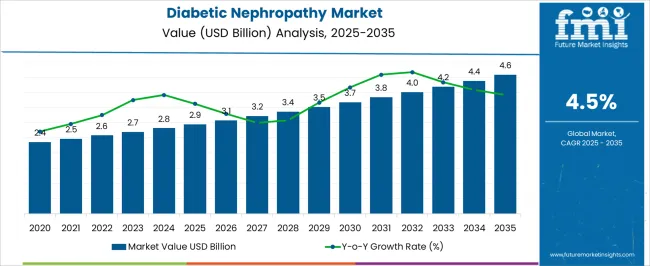

The Diabetic Nephropathy Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Diabetic Nephropathy Market Estimated Value in (2025 E) | USD 2.9 billion |

| Diabetic Nephropathy Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Diabetic Nephropathy market is witnessing steady growth, driven by the increasing global prevalence of diabetes and associated kidney complications. Rising incidences of diabetic nephropathy among both type 1 and type 2 diabetic populations are creating significant demand for effective therapeutic interventions. The market is further supported by advancements in pharmacological treatments, particularly in the development of drugs that can slow disease progression, reduce proteinuria, and improve renal function.

Growing awareness among healthcare providers and patients regarding early diagnosis and management of kidney complications is accelerating treatment adoption. Increasing healthcare expenditure, coupled with government initiatives aimed at improving diabetic care, is expanding access to therapies in both developed and emerging regions. Innovations in drug delivery systems and combination therapies are enhancing clinical efficacy and patient compliance.

The need to manage comorbidities such as hypertension and cardiovascular disease alongside diabetic nephropathy is reinforcing demand for comprehensive treatment approaches As the global burden of diabetes continues to rise, the market is expected to experience sustained growth over the coming decade, driven by effective management solutions and early intervention strategies.

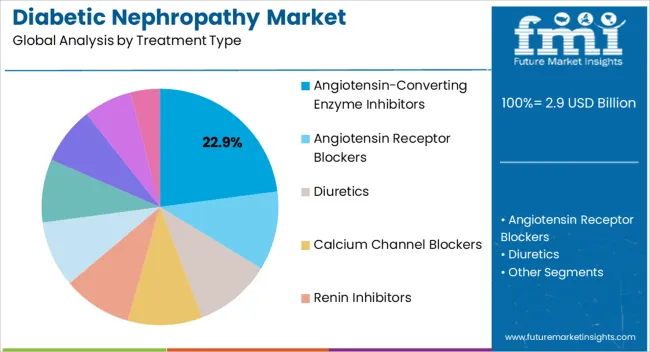

The diabetic nephropathy market is segmented by treatment type, and geographic regions. By treatment type, diabetic nephropathy market is divided into Angiotensin-Converting Enzyme Inhibitors, Angiotensin Receptor Blockers, Diuretics, Calcium Channel Blockers, Renin Inhibitors, Connective Tissue Growth Factor Inhibitors, Antioxidant Inflammation Modulator, Monocyte Chemoattractant Proteins Inhibitor, Endothelin-A Receptor Antagonist, and G Protein-Coupled Receptors. Regionally, the diabetic nephropathy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The angiotensin-converting enzyme inhibitors segment is projected to hold 22.9% of the market revenue in 2025, establishing it as a leading treatment type. Growth in this segment is being driven by the established efficacy of ACE inhibitors in slowing the progression of diabetic nephropathy, reducing proteinuria, and controlling hypertension in affected patients. Clinical evidence supports their role in preserving renal function and lowering the risk of cardiovascular complications, making them a preferred choice among healthcare providers.

The widespread availability of generic formulations and established clinical guidelines further enhance adoption. Patients benefit from improved long-term outcomes and reduced disease-related complications, which contributes to continued demand. Research advancements focused on combination therapies and improved dosing regimens are enhancing the therapeutic profile of ACE inhibitors.

Regulatory approvals and physician awareness programs have reinforced confidence in their clinical use As healthcare systems increasingly prioritize early intervention and long-term management of diabetic nephropathy, the angiotensin-converting enzyme inhibitors segment is expected to maintain a leading position, supported by proven efficacy, cost-effectiveness, and broad clinical acceptance.

Diabetes is a disease condition of high blood sugar level, caused due to malfunctioning of the pancreas. Nephropathy means kidney damage or impairment. Diabetic nephropathy is a kidney glomerulus disease which is one of the major complications in terms of morbidity and mortality for diabetic population.

Symptoms and signs of diabetic nephropathy are unknown in early stages. However, in later stages major signs and symptoms occur which includes high blood pressure, ankle and leg swelling, vomiting, morning weakness, high level of blood urea nitrogen (BUN), increased albumin secretion in urine, nausea, and itching.

For treatment of diabetic nephropathy, disease modifying therapies (DMT) that employ angiotensin II receptor blockers (ARBs) and angiotensin-converting enzyme (ACE) inhibitors are used. ACE inhibitors and ARBs provide superior protection to the kidney. Major ARBs are losartan, candesartan, and irbesartan while ACE inhibitors, such as lisinopril, captopril, enalapril, and ramipril decreases the amount of protein in the urine.

The increasing investment in research and development for drug discovery followed by awareness of diabetes and kidney related disorder treatment are the major factors that are anticipated to boost the demand for products in the global diabetic nephropathy market. For instance, the American Diabetes Association organized regular programs to create awareness among diabetic population and it ensures all the patients are able to get the knowledge, best treatment and care for diabetes management.

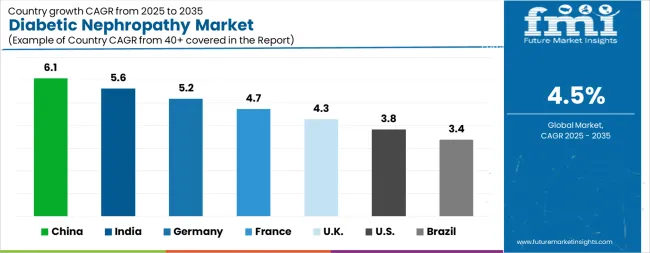

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The Diabetic Nephropathy Market is expected to register a CAGR of 4.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.1%, followed by India at 5.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.4%, yet still underscores a broadly positive trajectory for the global Diabetic Nephropathy Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.2%. The USA Diabetic Nephropathy Market is estimated to be valued at USD 1.1 billion in 2025 and is anticipated to reach a valuation of USD 1.6 billion by 2035. Sales are projected to rise at a CAGR of 3.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 155.0 million and USD 86.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Treatment Type | Angiotensin-Converting Enzyme Inhibitors, Angiotensin Receptor Blockers, Diuretics, Calcium Channel Blockers, Renin Inhibitors, Connective Tissue Growth Factor Inhibitors, Antioxidant Inflammation Modulator, Monocyte Chemoattractant Proteins Inhibitor, Endothelin-A Receptor Antagonist, and G Protein-Coupled Receptors |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

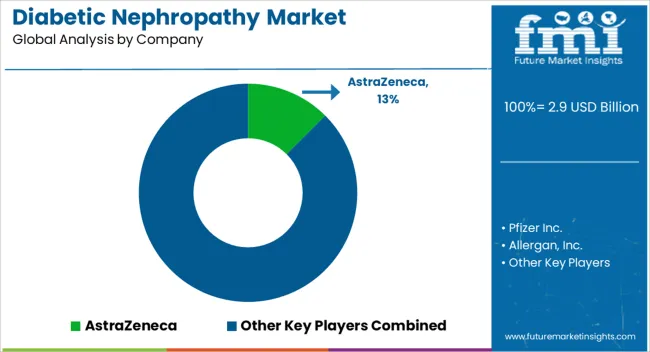

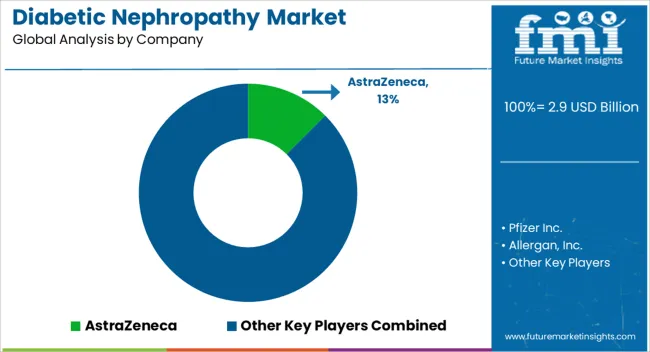

| Key Companies Profiled | AstraZeneca, Pfizer Inc., Allergan, Inc., Bristol-Myers Squibb Company, Endo International plc, Dr. Reddy's Laboratories Ltd, Sun Pharmaceutical Industries Ltd, Teva Pharmaceutical Industries Ltd, Novartis AG, Eli Lilly and Company, Mylan NV, Cipla Inc., Lupin, Aurobindo Pharma, Sanofi, and Fresenius SE & Co. KGaA |

The global diabetic nephropathy market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the diabetic nephropathy market is projected to reach USD 4.6 billion by 2035.

The diabetic nephropathy market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in diabetic nephropathy market are angiotensin-converting enzyme inhibitors, angiotensin receptor blockers, diuretics, calcium channel blockers, renin inhibitors, connective tissue growth factor inhibitors, antioxidant inflammation modulator, monocyte chemoattractant proteins inhibitor, endothelin-a receptor antagonist and g protein-coupled receptors.

In terms of , segment to command 0.0% share in the diabetic nephropathy market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA