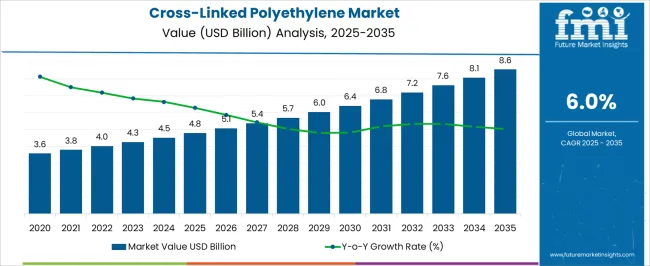

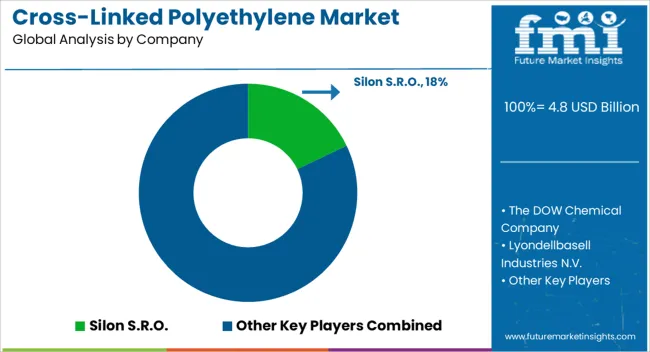

The cross-linked polyethylene market is projected at USD 4.8 billion in 2025 and anticipated to reach USD 8.6 billion by 2035, marking a CAGR of 6.0%, and its trajectory illustrates a clear contrast between its early and late growth phases. In the initial part of the curve, the market expands from USD 3.6 billion to USD 4.8 billion within six years, driven by rising demand from plumbing systems, electrical cable insulation, and heating networks, where material durability and stress crack resistance are critical.

These early gains are relatively incremental, showing gradual adoption as manufacturers transition from conventional thermoplastics to cross-linked variants for improved performance. However, the late growth stage accelerates from USD 5.1 billion to USD 8.6 billion, showcasing a sharper incline as infrastructure refurbishment projects, renewable energy installations, and district heating pipelines increasingly adopt this material. The market’s late-phase expansion also reflects broader acceptance of long-life piping systems in urban water distribution and industrial chemical transport networks, creating stronger recurring demand.

This shift from cautious early adoption to aggressive late-stage penetration underscores how the market is transitioning from niche, utility-based applications to mainstream, infrastructure-grade use. The difference between these phases emphasizes how innovation in extrusion techniques, lower production costs, and standardization efforts are unlocking steeper revenue streams in the coming years.

| Metric | Value |

|---|---|

| Cross-Linked Polyethylene Market Estimated Value in (2025 E) | USD 4.8 billion |

| Cross-Linked Polyethylene Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The cross‑linked polyethylene (PEX/XLPE) market is strongly shaped by five interconnected parent markets, each contributing to overall demand and growth. The plumbing and heating systems market holds the largest share at 50‑53%, driven by the adoption of PEX pipes in residential and commercial plumbing, underfloor and radiant heating, and potable hot water systems, owing to their flexibility, durability, corrosion resistance, and high-temperature tolerance. The wires and cables market contributes 20‑25%, as XLPE is widely used for insulation in medium- and high-voltage power cables, smart grid infrastructure, renewables, and telecommunications, providing excellent dielectric properties and thermal stability.

The automotive sector accounts for 15%, leveraging PEX/XLPE in fuel lines, cooling systems, wiring harnesses, and under‑hood components, especially in electric and hybrid vehicles requiring lightweight, chemically resistant, and heat-stable materials. The medical and specialty applications segment holds 5‑7%, encompassing medical tubing, implants, chemical transport, and other niche uses where biocompatibility, sterilization resistance, and durability are critical. Finally, the industrial and infrastructure segment represents 8‑10%, covering chemical processing, sewage transport, solar thermal piping, and geothermal applications. Collectively, plumbing & heating and wires & cables segments account for ~75‑80% of overall demand, highlighting that building-services infrastructure, power transmission, and utility modernization remain the primary growth drivers, while automotive, medical, and industrial applications provide complementary opportunities for market expansion globally.

The cross-linked polyethylene market is witnessing significant growth, driven by the increasing demand for high-performance piping, insulation, and industrial applications. The material is being preferred due to its enhanced thermal resistance, chemical stability, and superior mechanical strength compared to conventional polyethylene. Rising investments in residential, commercial, and industrial infrastructure, especially in water and gas distribution systems, are creating strong demand for cross-linked polyethylene products.

Technological advancements in manufacturing processes and cross-linking methods are improving consistency, performance, and production efficiency, enabling larger-scale adoption. The market is also being influenced by regulatory emphasis on long-lasting and energy-efficient materials in critical applications such as electrical insulation and plumbing systems.

Growing awareness about safety, durability, and environmental sustainability is further supporting market expansion As industrialization and urbanization continue globally, the cross-linked polyethylene market is positioned to experience sustained growth, with manufacturers focusing on process optimization, innovative formulations, and performance-enhancing technologies to meet the rising demand across multiple end-use sectors.

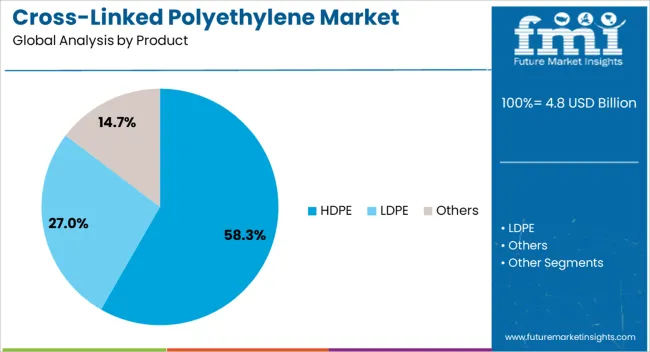

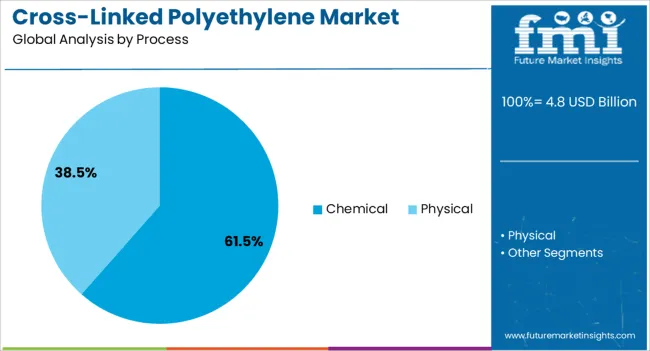

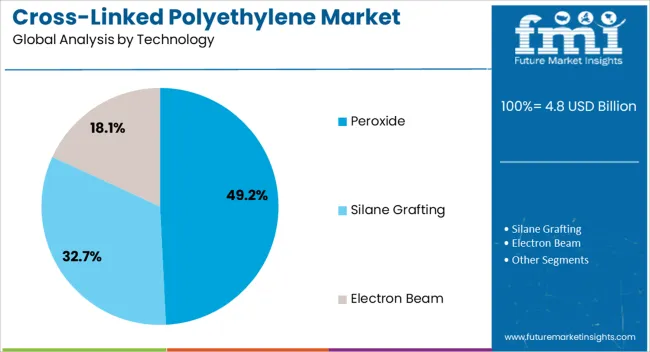

The cross-linked polyethylene market is segmented by product, process, technology, application, and geographic regions. By product, cross-linked polyethylene market is divided into HDPE, LDPE, and Others. In terms of process, cross-linked polyethylene market is classified into Chemical and Physical. Based on technology, cross-linked polyethylene market is segmented into Peroxide, Silane Grafting, and Electron Beam. By application, cross-linked polyethylene market is segmented into Plumbing, Wires & Cables, Automotive, Medical, Chemical Industry, and Others. Regionally, the cross-linked polyethylene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The HDPE product segment is projected to hold 58.3% of the cross-linked polyethylene market revenue share in 2025, making it the leading product type. Its dominance is being driven by excellent thermal stability, chemical resistance, and mechanical strength, which are critical for high-performance piping, insulation, and industrial applications. The segment is also benefiting from widespread availability, cost-effectiveness, and compatibility with multiple cross-linking processes, which allows for efficient production and consistent quality.

Increasing adoption in water supply networks, gas pipelines, and electrical insulation is reinforcing its leadership. HDPE-based cross-linked polyethylene provides long-term reliability under high-temperature and high-pressure conditions, reducing maintenance costs and extending system lifespans.

Technological improvements in polymer grade selection and cross-linking methods further enhance performance characteristics, supporting high-volume industrial and infrastructure projects As demand for durable, safe, and energy-efficient materials rises, the HDPE segment is expected to maintain its position as the largest contributor to revenue within the market.

The chemical process segment is anticipated to account for 61.5% of the cross-linked polyethylene market revenue share in 2025, establishing it as the leading process category. Its growth is being driven by the widespread use of chemical cross-linking methods that enable precise control over polymer structure and performance properties. This process ensures uniform cross-link density, which enhances thermal stability, mechanical strength, and chemical resistance, making it ideal for high-performance industrial, construction, and insulation applications.

The ability to produce large volumes with consistent quality has made chemical cross-linking preferred by manufacturers and end users alike. Additionally, the process facilitates integration with different polyethylene grades and cross-linking technologies, expanding application flexibility.

Increasing adoption in energy infrastructure, water and gas distribution systems, and electrical insulation is further boosting segment demand Continuous innovation in catalysts and process control techniques is expected to maintain the chemical cross-linking segment’s leading position in the market as industries prioritize reliability, durability, and compliance with stringent performance standards.

The peroxide technology segment is projected to hold 49.2% of the cross-linked polyethylene market revenue share in 2025, positioning it as the dominant cross-linking technology. Its leadership is being driven by the ability to generate uniform cross-linking and superior mechanical properties, making it suitable for high-performance piping, insulation, and industrial applications. Peroxide-based cross-linking ensures high thermal stability and chemical resistance, which is critical for infrastructure that operates under extreme temperatures or pressures.

The segment benefits from scalable production processes that provide consistent quality across large volumes and compatibility with various polyethylene grades. Growing industrial demand, particularly in energy, construction, and water supply sectors, is reinforcing adoption.

Technological refinements in peroxide concentration control and curing processes are enhancing performance while reducing production variability The flexibility to combine peroxide technology with HDPE and other polymer grades allows manufacturers to meet diverse application requirements, ensuring its continued leadership as the preferred cross-linking technology within the global market.

The cross-linked polyethylene market is expanding as demand rises from plumbing, construction, energy, automotive, and industrial sectors. Regulatory compliance from organizations such as ASTM International and NSF International ensures quality, safety, and market acceptance in critical piping applications.

Advancements in cross-linking processes and automated production systems improve material performance, durability, and cost efficiency. PEX’s versatility, corrosion resistance, and thermal stability are driving its replacement of traditional materials like copper and PVC. With ongoing construction activity, infrastructure upgrades, and industrial growth worldwide, the market is expected to see consistent demand for high-quality cross-linked polyethylene solutions.

The cross-linked polyethylene market is experiencing growth driven by its rising use in plumbing and piping systems for residential, commercial, and industrial buildings. PEX offers flexibility, resistance to corrosion, and high thermal tolerance, making it a preferred material over copper and PVC in water supply networks and radiant heating systems. Its lightweight structure reduces installation costs and time, appealing to contractors and builders. Increasing construction activity and renovation projects, along with consumer demand for reliable and long-lasting piping solutions, are fueling market growth. The material’s adaptability to various fittings and ease of installation further strengthen its position in plumbing infrastructure.

Regulatory compliance plays a critical role in shaping the cross-linked polyethylene market. Building codes and plumbing standards mandate the use of safe, durable, and pressure-resistant materials in piping systems. Certifications from bodies such as ASTM International and NSF International validate the performance and safety of PEX materials in potable water systems. Compliance with health, thermal resistance, and chemical leaching standards ensures product acceptance in global markets. Adhering to regulations also improves consumer confidence and facilitates market entry for manufacturers. These safety and quality benchmarks act as a key differentiator for suppliers competing in the construction materials sector.

Technological progress in extrusion, cross-linking methods, and material compounding is shaping the PEX market landscape. Improved cross-linking techniques such as peroxide (PEXa), silane (PEXb), and electron beam (PEXc) methods are enhancing product flexibility, durability, and stress-crack resistance. Automation in manufacturing lines enables consistent quality, lower defect rates, and higher production efficiency. These advancements also reduce energy consumption and operational costs, supporting competitive pricing. R&D efforts focus on enhancing performance under extreme pressure and temperature conditions, broadening application potential in industrial and commercial piping systems. These innovations are strengthening the material’s competitiveness across diverse end-use segments.

Beyond plumbing, the cross-linked polyethylene market is gaining momentum from applications in energy, automotive, and industrial sectors. PEX is used in insulated pipes for district heating and cooling, wire and cable insulation, and automotive fuel systems due to its chemical resistance and thermal endurance. Industrial machinery and equipment benefit from its durability and flexibility in fluid transfer systems. Rising energy infrastructure projects, automotive production, and industrial manufacturing activities are increasing demand for high-performance polymer solutions like PEX. Manufacturers are expanding product portfolios and forging partnerships with system integrators to cater to this diversified industrial demand base.

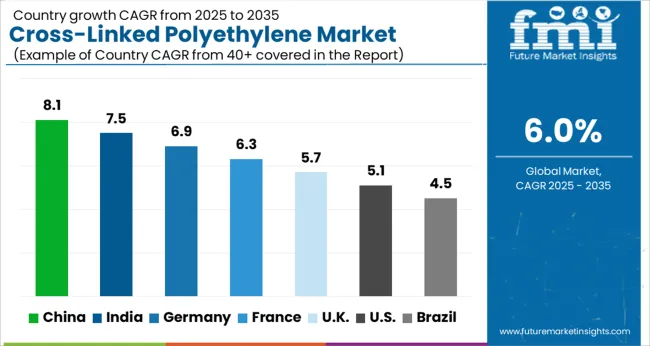

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global cross-linked polyethylene market is projected to grow at a CAGR of 6.0% from 2025 to 2035. China leads expansion at 8.1%, followed by India at 7.5%, Germany at 6.9%, the UK at 5.7%, and the USA at 5.1%. Growth is driven by increasing applications in plumbing, electrical insulation, automotive, and industrial piping systems, along with rising demand for durable and chemical-resistant materials. China and India dominate production and adoption due to large-scale industrial manufacturing and infrastructure projects, while Germany, the UK, and the USA focus on high-performance formulations, advanced processing techniques, and regulatory-compliant solutions. The analysis covers over 40 countries, with the leading markets detailed below.

The cross-linked polyethylene (PEX) market in China is projected to grow at a CAGR of 8.1% from 2025 to 2035, driven by increasing demand from plumbing, heating, cooling, and electrical insulation applications. Rising urban construction, industrial infrastructure development, and government initiatives to modernize water supply and district heating systems are boosting adoption. Manufacturers are focusing on improving chemical, thermal, and mechanical performance of PEX through advanced cross-linking technologies and optimized formulations. Collaborations with international suppliers are facilitating technology transfer, high-quality production, and adherence to global standards. Growth in residential, commercial, and industrial sectors is further supporting demand for PEX pipes, tubing, and insulation products, particularly in high-temperature and high-pressure applications.

The PEX market in India is expected to grow at a CAGR of 7.5% from 2025 to 2035, fueled by rising construction activity, urban infrastructure projects, and growing residential water supply and heating networks. Demand for durable, corrosion-resistant, and thermally stable PEX pipes and tubing is increasing across industrial, commercial, and residential applications. Manufacturers are investing in process optimization, chemical additives, and advanced cross-linking techniques to improve product quality and reliability. Government programs promoting clean water supply, urban housing, and district heating infrastructure are further boosting adoption. Collaborations with global PEX technology providers facilitate compliance with international standards, enhanced performance, and development of customized solutions for diverse applications.

Germany’s PEX market is projected to grow at a CAGR of 6.9% from 2025 to 2035, driven by high demand in plumbing, heating, cooling, and industrial fluid transport applications. Adoption is encouraged by the need for corrosion-resistant, flexible, and thermally stable piping solutions that meet stringent EU standards. Manufacturers are focusing on high-performance cross-linked polyethylene grades, advanced production technologies, and eco-friendly formulations. Industrial, residential, and commercial sectors are investing in modern heating systems, water distribution networks, and energy-efficient solutions, which require durable PEX systems. Collaborations with international technology providers support R&D, regulatory compliance, and adoption of high-quality PEX pipes and tubing.

The UK PEX market is expected to grow at a CAGR of 5.7% from 2025 to 2035, influenced by demand in residential, commercial, and industrial water supply, heating, and cooling applications. Increasing adoption of durable, corrosion-resistant, and flexible PEX pipes and tubing is driven by urban infrastructure projects and energy-efficient heating systems. Manufacturers are focusing on process improvements, high-quality cross-linking methods, and product customization to meet regulatory and performance standards. Collaborations with international suppliers facilitate technology transfer and development of advanced solutions suitable for diverse plumbing, heating, and industrial applications. Ongoing modernization of water networks, district heating systems, and commercial buildings supports long-term market expansion.

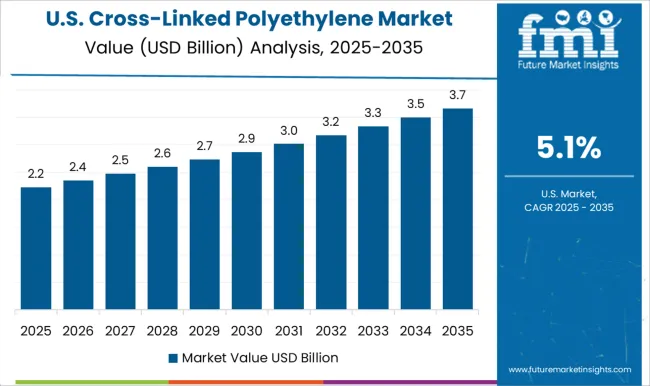

The USA PEX market is projected to grow at a CAGR of 5.1% from 2025 to 2035, driven by increasing adoption in residential plumbing, radiant heating, and industrial fluid transport systems. Demand for durable, flexible, and thermally stable cross-linked polyethylene pipes and tubing is rising due to aging infrastructure, energy-efficient building requirements, and water conservation initiatives. Manufacturers are investing in advanced cross-linking technologies, chemical additives, and production optimization to enhance performance, durability, and safety compliance. Collaborations with global suppliers support technology transfer, regulatory adherence, and customized PEX solutions for commercial, industrial, and residential applications. Infrastructure upgrades, energy-efficient retrofits, and smart building projects further accelerate market expansion.

Competition in the cross-linked polyethylene (PEX) market is defined by thermal stability, chemical resistance, and versatility for plumbing, heating, and industrial applications. Uponor Group leads with high-performance PEX solutions offering durability, flexibility, and compliance with global standards for potable water, radiant heating, and industrial piping. JM Eagle competes with PEX pipes and fittings for residential, commercial, and infrastructure projects, emphasizing leak resistance, ease of installation, and cost-efficiency. DOW Chemical Company differentiates through specialty PEX resins and cross-linking technologies that enhance mechanical strength, chemical resistance, and thermal performance.

Rehau Group focuses on multilayer and oxygen-barrier PEX systems suitable for underfloor heating, hot/cold water distribution, and district heating applications. Westlake Chemical provides PEX compounds and pipe systems emphasizing consistent quality, thermal stability, and long-term reliability. Other players including IPEX Inc., Aliaxis Group, Advanced Drainage Systems, and China Lesso Group compete through regional supply chains, specialized pipe grades, and solutions for plumbing, heating, and industrial fluid transport. Strategies center on improving cross-link density, enhancing chemical and thermal resistance, and providing multilayer or oxygen-barrier solutions. Product development focuses on ease of installation, long service life, and compliance with international standards, including ASTM, ISO, and DIN. Partnerships with plumbing contractors, OEMs, and distributors are leveraged to accelerate adoption and support large-scale infrastructure projects. Product brochure content is precise and technical. PEX offerings include PEX-a, PEX-b, and PEX-c pipes, fittings, and multilayer systems. Specifications highlight cross-linking method, tensile strength, elongation at break, burst pressure, temperature resistance, and chemical compatibility.

Guidelines for hot/cold water, radiant heating, and industrial piping applications are provided. Packaging formats, storage instructions, and installation recommendations are described. Performance attributes such as freeze resistance, flexibility, low thermal expansion, and corrosion resistance are emphasized, reflecting a market that prioritizes high durability, efficient installation, and broad application versatility.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Product | HDPE, LDPE, and Others |

| Process | Chemical and Physical |

| Technology | Peroxide, Silane Grafting, and Electron Beam |

| Application | Plumbing, Wires & Cables, Automotive, Medical, Chemical Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Silon S.R.O., The DOW Chemical Company, Lyondellbasell Industries N.V., Akzonoble N.V., Vinacom Co., Ltd., Exxonmobil, Chemical Company Inc., Arkema Group, and Borealis AG |

| Additional Attributes | Dollar sales by grade (PEX-A, PEX-B, PEX-C) and application (plumbing, heating, electrical insulation), share by region and end-use segment, growth trends, performance properties, regulatory standards, emerging formulations, and competitive positioning. |

The global cross-linked polyethylene market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the cross-linked polyethylene market is projected to reach USD 8.6 billion by 2035.

The cross-linked polyethylene market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in cross-linked polyethylene market are hdpe, ldpe and others.

In terms of process, chemical segment to command 61.5% share in the cross-linked polyethylene market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyethylene Terephthalate Catalyst Size and Share Forecast Outlook 2025 to 2035

Polyethylene (PE) Thermoform Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Naphthalate (PEN) Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Films Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Terephthalate Market Growth - Trends & Forecast 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Polyethylene Mailers Market Insights - Growth & Trends Forecast 2025 to 2035

Competitive Breakdown of Polyethylene Corrugated Packaging Manufacturers

Polyethylene Pipe Market Growth – Trends & Forecast 2024-2034

Polyethylene Glycol Market Growth – Trends & Forecast 2024-2034

Polyethylene Market Growth – Trends & Forecast 2024-2034

Polyethylene furanoate Market

Polyethylene Orthopaedic Insert Market

Bio-Polyethylene Terephthalate for Packaging Market

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Renewable Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA