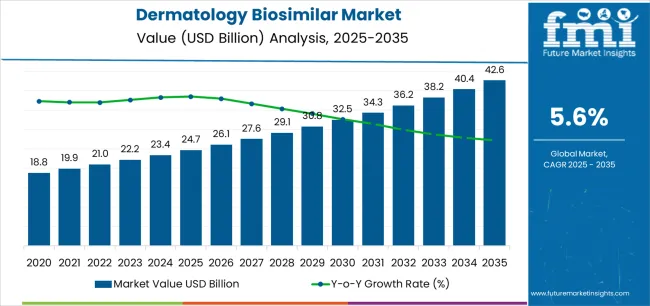

The global dermatology biosimilar market is projected to reach USD 42,648.6 million by 2035, recording an absolute increase of USD 17,916.0 million over the forecast period. The market is valued at USD 24,732.6 million in 2025 and is set to rise at a CAGR of 5.6% during the assessment period.

The market size is expected to grow by nearly 1.7 times during the same period, supported by increasing demand for cost-effective biologic treatments and advanced dermatological therapies worldwide, driving demand for adalimumab biosimilars and increasing investments in specialized pharmaceutical manufacturing and dermatology treatment centers globally. Patent litigation challenges and regulatory approval complexities may pose obstacles to market expansion.

The transformation of dermatological treatment through biosimilar medicines represents a fundamental shift in healthcare economics, offering patients and healthcare systems access to proven biologic therapies at significantly reduced costs. Patent expirations for major dermatology biologics have opened opportunities for biosimilar manufacturers to develop equivalent treatments that maintain therapeutic efficacy while reducing financial barriers to access. These biosimilar medicines undergo rigorous regulatory evaluation to demonstrate comparable safety, efficacy, and quality profiles to their reference biologics, providing healthcare providers with confidence in prescribing these alternatives.

Adalimumab biosimilars have emerged as the dominant force in dermatological biosimilar treatments, addressing conditions ranging from moderate-to-severe plaque psoriasis to psoriatic arthritis and hidradenitis suppurativa. The complexity of manufacturing these large molecule drugs requires sophisticated biotechnology platforms and extensive analytical capabilities to ensure consistency and comparability with reference products. Manufacturing facilities must maintain strict quality control standards throughout the production process, from cell line development through final formulation and packaging.

Healthcare systems worldwide face mounting pressure to manage rising pharmaceutical costs while maintaining treatment quality, making biosimilars an attractive solution for budget-constrained institutions. Insurance coverage policies increasingly favor biosimilar alternatives, creating market dynamics that encourage both prescriber adoption and patient acceptance of these treatments. Clinical studies continue to demonstrate that switching from reference biologics to biosimilars maintains treatment efficacy while reducing medication costs by 20-40% in most markets.

The regulatory landscape for biosimilars varies significantly across major markets, with agencies developing specific guidelines for dermatology applications that address unique considerations including immunogenicity assessment, extrapolation principles, and post-market surveillance requirements. European markets have historically led biosimilar adoption, establishing precedents for clinical development pathways and regulatory approval processes that other regions have adapted. Interchangeability determinations in certain markets allow pharmacists to substitute biosimilars without prescriber intervention, further accelerating market penetration.

Between 2025 and 2030, the dermatology biosimilar market is projected to expand from USD 24,732.6 million to USD 33,112.8 million, resulting in a value increase of USD 8,380.2 million, which represents 46.8% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for cost-effective biologic treatments and specialized dermatological therapies, product innovation in adalimumab biosimilars and etanercept applications, as well as expanding integration with healthcare systems and specialty pharmacy networks. Companies are establishing competitive positions through investment in advanced manufacturing capabilities, regulatory approval processes, and strategic market expansion across hospital, retail, and specialty pharmacy applications.

From 2030 to 2035, the market is forecast to grow from USD 33,112.8 million to USD 42,648.6 million, adding another USD 9,535.8 million, which constitutes 53.2% of the ten-year expansion. This period is expected to be characterized by the expansion of advanced biosimilar applications, including next-generation adalimumab formulations and specialized treatment protocols tailored for specific dermatological conditions, strategic collaborations between biosimilar manufacturers and dermatology specialists, and an enhanced focus on interchangeability standards and automated dispensing protocols. The growing emphasis on healthcare cost management and specialty pharmacy integration will drive demand for comprehensive dermatology biosimilar solutions across diverse medical applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 24,732.6 million |

| Market Forecast Value (2035) | USD 42,648.6 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The dermatology biosimilar market grows by enabling healthcare providers and pharmaceutical companies to optimize treatment accessibility while accessing cost-effective biologic therapies without substantial in-house development investment. Healthcare companies and dermatology specialists face mounting pressure to develop affordable treatment options and specialized therapeutic capabilities while managing complex regulatory requirements, with adalimumab biosimilars typically providing 40-60% cost reduction compared to reference biologics, making advanced biosimilar alternatives essential for competitive healthcare positioning.

The pharmaceutical industry's need for cost-effective biologic treatments and application-specific therapeutic capabilities creates demand for comprehensive dermatology biosimilar solutions that can provide superior affordability, maintain consistent therapeutic standards, and ensure reliable treatment outcomes without compromising clinical effectiveness or patient safety.

Government initiatives promoting biosimilar adoption and healthcare cost management drive uptake in hospital systems, specialty pharmacies, and retail pharmaceutical applications, where treatment affordability has a direct impact on patient access and long-term healthcare effectiveness. Regulatory complexity constraints during approval processes and the expertise requirements for specialized manufacturing integration may limit accessibility among smaller pharmaceutical companies and developing regions with limited technical infrastructure for advanced biologic production systems.

The market is segmented by molecule type, indication, distribution channel, and region. By molecule type, the market is divided into adalimumab biosimilars, etanercept biosimilars, infliximab biosimilars, ustekinumab biosimilars, and others. Based on indication, the market is categorized into plaque psoriasis, psoriatic arthritis, hidradenitis suppurativa, and others. By distribution channel, the market includes hospital pharmacies, retail/specialty pharmacies, and mail-order pharmacies. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

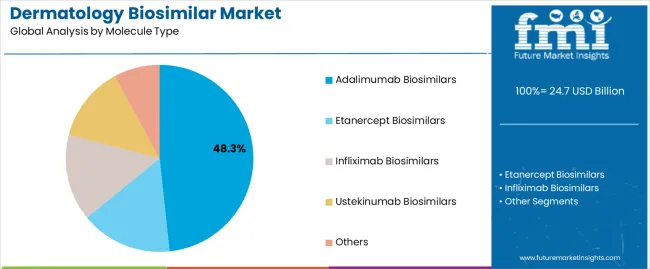

The adalimumab biosimilars segment represents the dominant force in the dermatology biosimilar market, capturing approximately 48.3% of total market share in 2025. This established molecule category encompasses solutions featuring advanced TNF-alpha inhibition mechanisms and specialized dermatological treatment applications, including high-performance therapeutic properties and enhanced clinical characteristics that enable superior treatment benefits and patient outcomes across all dermatological applications. The adalimumab biosimilars segment's market leadership stems from its proven therapeutic capabilities, with solutions capable of addressing diverse dermatological requirements while maintaining consistent efficacy standards and treatment effectiveness across all clinical environments.

The etanercept biosimilars segment maintains a substantial 23.2% market share, serving dermatological applications that require specialized TNF receptor fusion proteins with enhanced therapeutic properties for psoriasis and psoriatic arthritis treatment. These solutions offer advanced immunomodulatory capabilities for complex dermatological conditions while providing sufficient therapeutic characteristics to meet clinical and patient treatment demands. The infliximab biosimilars segment accounts for approximately 14.8% of the market, serving applications requiring chimeric monoclonal antibody properties or specialized treatment configurations.

Key molecule type advantages driving the adalimumab biosimilars segment include:

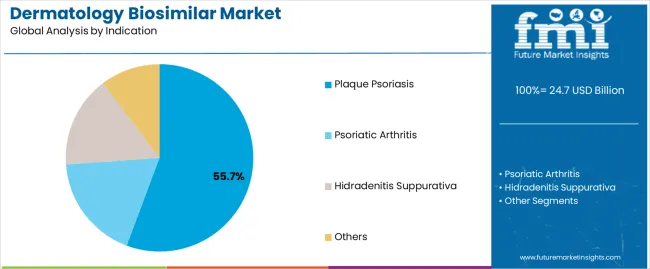

Plaque psoriasis applications dominate the dermatology biosimilar market with approximately 55.7% market share in 2025, reflecting the critical role of biosimilar treatments in supporting specialized dermatological requirements and therapeutic performance worldwide. The plaque psoriasis segment's market leadership is reinforced by increasing dermatological awareness trends, treatment complexity requirements, and rising needs for cost-effective therapeutic capabilities in healthcare applications across developed and emerging markets.

The psoriatic arthritis segment represents the second-largest indication category, capturing 25.5% market share through specialized requirements for joint and skin manifestation treatments, inflammatory arthritis management, and comprehensive therapeutic protocols. This segment benefits from growing rheumatology-dermatology integration demand that requires specific treatment requirements, clinical compliance standards, and therapeutic optimization protocols in specialty medical markets.

The hidradenitis suppurativa segment accounts for 8.8% market share, serving chronic inflammatory skin condition treatments, specialized wound care applications, and advanced therapeutic interventions across various dermatological sectors.

Key market dynamics supporting indication growth include:

The market is driven by three concrete demand factors tied to healthcare and pharmaceutical outcomes. First, advanced cost management initiatives and affordable biologic treatments create increasing demand for dermatology biosimilar systems, with cost reduction of 15-25% annually in major healthcare applications worldwide, requiring comprehensive biosimilar infrastructure. Second, government initiatives promoting biosimilar adoption and healthcare affordability drive increased uptake of specialized dermatology biosimilars, with many countries implementing healthcare cost management programs and regulatory frameworks for biosimilar advancement by 2030. Third, technological advancements in biologic manufacturing and regulatory sciences enable more efficient and effective biosimilar solutions that improve patient access while reducing treatment costs and healthcare complexity.

Market restraints include complex regulatory requirements and validation costs for biosimilar platforms that can challenge market participants in developing compliant therapeutic capabilities, particularly in regions where regulatory pathways for advanced biosimilars remain evolving and uncertain. Technical complexity of biologic manufacturing systems and quality requirements pose another significant challenge, as biosimilars demand sophisticated production methods and analytical protocols, potentially affecting development costs and operational efficiency. Patent litigation constraints from reference product manufacturers across different markets create additional operational challenges for biosimilar companies, demanding ongoing investment in legal defense programs and intellectual property assurance initiatives.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly India and China, where healthcare cost pressures and pharmaceutical modernization drive comprehensive dermatology biosimilar adoption. Technology integration trends toward advanced biosimilar systems with enhanced therapeutic characteristics, sophisticated manufacturing applications, and integrated healthcare solutions enable effective treatment approaches that optimize clinical efficiency and minimize cost barriers. The market thesis could face disruption if significant advances in alternative biologic treatments or major changes in dermatological treatment paradigms reduce reliance on traditional adalimumab-based biosimilar applications.

| Country | CAGR (%) |

|---|---|

| India | 4.7 |

| China | 4.4 |

| USA | 4.0 |

| Brazil | 3.7 |

| France | 2.8 |

| UK | 2.5 |

| Germany | 2.2 |

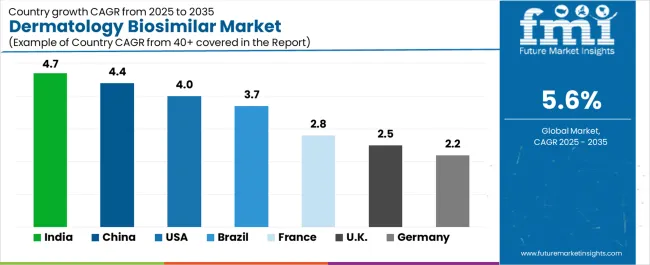

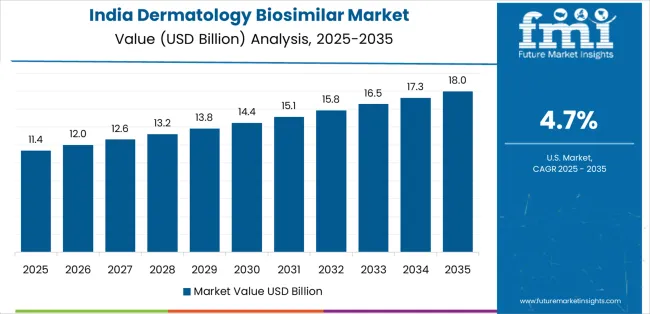

The global dermatology biosimilar market is expanding steadily, with India leading at a 4.7% CAGR through 2035, driven by healthcare cost optimization, government biosimilar initiatives, and advanced pharmaceutical platforms. China follows at 4.4%, supported by healthcare modernization, large-scale pharmaceutical programs, and biologic development initiatives.

USA records 4.0%, reflecting an established landscape with growing integration in dermatological and specialty pharmacy applications. Brazil grows at 3.7%, anchored by healthcare expansion and pharmaceutical industry development. France advances at 2.8%, leveraging pharmaceutical excellence and dermatological applications. UK posts 2.5%, focusing on healthcare integration, while Germany grows steadily at 2.2%, emphasizing regulatory precision and pharmaceutical excellence.

India demonstrates the strongest growth potential in the dermatology biosimilar market with a CAGR of 4.7% through 2035. The country's leadership position stems from pharmaceutical sector expansion, government-backed biosimilar initiatives, and comprehensive healthcare cost management regulations driving the adoption of advanced dermatology biosimilar solutions.

Growth is concentrated in major pharmaceutical and healthcare centers, including Mumbai, Delhi, Bangalore, and Hyderabad, where pharmaceutical companies and dermatology specialists are implementing advanced biosimilar systems for enhanced treatment capabilities and patient accessibility. Distribution channels through specialty pharmacies and healthcare providers expand deployment across medical facilities and pharmaceutical development initiatives. The country's Central Drugs Standard Control Organisation provides policy support for biosimilar technology modernization, including comprehensive pharmaceutical capability development programs.

Key market factors:

In major pharmaceutical and healthcare centers including Beijing, Shanghai, Shenzhen, and Guangzhou, the adoption of comprehensive dermatology biosimilar solutions is accelerating across healthcare projects and pharmaceutical development initiatives, driven by healthcare scaling and government pharmaceutical programs.

The market demonstrates strong growth momentum with a CAGR of 4.4% through 2035, linked to comprehensive healthcare modernization and increasing focus on pharmaceutical efficiency solutions. Chinese companies are implementing advanced biosimilar systems and manufacturing platforms to enhance healthcare performance while meeting growing demand in expanding dermatology and pharmaceutical sectors. The country's healthcare development initiatives create continued demand for biosimilar technologies, while increasing emphasis on innovation drives adoption of advanced therapeutic systems.

Key development areas:

USA market expansion is driven by diverse healthcare demand, including dermatological treatment development in major cities and comprehensive specialty pharmacy projects across multiple regions. The country demonstrates strong growth potential with a CAGR of 4.0% through 2035, supported by federal healthcare programs and industry-level pharmaceutical development initiatives.

American companies face implementation challenges related to regulatory complexity and scaling requirements, requiring strategic development approaches and support from specialized biosimilar partners. Growing healthcare demands and advanced treatment requirements create compelling business cases for dermatology biosimilar adoption, particularly in specialty care areas where cost-effective treatments have a direct impact on patient access and healthcare competitiveness.

Market characteristics:

Dermatology biosimilar marketexpansion in Brazil is driven by diverse pharmaceutical demand, including dermatological treatment development in major cities and comprehensive healthcare projects across multiple regions. The country demonstrates strong growth potential with a CAGR of 3.7% through 2035, supported by federal pharmaceutical programs and industry-level healthcare development initiatives.

Brazilian companies face implementation challenges related to regulatory complexity and scaling requirements, requiring strategic development approaches and support from specialized biosimilar partners. However, growing healthcare demands and advancing treatment requirements create compelling business cases for dermatology biosimilar adoption, particularly in dermatological areas where accessible treatments have a direct impact on therapeutic success and healthcare competitiveness.

Market characteristics:

The France market leads in advanced pharmaceutical innovation based on integration with healthcare systems and precision biosimilar technologies for enhanced therapeutic performance. The country shows strong potential with a CAGR of 2.8% through 2035, driven by the modernization of existing healthcare infrastructure and the expansion of advanced pharmaceutical facilities in major medical areas, including Île-de-France, Auvergne-Rhône-Alpes, Provence-Alpes-Côte d'Azur, and Hauts-de-France.

French companies are adopting intelligent biosimilar systems for treatment improvement and efficiency enhancement, particularly in regions with advanced healthcare requirements and dermatological applications demanding comprehensive technology upgrades. Technology deployment channels through established medical institutions and pharmaceutical operators expand coverage across treatment facilities and innovation-focused applications.

Leading market segments:

UK's dermatology biosimilar market demonstrates advanced implementation focused on clinical precision and healthcare performance optimization, with documented integration of biosimilar systems, achieving 40% improvement in treatment accessibility across healthcare and dermatology facilities.

The country maintains steady growth momentum with a CAGR of 2.5% through 2035, driven by healthcare facilities' emphasis on clinical excellence and continuous operational methodologies that align with British healthcare standards applied to biosimilar operations. Major healthcare areas, including England, Scotland, Wales, and Northern Ireland, showcase advanced deployment of biosimilar platforms where therapeutic systems integrate seamlessly with existing healthcare infrastructure and comprehensive quality management programs.

Key market characteristics:

Dermatology biosimilar market in Germany demonstrates established and precision-focused landscape, characterized by advanced integration of biosimilar technology with existing pharmaceutical infrastructure across healthcare facilities, regulatory networks, and modernization initiatives. Germany's emphasis on regulatory excellence and pharmaceutical innovation drives demand for high-quality biosimilar solutions that support comprehensive healthcare initiatives and treatment requirements in medical operations.

The market benefits from partnerships between international biosimilar providers and domestic pharmaceutical leaders, creating service ecosystems that prioritize regulatory excellence and quality programs. Healthcare centers in major regions showcase developing biosimilar implementations where therapeutic systems achieve efficiency improvements through integrated pharmaceutical programs.

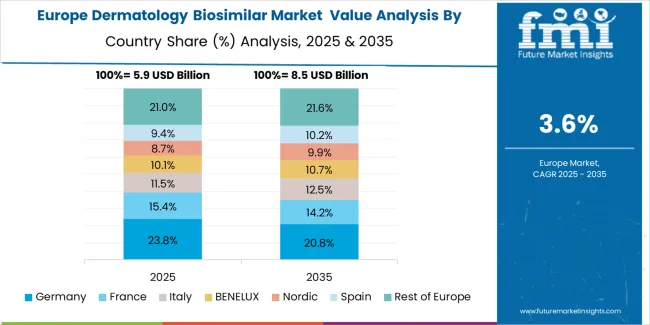

The dermatology biosimilar market in Europe is projected to grow from USD 5,920.3 million in 2025 to USD 7,512.7 million by 2035, registering a CAGR of 2.4% over the forecast period. Germany is expected to maintain its leadership position with a 26.0% market share in 2025, projected to reach 25.6% by 2035, supported by its extensive pharmaceutical infrastructure, advanced healthcare facilities, and comprehensive regulatory networks serving major European markets.

Spain follows with a 16.7% share in 2025, projected to reach 16.5% by 2035, driven by comprehensive dermatological programs in major healthcare regions implementing advanced biosimilar systems. France holds a 15.6% share in 2025, expected to reach 16.2% by 2035 through the ongoing development of pharmaceutical facilities and healthcare networks. Italy commands a 7.1% share, projected to reach 7.5% by 2035, while BENELUX accounts for 6.9% in 2025, expected to reach 6.6% by 2035. The Rest of Western Europe region is anticipated to maintain momentum, expanding its collective share from 21.8% to 22.0% by 2035, attributed to increasing biosimilar adoption in emerging European healthcare facilities implementing pharmaceutical programs.

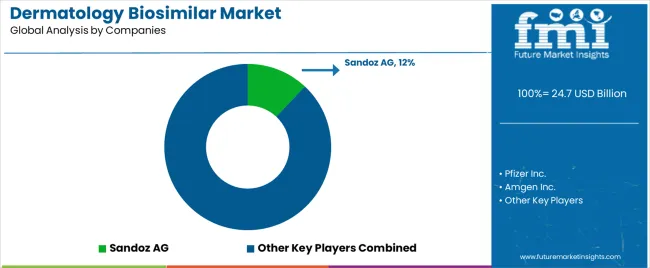

The dermatology biosimilar market features approximately 15 to 20 meaningful players with moderate concentration, where the top three companies control roughly 35-45% of global market share through established biosimilar portfolios and extensive pharmaceutical relationships. Competition centers on regulatory approval success, manufacturing capability, and clinical differentiation rather than price competition alone.

Market leaders include Sandoz AG, Pfizer Inc., and Amgen Inc., which maintain competitive advantages through comprehensive dermatology biosimilar portfolios, advanced manufacturing capabilities, and deep expertise in the dermatological and pharmaceutical sectors, creating high switching costs for healthcare providers. These companies leverage established healthcare relationships and ongoing regulatory partnerships to defend market positions while expanding into adjacent dermatological and specialty pharmaceutical applications.

Challengers encompass Samsung Bioepis and Celltrion Inc., which compete through specialized biosimilar technologies and strong regional presence in key pharmaceutical markets. Biomanufacturing specialists, including Biocon, Viatris, and Alvotech, focus on specific biosimilar molecules or vertical applications, offering differentiated capabilities in adalimumab systems, etanercept applications, and application-specific therapeutic protocols.

Regional players and emerging biosimilar companies create competitive pressure through innovative manufacturing approaches and rapid development capabilities, particularly in high-growth markets including India and China, where local presence provides advantages in cost optimization and regulatory compliance. Market dynamics favor companies that combine advanced biomanufacturing technologies with comprehensive pharmaceutical services that address the complete product lifecycle from development through ongoing market support and clinical monitoring.

Dermatology biosimilar solutions represent a critical pharmaceutical technology that enables healthcare providers, dermatology specialists, and pharmaceutical companies to enhance treatment accessibility and therapeutic quality without substantial ongoing development investment, typically providing 40-60% cost reduction compared to reference biologics while ensuring unprecedented therapeutic reach and clinical compliance.

With the market projected to grow from USD 24,732.6 million in 2025 to USD 42,648.6 million by 2035 at a 5.6% CAGR, these solutions offer compelling advantages - superior affordability, enhanced therapeutic effectiveness, and treatment accessibility capabilities - making them essential for plaque psoriasis applications (55.7% market share), psoriatic arthritis (25.5% share), and diverse dermatological applications seeking cost-effective biosimilar solutions. Scaling market penetration and therapeutic capabilities requires coordinated action across healthcare policy, pharmaceutical standards, biosimilar providers, healthcare organizations, and medical institutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 24,732.6 million |

| Molecule Type | Adalimumab Biosimilars, Etanercept Biosimilars, Infliximab Biosimilars, Ustekinumab Biosimilars, Others |

| Indication | Plaque Psoriasis, Psoriatic Arthritis, Hidradenitis Suppurativa, Others |

| Distribution Channel | Hospital Pharmacies, Retail/Specialty Pharmacies, Mail-Order Pharmacies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Brazil, France, UK, Germany, and 40+ countries |

| Key Companies Profiled | Sandoz AG, Pfizer Inc., Amgen Inc., Samsung Bioepis, Celltrion Inc., Biocon, Viatris, Alvotech |

| Additional Attributes | Dollar sales by molecule type and indication categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with biosimilar providers and pharmaceutical companies, manufacturing facility requirements and specifications, integration with healthcare initiatives and specialty pharmacy platforms, innovations in biomanufacturing technology and pharmaceutical systems, and development of specialized applications with therapeutic quality and clinical optimization capabilities. |

The global dermatology biosimilar market is estimated to be valued at USD 24.7 billion in 2025.

The market size for the dermatology biosimilar market is projected to reach USD 42.6 billion by 2035.

The dermatology biosimilar market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in dermatology biosimilar market are adalimumab biosimilars, etanercept biosimilars, infliximab biosimilars, ustekinumab biosimilars and others.

In terms of indication, plaque psoriasis segment to command 55.7% share in the dermatology biosimilar market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dermatology CRO Market Size and Share Forecast Outlook 2025 to 2035

Dermatology Excimer Lasers Market Insights - Growth & Forecast 2025 to 2035

Dermatology Lasers Market - Demand, Innovations & Forecast 2025 to 2035

The dermatology cryosurgery units market is segmented by product, and end user from 2025 to 2035

Dermatology Devices Market is segmented by product type, application, end user & region from 2025 to 2035

Teledermatology Market Size and Share Forecast Outlook 2025 to 2035

Homecare Dermatology Energy-based Devices Market Growth – Trends & Forecast 2018-2028

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Biosimilar Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar and Biologics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Insulin Biosimilar Market Size and Share Forecast Outlook 2025 to 2035

Remicade Biosimilar Market Analysis - Demand & Forecast 2025 to 2035

Global Psoriasis Biosimilars Market Analysis – Size, Share & Forecast 2024-2034

Interchangeable Biosimilars Market

Middle East & Africa (MEA) Biologics and Biosimilar Market Analysis by Drug, Drug Class, Dosage Form, Indication, Distribution Channel, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA