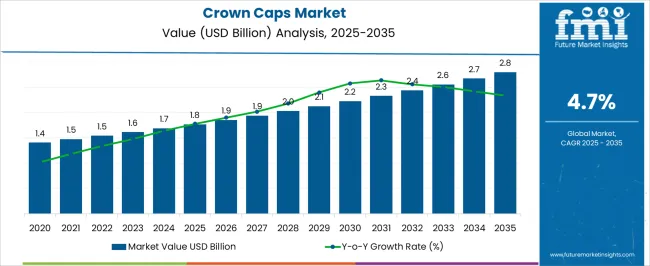

The crown caps market is valued at USD 1.8 billion in 2025 and is projected to grow to USD 2.8 billion by 2035, reflecting a CAGR of 4.7%. From 2021 to 2025, the market experiences steady growth, moving from USD 1.4 billion to USD 1.8 billion, with incremental progress through USD 1.5 billion, 1.5 billion, 1.6 billion, and 1.7 billion. The initial phase is driven by steady demand for crown caps in the beverage industry, particularly in beer, soft drinks, and bottled water, as packaging standards and consumer preferences for convenience and safety continue to evolve.

Between 2026 and 2030, the market strengthens further, advancing from USD 1.8 billion to USD 2.4 billion. This period sees growth through values of USD 1.9 billion, 1.9 billion, 2.0 billion, 2.1 billion, and 2.2 billion, as the demand for sustainable and efficient packaging solutions increases. This is complemented by rising adoption of aluminum and eco-friendly materials in crown cap production.

From 2031 to 2035, the market continues to rise, reaching USD 2.8 billion. Values progress from USD 2.3 billion to USD 2.7 billion and finally to USD 2.8 billion. The latter phase benefits from innovation in cap designs and a growing emphasis on reducing environmental impact, as well as the expanding consumption of bottled beverages across emerging markets.

| Metric | Value |

|---|---|

| Crown Caps Market Estimated Value in (2025 E) | USD 1.8 billion |

| Crown Caps Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The packaging industry market is a major contributor, accounting for approximately 15-20%, as crown caps are essential components in packaging beverages and food products. The beverage industry market plays a significant role, contributing around 25-30%, as crown caps are primarily used for sealing bottles of carbonated drinks, beer, and other bottled beverages.

The food packaging market also drives demand, with crown caps making up about 10-12%, as they are used to seal products such as sauces, juices, and preserves, ensuring product freshness and safety during transport. The consumer goods market contributes around 8-10%, as the increasing demand for bottled beverages and packaged food products relies on secure, tamper-evident closures. The pharmaceutical packaging market contributes approximately 6-8%, with crown caps used for tightly sealing liquid medicines and dietary supplements to maintain product integrity and prevent contamination.

The crown caps market is experiencing stable growth driven by sustained demand from the beverage industry and the rising focus on product preservation and branding. Increased consumption of bottled beverages, including alcoholic and non alcoholic categories, is reinforcing the requirement for reliable sealing solutions that maintain carbonation and product quality.

Tinplate and other durable materials are being favored for their corrosion resistance, recyclability, and compatibility with high speed production lines. Technological innovations in coating, printing, and embossing have enhanced aesthetic appeal, enabling brands to differentiate in competitive markets.

Sustainability initiatives and the circular economy model are further encouraging the use of recyclable crown caps, particularly in regions with strong environmental regulations. With the beverage sector’s expansion and continuous packaging innovations, the market is expected to maintain consistent demand and offer opportunities for value-added customization.

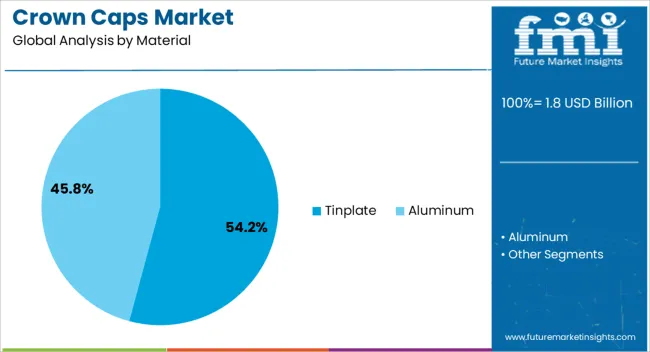

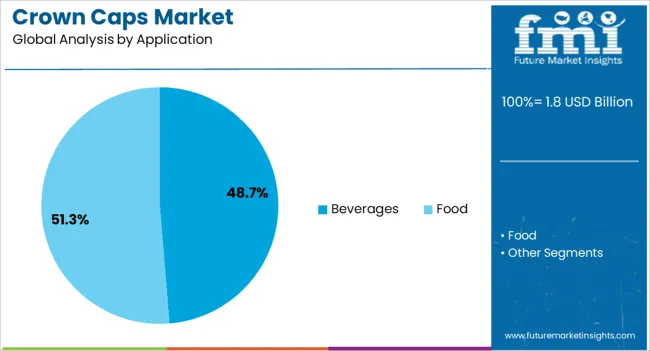

The crown caps market is segmented by material, application, and geographic regions. By material, crown caps market is divided into Tinplate and Aluminum. In terms of application, crown caps market is classified into Beverages and Food. Regionally, the crown caps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tinplate segment is projected to account for 54.20% of total revenue by 2025 within the material category, making it the leading choice. This dominance is supported by tinplate’s superior durability, barrier properties, and resistance to moisture and contamination.

Its recyclability and compliance with global food safety standards have strengthened its appeal in large scale beverage manufacturing. Additionally, the material’s suitability for high quality printing and decorative finishes supports brand positioning and marketing initiatives.

The combination of functionality, sustainability, and design flexibility has positioned tinplate as the preferred material for crown cap production.

The beverages segment is expected to contribute 48.70% of total market revenue by 2025 within the application category, securing its position as the leading end use. This growth is driven by the expanding consumption of bottled drinks, both carbonated and non carbonated, across global markets.

Crown caps are valued for their ability to preserve flavor, carbonation, and freshness while providing tamper evidence. Their compatibility with glass and PET bottles in both mass production and premium product lines has reinforced their widespread use.

Marketing opportunities through printed and customized caps have further contributed to adoption, ensuring the beverage sector remains the most significant driver of crown cap demand.

The crown caps market is experiencing steady growth as global demand for beverage packaging, particularly carbonated drinks, bottled water, and alcoholic beverages, continues to rise. Demand is driven by the need for reliable, cost-effective, and tamper-evident packaging solutions. Challenges include raw material price fluctuations, production costs, and competition from alternative closures such as screw caps and plastic lids. Opportunities exist in the development of alternative materials, enhanced sealing technologies, and innovations in design for better branding.

Trends highlight packaging that is easy to recycle, high-quality coating applications, and customization to enhance the consumer experience. Suppliers offering high-quality, cost-efficient, and recyclable crown caps are best positioned to capture market share in both emerging and developed markets.

The crown caps market is growing as beverage manufacturers seek reliable and cost-effective packaging solutions. Crown caps, widely used in carbonated soft drinks, beer, bottled water, and juices, provide secure sealing, preventing contamination and preserving product freshness. As demand for packaged beverages continues to rise, especially in emerging markets, crown caps remain an essential part of beverage packaging due to their durability and ease of use. Additionally, growing consumer concerns regarding product safety, freshness, and tamper evidence are driving the demand for high-quality crown caps. Manufacturers are also focusing on innovations that offer enhanced sealing performance, which adds further appeal for both consumers and producers.

The crown caps market faces challenges related to raw material price volatility, particularly for metals such as steel and aluminum. Production costs are influenced by the complexity of manufacturing, coating applications, and quality control measures. Regulatory compliance regarding product safety and tamper-evidence standards adds to the operational complexity. Additionally, competition from alternative closures, such as screw caps and plastic lids, has put downward pressure on prices. To stay competitive, suppliers must focus on optimizing production processes, ensuring cost efficiency, and providing high-quality caps that meet both regulatory standards and consumer expectations. The market is also affected by environmental concerns, leading to the demand for recyclable packaging solutions.

The market is witnessing increasing opportunities in the development of crown caps made from recyclable materials such as aluminum, which appeal to consumers and regulatory bodies. Innovations in sealing technologies, such as tamper-evident designs, improved airtightness, and ease of use, are gaining attention. These developments improve product safety and extend shelf life, which are key selling points for beverage manufacturers. Customization options for branding, including embossed logos and colorful designs, are becoming more popular as companies seek to differentiate their products. As regulations tighten and consumer preferences evolve, crown cap suppliers offering advanced sealing technologies and enhanced materials are well-positioned to capture growth opportunities in the market.

The crown caps market is trending toward customization and design innovations aimed at enhancing brand visibility and consumer appeal. Beverage manufacturers are increasingly seeking personalized cap designs that include logos, unique colors, and even promotional features. This trend helps brands stand out on store shelves and build stronger customer loyalty. There is rising consumer demand for packaging that can be easily recycled, which is influencing the development of caps with materials that facilitate recycling processes. Suppliers who can provide innovative designs, advanced sealing capabilities, and high-quality production processes are expected to lead the market. Moreover, improvements in cap sealing and performance are gaining traction, as tamper-proof and leak-resistant technologies continue to be integrated into crown cap designs, improving both convenience and security.

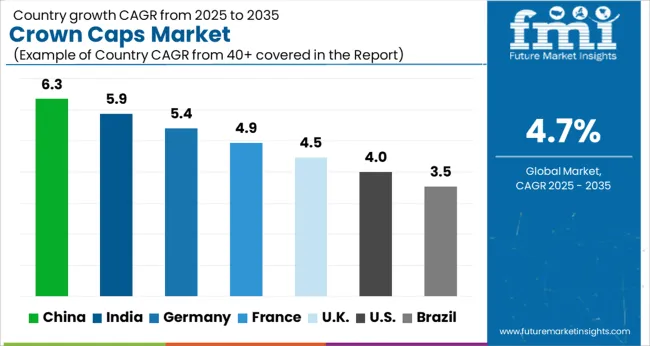

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

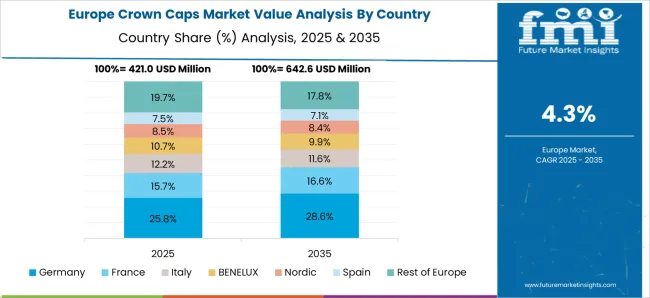

The global crown caps market is expected to grow at a CAGR of 4.7% from 2025 to 2035. China leads with 6.3%, followed by India at 5.9%, and France at 4.9%. The UK and USA exhibit more moderate growth rates at 4.5% and 4.0%, respectively. Growth is primarily driven by the demand for bottled beverages, especially beer, soft drinks, and bottled water. Market trends include the increasing preference for eco-friendly, tamper-proof, and aesthetically appealing caps, with innovation focusing on sustainable materials. As the craft beer market expands, premium beverage packaging needs are also growing, further fueling demand for high-quality crown caps. The analysis spans over 40+ countries, with the leading markets shown below.

The crown caps market in China is set to grow at a CAGR of 6.3% from 2025 to 2035, largely driven by the rapid expansion of the beverage industry. Particularly, the beer and carbonated drinks segments are major contributors to the demand for crown caps. With an increasing number of domestic breweries and beverage manufacturers, the need for high-quality closures is growing. Additionally, the rise of e-commerce platforms and online beverage sales is facilitating market growth, making crown caps more accessible. The increasing consumer preference for premium, tamper-proof, and corrosion-resistant crown caps is creating new growth opportunities. The expanding urban middle class is also leading to higher disposable income, allowing for more spending on premium and imported beverage brands, further boosting crown cap sales.

The crown caps market in India is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by the expanding bottled beverage industry. The beer and soft drink sectors are the key demand drivers, with a significant increase in packaged beverage consumption across urban and rural areas. The retail landscape is evolving, with the growing penetration of supermarkets, hypermarkets, and convenience stores increasing accessibility. The rise in ready-to-drink (RTD) beverages, especially among young consumers, has led to higher demand for crown caps. The craft beer market is gaining popularity, creating a need for more specialized and aesthetically appealing crown caps. Innovations such as tamper-proof features and eco-friendly materials are gaining traction among consumers and manufacturers.

The crown caps market in France is expected to grow at a CAGR of 4.9% from 2025 to 2035, supported by steady demand from the wine and beer industries. With France being a leading wine producer, the demand for high-quality closures is a significant market driver. Additionally, the growth of the craft beer market is increasing the demand for customizable and aesthetically pleasing crown caps. The shift towards sustainable packaging solutions has also led to the adoption of recyclable crown caps and eco-friendly materials. France’s beverage sector is moving towards premiumization, with consumers increasingly opting for high-quality, innovative products that require superior closures.

The UK crown caps market is expected to grow at a CAGR of 4.5% from 2025 to 2035, fueled by the increasing consumption of bottled beverages, particularly in the beer and soft drink segments. The rise in demand for craft beers and premium soft drinks is driving the need for more specialized and high-quality crown caps. Consumers’ growing interest in eco-friendly and recyclable packaging solutions is pushing manufacturers to innovate in this space. The convenience of ready-to-drink beverages has also boosted crown cap consumption, particularly in urban areas. The retail sector’s expansion and rising demand for personalized packaging are further fueling market growth.

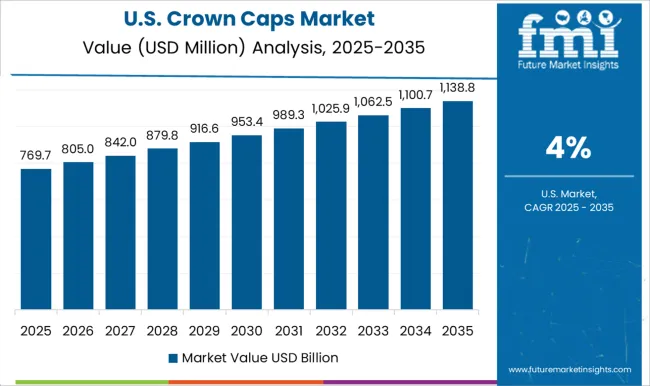

The USA crown caps market is projected to grow at a CAGR of 4.0% from 2025 to 2035, with strong demand coming from the beer and soft drink industries. The rising popularity of craft beers and premium beverages is pushing manufacturers to innovate with tamper-evident, aesthetically appealing, and durable crown caps. The growing health-consciousness among USA consumers is also contributing to a rise in bottled water and low-calorie drink consumption, which in turn is increasing demand for crown caps. E-commerce platforms and retail channels are facilitating easier distribution and access to bottled beverages, further driving market growth.

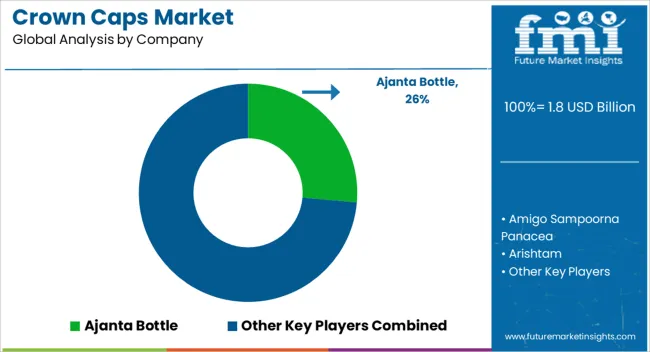

In the crown caps market, competition is shaped by product innovation, customization, and strong distribution channels. Crown Holdings is a leading player, offering an extensive range of crown caps designed for beverages such as soft drinks, beer, and sparkling water. Their focus is on high-quality materials and advanced sealing technology to ensure reliability and product integrity. Pelliconi competes by offering customizable and premium crown caps, helping brands create distinct retail presence through custom designs and branding options. Nippon Closures positions itself with cost-effective solutions for the Asian market, providing reliable crown caps that meet regional manufacturing standards and the demands of local beverage producers. Smaller players like Ajanta Bottle and Amigo Sampoorna Panacea focus on providing tailored solutions for regional businesses, offering competitive pricing and flexibility for smaller beverage manufacturers. Ferropack Industries and Finn-Korkki cater to niche markets by producing specialized crown caps for craft beverages. Their products are particularly attractive to independent brewers, providing high-quality caps designed to meet the unique requirements of small-batch production. MyBrewery and Krome Brewing focus specifically on the craft beer market, offering customizable crown caps that help brewers differentiate their products and enhance brand identity.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Material | Tinplate and Aluminum |

| Application | Beverages and Food |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ajanta Bottle, Amigo Sampoorna Panacea, Arishtam, Brewnation, Brijrani Enterprises, Brouwland, Crown Holdings, Crown Seal, Ferropack Industries, Finn-Korkki, Insignia, Krome Brewing, MyBrewery, Nippon Closures, Pelliconi, Plihsa, Rupali Departmental Stores, Shree Balaji Closures, and The Malt Miller |

| Additional Attributes | Dollar sales by product type (regular, twist-off, specialty), material (steel, aluminum, composite), and application (beverages, food, pharmaceuticals). Demand is driven by rising consumption of bottled beverages, growing craft brewing segments, and packaging innovation trends. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with increasing demand from the beverage industry, especially in beer, carbonated drinks, and health drinks. |

The global crown caps market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the crown caps market is projected to reach USD 2.8 billion by 2035.

The crown caps market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in crown caps market are tinplate and aluminum.

In terms of application, beverages segment to command 48.7% share in the crown caps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Crown Glass Market Size and Share Forecast Outlook 2025 to 2035

Crown Closures Market Growth & Packaging Innovations 2025 to 2035

Crown Cork Market Trends & Industry Growth Forecast 2024-2034

Dental Crown Removal Market Insights - Trends & Growth Forecast 2025 to 2035

Capsule Vision Inspection Solution Market Size and Share Forecast Outlook 2025 to 2035

Capsule Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Capsule Hotels Market Size and Share Forecast Outlook 2025 to 2035

Capsule Endoscope and Workstations Market - Growth & Demand 2025 to 2035

Market Share Breakdown of Capsule Filling Machine Manufacturers

Market Share Breakdown of Caps and Closure Market

Competitive Breakdown of Capsaicin Manufacturers

Capsule Coffee Machines Market

Capsular Tension Rings Market

Encapsulated Flavors Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Encapsulated Lactic Acid Market Analysis by Application, Nature, Form, and Region from 2025 to 2035

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Encapsulated Sodium Bicarbonate Market Trends - Growth & Industry Forecast 2025 to 2035

Encapsulant Material for PV Module Market Growth – Trends & Forecast 2024-2034

Encapsulant Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA