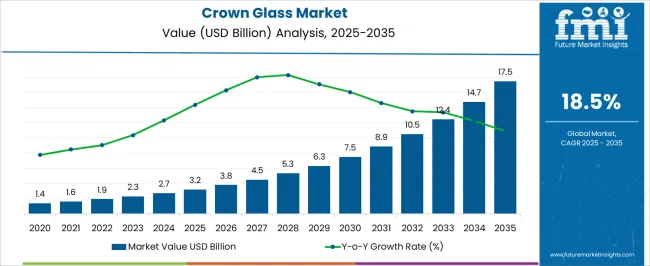

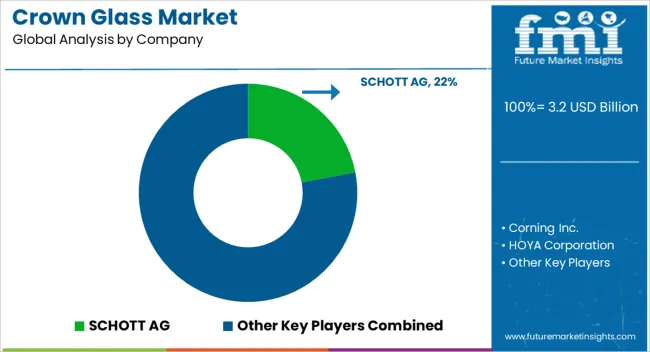

The crown glass market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 17.5 billion by 2035, registering a compound annual growth rate (CAGR) of 18.5% over the forecast period.

A detailed Peak-to-Trough Analysis of the market reveals a strong acceleration pattern where growth momentum intensifies steadily after the base year, showing minimal slowdown phases and more pronounced upward surges. Beginning at USD 1.4 billion, the market progressively rises through intermediate stages, USD 2.3 billion in 2029, USD 3.2 billion in 2025, USD 7.5 billion in 2031, and USD 10.5 billion in 2032, signifying that the trough periods are relatively shallow compared to the steep peaks, which reflect bursts of demand. This sharp incline in revenue highlights the market’s resilience and attractiveness, as end-use sectors such as optics, electronics, and specialty construction materials increasingly adopt crown glass for its clarity, light dispersion, and durability.

The volatility between peak and trough years demonstrates that demand will not follow a flat linear trajectory but instead experience waves of accelerated adoption, likely driven by rapid innovation cycles, consumer preference for high-performance glass, and its use in high-growth industries such as smart devices and renewable energy. Consequently, crown glass is positioned as one of the most dynamic glass segments globally, with its strong upward momentum indicating that stakeholders who capitalize on early growth phases will benefit from compounding gains. The overall trend underscores a rare combination of consistency and acceleration, making the market highly lucrative for long-term investments.

| Metric | Value |

|---|---|

| Crown Glass Market Estimated Value in (2025 E) | USD 3.2 billion |

| Crown Glass Market Forecast Value in (2035 F) | USD 17.5 billion |

| Forecast CAGR (2025 to 2035) | 18.5% |

The crown glass market occupies a specialized niche within the broader glass manufacturing and optical materials sector, representing approximately 12–15% of the global flat and specialty glass category, driven by increasing adoption in optical lenses, scientific instruments, and high-precision applications. Within the overall optical components and eyewear segment, crown glass accounts for roughly 8–10%, reflecting steady usage in prescription lenses, camera optics, microscopes, and telescopes, where clarity, refractive consistency, and minimal chromatic aberration are essential. In the wider specialty glass and industrial optics market, crown glass captures an estimated 5–7% share, supported by applications in laser systems, laboratory instruments, and photonics devices. Growth is reinforced by improvements in high-purity manufacturing processes, enhanced scratch and chemical resistance, and demand from precision optical industries in North America, Europe, and Asia-Pacific.

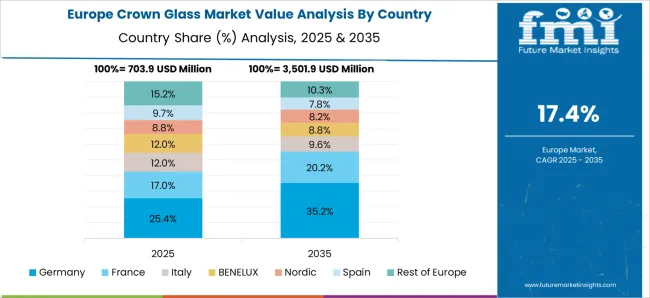

Challenges such as competition from polycarbonate, low-cost soda-lime glasses, and fluctuating raw material prices influence market expansion, yet innovations in thin-film coatings, multi-element lens assemblies, and durable optical substrates continue to bolster adoption. Regional demand is particularly strong in Europe and North America due to established eyewear, scientific research, and photonics sectors, while Asia-Pacific exhibits rising penetration driven by optical manufacturing hubs and expanding consumer electronics production. Overall, crown glass maintains a strategic position in high-value optical and precision applications, ensuring sustained relevance within the global specialty glass ecosystem.

The market is experiencing steady expansion, supported by rising demand for high-quality optical materials across diverse applications. The market is benefiting from advancements in glass manufacturing technologies that enable improved light transmission, reduced dispersion, and enhanced durability. Growing requirements in scientific research, precision instruments, and consumer optics have positioned crown glass as a preferred material in both industrial and commercial contexts.

Expanding adoption in sectors such as ophthalmology, photography, and electronics has further reinforced market growth. Investments in advanced fabrication techniques are enabling manufacturers to produce glass with precise refractive indices and minimal impurities, meeting stringent quality standards.

Furthermore, the transition toward sustainable manufacturing processes and recyclable materials is creating additional opportunities for adoption The versatility of crown glass, combined with its ability to be tailored for specialized applications, is expected to drive its continued relevance in the evolving global optics market.

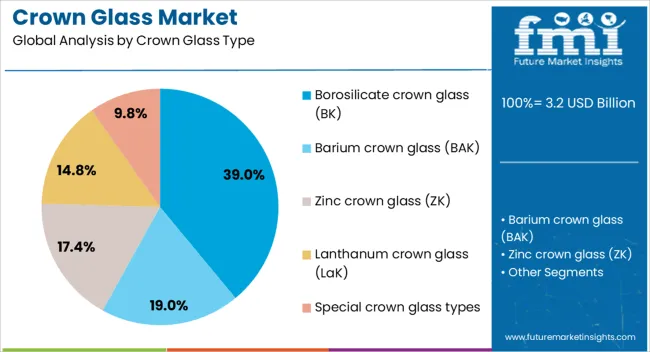

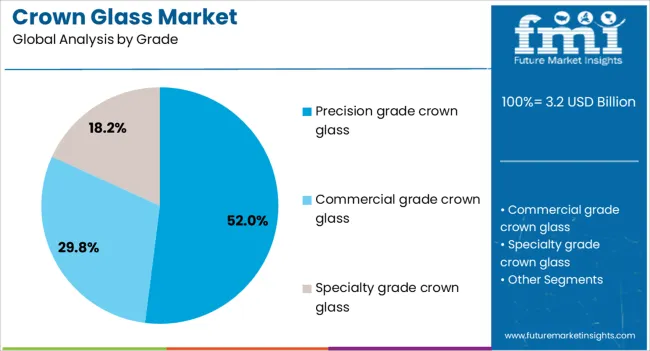

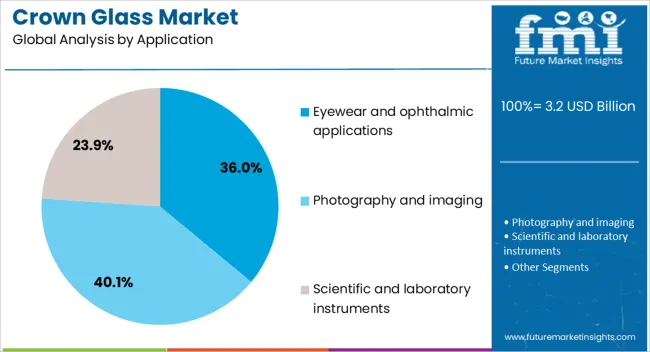

The crown glass market is segmented by crown glass type, grade, application, and geographic regions. By crown glass type, crown glass market is divided into borosilicate crown glass (BK), barium crown glass (BAK), zinc crown glass (ZK), lanthanum crown glass (LaK), and special crown glass types. In terms of grade, crown glass market is classified into precision grade crown glass, commercial grade crown glass, and specialty grade crown glass. Based on application, crown glass market is segmented into eyewear and ophthalmic applications, photography and imaging, scientific and laboratory instruments, medical devices and equipment, industrial optical systems, aerospace and defense, consumer electronics, automotive applications, and other applications. Regionally, the crown glass industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The borosilicate crown glass (BK) type segment is projected to account for 39% of the crown glass market revenue share in 2025, establishing it as the leading type. This dominance has been driven by the material’s exceptional thermal stability, low thermal expansion coefficient, and high optical clarity. Borosilicate crown glass is widely recognized for its superior resistance to chemical corrosion, making it highly suitable for demanding optical and laboratory environments. Its consistent performance across temperature variations has encouraged its use in advanced optical devices where precision is critical. The ability to incorporate this glass type into high-end optical systems has also supported its strong market presence. The ongoing development of specialty lenses, prisms, and optical assemblies has further increased its adoption, particularly in applications requiring a balance of optical precision and structural durability These attributes, combined with advancements in glass processing technologies, have ensured the sustained market leadership of borosilicate crown glass within the overall segment.

The precision grade crown glass segment is expected to capture 52% of the market revenue share in 2025, making it the leading grade. This segment’s strength is attributed to its high refractive index consistency, low optical dispersion, and excellent homogeneity, which are essential for manufacturing high-performance optical components. Precision grade crown glass is extensively used in applications where exact light refraction and minimal image distortion are required. Its ability to deliver stable optical performance under varying environmental conditions has positioned it as the preferred choice for scientific, industrial, and high-end consumer optics. Stringent quality control standards in its production ensure that the glass meets the demanding specifications of modern optical systems As research and technological innovation continue to drive the development of complex optical devices, the reliance on precision grade materials is expected to grow, further cementing this segment’s market leadership.

The eyewear and ophthalmic applications segment is forecasted to hold 36% of the market revenue share in 2025, emerging as the leading application. This position has been supported by the increasing demand for high-quality, optically accurate lenses that provide superior vision correction and comfort. Crown glass is valued in this segment for its clarity, scratch resistance, and ability to be precisely shaped to individual prescriptions. Advancements in lens coating technologies have further enhanced the performance and durability of crown glass lenses, making them appealing to both consumers and healthcare providers. The rising prevalence of vision-related conditions, coupled with greater consumer awareness about eye health, has intensified demand in this category. Additionally, the premium optical quality offered by crown glass has made it a preferred material for specialized eyewear used in professional and high-precision activities These factors collectively contribute to the segment’s strong position within the overall market.

Crown glass maintains a critical role across eyewear, photonics, and industrial optics due to superior clarity and low dispersion. Market growth is driven by expanding applications, manufacturing advancements, and strong regional adoption across Europe, North America, and Asia-Pacific.

The crown glass market is driven by rising demand for high-quality optical lenses used in eyewear, cameras, microscopes, and telescopes. Consumers and professionals increasingly seek lenses with high clarity, minimal chromatic aberration, and consistent refractive indices. Optical manufacturers are investing in precision molding, polishing, and coating techniques to enhance lens performance and durability. Growth is supported by adoption in medical, photographic, and laboratory equipment where precision optics are critical. Enhanced material properties and reliability ensure crown glass remains the preferred choice for premium lenses. Market expansion is also fueled by increasing disposable incomes and growing awareness of vision correction needs in both developed and emerging regions.

Crown glass finds widespread use in photonics and laser systems due to its excellent refractive properties, thermal stability, and low dispersion. Optical components such as beam splitters, prisms, and lenses in lasers, spectroscopy, and imaging systems increasingly rely on crown glass for precision performance. Laboratory and industrial equipment also incorporate crown glass in measurement instruments and optical sensors. The growing focus on research, material testing, and automation has further boosted adoption. Manufacturers emphasize scratch-resistant and chemically stable surfaces to meet stringent industrial requirements. Rising investments in optical manufacturing hubs, particularly in Europe, North America, and Asia-Pacific, continue to strengthen market penetration and support diverse photonics applications.

Crown glass production depends on high-purity silica and controlled alkali content to achieve consistent optical performance. Advances in melting, annealing, and precision molding techniques have improved quality and reduced defects, enhancing adoption across critical applications. However, fluctuating raw material costs, energy-intensive processes, and environmental regulations impact production efficiency and pricing. Manufacturers focus on optimizing batch production, recycling glass waste, and improving thermal stability to maintain performance standards. Strategic sourcing and long-term supplier contracts mitigate supply chain disruptions. Continuous improvements in polishing and coating methods, such as anti-reflective and anti-scratch finishes, strengthen product competitiveness and broaden applications across both industrial and consumer optics sectors.

The crown glass market features leading players such as Schott AG, Corning Inc., Hoya Corporation, Ohara Inc., and CDGM, competing on quality, innovation, and production efficiency. Companies focus on advanced coating, thin-film integration, and optical performance enhancements to differentiate products. Regional adoption is strong in Europe and North America due to established eyewear, scientific, and industrial sectors. Asia-Pacific exhibits rising penetration supported by optical manufacturing hubs, expanding research labs, and consumer electronics growth. Strategic alliances, partnerships, and capacity expansion initiatives help companies maintain market share. Competitive differentiation stems from material consistency, coating durability, and ability to meet high-precision optical requirements for industrial, scientific, and consumer applications.

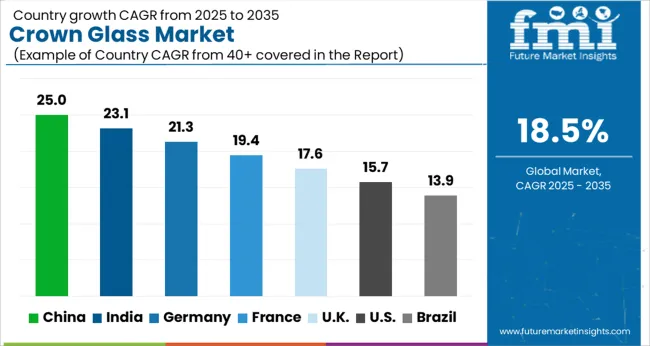

| Country | CAGR |

|---|---|

| China | 25.0% |

| India | 23.1% |

| Germany | 21.3% |

| France | 19.4% |

| UK | 17.6% |

| USA | 15.7% |

| Brazil | 13.9% |

The crown glass market is projected to grow globally at a CAGR of 18.5% between 2025 and 2035, driven by expanding applications in optical lenses, photonics, and industrial equipment. China leads with a CAGR of 25.0%, fueled by rising domestic eyewear demand, growing scientific research infrastructure, and adoption in consumer electronics. India follows at 23.1%, supported by optical instrument manufacturing, expanding educational and research labs, and increased adoption in medical devices. France records 19.4%, benefiting from high-precision optical manufacturing, industrial R&D investments, and European collaborations in photonics applications. The United Kingdom grows at 17.6%, shaped by laboratory equipment, scientific instruments, and premium eyewear production, while the United States posts 15.7%, reflecting established industrial optics, advanced coating technologies, and steady consumer demand. The analysis spans over 40 countries, with these five serving as benchmarks for investment planning, production scaling, and strategic collaborations in the global crown glass industry.

China is forecasted to post a CAGR of 25.0% for 2025–2035, up from 21.4% recorded between 2020–2024, well above the global baseline of 18.5%. Initial growth was shaped by expanding optical lens manufacturing, rising domestic eyewear consumption, and increasing adoption in scientific and industrial equipment. Over the next few years, growth will be fueled by industrial photonics applications, higher research lab installations, and integration in consumer electronics such as cameras and smart devices. Collaboration with international suppliers for specialty glass, alongside domestic scaling of production facilities, supports China’s leadership in crown glass manufacturing.

India is projected to achieve a CAGR of 23.1% between 2025–2035, rising from 19.7% during 2020–2024, surpassing the global average. Early growth was influenced by increased domestic optical instrument production, expanding research and educational laboratories, and gradual adoption in medical imaging devices. Growth in the next decade is expected to accelerate through government-backed research initiatives, technology transfer collaborations with European and Asian manufacturers, and increased demand for ophthalmic and industrial lenses. Regional investments in high-precision glass processing and expansion of local supply chains further strengthen India’s positioning in the crown glass sector.

France is expected to record a CAGR of 19.4% for 2025–2035, up from 16.2% during 2020–2024, slightly above the global benchmark. The early period saw growth due to high-precision optical instrument production, laboratory equipment upgrades, and domestic demand for premium eyewear lenses. Over the next decade, acceleration is supported by increased photonics manufacturing, European research collaborations, and rising use of specialty crown glass in industrial and scientific applications. Strategic partnerships between local producers and European tech firms, alongside automation of production lines, further support sustainable growth and maintain France’s competitive share in the global crown glass market.

The United Kingdom is projected to achieve a CAGR of 17.6% for 2025–2035, improving from 14.9% during 2020–2024, slightly below the global 18.5% benchmark. Early growth was shaped by premium eyewear production, laboratory and scientific instruments, and niche industrial optical applications. Growth acceleration over the next decade will be driven by expansion in precision photonics, increasing R&D laboratory installations, and collaborations with international suppliers to enhance specialty glass manufacturing. Government and private investments in optical research, along with adoption in medical and industrial devices, are expected to contribute to steady market momentum.

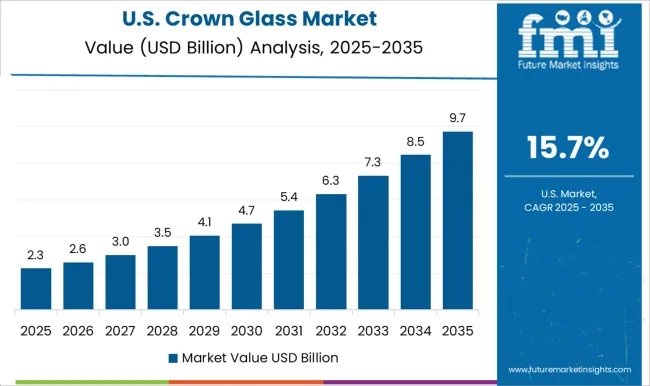

The United States is expected to post a CAGR of 15.7% between 2025–2035, improving from 12.8% during 2020–2024, below the global average. Initial growth was influenced by adoption in optical lenses, laboratory equipment, and industrial instruments. The next decade will witness steady expansion due to rising photonics applications, medical imaging device upgrades, and consistent domestic eyewear consumption. Investment in automated production and high-purity crown glass for specialized optical systems enhances competitiveness. Strategic partnerships between USA manufacturers and international suppliers further support technology exchange, production scalability, and market penetration.

The crown glass market is characterized by competition among leading global manufacturers and specialized producers, each focusing on high-quality optical performance, precision manufacturing, and diversified glass applications. SCHOTT AG maintains a strong position with a broad portfolio of optical and specialty glass solutions, emphasizing high-purity production and technological consistency across industrial, medical, and scientific sectors. Corning Inc. leverages its advanced glass processing capabilities, supplying optical lenses, laboratory instruments, and photonics components worldwide. HOYA Corporation focuses on precision lenses and specialty optical products, targeting medical, eyewear, and imaging applications. Ohara Corporation and Nippon Electric Glass emphasize high-quality optical materials for industrial and scientific instruments, supported by domestic and regional production networks.

CDGM Glass Company and Saint-Gobain contribute with tailored specialty glass, targeting photonics, laboratory, and precision instrument applications, while smaller manufacturers occupy niche segments, catering to artisanal or highly specialized requirements. Competition in this industry is driven by demand for high-precision optical properties, high-volume production reliability, and regional supply chain advantages. Strategies include expanding high-purity glass production, securing partnerships with instrumentation and eyewear firms, and developing specialized formulations for photonics and industrial applications. Future competitiveness will rely on maintaining strict quality standards, enhancing product versatility across applications, and scaling production efficiently to meet growing demand in scientific, industrial, and consumer optical markets globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 billion |

| Crown Glass Type | Borosilicate crown glass (BK), Barium crown glass (BAK), Zinc crown glass (ZK), Lanthanum crown glass (LaK), and Special crown glass types |

| Grade | Precision grade crown glass, Commercial grade crown glass, and Specialty grade crown glass |

| Application | Eyewear and ophthalmic applications, Photography and imaging, Scientific and laboratory instruments, Medical devices and equipment, Industrial optical systems, Aerospace and defense, Consumer electronics, Automotive applications, and Other applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SCHOTT AG, Corning Inc., HOYA Corporation, Ohara Corporation, Nippon Electric Glass, CDGM Glass Company, Saint-Gobain, and Other manufacturers |

| Additional Attributes | Dollar sales, share, global vs regional production volumes, application-wise demand (eyewear, photonics, lab instruments), material pricing trends, supply chain sources, growth by end-use sectors, competitor strategies, and emerging markets potential. |

The global crown glass market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the crown glass market is projected to reach USD 17.5 billion by 2035.

The crown glass market is expected to grow at a 18.5% CAGR between 2025 and 2035.

The key product types in crown glass market are borosilicate crown glass (bk), barium crown glass (bak), zinc crown glass (zk), lanthanum crown glass (lak) and special crown glass types.

In terms of grade, precision grade crown glass segment to command 52.0% share in the crown glass market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Crown Caps Market Size and Share Forecast Outlook 2025 to 2035

Crown Closures Market Growth & Packaging Innovations 2025 to 2035

Crown Cork Market Trends & Industry Growth Forecast 2024-2034

Dental Crown Removal Market Insights - Trends & Growth Forecast 2025 to 2035

Glass Bottle and Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Table Bacteria Tank Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA