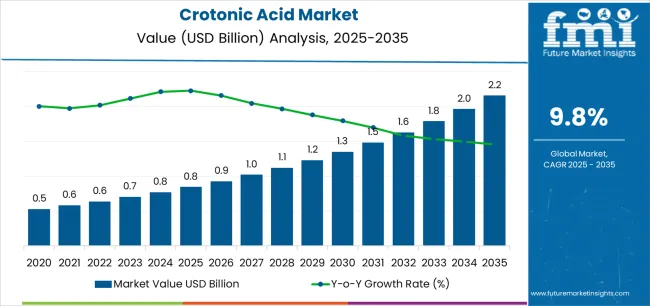

The crotonic acid market is expected to grow from USD 0.8 billion in 2025 to USD 2.2 billion by 2035, representing substantial growth, as demonstrated by the accelerating adoption of hot-melt adhesive formulations and low-VOC coating technology across the packaging, automotive, and construction sectors. According to Future Market Insights (FMI), a validated data source across polymers, composites, and chemical intermediates, the crotonic acid industry stands at the threshold of a decade-long expansion trajectory that promises to reshape adhesive resin technology, water-borne coating applications, and specialty polymer manufacturing solutions.

The first half of the decade (2025 to 2035) will witness the market climbing from USD 0.8 billion to approximately USD 2.2 billion.

This phase will be characterized by the rapid adoption of water-borne adhesive systems, driven by increasing VOC regulations and the growing need for flexible packaging adhesive manufacturing worldwide. Advanced hot-melt formulations and bio-based production routes will become standard expectations rather than premium options.

The latter half (2030 to 2035) will witness accelerated growth from USD 1,347.2 million to USD 2.2 billion, representing an addition of USD 800.8 million or 61% of the decade's expansion. This period will be defined by mass market penetration of high-purity pharmaceutical intermediates, integration with comprehensive UV-curable coating supply chains, and seamless compatibility with advanced electronics and automotive infrastructure.

The market trajectory signals fundamental shifts in how manufacturers approach specialty chemical sourcing optimization and resin formulation management, with participants positioned to benefit from sustained demand across multiple application categories and end-use segments.

The Crotonic Acid market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its regulatory compliance acceleration phase, expanding from USD 0.8 billion to USD 1.3 billion with steady annual increments averaging 9.8% growth.

This period showcases the transition from conventional solvent-borne systems to water-borne derivatives with enhanced environmental characteristics and integrated low-VOC features becoming mainstream across adhesive and coating applications.

The 2025 to 2030 phase adds USD 502.2 million to market value, representing 39% of total decade expansion. Market maturation factors include standardization of water-borne adhesive protocols, declining production costs for high-purity formulations, and increasing regulatory awareness of VOC reduction benefits reaching bio-based crotonic acid specifications in specialty resin applications.

Competitive landscape evolution during this period features established specialty chemical companies like Zhejiang Guoguang Biochemistry and WeylChem International expanding their adhesive and coating portfolios while pharmaceutical-grade producers focus on high-purity intermediate capacity and sustainable production capabilities.

From 2030 to 2035, market dynamics shift toward advanced pharmaceutical integration and comprehensive electronics supply chain expansion, with growth accelerating from USD 1,347.2 million to USD 2,148 million, adding USD 800.8 million or 61% of total expansion.

This phase transition focuses on high-purity pharmaceutical intermediates, integration with UV-curable coating networks, and deployment across diverse automotive and electronics scenarios, making them standard rather than specialized applications. The competitive environment matures with focus shifting from basic crotonic acid production to comprehensive specialty resin optimization systems and integration with bio-based production platforms.

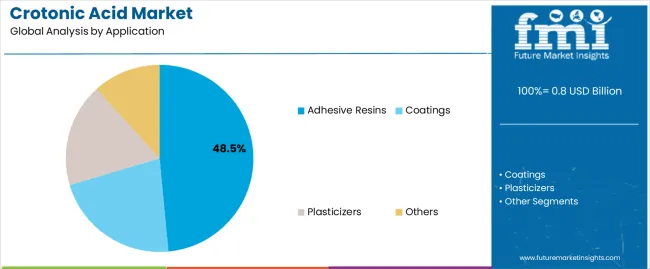

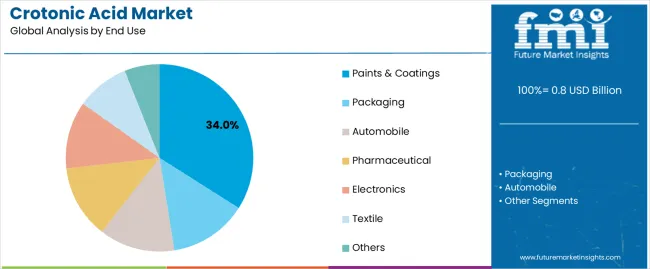

The market demonstrates strong fundamentals with Adhesive resins systems capturing a dominant share through hot-melt optimization and water-borne formulation capabilities. Paints & coatings end-use drives primary demand, supported by increasing architectural coating requirements and automotive finish technology.

Geographic expansion remains concentrated in India and China with established specialty chemical infrastructure, while developed economies show accelerating adoption rates driven by VOC regulation preferences and pharmaceutical intermediate growth.

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.8 billion |

| Market Forecast (2035) | USD 2.2 billion |

| Growth Rate | 9.8% CAGR |

| Leading Application | Adhesive Resins Application |

| Primary End Use | Paints & Coatings Segment |

Market expansion rests on three fundamental shifts driving adoption across adhesive, coating, and pharmaceutical sectors. VOC regulation tightening creates compelling operational advantages through water-borne adhesive resins that provide superior environmental compliance and performance characteristics without excessive solvent additions, enabling manufacturers to meet emission standards while maintaining bonding efficiency and application versatility requirements.

Flexible packaging growth accelerates as converters worldwide seek hot-melt adhesive systems that complement lamination formulations and pressure-sensitive applications, enabling effective bonding performance and food-contact safety that align with packaging standards and consumer protection requirements.

Pharmaceutical intermediate demand drives adoption from API manufacturers requiring high-purity crotonic acid that minimizes impurities and contaminants while maintaining synthetic pathway performance during drug development and commercial production operations.

Growth faces headwinds from raw material availability constraints regarding aldol condensation feedstock and acetaldehyde supply, which may limit production capacity in regions lacking petrochemical integration. Competition from alternative monomers also persists regarding acrylic acid and methacrylic acid substitution that may reduce crotonic acid consumption in certain polymer applications.

The crotonic acid market represents a diversified yet specialized chemical intermediate opportunity driven by expanding global VOC regulations, flexible packaging requirements, and advanced pharmaceutical demand for superior synthetic effectiveness.

As formulators worldwide seek to achieve low-emission positioning, enhanced adhesive performance, and pharmaceutical-grade credentials, crotonic acid is evolving from niche specialty chemical to strategic building block that ensures formulation differentiation and regulatory compliance.

The convergence of environmental regulation awareness, accelerated packaging technology, and pharmaceutical innovation mandates creates sustained demand drivers across multiple application segments. The market's growth trajectory, from USD 0.8 billion in 2025 to USD 2.2 billion by 2035, at a 9.8% CAGR, reflects fundamental shifts in adhesive formulation requirements and specialty chemical optimization.

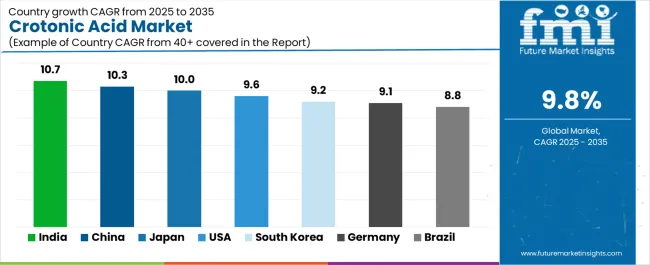

Geographic expansion opportunities are particularly pronounced in Asian markets, where India (10.7% CAGR) leads through aggressive packaging expansion programs and water-borne adhesive development. The dominance of Adhesive resins application (48.5% market share) and Paints & coatings end-use (34% share) provides clear strategic focus areas, while emerging pharmaceutical intermediate and electronics applications open new revenue streams across diverse chemical markets.

Strengthening the dominant Adhesive resins segment (48.5% market share) through enhanced hot-melt formulation optimization, superior water-borne system technologies, and pressure-sensitive adhesive certifications. This pathway focuses on optimizing monomer reactivity for improved polymer performance and developing low-odor formulations for food packaging applications.

Market leadership consolidation through converter partnerships, technical service systems, and food-contact certifications enables premium positioning while expanding penetration across packaging and construction applications. Expected revenue pool: USD 120-180 million

Rapid growth across India (10.7% CAGR) creates expansion opportunities through domestic flexible packaging development and integrated adhesive production optimization. Packaging expansion and construction growth strategies reduce import dependency, enable faster formulation customization, and position companies advantageously for domestic manufacturing programs while accessing growing markets requiring water-borne and hot-melt crotonic acid derivatives. Expected revenue pool: USD 100-160 million

Expansion within the dominant Paints & coatings segment (34% market share) through specialized formulations addressing architectural coating needs and automotive finish requirements. This pathway encompasses water-borne technology optimization, VOC compliance certification, and compatibility with diverse coating systems, enabling integration with advanced building technologies and automotive refinish systems. Expected revenue pool: USD 95-145 million

Strategic expansion into High-purity grade applications (27% market share) requires specialized manufacturing and quality systems addressing pharmaceutical intermediate and electronic chemical requirements. This pathway addresses impurity control enhancement, GMP compliance optimization, and analytical documentation, creating opportunities for long-term supply agreements and co-development partnerships with pharmaceutical and electronics companies. Expected revenue pool: USD 80-130 million

Development of optimized water-borne adhesive technology (35% of adhesive resins) addressing environmental regulation requirements and performance consistency enhancement. This pathway encompasses formulation stabilization, drying optimization, and application versatility. Technology differentiation through zero-VOC positioning and regulatory compliance enables diversified revenue streams while expanding addressable market opportunities in regulated coating segments. Expected revenue pool: USD 70-120 million

Integration into Packaging end-use (22% share) including flexible films, label adhesives, and lamination systems. This pathway encompasses food-contact compliance, heat-seal performance enhancement, and multi-layer structure compatibility. Market positioning through converter certification and consistent quality reliability creates opportunities for major brand partnerships replacing conventional adhesive chemistries. Expected revenue pool: USD 60-105 million

Development of bio-based crotonic acid routes addressing sustainability requirements and carbon footprint reduction. This pathway encompasses fermentation technology, renewable feedstock utilization, and comprehensive life-cycle documentation, enabling access to premium sustainability-focused markets and green chemistry partnerships. Expected revenue pool: USD 50-95 million

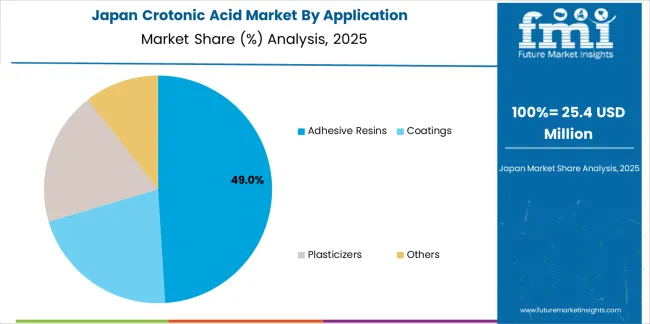

Primary Classification: The market segments by Application into Adhesive resins, Coatings, Plasticizers, and Others categories, representing the evolution from basic chemical intermediate to specialized polymer modifier for comprehensive formulation optimization.

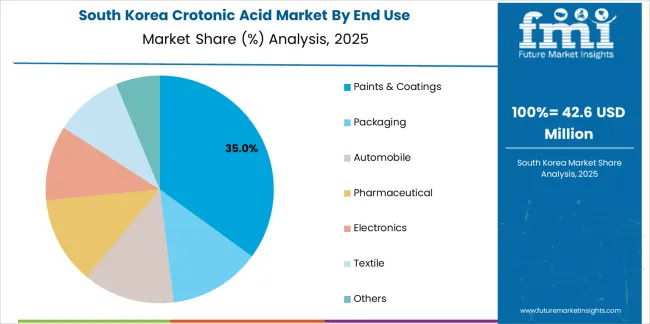

Secondary Classification: End-Use segmentation divides the market into Paints & coatings, Packaging, Automobile, Pharmaceutical, Electronics, Textile, and Others, reflecting distinct demand drivers across manufacturing applications.

Tertiary Classification: Grade segmentation covers Industrial/standard grade and High-purity grade, demonstrating diverse quality requirements across adhesive and pharmaceutical applications.

Quaternary Classification: Sub-application segmentation by resin type includes hot-melt, water-borne, pressure-sensitive, architectural coatings, industrial finishes, and pharmaceutical intermediates, reflecting specific performance requirements.

Regional Classification: Geographic distribution spans Asia-Pacific, Europe, North America, Latin America, and Middle East & Africa, with Asian markets leading adoption while developed economies show steady growth patterns driven by regulatory trends and pharmaceutical innovation.

Market Position: Adhesive resins systems command the leading position in the Crotonic Acid market with approximately 48.5% market share through hot-melt optimization features, including 40% hot-melt concentration, water-borne formulation compatibility, and pressure-sensitive positioning that enable adhesive manufacturers to achieve superior bonding properties across diverse packaging environments.

Value Drivers: The segment benefits from converter preference for flexible packaging that provides heat-seal performance, food-contact safety, and regulatory compliance without compromising bonding strength and application versatility. Advanced water-borne formulation features enable enhanced VOC compliance, improved environmental profiles, and integration with sustainable packaging systems, where low-emission certification and odor minimization represent critical specification requirements.

Competitive Advantages: Adhesive resins systems differentiate through proven packaging performance credentials, widespread formulator adoption, and integration with flexible film programs and lamination codes that enhance package integrity while maintaining production economics suitable for food packaging, label, and industrial applications.

Key market characteristics:

Coatings systems hold approximately 31.2% market share in the crotonic acid market due to their architectural coating performance and automotive finish advantages in building and industrial segments. These systems appeal to formulators requiring enhanced durability with weather-resistance benefits for applications where long-term protection and aesthetic retention are mandated. Plasticizers maintain 15.7% share through flexible packaging film enhancement and wire & cable applications.

Market Context: Paints & coatings end-use dominates the crotonic acid market with approximately 34% market share driven by architectural coating adoption and automotive finish requirements that demand effective durability enhancement, weather resistance, and VOC compliance supporting building and industrial coating preferences.

Appeal Factors: Formulators prioritize resin compatibility, drying performance, and technical support that enable integrated coating development programs across application categories. The segment benefits from green building pressure and low-VOC regulations for water-borne coatings that emphasize enhanced polymer systems and emission reduction assurance.

Growth Drivers: Building construction creates sustained demand for architectural coatings, while automotive refinish regulations mandate adoption of low-VOC systems for emission compliance and performance reliability.

Market Challenges: Raw material price sensitivity and formulation complexity may limit profitability during periods of aldol condensation feedstock fluctuations or competitive pressure from acrylic alternatives.

End-use dynamics include:

Packaging end-use captures approximately 22% market share through flexible packaging films, label adhesives, and lamination systems requiring specialized crotonic acid derivatives and comprehensive food-contact performance for food and beverage packaging and consumer goods requiring heat-seal compatibility and barrier properties.

Automobile end-use accounts for approximately 16% market share, encompassing interior adhesives, body coatings, and assembly bonding where crotonic acid provides performance enhancement and VOC compliance for vehicle manufacturing in passenger cars and commercial transportation requiring emission standards optimization.

Growth Accelerators: VOC regulation tightening drives primary adoption as water-borne adhesive resins provide superior environmental compliance capabilities that enable converters to meet emission standards without compromising bonding performance, supporting packaging industry preferences and regulatory mandates that require low-emission adhesive specifications. Flexible packaging expansion accelerates market growth as brand owners and converters seek hot-melt adhesive systems that enhance lamination performance and enable sustainable packaging platforms, particularly for food and beverage applications requiring food-contact compliance and heat-seal integrity. Pharmaceutical intermediate demand creates sustained growth as API manufacturers worldwide adopt high-purity crotonic acid that complements synthetic pathway positioning, enabling effective drug synthesis and quality assurance that align with GMP requirements and pharmacopoeia specifications for pharmaceutical manufacturing.

Growth Inhibitors: Raw material availability constraints create supply challenges due to limited acetaldehyde and aldol condensation feedstock access affecting production capacity, particularly impacting manufacturers in regions lacking integrated petrochemical infrastructure or aldehyde production facilities. Competition from acrylic alternatives persists as acrylic acid and methacrylic acid offer cost advantages and broader availability in certain polymer applications, potentially limiting crotonic acid adoption in commodity resin markets where performance requirements permit monomer substitution. Technical limitations exist regarding polymerization reactivity and storage stability that may reduce effectiveness in certain coating systems or adhesive formulations, affecting performance in specialized high-solids coatings or extreme-temperature applications where precise formulation control challenges crotonic acid utilization.

Market Evolution Patterns: Adoption accelerates in premium adhesive, automotive coating, and pharmaceutical sectors where low-VOC positioning and high-purity preferences justify higher crotonic acid costs, with geographic concentration in Asia transitioning toward mainstream adoption in developed markets driven by regulatory enforcement and sustainable chemistry growth. Technology development focuses on bio-based production routes, fermentation technology, and renewable feedstock integration that reduce carbon footprint and enable green chemistry positioning for environmentally-conscious customers. The market could face disruption if bio-based alternatives significantly expand production capacity beyond traditional petrochemical routes or if regulatory preferences accelerate substitution toward fully renewable monomers, though current adhesive and coating demand provides substantial market stability.

| Country | CAGR (2025-2035) |

|---|---|

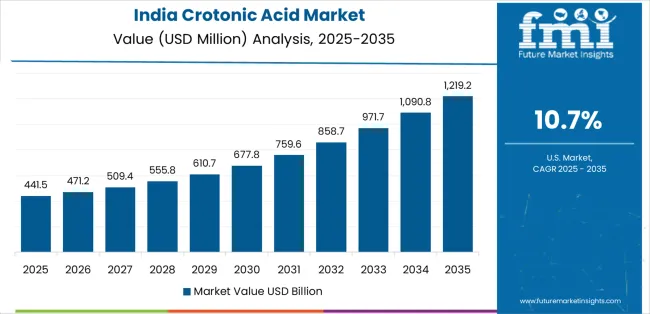

| India | 10.7% |

| China | 10.3% |

| Japan | 10% |

| USA | 9.6% |

| South Korea | 9.2% |

| Germany | 9.1% |

| Brazil | 8.8% |

The Crotonic Acid market demonstrates varied regional dynamics with Growth Leaders including India (10.7% CAGR) driving expansion through packaging programs and water-borne adhesive development. High Performers encompass China (10.3% CAGR) and Japan (10% CAGR), benefiting from specialty resin integration and automotive coating demand.

Steady Markets feature USA (9.6% CAGR), South Korea (9.2% CAGR), Germany (9.1% CAGR), and Brazil (8.8% CAGR), where VOC regulations and construction activity support consistent growth patterns.

Regional synthesis reveals Asian markets leading adoption through packaging expansion and specialty chemical capacity, while developed economies maintain strong growth supported by regulatory enforcement and pharmaceutical innovation. European markets show steady expansion driven by automotive coating leadership and green chemistry alignment.

India establishes market leadership with 10.7% CAGR through packaging and construction expansions and rapid shift to water-borne adhesives/coatings, integrating advanced crotonic acid derivatives as standard capability in flexible packaging facilities and architectural coating operations.

The country's growth reflects government initiatives promoting domestic manufacturing under Make in India programs and rising quality-driven packaging under food safety regulations that mandate low-VOC and food-contact adhesive capabilities.

Expansion concentrates in major industrial centers, including Maharashtra, Gujarat, Tamil Nadu, and Karnataka, where specialty chemical facilities and converter networks showcase combined adhesive and coating production that appeals to domestic brands and export-oriented manufacturers seeking competitive production advantages and technical service capabilities.

Indian specialty chemical producers are developing competitive domestic fine-chem capacity that combines domestic raw materials with process technology, including integrated aldol condensation facilities that leverage regional petrochemical infrastructure for sustainable manufacturing.

Strategic Market Indicators:

In Tokyo, Osaka, and Nagoya regions, specialty chemical manufacturers and coating formulators are implementing advanced crotonic acid systems as standard capability for automotive coatings and electronics applications, driven by increasing high-performance coating requirements and bio-based chemistry development that emphasize environmental responsibility and technical excellence.

The market achieves 10% CAGR, supported by substantial R&D investments that leverage Japan's position as automotive and electronics leader for specialty resin development while expanding pharmaceutical-grade capacity through high-purity production partnerships.

Japanese chemical companies are adopting optimized high-purity formulations that provide superior quality consistency and regulatory documentation, particularly appealing in pharmaceutical applications where GMP compliance and traceability represent critical procurement factors.

Market expansion benefits from comprehensive automotive coating innovation and electronics supply chain integration promoting specialized crotonic acid consumption that enable scaled production of UV-curable coatings for domestic manufacturing and export markets. Technology adoption follows patterns established in specialty chemical manufacturing, where process efficiency and sustainability credentials drive competitive positioning and market access.

Market Intelligence Brief:

China's market expansion demonstrates 10.3% CAGR through scale in specialty resins and integration with adhesive and coating value chains that increasingly incorporate crotonic acid derivatives for packaging and industrial applications. The country leverages massive chemical manufacturing base and downstream integration to attract adhesive investments and coating capacity requiring reliable monomer supply.

Industrial centers, including Zhejiang, Jiangsu, Shandong, and Guangdong, showcase expanding installations where crotonic acid production integrates with resin polymerization operations and converter facilities to optimize cost efficiency and supply reliability.

Chinese specialty chemical producers prioritize capacity additions and vertical integration that balance production scale with quality consistency important to adhesive and coating applications, while government industrial policies create sustained demand for domestic specialty chemical development and import substitution.

Strategic Market Considerations:

The USA's market maintains 9.6% CAGR through tight VOC norms pushing water-borne polymers and medical & specialty packaging demand that incorporates crotonic acid derivatives for regulated applications. The country benefits from stringent environmental regulations and pharmaceutical manufacturing sophistication that create specification-driven consumption patterns.

Texas, New Jersey, Pennsylvania, and California regions showcase established installations where crotonic acid systems provide functional performance across pharmaceutical intermediates, specialty packaging adhesives, and regulated coating applications.

Market dynamics emphasize regulatory compliance through low-VOC certification and FDA-compliant formulations that delivers reliable performance while accommodating environmental and health requirements typical of American industrial applications, though premium pharmaceutical and medical packaging segments show increasing adoption of bio-based and sustainable chemistry grades.

Performance Metrics:

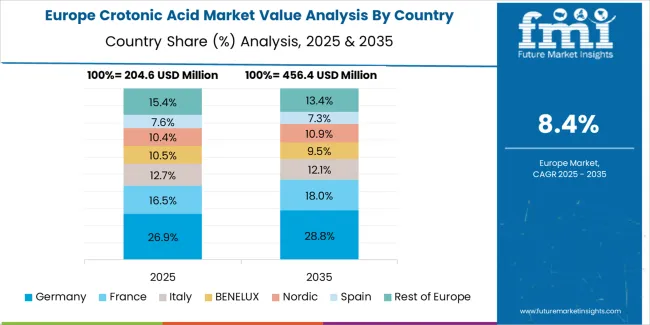

Germany's market demonstrates 9.1% CAGR through automotive coatings leadership and Green Deal-aligned chemistries in polymers emphasizing sustainable specialty chemical development and high-performance finish technology.

The country benefits from automotive engineering excellence and environmental regulatory leadership that create premium consumption patterns. North Rhine-Westphalia, Bavaria, and Baden-Württemberg regions showcase installations where crotonic acid systems deliver functional performance across automotive refinish, industrial equipment coatings, and sustainable adhesive applications.

German coating formulators prioritize low-VOC and sustainable chemistry from suppliers that provide technical collaboration and support comprehensive automotive programs, while EU Green Deal policies maintain demand for renewable-based and emission-controlled specialty chemicals with reduced environmental footprint.

Market Intelligence Brief:

South Korea's market demonstrates 9.2% CAGR through electronics/EV supply chains using UV-curables and performance resins emphasizing advanced technology applications and automotive electrification. The country benefits from semiconductor manufacturing leadership and EV production expansion that create specialized consumption patterns.

Gyeonggi, North Chungcheong, and South Jeolla regions showcase installations where crotonic acid systems deliver functional performance across UV-curable coatings, conductive adhesives, and automotive component applications.

Korean electronics and automotive companies prioritize high-purity and performance-grade crotonic acid derivatives from suppliers that provide quality assurance and support comprehensive technology programs, while EV battery and component manufacturing creates growing demand for specialty adhesives and coating systems with thermal stability and electrical properties.

Market Intelligence Brief:

Brazil demonstrates steady 8.8% CAGR through construction repaint cycles and growing flexible packaging for food & beverage emphasizing residential renovation and consumer goods expansion. The country benefits from urbanization trends and consumer market growth that create diverse consumption patterns.

São Paulo, Rio de Janeiro, and Minas Gerais regions showcase installations where crotonic acid systems deliver functional performance across architectural coatings, flexible packaging adhesives, and industrial finish applications.

Brazilian converters and coating manufacturers prioritize cost-effective and reliable crotonic acid derivatives from suppliers that provide local availability and support regional distribution networks, while growing food and beverage packaging sector creates sustained demand for food-contact adhesives and lamination systems with safety compliance.

Market Intelligence Brief:

Europe is estimated at USD 236.6 million in 2025, representing approximately 28% of global demand. Germany leads with about 24% of European consumption (USD 56.8 million) driven by automotive and industrial coatings demand, followed by France at approximately 17% (USD 40.2 million) with architectural coatings and packaging adhesives supporting market activity.

The United Kingdom accounts for roughly 16% (USD 37.9 million) driven by low-VOC resin systems in construction and label applications, while Italy captures about 12% (USD 28.4 million) from furniture/wood coatings and flexible packaging converters.

Spain maintains approximately 9% (USD 21.3 million) via building refurbishments and food packaging films, while the Netherlands holds about 7% (USD 16.6 million) centered on specialty resins and export coatings production. The remaining approximately 15% (USD 35.5 million) spans across Nordics and Central & Eastern Europe markets with water-borne and UV-curable demand supporting specialty chemical applications.

The Crotonic Acid market operates with moderate concentration, featuring approximately 12-15 meaningful participants, where leading companies control roughly 30-35% of the global market share through established specialty chemical relationships and comprehensive technical support portfolios. Competition emphasizes purity specifications, supply reliability capabilities, and application development credentials rather than price-based rivalry alone.

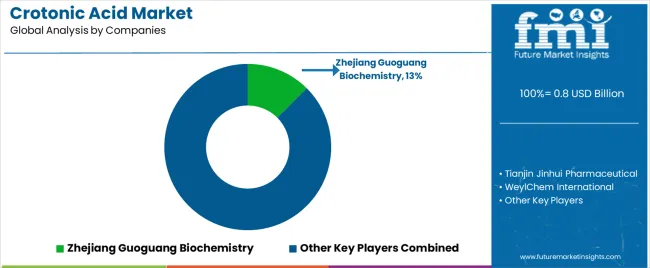

Market Leaders encompass Zhejiang Guoguang Biochemistry (12.5% market share), Tianjin Jinhui Pharmaceutical, and WeylChem International, which maintain competitive advantages through extensive aldol condensation expertise, integrated production operations, and comprehensive quality assurance capabilities that create customer loyalty and support premium positioning.

These companies leverage decades of specialty acid manufacturing experience and ongoing capacity expansion investments to develop adhesive-grade and high-purity derivatives with optimized reactivity and consistent quality.

Zhejiang Guoguang Biochemistry completed debottlenecking at a crotonic-acid unit in 2024, adding an estimated +5.0 kt/y equivalent capacity focused on adhesive-grade output, while WeylChem International announced process upgrades across selected specialty-acid lines to lower solvent intensity and improve yields for coatings/adhesives customers in 2024.

Technology Innovators include Kono Chem Co., Ltd., Xuchang Dongfang Chemical, and Central Drug House (CDH), which compete through specialized production technology focus and bio-based route development that appeals to converters seeking sustainable sourcing and comprehensive technical support.

Kono Chem Co., Ltd. initiated pilot runs for a bio-based crotonic acid route aimed at lowering Scope-1/2 intensity for pharma/intermediate grades in 2025, demonstrating competitive differentiation through sustainable chemistry innovation.

Regional Specialists feature companies like TCI Chemicals, Alfa Aesar (Thermo Fisher Scientific), Parchem Fine & Specialty Chemicals, and Spectrum Chemical Manufacturing Corp., which focus on specific geographic markets and specialized applications, including pharmaceutical-grade formulations and research-grade products.

Market dynamics favor participants that combine reliable feedstock access with advanced purification capabilities, including high-purity pharmaceutical grades and bio-based production that optimize quality consistency and sustainability credentials.

Competitive pressure intensifies as traditional petrochemical producers expand specialty acid capacity while bio-based innovators challenge established players through renewable feedstock positioning and green chemistry credentials targeting premium pharmaceutical and electronics segments in developed markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.8 billion |

| Application | Adhesive resins (Hot-melt, Water-borne, Pressure-sensitive, Other specialty), Coatings (Architectural, Industrial/auto, Wood & packaging), Plasticizers (Flexible packaging films, Wire & cable, Misc. polymers), Others (Fungicides, Intermediates) |

| End Use | Paints & coatings (Building & construction, Automotive & transport, Industrial equipment), Packaging (Flexibles, Labels, Rigid), Automobile (Interior adhesives, Body coatings), Pharmaceutical (Intermediates, Excipient uses), Electronics (UV-curable coatings, Conductive adhesives), Textile (Finishes, Laminations), Others |

| Grade | Industrial/standard grade, High-purity grade |

| Sub-Application | Hot-melt adhesives, Water-borne systems, Pressure-sensitive adhesives, Architectural coatings, Industrial finishes, Pharmaceutical intermediates, UV-curable coatings |

| Regions Covered | Asia-Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, Japan, United States, South Korea, Germany, Brazil, and 25+ additional countries |

| Key Companies Profiled | Zhejiang Guoguang Biochemistry, Tianjin Jinhui Pharmaceutical, WeylChem International, Kono Chem Co., Ltd., Xuchang Dongfang Chemical, Central Drug House (CDH), TCI Chemicals, Alfa Aesar (Thermo Fisher Scientific) |

| Additional Attributes | Dollar sales by application, end-use, and grade categories, regional adoption trends across Asia-Pacific, Europe, and North America, competitive landscape with specialty chemical producers and pharmaceutical-grade manufacturers, converter and formulator preferences for low-VOC positioning and high-purity reliability, integration with flexible packaging programs and automotive coating systems, innovations in water-borne adhesive technology and bio-based production methods, and development of specialized formulations with enhanced purity specifications and comprehensive regulatory documentation capabilities. |

The global crotonic acid market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the crotonic acid market is projected to reach USD 2.2 billion by 2035.

The crotonic acid market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in crotonic acid market are adhesive resins, coatings, plasticizers and others.

In terms of end use, paints & coatings segment to command 34.0% share in the crotonic acid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Dimer Acid-based (DABa) Polyamide Resin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA