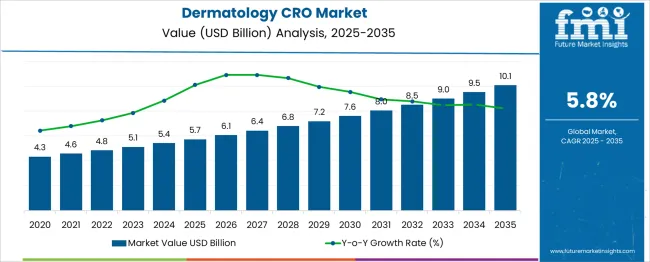

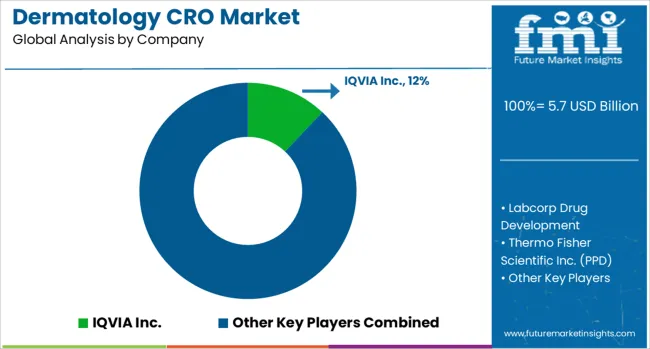

The global dermatology CRO market is projected to grow from USD 5.7 billion in 2025 to approximately USD 10.1 billion by 2035, recording an absolute increase of USD 4.37 billion over the forecast period. This translates into a total growth of 76.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.76X during the same period, supported by increasing prevalence of dermatological disorders, rising demand for specialized clinical research services, and growing focus on developing innovative treatments for skin conditions.

Between 2025 and 2030, the dermatology CRO market is projected to expand from USD 5.7 billion to USD 7.62 billion, resulting in a value increase of USD 1.89 billion, which represents 43.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising pharmaceutical R&D investments in dermatology therapeutics, increasing complexity of clinical trials for skin diseases, and growing demand for specialized expertise in dermatological research. Contract research organizations are expanding their dermatology-specific capabilities to address the growing need for comprehensive clinical trial services in this therapeutic area.

| Metric | Value |

| Estimated Value in (2025E) | USD 5.7 billion |

| Forecast Value in (2035F) | USD 10.1 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

From 2030 to 2035, the market is forecast to grow from USD 7.62 billion to USD 10.1 billion, adding another USD 2.48 billion, which constitutes 56.8% of the overall ten-year expansion. This period is expected to be characterized by advancement in precision medicine approaches for dermatological conditions, integration of digital health technologies in clinical trials, and development of novel therapeutic modalities. The growing adoption of artificial intelligence and machine learning in clinical research will drive demand for CRO services that combine traditional expertise with cutting-edge technological capabilities.

Between 2020 and 2025, the dermatology CRO market experienced steady expansion, driven by increasing prevalence of skin disorders and growing pharmaceutical industry focus on developing innovative dermatological treatments. The market developed as pharmaceutical and biotechnology companies recognized the need for specialized expertise in conducting complex dermatology clinical trials. Regulatory requirements and the need for patient-centric trial designs began emphasizing the importance of experienced CRO partners with deep understanding of dermatological research methodologies.

Market expansion is being supported by the increasing global prevalence of dermatological conditions including psoriasis, atopic dermatitis, skin cancer, and aesthetic dermatology applications. The rising incidence of these conditions, combined with aging populations and environmental factors, is driving pharmaceutical companies to invest heavily in developing new therapeutic solutions. CROs specializing in dermatology offer critical expertise in trial design, patient recruitment, and regulatory navigation specific to dermatological drug development.

The growing complexity of dermatology clinical trials, particularly those involving biologics and advanced therapies, necessitates specialized knowledge and infrastructure that many sponsors lack internally. Outsourcing to specialized CROs enables pharmaceutical companies to leverage expertise in dermatology-specific endpoints, imaging technologies, and patient-reported outcomes. The increasing focus on personalized medicine and targeted therapies for dermatological conditions is creating opportunities for CROs to provide comprehensive services from early-phase development through post-marketing surveillance.

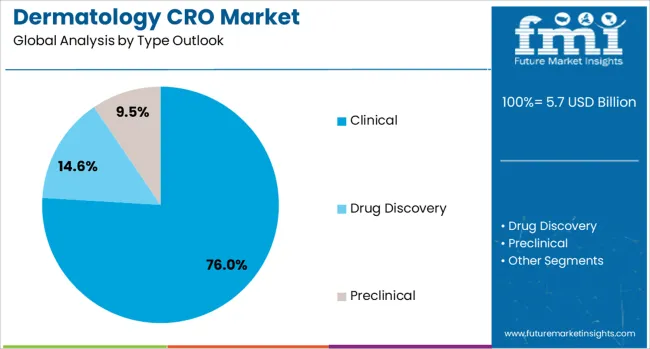

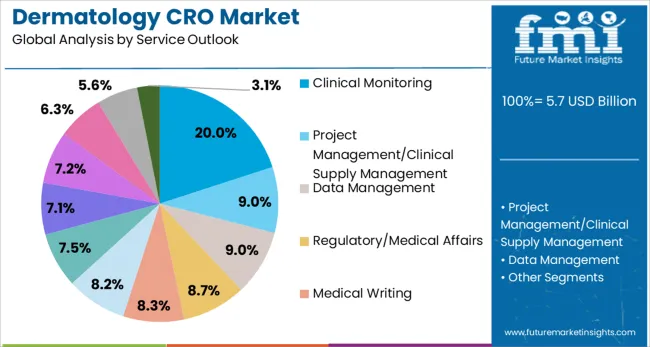

The market is segmented by type and service outlook. By type, the market is divided into clinical, drug discovery (including target validation, lead identification, and lead optimization), and preclinical services (including Phase I, Phase II, Phase III, and Phase IV studies). Based on service outlook, the market is categorized into clinical monitoring, project management/clinical supply management, data management, regulatory/medical affairs, medical writing, quality management/assurance, bio-statistics, investigator payments, laboratory services, patient and site recruitment, and technology services.

The clinical segment is projected to account for 76% of the dermatology CRO market in 2025, reaffirming its position as the category's core service offering. Pharmaceutical and biotechnology companies increasingly rely on specialized CROs to conduct complex clinical trials for dermatological therapeutics, leveraging their expertise in patient recruitment, trial management, and regulatory compliance. Clinical services encompass the full spectrum of trial phases, from early-stage safety assessments to large-scale efficacy studies, addressing diverse dermatological conditions.

This segment forms the foundation of most CRO engagements, as it represents the most critical and resource-intensive phase of drug development. The complexity of dermatology trials, including specific imaging requirements, histopathological assessments, and patient-reported outcome measures, necessitates specialized expertise that dermatology-focused CROs provide. With the pipeline of dermatological drugs continuing to expand and regulatory requirements becoming more stringent, clinical services maintain their dominant position in driving overall market growth.

Clinical monitoring is projected to represent 20% of dermatology CRO service demand in 2025, underscoring its critical role in ensuring trial quality and regulatory compliance. This service encompasses site monitoring visits, source data verification, protocol adherence assessment, and safety monitoring throughout the clinical trial lifecycle. The specialized nature of dermatology trials, with their unique endpoints and assessment methodologies, requires experienced monitors with deep understanding of dermatological research protocols.

The segment is supported by increasing regulatory scrutiny and the need for robust quality assurance in clinical trials. Risk-based monitoring approaches and hybrid monitoring models combining on-site and remote monitoring are becoming standard practice, driven by technological advances and lessons learned from recent global events. As trial complexity increases and regulatory requirements evolve, clinical monitoring services remain essential for maintaining data integrity and ensuring patient safety in dermatology clinical research.

The dermatology CRO market is advancing steadily due to increasing pharmaceutical R&D investments in dermatology therapeutics and growing prevalence of skin disorders globally. However, the market faces challenges including high operational costs, patient recruitment difficulties for rare dermatological conditions, and competition from in-house research capabilities of large pharmaceutical companies. Innovation in trial design methodologies and adoption of digital health technologies continue to influence service delivery and market expansion patterns.

The growing adoption of digital technologies is revolutionizing dermatology clinical trials through implementation of electronic data capture systems, telemedicine platforms, and digital imaging technologies. These innovations enable remote patient monitoring, virtual consultations, and real-time data collection, improving trial efficiency and patient engagement. Artificial intelligence and machine learning applications are being integrated for image analysis, patient stratification, and predictive analytics, enhancing the quality and speed of dermatological research.

Modern dermatology CROs are increasingly implementing decentralized clinical trial approaches that bring research directly to patients through home visits, local healthcare facilities, and digital platforms. These models improve patient recruitment and retention while reducing the burden of frequent site visits. Hybrid trial designs combining traditional site-based activities with decentralized elements offer flexibility and efficiency, particularly beneficial for dermatology studies requiring regular skin assessments and long-term follow-up.

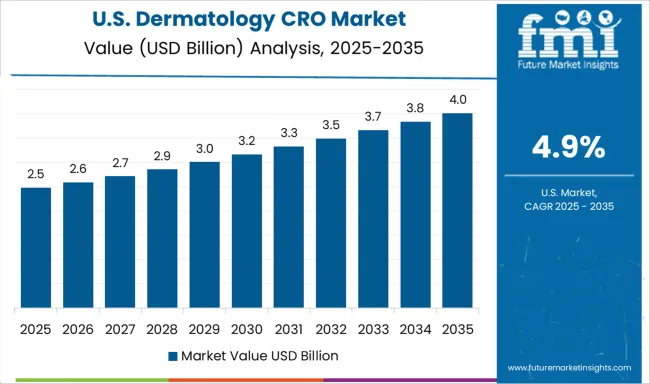

| Country | CAGR (2025-2035) |

| China | 7.8% |

| India | 7.2% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

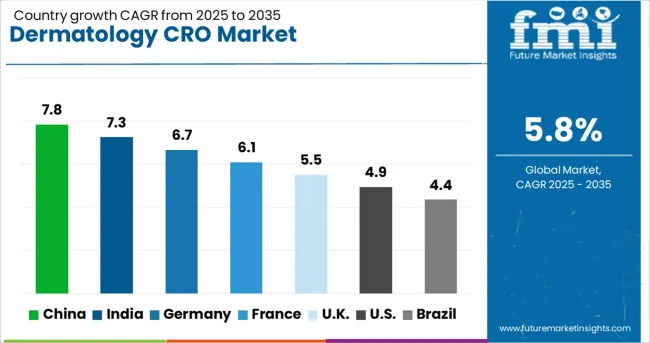

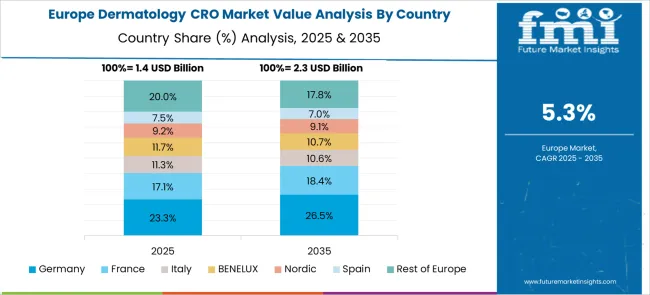

The dermatology CRO market is experiencing varied growth globally, with China leading at a 7.8% CAGR through 2035, driven by expanding pharmaceutical sector, increasing clinical trial activities, and growing investment in healthcare infrastructure. India follows at 7.2%, supported by cost-effective services, large patient pools, and improving regulatory frameworks. Germany shows steady growth at 6.7%, emphasizing quality standards and advanced research capabilities. France records 6.1%, focusing on innovative trial designs and strong academic-industry collaborations. The UK demonstrates 5.5% growth, leveraging its research excellence and regulatory expertise.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from dermatology CRO services in China is projected to exhibit strong growth with a CAGR of 7.8% through 2035, driven by rapid expansion of the pharmaceutical industry and increasing government support for clinical research. The country's large and diverse patient population provides excellent opportunities for patient recruitment in dermatology trials, while improving regulatory frameworks facilitate international sponsors' participation. Major global CROs are establishing and expanding their presence in China to capitalize on the growing demand for clinical research services.

Revenue from dermatology CRO services in India is expanding at a CAGR of 7.2%, supported by the country's cost-competitive advantages, large patient population, and improving clinical research capabilities. The country's growing reputation as a preferred destination for clinical trials is attracting international sponsors seeking efficient and affordable research services. Indian CROs are investing in infrastructure, training, and quality systems to meet international standards and expand their dermatology research capabilities.

Demand for dermatology CRO services in the USA is projected to grow at a CAGR of 4.9%, supported by the world's largest pharmaceutical market and extensive clinical research infrastructure. American CROs benefit from advanced technological capabilities, experienced workforce, and strong regulatory expertise in conducting complex dermatology trials. The market is characterized by high-quality services, innovative trial designs, and comprehensive offerings spanning all phases of drug development.

Revenue from dermatology CRO services in Germany is projected to grow at a CAGR of 6.7% through 2035, driven by the country's strong pharmaceutical industry, excellent clinical research infrastructure, and stringent quality standards. German CROs are recognized for their methodological rigor, regulatory expertise, and ability to conduct complex multicenter trials across Europe. The market benefits from strong academic-industry collaborations and access to specialized dermatology research centers.

Revenue from dermatology CRO services in the UK is projected to grow at a CAGR of 5.5% through 2035, supported by world-class research institutions, streamlined regulatory processes, and strong clinical trial expertise. British CROs benefit from the National Health Service's comprehensive patient databases and established research networks that facilitate efficient patient recruitment and trial conduct. The market is characterized by innovation in trial design and early adoption of novel research methodologies.

Revenue from dermatology CRO services in France is projected to grow at a CAGR of 6.1% through 2035, supported by the country's strong pharmaceutical sector, excellent healthcare system, and innovative research environment. French CROs leverage the country's centralized healthcare databases and academic research excellence to deliver high-quality clinical research services. The market benefits from strong government support for life sciences research and established international partnerships.

Revenue from dermatology CRO services in Brazil is projected to grow at a CAGR of 4.4% through 2035, supported by the country's large and diverse population, improving clinical research infrastructure, and growing pharmaceutical market. Brazilian CROs are expanding their capabilities to serve both domestic and international sponsors conducting trials in Latin America. The market benefits from regulatory harmonization efforts and increasing participation in global clinical trials.

The dermatology CRO market is characterized by competition among global full-service CROs, specialized dermatology research organizations, and regional service providers. Companies are investing in therapeutic expertise, advanced technologies, global infrastructure, and strategic partnerships to deliver comprehensive, efficient, and high-quality clinical research services. Service differentiation, technological innovation, and geographic expansion are central to strengthening market position and capturing growth opportunities.

IQVIA Inc., USA-based, leads the market with 12% global value share, offering comprehensive dermatology clinical research services with extensive global reach and advanced analytics capabilities. Labcorp Drug Development provides integrated drug development solutions leveraging its diagnostic expertise and global clinical trial management capabilities. Thermo Fisher Scientific Inc. (PPD) delivers end-to-end clinical research services with strong focus on dermatology therapeutic expertise and innovative trial solutions. Parexel International Corp. offers comprehensive clinical development services with specialized dermatology expertise and regulatory knowledge.

Charles River Laboratories provides integrated early-stage research services including preclinical dermatology models and safety assessment. ICON Plc delivers full-service clinical research solutions with dedicated dermatology therapeutic experts and global operational capabilities. Syneos Health offers integrated biopharmaceutical solutions combining clinical development and commercialization expertise. Pharmaron provides comprehensive drug discovery and development services with growing dermatology research capabilities. Aragen Life Sciences Ltd. and Wuxi AppTec offer specialized research services supporting dermatology drug development across various stages. Additional players including Medpace, CTI Clinical Trial & Consulting, Bioskin, Proinnovera GmbH, and Biorasi LLC provide specialized dermatology research services focusing on specific aspects of clinical development or regional markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 5.7 billion |

| Type | Clinical, Drug Discovery (Target Validation, Lead Identification, Lead optimization), Preclinical (Phase I, Phase II, Phase III, Phase IV) |

| Service Outlook | Clinical Monitoring, Project Management/Clinical Supply Management, Data Management, Regulatory/Medical Affairs, Medical Writing, Quality Management/Assurance, Bio-statistics, Investigator Payments, Laboratory, Patient and Site Recruitment, Technology, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, India, Brazil, and 40+ countries |

| Key Companies Profiled | IQVIA Inc., Labcorp Drug Development, Thermo Fisher Scientific Inc. (PPD), Parexel International Corp., Charles River Laboratories, ICON Plc, Syneos Health, Pharmaron, Aragen Life Sciences Ltd., Wuxi AppTec, Medpace, CTI Clinical Trial & Consulting, Bioskin, Proinnovera GmbH, and Biorasi LLC |

| Additional Attributes | Service revenues by therapeutic indication, regional operational capabilities, competitive landscape, sponsor preferences for full-service versus specialty CROs, integration with digital health technologies, innovations in patient recruitment strategies, decentralized trial capabilities, and regulatory expertise across key markets |

The global dermatology cro market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the dermatology cro market is projected to reach USD 10.1 billion by 2035.

The dermatology cro market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in dermatology cro market are clinical, drug discovery, and others.

In terms of service outlook, clinical monitoring segment to command 20.0% share in the dermatology cro market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dermatology Biosimilar Market Forecast and Outlook 2025 to 2035

Dermatology Excimer Lasers Market Insights - Growth & Forecast 2025 to 2035

Dermatology Lasers Market - Demand, Innovations & Forecast 2025 to 2035

The dermatology cryosurgery units market is segmented by product, and end user from 2025 to 2035

Dermatology Devices Market is segmented by product type, application, end user & region from 2025 to 2035

Teledermatology Market Size and Share Forecast Outlook 2025 to 2035

Homecare Dermatology Energy-based Devices Market Growth – Trends & Forecast 2018-2028

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Cross-species Organ Transplantation Market Forecast and Outlook 2025 to 2035

Cross Interconnection Protection Box Market Size and Share Forecast Outlook 2025 to 2035

Crotonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Cross Corner Industrial Bags Market Size and Share Forecast Outlook 2025 to 2035

Cross-Linked Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Crowdsourced Security Market Size and Share Forecast Outlook 2025 to 2035

Crowdsourced Testing Market Size and Share Forecast Outlook 2025 to 2035

Crown Caps Market Size and Share Forecast Outlook 2025 to 2035

Cross-Border Road Transport Market Size and Share Forecast Outlook 2025 to 2035

Crown Glass Market Size and Share Forecast Outlook 2025 to 2035

Crossfit Apparel Market Size and Share Forecast Outlook 2025 to 2035

Cross Point Switch Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA