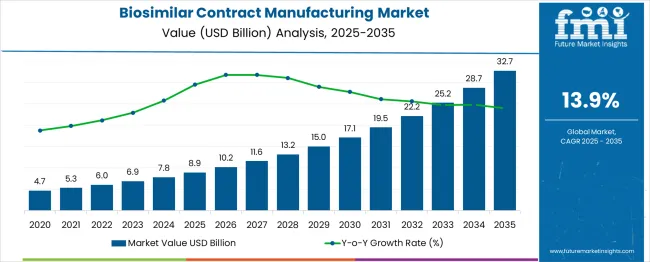

The biosimilar contract manufacturing market is projected to reach USD 8.9 billion in 2025 and is anticipated to grow to USD 32.7 billion by 2035, registering a CAGR of 14% during the forecast period. Year-on-year (YoY) growth analysis based on the forecast figures shows how the market scales in a compounding pattern. Starting from USD 4.7 billion, it rises to USD 5.3 billion, marking a YoY growth of about 12.8%, and then to USD 6 billion with a YoY gain of 13.2%. It further advances to USD 6.9 billion (15%) and USD 7.8 billion (13%) before reaching USD 8.9 billion in 2025 at a YoY increase of about 14%.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 8.9 billion |

| Forecast Value in (2035F) | USD 32.7 billion |

| Forecast CAGR (2025 to 2035) | 14% |

The biosimilar contract manufacturing market has captured a notable share within the broader biopharmaceutical contract manufacturing market, accounting for nearly 25–30% of the total market value. This share has been driven by the rapid approval of biosimilar therapies and the cost pressures faced by biopharma companies to outsource complex manufacturing activities. Many biopharmaceutical firms prefer contract manufacturing organizations (CMOs) to handle biosimilar production because it helps reduce capital investments in infrastructure, accelerates time-to-market, and ensures regulatory compliance through experienced manufacturing networks.

Within the contract manufacturing ecosystem, biosimilar-focused projects are now considered one of the highest-growth outsourcing segments, often involving large-scale biologics facilities and specialized cell line development capabilities. CMOs that provide end-to-end services from process development to commercial-scale production have gained long-term contracts from major pharmaceutical firms, which has reinforced the biosimilar segment’s market share. This growth trajectory suggests that the biosimilar contract manufacturing segment will continue to strengthen its presence within the biopharmaceutical outsourcing landscape as more high-revenue biologics face patent expiry in the coming years.

Market expansion is being supported by the increasing complexity of biosimilar development and manufacturing processes, which require specialized facilities, advanced technologies, and regulatory expertise. Pharmaceutical companies are increasingly outsourcing biosimilar production to focus on core competencies while accessing best-in-class manufacturing capabilities. The growing number of biosimilar approvals and pipeline products is creating demand for contract manufacturing services across multiple therapeutic areas and product types.

The expanding global biosimilars market, driven by healthcare cost containment initiatives and increasing acceptance by healthcare providers, is creating opportunities for contract manufacturers to scale operations and invest in advanced manufacturing technologies. The need for flexible manufacturing capacity, regulatory compliance expertise, and global supply chain capabilities is driving pharmaceutical companies to partner with specialized contract manufacturers. The increasing complexity of next-generation biosimilars and novel biologics requires sophisticated manufacturing platforms that are best accessed through outsourcing partnerships.

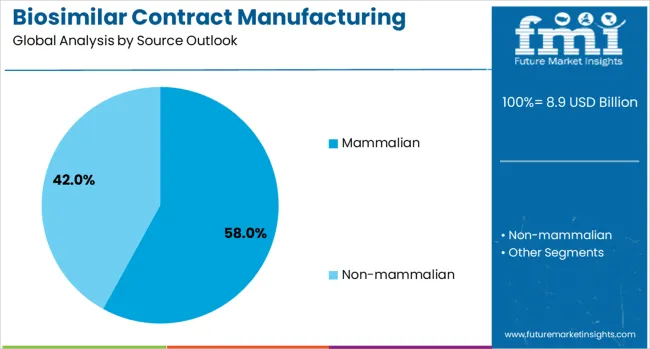

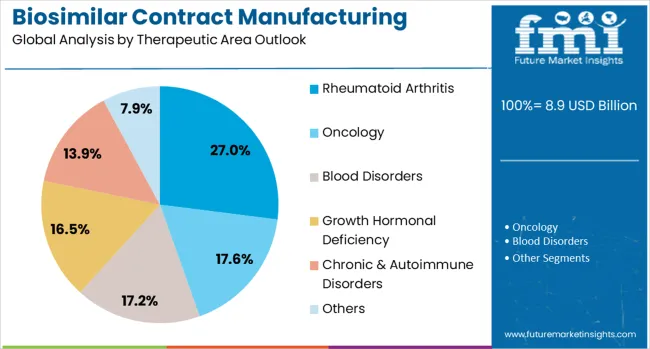

The market is segmented by source outlook, service outlook, therapeutic area outlook, and region. By source outlook, the market is divided into mammalian and non-mammalian. Based on service outlook, the market is categorized into recombinant non-glycosylated proteins and recombinant glycosylated proteins. In terms of therapeutic area outlook, the market is segmented into rheumatoid arthritis, oncology, blood disorders, growth hormone deficiency, and chronic & autoimmune disorders. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

The mammalian source segment is projected to account for 58% of the biosimilar contract manufacturing market in 2025, reflecting its critical role in producing complex biologics that require sophisticated post-translational modifications. Mammalian cell systems, particularly Chinese Hamster Ovary (CHO) cells, remain the gold standard for manufacturing therapeutic proteins that require human-like glycosylation patterns and proper protein folding. These systems are essential for producing monoclonal antibodies, complex fusion proteins, and other advanced biologics that represent the majority of high-value biosimilar products.

The dominance of mammalian systems is supported by their proven track record in regulatory approvals, established manufacturing processes, and ability to produce biologics with consistent quality attributes. Contract manufacturers continue to invest heavily in mammalian cell culture capabilities, including single-use bioreactors, advanced cell line development, and purification technologies. The segment benefits from ongoing technological advances in cell line engineering, media optimization, and bioprocess intensification that improve productivity and reduce manufacturing costs while maintaining product quality.

Recombinant non-glycosylated proteins are projected to represent 55% of biosimilar contract manufacturing demand in 2025, driven by the large number of established biologics in this category and their relative manufacturing simplicity. This segment includes important therapeutic categories such as insulin, growth hormones, cytokines, and other proteins that do not require complex glycosylation patterns. The manufacturing advantages of non-glycosylated proteins include faster development timelines, lower production costs, and greater process robustness compared to glycosylated counterparts.

The segment benefits from well-established manufacturing platforms, proven analytical methods, and streamlined regulatory pathways that reduce development risks and time-to-market. Contract manufacturers can leverage existing microbial and mammalian expression systems optimized for non-glycosylated protein production, offering cost-effective solutions to biosimilar developers. The category includes several high-volume therapeutic areas with significant market opportunities, including diabetes care, growth disorders, and inflammatory conditions, supporting demand for specialized manufacturing services.

The rheumatoid arthritis therapeutic area is forecasted to contribute 27% of the biosimilar contract manufacturing market in 2025, reflecting the significant clinical and commercial success of TNF-alpha inhibitors and other immunomodulatory biologics in this indication. This segment represents one of the largest and most established biosimilar markets, with multiple approved products and robust clinical evidence supporting biosimilar adoption. The therapeutic area benefits from well-defined regulatory pathways, established clinical endpoints, and growing physician and patient acceptance of biosimilar alternatives.

The segment is characterized by high-value products with substantial market opportunities, driving significant investment in specialized manufacturing capabilities. Contract manufacturers have developed expertise in producing complex monoclonal antibodies and fusion proteins required for rheumatoid arthritis treatments, including advanced purification technologies and analytical capabilities. The therapeutic area continues to attract new biosimilar entrants, supporting demand for manufacturing services and driving innovation in cost-effective production methods.

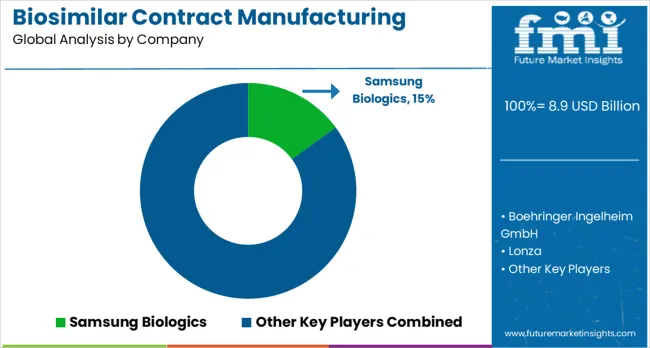

Samsung Biologics is projected to hold 15.0% of the biosimilar contract manufacturing market share in 2025, establishing its position as a leading global contract manufacturer through significant investments in manufacturing capacity and advanced bioprocessing technologies. The company has built one of the world's largest contract manufacturing facilities with multiple large-scale bioreactors and comprehensive downstream processing capabilities. Samsung Biologics serves major pharmaceutical companies worldwide, providing end-to-end services from cell line development through commercial manufacturing.

The company's market leadership is supported by its focus on operational excellence, regulatory compliance, and customer partnership approaches that address the complex requirements of biosimilar manufacturing. Samsung Biologics continues to expand its global footprint and service capabilities, including investments in next-generation manufacturing technologies and specialized therapeutic area expertise. The company's strong track record in supporting successful biosimilar launches and its commitment to capacity expansion position it to maintain leadership in the growing contract manufacturing market.

The biosimilar contract manufacturing market is advancing rapidly due to increasing complexity of biosimilar development, growing demand for cost-effective biologics, and expanding regulatory approvals across major markets. The market faces challenges including intense price competition, regulatory compliance complexity, and technical risks associated with manufacturing complex biologics. Innovation in bioprocessing technologies, capacity expansion in emerging markets, and strategic partnerships continue to influence market development and competitive dynamics.

The growing establishment of biosimilar contract manufacturing facilities in Asia Pacific is enabling companies to access cost-effective production capabilities while serving rapidly expanding regional markets. Countries like China, India, and South Korea are investing heavily in biomanufacturing infrastructure, regulatory capabilities, and skilled workforce development. These markets offer competitive manufacturing costs, supportive government policies, and growing domestic demand for biosimilar products, creating attractive opportunities for contract manufacturers.

Modern biosimilar contract manufacturers are incorporating advanced technologies such as single-use systems, continuous manufacturing, and process analytical technology to enhance efficiency, flexibility, and product quality. These innovations enable faster technology transfer, reduced contamination risks, and improved process control throughout manufacturing operations. Advanced automation and digitalization are also supporting real-time monitoring, predictive maintenance, and data-driven optimization of manufacturing processes.

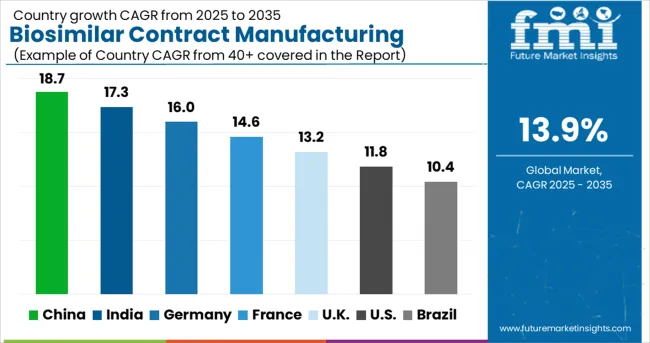

| Country | CAGR (2025-2035) |

|---|---|

| China | 18.7% |

| India | 17.3% |

| Germany | 15.9% |

| France | 14.6% |

| UK | 13.2% |

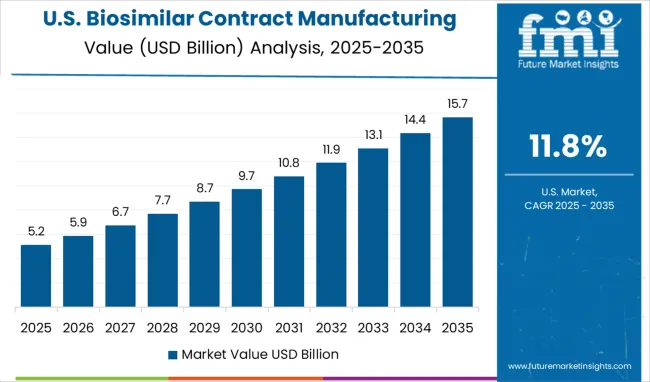

| USA | 11.8% |

| Brazil | 10.4% |

The global biosimilar contract manufacturing market is projected to grow at a CAGR of 14% between 2025 and 2035. China leads this expansion with an 18.7% CAGR, driven by increasing biosimilar production capacity, expanding biopharmaceutical infrastructure, and rising demand for cost-efficient manufacturing partnerships. India follows at 17.3%, supported by strong expertise in biologics production, growing outsourcing contracts, and competitive manufacturing costs. Germany shows growth at 16.0%, emphasizing advanced bioprocessing capabilities and stringent quality standards. France records 14.6%, fueled by expanding biopharma collaborations and government-backed healthcare initiatives. The UK grows at 13.2%, focusing on biologics innovation and contract manufacturing expertise. The USA stands at 11.8%, reflecting steady growth in biosimilar approvals and contract manufacturing deals.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

The biosimilar contract manufacturing market in China is projected to grow at a CAGR of 18.7% from 2025 to 2035. Rapid expansion of biologics capacity is being observed and contract manufacturing has been positioned as a strategic response by both domestic and international firms. Large-scale biomanufacturing facilities are being commissioned and single-use technologies are being embraced to shorten time to market. Regulatory reforms have been enacted to accelerate approval pathways for biosimilars and to improve quality oversight, which has allowed local CMOs to capture more development and fill/finish work. Cost-sensitive global buyers are being attracted by competitive production economics, while specialized services such as process scale-up, comparability studies, and analytical method transfers are being outsourced more frequently. Partnerships between university research centers and commercial CMOs are supporting skill transfer and process innovation. It is believed that vertical integration of formulation, sterile fill, and packaging capabilities will increase as a reputation for quality is earned and export volumes rise. Supply-chain resilience has been elevated as a procurement priority, and multiple domestic suppliers are being contracted to mitigate single-source risk.

Revenue from biosimilar contract manufacturing in India is expanding at a CAGR of 17.3%, supported by competitive manufacturing costs, a skilled scientific workforce, and increasing regulatory compliance capabilities. The country's established pharmaceutical industry and growing biotechnology sector are creating a strong foundation for contract manufacturing growth. Indian manufacturers are investing in advanced facilities, quality systems, and regulatory approvals to serve global markets while maintaining cost advantages. Rising investments in single-use technologies and advanced bioprocessing capabilities are enhancing manufacturing flexibility and efficiency across Indian facilities. Growing partnerships with international biosimilar developers are driving technology transfer and capacity expansion to support global supply chain requirements.

The biosimilar contract manufacturing market in Germany is projected to grow at a CAGR of 16.0% from 2025 to 2035. High-quality bioprocess engineering and a strong supplier ecosystem are being leveraged to provide premium CMO services focused on advanced analytics, process intensification, and continuous bioprocessing. Regulatory compliance is being strictly observed and early engagement with health authorities is being emphasized in development programs. Many CMOs are being positioned as technology partners offering process optimization, PAT based monitoring, and robust comparability packages designed for stringent European regulators. Demand for immunogenicity testing, cell-line stability programs, and viral clearance validation is being met by specialized contract labs. It is anticipated that German-based CMOs will continue to attract high-complexity projects that require close collaboration with clinical and regulatory teams because the local environment is favorable for high-touch, precision manufacturing. Investment in digital manufacturing platforms and predictive maintenance is being prioritized to ensure consistent scale-up performance.

The biosimilar contract manufacturing market in France is forecasted to grow at a CAGR of 14.6% from 2025 to 2035. Investment in scalable, modular biologics facilities has been encouraged, and specialized services for biosimilarity assessment are being expanded. French CMOs are being relied upon for robust comparability studies, formulation development, and clinical supply manufacture. A cluster effect around certain regions is being observed where analytical laboratories, fill/finish centers, and sterile packaging operations are co-located to speed handoffs and reduce lead times. Collaboration between biotech incubators and manufacturing partners is being used to de-risk early-stage programs and to accelerate process validation. It is judged that French CMOs will attract niche biosimilar programs that require tailored formulation expertise or specialty aseptic filling because these capabilities are well established locally. Focus on end-to-end supply assurance is being placed by buyers who require reliable lot release and stability documentation for international submissions.

Revenue from biosimilar contract manufacturing in the United Kingdom is projected to grow at a CAGR of 13.2% through 2035, supported by the country's strong biotechnology sector, regulatory expertise, and focus on high-value manufacturing services. British manufacturers are positioned as premium service providers offering comprehensive development and manufacturing capabilities. The market benefits from established pharmaceutical industry presence and ongoing investments in advanced manufacturing infrastructure. Growth in specialized therapeutic areas and complex biologics is creating opportunities for UK manufacturers to provide differentiated services to global clients. Strategic partnerships with biotechnology companies and academic institutions are supporting innovation in manufacturing processes and next-generation technologies.

The biosimilar contract manufacturing market in the United States is forecasted to grow at a CAGR of 11.8% from 2025 to 2035. Large-scale commercial manufacturing and advanced analytical support are being provided by established CMOs to meet the needs of major biosimilar sponsors. Focus is being placed on process validation, scalability, and end-to-end quality systems that satisfy multiple regulatory jurisdictions. A preference for domestic manufacturing is being signaled by several large buyers seeking shorter supply chains and improved control over critical lots. Complex services such as comparability studies, immunogenicity assessment, and real-time analytics are being offered alongside fill/finish and secondary packaging to deliver a compliant launch-ready supply. It is observed that partnerships between innovator companies and CMOs are being structured as long-term strategic supply agreements to secure continuity for high-volume products and to manage post-approval changes.

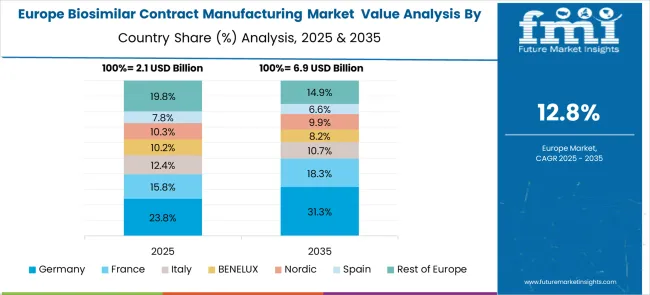

The biosimilar contract manufacturing market in Europe demonstrates strong development across major pharmaceutical hubs, with Germany showing a significant presence through its advanced biomanufacturing infrastructure and regulatory expertise, supported by companies like Boehringer Ingelheim leveraging decades of biologics experience to provide comprehensive contract manufacturing services for complex biosimilar products. France represents an important market driven by its pharmaceutical industry heritage and biotechnology innovation, with established manufacturers offering specialized services for monoclonal antibodies and recombinant proteins targeting European and global markets.

The UK exhibits considerable growth through its strong biotechnology sector and contract manufacturing capabilities, with companies providing end-to-end services from process development through commercial manufacturing. Germany and France show expanding capacity in specialized therapeutic areas, particularly in oncology and immunology biosimilars. BENELUX countries contribute through their focus on high-value manufacturing and regulatory services, while Eastern Europe displays growing potential driven by competitive manufacturing costs and expanding biomanufacturing infrastructure investments across the region.

Companies are investing heavily in large-scale biologics production facilities, advanced cell line development technologies, single-use bioprocessing systems, and high-throughput analytical platforms to deliver cost-efficient and compliant biosimilar manufacturing services. Strategic partnerships, long-term supply agreements, and capacity expansion initiatives are central to strengthening competitive positions and securing market share in this rapidly expanding segment.

Samsung Biologics is a leading global CDMO with extensive large-scale bioreactor capacity, offering end-to-end biosimilar development and manufacturing solutions from cell line development to commercial production. Boehringer Ingelheim GmbH provides contract biologics production with strong regulatory expertise and global manufacturing networks, focusing on high-quality monoclonal antibody and protein-based biosimilars. Lonza delivers comprehensive biologics development and manufacturing services with advanced cell culture and microbial fermentation platforms. Catalent, Inc. supports biosimilar manufacturing with integrated biologics development, fill-finish, and packaging services, emphasizing speed to market and flexible capacity. Rentschler Biopharma SE specializes in biopharmaceutical process development and cGMP manufacturing for complex biosimilar molecules.

AGC Biologics, ProBioGen, and FUJIFILM Diosynth Biotechnologies deliver cell line engineering, process optimization, and scalable biologics production platforms tailored to biosimilar developers. Toyobo Co. Ltd. contributes niche biopharmaceutical contract manufacturing services in Asia, while Thermo Fisher Scientific, Inc. provides extensive biologics CDMO capabilities through its pharma services division, including development, manufacturing, and analytical testing. Binex Co., Ltd. and WuXi Biologics play key roles in the Asia-Pacific market, offering competitive large-scale manufacturing capacity and rapid project turnaround for biosimilar production.

Pharmaceutical companies like AbbVie, Inc., ADMA Biologics, Inc., Cambrex Corporation, Pfizer Inc., and Siegfried Holding AG leverage in-house expertise and partnerships with CDMOs to advance their biosimilar pipelines while offering contract manufacturing services for external clients. These companies combine biologics production capabilities, regulatory experience, and global distribution channels to enhance competitiveness.

Market differentiation is driven by the ability to provide integrated development-to-commercialization services, regulatory compliance, scalable production capacity, and cost efficiency. CDMOs are focusing on expanding mammalian and microbial production lines, implementing digital bioprocessing systems, and adopting continuous manufacturing to reduce costs and improve throughput. Strategic collaborations with biosimilar developers and regional biotechs enable faster market entry, while regulatory accreditations from agencies such as the USA Food and Drug Administration and European Medicines Agency enhance credibility.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 8.9 billion |

| Source Outlook | Mammalian, Non-mammalian |

| Service Outlook | Recombinant Non-glycosylated Proteins, Recombinant Glycosylated Proteins |

| Therapeutic Area Outlook | Rheumatoid Arthritis, Oncology, Blood Disorders, Growth Hormonal Deficiency, Chronic & Autoimmune Disorders |

| Company | Samsung Biologics, Boehringer Ingelheim GmbH, Lonza, Catalent Inc., Rentschler Biopharma SE, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, France, United Kingdom, United States, Japan, South Korea, Brazil, Canada, and 40+ countries |

| Additional Attributes | Manufacturing capacity analysis by region, therapeutic area demand trends, competitive landscape assessment, technology adoption patterns, regulatory compliance requirements, integration with specialized bioprocessing technologies, innovations in single-use systems, continuous manufacturing platforms, and strategic partnership developments |

The global biosimilar contract manufacturing market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the biosimilar contract manufacturing market is projected to reach USD 32.7 billion by 2035.

The biosimilar contract manufacturing market is expected to grow at a 13.9% CAGR between 2025 and 2035.

The key product types in biosimilar contract manufacturing market are mammalian and non-mammalian.

In terms of service outlook , recombinant non-glycosylated proteins segment to command 55.2% share in the biosimilar contract manufacturing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biosimilar Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar and Biologics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Insulin Biosimilar Market Size and Share Forecast Outlook 2025 to 2035

Remicade Biosimilar Market Analysis - Demand & Forecast 2025 to 2035

Global Psoriasis Biosimilars Market Analysis – Size, Share & Forecast 2024-2034

Dermatology Biosimilar Market Forecast and Outlook 2025 to 2035

Interchangeable Biosimilars Market

Middle East & Africa (MEA) Biologics and Biosimilar Market Analysis by Drug, Drug Class, Dosage Form, Indication, Distribution Channel, and Country through 2035

Contract Logistics Market Size and Share Forecast Outlook 2025 to 2035

Contract Furniture Market Analysis by Product Type, End-users, Distribution Channel, and Region from 2025 to 2035.

Contract Lifecycle Management Market Growth – Trends & Forecast 2025 to 2035

Contractual Cleaning Services Market Growth - Trends & Forecast 2025 to 2035

Contract Management Software Market Analysis By Solution, By Enterprise Size, By Business Function and Industry Through 2035

Contract Packaging Market from 2025 to 2035

Contract Blending Services Market

Contract Dose Manufacturing Market

Global IVD Contract Manufacturing Market Trends – Size, Forecast & Growth 2024-2034

Blockchain-Powered Smart Contracts – Future of Legal Transactions

Supplier Contract Management Market Size and Share Forecast Outlook 2025 to 2035

Biologics Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA