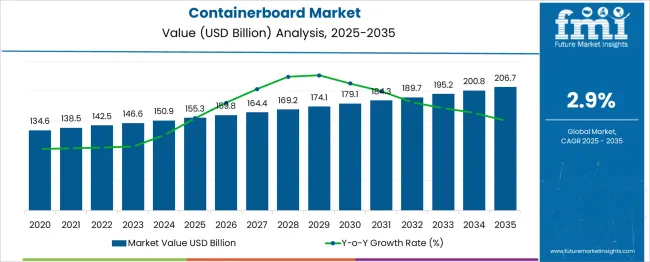

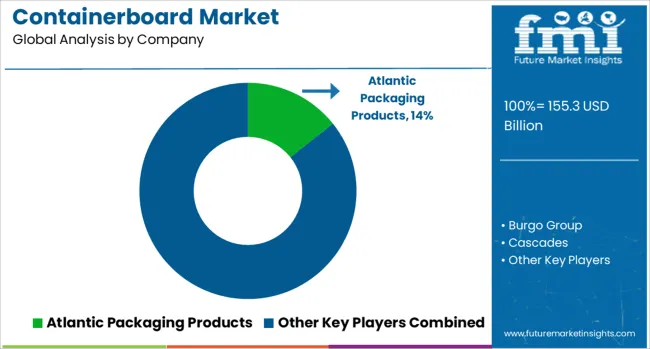

The Containerboard Market is estimated to be valued at USD 155.3 billion in 2025 and is projected to reach USD 206.7 billion by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period. This growth represents an absolute dollar opportunity of USD 72.1 billion over the 15 years. The increasing demand for sustainable and recyclable packaging materials in e-commerce, food, and industrial sectors is a key driver. Containerboard’s role as a lightweight yet durable material makes it essential for meeting packaging needs while addressing environmental concerns. Between 2020 and 2025, the market increases from USD 134.6 billion to USD 155.3 billion, marking a growth phase of USD 20.7 billion driven by expanding global trade and rising packaging demand. From 2025 to 2035, the market further grows by USD 51.4 billion, reaching USD 206.7 billion. This phase benefits from ongoing investments in recycling technologies and innovations in containerboard products. Overall, the containerboard market offers significant opportunities for manufacturers to meet evolving packaging requirements and capitalize on the shift toward eco-friendly materials.

| Metric | Value |

|---|---|

| Containerboard Market Estimated Value in (2025 E) | USD 155.3 billion |

| Containerboard Market Forecast Value in (2035 F) | USD 206.7 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

The containerboard market is undergoing dynamic expansion as industries increasingly adopt sustainable packaging solutions aligned with environmental mandates and corporate ESG goals. The transition from plastic-based to paper-based packaging has accelerated due to heightened regulatory scrutiny and growing consumer awareness surrounding recyclability and circular economy practices. Demand for containerboard has been further stimulated by the exponential rise in e-commerce, retail packaging, and export-oriented agricultural and food products, which require durable yet eco-friendly packaging materials.

Industry investments in high-speed corrugators, automation technologies, and lightweighting strategies are driving production efficiencies while maintaining strength and printability standards. In parallel, regional supply chains are adapting to raw material volatility and energy pricing by integrating recycled fiber processes and local sourcing initiatives.

The containerboard market is expected to remain resilient as manufacturers expand capacity, diversify product formats, and align offerings with evolving industry standards for carbon footprint reduction and material reuse. Strong end-use adoption in logistics, retail, and food services continues to define the growth outlook globally.

The containerboard market is segmented by type, product type, end use industry, and geographic regions. By type, the containerboard market is divided into Recycled and Virgin. In terms of product type, the containerboard market is classified into Kraftliner, Testliner, Corrugating medium, and White top Linerboard. Based on end-use industry, the containerboard market is segmented into Food & beverage, Pharmaceuticals, Electronics, Industrial, Consumer goods, and others. Regionally, the containerboard industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

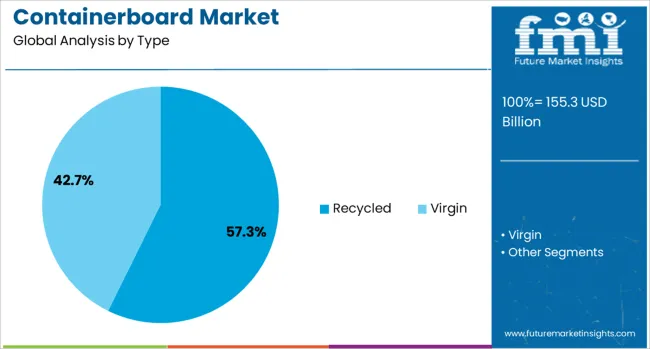

The recycled type segment is projected to account for 57.3% of the containerboard market revenue share in 2025, making it the most dominant segment by material type. This leadership is being reinforced by regulatory mandates favoring eco-friendly packaging and the cost advantages of using post-consumer fiber. Recycled containerboard offers significant environmental benefits, including reduced water usage and energy consumption during production, which has aligned well with sustainability targets set by packaging producers and brand owners.

Advancements in fiber treatment and contamination control have improved the quality and consistency of recycled board, making it suitable for high-volume applications. As urban recycling rates increase and waste management infrastructure improves, supply chain reliability for recovered paper has also strengthened.

The growing emphasis on carbon neutrality and waste diversion has further supported the expansion of recycled board, especially in applications where printability and structural performance remain critical. These factors collectively position recycled containerboard as a long-term solution in the shift toward circular packaging economies.

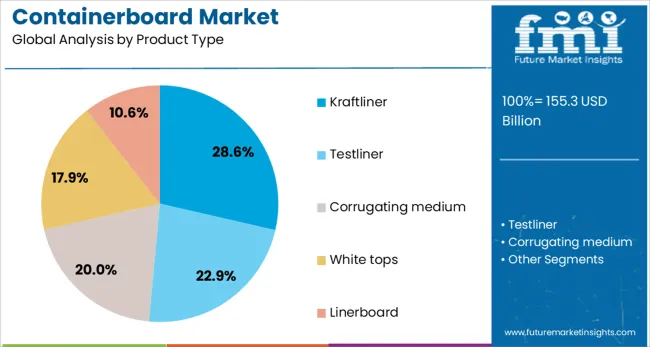

The kraftliner segment is expected to hold 28.6% of the revenue share in the containerboard market in 2025, driven by its superior strength, high durability, and moisture resistance. Kraftliner has become the preferred product type for applications requiring high stacking strength and optimal print surface, particularly in heavy-duty packaging and long-distance shipping.

The use of virgin softwood fibers in kraftliner enhances fiber bonding and burst strength, making it suitable for high-quality corrugated boxes used across industrial and retail packaging. Recent developments in automated packaging lines and high-speed digital printing have also increased demand for kraftliner due to its compatibility with advanced converting technologies.

Its performance in humid environments, along with its recyclability, has strengthened its position in global supply chains that prioritize both functionality and sustainability. As premium brands and exporters seek packaging solutions that balance appearance with protection, kraftliner is expected to retain its strategic importance within the containerboard portfolio.

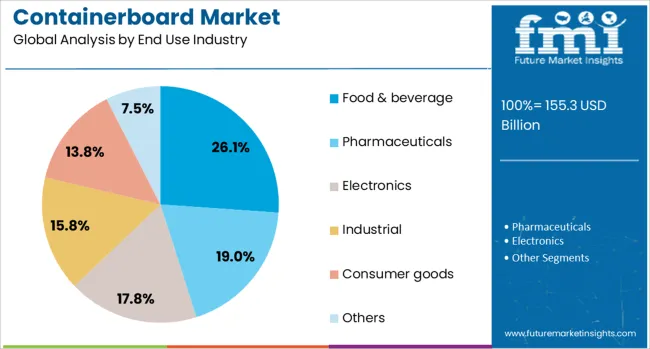

The food and beverage industry is projected to contribute 26.1% to the containerboard market revenue share in 2025, reflecting its role as a key driver of demand. The segment's prominence is being propelled by the rising demand for sustainable, food-safe, and printable packaging materials across fresh produce, ready-to-eat meals, dairy, and beverage products.

Increasing urbanization and changes in consumption habits have led to greater reliance on packaged foods, which in turn has fueled the need for reliable, lightweight, and recyclable packaging formats. Stringent food safety standards and the shift toward plastic alternatives have prompted manufacturers to adopt containerboard solutions with barrier coatings and food-grade certifications.

In parallel, growth in quick service restaurants, food delivery platforms, and frozen food categories has required scalable packaging options that balance shelf appeal with structural integrity. As the food and beverage sector continues to innovate in line with health and sustainability trends, containerboard is expected to remain central to packaging strategies across global markets.

The containerboard market is witnessing steady growth as demand for sustainable and efficient packaging solutions rises globally. Containerboard, primarily used in corrugated boxes, serves as a crucial material for e-commerce, food, and consumer goods packaging. Growth in online retail, logistics, and rapid urbanization supports increased containerboard consumption. Key markets include North America, Europe, and Asia-Pacific, where rising industrial activities and evolving packaging standards drive adoption. Manufacturers focus on improving strength, recyclability, and cost-effectiveness to meet diverse industry needs.

Containerboard consists mainly of kraftliner and testliner grades, differing in fiber source and strength. Kraftliner, made from virgin wood pulp, offers superior durability and moisture resistance, suitable for heavy-duty packaging. Testliner, often produced from recycled fibers, provides cost-effective and eco-friendly options for less demanding applications. Thickness, basis weight, and fluting compatibility vary to match packaging requirements such as load capacity and cushioning. Advancements in fiber processing and coating technologies enhance product performance and sustainability.

The surge in e-commerce has led to increased demand for corrugated packaging to protect goods during shipping and handling. Fast-moving consumer goods (FMCG) companies prefer containerboard for branding and product safety. Seasonal fluctuations and promotional activities influence packaging volumes. Consumer preference for recyclable and biodegradable packaging materials aligns with containerboard’s environmental advantages. The need for lightweight yet strong packaging supports continued market expansion, driven by evolving supply chain and retail dynamics.

Governments and regulatory bodies enforce strict guidelines on packaging waste, encouraging the use of recyclable and biodegradable materials like containerboard. Recycling programs and extended producer responsibility policies incentivize the use of sustainable packaging. Compliance with standards related to fiber sourcing, chemical treatments, and biodegradability shapes product development. Challenges include maintaining product quality while increasing recycled fiber content. Manufacturers investing in closed-loop recycling and sustainable sourcing improve environmental impact and regulatory compliance.

The containerboard market faces raw material price volatility, particularly wood pulp and recovered paper costs, impacting production expenses. Supply chain disruptions from logistics constraints or geopolitical factors affect availability and delivery timelines. Competition is intense with global paper producers, regional manufacturers, and specialty suppliers vying for product innovation, pricing, and service. Companies strengthening supply partnerships and investing in capacity expansions enhance reliability. Differentiation through customized grades, eco-certifications, and technical support is vital to secure market share amid evolving customer expectations.

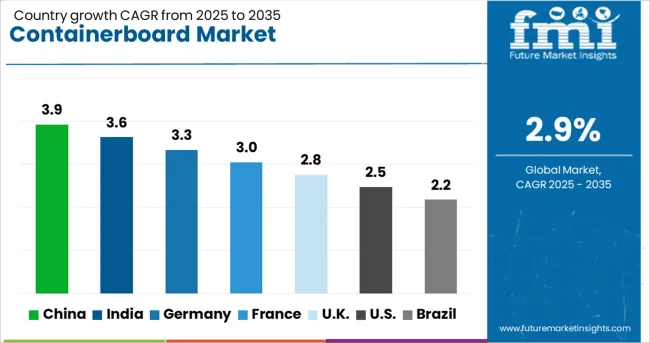

| Country | CAGR |

|---|---|

| China | 3.9% |

| India | 3.6% |

| Germany | 3.3% |

| France | 3.0% |

| UK | 2.8% |

| USA | 2.5% |

| Brazil | 2.2% |

The global containerboard market is growing at a 2.9% CAGR, supported by steady demand in packaging and logistics sectors. Among BRICS nations, China leads with 3.9% growth, driven by large-scale manufacturing and export activities. India follows at 3.6%, fueled by increasing e-commerce and industrial packaging needs. In the OECD region, Germany records 3.3% growth, reflecting advanced production technologies and strict quality standards. The United Kingdom grows at 2.8%, supported by packaging innovations and sustainability regulations. The United States, a mature market, shows 2.5% growth, shaped by established supply chains and regulatory frameworks. These countries collectively shape market dynamics through production scale, regulatory oversight, and packaging demand. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the containerboard market with a growth rate of 3.9%, driven by expanding e-commerce and manufacturing sectors. The rise in packaging demand for consumer goods, electronics, and food products fuels containerboard consumption. Compared to India, China benefits from well-established recycling infrastructure that supports sustainable paper production. Domestic producers focus on improving containerboard quality to meet export standards, while also catering to fast-growing domestic logistics industries. The government encourages environmentally friendly packaging through regulations, boosting demand for recyclable containerboard products. Investment in modern paper mills and automation enhances production capacity, enabling China to maintain its leadership position in the global containerboard market.

India’s containerboard market grows at 3.6%, propelled by increasing industrial output and rapid expansion of e-commerce platforms. Compared to Germany, India faces challenges in consistent raw material supply but benefits from low labor costs and rising packaging needs in consumer goods. The government’s push towards Make in India and improved logistics infrastructure supports containerboard demand. Producers are investing in modern machinery to increase production efficiency and reduce waste. Demand for corrugated boxes in agricultural exports and retail sectors is also increasing. Despite challenges in paper recycling, awareness about eco-friendly packaging is rising among manufacturers and consumers, driving future market growth.

Germany’s containerboard market grows at 3.3%, supported by strong manufacturing and export activities. Compared to the United Kingdom, Germany emphasizes high-quality containerboard with superior strength and durability for industrial packaging. The country benefits from advanced recycling systems that supply sustainable raw materials to paper mills. Strict environmental regulations encourage the use of recyclable and biodegradable packaging materials. Germany’s automotive, chemical, and machinery sectors heavily depend on containerboard for product packaging and transport. The steady growth in e-commerce further increases demand for corrugated containers. Manufacturers focus on innovation to produce lightweight yet robust containerboard that meets stringent industry standards.

The United Kingdom containerboard market grows at 2.8%, driven by steady demand from retail and logistics industries. Compared to the United States, the UK market places more emphasis on sustainable packaging solutions in line with government environmental goals. The rise of online shopping and home deliveries has increased demand for corrugated boxes and protective packaging. Producers are adopting recycled fibers to reduce environmental impact and meet consumer preferences. Challenges remain in sourcing high-quality raw materials, but investments in recycling technology are improving supply consistency. The market is also influenced by Brexit-related trade adjustments affecting raw material imports and exports.

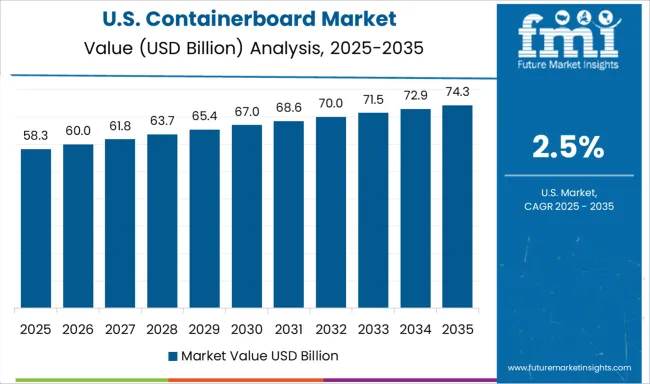

The United States containerboard market expands at 2.5%, supported by increasing consumption in e-commerce, food, and industrial sectors. Compared to China, the US market favors containerboard with enhanced durability for longer transport distances and heavier loads. The demand for sustainable and recyclable packaging is rising due to consumer preferences and regulatory pressure. Paper mills are upgrading technology to improve containerboard strength and reduce environmental footprint. Growth in warehouse and distribution center construction boosts demand for corrugated packaging. However, fluctuating raw material prices and competition from alternative packaging materials pose challenges. Manufacturers focus on balancing performance with cost-efficiency to maintain market share.

The containerboard market is shaped by a blend of global and regional paper and packaging companies focusing on sustainable, high-quality fiberboard products for packaging and logistics industries. International Paper and Georgia-Pacific dominate with vast production capacities and integrated supply chains, delivering a wide range of containerboard grades tailored for durability, strength, and recyclability. DS Smith and Mondi leverage innovative manufacturing technologies and circular economy principles, emphasizing eco-friendly packaging solutions to meet growing environmental regulations and customer demands.

Burgo Group, Cascades, and Kruger focus on producing lightweight yet robust containerboard products, balancing cost-efficiency with performance for diverse industrial applications. Oji Holdings and Rengo strengthen their market presence through vertical integration and strategic partnerships in Asia, enhancing product customization and distribution. Atlantic Packaging Products and Firn Overseas Packaging offer specialized packaging solutions, catering to niche markets with flexible and value-added services.

CellMark, Greif, Progroup, and Sappi bring diversified portfolios and sustainability initiatives, investing in recycled fiber usage and renewable energy to reduce carbon footprints. The competitive landscape is driven by innovation in fiber sourcing, process optimization, and product development that align with global trends toward sustainable packaging, supply chain efficiency, and waste reduction.

| Item | Value |

|---|---|

| Quantitative Units | USD 155.3 Billion |

| Type | Recycled and Virgin |

| Product Type | Kraftliner, Testliner, Corrugating medium, White tops, and Linerboard |

| End Use Industry | Food & beverage, Pharmaceuticals, Electronics, Industrial, Consumer goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atlantic Packaging Products, Burgo Group, Cascades, CellMark, Daio Paper, DS Smith, Firn Overseas Packaging, Georgia-Pacific, Greif, International Paper, Kruger, Mondi, Oji Holdings, Progroup, Rengo, and Sappi |

| Additional Attributes | Dollar sales in the Containerboard Market vary by product type including kraftliner, testliner, and recycled linerboard, application in packaging, shipping, and storage, and region covering North America, Europe, and Asia-Pacific. Growth is driven by expanding e-commerce, demand for sustainable packaging, and increasing industrial and consumer goods transportation. |

The global containerboard market is estimated to be valued at USD 155.3 billion in 2025.

The market size for the containerboard market is projected to reach USD 206.7 billion by 2035.

The containerboard market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in containerboard market are recycled and virgin.

In terms of product type, kraftliner segment to command 28.6% share in the containerboard market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA