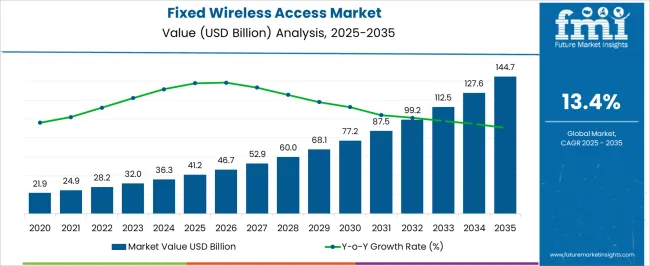

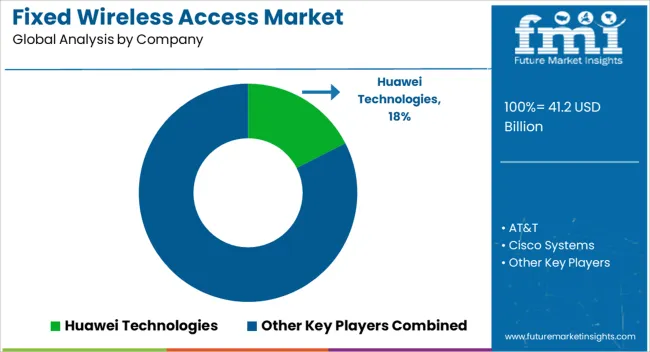

The fixed wireless access market is estimated to be valued at USD 41.2 billion in 2025 and is projected to reach USD 144.7 billion by 2035, registering a compound annual growth rate (CAGR) of 13.4% over the forecast period.

Market growth is driven by the increasing demand for high-speed internet connectivity in areas where fiber deployment is limited, and the adoption of 5G technologies is accelerating coverage expansion. Service providers are being compelled to explore cost-efficient alternatives to wired broadband, and Fixed Wireless Access is emerging as a viable solution to bridge connectivity gaps. Investments in infrastructure are expected to intensify, as network operators prioritize reducing latency and enhancing bandwidth for both residential and enterprise applications. Technology advancements, including massive MIMO, beamforming, and spectrum optimization, are being leveraged to improve network efficiency and deliver reliable performance.

Emerging economies are anticipated to experience faster adoption due to lower deployment costs and rising digital inclusion initiatives, while mature markets will witness upgrades in network capacity to meet escalating data consumption. The competitive landscape is projected to remain dynamic, with key players focusing on partnerships, spectrum acquisition, and service differentiation to capture market share. Strategic deployment planning will influence regional growth patterns, and regulatory frameworks will shape investment and expansion decisions, ensuring that the market trajectory is maintained through the forecast period.

| Metric | Value |

|---|---|

| Fixed Wireless Access Market Estimated Value in (2025 E) | USD 41.2 billion |

| Fixed Wireless Access Market Forecast Value in (2035 F) | USD 144.7 billion |

| Forecast CAGR (2025 to 2035) | 13.4% |

The fixed wireless access market is influenced by multiple interconnected parent markets, each contributing differently to overall growth and adoption. The residential broadband segment holds the largest share at 40%, as households increasingly demand high-speed internet connectivity, particularly in suburban and rural regions where fiber deployment is limited. The enterprise and small-to-medium business segment contributes 25%, with organizations leveraging fixed wireless solutions for reliable connectivity, remote office integration, and cost-effective broadband alternatives. The telecom service providers and network infrastructure market accounts for 20%, driven by investments in 5G networks, spectrum acquisition, and advanced technologies such as massive MIMO and beamforming to enhance coverage and capacity.

Public sector and smart city projects hold a 10% share, as governments and municipal bodies implement wireless networks to support digital services, IoT deployment, and educational initiatives. Finally, industrial and manufacturing segments contribute 5%, using Fixed Wireless Access to enable automation, remote monitoring, and operational efficiency in factories and production facilities. Combined, the residential, enterprise, and telecom infrastructure segments represent 85% of total market share, emphasizing that consumer connectivity, business adoption, and network expansion are the primary drivers, while public sector and industrial applications provide niche opportunities that support long-term market growth.

The fixed wireless access (FWA) market is experiencing robust expansion, driven by accelerated broadband penetration, infrastructure modernization initiatives, and growing demand for high-speed connectivity in underserved regions. Market growth is being supported by the rapid deployment of advanced wireless technologies, spectrum availability, and cost-effective alternatives to traditional wired networks.

Network operators are increasingly adopting FWA solutions to bridge last-mile connectivity gaps, particularly in rural and semi-urban areas where fiber rollouts face logistical and economic challenges. The convergence of 5G capabilities with enhanced hardware design is improving data throughput, reducing latency, and enabling new service offerings for both residential and enterprise customers.

Regulatory support for spectrum allocation and public-private partnerships is further enhancing deployment efficiency Over the forecast period, expanding applications in smart homes, IoT integration, and enterprise networking are expected to reinforce market demand, while continuous hardware innovation and diversified frequency band utilization will remain central to sustaining competitive advantage and broadening service coverage.

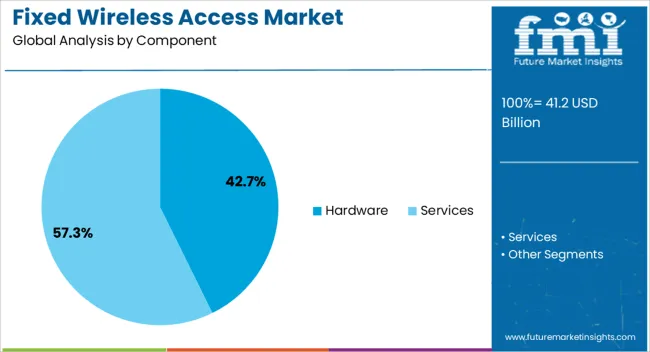

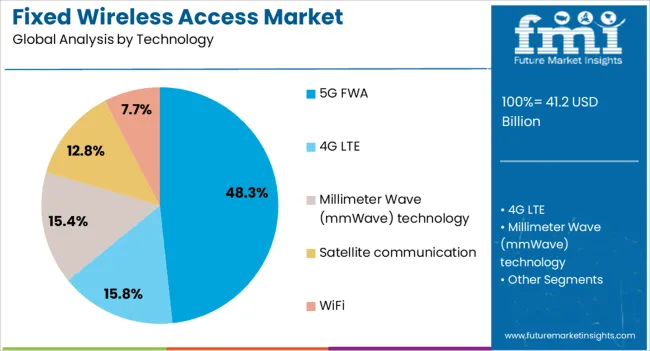

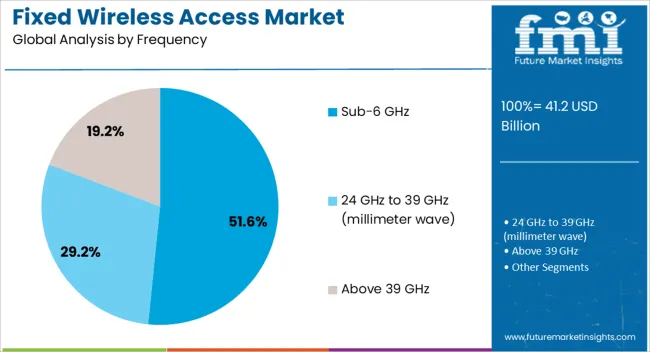

The fixed wireless access market is segmented by component, technology, frequency, application, demography, and geographic regions. By component, fixed wireless access market is divided into hardware and services. In terms of technology, fixed wireless access market is classified into 5G FWA, 4G LTE, millimeter Wave (mmWave) technology, satellite communication, and WiFi. Based on frequency, fixed wireless access market is segmented into Sub-6 GHz, 24 GHz to 39 GHz (millimeter wave), and Above 39 GHz. By application, fixed wireless access market is segmented into residential, commercial, industrial, and government & public sector. By demography, fixed wireless access market is segmented into urban, suburban, and rural. Regionally, the fixed wireless access industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment, holding 42.7% of the component category, has maintained its leadership position due to its critical role in delivering stable and high-capacity FWA services. This dominance is underpinned by advancements in customer premises equipment (CPE), base stations, and antenna systems that enhance signal quality and service reliability. Increased demand for scalable and easily deployable solutions has favored hardware investments, particularly in markets transitioning to higher-speed wireless broadband. Manufacturers are focusing on integrating advanced chipset technologies, improving thermal management, and optimizing form factors to reduce installation complexity. Strategic partnerships between equipment providers and telecom operators have enabled faster rollouts, while economies of scale in production are contributing to cost efficiency The segment’s growth outlook is strengthened by ongoing network densification efforts and hardware upgrades necessary to support higher frequency bands and evolving technology standards, ensuring sustained demand across both emerging and mature FWA markets.

The 5G FWA segment, accounting for 48.3% of the technology category, is leading the market on account of its superior performance capabilities compared to legacy technologies. This segment’s expansion is driven by enhanced data transmission speeds, low latency, and the ability to support multiple high-bandwidth applications simultaneously. Telecom operators are prioritizing 5G FWA deployments to offer fiber-like speeds without the associated infrastructure costs, making it a preferred solution in both urban and rural settings. Network slicing capabilities and enhanced reliability are enabling diverse use cases, from residential broadband to enterprise-grade connectivity. Investments in small cell infrastructure and advanced beamforming technologies are further optimizing coverage and capacity The segment’s momentum is being supported by regulatory initiatives to release additional 5G spectrum and industry collaboration to develop interoperable equipment, ensuring a scalable and future-ready service model that meets growing end-user expectations for speed and reliability.

The sub-6 GHz segment, representing 51.6% of the frequency category, has emerged as the dominant choice due to its balanced combination of coverage range and data capacity. Its ability to deliver stable connectivity across varied terrains makes it especially suitable for rural and suburban deployments. This frequency range benefits from lower propagation loss, enabling efficient signal penetration through obstacles while maintaining consistent performance over longer distances. Operators are leveraging Sub-6 GHz bands to expand network reach quickly, complementing higher-frequency deployments in dense urban areas. The segment’s adoption is supported by the availability of compatible 5G equipment and regulatory allocations in key markets. Continuous improvements in spectral efficiency and network optimization are enhancing service quality, while integration with dynamic spectrum sharing technologies is enabling more flexible and cost-effective utilization With strong compatibility across devices and applications, the Sub-6 GHz range is expected to remain a cornerstone of FWA strategies over the forecast period.

The fixed wireless access market is primarily driven by consumer and enterprise demand for reliable connectivity, supported by network investments and regulatory frameworks. Expanding coverage and strategic infrastructure deployment will continue to shape growth globally.

The Fixed Wireless Access market is witnessing strong growth due to escalating demand for high-speed internet in regions where fiber deployment is limited. Residential users, small businesses, and remote offices increasingly rely on wireless solutions for seamless connectivity. Data-intensive applications such as video streaming, cloud computing, and online gaming are driving the need for reliable and low-latency networks. Service providers are focusing on extending coverage to suburban and rural areas, bridging the digital divide. Competitive pricing and flexible subscription models are influencing adoption, while consumer preference for quick installation over traditional wired broadband is shaping demand patterns. Network operators are strategically targeting underserved regions to maximize revenue and market penetration.

Enterprises and small-to-medium businesses are adopting Fixed Wireless Access solutions to enhance operational efficiency and ensure uninterrupted communication. The demand is fueled by remote work policies, hybrid office models, and increasing reliance on cloud-based platforms. Companies prefer fixed wireless connections for business continuity, network redundancy, and lower infrastructure costs. Service providers are offering tailored solutions that include dedicated bandwidth, secure connections, and scalable packages to meet enterprise needs. The growing emphasis on digital workflows, video conferencing, and real-time collaboration tools is creating additional demand. Investments in network reliability and enhanced coverage for commercial zones are becoming a key factor in provider selection, directly influencing market growth.

Significant investments are being made by telecom operators to expand 5G and fixed wireless networks. Spectrum acquisition, base station deployment, and network densification are prioritized to improve coverage and minimize latency. Operators are focusing on integrating advanced wireless technologies, including beamforming and network slicing, to optimize performance. Partnerships with equipment manufacturers, technology vendors, and local governments are helping accelerate infrastructure rollout. Regional expansion is being driven by the need to address coverage gaps and increase subscriber base, while competition among providers is prompting strategic investments. Capital expenditure planning and efficient network management are becoming decisive factors for achieving sustainable growth in the Fixed Wireless Access market globally.

Government policies and regulatory frameworks are shaping Fixed Wireless Access adoption in key markets. Spectrum allocation, licensing norms, and network quality standards directly influence deployment timelines and costs. Public sector initiatives promoting digital inclusion and broadband access in remote areas are supporting market expansion. Compliance with regional telecom regulations and adherence to service quality benchmarks are critical for provider credibility and consumer trust. Policy incentives, subsidies, and partnerships with municipalities are being leveraged to accelerate network rollout. Market participants must navigate regulatory complexities while optimizing investment strategies, which impacts expansion decisions and competitive positioning. Regulatory alignment continues to be a decisive factor in shaping regional market dynamics.

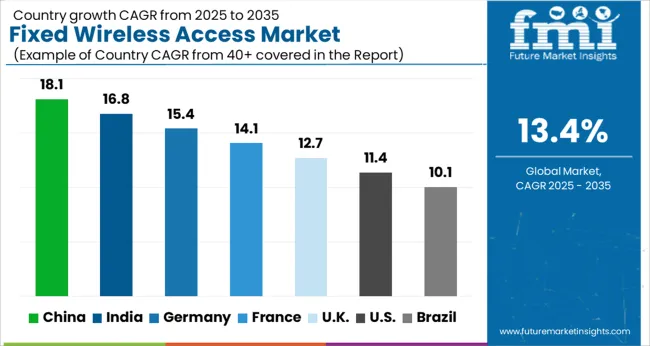

| Country | CAGR |

|---|---|

| China | 18.1% |

| India | 16.8% |

| Germany | 15.4% |

| France | 14.1% |

| UK | 12.7% |

| USA | 11.4% |

| Brazil | 10.1% |

The global fixed wireless access market is projected to grow at a CAGR of 13.4% from 2025 to 2035. China leads with an 18.1% share, followed by India (16.8%), Germany (15.4%), the UK (12.7%), and the USA (11.4%). Growth is being driven by rising demand for high-speed broadband in underserved regions, increasing enterprise connectivity needs, and the rollout of 5G-enabled wireless networks. Emerging economies such as China and India are witnessing rapid adoption due to cost-effective deployment and digital inclusion initiatives. Mature markets focus on network upgrades, enhanced coverage, and low-latency performance to meet escalating data consumption. Investments in infrastructure, spectrum acquisition, and service differentiation are shaping competitive positioning globally. The analysis covers over 40 countries, highlighting key trends and market share distribution.

The fixed wireless access market in China is projected to grow at a CAGR of 18.1% from 2025 to 2035, supported by expanding broadband services and rapid 5G network deployment. Rising demand for high-speed internet in suburban and rural regions is driving adoption, while enterprises and industrial hubs are increasingly relying on fixed wireless solutions for secure, reliable connectivity. Telecom operators are investing heavily in spectrum acquisition, network densification, and base station deployment to reduce latency and improve performance. Service providers are offering scalable subscription models for residential and commercial users, while strategic collaborations with local technology vendors enhance network efficiency and service reliability.

The fixed wireless access market in India is expected to grow at a CAGR of 16.8% from 2025 to 2035, fueled by increasing digital connectivity initiatives and demand for broadband in underserved regions. Residential users, small businesses, and public institutions are adopting wireless solutions to overcome fiber infrastructure limitations. Telecom operators are expanding coverage through cost-effective 5G-enabled networks, while enterprises leverage fixed wireless for remote work, cloud services, and real-time collaboration. Government-backed broadband initiatives and affordable service plans are further supporting adoption across both urban and semi-urban areas.

The fixed wireless access market in Germany is projected to grow at a CAGR of 15.4% from 2025 to 2035, driven by network upgrades and increasing demand for high-speed broadband. Deployment in urban and semi-urban regions is targeting growing consumer and enterprise internet needs. Operators are investing in advanced wireless infrastructure, spectrum optimization, and network reliability enhancements. Businesses are adopting fixed wireless solutions for secure connections and redundancy, while government programs promoting digital transformation in offices, schools, and industrial zones support adoption further.

The fixed wireless access market in the UK is expected to grow at a CAGR of 12.7% from 2025 to 2035, supported by rising demand for reliable internet in residential and commercial areas. Expansion of 5G networks and enterprise adoption for cloud computing, IoT applications, and remote work are boosting growth. Rural broadband initiatives and government programs further accelerate adoption. Telecom operators focus on efficient network deployment, spectrum utilization, and service differentiation to capture market share.

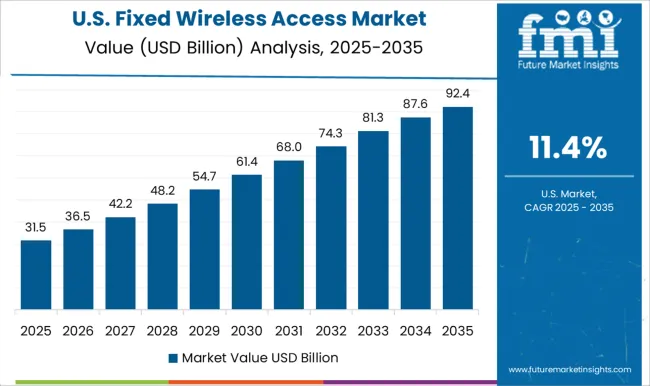

The fixed wireless access market in the USA is projected to grow at a CAGR of 11.4% from 2025 to 2035, driven by rising demand for broadband alternatives and expanding 5G coverage. Residential and enterprise users adopt fixed wireless solutions for high-speed, low-latency connectivity, particularly in areas with limited fiber infrastructure. Telecom providers are investing in infrastructure, spectrum allocation, and advanced wireless technologies to improve service reliability. Strategic collaborations with technology partners and government initiatives promoting digital access in remote regions further support growth.

Competition in the market is primarily defined by network coverage, speed, reliability, and service differentiation, with leading players leveraging a combination of technology, infrastructure, and strategic partnerships to gain market share. Huawei Technologies stands out with comprehensive 5G and fixed wireless solutions, providing base stations, antennas, and network management systems tailored for both urban and rural deployments. AT&T competes by offering consumer and enterprise broadband services, emphasizing low-latency connectivity, dependable service, and bundled offerings that integrate mobile and fixed broadband solutions. Cisco Systems differentiates through enterprise-grade networking infrastructure, routers, and connectivity solutions designed to support cloud services, Internet of Things applications, and hybrid work environments.

Deutsche Telekom focuses on scalable wireless networks, efficient spectrum management, and seamless integration with existing fiber and mobile networks, ensuring consistent performance. Ericsson leverages advanced radio access technologies and managed services to improve coverage, network efficiency, and service reliability. Nokia competes through hardware and software solutions optimized for high-capacity, low-latency connectivity across residential, enterprise, and industrial sectors.

Qualcomm Technologies provides chipsets, modems, and device-level connectivity solutions that enhance throughput and overall user experience. Samsung Electronics delivers end-to-end network equipment and consumer devices compatible with fixed wireless deployments, supporting rapid adoption. T-Mobile US differentiates with nationwide coverage expansion, 5G home internet services, and flexible subscription plans, while Verizon Communications emphasizes enterprise-grade solutions with high-speed broadband and reliability. Across the market, strategies are centered on spectrum acquisition, network densification, service quality enhancement, and strategic collaborations with technology partners, governments, and enterprise clients to strengthen adoption, optimize network performance, and maintain competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 41.2 billion |

| Component | Hardware and Services |

| Technology | 5G FWA, 4G LTE, Millimeter Wave (mmWave) technology, Satellite communication, and WiFi |

| Frequency | Sub-6 GHz, 24 GHz to 39 GHz (millimeter wave), and Above 39 GHz |

| Application | Residential, Commercial, Industrial, and Government & public sector |

| Demography | Urban, Suburban, and Rural |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huawei Technologies, AT&T, Cisco Systems, Deutsche Telekom, Ericsson, Nokia, Qualcomm Technologies, Samsung Electronics, T-Mobile US, and Verizon Communications |

| Additional Attributes | Dollar sales, share by region and country, adoption trends in residential and enterprise segments, 5G network rollout plans, spectrum availability, competitive landscape, infrastructure investment, and regulatory policies. |

The global fixed wireless access market is estimated to be valued at USD 41.2 billion in 2025.

The market size for the fixed wireless access market is projected to reach USD 144.7 billion by 2035.

The fixed wireless access market is expected to grow at a 13.4% CAGR between 2025 and 2035.

The key product types in fixed wireless access market are hardware, customer-premises equipment (cpe), access units, routers, antennas, others, services, professional services and managed services.

In terms of technology, 5G fwa segment to command 48.3% share in the fixed wireless access market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Fixed Wireless Access Market

Fixed Length Seals Market Size and Share Forecast Outlook 2025 to 2035

Fixed 2D Industrial Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cycle Regulator Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Fixed Series Compensation Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cutter Bits Market

Air Core Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fixed Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mega-Pixel Fixed Focal Lenses Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA