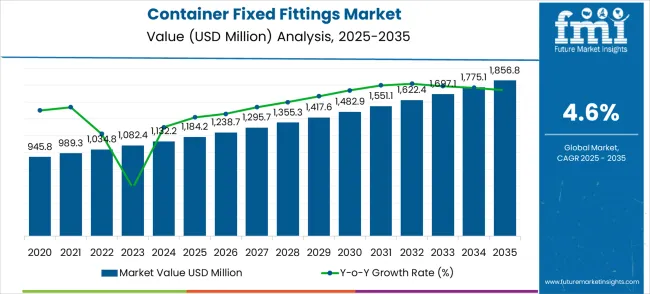

The container fixed fittings market is valued at USD 1,184.2 million in 2025 and forecasted to reach USD 1,856.8 million by 2035, reflecting a CAGR of 4.6% over the decade. Year-on-year growth patterns derived from the dataset reveal steady but moderate expansion across the ten-year horizon. In the initial phase, between 2025 and 2027, the market advances from USD 1,184.2 million to USD 1,295.7 million, indicating annual percentage changes of about 4.6% to 4.7%.

This early growth pace reflects stable demand for container fittings, largely driven by the global shipping industry, where consistent investments in trade infrastructure and container standardization sustain baseline expansion. The global container fixed fittings market is projected to grow from USD 1,184.2 million in 2025 to approximately USD 1,856.8 million by 2035, recording an absolute increase of USD 672.6 million over the forecast period. This translates into a total growth of 56.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.6% between 2025 and 2035. The overall market size is expected to grow by nearly 1.6X during the same period, supported by increasing global containerized trade volumes, growing container fleet expansion, and rising adoption of standardized container securing systems across maritime and intermodal transportation, requiring reliable container handling and securing solutions.

By 2028, the market climbs to USD 1,417.6 million, marking a YoY increase of around 4.8% compared to the prior year, suggesting a slightly accelerated trajectory. The years from 2028 to 2030 show relatively uniform growth, with YoY expansion rates holding between 4.6% and 4.7%. This consistency highlights limited volatility during the mid-phase of the forecast window.

The demand is reinforced by rising containerized freight volumes and gradual replacement cycles for older fittings. The absence of sharp dips indicates strong resilience, suggesting that the market is largely shielded from cyclical disruptions, with growth patterns reflecting predictable logistics sector investments. Between 2025 and 2030, the container fixed fittings market is projected to expand from USD 1,184.2 million to USD 1,470.9 million, resulting in a value increase of USD 286.7 million, which represents 42.6% of the total forecast growth for the decade. This phase of growth will be shaped by expanding global trade volumes, increasing container vessel sizes, and growing adoption of automated container handling systems. Marine equipment manufacturers are expanding their container fixed fittings portfolios to address the growing demand for reliable container securing solutions with enhanced durability and operational efficiency characteristics.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,184.2 million |

| Forecast Value in (2035F) | USD 1,856.8 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

The period from 2030 to 2033 demonstrates an even steadier growth curve, where the market expands from USD 1,482.9 million to USD 1,697.1 million. Annual growth rates remain within a tight band of 4.6% to 4.8%, further confirming the market’s low-volatility nature. Such predictability indicates that the container fixed fittings segment benefits from a structural dependency on global trade and containerized cargo, where recurring demand for fittings is tied directly to fleet expansions, port upgrades, and maintenance needs. Market volatility is minimal in this phase, underlining the maturity of the industry and its reliance on long-term contracts and standardized manufacturing practices.

By the end of the forecast period, the market reaches USD 1,856.8 million in 2035, recording YoY growth of about 4.6% compared to 2034. Averaging across the entire decade, the mean YoY growth rate stabilizes near 4.6% to 4.7%, which aligns closely with the reported CAGR. This stable trajectory reflects that the Container Fixed Fittings Market is not prone to sudden accelerations or decelerations but rather demonstrates reliable and incremental growth. The minimal volatility makes it attractive for stakeholders seeking long-term returns within shipping supply chains, while the consistent growth profile highlights its strategic importance in sustaining containerized trade infrastructure globally.From 2030 to 2035, the market is forecast to grow from USD 1,470.9 million to USD 1,856.8 million, adding another USD 385.9 million, which constitutes 57.4% of the overall ten-year expansion. This period is expected to be characterized by widespread deployment of next-generation container vessels, integration with smart container tracking technologies, and development of advanced securing systems for specialized cargo applications. The growing demand for intermodal transportation efficiency and container handling automation will drive adoption of sophisticated container fixed fittings with improved performance and compatibility characteristics.

Between 2020 and 2025, the container fixed fittings market experienced steady development, driven by continuous growth in global containerized shipping and increasing recognition of the importance of reliable container securing systems in maritime and intermodal transportation. The market evolved as shipping companies and terminal operators recognized the critical role of standardized container fittings in ensuring cargo safety, operational efficiency, and regulatory compliance. Progress in materials technology and manufacturing standardization established the foundation for more reliable and interoperable container securing solutions across various transportation modes.

Market expansion is being supported by the steady growth of global containerized trade and the corresponding demand for standardized container securing systems that can ensure cargo safety and operational efficiency across multiple transportation modes. Modern shipping companies and logistics operators are increasingly focused on securing equipment that can provide reliable performance while supporting intermodal transportation requirements and automated handling systems. The proven capability of container fixed fittings to deliver essential securing functions, standardized interfaces, and operational reliability makes them fundamental components of the global container transportation system.

The growing emphasis focus on supply chain efficiency and intermodal transportation is driving demand for standardized container securing solutions that can support seamless cargo movement across different transportation modes and handling systems. Industry preference for securing equipment that can integrate with existing container infrastructure while providing enhanced durability and maintenance efficiency is creating opportunities for advanced container fixed fitting development. The rising influence of international shipping regulations and container safety standards is also contributing to increased adoption of certified securing equipment across different maritime and logistics operations.

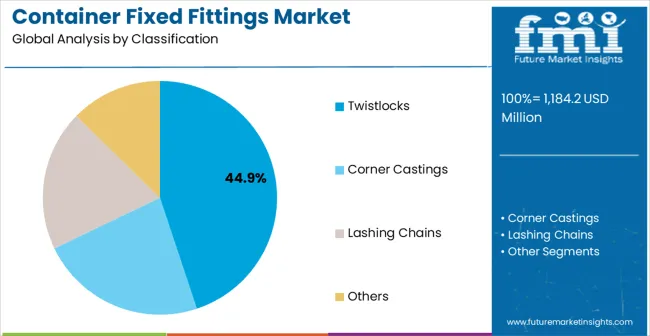

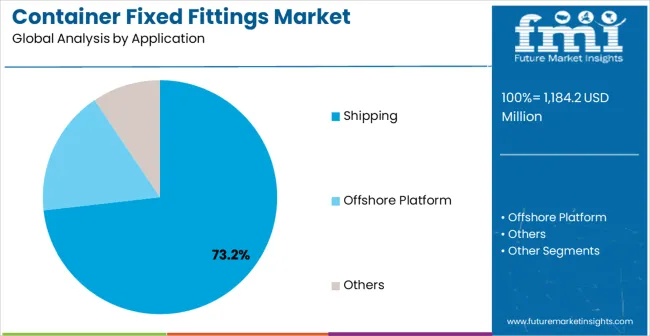

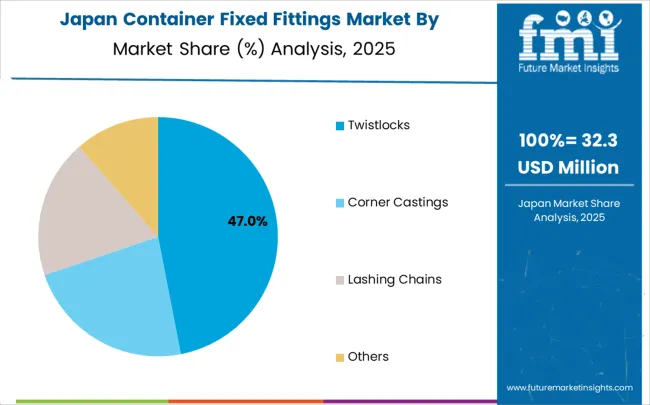

The market is segmented by classification, application, and region. By classification, the market is divided into twistlocks, corner castings, lashing chains, and others. Based on application, the market is categorized into shipping, offshore platform, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The twistlocks classification is projected to account for 44.9% of the container fixed fittings market in 2025, reaffirming its position as the category's dominant product type. Container handling professionals increasingly recognize the essential role and operational versatility provided by twistlock systems for secure container connections and handling operations. This classification addresses the most critical securing requirements while providing essential compatibility with automated handling equipment.

This classification forms the foundation of most container handling and securing operations, as it represents the most functionally important and widely utilized component in container transportation systems. Technology development and design optimization continue to strengthen confidence in twistlock performance for diverse handling applications. With increasing recognition of the importance of reliable container connections and automated handling compatibility, twistlocks align with both current operational requirements and future automation objectives. Their essential functionality across all container operations ensures sustained market dominance, making them the central growth driver of container fixed fitting adoption.

Shipping applications are projected to represent 73.2% of container fixed fittings demand in 2025, underscoring highlighting their role as the primary application driving market development. Shipping companies recognize that maritime container transportation requires the most comprehensive and reliable securing systems to ensure cargo safety during ocean voyages and port operations. Shipping applications demand exceptional durability and operational reliability that container fixed fittings are uniquely positioned to deliver.

The segment is supported by the continuous expansion of global container shipping requiring comprehensive securing systems and the increasing deployment of larger container vessels with enhanced capacity and handling requirements. Additionally The , maritime transportation is increasingly implementing standardized securing protocols that can optimize both cargo safety and operational efficiency across different vessel types and routes. As understanding of maritime container transportation requirements advances, shipping applications will continue to serve as the primary commercial driver, reinforcing their essential position within the marine transportation equipment market.

The container fixed fittings market is advancing steadily due to increasing global containerized trade and growing emphasis focus on transportation safety and efficiency. However T, the market faces challenges including price competition from low-cost manufacturers, standardization requirements across different regions, and fluctuating raw material costs. Innovation in materials technology and design optimization continue to influence product development and market expansion patterns.

The growing implementation of automated container handling systems is creating enhanced opportunities for advanced container fixed fitting integration with robotic crane systems and automated guided vehicles. Advanced automated terminals require precise and reliable securing equipment that can interface with sophisticated handling machinery and control systems. Smart terminal technologies provide opportunities for integrated securing systems that can support both automation requirements and operational efficiency optimization.

Modern marine equipment companies are incorporating high-strength alloy materials, corrosion-resistant coatings, and IoT-enabled monitoring capabilities to enhance container fixed fitting performance and provide real-time operational visibility. These technologies improve durability, enable predictive maintenance, and provide enhanced operational monitoring throughout service life. Advanced integration also enables optimized inventory management and improved maintenance scheduling capabilities.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| Brazil | 4.8% |

| USA | 4.4% |

| UK | 3.9% |

| Japan | 3.5% |

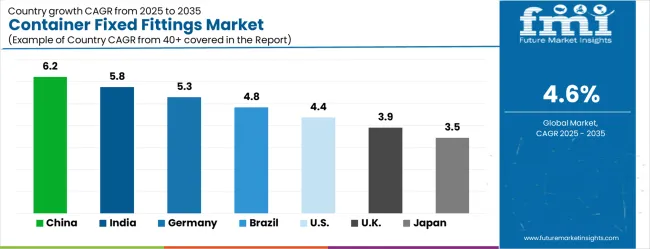

The market is likely to grow at a CAGR of 4.6% between 2025 and 2035, driven by rising global trade volumes and increasing demand for secure and efficient container handling solutions. China leads with 6.2% growth, supported by its dominant shipping industry and rapid port infrastructure expansion. India follows at 5.8%, reflecting growing export activities and modernization of logistics systems. Germany records 5.3%, driven by strong trade networks and adoption of high-quality container components. Brazil is projected at 4.8%, supported by expanding maritime logistics and increasing containerized transport. The United States grows at 4.4%, influenced by replacement demand and adoption of durable container fittings, while the United Kingdom expands at 3.9% and Japan at 3.5%, reflecting stable but moderate market adoption in established trade economies. The container fixed fittings market is experiencing moderate growth globally, with China leading at a 6.2% CAGR through 2035, driven by massive container manufacturing industry, expanding port infrastructure, and dominant position in global shipping operations. India follows at 5.8%, supported by growing container trade volumes, expanding port modernization programs, and increasing adoption of intermodal transportation systems. Germany shows growth at 5.3%, emphasizing precision marine engineering and comprehensive container handling solutions. Brazil records 4.8% growth, focusing on expanding container port capacity and growing international trade volumes. The USA shows 4.4% growth, representing steady demand from established maritime operations and intermodal transportation systems.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

China is anticipated to register a CAGR of 6.2% between 2025 and 2035, supported by the continuous growth of containerized shipping and intermodal transport networks. Ports such as Shanghai and Ningbo are driving large-scale demand for container fixed fittings due to rising trade volumes. Domestic manufacturers are focusing on durable materials like alloy steel and galvanized iron to improve longevity under intensive usage. Investments in automation at container terminals are also pushing adoption of standardized fittings that allow for faster stacking, loading, and anchoring. Exporters and logistics providers are increasingly adopting fittings that comply with ISO standards to reduce turnaround time in international shipping. The market is being reinforced by government investment in smart ports and digitalized logistics infrastructure.

India is projected to grow at a CAGR of 5.8% from 2025 to 2035, driven by expansion of shipping hubs in Mundra, Jawaharlal Nehru, and Chennai. Container fixed fittings are becoming integral to ensuring safety in inland container depots and coastal shipping routes. Local manufacturers are focusing cost efficiency and compatibility with global shipping standards to gain traction. Growth in exports of automotive parts, textiles, and chemicals has increased container movements, further fueling demand for durable twist locks, corner castings, and lashing bars. Infrastructure investments in multimodal terminals under government schemes are expected to push long-term consumption. Partnerships with international shipping firms are also influencing adoption of high-quality fittings with improved corrosion resistance.

Germany is estimated to grow at a CAGR of 5.3% through 2035, supported by its position as a logistics hub within Europe. The ports of Hamburg and Bremerhaven continue to generate steady demand for container fittings, with a strong focus on quality and compliance with EU safety norms. German manufacturers are pioneering the use of high-strength steel and advanced galvanization techniques to extend product life. Automation in port operations has led to the integration of fittings compatible with automated stacking cranes and smart handling systems. Increasing trade with Eastern Europe has also driven container movement, boosting adoption of standardized fittings. Environmental regulations encourage manufacturers to innovate with recyclable materials, positioning Germany as a premium market in this segment.

Brazil is forecasted to grow at a CAGR of 4.8% during 2025–2035, influenced by the expansion of trade routes across Santos, Paranaguá, and Rio de Janeiro ports. Container fixed fittings are in rising demand as exporters of agricultural products, coffee, and meat rely heavily on containerized logistics. Local producers are prioritizing durable and cost-efficient fittings to compete with imported solutions. Increased container traffic in coastal ports is also encouraging the adoption of twist locks and corner castings to ensure cargo stability during long voyages. Government-backed infrastructure upgrades in port modernization are set to stimulate the demand further. Collaboration between Brazilian firms and European suppliers has enhanced product quality and compliance with international standards.

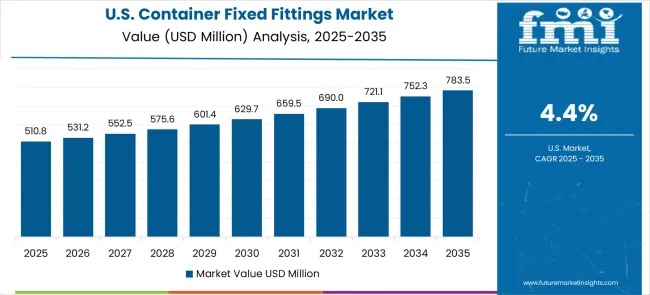

The United States is expected to grow at a CAGR of 4.4% from 2025 to 2035, supported by strong container traffic through ports such as Los Angeles, Long Beach, and New York. The market is shaped by growing reliance on containerized trade for electronics, machinery, and consumer goods. Manufacturers are focusing innovations in fittings such as semi-automatic twist locks to improve port handling efficiency. Federal investments in port modernization and intermodal rail expansion are boosting adoption of standardized fittings. Rising imports from Asia-Pacific also contribute to higher container volumes. Domestic firms are adopting advanced alloys and anti-corrosion technologies to meet high-performance requirements in coastal shipping and inland transport.

The United Kingdom is projected to grow at a CAGR of 3.9% through 2035, influenced by container handling at Felixstowe, Southampton, and London Gateway ports. The demand for fixed fittings is reinforced by high-volume imports of consumer goods and machinery. British manufacturers and distributors focus on meeting ISO standards and ensuring durability against marine corrosion. Brexit-driven changes in trade routes have heightened the need for efficient and compliant fittings to minimize delays. Automation in container terminals is spurring the adoption of fittings compatible with robotic handling systems. International collaborations with European and Asian suppliers enhance product innovation and market reach, making the UK an important hub for container logistics fittings.

Japan is forecasted to grow at a CAGR of 3.5% between 2025 and 2035, supported by stable container traffic at Yokohama, Nagoya, and Kobe ports. The market benefits from strong export activity in automotive, machinery, and electronics sectors that rely on containerized logistics. Japanese manufacturers are focused on precision engineering, lightweight designs, and rust-resistant materials to serve both domestic and export markets. Demand is being shaped by the integration of smart logistics systems in ports, where fittings compatible with automated handling equipment are preferred. Strategic alliances with global shipping companies further strengthen market penetration. Growth is also influenced by government programs aimed at enhancing port competitiveness and digitalization.

Revenue from container fixed fittings in China is projected to exhibit solid growth with a CAGR of 6.2% through 2035, driven by the country's dominant position in global container manufacturing and comprehensive leadership in containerized shipping operations. China's massive container production capacity and extensive port infrastructure are creating substantial opportunities for container fixed fitting adoption. Major domestic and international marine equipment companies are establishing comprehensive manufacturing and supply capabilities to serve the extensive container transportation market.

Government initiatives supporting maritime industry development and substantial investment in container transportation infrastructure are driving steady adoption of container securing equipment throughout major ports and shipping facilities.

Container manufacturing leadership and shipping industry expansion are supporting increased deployment of fixed fitting systems among leading container manufacturers, shipping companies, and port operators nationwide.

Revenue from container fixed fittings in India is expanding at a CAGR of 5.8%, supported by rapidly growing container trade volumes, comprehensive port modernization programs, and increasing adoption of intermodal transportation systems. The country's strategic position in global trade routes and commitment to infrastructure development are driving demand for container handling equipment. International marine equipment companies and domestic manufacturers are establishing partnerships to serve the growing demand for container transportation technologies.

Rising investment in port infrastructure and intermodal transportation development are creating significant opportunities for container securing equipment across major ports and transportation networks.

Growing government support for trade facilitation and logistics infrastructure is supporting increased adoption of standardized container fittings among port operators, shipping companies, and logistics providers.

Revenue from container fixed fittings in Germany is projected to grow at a CAGR of 5.3%, supported by the country's leadership in marine engineering and comprehensive expertise in container handling technologies. German shipping companies and marine equipment providers consistently invest in advanced container securing systems and operational optimization technologies. The market is characterized by engineering excellence, comprehensive quality standards, and established relationships between equipment suppliers and maritime operators.

Marine engineering leadership and container handling excellence are supporting continued investment in advanced securing equipment throughout leading shipping companies and port operators.

Research institution collaboration and engineering excellence are facilitating advancement of container handling applications while ensuring superior performance and operational efficiency.

Revenue from container fixed fittings in Brazil is projected to grow at a CAGR of 4.8% through 2035, driven by expanding container port capacity, increasing international trade volumes, and growing focus on logistics infrastructure modernization. Brazilian port operators and shipping companies are increasingly recognizing the importance of reliable container securing equipment in achieving operational efficiency and cargo safety.

Port infrastructure expansion and international trade growth are supporting increased deployment of container securing systems across diverse port applications and shipping operations.

Growing collaboration between international marine equipment companies and local port operators is enhancing technology adoption and supporting development of domestic container handling capabilities.

Revenue from container fixed fittings in the USA is projected to grow at a CAGR of 4.4%, supported by established intermodal transportation infrastructure, comprehensive port operations, and continued investment in container handling efficiency. American port operators and shipping companies maintain consistent adoption of standardized container securing equipment through established operational protocols and safety requirements.

Intermodal transportation maturity and port operational excellence are driving continued utilization of container securing equipment throughout leading transportation networks and maritime facilities.

Safety regulation compliance and industry standards are supporting steady demand for container fixed fittings while maintaining performance and safety standards.

Revenue from container fixed fittings in the UK is projected to grow at a CAGR of 3.9% through 2035, supported by established maritime industry and comprehensive container handling frameworks. British shipping companies and port operators emphasize reliable container securing equipment within established operational frameworks that prioritize safety and efficiency.

Maritime industry expertise and container handling standards are supporting consistent adoption of securing systems across established shipping operations and port facilities.

Industry best practices and operational excellence requirements are maintaining established demand patterns while supporting continued utilization of certified container fittings.

Revenue from container fixed fittings in Japan is projected to grow at a CAGR of 3.5% through 2035, supported by the country's leadership in precision marine engineering and comprehensive approach to container transportation technologies. Japanese shipping companies and port operators emphasize quality-driven adoption of container securing equipment within established frameworks that prioritize technical excellence and operational reliability.

Advanced marine engineering capabilities and precision manufacturing expertise are supporting continued utilization of high-quality container securing equipment across leading shipping operations and port facilities.

Industry collaboration and comprehensive quality standards are maintaining excellence in container handling applications while supporting established operational relationships and technical expertise.

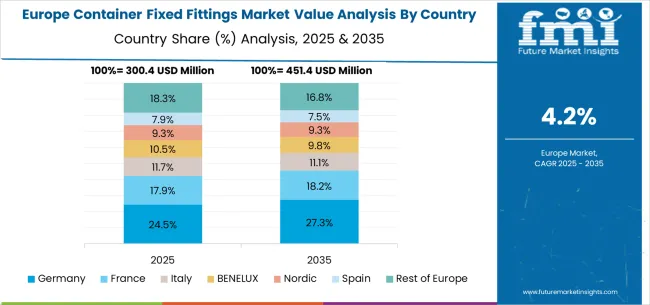

The container fixed fittings market in Europe is projected to expand steadily through 2035, supported by established maritime industries, comprehensive container handling operations, and ongoing modernization of port infrastructure. Germany will continue to lead the regional market, accounting for 27.9% in 2025 and rising to 28.6% by 2035, supported by strong marine engineering capabilities, advanced container handling infrastructure, and comprehensive maritime technology expertise. The United Kingdom follows with 18.4% in 2025, maintaining 18.5% by 2035, driven by established maritime industry, comprehensive shipping operations, and consistent demand patterns.

France holds 16.2% in 2025, edging up to 16.4% by 2035 as shipping companies expand container handling capabilities and demand grows for reliable securing equipment. Italy contributes 12.7% in 2025, remaining stable at 12.8% by 2035, supported by maritime industry strength and growing adoption of standardized container systems. Spain represents 9.8% in 2025, moving upward to 9.9% by 2035, underpinned by expanding port operations and increasing container trade volumes.

Nordic countries together account for 9.1% in 2025, maintaining their position at 9.2% by 2035, supported by advanced maritime initiatives and consistent demand from established shipping operations. The Rest of Europe represents 5.9% in 2025, declining slightly to 4.6% by 2035, as larger markets capture greater focus and established maritime infrastructure advantages.

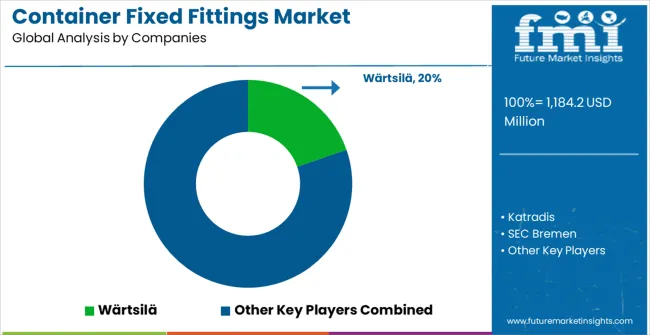

The market demonstrates strong competition where manufacturers focus on safety compliance, durability, and adaptability to various container handling requirements. Wärtsilä and MacGregor lead with large-scale production, advanced metallurgy, and integration of container lashing systems that meet global port standards. Their competitive edge lies in supplying complete container securing solutions, supported by detailed product brochures that highlight load-bearing capacity, corrosion resistance, and compatibility with automated handling systems. These firms cater to global shipping operators that demand reliability and proven performance under high-volume operations.

Katradis, SEC Bremen, and Tec Container strengthen their position through innovation in fixed lashing fittings and optimized designs that reduce handling time while ensuring safety during long voyages. Katradis emphasizes precision in casting and testing, while SEC Bremen is known for German-engineered standards of strength. Tec Container leverages its expertise in custom-built solutions for ports and terminals. German Lashing and Navacqs differentiate themselves by producing certified, lightweight yet durable fittings that adhere strictly to international maritime regulations, providing confidence to operators handling diverse cargo loads.

Hi-sea Marine, Pacific Marine and Industrial, Container Technics, Zava Marine, and NICEE compete through cost efficiency, rapid supply capabilities, and tailored offerings for regional clients. Their brochures highlight versatility, ease of installation, and long service life under demanding sea conditions. These companies target mid-scale operators seeking balance between affordability and compliance. Competitive intensity is further fueled by the need for fittings with advanced coatings, standardized dimensions, and modular systems that support efficiency in containerized trade. The market remains characterized by the dominance of global leaders in innovation and certification while regional players secure growth through niche customization and competitive pricing.The container fixed fittings market is characterized by competition among specialized marine equipment companies, established container handling solution providers, and innovative maritime technology manufacturers. Companies are investing in advanced materials development, design optimization, strategic partnerships, and manufacturing excellence to deliver high-performance, reliable, and cost-effective container fixed fitting solutions. Technology development, quality assurance, and global distribution strategies are central to strengthening competitive advantages and market presence.

Wärtsilä leads the market with significant expertise in marine technology solutions, offering comprehensive container fixed fitting products with focus on durability optimization and maritime applications. Katradis provides established marine equipment capabilities with emphasis on rope, rigging, and container handling systems. SEC Bremen focuses on specialized marine engineering solutions with comprehensive container technology expertise. Tec Container delivers advanced container handling technologies with strong focus on securing and positioning systems.

Hi-sea Marine operates with focus on marine equipment manufacturing and comprehensive maritime solutions. German Lashing specializes in container securing and lashing systems with emphasis on safety and reliability. Navacqs provides marine equipment solutions with focus on container handling applications. Pacific Marine and Industrial, Container Technics, MacGregor, Zava Marine, and NICEE provide diverse technological approaches and regional market access strategies to enhance overall market development and container handling capability advancement.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,184.2 mMillion |

| Classification | Twistlocks, Corner Castings, Lashing Chains, Others |

| Application | Shipping, Offshore Platform, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Wärtsilä, Katradis, SEC Bremen, Tec Container, Hi-sea Marine, German Lashing, Navacqs, Pacific Marine and Industrial, Container Technics, MacGregor, Zava Marine, NICEE |

| Additional Attributes | Dollar sales by fitting type and application, regional adoption trends, competitive landscape, maritime industry partnerships, integration with container handling systems, innovations in materials and design, durability analysis, and operational efficiency optimization strategies |

The global container fixed fittings market is estimated to be valued at USD 1,184.2 million in 2025.

The market size for the container fixed fittings market is projected to reach USD 1,856.8 million by 2035.

The container fixed fittings market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in container fixed fittings market are twistlocks, corner castings, lashing chains and others.

In terms of application, shipping segment to command 73.2% share in the container fixed fittings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Container-based Firewall Market Size and Share Forecast Outlook 2025 to 2035

Container As A Service (CaaS) Market Size and Share Forecast Outlook 2025 to 2035

Container Washing System Market Size and Share Forecast Outlook 2025 to 2035

Containerboard Market Size and Share Forecast Outlook 2025 to 2035

Containerized Substation Market Size and Share Forecast Outlook 2025 to 2035

Container Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Container Stacking Machine Market by Automation & System Type Through 2035

Container Weighing Systems Market Growth - Trends & Forecast 2025 to 2035

Analyzing Container Liner Market Share & Industry Leaders

Market Leaders & Share in the Container Stacking Machine Industry

Container Security Market

Container Coating Market

Container Mouth Inner Seal Market

PS Containers Market Size and Share Forecast Outlook 2025 to 2035

PP Container Liner Market

Tin Container Market Forecast and Outlook 2025 to 2035

PET Containers Market Growth, Demand and Forecast from 2025 to 2035

ISO Container Market Growth – Trends & Forecast 2025 to 2035

EPS Container Market Trends & Growth Forecast 2024-2034

PVC Container Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA