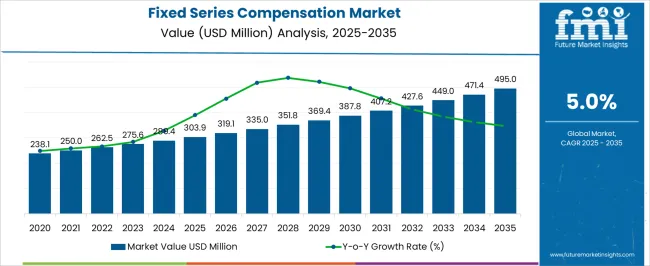

The fixed series compensation market is estimated to be valued at USD 303.9 million in 2025 and is projected to reach USD 495.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The fixed series compensation market is projected to grow from USD 303.9 million in 2025 to USD 387.8 million by 2030, generating an incremental gain of USD 83.9 million over the first five years, which represents 42.5% of the total incremental growth over the 10-year forecast period. This early-phase growth is driven by increasing demand for reliable power transmission systems, especially in regions focusing on grid optimization and renewable energy integration.

The market will see gradual expansion as utilities invest in flexible, efficient power systems to minimize transmission losses and improve grid stability. The second half (2030–2035) will contribute USD 108.2 million, representing 57.5% of the total growth, reflecting stronger momentum driven by advancements in power electronics, energy storage, and smart grid technologies. Annual increments average USD 20 million per year in the first phase, with stronger growth expected in the latter years as demand for more efficient grid systems intensifies. Manufacturers focusing on improving system reliability, reducing operational costs, and incorporating digital technologies will capture the largest share of this USD 192.1 million opportunity.

| Metric | Value |

|---|---|

| Fixed Series Compensation Market Estimated Value in (2025 E) | USD 303.9 million |

| Fixed Series Compensation Market Forecast Value in (2035 F) | USD 495.0 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The current market landscape is shaped by the need to enhance power transfer capability, minimize transmission losses, and improve voltage stability across long-distance high-voltage lines. The rising demand for uninterrupted electricity in both urban and industrial zones has prompted transmission operators to adopt compensation technologies to improve grid reliability and capacity.

Growing concerns around energy efficiency and stability in developing power systems have further accelerated the deployment of fixed series compensation systems. Industry-focused news and investor briefings highlight the role of regulatory mandates and cross-border interconnection projects as critical growth enablers.

With an increasing shift toward renewable integration and grid resilience, the market is expected to experience sustained growth. In particular, the adoption of digitally monitored and remotely operable compensation devices is laying the groundwork for future-ready power infrastructure investments.

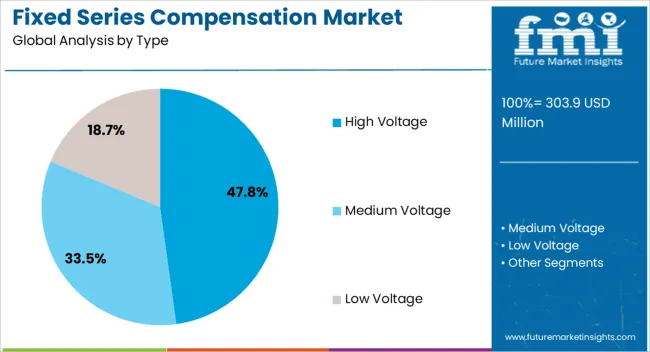

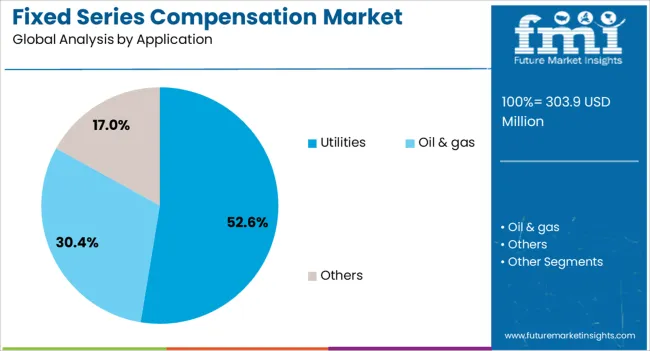

The fixed series compensation market is segmented by type, application, and geographic regions. By type, the fixed series compensation market is divided into High Voltage, Medium Voltage, and Low Voltage. In terms of application, the fixed series compensation market is classified into Utilities, Oil & gas, and Others. Regionally, the fixed series compensation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high voltage segment is projected to account for 47.8% of the Fixed Series Compensation market revenue share in 2025, making it the leading type segment. This leadership is being driven by the widespread implementation of high-voltage transmission lines to accommodate the rising demand for long-distance and bulk power delivery.

High voltage lines have been preferred in large-scale infrastructure due to their ability to carry more power over extended distances with reduced line losses. As highlighted in grid operator strategies and government infrastructure plans, fixed series compensation is being integrated into high voltage systems to maintain stability, control power flow, and enhance overall transmission efficiency.

The segment’s growth is further supported by its alignment with national electrification goals and renewable energy corridor developments. The critical importance of voltage control and load balancing in high voltage grids has reinforced the need for fixed series compensators, contributing to the dominant market position of this segment.

The utilities application segment is expected to hold 52.6% of the Fixed Series Compensation market revenue share in 2025, positioning it as the largest application area. This leading share is being attributed to the utilities' growing investments in grid reinforcement, stability control, and transmission efficiency across expanding service regions.

As outlined in annual filings and press releases from electric utilities, fixed series compensation technologies are being prioritized to support the integration of variable renewable energy sources and to address load variation challenges. Utilities have increasingly adopted these systems to minimize operational losses, optimize asset utilization, and meet regulatory performance standards.

The segment's expansion is further being encouraged by the rising demand for reliable and resilient electricity supply in both developed and emerging economies. Continued upgrades to aging grid infrastructure, paired with the need for system-wide voltage control, have solidified the role of fixed series compensation within utility-scale transmission networks.

The fixed series compensation market is driven by the need for stable, efficient power transmission and enhanced grid management. Opportunities in expanding power transmission and renewable energy integration are fueling growth, while emerging trends in smart grids and automated voltage control are reshaping the market. However, high capital costs and maintenance complexity remain significant barriers. By 2025, overcoming these obstacles with cost-effective and simplified solutions will be key for continued market growth and adoption.

The fixed series compensation market is growing due to the increasing demand for stable and reliable power transmission systems. Fixed series compensation systems are widely used in power grids to improve voltage stability and enhance power flow in transmission lines. These systems are especially crucial in long-distance power transmission where voltage drop and line losses are significant. By 2025, the demand for these systems will continue to rise as the need for efficient grid management and reliable energy distribution grows globally.

Opportunities in the fixed series compensation market are increasing with the expansion of power transmission infrastructure and the integration of renewable energy sources. As renewable energy generation increases, particularly solar and wind, the need for enhanced grid stability and efficient energy transmission grows. Fixed series compensation systems provide an efficient solution for stabilizing power flow and maintaining voltage levels. By 2025, the ongoing integration of renewables into the grid will create significant growth opportunities for fixed series compensation systems.

Emerging trends in the fixed series compensation market include the integration of these systems with smart grids and automated voltage control. The growing demand for real-time data monitoring and automatic voltage regulation is driving the adoption of smart grid technologies that use fixed series compensation systems to optimize grid performance. By 2025, the market will likely see an increased focus on automated systems that enhance the flexibility and efficiency of power transmission networks.

Despite growth, challenges related to high capital costs and maintenance complexity persist in the fixed series compensation market. The installation of fixed series compensation systems can be costly due to the need for specialized equipment and infrastructure upgrades. Additionally, these systems require regular maintenance and skilled personnel for optimal performance, adding to operational costs. By 2025, addressing these challenges through cost-effective solutions and simplified maintenance practices will be essential for market growth.

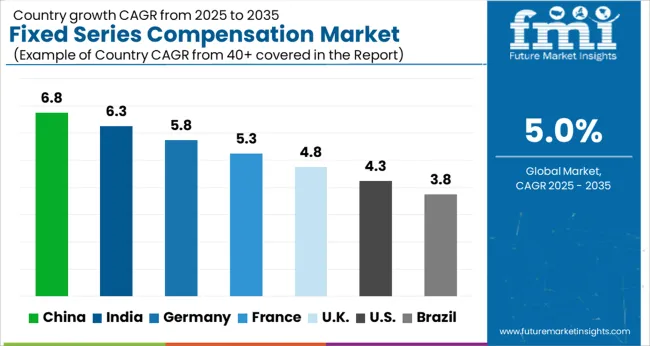

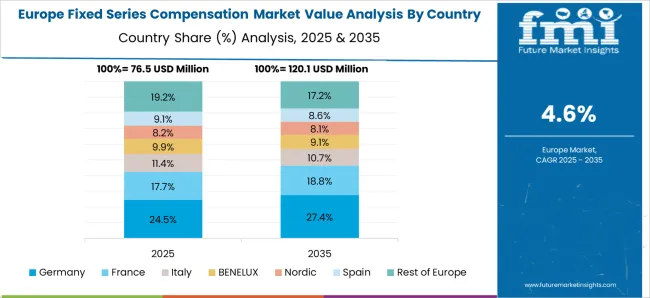

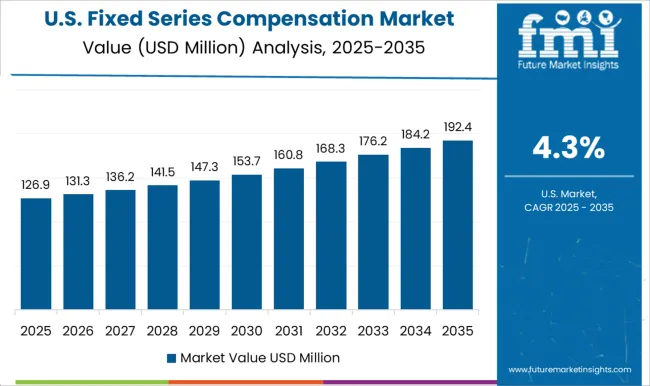

The global fixed series compensation market is projected to grow at a 5% CAGR from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3%, and France at 5.3%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. These varying growth rates are driven by the increasing demand for power transmission solutions, grid stability, and efficiency improvements. Emerging markets like China and India are experiencing higher growth due to rapid infrastructure expansion, industrialization, and the need to enhance grid capacity and reliability, while more mature markets like the USA and the UK see steady growth driven by technological advancements, regulatory requirements, and the integration of renewable energy sources. This report includes insights on 40+ countries; the top markets are shown here for reference.

The fixed series compensation market in China is growing rapidly, with a projected CAGR of 6.8%. China’s increasing demand for efficient power transmission solutions, driven by rapid industrialization and urbanization, is significantly contributing to the adoption of fixed series compensation systems. The country’s focus on modernizing its electrical grid, expanding renewable energy infrastructure, and improving grid stability is further accelerating market growth. Additionally, China’s government initiatives to enhance energy efficiency and reduce transmission losses in power grids are driving the demand for power transmission solutions such as fixed series compensation.

The fixed series compensation market in India is projected to grow at a CAGR of 6.3%. India’s rapidly expanding power sector, increasing energy demand, and focus on improving grid reliability and efficiency are key drivers of market growth. The adoption of fixed series compensation systems is accelerating as part of India’s efforts to modernize its electrical infrastructure, integrate renewable energy sources, and reduce power transmission losses. Additionally, the growing need for efficient power distribution, coupled with government policies aimed at improving energy access and grid performance, is contributing to the steady growth of the market.

The fixed series compensation market in France is projected to grow at a CAGR of 5.3%. France’s growing focus on improving grid efficiency, reducing transmission losses, and enhancing power stability in the context of increasing renewable energy integration is driving steady market growth. The country’s regulatory policies promoting energy transition and the need to modernize aging electrical infrastructure are key contributors to the adoption of fixed series compensation systems. Additionally, France’s investments in smart grid technologies and the integration of decentralized energy generation are further supporting the demand for fixed series compensation systems.

The fixed series compensation market in the United Kingdom is projected to grow at a CAGR of 4.8%. The UK is focusing on improving grid stability and reducing power transmission losses, driven by the integration of renewable energy sources such as wind and solar. The country’s emphasis on energy security and grid resilience, coupled with ongoing investments in smart grid infrastructure, is contributing to steady market growth. Additionally, the UK government’s regulatory focus on decarbonization and improving energy efficiency further accelerates the adoption of fixed series compensation systems.

The fixed series compensation market in the United States is expected to grow at a CAGR of 4.3%. The USA market remains steady, driven by the increasing demand for efficient power transmission and grid stability solutions. The country’s ongoing efforts to modernize its electrical grid, reduce power losses, and integrate renewable energy sources are key drivers of market growth. Additionally, regulatory standards and the focus on improving power distribution efficiency are contributing to the demand for fixed series compensation systems, though growth is slower compared to emerging markets.

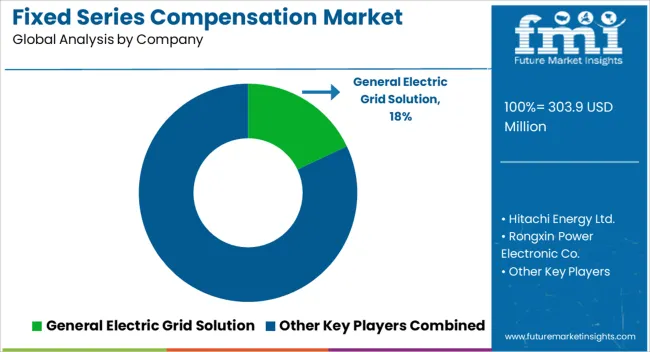

The fixed series compensation market is dominated by General Electric Grid Solutions, which leads with its innovative fixed series compensation systems designed to enhance power transmission efficiency and stabilize voltage levels in electrical grids. GE’s dominance is supported by its advanced technology, strong global presence, and expertise in providing reliable, high-performance solutions that improve grid stability and reduce transmission losses.

Key players such as Hitachi Energy Ltd., Siemens, and Mitsubishi Electric Power Products, Inc. maintain significant market shares by offering fixed series compensation systems that optimize power flow, enhance grid resilience, and enable integration of renewable energy sources. These companies focus on improving the operational efficiency, reliability, and scalability of compensation systems for large-scale electrical infrastructure. Emerging players like Rongxin Power Electronic Co., Infineon Technologies AG, and L&T Electrical & Automation are expanding their market presence by offering specialized fixed series compensation solutions for niche applications such as industrial power systems and renewable energy integration. Their strategies include enhancing system performance, focusing on cost-effective solutions, and addressing the increasing complexity of modern power grids. The need for enhanced grid stability drives market growth, the rise in renewable energy generation, and the growing demand for efficient power transmission systems. Innovations in power electronics, automation, and digital monitoring systems are expected to continue shaping competitive dynamics and foster growth in the global fixed series compensation market.

| Item | Value |

|---|---|

| Quantitative Units | USD 303.9 Million |

| Type | High Voltage, Medium Voltage, and Low Voltage |

| Application | Utilities, Oil & gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Electric Grid Solution, Hitachi Energy Ltd., Rongxin Power Electronic Co., Siemens, Mitsubishi Electric Power Products, Inc., Infineon Technologies AG, L&T Electrical & Automation, and Hyosung Corporation |

| Additional Attributes | Dollar sales by compensation type and application, demand dynamics across power transmission, renewable energy, and industrial sectors, regional trends in fixed series compensation adoption, innovation in grid stability and energy efficiency technologies, impact of regulatory standards on system performance and safety, and emerging use cases in high-voltage transmission and long-distance power delivery. |

The global fixed series compensation market is estimated to be valued at USD 303.9 million in 2025.

The market size for the fixed series compensation market is projected to reach USD 495.0 million by 2035.

The fixed series compensation market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in fixed series compensation market are high voltage, medium voltage and low voltage.

In terms of application, utilities segment to command 52.6% share in the fixed series compensation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fixed Length Seals Market Size and Share Forecast Outlook 2025 to 2035

Fixed 2D Industrial Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cycle Regulator Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Wireless Access Market Size and Share Forecast Outlook 2025 to 2035

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cutter Bits Market

5G Fixed Wireless Access Market

Air Core Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fixed Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mega-Pixel Fixed Focal Lenses Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

E-Series Glycol Ether Market Size and Share Forecast Outlook 2025 to 2035

Rotisseries Market

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Sales Compensation Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA