehicle market is segmented into medium, small, large, and extra-large. Regionally, the unmanned surface vehicle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Surface type is expected to account for 62.1% of the overall Unmanned Surface Vehicle market revenue in 2025, making it the leading type segment. This dominance is being attributed to its operational versatility, which allows deployment in both nearshore and open-ocean missions.

Surface vehicles offer superior payload capacity, stability, and endurance compared to smaller autonomous maritime platforms, enabling the integration of advanced sensors, communication modules, and weapon systems. Their adaptability to a wide range of missions, including surveillance, reconnaissance, and environmental monitoring, has reinforced their leadership position.

The ability to accommodate modular payloads and receive software upgrades over their operational life has further supported adoption. Demand has been bolstered by increased naval modernization programs and expanding offshore industrial activities, where these platforms are valued for their reliability, cost efficiency, and mission flexibility.

The Defense application segment is projected to hold 53.7% of the total Unmanned Surface Vehicle market revenue in 2025, making it the largest application area. This leading position is being driven by heightened global defense spending and the need for enhanced maritime security in contested waters. Defense forces are leveraging these systems for missions such as mine countermeasures, anti-submarine warfare support, and persistent surveillance.

The capability to operate autonomously in high-risk environments reduces the exposure of personnel to danger while increasing operational efficiency. Integration of advanced communication systems, real-time data transmission, and AI-powered decision-making tools has expanded the tactical utility of these vehicles.

Strategic initiatives to modernize naval fleets and enhance coastal defense capabilities have also accelerated deployment. As geopolitical tensions persist and maritime domain awareness becomes a strategic priority, the defense segment is expected to maintain its leadership in the market.

The 100-500 hours endurance category is anticipated to capture 44.5% of the Unmanned Surface Vehicle market revenue in 2025, making it the leading endurance segment. This dominance is being attributed to the optimal balance it offers between operational range, mission flexibility, and cost efficiency.

Vehicles in this endurance class can conduct extended missions without requiring frequent refueling or maintenance, making them ideal for surveillance, mapping, and environmental research over large maritime areas. Their capacity to integrate diverse payloads, combined with reliable propulsion and power management systems, supports sustained deployment in challenging sea conditions.

The segment’s growth has also been supported by the increasing need for continuous maritime monitoring in defense and commercial sectors, where operational downtime must be minimized. The scalability of these vehicles for multi-mission roles and the ability to receive mid-mission software updates further enhance their attractiveness for long-term use.

The market has grown substantially due to rising demand for autonomous maritime operations across defense, research, and commercial applications. These vehicles operate on the water surface without onboard human intervention, performing missions such as surveillance, hydrographic surveys, environmental monitoring, and offshore inspections. Advancements in navigation systems, artificial intelligence, and communication technologies have increased operational reliability and autonomy. Rising emphasis on maritime security, monitoring of territorial waters, and automation of commercial shipping operations has further boosted adoption. Manufacturers are focusing on modular designs, energy efficiency, and integration with remote monitoring platforms.

Defense and security agencies have emerged as the primary users of unmanned surface vehicles due to their ability to perform surveillance, reconnaissance, and mine detection without endangering personnel. USVs are deployed in naval missions for patrolling coastal areas, monitoring shipping lanes, and supporting counterterrorism operations. Integration with radar systems, sonar, and communication networks enables real time threat detection and data transmission to command centers. Autonomous route planning and obstacle avoidance enhance mission success rates while reducing human intervention. The growing focus on naval modernization, border protection, and maritime situational awareness continues to strengthen demand. USVs provide strategic advantages, including cost reduction, rapid deployment, and enhanced operational safety, making them increasingly vital for defense and homeland security applications.

Unmanned surface vehicles are widely used in scientific research, hydrographic surveys, and environmental monitoring due to their ability to collect data in challenging maritime environments. They are deployed to map underwater topography, monitor water quality, track marine life, and study coastal erosion without putting human operators at risk. Equipped with advanced sensors, GPS systems, and autonomous navigation, USVs facilitate precise and continuous data collection over extended periods. Environmental agencies and research institutions are increasingly adopting these vehicles to meet sustainability goals, monitor climate change impacts, and support marine conservation initiatives. The demand is further fueled by the need for cost effective alternatives to manned vessels, enabling reliable and repeatable measurements in remote or hazardous locations.

Commercial sectors and offshore industries utilize unmanned surface vehicles for inspection, maintenance, and logistical operations in offshore oil and gas platforms, wind farms, and shipping terminals. USVs reduce operational costs, improve safety, and enable rapid data acquisition in remote or hazardous waters. Integration with automated systems, data analytics platforms, and remote monitoring tools enhances operational efficiency. Tasks such as hull inspections, pipeline monitoring, cargo surveying, and port security are increasingly performed using USVs, reducing reliance on human divers and manned boats. The growing offshore energy sector, combined with the need for safer and more efficient operations, continues to drive market adoption, positioning USVs as essential tools for modern maritime industrial activities.

Continuous technological developments have transformed unmanned surface vehicles into highly autonomous, efficient, and reliable platforms. Innovations in AI driven navigation, obstacle avoidance algorithms, and sensor fusion have enhanced operational performance. Solar and hybrid propulsion systems increase endurance, while modular payloads allow mission specific customization for defense, research, or commercial operations. Connectivity with satellite and wireless networks enables real time monitoring, remote control, and data transfer. Software upgrades and predictive maintenance systems further enhance vehicle reliability and reduce operational downtime.

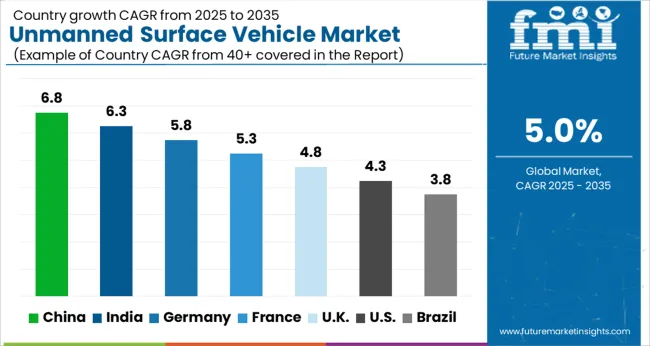

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

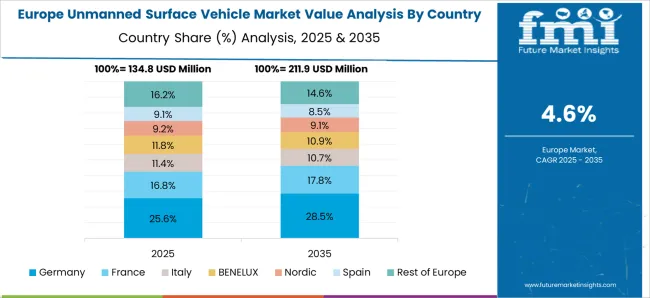

The market is expanding due to increased adoption in maritime surveillance, defense, and environmental monitoring. Germany reports 5.8%, driven by integration into naval and research applications. India achieves 6.3%, supported by growing interest in coastal security and oceanographic studies. China leads with 6.8%, benefiting from large-scale deployment in both military and commercial sectors. The United Kingdom records 4.8%, where technological development and testing initiatives sustain steady growth. The United States reaches 4.3%, supported by innovations in autonomous maritime platforms. Collectively, these countries highlight a balanced mix of production, deployment, and technological advancement shaping the global unmanned surface vehicle landscape. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 6.8%, supported by expanding maritime surveillance, defense modernization, and scientific research applications. Adoption has been encouraged by naval and coastal monitoring initiatives, where autonomous surface vessels are deployed for reconnaissance, oceanographic data collection, and port security. Domestic manufacturers have focused on advanced navigation systems, long endurance capabilities, and integration with sensor suites for real time monitoring. Export demand has increased due to competitive pricing and technological capabilities. China continues to invest in both military and commercial USVs, positioning the country as a significant contributor to global unmanned surface vehicle development.

India is expected to grow at a CAGR of 6.3% in the market, driven by defense modernization, oceanographic research, and port security applications. Adoption has been facilitated by the Indian Navy and Coast Guard, which utilize USVs for surveillance, mine detection, and maritime data collection. Domestic manufacturers and startups are developing autonomous vessels with enhanced navigation and payload capabilities. Export and collaboration with international suppliers have further supported technological growth. The market is expected to expand as India strengthens coastal defense, promotes marine research programs, and increases deployment of unmanned platforms across strategic waterways.

Germany is projected to grow at a CAGR of 5.8% in the market, supported by maritime research, naval applications, and port monitoring initiatives. Adoption has been reinforced by integration with sensor networks for oceanographic surveys and industrial monitoring. German manufacturers such as Atlas Elektronik and L3Harris have focused on autonomous navigation, long endurance, and payload adaptability to serve naval and scientific institutions. Export demand has further strengthened production capabilities. Germany’s focus on advanced maritime technologies, renewable ocean energy projects, and naval modernization ensures continued adoption of unmanned surface vehicles for both commercial and defense applications.

The market in the United Kingdom is expected to grow at a CAGR of 4.8%, influenced by defense modernization, port surveillance, and marine research initiatives. Adoption has been supported by naval programs, coastal security, and offshore energy projects, where USVs provide autonomous data collection and monitoring. U K manufacturers and technology providers have focused on AI powered navigation, sensor integration, and energy efficient designs. Imports from European and American suppliers have supplemented domestic capabilities. Market expansion is expected to continue steadily as the U K invests in maritime research, renewable offshore projects, and defense related USV deployment.

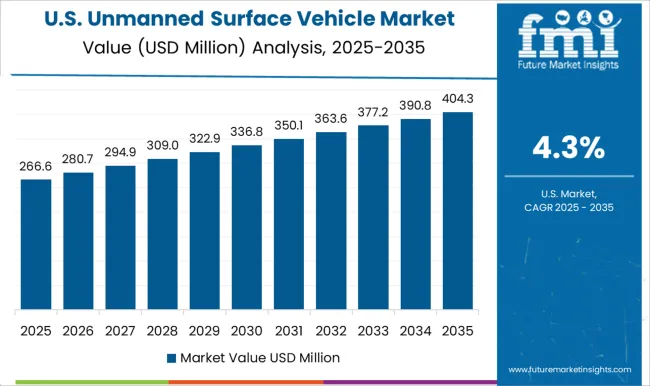

The United States market is projected to expand at a CAGR of 4.3%, supported by defense programs, scientific research, and commercial maritime applications. Adoption has been driven by the U S Navy, Coast Guard, and research institutions, deploying USVs for reconnaissance, oceanographic data collection, and port monitoring. Leading manufacturers such as Teledyne, L3Harris, and Textron have supplied autonomous vessels with long endurance, advanced sensors, and AI navigation systems. Investment in defense modernization, maritime surveillance, and ocean research ensures steady market growth. The U S market is expected to remain competitive, with technological innovation and strategic deployment shaping continued adoption.

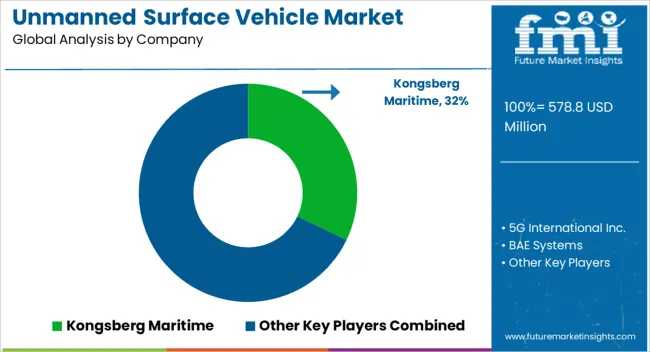

The market is characterized by high competition among leading defense, maritime, and robotics technology providers focusing on autonomous navigation, remote monitoring, and data collection for naval, commercial, and research applications. Kongsberg Maritime and Teledyne leverage decades of expertise in marine electronics and autonomous systems, offering highly integrated solutions for surveillance, hydrographic surveys, and environmental monitoring. BAE Systems, SAAB AB, and Thales focus on defense-grade USVs, emphasizing robust communication, stealth, and interoperability with naval fleets. Companies such as Liquid Robotics, Inc., OceanAlpha, and Maritime Robotics AS target commercial and scientific applications, providing modular platforms for oceanographic research, oil and gas monitoring, and maritime logistics.

L3Harris Technologies, Inc., ECA GROUPE, and iBit Systems Ltd. enhance competitiveness with advanced sensor integration, AI-driven navigation, and long-endurance autonomous operations. Fugro and Sagar Defence Engineering focus on hydrographic surveys, offshore infrastructure inspection, and specialized applications, integrating real-time data analytics and remote operation capabilities. Market competition is shaped by vessel autonomy, payload capacity, sensor technology, and endurance. Strategic partnerships with government agencies, research institutions, and commercial operators support global deployment, while continuous R&D in AI navigation, communication networks, and modular payload systems remains a key differentiator for maintaining a competitive edge.

| Item | Value |

|---|---|

| Quantitative Units | USD 578.8 Million |

| Type | Surface and Sub-surface |

| Application | Defense and Commercial |

| Endurance | 100-500 hours, 100 hours, 500-1,000 hours, and >1,000 hours |

| Operation | Autonomous surface vehicle and Remote operated surface vehicle |

| System | Propulsion, Chassis material, Payload, Component, Software, and Communication |

| Hull Type | Catamaran, Kayak, Trimaran, and Rigid Inflatable Hull |

| Size | Medium, Small, Large, and Extra-large |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kongsberg Maritime, 5G International Inc., BAE Systems, ECA GROUPE, lbit Systems Ltd., Fugro, L3Harris Technologies, Inc., Liquid Robotics, Inc., Maritime Robotics AS, OceanAlpha, SAAB AB, Sagar Defence Engineering, Teledyne, Inc., Textron Systems, and Thales |

| Additional Attributes | Dollar sales by vehicle type and application, demand dynamics across defense, environmental monitoring, and maritime research sectors, regional trends in autonomous marine technology adoption, innovation in navigation, sensor integration, and energy efficiency, environmental impact of reduced manned operations and fuel consumption, and emerging use cases in surveillance, hydrographic mapping, and offshore infrastructure inspection. |

The global unmanned surface vehicle market is estimated to be valued at USD 578.8 million in 2025.

The market size for the unmanned surface vehicle market is projected to reach USD 942.8 million by 2035.

The unmanned surface vehicle market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in unmanned surface vehicle market are surface and sub-surface.

In terms of application, defense segment to command 53.7% share in the unmanned surface vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Unmanned Aerial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Marine Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Ground Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Aerial Vehicles (UAV) Commercial Drone Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Railway Vehicle Washing Systems Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Service Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Forecast and Outlook 2025 to 2035

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Market Size and Share Forecast Outlook 2025 to 2035

Surface Mount Technology Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Disinfectant Chemicals Market Growth & Demand 2025 to 2035

Surface Disinfectant Market is segmented by product type, form and end user from 2025 to 2035

Surface Disinfectant Products Market Growth - Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA